Economic Modeling For Electrochemical Iron Production Projects

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrochemical Iron Production Background and Objectives

Electrochemical iron production represents a paradigm shift in metallurgical processing, emerging as a promising alternative to conventional blast furnace technology that has dominated iron production for centuries. This innovative approach utilizes electrochemical principles to extract iron from its ores through direct reduction processes powered by electricity rather than carbon-based fuels. The evolution of this technology traces back to early experiments in the 20th century, but has gained significant momentum in the past two decades due to increasing environmental concerns and the global push toward decarbonization of heavy industries.

The technological trajectory of electrochemical iron production has been characterized by progressive improvements in electrode materials, cell design, and electrolyte compositions. Recent breakthroughs in membrane technology and catalyst development have substantially enhanced process efficiency, making this approach increasingly competitive with traditional methods. The convergence of renewable energy expansion and advances in electrochemical engineering has created a favorable environment for accelerated development in this field.

The primary objective of electrochemical iron production is to achieve carbon-neutral or carbon-negative metal extraction while maintaining economic viability. This aligns with global climate goals, particularly the steel industry's commitment to reduce carbon emissions by 30% by 2030 and achieve carbon neutrality by 2050. Secondary objectives include reducing dependence on coking coal, minimizing environmental impacts associated with conventional ironmaking, and enabling more distributed production models that can operate at smaller scales.

Technical goals for this technology include achieving energy efficiencies exceeding 85%, developing durable electrode materials capable of withstanding harsh operating conditions for extended periods, and designing scalable reactor systems that can be integrated with renewable energy sources. Process optimization aims to minimize impurities in the final product while maximizing production rates to compete with conventional methods.

The economic modeling of electrochemical iron production projects must account for the technology's current developmental stage, which sits at the transition between laboratory demonstration and early commercial deployment. Several pilot plants are operational globally, providing valuable data on operational parameters and economic factors. These projects serve as critical validation points for the technology's commercial potential and inform investment decisions for larger-scale implementations.

As the technology matures, understanding the economic drivers and constraints becomes increasingly important for strategic planning and resource allocation. This necessitates comprehensive modeling approaches that can capture both the technical and economic dimensions of electrochemical iron production across different scales and operational contexts.

The technological trajectory of electrochemical iron production has been characterized by progressive improvements in electrode materials, cell design, and electrolyte compositions. Recent breakthroughs in membrane technology and catalyst development have substantially enhanced process efficiency, making this approach increasingly competitive with traditional methods. The convergence of renewable energy expansion and advances in electrochemical engineering has created a favorable environment for accelerated development in this field.

The primary objective of electrochemical iron production is to achieve carbon-neutral or carbon-negative metal extraction while maintaining economic viability. This aligns with global climate goals, particularly the steel industry's commitment to reduce carbon emissions by 30% by 2030 and achieve carbon neutrality by 2050. Secondary objectives include reducing dependence on coking coal, minimizing environmental impacts associated with conventional ironmaking, and enabling more distributed production models that can operate at smaller scales.

Technical goals for this technology include achieving energy efficiencies exceeding 85%, developing durable electrode materials capable of withstanding harsh operating conditions for extended periods, and designing scalable reactor systems that can be integrated with renewable energy sources. Process optimization aims to minimize impurities in the final product while maximizing production rates to compete with conventional methods.

The economic modeling of electrochemical iron production projects must account for the technology's current developmental stage, which sits at the transition between laboratory demonstration and early commercial deployment. Several pilot plants are operational globally, providing valuable data on operational parameters and economic factors. These projects serve as critical validation points for the technology's commercial potential and inform investment decisions for larger-scale implementations.

As the technology matures, understanding the economic drivers and constraints becomes increasingly important for strategic planning and resource allocation. This necessitates comprehensive modeling approaches that can capture both the technical and economic dimensions of electrochemical iron production across different scales and operational contexts.

Market Analysis for Green Steel Technologies

The global steel industry is undergoing a significant transformation driven by increasing environmental concerns and regulatory pressures. Traditional steelmaking processes account for approximately 7-9% of global CO2 emissions, making the sector one of the largest industrial carbon emitters. This environmental impact has created substantial market demand for greener alternatives, with electrochemical iron production emerging as a promising technology.

Market analysis indicates that the green steel market is projected to grow at a CAGR of 6.5% between 2023 and 2030, potentially reaching a market value of $2.5 billion by 2030. This growth is primarily driven by stringent carbon regulations in Europe and North America, coupled with increasing corporate commitments to carbon neutrality across supply chains.

Consumer willingness to pay premium prices for green steel varies significantly by sector. Automotive manufacturers have demonstrated the highest willingness to pay, with premium tolerances of 10-20% for certified low-carbon steel. Construction and infrastructure sectors show moderate premium acceptance of 5-10%, while price-sensitive sectors like general manufacturing remain hesitant to absorb significant green premiums.

Geographically, Europe leads the demand for green steel technologies, spearheaded by the EU's Carbon Border Adjustment Mechanism and ambitious decarbonization targets. North America follows with growing interest, particularly from technology and automotive companies with strong ESG commitments. The Asia-Pacific region, despite being the largest steel producer globally, shows more varied adoption patterns with Japan and South Korea demonstrating stronger interest than China and India.

Electrochemical iron production specifically addresses several market needs that traditional green steel approaches cannot satisfy. Unlike hydrogen-based direct reduction, electrochemical processes can potentially operate with lower capital expenditure and at smaller scales, making them suitable for distributed production models. Market analysis suggests this could open new business models for mini-mills and specialized steel producers.

The economic viability of electrochemical iron production is heavily influenced by electricity costs, which typically represent 30-40% of operational expenses. Regions with abundant renewable energy resources and favorable electricity pricing structures present the most attractive markets for initial deployment. Countries like Norway, Canada, and Chile, with their substantial hydroelectric or solar resources, offer particularly favorable conditions for early commercial implementation.

Market barriers include the conservative nature of the steel industry, high capital requirements for new facilities, and uncertainty regarding long-term policy frameworks for carbon pricing. However, the increasing investor focus on ESG metrics and the growing corporate demand for verifiable emissions reductions in supply chains are creating strong market pull for technologies like electrochemical iron production.

Market analysis indicates that the green steel market is projected to grow at a CAGR of 6.5% between 2023 and 2030, potentially reaching a market value of $2.5 billion by 2030. This growth is primarily driven by stringent carbon regulations in Europe and North America, coupled with increasing corporate commitments to carbon neutrality across supply chains.

Consumer willingness to pay premium prices for green steel varies significantly by sector. Automotive manufacturers have demonstrated the highest willingness to pay, with premium tolerances of 10-20% for certified low-carbon steel. Construction and infrastructure sectors show moderate premium acceptance of 5-10%, while price-sensitive sectors like general manufacturing remain hesitant to absorb significant green premiums.

Geographically, Europe leads the demand for green steel technologies, spearheaded by the EU's Carbon Border Adjustment Mechanism and ambitious decarbonization targets. North America follows with growing interest, particularly from technology and automotive companies with strong ESG commitments. The Asia-Pacific region, despite being the largest steel producer globally, shows more varied adoption patterns with Japan and South Korea demonstrating stronger interest than China and India.

Electrochemical iron production specifically addresses several market needs that traditional green steel approaches cannot satisfy. Unlike hydrogen-based direct reduction, electrochemical processes can potentially operate with lower capital expenditure and at smaller scales, making them suitable for distributed production models. Market analysis suggests this could open new business models for mini-mills and specialized steel producers.

The economic viability of electrochemical iron production is heavily influenced by electricity costs, which typically represent 30-40% of operational expenses. Regions with abundant renewable energy resources and favorable electricity pricing structures present the most attractive markets for initial deployment. Countries like Norway, Canada, and Chile, with their substantial hydroelectric or solar resources, offer particularly favorable conditions for early commercial implementation.

Market barriers include the conservative nature of the steel industry, high capital requirements for new facilities, and uncertainty regarding long-term policy frameworks for carbon pricing. However, the increasing investor focus on ESG metrics and the growing corporate demand for verifiable emissions reductions in supply chains are creating strong market pull for technologies like electrochemical iron production.

Technical Challenges and Global Development Status

Electrochemical iron production technology currently faces several significant technical challenges that have limited its widespread commercial adoption. The primary obstacle remains the high energy consumption compared to conventional blast furnace methods, with current electrochemical processes requiring 3-4 MWh per ton of iron produced. This energy intensity creates economic barriers in regions without access to low-cost renewable electricity sources.

Electrode durability presents another critical challenge, as the harsh electrochemical environment causes degradation over time, necessitating frequent replacement and increasing operational costs. Most commercial-scale operations report electrode lifespans of only 3-6 months, significantly impacting economic viability.

Electrolyte management also poses difficulties, particularly in maintaining optimal ionic conductivity while preventing contamination that reduces product purity. Current systems struggle to achieve consistent iron purity above 99.5% without additional refining steps.

Globally, electrochemical iron production remains predominantly at the pilot scale, with only limited commercial implementation. North America leads research efforts, with Boston Metal (USA) operating a demonstration plant capable of producing 25,000 tons annually. Their molten oxide electrolysis technology has attracted over $200 million in investment but still faces scalability challenges.

In Europe, the SIDERWIN consortium has established a pilot facility in France producing 50 kg of iron daily through alkaline electrolysis. The European Union has allocated €18 million to advance this technology under its carbon reduction initiatives.

Asian development is accelerating, particularly in China where government-backed research programs at Northeastern University and Central South University focus on adapting electrochemical processes to utilize renewable energy sources. Japan's COURSE50 project integrates hydrogen-based reduction with electrochemical processes to reduce carbon emissions.

Australia has leveraged its abundant renewable energy resources to establish testing facilities for electrochemical iron production, with companies like Rio Tinto investing in pilot plants in Queensland that utilize solar power for electrolysis operations.

Despite these global efforts, the technology readiness level (TRL) for electrochemical iron production remains at 6-7, indicating that while demonstration systems exist, full commercial viability has not yet been achieved. The geographical distribution of development efforts closely correlates with regions possessing either strong metallurgical research infrastructure or abundant renewable energy resources.

Electrode durability presents another critical challenge, as the harsh electrochemical environment causes degradation over time, necessitating frequent replacement and increasing operational costs. Most commercial-scale operations report electrode lifespans of only 3-6 months, significantly impacting economic viability.

Electrolyte management also poses difficulties, particularly in maintaining optimal ionic conductivity while preventing contamination that reduces product purity. Current systems struggle to achieve consistent iron purity above 99.5% without additional refining steps.

Globally, electrochemical iron production remains predominantly at the pilot scale, with only limited commercial implementation. North America leads research efforts, with Boston Metal (USA) operating a demonstration plant capable of producing 25,000 tons annually. Their molten oxide electrolysis technology has attracted over $200 million in investment but still faces scalability challenges.

In Europe, the SIDERWIN consortium has established a pilot facility in France producing 50 kg of iron daily through alkaline electrolysis. The European Union has allocated €18 million to advance this technology under its carbon reduction initiatives.

Asian development is accelerating, particularly in China where government-backed research programs at Northeastern University and Central South University focus on adapting electrochemical processes to utilize renewable energy sources. Japan's COURSE50 project integrates hydrogen-based reduction with electrochemical processes to reduce carbon emissions.

Australia has leveraged its abundant renewable energy resources to establish testing facilities for electrochemical iron production, with companies like Rio Tinto investing in pilot plants in Queensland that utilize solar power for electrolysis operations.

Despite these global efforts, the technology readiness level (TRL) for electrochemical iron production remains at 6-7, indicating that while demonstration systems exist, full commercial viability has not yet been achieved. The geographical distribution of development efforts closely correlates with regions possessing either strong metallurgical research infrastructure or abundant renewable energy resources.

Current Economic Models for Electrochemical Iron Production

01 Cost modeling and economic analysis for electrochemical iron production

Economic modeling frameworks for electrochemical iron production processes that analyze production costs, capital expenditures, and operational expenses. These models evaluate the financial viability of electrochemical methods compared to traditional ironmaking, incorporating factors such as energy consumption, raw material costs, and equipment investments to determine profitability and return on investment.- Cost modeling and economic analysis for electrochemical iron production: Economic modeling frameworks for electrochemical iron production processes that analyze production costs, capital expenditures, and operational expenses. These models evaluate factors such as energy consumption, raw material costs, equipment efficiency, and market conditions to determine the economic viability of electrochemical iron production methods compared to traditional processes. The models help in optimizing production parameters to achieve cost-effectiveness while maintaining product quality.

- Energy efficiency optimization in electrochemical iron production: Methods and systems for optimizing energy efficiency in electrochemical iron production processes. These approaches focus on reducing energy consumption through improved cell design, electrode materials, and process control strategies. Energy efficiency optimization includes modeling electricity usage patterns, implementing renewable energy sources, and developing energy recovery systems. These innovations aim to lower production costs while reducing the carbon footprint of iron production.

- Environmental impact assessment and sustainability modeling: Economic models that incorporate environmental impact assessments and sustainability metrics for electrochemical iron production. These models evaluate carbon emissions, waste generation, resource utilization, and regulatory compliance costs. By quantifying environmental externalities and potential carbon taxes, these models help producers make informed decisions about process modifications and technology investments to achieve both economic and environmental sustainability goals.

- Supply chain and market analysis for electrochemical iron: Economic modeling approaches that analyze the entire supply chain for electrochemically produced iron, from raw material sourcing to market distribution. These models evaluate factors such as transportation costs, market demand fluctuations, price volatility, and competitive positioning. By understanding supply chain dynamics and market trends, producers can optimize production volumes, pricing strategies, and distribution networks to maximize profitability and market share.

- Process optimization and scaling economics: Economic models focused on process optimization and scaling economics for electrochemical iron production. These models analyze the relationship between production scale and unit costs, identifying optimal plant sizes and production capacities. They incorporate factors such as equipment sizing, automation levels, labor requirements, and maintenance costs. The models help in determining the most economical production configuration and provide insights into scaling strategies for commercial implementation.

02 Energy efficiency optimization in electrochemical iron production

Methods for optimizing energy consumption in electrochemical iron production processes to improve economic viability. These approaches include advanced electrode designs, electrolyte composition optimization, and process parameter control to reduce electricity usage while maintaining production rates. Energy efficiency improvements directly impact operational costs and environmental footprint, making the process more economically competitive.Expand Specific Solutions03 Sustainable and low-carbon electrochemical iron production systems

Economic models for environmentally sustainable electrochemical iron production that incorporate carbon pricing, emissions reduction benefits, and regulatory compliance costs. These systems evaluate the financial advantages of low-carbon production methods, including integration with renewable energy sources, carbon capture technologies, and circular economy principles to create competitive advantages in markets with environmental regulations.Expand Specific Solutions04 Supply chain and market analysis for electrochemical iron products

Economic frameworks analyzing the supply chain dynamics and market positioning of electrochemically produced iron. These models evaluate raw material sourcing strategies, product distribution networks, market demand forecasts, and competitive positioning. The analyses help determine optimal pricing strategies, identify target markets, and assess the economic impact of supply chain disruptions on production economics.Expand Specific Solutions05 Scale-up economics and commercialization pathways

Economic models focusing on the transition from laboratory-scale to commercial-scale electrochemical iron production. These frameworks analyze the capital requirements, economies of scale, production capacity optimization, and technology readiness levels. The models help identify economic barriers to commercialization, optimal plant sizes, phased implementation strategies, and investment timelines to achieve commercial viability.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The electrochemical iron production market is in its early growth phase, characterized by increasing investment in decarbonization technologies for steel manufacturing. The global market size remains relatively small but is expanding rapidly due to heightened focus on reducing carbon emissions in heavy industry. Technologically, the field is still evolving with varying levels of maturity across different approaches. Form Energy leads in grid-scale iron-air battery technology, while Electra and Xilectric are pioneering direct electrochemical iron production methods. Traditional steel producers like Shanxi Taigang and Wuhan Iron & Steel are beginning to explore these technologies. Research institutions including the Institute of Process Engineering CAS and universities such as Wuhan University are advancing fundamental research, creating a competitive landscape balanced between innovative startups and established industrial players adapting to the energy transition.

Form Energy, Inc.

Technical Solution: Form Energy has developed a comprehensive economic modeling framework for their iron-air battery technology, which leverages electrochemical iron production principles. Their approach integrates capital expenditure modeling, operational cost analysis, and revenue projection specifically tailored for grid-scale energy storage systems. The company's economic models account for the full lifecycle of iron electrodes, including raw material sourcing costs, manufacturing processes, and end-of-life recycling. Form Energy's modeling incorporates multi-day discharge capabilities (up to 100+ hours) and factors in the economic benefits of using abundant, low-cost materials like iron, air, and water. Their models demonstrate how electrochemical iron systems can achieve costs below $20/kWh for storage components, making renewable energy dispatchable and cost-competitive with conventional power generation.

Strengths: Specialized in long-duration energy storage economics with iron-air technology; models incorporate real-world deployment data from pilot projects. Weaknesses: Models may be overly optimized for grid applications rather than broader industrial iron production; economic projections still rely on scaling assumptions that remain unproven at commercial scale.

Institute of Process Engineering, Chinese Academy of Sciences

Technical Solution: The Institute has developed sophisticated techno-economic assessment frameworks specifically for electrochemical iron production pathways in the Chinese industrial context. Their modeling approach integrates detailed process simulation with economic analysis, accounting for China's unique electricity market structures, industrial policy incentives, and decarbonization targets. The Institute's models incorporate comprehensive material and energy flow analysis across the entire production chain, from raw material preparation to final product processing. Their economic assessments include detailed sensitivity analysis for key parameters including electricity prices, carbon taxation scenarios, and capital equipment costs. The Institute's research demonstrates that electrochemical iron production could achieve cost parity with conventional blast furnace routes in China by 2030 under moderate carbon pricing scenarios, with potential cost advantages of 10-20% in regions with abundant renewable electricity. Their modeling framework also quantifies the economic impacts of various technological innovations in electrode materials, cell design, and system integration.

Strengths: Comprehensive integration of technical process modeling with economic assessment; models specifically calibrated for Chinese industrial context and policy environment. Weaknesses: Models may overemphasize policy-driven scenarios rather than pure market economics; limited consideration of international market dynamics and trade implications.

Critical Patents and Technical Literature Review

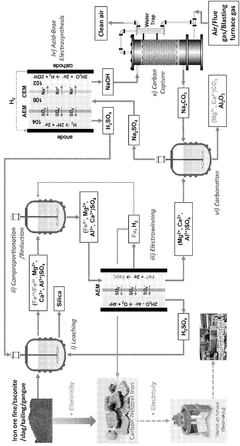

Electrochemical cogeneration of iron and commodity chemicals

PatentWO2025034747A1

Innovation

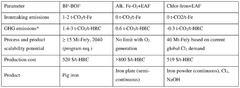

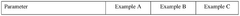

- The chlor-iron process employs an electrochemical reactor with a magnetic field to continuously produce iron metal from low-grade ores, simultaneously generating valuable co-products like NaOH and chlorine, which help offset production costs and sequester CO2.

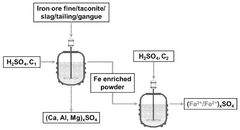

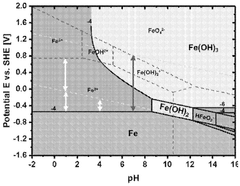

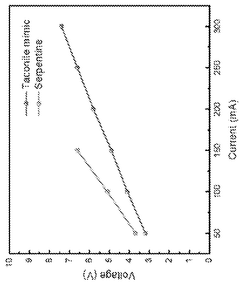

Electrochemical hydrometallurgy for sustainable ironmaking

PatentWO2025101445A1

Innovation

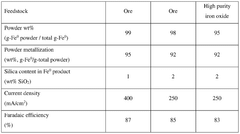

- An electrochemical hydrometallurgical system (EHSI) that utilizes a flow electro-synthesizer, carbon dioxide capturing, acid leaching, comproportionation, electrowinning, and carbonation processes to produce high-purity iron from iron-containing materials while capturing and sequestering carbon dioxide.

Regulatory Framework and Carbon Pricing Impacts

The regulatory landscape for electrochemical iron production is rapidly evolving as governments worldwide implement policies to reduce carbon emissions in heavy industries. Carbon pricing mechanisms, including carbon taxes and emissions trading systems (ETS), have become increasingly prevalent across major economies, directly impacting the economic viability of traditional iron production methods versus emerging electrochemical alternatives.

In the European Union, the Emissions Trading System represents the cornerstone of climate policy, with carbon prices reaching record levels of €100 per tonne in 2023. This significant price signal creates a compelling economic case for electrochemical iron production, which can reduce emissions by up to 90% compared to conventional blast furnace methods. The EU's Carbon Border Adjustment Mechanism (CBAM), being phased in from 2023, will further enhance the competitiveness of low-carbon production methods by imposing carbon costs on imports.

North American regulatory frameworks show considerable regional variation. While the United States lacks a federal carbon pricing system, state-level initiatives like California's cap-and-trade program and the Regional Greenhouse Gas Initiative provide important market signals. Canada's federal carbon pricing backstop, reaching CAD$170 per tonne by 2030, offers a more predictable trajectory for investment planning in electrochemical technologies.

The Asia-Pacific region presents a complex regulatory environment. China's national ETS, though currently limited in scope, signals the world's largest steel producer's commitment to emissions reduction. Japan and South Korea have established carbon pricing mechanisms that increasingly favor low-carbon production technologies, though price levels remain lower than European counterparts.

Sensitivity analysis reveals that electrochemical iron production projects become economically competitive with conventional methods at carbon prices between $50-80 per tonne, depending on local electricity costs and iron ore prices. This threshold is already surpassed in several jurisdictions, creating immediate investment opportunities.

Future regulatory trends indicate strengthening carbon pricing mechanisms globally, with prices projected to reach $100-150 per tonne in major economies by 2030. This trajectory significantly improves the long-term economics of electrochemical iron production investments. Additionally, complementary policies such as green procurement requirements, production subsidies for low-carbon materials, and technology-specific innovation funding further enhance the economic case beyond direct carbon pricing impacts.

In the European Union, the Emissions Trading System represents the cornerstone of climate policy, with carbon prices reaching record levels of €100 per tonne in 2023. This significant price signal creates a compelling economic case for electrochemical iron production, which can reduce emissions by up to 90% compared to conventional blast furnace methods. The EU's Carbon Border Adjustment Mechanism (CBAM), being phased in from 2023, will further enhance the competitiveness of low-carbon production methods by imposing carbon costs on imports.

North American regulatory frameworks show considerable regional variation. While the United States lacks a federal carbon pricing system, state-level initiatives like California's cap-and-trade program and the Regional Greenhouse Gas Initiative provide important market signals. Canada's federal carbon pricing backstop, reaching CAD$170 per tonne by 2030, offers a more predictable trajectory for investment planning in electrochemical technologies.

The Asia-Pacific region presents a complex regulatory environment. China's national ETS, though currently limited in scope, signals the world's largest steel producer's commitment to emissions reduction. Japan and South Korea have established carbon pricing mechanisms that increasingly favor low-carbon production technologies, though price levels remain lower than European counterparts.

Sensitivity analysis reveals that electrochemical iron production projects become economically competitive with conventional methods at carbon prices between $50-80 per tonne, depending on local electricity costs and iron ore prices. This threshold is already surpassed in several jurisdictions, creating immediate investment opportunities.

Future regulatory trends indicate strengthening carbon pricing mechanisms globally, with prices projected to reach $100-150 per tonne in major economies by 2030. This trajectory significantly improves the long-term economics of electrochemical iron production investments. Additionally, complementary policies such as green procurement requirements, production subsidies for low-carbon materials, and technology-specific innovation funding further enhance the economic case beyond direct carbon pricing impacts.

Investment Risk Assessment and Mitigation Strategies

Electrochemical iron production projects face a complex landscape of investment risks that require systematic assessment and strategic mitigation approaches. Market volatility represents a primary concern, with fluctuating iron prices potentially undermining project economics. Historical price data indicates that iron commodities can experience up to 30% annual price variations, necessitating robust financial modeling that incorporates multiple price scenarios. Additionally, technology maturity risks are significant as electrochemical processes for iron production remain relatively novel compared to traditional blast furnace methods, with limited commercial-scale implementation data available.

Regulatory uncertainties constitute another substantial risk category, particularly regarding carbon pricing mechanisms and environmental compliance requirements. Projects may face unexpected cost increases if carbon taxation policies change during the operational lifetime. For instance, carbon prices in key markets have shown compound annual growth rates of 15-25% in recent years, potentially transforming project economics if not adequately forecasted.

Capital expenditure overruns represent a persistent threat, with industry benchmarks suggesting that innovative metallurgical projects typically experience 15-40% cost escalation from initial estimates. Implementing stage-gate investment approaches with clearly defined technical and economic milestones can significantly reduce exposure to runaway costs. Furthermore, establishing contingency reserves proportional to technology readiness levels provides essential financial buffers.

Operational risks, including energy price volatility and supply chain disruptions, require dedicated mitigation strategies. Long-term power purchase agreements can stabilize a major cost component, while diversified supplier networks enhance resilience against material shortages. Sensitivity analysis indicates that electricity costs typically account for 30-45% of operational expenses in electrochemical iron production, making energy price hedging particularly valuable.

Strategic partnerships offer powerful risk mitigation opportunities, distributing financial exposure while providing access to complementary expertise. Joint ventures with established metallurgical companies can accelerate commercialization timelines and improve market access. Additionally, phased implementation approaches allow for iterative learning and optimization before full-scale deployment commitments.

Insurance instruments specifically designed for emerging industrial technologies are increasingly available, covering aspects from technology performance shortfalls to business interruption scenarios. These financial tools, while representing additional costs, can significantly reduce downside exposure and improve project bankability with conservative investors.

Regulatory uncertainties constitute another substantial risk category, particularly regarding carbon pricing mechanisms and environmental compliance requirements. Projects may face unexpected cost increases if carbon taxation policies change during the operational lifetime. For instance, carbon prices in key markets have shown compound annual growth rates of 15-25% in recent years, potentially transforming project economics if not adequately forecasted.

Capital expenditure overruns represent a persistent threat, with industry benchmarks suggesting that innovative metallurgical projects typically experience 15-40% cost escalation from initial estimates. Implementing stage-gate investment approaches with clearly defined technical and economic milestones can significantly reduce exposure to runaway costs. Furthermore, establishing contingency reserves proportional to technology readiness levels provides essential financial buffers.

Operational risks, including energy price volatility and supply chain disruptions, require dedicated mitigation strategies. Long-term power purchase agreements can stabilize a major cost component, while diversified supplier networks enhance resilience against material shortages. Sensitivity analysis indicates that electricity costs typically account for 30-45% of operational expenses in electrochemical iron production, making energy price hedging particularly valuable.

Strategic partnerships offer powerful risk mitigation opportunities, distributing financial exposure while providing access to complementary expertise. Joint ventures with established metallurgical companies can accelerate commercialization timelines and improve market access. Additionally, phased implementation approaches allow for iterative learning and optimization before full-scale deployment commitments.

Insurance instruments specifically designed for emerging industrial technologies are increasingly available, covering aspects from technology performance shortfalls to business interruption scenarios. These financial tools, while representing additional costs, can significantly reduce downside exposure and improve project bankability with conservative investors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!