Electrochemical Ironmaking Capital Expenditure Model And Sensitivity Analysis

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrochemical Ironmaking Background and Objectives

Electrochemical ironmaking represents a revolutionary approach to steel production that aims to significantly reduce carbon emissions in an industry traditionally known for its high environmental impact. The technology has evolved from early conceptual research in the 1990s to more sophisticated laboratory demonstrations in recent years. This evolution has been driven by increasing global pressure to decarbonize heavy industries, with the steel sector accounting for approximately 7-9% of global CO2 emissions. The trajectory of development has accelerated notably since 2015, with substantial research investments from both public and private sectors.

The primary objective of electrochemical ironmaking is to replace the conventional blast furnace process with an electricity-driven reduction method that eliminates the need for coal as a reducing agent. This fundamental shift promises to reduce direct CO2 emissions by up to 90% when powered by renewable electricity sources. Secondary objectives include developing processes that can integrate with existing steel mill infrastructure, operate economically at industrial scales, and produce iron of comparable quality to traditional methods.

Current technological approaches include molten oxide electrolysis, aqueous electrolysis, and solid oxide membrane technologies, each with distinct advantages and challenges. The field has seen significant breakthroughs in electrode materials, cell design, and process efficiency, though commercialization remains limited to pilot projects. Research institutions in Europe, North America, and East Asia have established themselves as leaders in this domain, with notable contributions from MIT, Boston Metal, ArcelorMittal, and various Chinese research institutes.

The economic viability of electrochemical ironmaking is heavily dependent on capital expenditure requirements, which currently exceed those of conventional blast furnaces. Understanding these capital costs and their sensitivity to various factors is crucial for strategic planning and investment decisions. Key variables affecting capital expenditure include electrode materials, cell design, scale of operation, and integration with existing infrastructure.

Looking forward, the technology is expected to reach commercial viability in the 2030s, contingent upon continued improvements in energy efficiency, electrode durability, and process scaling. The development timeline is being accelerated by supportive policy environments in many regions, including carbon pricing mechanisms and green steel incentives. The ultimate goal remains creating a cost-competitive, environmentally sustainable alternative to conventional ironmaking that can be widely adopted across the global steel industry.

The primary objective of electrochemical ironmaking is to replace the conventional blast furnace process with an electricity-driven reduction method that eliminates the need for coal as a reducing agent. This fundamental shift promises to reduce direct CO2 emissions by up to 90% when powered by renewable electricity sources. Secondary objectives include developing processes that can integrate with existing steel mill infrastructure, operate economically at industrial scales, and produce iron of comparable quality to traditional methods.

Current technological approaches include molten oxide electrolysis, aqueous electrolysis, and solid oxide membrane technologies, each with distinct advantages and challenges. The field has seen significant breakthroughs in electrode materials, cell design, and process efficiency, though commercialization remains limited to pilot projects. Research institutions in Europe, North America, and East Asia have established themselves as leaders in this domain, with notable contributions from MIT, Boston Metal, ArcelorMittal, and various Chinese research institutes.

The economic viability of electrochemical ironmaking is heavily dependent on capital expenditure requirements, which currently exceed those of conventional blast furnaces. Understanding these capital costs and their sensitivity to various factors is crucial for strategic planning and investment decisions. Key variables affecting capital expenditure include electrode materials, cell design, scale of operation, and integration with existing infrastructure.

Looking forward, the technology is expected to reach commercial viability in the 2030s, contingent upon continued improvements in energy efficiency, electrode durability, and process scaling. The development timeline is being accelerated by supportive policy environments in many regions, including carbon pricing mechanisms and green steel incentives. The ultimate goal remains creating a cost-competitive, environmentally sustainable alternative to conventional ironmaking that can be widely adopted across the global steel industry.

Market Demand Analysis for Low-Carbon Steelmaking

The global steel industry is experiencing a significant shift towards low-carbon production methods, driven by increasingly stringent environmental regulations and growing corporate sustainability commitments. Current market analysis indicates that traditional blast furnace-based steelmaking accounts for approximately 7-9% of global CO2 emissions, creating substantial demand for alternative production technologies like electrochemical ironmaking. This demand is particularly pronounced in regions with ambitious carbon reduction targets, including the European Union with its Carbon Border Adjustment Mechanism, China with its 2060 carbon neutrality goal, and North America with various state and federal climate initiatives.

Market research reveals that major steel producers are actively seeking capital-efficient pathways to decarbonize their operations while maintaining competitive production costs. The potential market for low-carbon steelmaking technologies is projected to grow substantially, with industry forecasts suggesting that green steel production could capture 25-30% of the global steel market by 2050, representing a value opportunity exceeding $100 billion annually.

Electrochemical ironmaking specifically addresses this market need by offering a production route that can potentially eliminate coal-based reduction processes. Customer interviews with steel industry executives indicate strong interest in technologies that can be implemented with manageable capital expenditure while delivering significant carbon reduction benefits. The sensitivity to initial capital costs remains high, with most producers seeking solutions with payback periods under 7 years when accounting for carbon pricing mechanisms.

Demand segmentation shows varying adoption readiness across different market segments. Integrated steel producers with aging blast furnace assets approaching end-of-life represent the most immediate addressable market, as they face critical reinvestment decisions. Mini-mill operators utilizing electric arc furnaces constitute a secondary market segment seeking to further reduce their carbon footprint through greener iron inputs.

Regional analysis indicates that European steelmakers face the most urgent pressure to adopt low-carbon technologies due to escalating carbon prices under the EU Emissions Trading System. Asian markets, particularly China and Japan, represent the largest volume opportunity but with more price sensitivity regarding capital expenditure requirements. North American demand is growing rapidly, driven by both regulatory pressures and corporate sustainability commitments.

Customer willingness-to-pay analysis suggests that premium pricing for green steel currently ranges from 10-15% above conventional steel, though this premium is expected to normalize as production scales. This pricing dynamic directly impacts the acceptable capital expenditure thresholds for new technology adoption, making cost-efficient implementation models critical for market penetration.

Market research reveals that major steel producers are actively seeking capital-efficient pathways to decarbonize their operations while maintaining competitive production costs. The potential market for low-carbon steelmaking technologies is projected to grow substantially, with industry forecasts suggesting that green steel production could capture 25-30% of the global steel market by 2050, representing a value opportunity exceeding $100 billion annually.

Electrochemical ironmaking specifically addresses this market need by offering a production route that can potentially eliminate coal-based reduction processes. Customer interviews with steel industry executives indicate strong interest in technologies that can be implemented with manageable capital expenditure while delivering significant carbon reduction benefits. The sensitivity to initial capital costs remains high, with most producers seeking solutions with payback periods under 7 years when accounting for carbon pricing mechanisms.

Demand segmentation shows varying adoption readiness across different market segments. Integrated steel producers with aging blast furnace assets approaching end-of-life represent the most immediate addressable market, as they face critical reinvestment decisions. Mini-mill operators utilizing electric arc furnaces constitute a secondary market segment seeking to further reduce their carbon footprint through greener iron inputs.

Regional analysis indicates that European steelmakers face the most urgent pressure to adopt low-carbon technologies due to escalating carbon prices under the EU Emissions Trading System. Asian markets, particularly China and Japan, represent the largest volume opportunity but with more price sensitivity regarding capital expenditure requirements. North American demand is growing rapidly, driven by both regulatory pressures and corporate sustainability commitments.

Customer willingness-to-pay analysis suggests that premium pricing for green steel currently ranges from 10-15% above conventional steel, though this premium is expected to normalize as production scales. This pricing dynamic directly impacts the acceptable capital expenditure thresholds for new technology adoption, making cost-efficient implementation models critical for market penetration.

Current Status and Technical Challenges in Electrochemical Ironmaking

Electrochemical ironmaking represents a paradigm shift in the steel industry, offering a potentially carbon-neutral alternative to conventional blast furnace technology. Currently, this technology exists primarily at laboratory and pilot scales, with several research institutions and companies demonstrating proof-of-concept operations. The Massachusetts Institute of Technology, Boston Metal, ArcelorMittal, and ULCOS consortium have made significant advancements in molten oxide electrolysis (MOE) technology, while alternative approaches such as aqueous electrolysis are being explored by researchers at the University of Utah and SIDERWIN project in Europe.

Despite promising developments, electrochemical ironmaking faces substantial technical challenges that impede commercial-scale implementation. The most critical issue is electrode durability, particularly the anode, which operates in extremely corrosive molten oxide environments at temperatures exceeding 1600°C. Current anode materials, including iridium, platinum, and certain ceramics, either degrade rapidly or are prohibitively expensive for industrial application.

Energy efficiency presents another significant hurdle. Current electrochemical processes require 3-4 MWh per ton of iron produced, substantially higher than the theoretical minimum. This inefficiency stems from ohmic losses, side reactions, and heat dissipation within electrolytic cells. The high operating temperatures necessary for maintaining oxide melts in liquid form further contribute to energy consumption challenges.

Scale-up complications constitute a third major obstacle. Laboratory demonstrations typically operate at currents of 10-100A, while commercial viability would require systems handling 10,000-100,000A. This thousand-fold scaling introduces complex engineering challenges related to heat management, current distribution, and materials handling that remain largely unresolved.

Feedstock preparation also presents difficulties. Unlike traditional blast furnaces that can utilize various iron ore qualities, electrochemical processes generally require higher purity input materials with specific physical properties to maintain stable electrolyte composition and prevent unwanted side reactions.

Geographically, research leadership in this field is concentrated in North America and Europe, with emerging activities in China, Japan, and Australia. The technology readiness level (TRL) currently stands at 5-6 for the most advanced systems, indicating validation in relevant environments but still requiring significant development before commercial deployment.

Economic viability remains uncertain, with capital expenditure estimates ranging from $800-2,000 per ton of annual capacity, significantly higher than conventional ironmaking technologies. This economic barrier, coupled with the technical challenges, represents the primary impediment to widespread adoption of electrochemical ironmaking processes.

Despite promising developments, electrochemical ironmaking faces substantial technical challenges that impede commercial-scale implementation. The most critical issue is electrode durability, particularly the anode, which operates in extremely corrosive molten oxide environments at temperatures exceeding 1600°C. Current anode materials, including iridium, platinum, and certain ceramics, either degrade rapidly or are prohibitively expensive for industrial application.

Energy efficiency presents another significant hurdle. Current electrochemical processes require 3-4 MWh per ton of iron produced, substantially higher than the theoretical minimum. This inefficiency stems from ohmic losses, side reactions, and heat dissipation within electrolytic cells. The high operating temperatures necessary for maintaining oxide melts in liquid form further contribute to energy consumption challenges.

Scale-up complications constitute a third major obstacle. Laboratory demonstrations typically operate at currents of 10-100A, while commercial viability would require systems handling 10,000-100,000A. This thousand-fold scaling introduces complex engineering challenges related to heat management, current distribution, and materials handling that remain largely unresolved.

Feedstock preparation also presents difficulties. Unlike traditional blast furnaces that can utilize various iron ore qualities, electrochemical processes generally require higher purity input materials with specific physical properties to maintain stable electrolyte composition and prevent unwanted side reactions.

Geographically, research leadership in this field is concentrated in North America and Europe, with emerging activities in China, Japan, and Australia. The technology readiness level (TRL) currently stands at 5-6 for the most advanced systems, indicating validation in relevant environments but still requiring significant development before commercial deployment.

Economic viability remains uncertain, with capital expenditure estimates ranging from $800-2,000 per ton of annual capacity, significantly higher than conventional ironmaking technologies. This economic barrier, coupled with the technical challenges, represents the primary impediment to widespread adoption of electrochemical ironmaking processes.

Current Capital Expenditure Models for Electrochemical Ironmaking

01 Capital expenditure analysis for electrochemical ironmaking facilities

Financial analysis and capital expenditure planning for electrochemical ironmaking facilities involves comprehensive assessment of initial investment requirements, operational costs, and return on investment projections. This includes evaluation of equipment costs, facility construction, infrastructure development, and technology implementation expenses specific to electrochemical processes for iron production. These analyses help stakeholders make informed decisions about investment feasibility and economic viability of transitioning to electrochemical ironmaking methods.- Capital cost analysis for electrochemical ironmaking processes: Electrochemical ironmaking processes require significant capital expenditure analysis to determine economic viability. This includes assessment of initial investment costs for equipment, facilities, and infrastructure specific to electrochemical reduction of iron ore. Financial models evaluate the return on investment, payback periods, and overall economic feasibility compared to conventional ironmaking technologies. These analyses help stakeholders make informed decisions about adopting electrochemical methods in iron production.

- Equipment and infrastructure requirements for electrochemical ironmaking: Electrochemical ironmaking requires specialized equipment including electrolytic cells, power supply systems, and material handling infrastructure. Capital expenditure planning must account for these specialized components along with supporting facilities such as electrical infrastructure, process control systems, and safety equipment. The design and configuration of these systems significantly impact both initial capital costs and ongoing operational expenses, making equipment selection a critical factor in overall project economics.

- Environmental compliance and sustainability investments: Capital expenditure for electrochemical ironmaking includes investments in environmental compliance and sustainability features. These encompass emissions control systems, waste management facilities, and energy efficiency technologies. While these environmental investments increase initial capital costs, they can reduce long-term operational expenses through lower carbon taxes, regulatory compliance costs, and improved resource efficiency. The sustainability aspects of electrochemical ironmaking often represent a significant portion of the total capital expenditure.

- Process optimization and efficiency improvements: Capital investments in process optimization technologies for electrochemical ironmaking focus on improving energy efficiency, increasing production rates, and enhancing product quality. These investments include advanced control systems, process monitoring equipment, and optimization software. Expenditures on efficiency improvements can significantly reduce operational costs over time, particularly energy consumption which represents a major cost component in electrochemical processes. The return on these investments is typically evaluated based on productivity gains and operational cost reductions.

- Scaling and commercialization strategies: Capital expenditure planning for electrochemical ironmaking must address scaling and commercialization challenges. This includes phased implementation approaches, modular design strategies, and capacity expansion planning. Investments may begin with pilot plants before scaling to commercial production, allowing for risk mitigation and technology validation. The capital allocation strategy must balance immediate production needs with long-term growth objectives, considering market demand forecasts and competitive positioning within the steel industry.

02 Cost reduction strategies in electrochemical ironmaking

Various cost reduction strategies can be implemented to optimize capital expenditure in electrochemical ironmaking operations. These include process optimization, energy efficiency improvements, equipment standardization, and modular plant design. By implementing these strategies, companies can reduce initial investment costs, minimize operational expenses, and improve the overall economic viability of electrochemical ironmaking technologies compared to traditional blast furnace methods.Expand Specific Solutions03 Equipment and infrastructure requirements for electrochemical ironmaking

Electrochemical ironmaking requires specialized equipment and infrastructure, which significantly impacts capital expenditure planning. This includes electrolytic cells, power supply systems, material handling equipment, and process control systems. The selection and configuration of these components must be optimized to balance initial investment costs with operational efficiency and production capacity, while ensuring compatibility with existing facilities or new construction requirements.Expand Specific Solutions04 Environmental compliance and sustainability investments

Capital expenditure for electrochemical ironmaking includes investments in environmental compliance and sustainability features. These investments cover emission control systems, waste management facilities, and energy recovery technologies. While these components increase initial capital requirements, they provide long-term benefits through reduced environmental impact, compliance with regulations, and potential carbon tax avoidance, ultimately improving the overall economic performance of electrochemical ironmaking operations.Expand Specific Solutions05 Financial modeling and risk assessment for electrochemical ironmaking projects

Financial modeling and risk assessment are critical components in evaluating capital expenditure for electrochemical ironmaking projects. These analyses include sensitivity studies, scenario planning, and risk mitigation strategies to account for market volatility, technology maturation, regulatory changes, and supply chain uncertainties. Comprehensive financial models help investors and operators understand the economic implications of various implementation approaches and optimize capital allocation decisions for electrochemical ironmaking facilities.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Electrochemical ironmaking technology is currently in an early development stage, with the market still emerging but showing significant growth potential due to global decarbonization efforts. The technology maturity varies across key players, with traditional steel manufacturers like JFE Steel, Baoshan Iron & Steel, and Shougang Group investing in research while adapting their conventional processes. Academic institutions including Wuhan University, China University of Mining & Technology, and Hubei University of Technology are advancing fundamental research. Companies with energy expertise such as Weichai Power and State Grid subsidiaries are exploring integration opportunities with renewable energy systems. The competitive landscape is characterized by strategic partnerships between established steel producers and technology providers, with most solutions still at pilot or demonstration scale rather than full commercial deployment.

JFE Steel Corp.

Technical Solution: JFE Steel has developed a sophisticated electrochemical ironmaking capital expenditure model that emphasizes integration with existing steelmaking infrastructure. Their approach focuses on molten salt electrolysis technology with specialized electrode materials designed to maximize durability while minimizing replacement costs. JFE's capital model incorporates detailed engineering specifications for electrolytic cell design, power management systems, and heat recovery infrastructure. Their sensitivity analysis framework employs multivariate regression techniques to identify correlations between operational parameters and economic outcomes. The model accounts for the time-value of capital through discounted cash flow analysis across various implementation timelines and scales. JFE has conducted extensive materials testing to optimize electrode compositions and cell designs, with these findings directly informing their capital expenditure projections. Their model includes detailed maintenance scheduling and associated costs based on accelerated degradation testing of critical components.

Strengths: Strong integration capabilities with existing steel production facilities; extensive materials science expertise applied to component optimization; detailed maintenance cost modeling. Weaknesses: Conservative approach may underestimate potential technological breakthroughs; higher emphasis on integration with conventional processes may limit disruptive potential; significant capital allocation required for initial implementation.

Baoshan Iron & Steel Co., Ltd.

Technical Solution: Baoshan Iron & Steel (Baosteel) has developed a comprehensive electrochemical ironmaking capital expenditure model that integrates process simulation with economic analysis. Their approach combines electrochemical reduction cells with renewable energy integration to reduce carbon emissions in steelmaking. The model accounts for capital costs including electrode materials, cell design, power supply systems, and auxiliary equipment. Baosteel's sensitivity analysis framework examines key variables such as electricity prices, carbon taxation, raw material costs, and production scale to optimize investment decisions. Their model incorporates Monte Carlo simulation techniques to account for market uncertainties and provides scenario-based ROI projections for different technology implementation pathways. Baosteel has implemented pilot-scale electrochemical ironmaking facilities to validate their capital expenditure projections against real-world performance data.

Strengths: Strong integration with existing steel production infrastructure; robust data validation from pilot implementations; comprehensive uncertainty modeling. Weaknesses: Higher initial capital requirements compared to conventional methods; sensitivity to electricity price fluctuations; technology still at early commercial scale with limited long-term operational data.

Critical Technology Patents and Cost Structure Analysis

Lithium battery electrochemical model parameter identification method

PatentActiveCN117633498A

Innovation

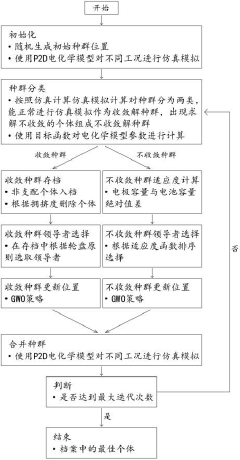

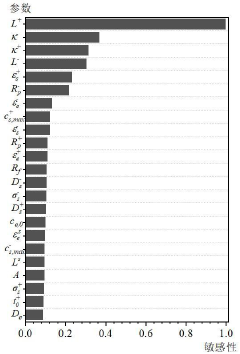

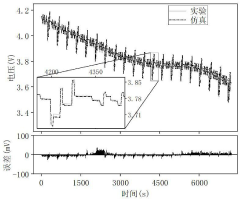

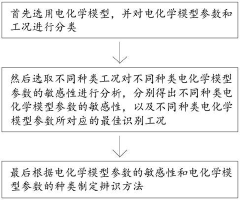

- By classifying the electrochemical model parameters and analyzing the sensitivity of different working conditions, a dual-population multi-objective wolf pack algorithm and a single-population multi-objective wolf pack algorithm were used, combined with the electrode capacity balance formula and dynamic stress test conditions, to design a step-by-step identification Strategies to improve the accuracy and applicability of parameter identification.

Design layout pattern proximity correction through fast edge placement error prediction

PatentActiveUS20180157161A1

Innovation

- The development of methods to generate proximity-corrected design layouts for photoresist, involving the estimation of in-feature plasma flux and edge placement error, using look-up tables constructed from computerized etch profile models, to optimize etch process parameters and improve accuracy.

Economic Sensitivity Analysis Framework

The Economic Sensitivity Analysis Framework for electrochemical ironmaking provides a structured approach to evaluate how variations in key economic parameters affect the overall financial viability of this emerging technology. This framework establishes a systematic methodology for identifying critical cost drivers and assessing their impact on capital expenditure requirements and long-term profitability.

The framework begins with the identification of key sensitivity variables specific to electrochemical ironmaking, including electricity costs, electrode materials, electrolyte composition, and equipment scaling factors. These variables are selected based on their significant contribution to overall capital and operational expenditures, as well as their inherent variability in different implementation scenarios.

For each identified variable, the framework establishes reasonable ranges of variation based on historical data, market projections, and technological uncertainties. These ranges are then incorporated into a Monte Carlo simulation model that generates probability distributions for key financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and payback period. This probabilistic approach provides decision-makers with a more nuanced understanding of project risks compared to traditional single-point estimates.

The sensitivity analysis also incorporates scenario planning to evaluate how combinations of variables might interact under different market conditions. Three primary scenarios are typically modeled: a base case representing most likely conditions, an optimistic case capturing potential technological breakthroughs and favorable market developments, and a pessimistic case accounting for implementation challenges and adverse economic conditions.

Tornado diagrams and spider plots are utilized to visualize the relative impact of each variable on financial outcomes, enabling stakeholders to quickly identify which parameters warrant the most attention during technology development and implementation planning. This visual representation helps prioritize research efforts toward areas with the greatest potential for cost reduction.

The framework further incorporates temporal considerations by analyzing how sensitivity to various parameters might evolve over time as the technology matures. Early-stage implementations typically show high sensitivity to capital costs and technical performance metrics, while mature implementations tend to be more sensitive to operational parameters like energy costs and maintenance requirements.

By applying this comprehensive economic sensitivity analysis framework, stakeholders can make more informed decisions about investment timing, technology development priorities, and risk mitigation strategies for electrochemical ironmaking projects.

The framework begins with the identification of key sensitivity variables specific to electrochemical ironmaking, including electricity costs, electrode materials, electrolyte composition, and equipment scaling factors. These variables are selected based on their significant contribution to overall capital and operational expenditures, as well as their inherent variability in different implementation scenarios.

For each identified variable, the framework establishes reasonable ranges of variation based on historical data, market projections, and technological uncertainties. These ranges are then incorporated into a Monte Carlo simulation model that generates probability distributions for key financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and payback period. This probabilistic approach provides decision-makers with a more nuanced understanding of project risks compared to traditional single-point estimates.

The sensitivity analysis also incorporates scenario planning to evaluate how combinations of variables might interact under different market conditions. Three primary scenarios are typically modeled: a base case representing most likely conditions, an optimistic case capturing potential technological breakthroughs and favorable market developments, and a pessimistic case accounting for implementation challenges and adverse economic conditions.

Tornado diagrams and spider plots are utilized to visualize the relative impact of each variable on financial outcomes, enabling stakeholders to quickly identify which parameters warrant the most attention during technology development and implementation planning. This visual representation helps prioritize research efforts toward areas with the greatest potential for cost reduction.

The framework further incorporates temporal considerations by analyzing how sensitivity to various parameters might evolve over time as the technology matures. Early-stage implementations typically show high sensitivity to capital costs and technical performance metrics, while mature implementations tend to be more sensitive to operational parameters like energy costs and maintenance requirements.

By applying this comprehensive economic sensitivity analysis framework, stakeholders can make more informed decisions about investment timing, technology development priorities, and risk mitigation strategies for electrochemical ironmaking projects.

Environmental Policy Impacts on Technology Adoption

Environmental policies are increasingly becoming a pivotal factor in the adoption of electrochemical ironmaking technologies. Carbon pricing mechanisms, implemented in various forms across different regions, directly impact the economic viability of traditional blast furnace operations. As carbon taxes and emissions trading schemes become more stringent, the relative cost advantage of low-emission technologies like electrochemical ironmaking improves significantly, potentially accelerating their adoption despite higher initial capital expenditures.

Regulatory frameworks mandating emissions reductions in the steel industry are evolving rapidly. The European Union's Carbon Border Adjustment Mechanism (CBAM) represents a landmark policy that will impose carbon costs on imported steel products, effectively leveling the playing field for domestic producers utilizing cleaner technologies. Similar policies are being considered in other major economies, creating a global trend toward stricter environmental regulations in steel production.

Government subsidies and incentives for green technology adoption play a crucial role in offsetting the high capital expenditure requirements of electrochemical ironmaking. Countries including Germany, Japan, and Sweden have established substantial funding programs specifically targeting low-carbon steelmaking technologies. These financial support mechanisms can significantly alter sensitivity analyses by reducing effective CAPEX burdens and shortening payback periods for early adopters.

International climate agreements, particularly the Paris Agreement commitments, are driving national policies that favor technologies with lower carbon footprints. Steel producers in signatory countries face increasing pressure to align their production methods with national decarbonization targets, making electrochemical processes more attractive despite their higher upfront costs. The timeline for technology transition is increasingly being dictated by policy-driven decarbonization roadmaps rather than purely economic considerations.

Regional variations in environmental policy create complex decision landscapes for multinational steel producers. While some regions maintain relatively lenient environmental standards, the trend toward policy harmonization suggests that eventually most major steel-producing regions will implement comparable carbon constraints. Forward-looking capital expenditure models must therefore incorporate scenario analyses for policy convergence, potentially accelerating technology adoption timelines based on anticipated regulatory changes rather than waiting for actual implementation.

Public procurement policies favoring low-carbon materials represent another significant driver for technology adoption. As governments increasingly specify maximum embodied carbon levels in steel used for infrastructure projects, producers utilizing electrochemical processes gain preferential market access, potentially justifying higher capital investments through premium pricing and guaranteed demand.

Regulatory frameworks mandating emissions reductions in the steel industry are evolving rapidly. The European Union's Carbon Border Adjustment Mechanism (CBAM) represents a landmark policy that will impose carbon costs on imported steel products, effectively leveling the playing field for domestic producers utilizing cleaner technologies. Similar policies are being considered in other major economies, creating a global trend toward stricter environmental regulations in steel production.

Government subsidies and incentives for green technology adoption play a crucial role in offsetting the high capital expenditure requirements of electrochemical ironmaking. Countries including Germany, Japan, and Sweden have established substantial funding programs specifically targeting low-carbon steelmaking technologies. These financial support mechanisms can significantly alter sensitivity analyses by reducing effective CAPEX burdens and shortening payback periods for early adopters.

International climate agreements, particularly the Paris Agreement commitments, are driving national policies that favor technologies with lower carbon footprints. Steel producers in signatory countries face increasing pressure to align their production methods with national decarbonization targets, making electrochemical processes more attractive despite their higher upfront costs. The timeline for technology transition is increasingly being dictated by policy-driven decarbonization roadmaps rather than purely economic considerations.

Regional variations in environmental policy create complex decision landscapes for multinational steel producers. While some regions maintain relatively lenient environmental standards, the trend toward policy harmonization suggests that eventually most major steel-producing regions will implement comparable carbon constraints. Forward-looking capital expenditure models must therefore incorporate scenario analyses for policy convergence, potentially accelerating technology adoption timelines based on anticipated regulatory changes rather than waiting for actual implementation.

Public procurement policies favoring low-carbon materials represent another significant driver for technology adoption. As governments increasingly specify maximum embodied carbon levels in steel used for infrastructure projects, producers utilizing electrochemical processes gain preferential market access, potentially justifying higher capital investments through premium pricing and guaranteed demand.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!