Anode Materials For Chloride-Based Iron Electrolysis: Stability And Cost Tradeoffs

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Chloride-Based Iron Electrolysis Background and Objectives

Chloride-based iron electrolysis represents a revolutionary approach to steel production that promises significant reductions in carbon emissions compared to conventional blast furnace methods. This technology has evolved from early electrochemical concepts in the 1970s to become a potential cornerstone of green steel manufacturing in the 2020s. The fundamental principle involves using electricity to extract iron from iron chloride solutions, offering a pathway to decarbonize one of the most carbon-intensive industrial sectors globally.

The evolution of this technology has accelerated in recent years due to increasing environmental pressures and carbon pricing mechanisms. Traditional steelmaking accounts for approximately 7-9% of global CO2 emissions, creating urgent demand for alternative production methods. Chloride-based electrolysis has emerged as a promising solution due to its potential for operation using renewable electricity and elimination of coal-based reduction processes.

Key technological milestones include the development of molten salt electrolysis in the 1980s, aqueous electrolysis research in the early 2000s, and recent breakthroughs in electrode materials and cell designs since 2015. The field has seen exponential growth in patent filings over the past decade, indicating increasing commercial interest and technological maturity.

The primary technical objective of current research focuses on developing anode materials that balance stability in highly corrosive chloride environments with economic viability for industrial-scale implementation. Ideal anodes must withstand chlorine evolution reactions while maintaining structural integrity over thousands of operational hours. Additionally, these materials must be cost-effective enough to enable competitive production costs compared to conventional steel.

Secondary objectives include optimizing electrolyte composition to enhance conductivity and iron solubility, designing cell architectures that maximize energy efficiency, and developing strategies for handling chlorine gas byproducts. The ultimate goal is to create a scalable technology that can be integrated into existing steel production infrastructure while significantly reducing carbon emissions.

The technology trajectory suggests potential for commercial deployment within the next 5-10 years, contingent upon successful resolution of key materials challenges. Current research indicates that dimensionally stable anodes based on mixed metal oxides and carbon-based materials represent the most promising pathways, though significant improvements in durability and cost reduction remain necessary for widespread adoption.

The evolution of this technology has accelerated in recent years due to increasing environmental pressures and carbon pricing mechanisms. Traditional steelmaking accounts for approximately 7-9% of global CO2 emissions, creating urgent demand for alternative production methods. Chloride-based electrolysis has emerged as a promising solution due to its potential for operation using renewable electricity and elimination of coal-based reduction processes.

Key technological milestones include the development of molten salt electrolysis in the 1980s, aqueous electrolysis research in the early 2000s, and recent breakthroughs in electrode materials and cell designs since 2015. The field has seen exponential growth in patent filings over the past decade, indicating increasing commercial interest and technological maturity.

The primary technical objective of current research focuses on developing anode materials that balance stability in highly corrosive chloride environments with economic viability for industrial-scale implementation. Ideal anodes must withstand chlorine evolution reactions while maintaining structural integrity over thousands of operational hours. Additionally, these materials must be cost-effective enough to enable competitive production costs compared to conventional steel.

Secondary objectives include optimizing electrolyte composition to enhance conductivity and iron solubility, designing cell architectures that maximize energy efficiency, and developing strategies for handling chlorine gas byproducts. The ultimate goal is to create a scalable technology that can be integrated into existing steel production infrastructure while significantly reducing carbon emissions.

The technology trajectory suggests potential for commercial deployment within the next 5-10 years, contingent upon successful resolution of key materials challenges. Current research indicates that dimensionally stable anodes based on mixed metal oxides and carbon-based materials represent the most promising pathways, though significant improvements in durability and cost reduction remain necessary for widespread adoption.

Market Analysis for Green Steel Production

The global steel industry is experiencing a significant shift towards greener production methods, driven by increasing environmental regulations and corporate sustainability commitments. The market for green steel production technologies, particularly those involving chloride-based iron electrolysis, is projected to grow substantially over the next decade. Current estimates value the green steel market at approximately $2.5 billion, with expectations to reach $8.2 billion by 2030, representing a compound annual growth rate of 14.8%.

Demand for green steel is primarily driven by automotive, construction, and renewable energy sectors, which collectively account for over 65% of potential green steel consumption. The automotive industry, facing stringent emissions regulations, has shown particular interest in sourcing low-carbon steel, with several major manufacturers announcing commitments to incorporate green steel in their supply chains by 2025.

Regional analysis reveals Europe leading the green steel transition, with significant investments in pilot plants and commercial-scale facilities. The European Union's carbon border adjustment mechanism is expected to further accelerate adoption. China, despite being the largest steel producer globally, is gradually increasing investments in decarbonization technologies, including electrolysis methods.

The economic viability of chloride-based iron electrolysis is heavily influenced by anode material selection, which directly impacts operational costs and production efficiency. Current market analysis indicates that while initial capital expenditure for electrolysis facilities remains 30-40% higher than conventional blast furnaces, the total cost of ownership over a 20-year period becomes competitive when carbon pricing exceeds $50 per ton.

Investor interest in green steel technologies has grown substantially, with venture capital funding in the sector increasing by 215% between 2019 and 2022. Strategic partnerships between technology developers, steel producers, and end-users are emerging as the preferred commercialization pathway, reducing market entry barriers.

Customer willingness to pay premiums for green steel varies significantly by sector. Premium products in automotive and consumer goods demonstrate tolerance for 10-15% price increases, while construction and infrastructure segments remain highly price-sensitive, accepting only 2-5% premiums. This market segmentation necessitates differentiated pricing strategies for green steel producers.

The competitive landscape features both established steel manufacturers investing in decarbonization and technology-focused startups developing novel electrolysis approaches. The market structure is evolving toward a more fragmented ecosystem where specialized technology providers collaborate with traditional steel producers, creating new value chain dynamics and business models centered around sustainable production methods.

Demand for green steel is primarily driven by automotive, construction, and renewable energy sectors, which collectively account for over 65% of potential green steel consumption. The automotive industry, facing stringent emissions regulations, has shown particular interest in sourcing low-carbon steel, with several major manufacturers announcing commitments to incorporate green steel in their supply chains by 2025.

Regional analysis reveals Europe leading the green steel transition, with significant investments in pilot plants and commercial-scale facilities. The European Union's carbon border adjustment mechanism is expected to further accelerate adoption. China, despite being the largest steel producer globally, is gradually increasing investments in decarbonization technologies, including electrolysis methods.

The economic viability of chloride-based iron electrolysis is heavily influenced by anode material selection, which directly impacts operational costs and production efficiency. Current market analysis indicates that while initial capital expenditure for electrolysis facilities remains 30-40% higher than conventional blast furnaces, the total cost of ownership over a 20-year period becomes competitive when carbon pricing exceeds $50 per ton.

Investor interest in green steel technologies has grown substantially, with venture capital funding in the sector increasing by 215% between 2019 and 2022. Strategic partnerships between technology developers, steel producers, and end-users are emerging as the preferred commercialization pathway, reducing market entry barriers.

Customer willingness to pay premiums for green steel varies significantly by sector. Premium products in automotive and consumer goods demonstrate tolerance for 10-15% price increases, while construction and infrastructure segments remain highly price-sensitive, accepting only 2-5% premiums. This market segmentation necessitates differentiated pricing strategies for green steel producers.

The competitive landscape features both established steel manufacturers investing in decarbonization and technology-focused startups developing novel electrolysis approaches. The market structure is evolving toward a more fragmented ecosystem where specialized technology providers collaborate with traditional steel producers, creating new value chain dynamics and business models centered around sustainable production methods.

Current Anode Materials Challenges and Limitations

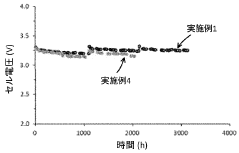

The current landscape of anode materials for chloride-based iron electrolysis presents several significant challenges that impede widespread commercial adoption. Dimensional stability remains a primary concern, as most anode materials undergo substantial degradation when exposed to the highly corrosive chloride environment. This degradation manifests as physical deformation, surface erosion, and structural failure, leading to decreased operational lifespans and increased maintenance requirements.

Corrosion resistance represents another critical limitation. The chloride-rich electrolyte creates an exceptionally aggressive environment that attacks conventional anode materials, resulting in accelerated dissolution rates and contamination of the electrolyte solution. Even materials traditionally considered corrosion-resistant, such as certain noble metals and their oxides, demonstrate compromised performance under these extreme conditions.

Electrical conductivity degradation over time presents a persistent challenge. As anodes corrode or develop passive layers, their electrical properties deteriorate, leading to increased cell voltage, reduced energy efficiency, and ultimately higher operational costs. This degradation often follows a non-linear pattern, making performance prediction and maintenance scheduling particularly difficult.

Cost considerations create a fundamental tension in material selection. While platinum group metals (PGMs) and their oxides offer superior stability, their prohibitive costs render them economically unviable for large-scale applications. Conversely, more affordable materials like carbon-based anodes or certain metal oxides fail to deliver acceptable durability, creating an unresolved stability-cost tradeoff that hampers industry adoption.

Manufacturing complexity further compounds these challenges. Advanced materials with promising laboratory performance often prove difficult to scale to industrial dimensions while maintaining consistent properties. Techniques for applying protective coatings or creating complex mixed-metal oxides require precise control and specialized equipment, increasing production costs and limiting supplier options.

Environmental and regulatory concerns add another dimension to material limitations. Certain potentially effective anode materials contain toxic elements that pose environmental risks through gradual leaching or disposal challenges. Increasingly stringent regulations regarding heavy metals and other hazardous substances further restrict the available material palette.

The combined effect of these challenges has created a significant innovation bottleneck in the field. Despite substantial research efforts, the fundamental stability-cost tradeoff remains largely unresolved, with incremental improvements failing to achieve the breakthrough performance needed for widespread commercial viability of chloride-based iron electrolysis.

Corrosion resistance represents another critical limitation. The chloride-rich electrolyte creates an exceptionally aggressive environment that attacks conventional anode materials, resulting in accelerated dissolution rates and contamination of the electrolyte solution. Even materials traditionally considered corrosion-resistant, such as certain noble metals and their oxides, demonstrate compromised performance under these extreme conditions.

Electrical conductivity degradation over time presents a persistent challenge. As anodes corrode or develop passive layers, their electrical properties deteriorate, leading to increased cell voltage, reduced energy efficiency, and ultimately higher operational costs. This degradation often follows a non-linear pattern, making performance prediction and maintenance scheduling particularly difficult.

Cost considerations create a fundamental tension in material selection. While platinum group metals (PGMs) and their oxides offer superior stability, their prohibitive costs render them economically unviable for large-scale applications. Conversely, more affordable materials like carbon-based anodes or certain metal oxides fail to deliver acceptable durability, creating an unresolved stability-cost tradeoff that hampers industry adoption.

Manufacturing complexity further compounds these challenges. Advanced materials with promising laboratory performance often prove difficult to scale to industrial dimensions while maintaining consistent properties. Techniques for applying protective coatings or creating complex mixed-metal oxides require precise control and specialized equipment, increasing production costs and limiting supplier options.

Environmental and regulatory concerns add another dimension to material limitations. Certain potentially effective anode materials contain toxic elements that pose environmental risks through gradual leaching or disposal challenges. Increasingly stringent regulations regarding heavy metals and other hazardous substances further restrict the available material palette.

The combined effect of these challenges has created a significant innovation bottleneck in the field. Despite substantial research efforts, the fundamental stability-cost tradeoff remains largely unresolved, with incremental improvements failing to achieve the breakthrough performance needed for widespread commercial viability of chloride-based iron electrolysis.

Current Anode Material Solutions and Tradeoffs

01 Titanium-based anode materials

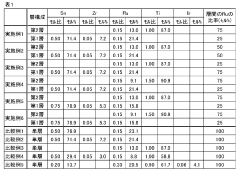

Titanium and its alloys are widely used as anode materials in chloride-based iron electrolysis due to their excellent corrosion resistance in chloride environments. These materials can be coated with noble metals or metal oxides to enhance their conductivity and stability. While titanium-based anodes have higher initial costs compared to other materials, their long service life and stability in aggressive chloride environments make them cost-effective in the long term.- Titanium-based anode materials: Titanium-based materials are widely used as anodes in chloride-based iron electrolysis due to their excellent corrosion resistance in chloride environments. These anodes often incorporate noble metal coatings such as ruthenium, iridium, or platinum to enhance conductivity and catalytic activity. The titanium substrate provides structural stability while the noble metal coating prevents passivation and extends service life, offering a balance between performance and cost-effectiveness for industrial applications.

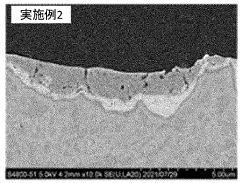

- Mixed metal oxide (MMO) anodes: Mixed metal oxide anodes combine various metal oxides to achieve optimal performance in chloride-based iron electrolysis. Typically consisting of base metals like titanium coated with oxides of iridium, ruthenium, tantalum, or tin, these anodes offer enhanced stability in aggressive chloride environments. The synergistic effect of different metal oxides improves catalytic activity while reducing manufacturing costs compared to pure noble metal anodes, making them economically viable for large-scale industrial applications.

- Carbon-based anode materials: Carbon-based materials serve as cost-effective anode options for chloride-based iron electrolysis. These include graphite, carbon fiber, and advanced carbon composites that offer good electrical conductivity and moderate chemical stability. While less resistant to chloride corrosion than metal-based alternatives, their significantly lower cost makes them attractive for certain applications. Various treatments and coatings can be applied to enhance their durability and performance, extending service life while maintaining economic advantages in specific electrolysis conditions.

- Ceramic and dimensionally stable anodes: Ceramic and dimensionally stable anodes (DSA) provide exceptional stability in aggressive chloride environments. These anodes typically consist of ceramic substrates or metal oxides that maintain their physical dimensions during prolonged electrolysis. Their resistance to dimensional changes prevents performance degradation over time, ensuring consistent electrolysis efficiency. While initial manufacturing costs may be higher, their extended operational lifespan and reduced maintenance requirements offer favorable long-term economics for industrial chloride-based iron electrolysis processes.

- Novel composite and coated anode materials: Emerging composite and coated anode materials combine advanced manufacturing techniques with innovative material combinations to address both stability and cost concerns in chloride-based iron electrolysis. These include nanomaterial-enhanced coatings, ceramic-metal composites, and specialized surface treatments that improve corrosion resistance while maintaining high conductivity. By strategically incorporating small amounts of expensive catalytic materials as thin coatings on less costly substrates, these anodes achieve optimal performance characteristics while minimizing the use of expensive components.

02 Mixed metal oxide (MMO) coatings

Mixed metal oxide coatings, particularly those containing ruthenium, iridium, and titanium oxides, significantly improve the performance and lifespan of anodes in chloride-based iron electrolysis. These coatings provide excellent electrocatalytic properties, reducing the overpotential required for the chlorine evolution reaction. The dimensional stability of these anodes under harsh electrolysis conditions makes them economically viable despite their higher initial cost compared to traditional materials.Expand Specific Solutions03 Carbon-based anode materials

Carbon-based materials, including graphite and various forms of carbon composites, offer a cost-effective alternative for anodes in chloride-based iron electrolysis. These materials are relatively inexpensive compared to noble metal-coated anodes. However, they typically have lower stability in chloride environments and may require more frequent replacement. Modifications with protective coatings or dopants can improve their resistance to chloride corrosion while maintaining their cost advantage.Expand Specific Solutions04 Ceramic and valve metal anodes

Ceramic materials and valve metals such as niobium and tantalum show promising stability in chloride-based electrolysis systems. These materials can withstand the aggressive conditions of iron chloride electrolysis while maintaining structural integrity. Ceramic-metal composites (cermets) combine the corrosion resistance of ceramics with the conductivity of metals, offering a balance between performance and cost. These materials are particularly suitable for applications requiring long-term stability under harsh operating conditions.Expand Specific Solutions05 Cost-effective coating techniques

Various coating techniques have been developed to improve the cost-effectiveness of anodes for chloride-based iron electrolysis. These include electrodeposition, thermal spraying, and sol-gel methods that allow for thinner, more uniform coatings of expensive catalytic materials. By optimizing the coating process, the amount of costly noble metals can be reduced while maintaining performance. Additionally, multilayer coating structures can extend anode lifespan by providing sacrificial layers that protect the underlying substrate from corrosion.Expand Specific Solutions

Key Industry Players in Iron Electrolysis

The chloride-based iron electrolysis market is in an early growth phase, characterized by increasing research activity but limited commercial deployment. The technology represents a promising pathway for green steel production, with a projected market size reaching $5-7 billion by 2030 as decarbonization efforts intensify. Technical maturity varies significantly among key players. Industry leaders like Industrie De Nora and AGC have established expertise in electrode materials and chlor-alkali technologies, while Form Energy is pioneering iron-air battery applications. Academic institutions (Zhejiang University of Technology, Wuhan University) are advancing fundamental research. Traditional metals companies (Norsk Hydro, Kobe Steel) are exploring applications within existing production frameworks. The primary technical challenge remains developing anode materials that balance corrosion resistance in chloride environments with cost-effectiveness, creating opportunities for specialized materials companies.

Industrie De Nora SpA

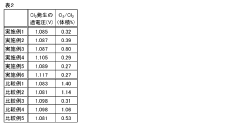

Technical Solution: Industrie De Nora has developed advanced DSA (Dimensionally Stable Anode) technology specifically engineered for chloride-based iron electrolysis. Their proprietary coating system consists of mixed metal oxides (primarily ruthenium, iridium, and titanium) applied to titanium substrates through thermal decomposition processes. This creates a highly conductive, corrosion-resistant surface that maintains stability in aggressive chloride environments. De Nora's anodes incorporate a gradient coating structure with optimized composition ratios that enhance chlorine evolution reaction (CER) efficiency while minimizing oxygen evolution. Their manufacturing process includes precise control of coating thickness (typically 10-15 μm) and thermal treatment protocols that ensure uniform distribution of active components and strong adhesion to the substrate, resulting in anodes with operational lifespans exceeding 4-6 years in industrial chlor-alkali applications.

Strengths: Industry-leading durability in chloride environments with documented performance in commercial chlor-alkali plants; proprietary coating technology with optimized electrocatalytic properties; established manufacturing infrastructure for consistent quality. Weaknesses: Higher initial capital cost compared to carbon-based alternatives; contains precious metals (ruthenium/iridium) subject to price volatility and supply constraints; requires specialized recoating processes at end-of-life.

Kunming Hendera Science & Technology Co., Ltd.

Technical Solution: Kunming Hendera has developed ceramic-based composite anodes specifically designed for chloride-based iron electrolysis. Their technology utilizes a core-shell structure with a conductive ceramic substrate (typically tin-doped indium oxide or antimony-doped tin oxide) coated with a mixed oxide layer containing manganese, cobalt, and iron oxides. This approach provides excellent corrosion resistance in chloride media while maintaining high electrical conductivity. The company's manufacturing process involves advanced powder metallurgy techniques, including controlled sintering at temperatures exceeding 1200°C, followed by specialized surface treatments to enhance electrocatalytic activity. Their anodes demonstrate chlorine evolution efficiency of approximately 95% with minimal side reactions, and laboratory testing shows stability for over 5,000 hours of continuous operation in concentrated chloride solutions at current densities up to 3 kA/m². The ceramic-based design eliminates the need for precious metal catalysts, significantly reducing material costs compared to traditional DSA technology.

Strengths: Cost-effective alternative to precious metal-based anodes; excellent stability in chloride environments; environmentally friendly composition using abundant materials; scalable manufacturing process. Weaknesses: Lower electrical conductivity compared to metal-based anodes requiring higher operating voltages; more brittle physical properties creating handling and installation challenges; limited commercial-scale operational history compared to established technologies.

Critical Patents in Chloride Electrolysis Anode Materials

anode FOR CHLORINE ELECTROLYTIC EVOLUTION

PatentInactiveID201600054A

Innovation

- Alternating layer structure with two different compositions: one layer comprising iridium oxide, ruthenium and valve metal (tantalum), and another layer comprising iridium oxide, ruthenium and tin.

- Combination of materials that simultaneously optimizes both anode potential and selectivity for chlorine evolution reaction.

- Integration of tin in the outer layer composition to enhance selectivity while maintaining valve metal in the inner layer for stability.

Positive electrode for chlorine generation electrolysis

PatentWO2024127921A1

Innovation

- A titanium-based anode with a catalyst layer comprising a laminated structure of ruthenium, tin, and zirconium oxides, along with titanium oxides, is developed, optimizing the composition to achieve low overvoltage and high chlorine generation efficiency without using iridium.

Environmental Impact Assessment of Electrolytic Iron Production

The environmental impact of electrolytic iron production using chloride-based systems is significantly influenced by the choice of anode materials, which presents important sustainability considerations alongside the stability and cost tradeoffs. Conventional iron production methods, particularly blast furnace processes, are responsible for approximately 7-9% of global CO2 emissions. Electrolytic iron production offers a potentially cleaner alternative, but its environmental profile depends heavily on anode material selection.

Carbon-based anodes, while cost-effective, generate CO2 during operation, partially offsetting the environmental benefits of electrolytic processes. In contrast, dimensionally stable anodes (DSAs) such as mixed metal oxides and precious metal-coated titanium substrates produce oxygen instead of carbon dioxide, substantially reducing the carbon footprint of the process. However, these environmentally superior options come with higher initial investment costs and potential resource scarcity concerns.

The chloride environment in these electrolytic cells presents unique environmental challenges. Chlorine gas evolution at the anode represents a significant environmental and safety hazard that must be carefully managed. Materials that minimize chlorine evolution in favor of oxygen evolution provide substantial environmental advantages but often face accelerated degradation in chloride media, leading to shorter operational lifespans and increased material consumption over time.

Life cycle assessment (LCA) studies indicate that the environmental impact of anode materials extends beyond operational emissions to include extraction and manufacturing processes. Platinum group metals used in high-performance anodes have intensive mining footprints, while ceramic oxide anodes may require energy-intensive sintering processes. These upstream environmental costs must be balanced against operational benefits when evaluating overall sustainability.

Energy efficiency represents another critical environmental factor. More stable anode materials typically offer lower overpotentials, reducing electricity consumption during operation. Given that electricity generation remains carbon-intensive in many regions, improved energy efficiency translates directly to reduced greenhouse gas emissions. Research indicates that a 10% improvement in anode efficiency could reduce the carbon footprint of electrolytic iron production by 5-8% in regions with average grid carbon intensity.

Water usage and wastewater management present additional environmental considerations. Certain anode materials may release metal ions during degradation, potentially requiring more extensive wastewater treatment systems. Ceramic-based anodes generally demonstrate superior performance in this regard, minimizing contamination of process streams and reducing water treatment requirements.

The environmental assessment must also consider end-of-life scenarios for spent anodes. Materials that enable effective recycling pathways offer significant advantages in reducing waste and conserving critical resources. Precious metal anodes, despite their higher initial environmental footprint, often allow for more complete material recovery compared to composite or ceramic alternatives.

Carbon-based anodes, while cost-effective, generate CO2 during operation, partially offsetting the environmental benefits of electrolytic processes. In contrast, dimensionally stable anodes (DSAs) such as mixed metal oxides and precious metal-coated titanium substrates produce oxygen instead of carbon dioxide, substantially reducing the carbon footprint of the process. However, these environmentally superior options come with higher initial investment costs and potential resource scarcity concerns.

The chloride environment in these electrolytic cells presents unique environmental challenges. Chlorine gas evolution at the anode represents a significant environmental and safety hazard that must be carefully managed. Materials that minimize chlorine evolution in favor of oxygen evolution provide substantial environmental advantages but often face accelerated degradation in chloride media, leading to shorter operational lifespans and increased material consumption over time.

Life cycle assessment (LCA) studies indicate that the environmental impact of anode materials extends beyond operational emissions to include extraction and manufacturing processes. Platinum group metals used in high-performance anodes have intensive mining footprints, while ceramic oxide anodes may require energy-intensive sintering processes. These upstream environmental costs must be balanced against operational benefits when evaluating overall sustainability.

Energy efficiency represents another critical environmental factor. More stable anode materials typically offer lower overpotentials, reducing electricity consumption during operation. Given that electricity generation remains carbon-intensive in many regions, improved energy efficiency translates directly to reduced greenhouse gas emissions. Research indicates that a 10% improvement in anode efficiency could reduce the carbon footprint of electrolytic iron production by 5-8% in regions with average grid carbon intensity.

Water usage and wastewater management present additional environmental considerations. Certain anode materials may release metal ions during degradation, potentially requiring more extensive wastewater treatment systems. Ceramic-based anodes generally demonstrate superior performance in this regard, minimizing contamination of process streams and reducing water treatment requirements.

The environmental assessment must also consider end-of-life scenarios for spent anodes. Materials that enable effective recycling pathways offer significant advantages in reducing waste and conserving critical resources. Precious metal anodes, despite their higher initial environmental footprint, often allow for more complete material recovery compared to composite or ceramic alternatives.

Economic Feasibility and Scaling Considerations

The economic feasibility of chloride-based iron electrolysis is heavily dependent on anode material selection, which directly impacts both capital expenditure and operational costs. Current market analysis indicates that dimensionally stable anodes (DSAs) with noble metal coatings represent approximately 15-20% of the total capital cost for industrial-scale electrolysis systems. This significant investment necessitates careful consideration of lifetime value rather than focusing solely on initial acquisition costs.

Cost modeling across various anode materials reveals a complex relationship between durability and economic viability. Platinum-based anodes, while offering superior stability in chloride environments with degradation rates below 1 μm/year, command premium pricing at $30,000-50,000 per square meter of active surface. Mixed metal oxide (MMO) anodes present a middle-ground option at $5,000-15,000 per square meter, with moderate degradation rates of 5-15 μm/year in aggressive chloride media.

Scaling considerations introduce additional economic complexities beyond material costs. As production scales increase from laboratory (0.1-1 m²) to industrial levels (100-1000 m²), economies of scale reduce per-unit anode costs by approximately 30-40%. However, this advantage is partially offset by increased replacement frequency in large-scale operations due to higher current densities and more aggressive operating conditions.

Lifecycle cost analysis demonstrates that lower-cost carbon-based anodes, despite their attractive initial price point of $500-2,000 per square meter, often result in higher total ownership costs due to frequent replacement requirements and associated production downtime. Each replacement cycle can incur 24-72 hours of system downtime, translating to production losses of $10,000-50,000 per day depending on facility scale.

Energy efficiency considerations further complicate the economic equation. Higher-quality anode materials typically offer reduced overpotential, saving 0.2-0.5 kWh per kilogram of iron produced. At industrial scales processing 50-100 tons daily, this efficiency difference represents annual energy cost variations of $500,000-1,200,000, significantly influencing the total cost of ownership calculation.

Market projections suggest that emerging ceramic-based composite anodes may offer the optimal balance between cost and performance for widespread commercial adoption. These materials, currently in advanced development stages, promise 80% of the performance of noble metal anodes at approximately 30% of the cost, potentially reducing the payback period for chloride-based iron electrolysis systems from 7-9 years to 4-5 years, making the technology considerably more attractive for industrial implementation.

Cost modeling across various anode materials reveals a complex relationship between durability and economic viability. Platinum-based anodes, while offering superior stability in chloride environments with degradation rates below 1 μm/year, command premium pricing at $30,000-50,000 per square meter of active surface. Mixed metal oxide (MMO) anodes present a middle-ground option at $5,000-15,000 per square meter, with moderate degradation rates of 5-15 μm/year in aggressive chloride media.

Scaling considerations introduce additional economic complexities beyond material costs. As production scales increase from laboratory (0.1-1 m²) to industrial levels (100-1000 m²), economies of scale reduce per-unit anode costs by approximately 30-40%. However, this advantage is partially offset by increased replacement frequency in large-scale operations due to higher current densities and more aggressive operating conditions.

Lifecycle cost analysis demonstrates that lower-cost carbon-based anodes, despite their attractive initial price point of $500-2,000 per square meter, often result in higher total ownership costs due to frequent replacement requirements and associated production downtime. Each replacement cycle can incur 24-72 hours of system downtime, translating to production losses of $10,000-50,000 per day depending on facility scale.

Energy efficiency considerations further complicate the economic equation. Higher-quality anode materials typically offer reduced overpotential, saving 0.2-0.5 kWh per kilogram of iron produced. At industrial scales processing 50-100 tons daily, this efficiency difference represents annual energy cost variations of $500,000-1,200,000, significantly influencing the total cost of ownership calculation.

Market projections suggest that emerging ceramic-based composite anodes may offer the optimal balance between cost and performance for widespread commercial adoption. These materials, currently in advanced development stages, promise 80% of the performance of noble metal anodes at approximately 30% of the cost, potentially reducing the payback period for chloride-based iron electrolysis systems from 7-9 years to 4-5 years, making the technology considerably more attractive for industrial implementation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!