What are the Applications of Bio-based Polymer in Construction?

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-based Polymer Evolution and Construction Goals

Bio-based polymers have evolved significantly over the past decades, transitioning from laboratory curiosities to commercially viable construction materials. The evolution began in the early 20th century with the development of cellulose-based polymers, but gained substantial momentum only in the 1990s when environmental concerns and sustainability goals became prominent in industrial sectors. The trajectory has been marked by progressive improvements in mechanical properties, durability, and processing capabilities, enabling these materials to compete with conventional petroleum-based polymers.

The development timeline reveals three distinct phases: initial discovery and basic formulation (1970s-1990s), commercial viability and performance enhancement (2000s-2010s), and current advanced applications with specialized functionalities (2010s-present). Each phase has contributed to expanding the application scope from simple non-load-bearing components to sophisticated structural elements in modern construction.

Recent technological breakthroughs have focused on addressing the inherent limitations of bio-based polymers, particularly their susceptibility to moisture, limited thermal stability, and variable mechanical properties. Innovations in polymer blending, cross-linking technologies, and nano-reinforcement have significantly improved performance metrics, making these materials increasingly suitable for demanding construction applications.

The construction industry's adoption of bio-based polymers aligns with several critical goals. Primary among these is reducing the carbon footprint of buildings, which currently account for approximately 39% of global carbon emissions. Bio-based polymers offer carbon sequestration potential during their growth phase and typically require less energy-intensive manufacturing processes compared to conventional materials.

Another significant goal is decreasing dependence on finite petroleum resources. As construction material demand continues to rise globally, particularly in developing economies, sustainable alternatives become increasingly essential for long-term resource security. Bio-based polymers derived from renewable agricultural feedstocks present a viable pathway toward this objective.

Performance goals for these materials include achieving comparable or superior mechanical properties to conventional polymers, ensuring durability under various environmental conditions, and maintaining cost competitiveness. Current research focuses on optimizing these parameters while maximizing the renewable content of the final products.

The technological trajectory suggests that bio-based polymers will increasingly incorporate smart functionalities, such as self-healing capabilities, thermal regulation properties, and embedded sensing technologies, aligning with the broader trend toward high-performance, multifunctional building materials that contribute to energy-efficient, sustainable construction practices.

The development timeline reveals three distinct phases: initial discovery and basic formulation (1970s-1990s), commercial viability and performance enhancement (2000s-2010s), and current advanced applications with specialized functionalities (2010s-present). Each phase has contributed to expanding the application scope from simple non-load-bearing components to sophisticated structural elements in modern construction.

Recent technological breakthroughs have focused on addressing the inherent limitations of bio-based polymers, particularly their susceptibility to moisture, limited thermal stability, and variable mechanical properties. Innovations in polymer blending, cross-linking technologies, and nano-reinforcement have significantly improved performance metrics, making these materials increasingly suitable for demanding construction applications.

The construction industry's adoption of bio-based polymers aligns with several critical goals. Primary among these is reducing the carbon footprint of buildings, which currently account for approximately 39% of global carbon emissions. Bio-based polymers offer carbon sequestration potential during their growth phase and typically require less energy-intensive manufacturing processes compared to conventional materials.

Another significant goal is decreasing dependence on finite petroleum resources. As construction material demand continues to rise globally, particularly in developing economies, sustainable alternatives become increasingly essential for long-term resource security. Bio-based polymers derived from renewable agricultural feedstocks present a viable pathway toward this objective.

Performance goals for these materials include achieving comparable or superior mechanical properties to conventional polymers, ensuring durability under various environmental conditions, and maintaining cost competitiveness. Current research focuses on optimizing these parameters while maximizing the renewable content of the final products.

The technological trajectory suggests that bio-based polymers will increasingly incorporate smart functionalities, such as self-healing capabilities, thermal regulation properties, and embedded sensing technologies, aligning with the broader trend toward high-performance, multifunctional building materials that contribute to energy-efficient, sustainable construction practices.

Market Demand Analysis for Sustainable Construction Materials

The global construction industry is experiencing a significant shift towards sustainable materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly bio-based polymers, has shown remarkable growth in recent years. According to market research, the global bio-based polymer market was valued at approximately $10.5 billion in 2022 and is projected to reach $29.7 billion by 2030, growing at a CAGR of 13.8% during the forecast period.

The demand for bio-based polymers in construction is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions and promoting circular economy principles. The European Union's Green Deal and various national policies worldwide have established ambitious targets for carbon neutrality, creating a favorable regulatory environment for sustainable construction materials. These regulations have effectively transformed market dynamics, making sustainability a competitive advantage rather than just a compliance requirement.

Consumer preferences have also evolved significantly, with increasing awareness about environmental issues driving demand for eco-friendly building materials. A recent survey conducted across major construction markets revealed that 67% of consumers are willing to pay a premium for buildings constructed with sustainable materials. This shift in consumer behavior has prompted construction companies to incorporate bio-based polymers in their projects as a marketing strategy to attract environmentally conscious clients.

The construction sector's demand for bio-based polymers varies across different applications. Insulation materials represent the largest market segment, accounting for approximately 35% of the total demand. Bio-based polymer composites for structural applications follow closely at 28%, while coatings, adhesives, and sealants collectively constitute about 25% of the market. The remaining 12% is distributed among various specialized applications such as geotextiles and reinforcement fibers.

Regional analysis indicates that Europe currently leads the market for bio-based polymers in construction, holding a market share of approximately 40%. North America follows with 30%, while the Asia-Pacific region, despite having the largest construction market globally, accounts for only 22% of bio-based polymer demand in construction. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to rapid urbanization and increasing government initiatives promoting green building practices.

The economic viability of bio-based polymers remains a significant factor influencing market adoption. Currently, these materials typically cost 15-30% more than their petroleum-based counterparts. However, this price premium is gradually decreasing due to technological advancements and economies of scale. Industry experts predict that price parity could be achieved for several key applications within the next 5-7 years, which would substantially accelerate market growth.

The demand for bio-based polymers in construction is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions and promoting circular economy principles. The European Union's Green Deal and various national policies worldwide have established ambitious targets for carbon neutrality, creating a favorable regulatory environment for sustainable construction materials. These regulations have effectively transformed market dynamics, making sustainability a competitive advantage rather than just a compliance requirement.

Consumer preferences have also evolved significantly, with increasing awareness about environmental issues driving demand for eco-friendly building materials. A recent survey conducted across major construction markets revealed that 67% of consumers are willing to pay a premium for buildings constructed with sustainable materials. This shift in consumer behavior has prompted construction companies to incorporate bio-based polymers in their projects as a marketing strategy to attract environmentally conscious clients.

The construction sector's demand for bio-based polymers varies across different applications. Insulation materials represent the largest market segment, accounting for approximately 35% of the total demand. Bio-based polymer composites for structural applications follow closely at 28%, while coatings, adhesives, and sealants collectively constitute about 25% of the market. The remaining 12% is distributed among various specialized applications such as geotextiles and reinforcement fibers.

Regional analysis indicates that Europe currently leads the market for bio-based polymers in construction, holding a market share of approximately 40%. North America follows with 30%, while the Asia-Pacific region, despite having the largest construction market globally, accounts for only 22% of bio-based polymer demand in construction. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years due to rapid urbanization and increasing government initiatives promoting green building practices.

The economic viability of bio-based polymers remains a significant factor influencing market adoption. Currently, these materials typically cost 15-30% more than their petroleum-based counterparts. However, this price premium is gradually decreasing due to technological advancements and economies of scale. Industry experts predict that price parity could be achieved for several key applications within the next 5-7 years, which would substantially accelerate market growth.

Current Status and Challenges in Bio-based Construction Polymers

The global adoption of bio-based polymers in construction has shown significant growth in recent years, with the market value projected to reach $39.1 billion by 2027. However, despite this promising trajectory, the sector faces numerous technical and commercial challenges that impede widespread implementation. Currently, bio-based polymers represent only about 2% of the total construction polymers market, indicating substantial room for growth but also highlighting existing barriers.

From a technical perspective, bio-based construction polymers still struggle with performance limitations compared to their petroleum-based counterparts. Durability remains a primary concern, with many bio-based alternatives demonstrating reduced resistance to UV radiation, moisture, and temperature fluctuations. For instance, PLA (Polylactic Acid) based materials, while renewable, exhibit lower thermal stability, limiting their application in exterior construction elements exposed to varying weather conditions.

Mechanical properties present another significant challenge. Bio-based polymers often display lower tensile strength and impact resistance, making them less suitable for load-bearing applications without substantial modifications or reinforcements. Research indicates that unmodified bio-based polymers typically achieve only 60-70% of the mechanical performance of conventional polymers used in construction.

Production scalability constitutes a major hurdle in the industry. Current manufacturing processes for bio-based construction polymers are predominantly batch-oriented rather than continuous, resulting in higher production costs and limited supply capacity. The average production cost remains 1.5-2.5 times higher than petroleum-based alternatives, creating a significant market entry barrier.

Geographical distribution of bio-based polymer technology shows notable concentration in Western Europe and North America, which together account for approximately 65% of research publications and 72% of patents in this field. Asia-Pacific, particularly Japan and China, is rapidly emerging as a significant player, with research output growing at an annual rate of 18% over the past five years.

Regulatory frameworks present both challenges and opportunities. While sustainability certifications like LEED and BREEAM incentivize the use of bio-based materials, inconsistent standards across regions create market fragmentation. The absence of unified global standards for testing and certifying bio-based construction polymers complicates international trade and technology transfer.

Feedstock availability and competition with food production remain contentious issues. First-generation bio-based polymers derived from food crops face ethical concerns and price volatility. The industry is gradually shifting toward second and third-generation feedstocks, including agricultural waste, algae, and non-food crops, though these supply chains are still developing and lack the robustness needed for large-scale construction applications.

From a technical perspective, bio-based construction polymers still struggle with performance limitations compared to their petroleum-based counterparts. Durability remains a primary concern, with many bio-based alternatives demonstrating reduced resistance to UV radiation, moisture, and temperature fluctuations. For instance, PLA (Polylactic Acid) based materials, while renewable, exhibit lower thermal stability, limiting their application in exterior construction elements exposed to varying weather conditions.

Mechanical properties present another significant challenge. Bio-based polymers often display lower tensile strength and impact resistance, making them less suitable for load-bearing applications without substantial modifications or reinforcements. Research indicates that unmodified bio-based polymers typically achieve only 60-70% of the mechanical performance of conventional polymers used in construction.

Production scalability constitutes a major hurdle in the industry. Current manufacturing processes for bio-based construction polymers are predominantly batch-oriented rather than continuous, resulting in higher production costs and limited supply capacity. The average production cost remains 1.5-2.5 times higher than petroleum-based alternatives, creating a significant market entry barrier.

Geographical distribution of bio-based polymer technology shows notable concentration in Western Europe and North America, which together account for approximately 65% of research publications and 72% of patents in this field. Asia-Pacific, particularly Japan and China, is rapidly emerging as a significant player, with research output growing at an annual rate of 18% over the past five years.

Regulatory frameworks present both challenges and opportunities. While sustainability certifications like LEED and BREEAM incentivize the use of bio-based materials, inconsistent standards across regions create market fragmentation. The absence of unified global standards for testing and certifying bio-based construction polymers complicates international trade and technology transfer.

Feedstock availability and competition with food production remain contentious issues. First-generation bio-based polymers derived from food crops face ethical concerns and price volatility. The industry is gradually shifting toward second and third-generation feedstocks, including agricultural waste, algae, and non-food crops, though these supply chains are still developing and lack the robustness needed for large-scale construction applications.

Current Bio-based Polymer Construction Applications

01 Bio-based polymers from renewable resources

Bio-based polymers derived from renewable resources such as plant materials offer sustainable alternatives to petroleum-based polymers. These polymers utilize biomass feedstocks like cellulose, starch, and plant oils to create environmentally friendly materials with reduced carbon footprints. The production processes focus on converting these renewable resources into functional polymers with properties comparable to conventional plastics while maintaining biodegradability and sustainability.- Bio-based polymers from renewable resources: Bio-based polymers derived from renewable resources such as plant materials offer sustainable alternatives to petroleum-based polymers. These polymers utilize biomass feedstocks like cellulose, starch, and plant oils to create environmentally friendly materials with reduced carbon footprints. The production processes focus on converting these renewable resources into functional polymers with comparable properties to conventional plastics while maintaining biodegradability and sustainability.

- Biodegradable polymer composites and blends: Biodegradable polymer composites and blends combine bio-based polymers with other materials to enhance performance characteristics. These formulations may incorporate natural fibers, minerals, or other biodegradable polymers to improve mechanical properties, thermal stability, or processing characteristics. The resulting materials maintain their environmentally friendly attributes while offering improved functionality for various applications, from packaging to consumer products.

- Processing technologies for bio-based polymers: Specialized processing technologies have been developed to effectively manufacture bio-based polymer products. These include modified extrusion techniques, injection molding processes, and other fabrication methods adapted specifically for the unique characteristics of bio-based materials. The technologies address challenges such as thermal sensitivity, moisture content, and processing window limitations that are common with bio-based polymers, enabling commercial-scale production of sustainable polymer products.

- Bio-based polymer applications in medical and pharmaceutical fields: Bio-based polymers offer unique advantages in medical and pharmaceutical applications due to their biocompatibility and controlled degradation properties. These materials are used in drug delivery systems, tissue engineering scaffolds, medical implants, and wound care products. Their natural origin often results in reduced immune responses and better integration with biological systems, while their degradation can be tailored to match healing or treatment timelines.

- Functionalized bio-based polymers with enhanced properties: Chemical modification and functionalization of bio-based polymers can enhance their properties for specific applications. These modifications include grafting, crosslinking, or introducing functional groups to improve characteristics such as water resistance, thermal stability, mechanical strength, or compatibility with other materials. Functionalized bio-based polymers bridge the performance gap with conventional plastics while maintaining their environmental benefits, expanding their potential applications in various industries.

02 Biodegradable polymer composites and blends

Biodegradable polymer composites and blends combine bio-based polymers with other materials to enhance performance characteristics. These formulations may incorporate natural fibers, minerals, or other biodegradable polymers to improve mechanical properties, thermal stability, or processing characteristics. The resulting materials maintain their biodegradability while offering improved functionality for various applications, from packaging to consumer products.Expand Specific Solutions03 Processing technologies for bio-based polymers

Specialized processing technologies have been developed to effectively manufacture bio-based polymer products. These include modified extrusion techniques, injection molding processes, and other fabrication methods adapted specifically for the unique characteristics of bio-based materials. These technologies address challenges such as thermal sensitivity, moisture content, and processing window limitations that are common with bio-based polymers, enabling their commercial viability.Expand Specific Solutions04 Bio-based polymers for medical and pharmaceutical applications

Bio-based polymers offer unique advantages for medical and pharmaceutical applications due to their biocompatibility and controlled degradation properties. These materials can be used for drug delivery systems, tissue engineering scaffolds, and medical devices. Their natural origin often results in reduced immunogenic responses, while their degradation profiles can be tailored to match specific therapeutic requirements, making them valuable for advanced healthcare applications.Expand Specific Solutions05 Functionalized bio-based polymers with enhanced properties

Chemical modification and functionalization of bio-based polymers can significantly enhance their properties and expand their application range. These modifications include grafting, crosslinking, and the introduction of functional groups to improve characteristics such as water resistance, thermal stability, mechanical strength, and compatibility with other materials. Functionalized bio-based polymers bridge the performance gap with conventional petroleum-based plastics while maintaining their environmental benefits.Expand Specific Solutions

Key Industry Players in Bio-based Construction Materials

The bio-based polymer market in construction is in a growth phase, with increasing market size driven by sustainability demands and regulatory pressures. The technology is advancing from early adoption to mainstream implementation, with market maturity varying across applications. Academic institutions like Massachusetts Institute of Technology, Rutgers University, and Huazhong University of Science & Technology are leading fundamental research, while companies such as Arkema, W.L. Gore & Associates, and Benjamin Moore are commercializing applications. Material producers like Archer-Daniels-Midland and Made of Air are developing carbon-negative alternatives, while construction specialists like Colas SA and The AZEK Group are integrating these materials into building products, creating a diverse ecosystem spanning research, material development, and practical implementation.

Massachusetts Institute of Technology

Technical Solution: MIT has developed innovative bio-based polymer composites for construction applications, focusing on cellulose nanofibrils (CNFs) and lignin-based materials. Their approach involves creating high-performance structural materials by combining bio-based polymers with conventional construction materials. MIT researchers have successfully developed bio-based polymer composites with enhanced mechanical properties, including improved tensile strength and durability comparable to traditional petroleum-based materials. Their technology incorporates cross-linking techniques to enhance the water resistance of naturally hydrophilic bio-polymers, making them suitable for external construction applications. MIT has also pioneered self-healing bio-based polymers that can repair microcracks autonomously, extending the service life of construction materials and reducing maintenance costs.

Strengths: Superior mechanical properties and innovative self-healing capabilities that extend material lifespan. Integration with existing construction practices allows for easier market adoption. Weaknesses: Higher production costs compared to conventional materials and limited large-scale implementation evidence in real-world construction projects.

Colas SA

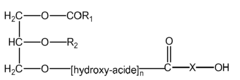

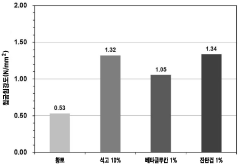

Technical Solution: Colas has pioneered the development of Vegecol®, a bio-based binder for road construction derived from renewable plant resources. This innovative material replaces traditional petroleum-based bitumen with bio-sourced polymers, reducing the carbon footprint of road construction by up to 70%. Colas' technology involves the polymerization of plant-derived monomers to create binding agents with comparable performance to conventional bitumen. Their bio-based polymers demonstrate excellent adhesion properties with mineral aggregates and can withstand heavy traffic loads and varying weather conditions. The company has successfully implemented this technology in numerous road projects across Europe, demonstrating durability comparable to traditional asphalt pavements. Colas has also developed bio-based additives that enhance the performance of recycled asphalt pavement (RAP), allowing for higher percentages of reclaimed materials in new road construction while maintaining structural integrity and performance standards.

Strengths: Proven field performance in actual road construction projects and significant carbon footprint reduction compared to petroleum-based alternatives. Compatible with existing asphalt plants and construction equipment. Weaknesses: Performance in extreme temperature conditions may not match traditional bitumen in all applications. Higher initial cost compared to conventional materials, though lifecycle costs may be competitive.

Core Patents and Research in Bio-based Construction Polymers

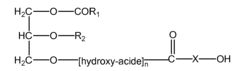

Use of a binder based on biopolymers in roadside and cilvil engineering applications

PatentInactiveEP2135851A1

Innovation

- The use of biopolymer-based resins derived from natural sources, such as polymerized hydroxy acid derivatives, monoglycerides, diglycerides, polylactic acid, and their esters, which are thermoplastic and can be used as binders in construction layers, coatings, and waterproofing products, replacing traditional bituminous and petrochemical binders.

Soil building material using biopolymer

PatentActiveKR1020150122092A

Innovation

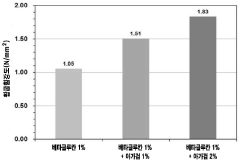

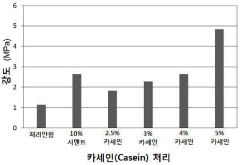

- A soil building material is produced by adding casein and high molecular weight viscous biopolymers, such as polysaccharides or proteins, to soil to improve strength and durability, utilizing methods like mixing, coating, or injecting these biopolymers into the soil, and inducing gelation with alkali or alkaline earth metal ions.

Environmental Impact Assessment and Life Cycle Analysis

The environmental impact assessment of bio-based polymers in construction reveals significant advantages over conventional petroleum-based materials. These polymers typically demonstrate reduced carbon footprints during production, with studies indicating 30-70% lower greenhouse gas emissions compared to their synthetic counterparts. This reduction stems primarily from the renewable nature of their feedstocks, which absorb carbon dioxide during growth phases, creating a partial carbon sequestration effect that offsets emissions during manufacturing processes.

Life cycle analyses (LCA) of bio-based construction polymers consistently highlight their environmental benefits across multiple impact categories. When examining the entire product lifecycle—from raw material extraction through manufacturing, use, and end-of-life management—these materials generally show reduced environmental burdens in terms of fossil resource depletion, acidification potential, and photochemical ozone creation. For instance, PLA (polylactic acid) and PHA (polyhydroxyalkanoates) used in construction applications demonstrate 40-60% lower non-renewable energy consumption compared to conventional polymers.

Water usage presents a more complex picture in the environmental assessment. While bio-based feedstocks often require significant irrigation during cultivation, advanced production techniques and the selection of drought-resistant crop varieties have helped mitigate this concern. Recent innovations in processing technologies have reduced water requirements by approximately 25% over the past decade, narrowing the gap with conventional polymer production.

Land use considerations remain a critical aspect of environmental assessment for bio-based construction polymers. The potential competition with food crops has prompted the development of second and third-generation feedstocks derived from agricultural residues, forestry byproducts, and non-food crops grown on marginal lands. These approaches minimize the land use impact while maintaining the environmental benefits of bio-based materials.

End-of-life scenarios significantly enhance the environmental profile of bio-based polymers in construction. Many of these materials offer biodegradability or compostability under specific conditions, reducing waste accumulation. Additionally, certain bio-based polymers can be effectively recycled through mechanical or chemical processes, further extending their useful life and improving their overall environmental performance. Studies indicate that incorporating end-of-life considerations can improve the overall environmental footprint by 15-30%.

Toxicity assessments generally favor bio-based polymers, which typically contain fewer harmful additives and release fewer toxic substances during their lifecycle. This characteristic is particularly valuable in indoor construction applications, where air quality and human health considerations are paramount. However, comprehensive toxicity evaluations must account for agricultural inputs such as pesticides and fertilizers used in feedstock production.

Life cycle analyses (LCA) of bio-based construction polymers consistently highlight their environmental benefits across multiple impact categories. When examining the entire product lifecycle—from raw material extraction through manufacturing, use, and end-of-life management—these materials generally show reduced environmental burdens in terms of fossil resource depletion, acidification potential, and photochemical ozone creation. For instance, PLA (polylactic acid) and PHA (polyhydroxyalkanoates) used in construction applications demonstrate 40-60% lower non-renewable energy consumption compared to conventional polymers.

Water usage presents a more complex picture in the environmental assessment. While bio-based feedstocks often require significant irrigation during cultivation, advanced production techniques and the selection of drought-resistant crop varieties have helped mitigate this concern. Recent innovations in processing technologies have reduced water requirements by approximately 25% over the past decade, narrowing the gap with conventional polymer production.

Land use considerations remain a critical aspect of environmental assessment for bio-based construction polymers. The potential competition with food crops has prompted the development of second and third-generation feedstocks derived from agricultural residues, forestry byproducts, and non-food crops grown on marginal lands. These approaches minimize the land use impact while maintaining the environmental benefits of bio-based materials.

End-of-life scenarios significantly enhance the environmental profile of bio-based polymers in construction. Many of these materials offer biodegradability or compostability under specific conditions, reducing waste accumulation. Additionally, certain bio-based polymers can be effectively recycled through mechanical or chemical processes, further extending their useful life and improving their overall environmental performance. Studies indicate that incorporating end-of-life considerations can improve the overall environmental footprint by 15-30%.

Toxicity assessments generally favor bio-based polymers, which typically contain fewer harmful additives and release fewer toxic substances during their lifecycle. This characteristic is particularly valuable in indoor construction applications, where air quality and human health considerations are paramount. However, comprehensive toxicity evaluations must account for agricultural inputs such as pesticides and fertilizers used in feedstock production.

Regulatory Framework for Bio-based Materials in Construction

The regulatory landscape for bio-based materials in construction has evolved significantly over the past decade, reflecting growing environmental concerns and sustainability goals. In the European Union, the Construction Products Regulation (CPR) establishes harmonized rules for the marketing of construction products, with specific provisions for bio-based materials through standards like EN 16785 for bio-based content determination. This framework ensures that bio-based polymers meet essential requirements for mechanical strength, fire safety, and environmental performance.

In North America, the ASTM D6866 standard provides a methodology for determining the bio-based content of materials using radiocarbon analysis, while the USDA BioPreferred Program offers certification for products meeting minimum bio-based content thresholds. These regulatory mechanisms have been instrumental in promoting market adoption of bio-based construction materials by providing verification methods and consumer confidence.

The International Organization for Standardization (ISO) has developed several standards specifically addressing bio-based polymers, including ISO 16620 for determination of bio-based carbon content and ISO 14855 for biodegradability assessment. These standards create a globally recognized framework that facilitates international trade and technology transfer in the bio-based construction materials sector.

Environmental Product Declarations (EPDs) have become increasingly important regulatory tools, with standards like EN 15804 providing a structured approach to life cycle assessment for construction materials. For bio-based polymers, these declarations must account for factors such as carbon sequestration during plant growth, agricultural impacts, and end-of-life scenarios, creating a comprehensive environmental profile that supports regulatory compliance.

Building codes across different regions are gradually incorporating provisions for bio-based materials, though significant variations exist. The International Building Code (IBC) in the United States has begun recognizing certain bio-based polymers for specific applications, while countries like Germany and the Netherlands have implemented more progressive regulatory frameworks that actively encourage bio-based material adoption through preferential treatment in public procurement and building certification systems.

Certification systems like LEED, BREEAM, and DGNB have incorporated credits for bio-based materials, creating market incentives that complement regulatory requirements. These systems typically award points for renewable material content, reduced carbon footprint, and improved indoor air quality—all potential advantages of bio-based polymers when properly formulated and applied.

Emerging regulatory trends include the development of end-of-life regulations addressing biodegradability, compostability, and recyclability of bio-based construction materials. The EU's Circular Economy Action Plan and similar initiatives worldwide are driving regulatory innovation in this area, with implications for how bio-based polymers are designed, manufactured, and ultimately disposed of or recycled.

In North America, the ASTM D6866 standard provides a methodology for determining the bio-based content of materials using radiocarbon analysis, while the USDA BioPreferred Program offers certification for products meeting minimum bio-based content thresholds. These regulatory mechanisms have been instrumental in promoting market adoption of bio-based construction materials by providing verification methods and consumer confidence.

The International Organization for Standardization (ISO) has developed several standards specifically addressing bio-based polymers, including ISO 16620 for determination of bio-based carbon content and ISO 14855 for biodegradability assessment. These standards create a globally recognized framework that facilitates international trade and technology transfer in the bio-based construction materials sector.

Environmental Product Declarations (EPDs) have become increasingly important regulatory tools, with standards like EN 15804 providing a structured approach to life cycle assessment for construction materials. For bio-based polymers, these declarations must account for factors such as carbon sequestration during plant growth, agricultural impacts, and end-of-life scenarios, creating a comprehensive environmental profile that supports regulatory compliance.

Building codes across different regions are gradually incorporating provisions for bio-based materials, though significant variations exist. The International Building Code (IBC) in the United States has begun recognizing certain bio-based polymers for specific applications, while countries like Germany and the Netherlands have implemented more progressive regulatory frameworks that actively encourage bio-based material adoption through preferential treatment in public procurement and building certification systems.

Certification systems like LEED, BREEAM, and DGNB have incorporated credits for bio-based materials, creating market incentives that complement regulatory requirements. These systems typically award points for renewable material content, reduced carbon footprint, and improved indoor air quality—all potential advantages of bio-based polymers when properly formulated and applied.

Emerging regulatory trends include the development of end-of-life regulations addressing biodegradability, compostability, and recyclability of bio-based construction materials. The EU's Circular Economy Action Plan and similar initiatives worldwide are driving regulatory innovation in this area, with implications for how bio-based polymers are designed, manufactured, and ultimately disposed of or recycled.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!