Advances in Heptane-Based Encapsulation Technologies for Active Ingredients

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Heptane Encapsulation Background and Objectives

Heptane-based encapsulation technologies have emerged as a promising field in the realm of active ingredient protection and delivery. This innovative approach leverages the unique properties of heptane, a hydrocarbon solvent, to create robust and efficient encapsulation systems. The evolution of this technology can be traced back to the early 2000s when researchers began exploring alternative solvents for microencapsulation processes.

The primary objective of heptane-based encapsulation is to enhance the stability, bioavailability, and controlled release of active ingredients across various industries, including pharmaceuticals, agrochemicals, and food additives. By utilizing heptane as a solvent, researchers aim to overcome limitations associated with traditional encapsulation methods, such as poor solvent compatibility and inadequate protection against environmental factors.

Over the past decade, significant advancements have been made in heptane-based encapsulation techniques. These developments have been driven by the growing demand for more effective and versatile encapsulation solutions in response to challenges faced in drug delivery, crop protection, and functional food formulations. The technology has progressed from simple emulsion-based systems to more sophisticated multi-layered structures and hybrid materials.

One of the key trends in this field is the integration of nanotechnology with heptane-based encapsulation. This convergence has led to the development of nanoscale capsules with enhanced penetration capabilities and improved targeting efficiency. Additionally, researchers are exploring the use of biodegradable and biocompatible materials in conjunction with heptane-based systems to address environmental concerns and regulatory requirements.

The future trajectory of heptane-based encapsulation technologies is expected to focus on several key areas. These include the development of stimuli-responsive release mechanisms, the incorporation of smart materials for enhanced functionality, and the optimization of scalable manufacturing processes. Furthermore, there is a growing interest in combining heptane-based encapsulation with other advanced technologies, such as 3D printing and microfluidics, to create novel delivery systems with unprecedented control over release kinetics and targeting specificity.

As research in this field continues to advance, the overarching goal is to establish heptane-based encapsulation as a versatile platform technology capable of addressing a wide range of encapsulation challenges across multiple industries. This includes improving the stability of sensitive compounds, enhancing the bioavailability of poorly soluble drugs, and developing controlled-release formulations for agrochemicals and nutraceuticals. By achieving these objectives, heptane-based encapsulation technologies have the potential to revolutionize active ingredient delivery and protection strategies in the coming years.

The primary objective of heptane-based encapsulation is to enhance the stability, bioavailability, and controlled release of active ingredients across various industries, including pharmaceuticals, agrochemicals, and food additives. By utilizing heptane as a solvent, researchers aim to overcome limitations associated with traditional encapsulation methods, such as poor solvent compatibility and inadequate protection against environmental factors.

Over the past decade, significant advancements have been made in heptane-based encapsulation techniques. These developments have been driven by the growing demand for more effective and versatile encapsulation solutions in response to challenges faced in drug delivery, crop protection, and functional food formulations. The technology has progressed from simple emulsion-based systems to more sophisticated multi-layered structures and hybrid materials.

One of the key trends in this field is the integration of nanotechnology with heptane-based encapsulation. This convergence has led to the development of nanoscale capsules with enhanced penetration capabilities and improved targeting efficiency. Additionally, researchers are exploring the use of biodegradable and biocompatible materials in conjunction with heptane-based systems to address environmental concerns and regulatory requirements.

The future trajectory of heptane-based encapsulation technologies is expected to focus on several key areas. These include the development of stimuli-responsive release mechanisms, the incorporation of smart materials for enhanced functionality, and the optimization of scalable manufacturing processes. Furthermore, there is a growing interest in combining heptane-based encapsulation with other advanced technologies, such as 3D printing and microfluidics, to create novel delivery systems with unprecedented control over release kinetics and targeting specificity.

As research in this field continues to advance, the overarching goal is to establish heptane-based encapsulation as a versatile platform technology capable of addressing a wide range of encapsulation challenges across multiple industries. This includes improving the stability of sensitive compounds, enhancing the bioavailability of poorly soluble drugs, and developing controlled-release formulations for agrochemicals and nutraceuticals. By achieving these objectives, heptane-based encapsulation technologies have the potential to revolutionize active ingredient delivery and protection strategies in the coming years.

Market Analysis for Encapsulated Active Ingredients

The market for encapsulated active ingredients has experienced significant growth in recent years, driven by increasing demand across various industries such as pharmaceuticals, food and beverages, cosmetics, and agriculture. This growth is largely attributed to the enhanced stability, controlled release, and improved bioavailability that encapsulation technologies offer to active ingredients.

In the pharmaceutical sector, encapsulated active ingredients have gained traction due to their ability to protect sensitive compounds from degradation and improve drug delivery efficiency. The global market for drug delivery systems, which includes encapsulation technologies, is projected to reach substantial values in the coming years, with a notable compound annual growth rate.

The food and beverage industry has also embraced encapsulation technologies, particularly for flavors, vitamins, and probiotics. Consumers' growing interest in functional foods and nutraceuticals has fueled this trend. The market for microencapsulated ingredients in the food sector has shown robust growth, with applications ranging from extended shelf life to masking undesirable tastes.

In the cosmetics and personal care industry, encapsulated active ingredients have found applications in skincare, haircare, and color cosmetics. The ability to protect sensitive ingredients from oxidation and control their release has made encapsulation an attractive option for formulators. The global cosmetic ingredients market, including encapsulated actives, has demonstrated steady growth and is expected to continue expanding.

The agricultural sector has also recognized the benefits of encapsulation technologies for pesticides, fertilizers, and other agrochemicals. Controlled release formulations have shown promise in reducing environmental impact and improving crop yields. The market for microencapsulated agrochemicals has seen steady growth, driven by the need for sustainable and efficient farming practices.

Geographically, North America and Europe have been leading markets for encapsulated active ingredients, owing to their advanced research and development capabilities and stringent regulations promoting innovative formulations. However, Asia-Pacific is emerging as a rapidly growing market, driven by increasing industrialization, rising disposable incomes, and growing awareness of advanced technologies in countries like China and India.

The market landscape is characterized by a mix of large multinational corporations and specialized encapsulation technology providers. Key players have been investing heavily in research and development to improve encapsulation techniques and expand their product portfolios. Strategic partnerships and collaborations between ingredient suppliers and encapsulation technology companies have become increasingly common, aiming to develop tailored solutions for specific industry needs.

In the pharmaceutical sector, encapsulated active ingredients have gained traction due to their ability to protect sensitive compounds from degradation and improve drug delivery efficiency. The global market for drug delivery systems, which includes encapsulation technologies, is projected to reach substantial values in the coming years, with a notable compound annual growth rate.

The food and beverage industry has also embraced encapsulation technologies, particularly for flavors, vitamins, and probiotics. Consumers' growing interest in functional foods and nutraceuticals has fueled this trend. The market for microencapsulated ingredients in the food sector has shown robust growth, with applications ranging from extended shelf life to masking undesirable tastes.

In the cosmetics and personal care industry, encapsulated active ingredients have found applications in skincare, haircare, and color cosmetics. The ability to protect sensitive ingredients from oxidation and control their release has made encapsulation an attractive option for formulators. The global cosmetic ingredients market, including encapsulated actives, has demonstrated steady growth and is expected to continue expanding.

The agricultural sector has also recognized the benefits of encapsulation technologies for pesticides, fertilizers, and other agrochemicals. Controlled release formulations have shown promise in reducing environmental impact and improving crop yields. The market for microencapsulated agrochemicals has seen steady growth, driven by the need for sustainable and efficient farming practices.

Geographically, North America and Europe have been leading markets for encapsulated active ingredients, owing to their advanced research and development capabilities and stringent regulations promoting innovative formulations. However, Asia-Pacific is emerging as a rapidly growing market, driven by increasing industrialization, rising disposable incomes, and growing awareness of advanced technologies in countries like China and India.

The market landscape is characterized by a mix of large multinational corporations and specialized encapsulation technology providers. Key players have been investing heavily in research and development to improve encapsulation techniques and expand their product portfolios. Strategic partnerships and collaborations between ingredient suppliers and encapsulation technology companies have become increasingly common, aiming to develop tailored solutions for specific industry needs.

Current Challenges in Heptane-Based Encapsulation

Heptane-based encapsulation technologies for active ingredients face several significant challenges that hinder their widespread adoption and efficacy. One of the primary issues is the volatility of heptane, which can lead to instability in the encapsulation process and final product. This volatility can result in inconsistent particle size distribution and reduced shelf life of the encapsulated ingredients.

Another major challenge is the limited solubility of certain active ingredients in heptane. This constraint restricts the range of compounds that can be effectively encapsulated using this method, potentially limiting its applicability across various industries. Researchers are actively seeking ways to modify the heptane-based systems to accommodate a broader spectrum of active ingredients.

The environmental and safety concerns associated with heptane usage pose additional challenges. Heptane is a volatile organic compound (VOC) with potential negative impacts on air quality and worker safety. Stringent regulations regarding VOC emissions and handling procedures add complexity and cost to the manufacturing process, making it less attractive for large-scale industrial applications.

Scalability remains a significant hurdle for heptane-based encapsulation technologies. While effective at laboratory scales, transitioning these processes to industrial production levels often encounters difficulties in maintaining consistent quality and efficiency. The need for specialized equipment and controlled environments further complicates scaling efforts.

Control over the release kinetics of encapsulated active ingredients presents another challenge. Achieving precise and predictable release profiles is crucial for many applications, particularly in pharmaceuticals and agriculture. Current heptane-based systems often struggle to provide the level of control required for these demanding applications.

The interaction between heptane and certain active ingredients can lead to degradation or alteration of the encapsulated compound. This chemical incompatibility limits the effectiveness of the encapsulation process and may compromise the integrity of the active ingredient. Developing strategies to mitigate these interactions is an ongoing area of research.

Lastly, the cost-effectiveness of heptane-based encapsulation compared to alternative methods remains a challenge. While offering certain advantages, the overall expense of the process, including raw materials, specialized equipment, and regulatory compliance, can make it less competitive in some market segments. Improving process efficiency and exploring more economical approaches are key focus areas for researchers and industry professionals.

Another major challenge is the limited solubility of certain active ingredients in heptane. This constraint restricts the range of compounds that can be effectively encapsulated using this method, potentially limiting its applicability across various industries. Researchers are actively seeking ways to modify the heptane-based systems to accommodate a broader spectrum of active ingredients.

The environmental and safety concerns associated with heptane usage pose additional challenges. Heptane is a volatile organic compound (VOC) with potential negative impacts on air quality and worker safety. Stringent regulations regarding VOC emissions and handling procedures add complexity and cost to the manufacturing process, making it less attractive for large-scale industrial applications.

Scalability remains a significant hurdle for heptane-based encapsulation technologies. While effective at laboratory scales, transitioning these processes to industrial production levels often encounters difficulties in maintaining consistent quality and efficiency. The need for specialized equipment and controlled environments further complicates scaling efforts.

Control over the release kinetics of encapsulated active ingredients presents another challenge. Achieving precise and predictable release profiles is crucial for many applications, particularly in pharmaceuticals and agriculture. Current heptane-based systems often struggle to provide the level of control required for these demanding applications.

The interaction between heptane and certain active ingredients can lead to degradation or alteration of the encapsulated compound. This chemical incompatibility limits the effectiveness of the encapsulation process and may compromise the integrity of the active ingredient. Developing strategies to mitigate these interactions is an ongoing area of research.

Lastly, the cost-effectiveness of heptane-based encapsulation compared to alternative methods remains a challenge. While offering certain advantages, the overall expense of the process, including raw materials, specialized equipment, and regulatory compliance, can make it less competitive in some market segments. Improving process efficiency and exploring more economical approaches are key focus areas for researchers and industry professionals.

State-of-the-Art Heptane Encapsulation Methods

01 Heptane-based encapsulation for battery components

Heptane-based encapsulation technologies are used in battery manufacturing, particularly for encapsulating electrode materials and other battery components. This method improves the stability and performance of battery cells, enhancing their overall efficiency and lifespan.- Heptane-based encapsulation for battery components: Heptane is used as a solvent in encapsulation processes for battery components, particularly for lithium-ion batteries. This method improves the performance and stability of battery materials, enhancing overall battery efficiency and lifespan.

- Microencapsulation techniques using heptane: Heptane is employed in microencapsulation processes, particularly for creating microcapsules containing various active ingredients. This technique is useful in industries such as pharmaceuticals, cosmetics, and agriculture for controlled release of substances.

- Heptane in semiconductor device fabrication: Heptane-based encapsulation is utilized in the manufacturing of semiconductor devices. It plays a role in protecting sensitive electronic components and improving the overall performance and durability of the devices.

- Encapsulation for organic light-emitting devices: Heptane-based encapsulation technologies are applied in the production of organic light-emitting devices (OLEDs). This method helps to protect the sensitive organic materials from moisture and oxygen, thereby extending the lifespan and improving the performance of OLEDs.

- Heptane in nanoparticle encapsulation: Heptane is used in the encapsulation of nanoparticles, particularly for drug delivery systems and other nanotechnology applications. This technique allows for better control of nanoparticle properties and improved stability in various environments.

02 Encapsulation techniques for semiconductor devices

Heptane-based encapsulation is applied in the fabrication of semiconductor devices. This process involves encapsulating various components of electronic devices, such as LEDs or transistors, to protect them from environmental factors and improve their durability and performance.Expand Specific Solutions03 Microencapsulation using heptane-based systems

Heptane-based systems are utilized in microencapsulation processes for various applications, including pharmaceuticals, cosmetics, and food industries. This technique allows for the controlled release of active ingredients and protection of sensitive compounds from external factors.Expand Specific Solutions04 Heptane-based encapsulation for solar cell technology

In solar cell manufacturing, heptane-based encapsulation technologies are employed to protect photovoltaic materials and improve the efficiency and longevity of solar panels. This method enhances the resistance of solar cells to environmental stressors and increases their overall performance.Expand Specific Solutions05 Encapsulation processes for nanomaterials

Heptane-based encapsulation techniques are applied in the field of nanotechnology for encapsulating various nanomaterials. This process helps in stabilizing nanoparticles, preventing agglomeration, and enhancing their properties for use in diverse applications such as drug delivery systems and advanced materials.Expand Specific Solutions

Key Players in Encapsulation Industry

The market for heptane-based encapsulation technologies for active ingredients is in a growth phase, driven by increasing demand for advanced drug delivery systems and functional ingredients across pharmaceutical, food, and cosmetic industries. The global market size is expanding, with projections indicating significant growth potential in the coming years. Technologically, the field is advancing rapidly, with key players like China Petroleum & Chemical Corp., Firmenich SA, and International Flavors & Fragrances leading innovation. These companies, along with others such as BASF Corp. and Kemin Industries, are investing heavily in R&D to improve encapsulation efficiency, stability, and controlled release properties. The technology's maturity varies across applications, with some areas nearing commercialization while others remain in early development stages.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced heptane-based encapsulation technologies for active ingredients, focusing on improving the stability and controlled release of various compounds. Their approach involves using heptane as a solvent in a modified emulsion-solvent evaporation method. This technique allows for the creation of microspheres with a uniform size distribution and high encapsulation efficiency[1]. The process involves dissolving the active ingredient and a biodegradable polymer in heptane, then emulsifying this solution in an aqueous phase. The heptane is then evaporated, leaving behind solid microspheres containing the encapsulated active ingredient[3]. Sinopec has also explored the use of heptane in supercritical fluid extraction processes for encapsulation, which offers advantages in terms of product purity and process efficiency[5].

Strengths: High encapsulation efficiency, uniform particle size distribution, and versatility for various active ingredients. Weaknesses: Potential environmental concerns due to heptane use, and the need for specialized equipment for supercritical fluid processes.

Firmenich SA

Technical Solution: Firmenich SA has pioneered innovative heptane-based encapsulation technologies for fragrance and flavor ingredients. Their approach utilizes a proprietary heptane-based microencapsulation process that enhances the stability and controlled release of volatile compounds. The technology involves creating a heptane-in-water emulsion, where the heptane phase contains the active ingredient and a polymer shell material[2]. As the heptane evaporates, it forms microcapsules with a core-shell structure. Firmenich has further refined this process by incorporating cross-linking agents to improve the mechanical strength of the capsules and enhance their resistance to environmental stressors[4]. Additionally, they have developed a multi-layer encapsulation technique using heptane, which allows for the sequential release of different active ingredients, providing a more complex and long-lasting fragrance or flavor profile[6].

Strengths: Enhanced stability of volatile compounds, controlled release capabilities, and potential for multi-layered encapsulation. Weaknesses: Higher production costs compared to traditional encapsulation methods, and potential limitations in scaling up the process.

Innovative Approaches in Heptane Encapsulation

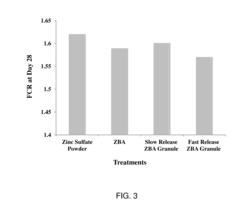

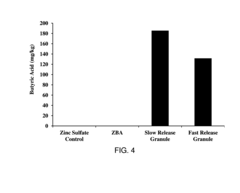

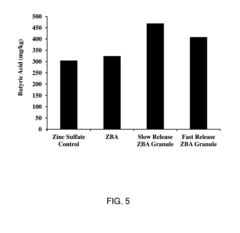

Encapsulated active ingredients for controlled enteric release

PatentActiveUS20170000736A1

Innovation

- Encapsulation of metal butyric acid salts in a modified fat matrix with a three-dimensional structure and the use of modifiers like propylene glycol to create spherical granules that allow for controlled and sustained release, tailored to specific animal species' gut retention times and acid levels, ensuring targeted delivery to the small intestine.

Encapsulated active ingredients, methods of preparation and their use

PatentInactiveEP1924156A2

Innovation

- Encapsulating active ingredients in coacervated capsules within a glassy matrix composed of 3-50wt% hydrophobically modified starch and 50-97wt% starch hydrolysate, creating an oxygen barrier and ensuring thermo-stability, while preventing unwanted flavor and aroma migration.

Environmental Impact of Heptane-Based Processes

The environmental impact of heptane-based encapsulation processes for active ingredients is a critical consideration in the development and implementation of these technologies. Heptane, a hydrocarbon solvent, poses several environmental challenges that must be carefully managed throughout the encapsulation process.

One of the primary concerns is the volatile organic compound (VOC) emissions associated with heptane use. These emissions can contribute to air pollution and the formation of ground-level ozone, potentially impacting both human health and ecosystems. Regulatory bodies worldwide have imposed strict limits on VOC emissions, necessitating the implementation of advanced emission control technologies in facilities utilizing heptane-based processes.

Water pollution is another significant environmental risk. Improper handling or disposal of heptane-containing waste can lead to contamination of water sources. Heptane's low water solubility and tendency to form a separate phase on water surfaces make it particularly problematic in aquatic environments, potentially harming marine life and disrupting ecosystems.

The production and transportation of heptane also contribute to its environmental footprint. As a petroleum-derived solvent, its manufacture is associated with the broader environmental impacts of the oil and gas industry, including greenhouse gas emissions and the risk of oil spills during extraction and transport.

However, recent advances in heptane-based encapsulation technologies have focused on mitigating these environmental concerns. Closed-loop systems and solvent recovery techniques have been developed to minimize heptane losses and reduce VOC emissions. These systems can recover up to 95% of the heptane used in the encapsulation process, significantly reducing both environmental impact and operational costs.

Furthermore, research into alternative, more environmentally friendly solvents that can replace or complement heptane in encapsulation processes is ongoing. Bio-based solvents derived from renewable resources are being explored as potential substitutes, offering lower toxicity and reduced environmental impact while maintaining the desired encapsulation properties.

The industry is also adopting green chemistry principles in the design of heptane-based encapsulation processes. This includes optimizing reaction conditions to reduce solvent use, improving energy efficiency, and developing catalysts that enable lower-temperature reactions, thereby reducing the overall energy consumption and carbon footprint of the process.

In conclusion, while heptane-based encapsulation technologies present significant environmental challenges, ongoing research and technological advancements are actively addressing these issues. The future of these technologies lies in balancing their effectiveness in encapsulating active ingredients with sustainable practices that minimize their environmental impact.

One of the primary concerns is the volatile organic compound (VOC) emissions associated with heptane use. These emissions can contribute to air pollution and the formation of ground-level ozone, potentially impacting both human health and ecosystems. Regulatory bodies worldwide have imposed strict limits on VOC emissions, necessitating the implementation of advanced emission control technologies in facilities utilizing heptane-based processes.

Water pollution is another significant environmental risk. Improper handling or disposal of heptane-containing waste can lead to contamination of water sources. Heptane's low water solubility and tendency to form a separate phase on water surfaces make it particularly problematic in aquatic environments, potentially harming marine life and disrupting ecosystems.

The production and transportation of heptane also contribute to its environmental footprint. As a petroleum-derived solvent, its manufacture is associated with the broader environmental impacts of the oil and gas industry, including greenhouse gas emissions and the risk of oil spills during extraction and transport.

However, recent advances in heptane-based encapsulation technologies have focused on mitigating these environmental concerns. Closed-loop systems and solvent recovery techniques have been developed to minimize heptane losses and reduce VOC emissions. These systems can recover up to 95% of the heptane used in the encapsulation process, significantly reducing both environmental impact and operational costs.

Furthermore, research into alternative, more environmentally friendly solvents that can replace or complement heptane in encapsulation processes is ongoing. Bio-based solvents derived from renewable resources are being explored as potential substitutes, offering lower toxicity and reduced environmental impact while maintaining the desired encapsulation properties.

The industry is also adopting green chemistry principles in the design of heptane-based encapsulation processes. This includes optimizing reaction conditions to reduce solvent use, improving energy efficiency, and developing catalysts that enable lower-temperature reactions, thereby reducing the overall energy consumption and carbon footprint of the process.

In conclusion, while heptane-based encapsulation technologies present significant environmental challenges, ongoing research and technological advancements are actively addressing these issues. The future of these technologies lies in balancing their effectiveness in encapsulating active ingredients with sustainable practices that minimize their environmental impact.

Regulatory Framework for Encapsulation Technologies

The regulatory framework for encapsulation technologies, particularly those involving heptane-based systems for active ingredients, is a complex and evolving landscape. Regulatory bodies worldwide have established guidelines and standards to ensure the safety and efficacy of encapsulated products across various industries, including pharmaceuticals, food, and agriculture.

In the United States, the Food and Drug Administration (FDA) plays a crucial role in overseeing encapsulation technologies used in food and drug products. The FDA's guidance on nanoparticle-based drug delivery systems, which includes certain encapsulation methods, provides a framework for evaluating the safety and efficacy of these technologies. For heptane-based encapsulation, manufacturers must adhere to strict solvent residue limits and demonstrate the absence of harmful effects from any residual heptane in the final product.

The European Medicines Agency (EMA) has similar regulations in place for the European Union. Their guidelines on the pharmaceutical development of medicines for human use include specific considerations for novel delivery systems, including encapsulation technologies. The EMA requires thorough characterization of encapsulated products and a comprehensive assessment of their stability, release profiles, and potential interactions with biological systems.

In the food industry, the European Food Safety Authority (EFSA) has established regulations for food additives and novel foods, which encompass certain encapsulation technologies. The EFSA's guidelines require extensive safety assessments and toxicological studies for new encapsulation methods before they can be approved for use in food products.

Globally, the International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use (ICH) provides harmonized guidelines that are adopted by many regulatory agencies. These guidelines address various aspects of pharmaceutical development, including the use of novel delivery systems like encapsulation technologies.

For agricultural applications, regulatory bodies such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) in the EU have established frameworks for assessing the environmental impact and safety of encapsulated pesticides and fertilizers. These regulations often focus on the controlled release properties of encapsulated products and their potential effects on non-target organisms.

As heptane-based encapsulation technologies advance, regulatory bodies are likely to update their guidelines to address specific concerns related to this solvent. Manufacturers and researchers must stay abreast of these evolving regulations and work closely with regulatory agencies to ensure compliance throughout the development and commercialization process of encapsulated products.

In the United States, the Food and Drug Administration (FDA) plays a crucial role in overseeing encapsulation technologies used in food and drug products. The FDA's guidance on nanoparticle-based drug delivery systems, which includes certain encapsulation methods, provides a framework for evaluating the safety and efficacy of these technologies. For heptane-based encapsulation, manufacturers must adhere to strict solvent residue limits and demonstrate the absence of harmful effects from any residual heptane in the final product.

The European Medicines Agency (EMA) has similar regulations in place for the European Union. Their guidelines on the pharmaceutical development of medicines for human use include specific considerations for novel delivery systems, including encapsulation technologies. The EMA requires thorough characterization of encapsulated products and a comprehensive assessment of their stability, release profiles, and potential interactions with biological systems.

In the food industry, the European Food Safety Authority (EFSA) has established regulations for food additives and novel foods, which encompass certain encapsulation technologies. The EFSA's guidelines require extensive safety assessments and toxicological studies for new encapsulation methods before they can be approved for use in food products.

Globally, the International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use (ICH) provides harmonized guidelines that are adopted by many regulatory agencies. These guidelines address various aspects of pharmaceutical development, including the use of novel delivery systems like encapsulation technologies.

For agricultural applications, regulatory bodies such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) in the EU have established frameworks for assessing the environmental impact and safety of encapsulated pesticides and fertilizers. These regulations often focus on the controlled release properties of encapsulated products and their potential effects on non-target organisms.

As heptane-based encapsulation technologies advance, regulatory bodies are likely to update their guidelines to address specific concerns related to this solvent. Manufacturers and researchers must stay abreast of these evolving regulations and work closely with regulatory agencies to ensure compliance throughout the development and commercialization process of encapsulated products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!