Heptane as a Model Compound in Catalytic Cracking Processes

JUL 25, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Heptane Cracking Background and Objectives

Catalytic cracking processes have been a cornerstone of the petroleum refining industry for decades, playing a crucial role in converting heavy hydrocarbon fractions into more valuable, lighter products. Within this context, heptane has emerged as a significant model compound for studying and optimizing these processes. The use of heptane as a representative molecule stems from its structural simplicity and its ability to mimic the behavior of more complex hydrocarbons found in real feedstocks.

The evolution of catalytic cracking technology can be traced back to the 1930s, with significant advancements occurring throughout the 20th century. Initially, thermal cracking was the primary method for breaking down heavy hydrocarbons. However, the introduction of catalysts revolutionized the process, leading to higher yields of desirable products and improved selectivity. As the technology progressed, researchers and industry professionals recognized the need for model compounds to better understand and predict cracking reactions.

Heptane, a straight-chain alkane with seven carbon atoms, has become a preferred model compound due to its intermediate molecular weight and well-defined structure. Its selection as a model compound allows researchers to study fundamental cracking mechanisms without the complexities introduced by more diverse feedstocks. By focusing on heptane, scientists can isolate specific reaction pathways, investigate catalyst performance, and develop kinetic models that can be extrapolated to more complex systems.

The primary objectives of using heptane as a model compound in catalytic cracking processes are multifaceted. Firstly, it aims to elucidate the reaction mechanisms involved in the cracking process, including the formation of various products such as lighter alkanes, alkenes, and aromatics. Secondly, researchers seek to optimize catalyst formulations and process conditions to enhance the yield of valuable products while minimizing undesirable byproducts. Additionally, the use of heptane allows for the development and validation of kinetic models that can predict product distributions under varying operating conditions.

Furthermore, studying heptane cracking provides insights into the deactivation mechanisms of catalysts, a critical aspect of industrial operations. By understanding how catalysts perform and degrade when processing heptane, researchers can develop strategies to extend catalyst lifetimes and improve overall process efficiency. This knowledge is particularly valuable as the refining industry faces increasing pressure to process heavier and more challenging feedstocks while maintaining high product quality and minimizing environmental impact.

In recent years, the focus on heptane as a model compound has expanded to include its role in developing more sustainable refining processes. As the industry moves towards cleaner fuels and explores bio-based feedstocks, understanding the fundamental cracking behavior of heptane continues to provide valuable insights that can be applied to these emerging areas. The ongoing research in this field aims to bridge the gap between laboratory studies and industrial applications, ultimately leading to more efficient and environmentally friendly catalytic cracking processes.

The evolution of catalytic cracking technology can be traced back to the 1930s, with significant advancements occurring throughout the 20th century. Initially, thermal cracking was the primary method for breaking down heavy hydrocarbons. However, the introduction of catalysts revolutionized the process, leading to higher yields of desirable products and improved selectivity. As the technology progressed, researchers and industry professionals recognized the need for model compounds to better understand and predict cracking reactions.

Heptane, a straight-chain alkane with seven carbon atoms, has become a preferred model compound due to its intermediate molecular weight and well-defined structure. Its selection as a model compound allows researchers to study fundamental cracking mechanisms without the complexities introduced by more diverse feedstocks. By focusing on heptane, scientists can isolate specific reaction pathways, investigate catalyst performance, and develop kinetic models that can be extrapolated to more complex systems.

The primary objectives of using heptane as a model compound in catalytic cracking processes are multifaceted. Firstly, it aims to elucidate the reaction mechanisms involved in the cracking process, including the formation of various products such as lighter alkanes, alkenes, and aromatics. Secondly, researchers seek to optimize catalyst formulations and process conditions to enhance the yield of valuable products while minimizing undesirable byproducts. Additionally, the use of heptane allows for the development and validation of kinetic models that can predict product distributions under varying operating conditions.

Furthermore, studying heptane cracking provides insights into the deactivation mechanisms of catalysts, a critical aspect of industrial operations. By understanding how catalysts perform and degrade when processing heptane, researchers can develop strategies to extend catalyst lifetimes and improve overall process efficiency. This knowledge is particularly valuable as the refining industry faces increasing pressure to process heavier and more challenging feedstocks while maintaining high product quality and minimizing environmental impact.

In recent years, the focus on heptane as a model compound has expanded to include its role in developing more sustainable refining processes. As the industry moves towards cleaner fuels and explores bio-based feedstocks, understanding the fundamental cracking behavior of heptane continues to provide valuable insights that can be applied to these emerging areas. The ongoing research in this field aims to bridge the gap between laboratory studies and industrial applications, ultimately leading to more efficient and environmentally friendly catalytic cracking processes.

Market Analysis for Catalytic Cracking Products

The catalytic cracking market has experienced significant growth in recent years, driven by the increasing demand for petroleum products and the need for more efficient refining processes. The global catalytic cracking market was valued at approximately $6.8 billion in 2020 and is projected to reach $8.5 billion by 2025, growing at a CAGR of 4.5% during the forecast period.

The primary products of catalytic cracking processes include gasoline, diesel fuel, liquefied petroleum gas (LPG), and other valuable petrochemical feedstocks. Among these, gasoline remains the dominant product segment, accounting for over 50% of the total market share. The demand for gasoline is expected to continue its upward trajectory, particularly in emerging economies where vehicle ownership is on the rise.

Diesel fuel, another crucial product of catalytic cracking, has witnessed steady growth due to its widespread use in transportation and industrial sectors. The global diesel market is anticipated to expand at a CAGR of 3.8% from 2021 to 2026, driven by increasing industrialization and infrastructure development in developing countries.

LPG, a versatile product with applications in residential, commercial, and industrial sectors, has shown robust growth potential. The global LPG market is forecasted to grow at a CAGR of 4.7% from 2021 to 2026, propelled by its increasing adoption as a clean cooking fuel in developing nations and its use as a petrochemical feedstock.

The petrochemical industry, a significant consumer of catalytic cracking products, is expected to drive market growth further. The global petrochemicals market is projected to reach $758 billion by 2025, growing at a CAGR of 8.5% from 2020 to 2025. This growth is attributed to the rising demand for plastics, synthetic fibers, and other chemical products derived from catalytic cracking processes.

Regionally, Asia-Pacific dominates the catalytic cracking products market, accounting for over 40% of the global market share. This dominance is primarily due to the rapid industrialization and urbanization in countries like China and India, coupled with increasing energy consumption. North America and Europe follow as the second and third-largest markets, respectively, driven by the presence of established refining industries and stringent environmental regulations promoting cleaner fuels.

The market for catalytic cracking products is highly competitive, with major players including ExxonMobil, Shell, Chevron, and Total. These companies are investing heavily in research and development to improve catalytic cracking processes and develop more efficient catalysts, aiming to enhance product yield and quality while reducing environmental impact.

The primary products of catalytic cracking processes include gasoline, diesel fuel, liquefied petroleum gas (LPG), and other valuable petrochemical feedstocks. Among these, gasoline remains the dominant product segment, accounting for over 50% of the total market share. The demand for gasoline is expected to continue its upward trajectory, particularly in emerging economies where vehicle ownership is on the rise.

Diesel fuel, another crucial product of catalytic cracking, has witnessed steady growth due to its widespread use in transportation and industrial sectors. The global diesel market is anticipated to expand at a CAGR of 3.8% from 2021 to 2026, driven by increasing industrialization and infrastructure development in developing countries.

LPG, a versatile product with applications in residential, commercial, and industrial sectors, has shown robust growth potential. The global LPG market is forecasted to grow at a CAGR of 4.7% from 2021 to 2026, propelled by its increasing adoption as a clean cooking fuel in developing nations and its use as a petrochemical feedstock.

The petrochemical industry, a significant consumer of catalytic cracking products, is expected to drive market growth further. The global petrochemicals market is projected to reach $758 billion by 2025, growing at a CAGR of 8.5% from 2020 to 2025. This growth is attributed to the rising demand for plastics, synthetic fibers, and other chemical products derived from catalytic cracking processes.

Regionally, Asia-Pacific dominates the catalytic cracking products market, accounting for over 40% of the global market share. This dominance is primarily due to the rapid industrialization and urbanization in countries like China and India, coupled with increasing energy consumption. North America and Europe follow as the second and third-largest markets, respectively, driven by the presence of established refining industries and stringent environmental regulations promoting cleaner fuels.

The market for catalytic cracking products is highly competitive, with major players including ExxonMobil, Shell, Chevron, and Total. These companies are investing heavily in research and development to improve catalytic cracking processes and develop more efficient catalysts, aiming to enhance product yield and quality while reducing environmental impact.

Current Challenges in Heptane Cracking

The catalytic cracking of heptane, while serving as a valuable model compound for understanding more complex hydrocarbon reactions, presents several significant challenges in current research and industrial applications. One of the primary difficulties lies in the precise control of reaction pathways and product selectivity. Heptane cracking can lead to a diverse range of products, including lighter hydrocarbons, olefins, and aromatics, making it challenging to optimize for specific desired outcomes.

The formation of coke during the cracking process remains a persistent issue, as it leads to catalyst deactivation and reduced efficiency. Coke deposition on catalyst surfaces blocks active sites and pores, necessitating frequent regeneration cycles and potentially shortening the catalyst's lifespan. Developing catalysts with enhanced coke resistance or improved regeneration capabilities is an ongoing area of research.

Another challenge is the energy intensity of the cracking process. Heptane cracking typically requires high temperatures, which translates to significant energy consumption and associated costs. Efforts to lower the energy requirements while maintaining or improving conversion rates and product yields are crucial for enhancing the overall efficiency and sustainability of the process.

The complexity of reaction kinetics in heptane cracking poses difficulties in modeling and predicting process outcomes accurately. The interplay of various reaction pathways, including isomerization, cracking, and aromatization, creates a complex reaction network that is challenging to fully characterize and control. This complexity hinders the development of precise process models and optimization strategies.

Catalyst design and optimization remain at the forefront of challenges in heptane cracking. While zeolites and other microporous materials have shown promise, there is a continuous need for catalysts with improved activity, selectivity, and stability. Tailoring pore structures, acidity, and metal incorporation to enhance specific reaction pathways while minimizing undesired side reactions is an ongoing research focus.

Environmental concerns also present challenges in heptane cracking processes. The production of light olefins, while valuable, can contribute to volatile organic compound (VOC) emissions if not properly managed. Additionally, the carbon footprint associated with the high-temperature processes and potential for CO2 emissions necessitates the development of more environmentally friendly approaches and technologies.

Lastly, scaling up laboratory findings to industrial-scale operations presents its own set of challenges. Factors such as heat and mass transfer limitations, catalyst lifetime under industrial conditions, and process integration complexities must be addressed to successfully implement new catalytic cracking technologies at a commercial scale.

The formation of coke during the cracking process remains a persistent issue, as it leads to catalyst deactivation and reduced efficiency. Coke deposition on catalyst surfaces blocks active sites and pores, necessitating frequent regeneration cycles and potentially shortening the catalyst's lifespan. Developing catalysts with enhanced coke resistance or improved regeneration capabilities is an ongoing area of research.

Another challenge is the energy intensity of the cracking process. Heptane cracking typically requires high temperatures, which translates to significant energy consumption and associated costs. Efforts to lower the energy requirements while maintaining or improving conversion rates and product yields are crucial for enhancing the overall efficiency and sustainability of the process.

The complexity of reaction kinetics in heptane cracking poses difficulties in modeling and predicting process outcomes accurately. The interplay of various reaction pathways, including isomerization, cracking, and aromatization, creates a complex reaction network that is challenging to fully characterize and control. This complexity hinders the development of precise process models and optimization strategies.

Catalyst design and optimization remain at the forefront of challenges in heptane cracking. While zeolites and other microporous materials have shown promise, there is a continuous need for catalysts with improved activity, selectivity, and stability. Tailoring pore structures, acidity, and metal incorporation to enhance specific reaction pathways while minimizing undesired side reactions is an ongoing research focus.

Environmental concerns also present challenges in heptane cracking processes. The production of light olefins, while valuable, can contribute to volatile organic compound (VOC) emissions if not properly managed. Additionally, the carbon footprint associated with the high-temperature processes and potential for CO2 emissions necessitates the development of more environmentally friendly approaches and technologies.

Lastly, scaling up laboratory findings to industrial-scale operations presents its own set of challenges. Factors such as heat and mass transfer limitations, catalyst lifetime under industrial conditions, and process integration complexities must be addressed to successfully implement new catalytic cracking technologies at a commercial scale.

Existing Heptane Cracking Methodologies

01 Use of heptane in chemical processes

Heptane is widely used as a solvent or reagent in various chemical processes. It is particularly useful in organic synthesis, extraction procedures, and as a component in reaction mixtures. Its properties make it suitable for applications in the petrochemical industry and in laboratory settings.- Use of heptane in separation processes: Heptane is utilized in various separation processes, particularly in the petrochemical industry. It serves as a solvent or extraction medium for isolating specific compounds from mixtures. Its non-polar nature makes it effective in separating hydrocarbons and other organic substances.

- Heptane as a component in polymer production: Heptane plays a role in polymer manufacturing processes. It can be used as a diluent or reaction medium in polymerization reactions, particularly for producing polyolefins. Its low boiling point allows for easy removal from the final product.

- Application of heptane in fuel formulations: Heptane is an important component in fuel formulations, particularly for internal combustion engines. It is used as a reference fuel for octane rating and can be blended with other hydrocarbons to adjust fuel properties such as volatility and combustion characteristics.

- Heptane in analytical and laboratory applications: Heptane finds use in various analytical and laboratory applications. It serves as a mobile phase in chromatography, a cleaning solvent for laboratory equipment, and a standard for calibrating instruments. Its well-defined properties make it valuable in research and quality control settings.

- Environmental and safety considerations for heptane use: The use of heptane requires careful consideration of environmental and safety factors. It is highly flammable and can form explosive mixtures with air. Proper handling, storage, and disposal procedures are necessary to minimize risks. Research focuses on developing safer alternatives or improving containment methods for heptane-based processes.

02 Heptane in fuel compositions

Heptane is an important component in fuel formulations, particularly for internal combustion engines. It is used to adjust the octane rating of gasoline and as a reference fuel for engine testing. The inclusion of heptane in fuel blends can improve combustion efficiency and engine performance.Expand Specific Solutions03 Heptane as a cleaning agent

Due to its solvent properties, heptane is employed as a cleaning agent in various industries. It is effective in removing oils, greases, and other organic contaminants from surfaces and equipment. Heptane-based cleaning formulations are used in electronics, automotive, and precision manufacturing sectors.Expand Specific Solutions04 Heptane in polymer processing

Heptane plays a role in polymer processing and manufacturing. It is used as a diluent or processing aid in the production of certain polymers and plastics. Heptane can also be employed in polymer extraction processes and as a component in polymer-based adhesive formulations.Expand Specific Solutions05 Environmental and safety considerations of heptane

The use of heptane in various applications necessitates careful consideration of environmental and safety factors. This includes developing methods for proper handling, storage, and disposal of heptane-containing materials. Research is ongoing to assess its environmental impact and to develop safer alternatives or improved containment strategies.Expand Specific Solutions

Key Players in Catalytic Cracking Industry

The catalytic cracking of heptane as a model compound is in a mature stage of development, with a significant market size due to its importance in petroleum refining. The technology's maturity is evident from the involvement of major players like China Petroleum & Chemical Corp., ExxonMobil Chemical Patents, Inc., and SABIC Global Technologies BV. These companies, along with research institutions such as Sinopec Research Institute of Petroleum Processing and King Abdullah University of Science & Technology, are continuously refining the process. The competitive landscape is characterized by a mix of established oil and gas companies, specialized chemical firms, and academic institutions, all contributing to the ongoing optimization of catalytic cracking processes using heptane as a model compound.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced catalytic cracking processes using heptane as a model compound. Their approach involves a novel zeolite-based catalyst with optimized pore structure and acidity, enhancing selectivity towards light olefins. The process employs a two-stage reactor system, with the first stage operating at higher temperatures (550-600°C) to maximize cracking, and the second stage at lower temperatures (450-500°C) to optimize product distribution[1]. Sinopec's technology also incorporates real-time monitoring of coke formation on the catalyst, allowing for precise control of regeneration cycles and maintaining catalyst activity[3].

Strengths: High selectivity towards valuable light olefins, improved catalyst longevity, and precise process control. Weaknesses: Potentially higher initial investment costs and complexity in operation compared to traditional FCC units.

Sinopec Research Institute of Petroleum Processing

Technical Solution: The Sinopec Research Institute of Petroleum Processing has focused on developing a novel catalyst system for heptane cracking, utilizing hierarchical zeolites with tailored mesoporosity. Their approach combines ZSM-5 zeolites with controlled Si/Al ratios and phosphorus modification to enhance shape selectivity and reduce hydrogen transfer reactions[2]. The institute has also pioneered the use of metal-organic frameworks (MOFs) as additives to traditional FCC catalysts, which has shown promising results in increasing the yield of propylene and reducing coke formation during heptane cracking[4]. Additionally, they have developed a proprietary process simulation model that accurately predicts product distributions based on feed composition and operating conditions, enabling rapid optimization of industrial-scale catalytic cracking units[5].

Strengths: Innovative catalyst design with improved selectivity and reduced coking, integration of advanced materials (MOFs), and powerful predictive modeling capabilities. Weaknesses: Potential scalability challenges for novel materials and higher catalyst production costs.

Innovative Catalysts for Heptane Cracking

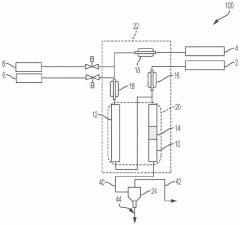

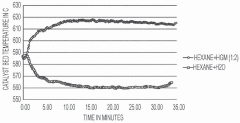

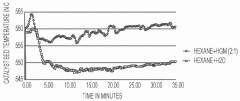

Internal heat generating material coupled hydrocarbon cracking

PatentPendingSG10202011092RA

Innovation

- The method involves using exothermic heat-generating materials (HGMs) like aldehydes or ketones, such as formaldehyde, to couple with hydrocarbon feeds in a cracking reactor, generating heat to offset the endothermic energy requirements and potentially achieve thermal neutrality in the cracking process.

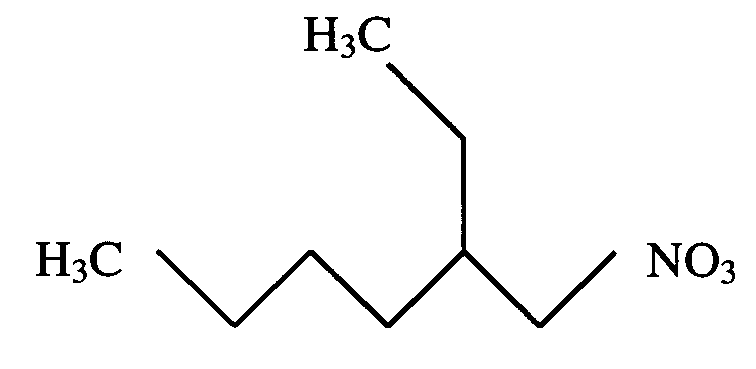

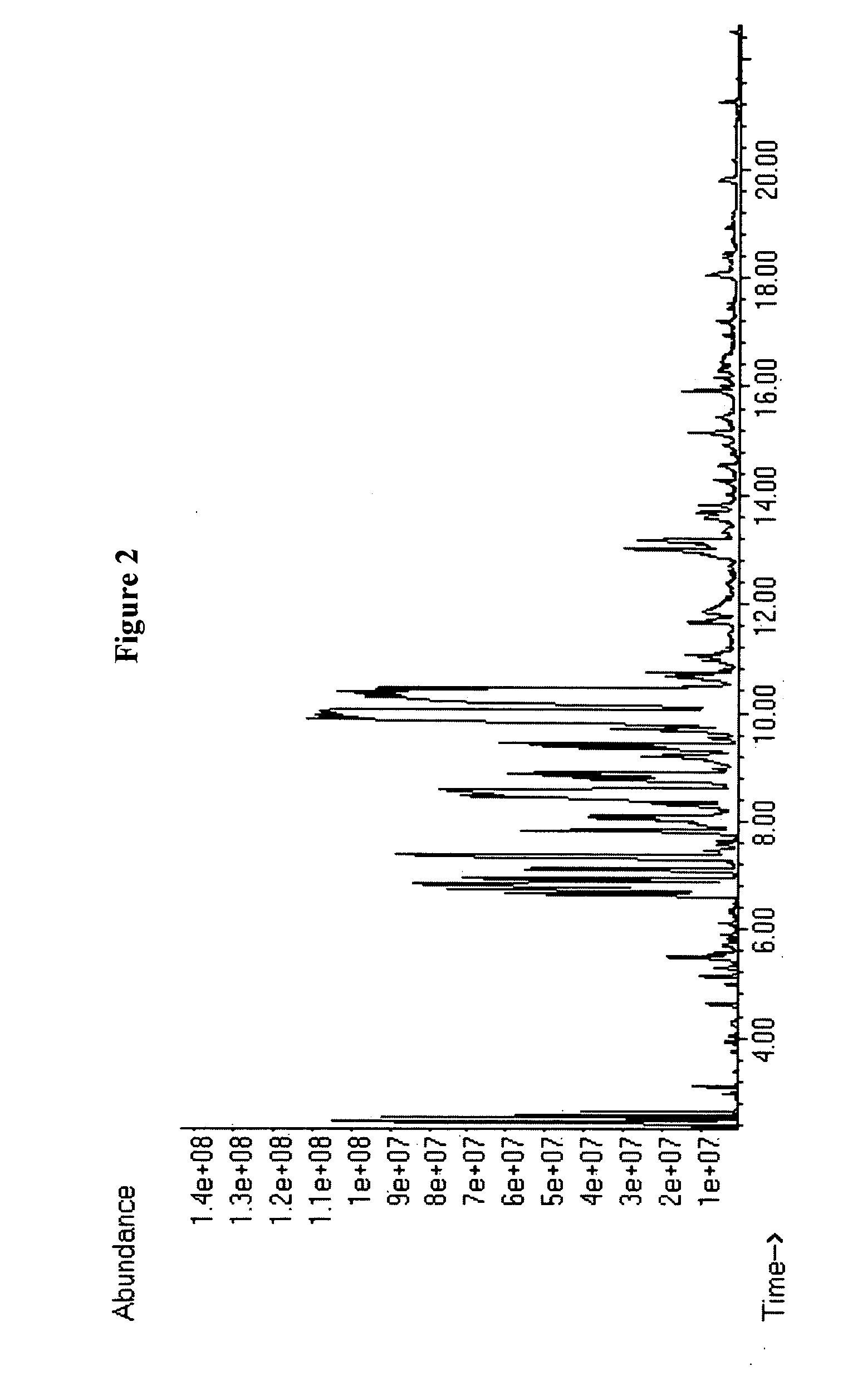

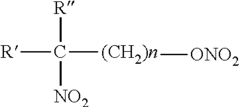

Nitrated non-cyclic N-Alkane scaffolds with differentiated-mean combustive equivalencies as high energy density fuel improvers

PatentInactiveUS20100293841A1

Innovation

- A high-energy-density fuel additive combining a nitrated, non-ring, n-alkane scaffold with trioxynitrate groups is introduced, which increases the Cetane Number and energy density of diesel fuels, improving combustion efficiency, reducing emissions, and enhancing cold weather performance when mixed with existing diesel fuels.

Environmental Impact of Catalytic Cracking

The environmental impact of catalytic cracking processes, particularly those involving heptane as a model compound, is a critical consideration in the petroleum refining industry. These processes, while essential for producing high-value fuels and petrochemicals, can have significant environmental implications if not properly managed.

One of the primary environmental concerns associated with catalytic cracking is the emission of greenhouse gases, particularly carbon dioxide. The high temperatures required for the cracking process contribute to substantial energy consumption, often derived from fossil fuel sources. This energy-intensive nature of catalytic cracking leads to increased carbon footprints for refineries, contributing to global climate change concerns.

Volatile organic compounds (VOCs) are another major environmental issue stemming from catalytic cracking operations. Heptane, being a volatile hydrocarbon, can escape into the atmosphere during various stages of the process. These VOC emissions not only represent a loss of valuable product but also contribute to air pollution and the formation of ground-level ozone, a key component of smog.

Particulate matter emissions are also a significant environmental challenge in catalytic cracking units. Fine catalyst particles can become entrained in the process gases and be released into the atmosphere if not adequately controlled. These particles can have adverse effects on air quality and human health, particularly in areas surrounding refineries.

Water pollution is another potential environmental impact of catalytic cracking processes. Wastewater from these operations can contain various contaminants, including hydrocarbons, suspended solids, and trace metals. If not properly treated, this wastewater can pose risks to aquatic ecosystems and water resources.

The use of catalysts in the cracking process introduces additional environmental considerations. While catalysts enhance process efficiency and selectivity, they also require periodic regeneration or replacement. The disposal of spent catalysts must be carefully managed to prevent soil and water contamination, as these materials may contain heavy metals and other hazardous substances.

To mitigate these environmental impacts, the refining industry has implemented various technologies and practices. These include advanced emission control systems, such as electrostatic precipitators and scrubbers, to reduce particulate and VOC emissions. Energy efficiency improvements and heat integration strategies are being employed to reduce the carbon footprint of cracking operations. Additionally, water treatment and recycling systems are increasingly being implemented to minimize water consumption and pollution.

Research into more environmentally friendly catalysts and process optimizations continues, aiming to further reduce the environmental impact of catalytic cracking. This includes exploring bio-based feedstocks and developing catalysts that operate at lower temperatures, potentially reducing energy consumption and associated emissions.

One of the primary environmental concerns associated with catalytic cracking is the emission of greenhouse gases, particularly carbon dioxide. The high temperatures required for the cracking process contribute to substantial energy consumption, often derived from fossil fuel sources. This energy-intensive nature of catalytic cracking leads to increased carbon footprints for refineries, contributing to global climate change concerns.

Volatile organic compounds (VOCs) are another major environmental issue stemming from catalytic cracking operations. Heptane, being a volatile hydrocarbon, can escape into the atmosphere during various stages of the process. These VOC emissions not only represent a loss of valuable product but also contribute to air pollution and the formation of ground-level ozone, a key component of smog.

Particulate matter emissions are also a significant environmental challenge in catalytic cracking units. Fine catalyst particles can become entrained in the process gases and be released into the atmosphere if not adequately controlled. These particles can have adverse effects on air quality and human health, particularly in areas surrounding refineries.

Water pollution is another potential environmental impact of catalytic cracking processes. Wastewater from these operations can contain various contaminants, including hydrocarbons, suspended solids, and trace metals. If not properly treated, this wastewater can pose risks to aquatic ecosystems and water resources.

The use of catalysts in the cracking process introduces additional environmental considerations. While catalysts enhance process efficiency and selectivity, they also require periodic regeneration or replacement. The disposal of spent catalysts must be carefully managed to prevent soil and water contamination, as these materials may contain heavy metals and other hazardous substances.

To mitigate these environmental impacts, the refining industry has implemented various technologies and practices. These include advanced emission control systems, such as electrostatic precipitators and scrubbers, to reduce particulate and VOC emissions. Energy efficiency improvements and heat integration strategies are being employed to reduce the carbon footprint of cracking operations. Additionally, water treatment and recycling systems are increasingly being implemented to minimize water consumption and pollution.

Research into more environmentally friendly catalysts and process optimizations continues, aiming to further reduce the environmental impact of catalytic cracking. This includes exploring bio-based feedstocks and developing catalysts that operate at lower temperatures, potentially reducing energy consumption and associated emissions.

Economic Feasibility of Heptane Cracking

The economic feasibility of heptane cracking is a crucial consideration in the broader context of catalytic cracking processes. Heptane, as a model compound, provides valuable insights into the economic viability of cracking operations for larger-scale industrial applications. The analysis of heptane cracking economics encompasses several key factors that influence the overall profitability and sustainability of the process.

One of the primary considerations is the cost of raw materials. Heptane, being a relatively simple hydrocarbon, is often more affordable compared to more complex feedstocks. This cost advantage can contribute positively to the economic feasibility of the cracking process. However, the availability and price fluctuations of heptane in the market must be carefully monitored to ensure a stable and cost-effective supply chain.

The energy requirements for heptane cracking also play a significant role in determining its economic viability. The process typically requires high temperatures and pressures, which translate to substantial energy inputs. Optimizing energy efficiency through advanced reactor designs and heat recovery systems can help mitigate these costs and improve the overall economics of the operation.

Catalyst performance and longevity are critical factors in the economic assessment of heptane cracking. High-performance catalysts that maintain their activity over extended periods can significantly reduce operational costs by minimizing the frequency of catalyst regeneration or replacement. Investments in catalyst research and development can lead to long-term economic benefits through improved conversion rates and selectivity.

The yield and product distribution obtained from heptane cracking directly impact the economic feasibility of the process. Higher yields of valuable products, such as light olefins, can substantially enhance the profitability of the operation. Optimizing reaction conditions and catalyst formulations to maximize the production of desired products is essential for improving the economic outlook.

Capital expenditure (CAPEX) for heptane cracking facilities is another crucial economic consideration. While the initial investment may be significant, economies of scale can be achieved through larger processing capacities. The design and construction of efficient, modular units can help reduce CAPEX and improve the overall return on investment.

Operational expenditure (OPEX) for heptane cracking includes costs associated with maintenance, labor, and utilities. Implementing advanced process control systems and predictive maintenance strategies can help minimize downtime and reduce operational costs, thereby enhancing the economic feasibility of the process.

Market demand and product pricing are external factors that significantly influence the economic viability of heptane cracking. Fluctuations in the demand for cracked products and their market values can impact the profitability of the operation. Diversifying the product portfolio and developing flexible production capabilities can help mitigate market risks and improve economic resilience.

In conclusion, the economic feasibility of heptane cracking as a model for catalytic cracking processes depends on a complex interplay of factors. By carefully optimizing raw material costs, energy efficiency, catalyst performance, product yields, and operational expenses, while considering market dynamics, the process can be economically viable and contribute valuable insights to the broader field of catalytic cracking.

One of the primary considerations is the cost of raw materials. Heptane, being a relatively simple hydrocarbon, is often more affordable compared to more complex feedstocks. This cost advantage can contribute positively to the economic feasibility of the cracking process. However, the availability and price fluctuations of heptane in the market must be carefully monitored to ensure a stable and cost-effective supply chain.

The energy requirements for heptane cracking also play a significant role in determining its economic viability. The process typically requires high temperatures and pressures, which translate to substantial energy inputs. Optimizing energy efficiency through advanced reactor designs and heat recovery systems can help mitigate these costs and improve the overall economics of the operation.

Catalyst performance and longevity are critical factors in the economic assessment of heptane cracking. High-performance catalysts that maintain their activity over extended periods can significantly reduce operational costs by minimizing the frequency of catalyst regeneration or replacement. Investments in catalyst research and development can lead to long-term economic benefits through improved conversion rates and selectivity.

The yield and product distribution obtained from heptane cracking directly impact the economic feasibility of the process. Higher yields of valuable products, such as light olefins, can substantially enhance the profitability of the operation. Optimizing reaction conditions and catalyst formulations to maximize the production of desired products is essential for improving the economic outlook.

Capital expenditure (CAPEX) for heptane cracking facilities is another crucial economic consideration. While the initial investment may be significant, economies of scale can be achieved through larger processing capacities. The design and construction of efficient, modular units can help reduce CAPEX and improve the overall return on investment.

Operational expenditure (OPEX) for heptane cracking includes costs associated with maintenance, labor, and utilities. Implementing advanced process control systems and predictive maintenance strategies can help minimize downtime and reduce operational costs, thereby enhancing the economic feasibility of the process.

Market demand and product pricing are external factors that significantly influence the economic viability of heptane cracking. Fluctuations in the demand for cracked products and their market values can impact the profitability of the operation. Diversifying the product portfolio and developing flexible production capabilities can help mitigate market risks and improve economic resilience.

In conclusion, the economic feasibility of heptane cracking as a model for catalytic cracking processes depends on a complex interplay of factors. By carefully optimizing raw material costs, energy efficiency, catalyst performance, product yields, and operational expenses, while considering market dynamics, the process can be economically viable and contribute valuable insights to the broader field of catalytic cracking.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!