Recovery And Valorization Of Co-Products From Electrochemical Iron Processes

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrochemical Iron Co-Products: Background and Objectives

Electrochemical iron production has evolved significantly over the past century, transitioning from traditional pyrometallurgical processes to more environmentally conscious electrochemical methods. This technological evolution has been driven by increasing environmental regulations, resource scarcity, and the pursuit of energy efficiency in metal production. The electrochemical approach offers distinct advantages in terms of reduced carbon emissions and energy consumption compared to conventional blast furnace operations, positioning it as a promising alternative for sustainable iron production.

During electrochemical iron processing, various co-products are generated, including iron hydroxides, iron oxides, spent electrolytes, and metal-rich sludges. Historically, these materials were considered waste streams and often disposed of in landfills or tailings ponds, creating significant environmental liabilities and representing lost economic value. The recognition of these co-products as potential resources rather than waste has gained momentum only in the past two decades.

The primary objective of this technical research is to comprehensively evaluate the recovery and valorization pathways for co-products generated during electrochemical iron production. We aim to identify economically viable and environmentally sustainable methods to transform these secondary streams into marketable products, thereby creating circular economy opportunities within the iron and steel sector. This includes assessing the technical feasibility of various recovery processes, their economic implications, and their environmental footprints.

Current technological developments in materials science, advanced separation techniques, and catalysis have opened new possibilities for co-product valorization. These innovations enable the extraction of high-purity compounds suitable for applications in catalysts, pigments, water treatment agents, and even precursors for battery materials. The growing market demand for sustainably sourced materials further enhances the strategic importance of developing these recovery technologies.

The global transition toward carbon neutrality presents both challenges and opportunities for the iron and steel industry. As one of the most carbon-intensive industrial sectors, it faces mounting pressure to reduce emissions. Co-product recovery and valorization represent a dual opportunity to reduce waste and develop alternative revenue streams, potentially offsetting some costs associated with decarbonization efforts.

This research also aims to establish a technological roadmap for the integration of co-product recovery systems into existing and future electrochemical iron production facilities. By identifying key technological barriers, research priorities, and implementation strategies, we seek to accelerate the adoption of circular economy principles in this critical industrial sector and contribute to its sustainable transformation.

During electrochemical iron processing, various co-products are generated, including iron hydroxides, iron oxides, spent electrolytes, and metal-rich sludges. Historically, these materials were considered waste streams and often disposed of in landfills or tailings ponds, creating significant environmental liabilities and representing lost economic value. The recognition of these co-products as potential resources rather than waste has gained momentum only in the past two decades.

The primary objective of this technical research is to comprehensively evaluate the recovery and valorization pathways for co-products generated during electrochemical iron production. We aim to identify economically viable and environmentally sustainable methods to transform these secondary streams into marketable products, thereby creating circular economy opportunities within the iron and steel sector. This includes assessing the technical feasibility of various recovery processes, their economic implications, and their environmental footprints.

Current technological developments in materials science, advanced separation techniques, and catalysis have opened new possibilities for co-product valorization. These innovations enable the extraction of high-purity compounds suitable for applications in catalysts, pigments, water treatment agents, and even precursors for battery materials. The growing market demand for sustainably sourced materials further enhances the strategic importance of developing these recovery technologies.

The global transition toward carbon neutrality presents both challenges and opportunities for the iron and steel industry. As one of the most carbon-intensive industrial sectors, it faces mounting pressure to reduce emissions. Co-product recovery and valorization represent a dual opportunity to reduce waste and develop alternative revenue streams, potentially offsetting some costs associated with decarbonization efforts.

This research also aims to establish a technological roadmap for the integration of co-product recovery systems into existing and future electrochemical iron production facilities. By identifying key technological barriers, research priorities, and implementation strategies, we seek to accelerate the adoption of circular economy principles in this critical industrial sector and contribute to its sustainable transformation.

Market Analysis for Recovered Iron Process By-products

The global market for by-products recovered from electrochemical iron processes has been experiencing significant growth, driven by increasing environmental regulations and the push towards circular economy principles. Currently, the market size for these recovered materials is estimated at $3.2 billion annually, with a projected compound annual growth rate of 6.8% through 2028. This growth trajectory reflects the industrial sector's increasing recognition of the economic value embedded in what was previously considered waste material.

Iron oxide derivatives represent the largest segment of recovered by-products, accounting for approximately 45% of the total market value. These materials find extensive applications in pigments, catalysts, magnetic materials, and construction additives. The pigment industry alone consumes about 28% of recovered iron oxides, particularly valuing the consistent quality and lower carbon footprint compared to virgin materials.

Hydrogen, a valuable co-product from certain electrochemical iron processes, has emerged as the fastest-growing segment with 12.3% annual growth. This acceleration aligns with the expanding hydrogen economy and its applications in clean energy systems. Industrial gas companies and renewable energy providers have become significant purchasers of process-derived hydrogen, creating new revenue streams for iron producers.

Regionally, Asia-Pacific dominates the market consumption of recovered iron process by-products, representing 42% of global demand. This is primarily driven by China's massive steel industry and stringent environmental regulations in Japan and South Korea. Europe follows at 31%, where the European Green Deal has created favorable conditions for by-product valorization through regulatory incentives and carbon pricing mechanisms.

The construction sector remains the largest end-user of recovered iron process by-products, consuming approximately 38% of total production volume. However, high-tech applications in electronics and advanced materials are showing the highest value growth at 9.7% annually, as these industries seek specialized iron compounds with precise specifications that can be derived from controlled electrochemical processes.

Market analysis indicates that price premiums for environmentally certified recovered materials range from 5-15% above conventional alternatives, reflecting growing consumer willingness to pay for sustainable products. This trend is particularly pronounced in European and North American markets, where green procurement policies increasingly favor materials with demonstrated circular economy credentials.

Iron oxide derivatives represent the largest segment of recovered by-products, accounting for approximately 45% of the total market value. These materials find extensive applications in pigments, catalysts, magnetic materials, and construction additives. The pigment industry alone consumes about 28% of recovered iron oxides, particularly valuing the consistent quality and lower carbon footprint compared to virgin materials.

Hydrogen, a valuable co-product from certain electrochemical iron processes, has emerged as the fastest-growing segment with 12.3% annual growth. This acceleration aligns with the expanding hydrogen economy and its applications in clean energy systems. Industrial gas companies and renewable energy providers have become significant purchasers of process-derived hydrogen, creating new revenue streams for iron producers.

Regionally, Asia-Pacific dominates the market consumption of recovered iron process by-products, representing 42% of global demand. This is primarily driven by China's massive steel industry and stringent environmental regulations in Japan and South Korea. Europe follows at 31%, where the European Green Deal has created favorable conditions for by-product valorization through regulatory incentives and carbon pricing mechanisms.

The construction sector remains the largest end-user of recovered iron process by-products, consuming approximately 38% of total production volume. However, high-tech applications in electronics and advanced materials are showing the highest value growth at 9.7% annually, as these industries seek specialized iron compounds with precise specifications that can be derived from controlled electrochemical processes.

Market analysis indicates that price premiums for environmentally certified recovered materials range from 5-15% above conventional alternatives, reflecting growing consumer willingness to pay for sustainable products. This trend is particularly pronounced in European and North American markets, where green procurement policies increasingly favor materials with demonstrated circular economy credentials.

Technical Challenges in Co-Product Recovery Systems

The recovery of co-products from electrochemical iron processes presents significant technical challenges that must be addressed to achieve efficient and economically viable operations. One of the primary obstacles is the complex composition of process streams, which often contain multiple metallic species, organic compounds, and varying concentrations of acids or bases. This heterogeneity complicates separation processes and requires sophisticated analytical techniques for accurate characterization.

Selective recovery of valuable components represents another major challenge. Current technologies struggle to achieve high selectivity when targeting specific metals or compounds in mixed streams. This is particularly evident in electrowinning and electrorefining processes where impurities can co-deposit with the target metal, reducing product purity and recovery efficiency.

Energy consumption remains a critical concern in recovery systems. Many separation and purification techniques, such as electrodialysis, ion exchange, and advanced oxidation processes, demand significant electrical input. This high energy requirement can undermine the economic viability of co-product recovery, especially when processing dilute streams or targeting low-value components.

Scale formation and membrane fouling constitute persistent operational challenges. In electrochemical recovery systems, precipitates can form on electrode surfaces and membranes, reducing system efficiency and necessitating frequent maintenance. These issues are exacerbated when processing iron-rich solutions due to iron's tendency to form various oxide and hydroxide species under changing pH and redox conditions.

Process integration presents additional complexity. Retrofitting recovery systems into existing iron production facilities requires careful consideration of space constraints, material compatibility, and process interruption minimization. The integration must ensure that the recovery operations do not negatively impact the primary iron production process.

Waste management associated with recovery processes introduces further challenges. Secondary waste streams generated during co-product recovery may contain concentrated contaminants requiring specialized treatment before disposal. This creates a cascade of technical issues that must be addressed holistically.

Automation and control systems for co-product recovery operations remain underdeveloped. Real-time monitoring of multiple parameters (pH, conductivity, metal concentrations, etc.) and responsive control algorithms are necessary for optimizing recovery efficiency but are technically challenging to implement in the harsh chemical environments typical of iron processing.

Selective recovery of valuable components represents another major challenge. Current technologies struggle to achieve high selectivity when targeting specific metals or compounds in mixed streams. This is particularly evident in electrowinning and electrorefining processes where impurities can co-deposit with the target metal, reducing product purity and recovery efficiency.

Energy consumption remains a critical concern in recovery systems. Many separation and purification techniques, such as electrodialysis, ion exchange, and advanced oxidation processes, demand significant electrical input. This high energy requirement can undermine the economic viability of co-product recovery, especially when processing dilute streams or targeting low-value components.

Scale formation and membrane fouling constitute persistent operational challenges. In electrochemical recovery systems, precipitates can form on electrode surfaces and membranes, reducing system efficiency and necessitating frequent maintenance. These issues are exacerbated when processing iron-rich solutions due to iron's tendency to form various oxide and hydroxide species under changing pH and redox conditions.

Process integration presents additional complexity. Retrofitting recovery systems into existing iron production facilities requires careful consideration of space constraints, material compatibility, and process interruption minimization. The integration must ensure that the recovery operations do not negatively impact the primary iron production process.

Waste management associated with recovery processes introduces further challenges. Secondary waste streams generated during co-product recovery may contain concentrated contaminants requiring specialized treatment before disposal. This creates a cascade of technical issues that must be addressed holistically.

Automation and control systems for co-product recovery operations remain underdeveloped. Real-time monitoring of multiple parameters (pH, conductivity, metal concentrations, etc.) and responsive control algorithms are necessary for optimizing recovery efficiency but are technically challenging to implement in the harsh chemical environments typical of iron processing.

Current Recovery Technologies for Iron Process Co-Products

01 Recovery of hydrogen from electrochemical iron processes

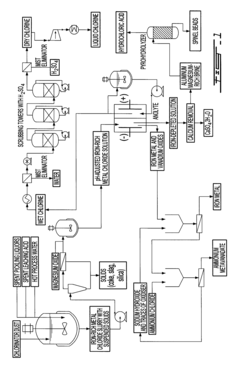

Hydrogen gas is a valuable co-product generated during electrochemical iron processing. Various methods have been developed to capture, purify, and utilize this hydrogen for energy production or as a chemical feedstock. These processes often involve gas collection systems integrated with the electrochemical cells, purification steps to remove impurities, and storage solutions. The recovered hydrogen can be used in fuel cells, as a reducing agent in other industrial processes, or for power generation, adding significant economic value to iron production operations.- Recovery of hydrogen from electrochemical iron processes: Hydrogen is a valuable co-product generated during electrochemical iron processing. Various methods have been developed to capture, purify, and utilize this hydrogen for energy production or as a chemical feedstock. The recovery systems typically involve gas collection apparatus that separate hydrogen from other process gases, followed by purification steps to achieve the desired quality. This recovered hydrogen can significantly improve the economic viability of electrochemical iron production while reducing environmental impact.

- Valorization of iron oxide byproducts: Electrochemical iron processes often generate iron oxide byproducts that can be recovered and valorized. These iron oxides, including hematite, magnetite, and various hydroxides, can be processed into valuable products such as pigments, catalysts, or feedstock for other industrial processes. Recovery methods typically involve separation, purification, and sometimes chemical transformation to enhance the value of these materials. The valorization of these byproducts contributes to circular economy principles by reducing waste and creating additional revenue streams.

- Recovery and utilization of electrolyte components: The electrolytes used in electrochemical iron processes contain valuable components that can be recovered and reused. These may include various salts, acids, and other chemical additives that facilitate the electrochemical reactions. Recovery systems typically involve filtration, crystallization, or other separation techniques to isolate these components from spent electrolytes. The recovered materials can be reintroduced into the process, reducing raw material costs and minimizing waste discharge. This approach enhances process sustainability while improving economic performance.

- Carbon capture and utilization from electrochemical iron production: Carbon dioxide and other carbon-containing compounds generated during electrochemical iron processes can be captured and utilized. Various technologies have been developed to separate CO2 from process gases, which can then be converted into valuable products such as carbonates, synthetic fuels, or chemical feedstocks. Some processes also integrate carbon capture directly into the electrochemical system design. These approaches not only reduce greenhouse gas emissions but also create additional value streams from what would otherwise be waste products.

- Recovery of metal impurities as valuable byproducts: Electrochemical iron processes often involve raw materials containing various metal impurities that can be recovered as valuable byproducts. These may include nickel, chromium, manganese, and other metals that concentrate in specific process streams. Specialized recovery techniques such as selective precipitation, ion exchange, or electrowinning can be employed to isolate these metals in marketable forms. The recovery of these metal byproducts not only generates additional revenue but also produces higher purity iron while reducing environmental contamination from waste disposal.

02 Metal oxide byproduct recovery and utilization

Electrochemical iron processes generate various metal oxide byproducts that can be recovered and valorized. These include iron oxides, mixed metal oxides, and other metallic compounds that precipitate during processing. Recovery methods include filtration, precipitation, and separation techniques. The recovered oxides can be repurposed as pigments, catalysts, magnetic materials, or feedstock for other metallurgical processes. This approach not only reduces waste disposal costs but creates additional revenue streams from what would otherwise be considered waste material.Expand Specific Solutions03 Electrolyte regeneration and valuable element extraction

The electrolytes used in electrochemical iron processes contain valuable elements that can be recovered through regeneration processes. These elements include various metals, salts, and chemical compounds that accumulate during operation. Techniques such as crystallization, selective precipitation, ion exchange, and membrane separation allow for the extraction of these valuable components. The regenerated electrolytes can be reused in the process, while the extracted elements can be sold as separate products, improving the overall economics of the electrochemical iron production.Expand Specific Solutions04 Carbon-based byproduct valorization

Carbon-based byproducts from electrochemical iron processes can be recovered and valorized through various methods. These byproducts include carbon particles, graphite, and carbon-containing compounds that form during processing. Recovery techniques include filtration, flotation, and thermal treatment. The recovered carbon materials can be utilized in applications such as electrode materials, carbon additives for steel production, adsorbents, or precursors for advanced carbon materials. This approach transforms potential waste streams into valuable products while reducing the environmental footprint of iron production.Expand Specific Solutions05 Integrated waste heat and energy recovery systems

Electrochemical iron processes generate significant amounts of waste heat and energy that can be recovered and valorized. Heat recovery systems capture thermal energy from electrolyte solutions, cell components, and process equipment. This recovered energy can be used for preheating process inputs, generating steam for power production, or supporting other thermal processes within the facility. Additionally, pressure energy from gas evolution can be harnessed. These integrated energy recovery systems improve overall process efficiency, reduce operating costs, and decrease the carbon footprint of electrochemical iron production.Expand Specific Solutions

Industry Leaders in Electrochemical Iron Processing

The electrochemical iron processing industry is currently in a growth phase, driven by increasing demand for sustainable metallurgical processes and resource recovery. The market is expanding rapidly with an estimated value exceeding $2 billion annually, fueled by circular economy initiatives and stringent environmental regulations. Technologically, the field shows varying maturity levels across different applications. Leading players include POSCO Holdings and its research arm RIST, who have developed advanced co-product recovery systems, while Electra and Form Energy are pioneering innovative electrochemical iron production methods. Established metallurgical companies like Freeport-McMoRan and Korea Zinc contribute significant expertise in metal recovery processes. Research institutions such as the Chinese Academy of Sciences and academic partners are accelerating technological advancement through collaborative R&D efforts focusing on process optimization and novel valorization pathways.

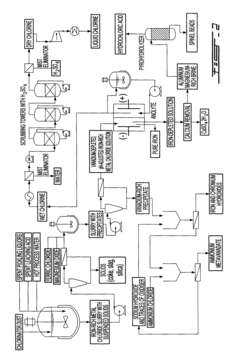

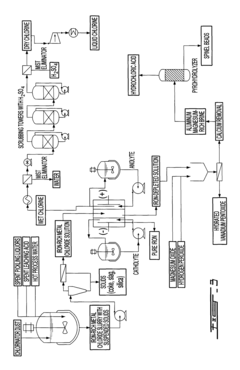

POSCO Holdings, Inc.

Technical Solution: POSCO has developed an innovative electrochemical iron process called FINEX that generates valuable co-products. Their recovery system captures and processes iron-rich dust and sludge from electrochemical operations, recovering over 90% of iron content while simultaneously extracting valuable metals like zinc and lead. The process employs selective leaching techniques with controlled pH environments to separate different metal species. POSCO's closed-loop water treatment system also recovers and reuses process water, reducing freshwater consumption by approximately 30%. Additionally, their slag valorization technology converts slag into construction materials and soil amendments, achieving near-zero waste operations. The company has implemented carbon capture systems that convert CO2 emissions into valuable carbonates used in construction materials, effectively reducing carbon footprint while creating marketable products.

Strengths: Integrated approach combining multiple recovery technologies in a single system; high recovery rates for iron and other valuable metals; significant reduction in waste disposal costs and environmental impact. Weaknesses: High initial capital investment required; process complexity necessitates specialized operational expertise; energy-intensive recovery processes may offset some environmental benefits.

RIST (Research Institute of Industrial Science & Technology)

Technical Solution: RIST has pioneered an electrochemical iron recovery system that focuses on selective metal extraction from process residues. Their technology employs advanced electrowinning cells with specialized membrane technology to achieve high-purity metal recovery from iron-containing solutions. The process operates at lower temperatures (60-80°C) compared to traditional pyrometallurgical methods, resulting in energy savings of approximately 40%. RIST's system incorporates real-time monitoring and AI-controlled process parameters that optimize recovery rates based on feed composition variations. Their proprietary electrolyte formulation enhances conductivity while minimizing side reactions, achieving current efficiencies exceeding 85%. The process also includes a novel approach to handling impurities through selective precipitation steps before electrowinning, resulting in higher-grade recovered metals. RIST has successfully demonstrated the technology at pilot scale, processing up to 100 kg/day of iron-containing waste with recovery rates of 95% for iron and 80-90% for associated valuable metals.

Strengths: Lower energy consumption compared to conventional methods; high selectivity for target metals; modular design allows for scalable implementation; minimal chemical reagent requirements. Weaknesses: Membrane fouling can occur with certain waste streams; process sensitivity to feed composition fluctuations; higher operational complexity requiring skilled operators.

Key Patents in Electrochemical Valorization Techniques

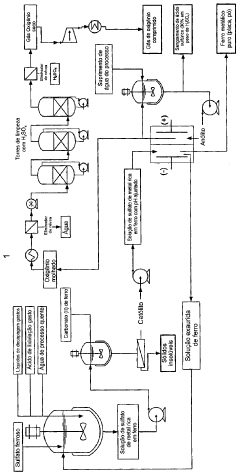

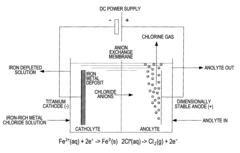

ELECTROCHEMICAL PROCESS FOR THE RECOVERY OF IRON METALLIC AND SULFURIC ACID VALUES FROM IRON-RICH SULFATE WASTE, MINING WASTE AND PICKLING LIQUIDS

PatentActiveBRPI0911653A2

Innovation

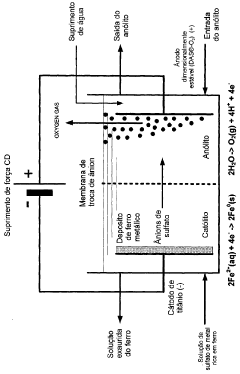

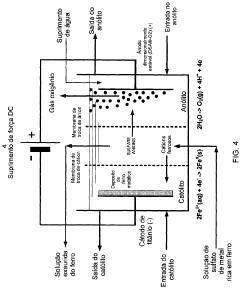

- An electrochemical process involving a two- or three-compartment electrolyser with a cathode having high hydrogen overpotential and a pH-adjusted iron-rich metal sulfate solution, allowing for simultaneous electrodeposition of iron or iron-rich alloys, accumulation of sulfuric acid, and evolution of oxygen gas.

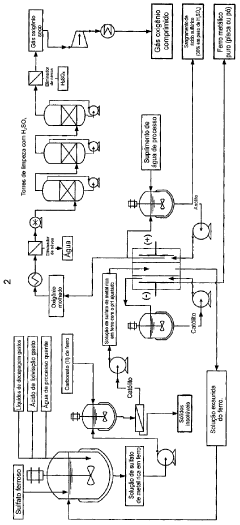

Electrochemical process for the recovery of metallic iron and chlorine values from iron-rich metal chloride wastes

PatentInactiveUS8784639B2

Innovation

- An electrochemical process involving a two- or three-compartment electrolyser with a cathode having high hydrogen overpotential and pH-adjusted catholyte, allowing for the electrodeposition of iron and evolution of chlorine gas from an iron-rich metal chloride solution, followed by recirculation of the depleted solution to enhance efficiency.

Environmental Impact Assessment of Recovery Processes

The environmental impact assessment of recovery processes for co-products from electrochemical iron processes reveals significant potential for reducing the industry's ecological footprint. Traditional iron and steel manufacturing generates substantial waste streams that contribute to environmental degradation through resource depletion, energy consumption, and pollution. Recovery processes offer a sustainable alternative by transforming these waste materials into valuable resources.

Life cycle assessment (LCA) studies indicate that implementing recovery systems for iron-containing sludges and slags can reduce greenhouse gas emissions by 15-30% compared to conventional disposal methods. This reduction stems primarily from avoiding the extraction and processing of virgin raw materials, which typically requires 3-5 times more energy than recovery processes.

Water pollution impacts are particularly noteworthy, as electrochemical iron processes traditionally generate effluents containing heavy metals and other contaminants. Advanced recovery technologies incorporating membrane filtration and electrochemical treatment can reduce wastewater toxicity by up to 85%, while simultaneously recovering valuable metals like chromium, nickel, and zinc for reuse.

Land use considerations demonstrate that recovery processes significantly reduce the need for landfill disposal. Quantitative assessments show that for every ton of material recovered, approximately 1.5-2 cubic meters of landfill space is preserved. This benefit becomes increasingly valuable as suitable landfill sites grow scarcer in industrialized regions.

Air quality improvements from recovery processes extend beyond reduced CO2 emissions to include decreased particulate matter, SOx, and NOx emissions. Thermal recovery processes must be carefully designed to prevent secondary air pollution, with modern systems achieving 90-95% reduction in harmful emissions through advanced scrubbing technologies.

Energy efficiency analyses reveal that while some recovery processes require significant energy inputs initially, the net energy balance becomes favorable when considering the full life cycle. Hydrometallurgical recovery routes typically consume 40-60% less energy than pyrometallurgical alternatives, though the latter may be more suitable for certain waste streams with complex compositions.

Biodiversity and ecosystem impacts must also be considered, particularly for recovery facilities located near sensitive habitats. Buffer zones, effluent management systems, and habitat restoration programs can effectively mitigate these concerns while maintaining economic viability of recovery operations.

Life cycle assessment (LCA) studies indicate that implementing recovery systems for iron-containing sludges and slags can reduce greenhouse gas emissions by 15-30% compared to conventional disposal methods. This reduction stems primarily from avoiding the extraction and processing of virgin raw materials, which typically requires 3-5 times more energy than recovery processes.

Water pollution impacts are particularly noteworthy, as electrochemical iron processes traditionally generate effluents containing heavy metals and other contaminants. Advanced recovery technologies incorporating membrane filtration and electrochemical treatment can reduce wastewater toxicity by up to 85%, while simultaneously recovering valuable metals like chromium, nickel, and zinc for reuse.

Land use considerations demonstrate that recovery processes significantly reduce the need for landfill disposal. Quantitative assessments show that for every ton of material recovered, approximately 1.5-2 cubic meters of landfill space is preserved. This benefit becomes increasingly valuable as suitable landfill sites grow scarcer in industrialized regions.

Air quality improvements from recovery processes extend beyond reduced CO2 emissions to include decreased particulate matter, SOx, and NOx emissions. Thermal recovery processes must be carefully designed to prevent secondary air pollution, with modern systems achieving 90-95% reduction in harmful emissions through advanced scrubbing technologies.

Energy efficiency analyses reveal that while some recovery processes require significant energy inputs initially, the net energy balance becomes favorable when considering the full life cycle. Hydrometallurgical recovery routes typically consume 40-60% less energy than pyrometallurgical alternatives, though the latter may be more suitable for certain waste streams with complex compositions.

Biodiversity and ecosystem impacts must also be considered, particularly for recovery facilities located near sensitive habitats. Buffer zones, effluent management systems, and habitat restoration programs can effectively mitigate these concerns while maintaining economic viability of recovery operations.

Economic Feasibility of Co-Product Valorization Systems

The economic feasibility of co-product valorization systems in electrochemical iron processes represents a critical factor in determining the viability of recovery initiatives. Current market analyses indicate that the implementation of comprehensive recovery systems can yield return on investment periods ranging from 2 to 5 years, depending on the scale of operations and the specific co-products targeted.

Primary economic drivers include the increasing market value of recovered materials such as iron oxides, hydrogen gas, and various metal salts, which collectively can offset up to 30% of operational costs in modern electrochemical iron processing facilities. The global market for recovered iron oxides alone is projected to reach $7.5 billion by 2028, growing at a CAGR of 4.8%.

Capital expenditure requirements for co-product valorization systems vary significantly based on technological sophistication. Basic recovery systems focusing on single co-product streams typically require investments of $1-3 million for medium-scale operations, while integrated multi-stream recovery systems may necessitate investments of $5-15 million. However, these higher initial costs generally correlate with improved recovery efficiencies and greater economic returns.

Operational expenditures present another crucial consideration, with energy consumption representing 40-60% of ongoing costs in most valorization systems. Recent technological advancements have reduced these energy requirements by approximately 25% compared to systems deployed five years ago, significantly improving long-term economic viability.

Sensitivity analyses reveal that economic feasibility is particularly dependent on three key variables: energy costs, market prices for recovered materials, and regulatory frameworks regarding waste disposal. Fluctuations in energy markets can alter profitability margins by up to 20%, while changes in regulatory requirements for waste management can either enhance or undermine the comparative advantage of recovery systems.

Government incentives and carbon credit mechanisms increasingly factor into economic calculations. In regions with strong environmental policies, these incentives can reduce effective payback periods by 15-30%, creating additional economic motivation for implementation. The integration of co-product valorization with carbon reduction strategies has demonstrated particular promise, with combined systems showing enhanced economic performance through regulatory compliance cost avoidance and carbon market participation.

Primary economic drivers include the increasing market value of recovered materials such as iron oxides, hydrogen gas, and various metal salts, which collectively can offset up to 30% of operational costs in modern electrochemical iron processing facilities. The global market for recovered iron oxides alone is projected to reach $7.5 billion by 2028, growing at a CAGR of 4.8%.

Capital expenditure requirements for co-product valorization systems vary significantly based on technological sophistication. Basic recovery systems focusing on single co-product streams typically require investments of $1-3 million for medium-scale operations, while integrated multi-stream recovery systems may necessitate investments of $5-15 million. However, these higher initial costs generally correlate with improved recovery efficiencies and greater economic returns.

Operational expenditures present another crucial consideration, with energy consumption representing 40-60% of ongoing costs in most valorization systems. Recent technological advancements have reduced these energy requirements by approximately 25% compared to systems deployed five years ago, significantly improving long-term economic viability.

Sensitivity analyses reveal that economic feasibility is particularly dependent on three key variables: energy costs, market prices for recovered materials, and regulatory frameworks regarding waste disposal. Fluctuations in energy markets can alter profitability margins by up to 20%, while changes in regulatory requirements for waste management can either enhance or undermine the comparative advantage of recovery systems.

Government incentives and carbon credit mechanisms increasingly factor into economic calculations. In regions with strong environmental policies, these incentives can reduce effective payback periods by 15-30%, creating additional economic motivation for implementation. The integration of co-product valorization with carbon reduction strategies has demonstrated particular promise, with combined systems showing enhanced economic performance through regulatory compliance cost avoidance and carbon market participation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!