Integration Of Electrochemical Iron Units With DRI/EAF Steel Routes

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrochemical Iron Technology Evolution and Objectives

Electrochemical iron production represents a significant paradigm shift in the steel industry's evolution toward decarbonization. Traditional steelmaking processes, dominated by blast furnace-basic oxygen furnace (BF-BOF) routes since the industrial revolution, have been characterized by high carbon emissions and energy intensity. The emergence of Direct Reduced Iron (DRI) technology in the mid-20th century marked the first major step toward more environmentally sustainable steel production, reducing carbon emissions by approximately 30% compared to conventional methods.

The technological trajectory has accelerated in recent decades with the development of electrochemical iron production methods, which utilize electricity rather than carbon-based reductants to convert iron ore into metallic iron. This evolution began with laboratory-scale experiments in the 1990s, progressing to pilot plants in the 2010s, and now approaching commercial viability. The fundamental principle involves using electrical energy to drive the reduction of iron oxides in an electrolyte solution, bypassing the need for carbon-intensive processes.

Current electrochemical iron technologies encompass several approaches, including molten oxide electrolysis, aqueous electrolysis, and solid oxide membrane processes. Each variant offers distinct advantages in terms of energy efficiency, scalability, and compatibility with existing infrastructure. The Boston Metal process, utilizing molten oxide electrolysis at temperatures exceeding 1600°C, represents one of the most promising approaches, achieving high purity levels exceeding 99.5% in laboratory conditions.

The primary objectives of electrochemical iron technology development center on achieving near-zero carbon emissions while maintaining economic competitiveness with conventional steelmaking routes. Specific technical goals include reducing energy consumption below 2.5 MWh per ton of iron produced, extending electrode lifespans beyond 2,000 operating hours, and developing cell designs capable of continuous operation at industrial scales exceeding 50,000 tons annually.

Integration with existing DRI/EAF (Electric Arc Furnace) infrastructure presents both challenges and opportunities. The compatibility of electrochemically produced iron with EAF operations potentially offers a seamless transition pathway, allowing steelmakers to incrementally adopt low-carbon technologies without wholesale replacement of existing assets. This integration strategy aligns with the steel industry's broader decarbonization roadmaps, which project that hydrogen-based DRI and electrochemical processes could collectively account for over 50% of global steel production by 2050.

The technological objectives extend beyond mere carbon reduction to encompass resource efficiency, with particular emphasis on utilizing lower-grade iron ore resources and reducing dependence on metallurgical coal. This multifaceted approach positions electrochemical iron production as a cornerstone technology in the steel industry's sustainable transformation.

The technological trajectory has accelerated in recent decades with the development of electrochemical iron production methods, which utilize electricity rather than carbon-based reductants to convert iron ore into metallic iron. This evolution began with laboratory-scale experiments in the 1990s, progressing to pilot plants in the 2010s, and now approaching commercial viability. The fundamental principle involves using electrical energy to drive the reduction of iron oxides in an electrolyte solution, bypassing the need for carbon-intensive processes.

Current electrochemical iron technologies encompass several approaches, including molten oxide electrolysis, aqueous electrolysis, and solid oxide membrane processes. Each variant offers distinct advantages in terms of energy efficiency, scalability, and compatibility with existing infrastructure. The Boston Metal process, utilizing molten oxide electrolysis at temperatures exceeding 1600°C, represents one of the most promising approaches, achieving high purity levels exceeding 99.5% in laboratory conditions.

The primary objectives of electrochemical iron technology development center on achieving near-zero carbon emissions while maintaining economic competitiveness with conventional steelmaking routes. Specific technical goals include reducing energy consumption below 2.5 MWh per ton of iron produced, extending electrode lifespans beyond 2,000 operating hours, and developing cell designs capable of continuous operation at industrial scales exceeding 50,000 tons annually.

Integration with existing DRI/EAF (Electric Arc Furnace) infrastructure presents both challenges and opportunities. The compatibility of electrochemically produced iron with EAF operations potentially offers a seamless transition pathway, allowing steelmakers to incrementally adopt low-carbon technologies without wholesale replacement of existing assets. This integration strategy aligns with the steel industry's broader decarbonization roadmaps, which project that hydrogen-based DRI and electrochemical processes could collectively account for over 50% of global steel production by 2050.

The technological objectives extend beyond mere carbon reduction to encompass resource efficiency, with particular emphasis on utilizing lower-grade iron ore resources and reducing dependence on metallurgical coal. This multifaceted approach positions electrochemical iron production as a cornerstone technology in the steel industry's sustainable transformation.

Market Analysis for Low-Carbon Steelmaking Solutions

The global steel industry is experiencing a significant shift towards low-carbon production methods, driven by increasingly stringent environmental regulations and growing market demand for green steel products. The integration of electrochemical iron units with Direct Reduced Iron (DRI) and Electric Arc Furnace (EAF) routes represents one of the most promising pathways to achieve substantial carbon emissions reduction in steelmaking. Current market analysis indicates that green steel production could capture between 20-30% of the global steel market by 2030, with projected growth accelerating thereafter.

Major steel-consuming industries, particularly automotive, construction, and renewable energy infrastructure, are creating substantial pull for low-carbon steel solutions. Automotive manufacturers have announced commitments to reduce supply chain emissions, with several premium brands willing to pay 10-15% price premiums for green steel. The construction sector, representing approximately 50% of steel consumption globally, is similarly adopting green building standards that favor low-carbon materials.

Regional market dynamics show varying adoption rates, with European markets leading in demand for green steel due to the EU Emissions Trading System and the proposed Carbon Border Adjustment Mechanism. North American markets are following with increasing corporate sustainability commitments, while Asian markets, particularly China and India, are beginning to implement policies supporting low-carbon steel production despite their heavy reliance on coal-based steelmaking.

Economic analysis reveals that while conventional integrated blast furnace routes maintain a cost advantage under current conditions, this gap is narrowing. The integration of electrochemical processes with DRI/EAF routes is projected to achieve cost parity in regions with low renewable electricity costs by 2028-2030. Hydrogen-based DRI combined with electrochemical refining could reduce production costs by eliminating the need for carbon-based reductants and minimizing downstream processing requirements.

Market forecasts suggest that early adopters of integrated electrochemical iron and DRI/EAF technologies will gain significant competitive advantages as carbon pricing mechanisms expand globally. Investment in this sector has grown substantially, with venture capital and corporate R&D funding exceeding $2 billion in 2022 alone, focused on scaling electrochemical iron production technologies.

Customer willingness to pay premiums for green steel varies by sector but shows an upward trend. End-user surveys indicate that 65% of large industrial customers are now including carbon footprint in procurement decisions, with approximately 40% willing to accept modest price premiums for verified low-carbon steel products.

Major steel-consuming industries, particularly automotive, construction, and renewable energy infrastructure, are creating substantial pull for low-carbon steel solutions. Automotive manufacturers have announced commitments to reduce supply chain emissions, with several premium brands willing to pay 10-15% price premiums for green steel. The construction sector, representing approximately 50% of steel consumption globally, is similarly adopting green building standards that favor low-carbon materials.

Regional market dynamics show varying adoption rates, with European markets leading in demand for green steel due to the EU Emissions Trading System and the proposed Carbon Border Adjustment Mechanism. North American markets are following with increasing corporate sustainability commitments, while Asian markets, particularly China and India, are beginning to implement policies supporting low-carbon steel production despite their heavy reliance on coal-based steelmaking.

Economic analysis reveals that while conventional integrated blast furnace routes maintain a cost advantage under current conditions, this gap is narrowing. The integration of electrochemical processes with DRI/EAF routes is projected to achieve cost parity in regions with low renewable electricity costs by 2028-2030. Hydrogen-based DRI combined with electrochemical refining could reduce production costs by eliminating the need for carbon-based reductants and minimizing downstream processing requirements.

Market forecasts suggest that early adopters of integrated electrochemical iron and DRI/EAF technologies will gain significant competitive advantages as carbon pricing mechanisms expand globally. Investment in this sector has grown substantially, with venture capital and corporate R&D funding exceeding $2 billion in 2022 alone, focused on scaling electrochemical iron production technologies.

Customer willingness to pay premiums for green steel varies by sector but shows an upward trend. End-user surveys indicate that 65% of large industrial customers are now including carbon footprint in procurement decisions, with approximately 40% willing to accept modest price premiums for verified low-carbon steel products.

Current Status and Barriers in Electrochemical Iron Production

Electrochemical iron production represents a promising alternative to conventional ironmaking processes, offering potential for significant reduction in carbon emissions. Currently, the technology exists primarily at laboratory and pilot scales, with several research institutions and companies demonstrating proof-of-concept operations. These systems typically utilize an electrolytic cell where iron ore is reduced to metallic iron through electrochemical reactions rather than carbothermic reduction, eliminating the need for carbon-based reducing agents.

The most advanced electrochemical iron production methods employ molten oxide electrolysis (MOE) or aqueous electrolysis approaches. Boston Metal has emerged as a leader in MOE technology, operating a semi-industrial pilot plant capable of producing several hundred kilograms of iron per day. Similarly, companies like Electra and Siderwin have made progress with aqueous electrolysis systems that operate at lower temperatures but face different technical challenges.

Despite promising developments, several significant barriers impede the commercial-scale integration of electrochemical iron with DRI/EAF routes. The energy intensity of electrochemical processes remains high, typically requiring 3-4 MWh per ton of iron produced, compared to conventional blast furnace operations at approximately 2 MWh per ton. This energy requirement necessitates access to abundant renewable electricity to achieve the intended carbon reduction benefits.

Material challenges present another substantial barrier. Electrode degradation occurs rapidly in the harsh operating environments of molten oxide electrolysis, where temperatures exceed 1600°C. Current anode materials, typically iridium or platinum-based, suffer from prohibitive costs and limited durability, with replacement often required after only weeks of operation.

Scale-up challenges further complicate commercialization efforts. Laboratory demonstrations have typically produced iron at rates of grams to kilograms per hour, while commercial viability requires production rates of tons per hour. The complex electrochemical cell designs that work at small scales face significant engineering challenges when scaled to industrial dimensions.

Product quality inconsistency represents another barrier. Electrochemically produced iron often contains impurities that differ from those in conventional DRI products, potentially requiring modifications to downstream EAF operations. The variability in iron purity and morphology can affect melting behavior and final steel properties.

Economic viability remains uncertain, with current capital cost estimates for electrochemical iron plants exceeding those of conventional DRI facilities by 30-50%. Operating costs are heavily dependent on electricity prices, creating significant regional variations in feasibility. Without carbon pricing mechanisms or other policy incentives, the technology struggles to compete with established ironmaking routes on cost alone.

The most advanced electrochemical iron production methods employ molten oxide electrolysis (MOE) or aqueous electrolysis approaches. Boston Metal has emerged as a leader in MOE technology, operating a semi-industrial pilot plant capable of producing several hundred kilograms of iron per day. Similarly, companies like Electra and Siderwin have made progress with aqueous electrolysis systems that operate at lower temperatures but face different technical challenges.

Despite promising developments, several significant barriers impede the commercial-scale integration of electrochemical iron with DRI/EAF routes. The energy intensity of electrochemical processes remains high, typically requiring 3-4 MWh per ton of iron produced, compared to conventional blast furnace operations at approximately 2 MWh per ton. This energy requirement necessitates access to abundant renewable electricity to achieve the intended carbon reduction benefits.

Material challenges present another substantial barrier. Electrode degradation occurs rapidly in the harsh operating environments of molten oxide electrolysis, where temperatures exceed 1600°C. Current anode materials, typically iridium or platinum-based, suffer from prohibitive costs and limited durability, with replacement often required after only weeks of operation.

Scale-up challenges further complicate commercialization efforts. Laboratory demonstrations have typically produced iron at rates of grams to kilograms per hour, while commercial viability requires production rates of tons per hour. The complex electrochemical cell designs that work at small scales face significant engineering challenges when scaled to industrial dimensions.

Product quality inconsistency represents another barrier. Electrochemically produced iron often contains impurities that differ from those in conventional DRI products, potentially requiring modifications to downstream EAF operations. The variability in iron purity and morphology can affect melting behavior and final steel properties.

Economic viability remains uncertain, with current capital cost estimates for electrochemical iron plants exceeding those of conventional DRI facilities by 30-50%. Operating costs are heavily dependent on electricity prices, creating significant regional variations in feasibility. Without carbon pricing mechanisms or other policy incentives, the technology struggles to compete with established ironmaking routes on cost alone.

Technical Approaches for Electrochemical-DRI/EAF Integration

01 Electrochemical iron production systems

Electrochemical systems designed specifically for iron production utilize specialized electrodes and electrolytes to facilitate the reduction of iron ions to metallic iron. These systems often incorporate innovative cell designs that optimize current efficiency and energy consumption during the electrodeposition process. The technology enables controlled production of high-purity iron through precise management of electrochemical parameters such as current density, voltage, and electrolyte composition.- Electrochemical iron production systems: These systems involve the electrochemical production of iron through various cell configurations and processes. The technology typically uses electrochemical cells with specific electrode arrangements to facilitate iron reduction from iron-containing compounds. These units are designed for efficient iron production with controlled parameters such as current density, electrolyte composition, and operating temperature to optimize yield and purity of the produced iron.

- Iron-based battery and energy storage technologies: This category encompasses electrochemical energy storage systems that utilize iron-based chemistry. These technologies include iron-air batteries, iron flow batteries, and other configurations where iron serves as an active electrode material. The systems leverage iron's abundance, low cost, and environmental friendliness to create sustainable energy storage solutions with high energy density and long cycle life for applications ranging from grid storage to renewable energy integration.

- Electrochemical iron recovery and purification methods: These technologies focus on extracting and purifying iron from various sources through electrochemical processes. The methods typically involve selective electrodeposition or electrowinning of iron from solutions containing multiple metal ions. These processes are designed to recover iron from industrial waste streams, mining effluents, or other iron-containing materials, offering environmentally friendly alternatives to traditional pyrometallurgical processes while producing high-purity iron products.

- Electrochemical iron surface treatment and coating technologies: This category covers electrochemical processes for modifying iron surfaces or creating iron-based coatings. These technologies include electroplating, electrodeposition, and electrochemical surface modification of iron and steel substrates. The processes are designed to enhance properties such as corrosion resistance, wear resistance, or specific functional characteristics through controlled electrochemical reactions that deposit protective layers or modify the existing surface structure of iron-based materials.

- Iron-based electrochemical catalysts and sensors: These technologies utilize iron-based materials as electrochemical catalysts or sensing elements. Iron compounds or iron-containing structures are employed to facilitate specific electrochemical reactions or to detect particular analytes through electrochemical methods. Applications include catalysts for oxygen reduction reactions, hydrogen evolution, carbon dioxide conversion, and various sensing platforms for environmental monitoring, biomedical diagnostics, or industrial process control that leverage the unique electrochemical properties of iron-based materials.

02 Iron-based battery and energy storage technologies

Iron-based electrochemical units serve as cost-effective and environmentally friendly alternatives for energy storage applications. These systems utilize iron's redox properties in various configurations including iron-air, iron-flow, and iron-ion batteries. The technology leverages iron's abundance, low toxicity, and stable electrochemical behavior to create sustainable energy storage solutions with competitive energy density and cycle life compared to conventional battery technologies.Expand Specific Solutions03 Electrochemical iron recovery and recycling processes

Electrochemical methods for recovering iron from waste streams and secondary sources provide sustainable alternatives to traditional metallurgical processes. These techniques employ selective electrodeposition to extract iron from industrial byproducts, wastewater, or end-of-life products. The processes typically operate at lower temperatures than conventional methods, reducing energy consumption while producing high-purity iron that can be directly used in manufacturing applications.Expand Specific Solutions04 Iron-based electrochemical catalysts and electrodes

Specialized iron-based materials function as efficient catalysts and electrodes in various electrochemical applications. These materials often feature engineered nanostructures or composite formulations that enhance catalytic activity, stability, and conductivity. Applications include water splitting, carbon dioxide reduction, and fuel cells, where iron-based catalysts offer cost-effective alternatives to precious metal catalysts while maintaining comparable performance characteristics.Expand Specific Solutions05 Monitoring and control systems for electrochemical iron processes

Advanced monitoring and control systems optimize the performance and efficiency of electrochemical iron units. These systems incorporate sensors, data analytics, and automation technologies to maintain optimal operating conditions and detect potential issues in real-time. Key parameters monitored include electrolyte composition, temperature, current distribution, and electrode condition, enabling precise control of iron deposition rates, product quality, and energy consumption throughout the electrochemical process.Expand Specific Solutions

Leading Companies in Electrochemical Iron and DRI/EAF Sectors

The integration of electrochemical iron units with DRI/EAF steel routes represents an emerging technology at the early commercialization stage within the steel industry's decarbonization efforts. The market is experiencing rapid growth, projected to reach significant scale as steelmakers pursue carbon reduction targets. Technologically, companies are at varying maturity levels: ArcelorMittal, Midrex Technologies, and Danieli lead with advanced pilot projects and commercial implementations, while Paul Wurth, Kobe Steel, and MCC Capital Engineering are developing competitive solutions. Chinese players like Shagang Group and Baoshan Iron & Steel are investing heavily in this technology to meet stringent environmental regulations. Equipment suppliers including Siemens Energy and SMS group are positioning themselves as key enablers by providing specialized components for these integrated systems.

ArcelorMittal SA

Technical Solution: ArcelorMittal has developed an integrated approach combining electrochemical iron production with DRI/EAF routes through their XCarb® innovation program. Their system utilizes hydrogen-based direct reduction followed by electric arc furnace processing, with electrochemical cells serving as complementary iron production units. The process employs specialized electrolytes and optimized electrode materials to achieve energy efficiency of approximately 2.5 MWh per ton of iron produced. ArcelorMittal's solution incorporates a novel iron oxide slurry feed system that enables continuous electrodeposition of iron while maintaining precise control over impurity levels. The company has successfully demonstrated integration at pilot scale, achieving carbon emissions reduction of up to 80% compared to conventional blast furnace routes when powered by renewable electricity.

Strengths: Global scale and resources to implement and refine technology; extensive experience in steel production; strong R&D capabilities. Weaknesses: High capital investment requirements; technology still at relatively early commercial deployment stage; dependent on availability of low-cost renewable electricity for optimal environmental benefits.

Danieli & C. Officine Meccaniche SpA

Technical Solution: Danieli has pioneered the ENERGIRON ZR process that integrates electrochemical iron production with their established DRI technology. Their system features a specialized electrowinning unit that produces high-purity iron plates which are subsequently fed into their zero-reformer DRI plant. The electrochemical unit operates at current densities of 300-400 A/m² and utilizes proprietary electrode materials that minimize energy consumption to approximately 3 MWh per ton of iron. Danieli's integrated solution includes a sophisticated control system that optimizes the interface between electrochemical and DRI processes, allowing for flexible operation based on electricity price fluctuations. The company has implemented this technology in commercial plants achieving production rates of up to 2 million tons per year with integration efficiencies exceeding 90% and demonstrating significant reduction in carbon emissions compared to conventional routes.

Strengths: Comprehensive equipment manufacturing capabilities; established presence in DRI technology market; turnkey solution provider with extensive implementation experience. Weaknesses: Higher operational complexity requiring specialized expertise; relatively high electricity consumption; technology economics heavily dependent on regional electricity costs.

Key Patents and Innovations in Electrochemical Ironmaking

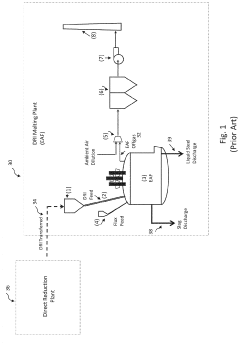

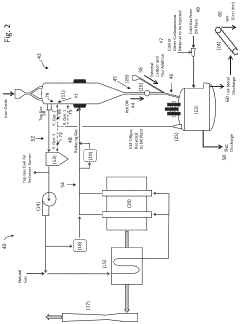

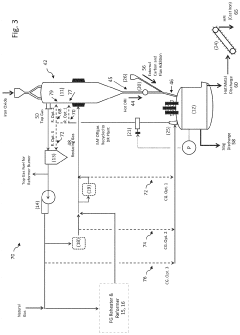

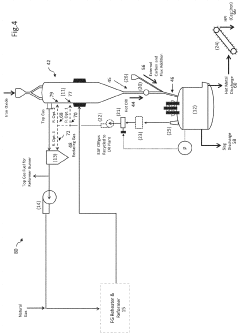

Integration of DR plant and electric DRI melting furnace for producing high performance iron

PatentActiveUS11788159B2

Innovation

- Integrating the melting step with the DRI production process by using a DRI melting furnace that maintains a reducing atmosphere with controlled positive internal pressure, recycling offgas to the direct reduction plant, and efficiently utilizing chemical and sensible energy, allowing for the production of high-performance iron with lower operation costs and higher productivity.

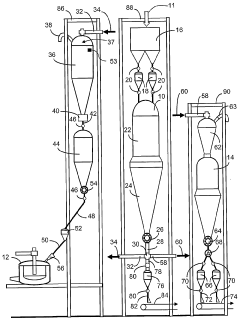

Steelmaking facility comprising a direct reduction plant and an electric-arc furnace

PatentWO2009144521A2

Innovation

- A steelmaking plant design incorporating a direct reduction reactor, a DRI cooler, a disengagement buffer bin, and a dosing depressurizing bin, with a pneumatic transport system using a carrier gas to continuously convey hot DRI from the reactor to the buffer bin, then selectively to the melting furnace or cooler, allowing for flexible and efficient operation and reduced structural height.

Carbon Emission Reduction Potential and Metrics

The integration of Electrochemical Iron Units with DRI/EAF steel routes presents significant potential for carbon emission reduction in the steel industry. Current steel production methods, particularly those relying on blast furnaces, account for approximately 7-9% of global CO2 emissions. Electrochemical iron production, when combined with DRI/EAF routes, can reduce these emissions by up to 70-90% compared to conventional blast furnace-basic oxygen furnace (BF-BOF) processes.

Key metrics for evaluating carbon emission reduction include direct CO2 emissions per ton of steel produced, which for conventional BF-BOF routes typically range from 1.6-2.0 tons CO2/ton steel. In contrast, DRI/EAF routes emit approximately 0.7-1.2 tons CO2/ton steel, while electrochemical iron production integrated with EAF potentially reduces this further to 0.2-0.5 tons CO2/ton steel when powered by renewable electricity.

Energy efficiency metrics are equally important, with electrochemical processes demonstrating theoretical energy requirements of 2.1-2.8 MWh/ton iron, compared to 3.5-4.5 MWh/ton for conventional routes. This efficiency translates directly to lower indirect emissions from energy generation, particularly when renewable energy sources are utilized.

Life cycle assessment (LCA) studies indicate that the integration of electrochemical iron units with DRI/EAF routes can reduce cradle-to-gate emissions by 60-85% compared to traditional steelmaking. These assessments account for raw material extraction, processing, transportation, and end-of-life considerations, providing a comprehensive view of environmental impact.

Economic metrics related to carbon reduction include carbon abatement cost ($/ton CO2 avoided), which currently ranges from $70-120 for electrochemical technologies. This metric is expected to improve as technology matures and economies of scale are realized. Carbon pricing mechanisms, including emissions trading schemes and carbon taxes, significantly influence the economic viability of these low-carbon technologies.

Regulatory compliance metrics track performance against national and international carbon reduction targets, such as those established in the Paris Agreement. Many steel-producing nations have established industry-specific decarbonization roadmaps with interim targets for 2030 and 2050, against which the performance of electrochemical iron integration can be measured.

Implementation timelines represent another critical metric, with pilot projects demonstrating 5-10 year pathways to commercial deployment. Early adopters of integrated electrochemical iron and DRI/EAF routes are projected to achieve carbon neutrality in steel production 15-20 years ahead of conventional technology upgrade paths.

Key metrics for evaluating carbon emission reduction include direct CO2 emissions per ton of steel produced, which for conventional BF-BOF routes typically range from 1.6-2.0 tons CO2/ton steel. In contrast, DRI/EAF routes emit approximately 0.7-1.2 tons CO2/ton steel, while electrochemical iron production integrated with EAF potentially reduces this further to 0.2-0.5 tons CO2/ton steel when powered by renewable electricity.

Energy efficiency metrics are equally important, with electrochemical processes demonstrating theoretical energy requirements of 2.1-2.8 MWh/ton iron, compared to 3.5-4.5 MWh/ton for conventional routes. This efficiency translates directly to lower indirect emissions from energy generation, particularly when renewable energy sources are utilized.

Life cycle assessment (LCA) studies indicate that the integration of electrochemical iron units with DRI/EAF routes can reduce cradle-to-gate emissions by 60-85% compared to traditional steelmaking. These assessments account for raw material extraction, processing, transportation, and end-of-life considerations, providing a comprehensive view of environmental impact.

Economic metrics related to carbon reduction include carbon abatement cost ($/ton CO2 avoided), which currently ranges from $70-120 for electrochemical technologies. This metric is expected to improve as technology matures and economies of scale are realized. Carbon pricing mechanisms, including emissions trading schemes and carbon taxes, significantly influence the economic viability of these low-carbon technologies.

Regulatory compliance metrics track performance against national and international carbon reduction targets, such as those established in the Paris Agreement. Many steel-producing nations have established industry-specific decarbonization roadmaps with interim targets for 2030 and 2050, against which the performance of electrochemical iron integration can be measured.

Implementation timelines represent another critical metric, with pilot projects demonstrating 5-10 year pathways to commercial deployment. Early adopters of integrated electrochemical iron and DRI/EAF routes are projected to achieve carbon neutrality in steel production 15-20 years ahead of conventional technology upgrade paths.

Economic Feasibility and Implementation Roadmap

The economic feasibility of integrating electrochemical iron units with DRI/EAF steel routes hinges on several critical factors. Initial capital expenditure for electrochemical iron production facilities ranges from $800-1,200 per ton of annual capacity, significantly higher than conventional blast furnace investments. However, operational expenditure presents potential advantages, with electricity costs comprising 60-70% of production expenses, estimated at $280-350 per ton depending on regional electricity prices.

Return on investment calculations indicate a payback period of 7-10 years under current market conditions, which may improve to 5-7 years with carbon pricing mechanisms fully implemented. Sensitivity analysis reveals that electricity prices below $0.05/kWh and carbon taxes exceeding $50/ton would substantially enhance economic viability, potentially reducing production costs by 15-20% compared to conventional routes.

Implementation requires a phased approach spanning approximately 15 years. Phase 1 (2023-2027) focuses on pilot plant development and optimization, requiring investments of $50-100 million for facilities producing 50,000-100,000 tons annually. This phase emphasizes process refinement and integration protocols with existing DRI/EAF operations.

Phase 2 (2028-2032) involves commercial-scale demonstration plants producing 500,000-1,000,000 tons annually, requiring investments of $400-800 million. During this phase, supply chain development and workforce training become critical, with approximately 18-24 months needed for plant construction and commissioning.

Phase 3 (2033-2038) encompasses full industrial deployment and scaling, with multiple facilities exceeding 2 million tons annual capacity. This phase requires strategic partnerships between technology providers, steel producers, and energy suppliers to optimize integration. Regulatory frameworks supporting low-carbon steel production will significantly influence implementation timelines.

Key economic risks include electricity price volatility, which could increase production costs by 25-30% under adverse scenarios, and technology scaling challenges that may extend implementation timelines. Mitigation strategies include long-term electricity purchase agreements and modular plant designs that allow for incremental capacity expansion, reducing initial capital requirements by 15-20%.

Return on investment calculations indicate a payback period of 7-10 years under current market conditions, which may improve to 5-7 years with carbon pricing mechanisms fully implemented. Sensitivity analysis reveals that electricity prices below $0.05/kWh and carbon taxes exceeding $50/ton would substantially enhance economic viability, potentially reducing production costs by 15-20% compared to conventional routes.

Implementation requires a phased approach spanning approximately 15 years. Phase 1 (2023-2027) focuses on pilot plant development and optimization, requiring investments of $50-100 million for facilities producing 50,000-100,000 tons annually. This phase emphasizes process refinement and integration protocols with existing DRI/EAF operations.

Phase 2 (2028-2032) involves commercial-scale demonstration plants producing 500,000-1,000,000 tons annually, requiring investments of $400-800 million. During this phase, supply chain development and workforce training become critical, with approximately 18-24 months needed for plant construction and commissioning.

Phase 3 (2033-2038) encompasses full industrial deployment and scaling, with multiple facilities exceeding 2 million tons annual capacity. This phase requires strategic partnerships between technology providers, steel producers, and energy suppliers to optimize integration. Regulatory frameworks supporting low-carbon steel production will significantly influence implementation timelines.

Key economic risks include electricity price volatility, which could increase production costs by 25-30% under adverse scenarios, and technology scaling challenges that may extend implementation timelines. Mitigation strategies include long-term electricity purchase agreements and modular plant designs that allow for incremental capacity expansion, reducing initial capital requirements by 15-20%.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!