Catalytic Conversion of Heptane to Aromatics: Catalyst Performance and Stability

JUL 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Heptane Aromatization Background and Objectives

The catalytic conversion of heptane to aromatics represents a significant area of research in the field of petrochemistry and catalysis. This process, known as heptane aromatization, has gained considerable attention due to its potential to produce high-value aromatic compounds from relatively low-value straight-chain hydrocarbons. The background of this technology dates back to the mid-20th century when the demand for aromatic compounds in the chemical industry began to surge.

Historically, the primary source of aromatics has been petroleum refining, particularly through catalytic reforming processes. However, as the global demand for aromatics continues to grow, especially in the production of plastics, fibers, and various chemical intermediates, there is an increasing need for alternative production methods. This is where heptane aromatization comes into play, offering a promising route to supplement traditional aromatic sources.

The evolution of heptane aromatization technology has been closely tied to advancements in catalyst design and process engineering. Early attempts at this conversion were plagued by low yields and rapid catalyst deactivation. Over the decades, significant progress has been made in developing more efficient and stable catalysts, primarily focusing on zeolite-based materials and noble metal catalysts.

The current technological landscape of heptane aromatization is characterized by a push towards higher conversion rates, improved selectivity for specific aromatic compounds, and enhanced catalyst longevity. These objectives are driven by both economic considerations and environmental concerns, as more efficient processes can lead to reduced energy consumption and waste generation.

One of the key challenges in this field has been balancing the trade-off between catalyst activity and stability. Highly active catalysts often suffer from rapid deactivation due to coke formation, while more stable catalysts may lack the desired level of activity. This has led to a focus on developing bifunctional catalysts that can effectively promote both the dehydrogenation and cyclization steps involved in the aromatization process.

The objectives of current research in heptane aromatization are multifaceted. Primarily, there is a drive to develop catalysts that can maintain high activity and selectivity over extended periods of operation. This involves not only the design of novel catalyst materials but also the optimization of reaction conditions to minimize side reactions and catalyst deactivation.

Another important goal is to enhance the selectivity towards specific aromatic products, particularly high-value compounds such as benzene, toluene, and xylenes (BTX). This requires a deep understanding of the reaction mechanisms and the ability to fine-tune catalyst properties to favor desired reaction pathways.

Historically, the primary source of aromatics has been petroleum refining, particularly through catalytic reforming processes. However, as the global demand for aromatics continues to grow, especially in the production of plastics, fibers, and various chemical intermediates, there is an increasing need for alternative production methods. This is where heptane aromatization comes into play, offering a promising route to supplement traditional aromatic sources.

The evolution of heptane aromatization technology has been closely tied to advancements in catalyst design and process engineering. Early attempts at this conversion were plagued by low yields and rapid catalyst deactivation. Over the decades, significant progress has been made in developing more efficient and stable catalysts, primarily focusing on zeolite-based materials and noble metal catalysts.

The current technological landscape of heptane aromatization is characterized by a push towards higher conversion rates, improved selectivity for specific aromatic compounds, and enhanced catalyst longevity. These objectives are driven by both economic considerations and environmental concerns, as more efficient processes can lead to reduced energy consumption and waste generation.

One of the key challenges in this field has been balancing the trade-off between catalyst activity and stability. Highly active catalysts often suffer from rapid deactivation due to coke formation, while more stable catalysts may lack the desired level of activity. This has led to a focus on developing bifunctional catalysts that can effectively promote both the dehydrogenation and cyclization steps involved in the aromatization process.

The objectives of current research in heptane aromatization are multifaceted. Primarily, there is a drive to develop catalysts that can maintain high activity and selectivity over extended periods of operation. This involves not only the design of novel catalyst materials but also the optimization of reaction conditions to minimize side reactions and catalyst deactivation.

Another important goal is to enhance the selectivity towards specific aromatic products, particularly high-value compounds such as benzene, toluene, and xylenes (BTX). This requires a deep understanding of the reaction mechanisms and the ability to fine-tune catalyst properties to favor desired reaction pathways.

Market Analysis for Aromatic Compounds

The global market for aromatic compounds has been experiencing steady growth, driven by increasing demand from various end-use industries such as petrochemicals, plastics, and pharmaceuticals. Aromatics, including benzene, toluene, and xylenes (BTX), are essential building blocks for numerous products, making them crucial components in the chemical industry.

The demand for aromatics is closely tied to economic growth and industrialization. Developing economies, particularly in Asia-Pacific, have been major contributors to market expansion. China, in particular, has emerged as a significant consumer and producer of aromatic compounds, influencing global market dynamics.

The automotive and construction sectors play a vital role in driving the demand for aromatics. These compounds are used in the production of various materials, including synthetic fibers, resins, and plastics, which are extensively utilized in vehicle manufacturing and building materials. As urbanization continues and infrastructure development accelerates in emerging economies, the demand for aromatic compounds is expected to rise further.

Environmental regulations and sustainability concerns have begun to impact the aromatics market. There is a growing emphasis on developing bio-based aromatics and more environmentally friendly production processes. This trend has led to increased research and development efforts in green chemistry and bio-refineries, potentially reshaping the market landscape in the coming years.

The petrochemical industry remains the primary source of aromatic compounds, with naphtha cracking and catalytic reforming being the dominant production methods. However, the volatility of crude oil prices directly affects the production costs and market dynamics of aromatics. This has led to a push for alternative feedstocks and more efficient production technologies, such as the catalytic conversion of heptane to aromatics.

Market analysts project continued growth in the global aromatics market, with Asia-Pacific expected to maintain its position as the fastest-growing region. The increasing use of aromatics in specialty chemicals and advanced materials is opening up new market opportunities. Additionally, the growing focus on circular economy principles is driving innovations in aromatics recycling and recovery technologies.

The competitive landscape of the aromatics market is characterized by the presence of major petrochemical companies and oil refineries. These players are investing in capacity expansions and technological advancements to maintain their market positions. Strategic partnerships and collaborations are becoming increasingly common as companies seek to leverage complementary strengths and address market challenges collectively.

The demand for aromatics is closely tied to economic growth and industrialization. Developing economies, particularly in Asia-Pacific, have been major contributors to market expansion. China, in particular, has emerged as a significant consumer and producer of aromatic compounds, influencing global market dynamics.

The automotive and construction sectors play a vital role in driving the demand for aromatics. These compounds are used in the production of various materials, including synthetic fibers, resins, and plastics, which are extensively utilized in vehicle manufacturing and building materials. As urbanization continues and infrastructure development accelerates in emerging economies, the demand for aromatic compounds is expected to rise further.

Environmental regulations and sustainability concerns have begun to impact the aromatics market. There is a growing emphasis on developing bio-based aromatics and more environmentally friendly production processes. This trend has led to increased research and development efforts in green chemistry and bio-refineries, potentially reshaping the market landscape in the coming years.

The petrochemical industry remains the primary source of aromatic compounds, with naphtha cracking and catalytic reforming being the dominant production methods. However, the volatility of crude oil prices directly affects the production costs and market dynamics of aromatics. This has led to a push for alternative feedstocks and more efficient production technologies, such as the catalytic conversion of heptane to aromatics.

Market analysts project continued growth in the global aromatics market, with Asia-Pacific expected to maintain its position as the fastest-growing region. The increasing use of aromatics in specialty chemicals and advanced materials is opening up new market opportunities. Additionally, the growing focus on circular economy principles is driving innovations in aromatics recycling and recovery technologies.

The competitive landscape of the aromatics market is characterized by the presence of major petrochemical companies and oil refineries. These players are investing in capacity expansions and technological advancements to maintain their market positions. Strategic partnerships and collaborations are becoming increasingly common as companies seek to leverage complementary strengths and address market challenges collectively.

Current Challenges in Catalytic Conversion

The catalytic conversion of heptane to aromatics faces several significant challenges that hinder its widespread industrial application. One of the primary issues is catalyst deactivation, which occurs due to coke formation on the catalyst surface. This carbon deposition leads to a reduction in active sites and pore blockage, resulting in decreased catalytic activity and selectivity over time. The rate of coke formation is particularly high in this process due to the high temperatures required for the aromatization reaction.

Another major challenge is the control of product selectivity. The conversion of heptane can lead to a wide range of products, including various aromatics, light hydrocarbons, and undesired by-products. Achieving high selectivity towards specific aromatic compounds, such as benzene, toluene, and xylenes (BTX), while minimizing the formation of unwanted products, remains a significant hurdle. This selectivity issue is closely related to the catalyst design and reaction conditions, which need to be optimized to favor the desired reaction pathways.

The stability of catalysts under the harsh reaction conditions is also a critical concern. The high temperatures and pressures required for the aromatization process can lead to sintering of metal particles, phase transformations, and structural collapse of the catalyst support. These phenomena result in a loss of catalytic performance over time, necessitating frequent catalyst regeneration or replacement, which increases operational costs and downtime.

Furthermore, the efficient utilization of hydrogen in the process presents a challenge. While hydrogen is necessary for some steps in the aromatization mechanism, excessive hydrogen can lead to undesired side reactions, such as hydrocracking, which reduce the yield of aromatic products. Balancing hydrogen availability to promote aromatization while minimizing competing reactions is a delicate task that requires precise control of reaction conditions and catalyst properties.

The development of catalysts that can withstand sulfur poisoning is another significant challenge. Sulfur-containing compounds, even in trace amounts, can severely deactivate the catalysts used in heptane aromatization. This necessitates either extensive pre-treatment of the feedstock to remove sulfur or the development of sulfur-tolerant catalysts, both of which add complexity and cost to the process.

Lastly, the energy intensity of the process poses both economic and environmental challenges. The high temperatures required for the endothermic aromatization reactions result in substantial energy consumption, contributing to increased operational costs and carbon emissions. Developing more energy-efficient processes or finding alternative reaction pathways that operate under milder conditions remains an important area of research in this field.

Another major challenge is the control of product selectivity. The conversion of heptane can lead to a wide range of products, including various aromatics, light hydrocarbons, and undesired by-products. Achieving high selectivity towards specific aromatic compounds, such as benzene, toluene, and xylenes (BTX), while minimizing the formation of unwanted products, remains a significant hurdle. This selectivity issue is closely related to the catalyst design and reaction conditions, which need to be optimized to favor the desired reaction pathways.

The stability of catalysts under the harsh reaction conditions is also a critical concern. The high temperatures and pressures required for the aromatization process can lead to sintering of metal particles, phase transformations, and structural collapse of the catalyst support. These phenomena result in a loss of catalytic performance over time, necessitating frequent catalyst regeneration or replacement, which increases operational costs and downtime.

Furthermore, the efficient utilization of hydrogen in the process presents a challenge. While hydrogen is necessary for some steps in the aromatization mechanism, excessive hydrogen can lead to undesired side reactions, such as hydrocracking, which reduce the yield of aromatic products. Balancing hydrogen availability to promote aromatization while minimizing competing reactions is a delicate task that requires precise control of reaction conditions and catalyst properties.

The development of catalysts that can withstand sulfur poisoning is another significant challenge. Sulfur-containing compounds, even in trace amounts, can severely deactivate the catalysts used in heptane aromatization. This necessitates either extensive pre-treatment of the feedstock to remove sulfur or the development of sulfur-tolerant catalysts, both of which add complexity and cost to the process.

Lastly, the energy intensity of the process poses both economic and environmental challenges. The high temperatures required for the endothermic aromatization reactions result in substantial energy consumption, contributing to increased operational costs and carbon emissions. Developing more energy-efficient processes or finding alternative reaction pathways that operate under milder conditions remains an important area of research in this field.

Existing Catalytic Systems for Aromatization

01 Zeolite-based catalysts for heptane conversion

Zeolite-based catalysts are widely used for heptane conversion due to their high surface area, shape selectivity, and thermal stability. These catalysts can be modified with various metals to enhance their performance and stability. The zeolite structure provides a suitable environment for the conversion reactions, while the metal components contribute to the catalytic activity.- Zeolite-based catalysts for heptane conversion: Zeolite-based catalysts have shown promising performance and stability in heptane conversion processes. These catalysts often incorporate metals such as platinum or palladium to enhance their catalytic activity. The zeolite structure provides shape selectivity and high surface area, contributing to improved conversion rates and product selectivity.

- Bimetallic catalysts for enhanced stability: Bimetallic catalysts, combining two different metal components, have demonstrated improved stability and performance in heptane conversion reactions. These catalysts often exhibit synergistic effects between the metal components, leading to enhanced catalytic activity, selectivity, and resistance to deactivation compared to monometallic counterparts.

- Catalyst support modifications for improved performance: Modifications to catalyst supports, such as the incorporation of promoters or the use of novel support materials, have been shown to enhance the performance and stability of catalysts for heptane conversion. These modifications can improve metal dispersion, prevent sintering, and increase the catalyst's resistance to coking and deactivation.

- Novel catalyst preparation methods: Innovative catalyst preparation methods have been developed to improve the performance and stability of catalysts for heptane conversion. These methods may include advanced synthesis techniques, controlled deposition of active components, or post-synthesis treatments to optimize catalyst properties and enhance their longevity in reaction conditions.

- Process optimization for catalyst stability: Optimizing reaction conditions and process parameters can significantly impact catalyst stability and performance in heptane conversion. This may include adjusting temperature, pressure, feed composition, or implementing regeneration strategies to maintain catalyst activity over extended periods of operation.

02 Noble metal catalysts for heptane conversion

Noble metals such as platinum, palladium, and rhodium are effective catalysts for heptane conversion. These metals exhibit high activity and selectivity for various reactions, including isomerization and dehydrogenation. The catalysts are often supported on high surface area materials to improve their dispersion and stability during the conversion process.Expand Specific Solutions03 Bimetallic catalysts for improved performance and stability

Bimetallic catalysts, combining two different metal components, have shown enhanced performance and stability in heptane conversion reactions. The synergistic effect between the two metals can lead to improved catalytic activity, selectivity, and resistance to deactivation. These catalysts often exhibit better long-term stability compared to their monometallic counterparts.Expand Specific Solutions04 Catalyst support materials for enhanced stability

The choice of support material plays a crucial role in the performance and stability of heptane conversion catalysts. High surface area materials such as alumina, silica, and carbon are commonly used. These supports not only provide a large surface area for the active components but also contribute to the thermal and mechanical stability of the catalyst during the conversion process.Expand Specific Solutions05 Catalyst regeneration and deactivation prevention

Maintaining catalyst performance and stability over extended periods is crucial for industrial heptane conversion processes. Various strategies are employed to prevent catalyst deactivation and enable regeneration. These include optimizing reaction conditions, adding promoters to the catalyst formulation, and developing regeneration protocols to remove coke deposits and restore catalytic activity.Expand Specific Solutions

Key Players in Petrochemical Catalysis

The catalytic conversion of heptane to aromatics is in a mature development stage, with significant market potential due to the growing demand for aromatic compounds in various industries. The technology's maturity is evident from the involvement of major players like China Petroleum & Chemical Corp., ExxonMobil Chemical Patents, Inc., and Saudi Basic Industries Corp. These companies have established research capabilities and commercial applications in this field. The market size is substantial, driven by the petrochemical industry's need for efficient conversion processes. However, the competitive landscape is intense, with companies like UOP LLC, Shell Internationale Research Maatschappij BV, and IFP Energies Nouvelles also actively developing and improving catalyst performance and stability for this process.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a novel catalyst system for the catalytic conversion of heptane to aromatics. Their approach utilizes a bifunctional catalyst combining a zeolite component with a metal oxide support. The zeolite provides shape selectivity and acidity for dehydrocyclization, while the metal oxide promotes dehydrogenation. Sinopec's catalyst incorporates nano-sized ZSM-5 zeolite crystals with optimized Si/Al ratios to enhance aromatics selectivity[1]. The metal oxide support is doped with promoters like gallium or zinc to improve catalyst stability and aromatics yield[3]. Sinopec has also implemented a proprietary regeneration process to extend catalyst lifetime by removing coke deposits periodically[5].

Strengths: High aromatics selectivity, improved catalyst stability, and extended lifetime through regeneration. Weaknesses: Potential high costs for nano-zeolite synthesis and metal promoters, possible sensitivity to feed impurities.

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil has developed an advanced catalyst system for heptane to aromatics conversion based on their proprietary ZSM-5 zeolite technology. Their approach utilizes a modified ZSM-5 zeolite with controlled mesoporosity to enhance diffusion of reactants and products[2]. The catalyst incorporates platinum as the active metal for dehydrogenation, dispersed on the zeolite surface using advanced impregnation techniques[4]. ExxonMobil's catalyst design also features a hierarchical pore structure, combining micropores for shape selectivity with mesopores for improved mass transfer[6]. To enhance stability, the catalyst is treated with phosphorus and rare earth elements, which help to maintain acidity and metal dispersion during prolonged operation[8].

Strengths: Enhanced mass transfer properties, high aromatics selectivity, and improved stability. Weaknesses: Complex synthesis process may lead to higher production costs, potential sensitivity to feed contaminants.

Innovative Catalyst Designs and Materials

Catalyst for aromatization of lower hydrocarbons and process for production of aromatic compounds

PatentWO2008114550A1

Innovation

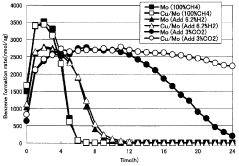

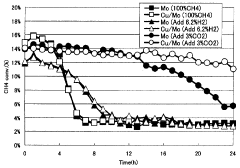

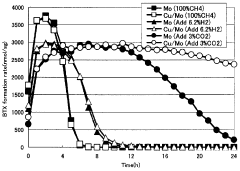

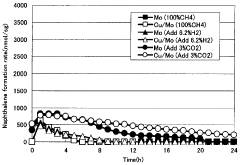

- A catalyst comprising molybdenum and copper supported on a silane-modified metallosilicate zeolite, with a molar ratio of copper to molybdenum between 0.01 and 0.8, and calcined at 550 to 800°C, reacts with methane and carbon dioxide to enhance methane conversion, benzene, naphthalene, and BTX production rates, while minimizing carbon production.

Selective catalytic reforming with high-stability catalyst

PatentInactiveUS5366617A

Innovation

- A reforming catalyst system comprising a non-acidic L-zeolite, a noble metal like platinum, and a non-noble Group VIII metal such as nickel, where the nickel is concentrated extrinsic to the zeolite pores, enhancing catalyst activity and stability, and incorporating a sulfur-tolerant design to minimize deactivation.

Environmental Impact Assessment

The catalytic conversion of heptane to aromatics, while offering significant benefits in terms of fuel production and chemical synthesis, also presents several environmental concerns that require careful assessment and mitigation strategies. The process inherently involves the transformation of hydrocarbon compounds, which can lead to various environmental impacts if not properly managed.

One of the primary environmental considerations is the potential for air pollution. The catalytic conversion process may release volatile organic compounds (VOCs) and other gaseous emissions into the atmosphere. These emissions can contribute to the formation of ground-level ozone and smog, which have detrimental effects on air quality and human health. Additionally, the release of aromatic compounds, such as benzene, toluene, and xylenes, poses specific health risks due to their carcinogenic properties.

Water pollution is another significant concern associated with this catalytic process. Wastewater generated during the conversion and subsequent product separation stages may contain trace amounts of hydrocarbons, catalysts, and other chemical compounds. If not adequately treated, these contaminants can potentially seep into groundwater or surface water bodies, affecting aquatic ecosystems and potentially entering the human water supply.

The production and disposal of spent catalysts also present environmental challenges. As catalysts degrade over time, they need to be replaced, generating solid waste that may contain heavy metals or other hazardous materials. Proper handling, recycling, or disposal of these spent catalysts is crucial to prevent soil contamination and minimize the environmental footprint of the process.

Energy consumption and greenhouse gas emissions are additional factors to consider in the environmental impact assessment. The catalytic conversion process typically requires high temperatures and pressures, resulting in significant energy demands. This energy consumption, if sourced from fossil fuels, contributes to carbon dioxide emissions and exacerbates climate change concerns.

To address these environmental impacts, various mitigation strategies can be implemented. Advanced emission control technologies, such as scrubbers and catalytic oxidizers, can be employed to reduce air pollutant emissions. Wastewater treatment systems can be optimized to remove hydrocarbon contaminants effectively. Catalyst recycling and regeneration processes can be developed to minimize waste generation and resource consumption.

Furthermore, life cycle assessment (LCA) studies should be conducted to evaluate the overall environmental impact of the catalytic conversion process, from raw material extraction to product use and disposal. This comprehensive approach allows for the identification of hotspots in the process where environmental improvements can be made most effectively.

Regulatory compliance is also a critical aspect of environmental impact assessment. The catalytic conversion process must adhere to local, national, and international environmental regulations, which may include emission limits, waste management protocols, and reporting requirements. Continuous monitoring and regular environmental audits are essential to ensure ongoing compliance and to identify opportunities for improvement in environmental performance.

One of the primary environmental considerations is the potential for air pollution. The catalytic conversion process may release volatile organic compounds (VOCs) and other gaseous emissions into the atmosphere. These emissions can contribute to the formation of ground-level ozone and smog, which have detrimental effects on air quality and human health. Additionally, the release of aromatic compounds, such as benzene, toluene, and xylenes, poses specific health risks due to their carcinogenic properties.

Water pollution is another significant concern associated with this catalytic process. Wastewater generated during the conversion and subsequent product separation stages may contain trace amounts of hydrocarbons, catalysts, and other chemical compounds. If not adequately treated, these contaminants can potentially seep into groundwater or surface water bodies, affecting aquatic ecosystems and potentially entering the human water supply.

The production and disposal of spent catalysts also present environmental challenges. As catalysts degrade over time, they need to be replaced, generating solid waste that may contain heavy metals or other hazardous materials. Proper handling, recycling, or disposal of these spent catalysts is crucial to prevent soil contamination and minimize the environmental footprint of the process.

Energy consumption and greenhouse gas emissions are additional factors to consider in the environmental impact assessment. The catalytic conversion process typically requires high temperatures and pressures, resulting in significant energy demands. This energy consumption, if sourced from fossil fuels, contributes to carbon dioxide emissions and exacerbates climate change concerns.

To address these environmental impacts, various mitigation strategies can be implemented. Advanced emission control technologies, such as scrubbers and catalytic oxidizers, can be employed to reduce air pollutant emissions. Wastewater treatment systems can be optimized to remove hydrocarbon contaminants effectively. Catalyst recycling and regeneration processes can be developed to minimize waste generation and resource consumption.

Furthermore, life cycle assessment (LCA) studies should be conducted to evaluate the overall environmental impact of the catalytic conversion process, from raw material extraction to product use and disposal. This comprehensive approach allows for the identification of hotspots in the process where environmental improvements can be made most effectively.

Regulatory compliance is also a critical aspect of environmental impact assessment. The catalytic conversion process must adhere to local, national, and international environmental regulations, which may include emission limits, waste management protocols, and reporting requirements. Continuous monitoring and regular environmental audits are essential to ensure ongoing compliance and to identify opportunities for improvement in environmental performance.

Process Economics and Scalability

The economic viability and scalability of the catalytic conversion of heptane to aromatics are crucial factors in determining the process's industrial applicability. The economics of this process are primarily driven by the cost of heptane feedstock, catalyst performance, and energy requirements. Heptane, being a relatively inexpensive hydrocarbon, provides a cost-effective starting material. However, the overall process economics heavily depend on the catalyst's efficiency and longevity.

Catalyst performance directly impacts the yield of aromatic products and the selectivity towards desired compounds. Higher conversion rates and selectivity translate to improved process economics. The stability of the catalyst over extended periods is equally important, as frequent catalyst regeneration or replacement can significantly increase operational costs. Advanced catalyst designs that exhibit prolonged activity and resistance to coking can substantially enhance the economic feasibility of the process.

Energy consumption is another critical factor affecting process economics. The conversion of heptane to aromatics typically requires high temperatures and pressures, necessitating significant energy input. Optimizing reactor designs and heat integration strategies can help minimize energy costs and improve overall efficiency. Additionally, the recovery and utilization of by-products, such as hydrogen, can contribute to the economic viability of the process.

Scalability considerations for this process involve several aspects. The ability to maintain catalyst performance and stability at larger scales is paramount. Laboratory-scale successes must be translated to pilot and industrial-scale operations without significant loss of efficiency. This scale-up process often requires modifications to reactor designs, catalyst formulations, and process conditions to achieve comparable results at larger scales.

Infrastructure requirements for large-scale implementation include specialized reactor vessels, separation units, and catalyst handling systems. The capital investment for such equipment can be substantial, necessitating a careful evaluation of return on investment. Furthermore, the availability of a consistent heptane supply chain and the market demand for aromatic products must be considered when assessing scalability.

Environmental regulations and sustainability concerns also play a role in the economics and scalability of the process. Emissions control, waste management, and compliance with environmental standards can add to the operational costs. However, the production of high-value aromatic compounds from relatively low-value heptane can potentially offset these additional expenses, making the process economically attractive despite regulatory challenges.

Catalyst performance directly impacts the yield of aromatic products and the selectivity towards desired compounds. Higher conversion rates and selectivity translate to improved process economics. The stability of the catalyst over extended periods is equally important, as frequent catalyst regeneration or replacement can significantly increase operational costs. Advanced catalyst designs that exhibit prolonged activity and resistance to coking can substantially enhance the economic feasibility of the process.

Energy consumption is another critical factor affecting process economics. The conversion of heptane to aromatics typically requires high temperatures and pressures, necessitating significant energy input. Optimizing reactor designs and heat integration strategies can help minimize energy costs and improve overall efficiency. Additionally, the recovery and utilization of by-products, such as hydrogen, can contribute to the economic viability of the process.

Scalability considerations for this process involve several aspects. The ability to maintain catalyst performance and stability at larger scales is paramount. Laboratory-scale successes must be translated to pilot and industrial-scale operations without significant loss of efficiency. This scale-up process often requires modifications to reactor designs, catalyst formulations, and process conditions to achieve comparable results at larger scales.

Infrastructure requirements for large-scale implementation include specialized reactor vessels, separation units, and catalyst handling systems. The capital investment for such equipment can be substantial, necessitating a careful evaluation of return on investment. Furthermore, the availability of a consistent heptane supply chain and the market demand for aromatic products must be considered when assessing scalability.

Environmental regulations and sustainability concerns also play a role in the economics and scalability of the process. Emissions control, waste management, and compliance with environmental standards can add to the operational costs. However, the production of high-value aromatic compounds from relatively low-value heptane can potentially offset these additional expenses, making the process economically attractive despite regulatory challenges.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!