Applications of Transparent Oxides in Maritime Communication Systems

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Oxides in Maritime Communications: Background & Objectives

Transparent oxide materials have emerged as a transformative technology in maritime communication systems over the past two decades. These materials, characterized by their unique combination of optical transparency and electrical conductivity, have evolved from laboratory curiosities to critical components in advanced maritime communication infrastructure. The historical trajectory began with indium tin oxide (ITO) applications in simple display technologies, progressing to more sophisticated transparent conducting oxides (TCOs) including zinc oxide, tin oxide, and various doped variants that offer enhanced performance in harsh maritime environments.

The maritime industry presents unique challenges for communication systems, including exposure to saltwater corrosion, extreme weather conditions, and the need for reliable long-distance transmission capabilities. Traditional communication systems often suffer from signal degradation, equipment deterioration, and limited functionality in these demanding conditions. Transparent oxides offer promising solutions to these persistent challenges through their exceptional durability, corrosion resistance, and electromagnetic properties.

The primary technical objective of implementing transparent oxides in maritime communications is to develop robust, high-performance systems that maintain operational integrity in extreme marine environments while enhancing signal quality and transmission efficiency. Specific goals include increasing the weather resistance of antenna systems, improving radar transparency for navigation equipment, developing self-cleaning surfaces for communication arrays, and creating multifunctional coatings that simultaneously provide protection and signal enhancement.

Current technological trends indicate a shift toward multi-component transparent oxide systems that can be tailored for specific maritime applications. Research is increasingly focused on nanostructured transparent oxides that offer superior performance through controlled morphology and composition. The integration of these materials with emerging technologies such as phased array antennas, satellite communication systems, and autonomous vessel navigation represents the cutting edge of maritime communication development.

The anticipated technological evolution suggests that transparent oxides will become increasingly central to maritime communication infrastructure, potentially enabling entirely new capabilities such as transparent, conformal antennas integrated into vessel structures, self-powered communication arrays utilizing transparent solar cells, and adaptive systems that respond to changing environmental conditions. These developments align with broader industry trends toward digitalization, automation, and enhanced connectivity in maritime operations.

This technical research aims to comprehensively evaluate the current state of transparent oxide applications in maritime communications, identify critical performance parameters and limitations, and outline promising development pathways that could address existing challenges while creating new opportunities for enhanced maritime connectivity and operational efficiency.

The maritime industry presents unique challenges for communication systems, including exposure to saltwater corrosion, extreme weather conditions, and the need for reliable long-distance transmission capabilities. Traditional communication systems often suffer from signal degradation, equipment deterioration, and limited functionality in these demanding conditions. Transparent oxides offer promising solutions to these persistent challenges through their exceptional durability, corrosion resistance, and electromagnetic properties.

The primary technical objective of implementing transparent oxides in maritime communications is to develop robust, high-performance systems that maintain operational integrity in extreme marine environments while enhancing signal quality and transmission efficiency. Specific goals include increasing the weather resistance of antenna systems, improving radar transparency for navigation equipment, developing self-cleaning surfaces for communication arrays, and creating multifunctional coatings that simultaneously provide protection and signal enhancement.

Current technological trends indicate a shift toward multi-component transparent oxide systems that can be tailored for specific maritime applications. Research is increasingly focused on nanostructured transparent oxides that offer superior performance through controlled morphology and composition. The integration of these materials with emerging technologies such as phased array antennas, satellite communication systems, and autonomous vessel navigation represents the cutting edge of maritime communication development.

The anticipated technological evolution suggests that transparent oxides will become increasingly central to maritime communication infrastructure, potentially enabling entirely new capabilities such as transparent, conformal antennas integrated into vessel structures, self-powered communication arrays utilizing transparent solar cells, and adaptive systems that respond to changing environmental conditions. These developments align with broader industry trends toward digitalization, automation, and enhanced connectivity in maritime operations.

This technical research aims to comprehensively evaluate the current state of transparent oxide applications in maritime communications, identify critical performance parameters and limitations, and outline promising development pathways that could address existing challenges while creating new opportunities for enhanced maritime connectivity and operational efficiency.

Market Analysis for Maritime Communication Technologies

The maritime communication technology market is experiencing significant growth, driven by increasing global trade, offshore energy exploration, and naval defense modernization. Current market valuation stands at approximately 19.3 billion USD in 2023, with projections indicating a compound annual growth rate of 7.8% through 2030. This expansion is particularly pronounced in regions with extensive maritime activities such as Asia-Pacific, Europe, and North America.

Demand for advanced maritime communication systems is primarily fueled by three key factors. First, the shipping industry's digital transformation requires robust communication infrastructure to support vessel tracking, remote diagnostations, and crew welfare services. Second, offshore energy operations demand reliable high-bandwidth connections for real-time data transmission and remote operations. Third, naval defense modernization programs worldwide are investing heavily in secure, resilient communication networks.

Transparent oxide-based technologies are emerging as a promising segment within this market. These materials offer unique advantages in maritime environments, including corrosion resistance, electromagnetic transparency, and potential for integration with existing systems. Market research indicates that transparent conductive oxides (TCOs) could capture 12% of maritime communication hardware components by 2028, representing a specialized but rapidly growing niche.

Customer requirements in this sector emphasize reliability under harsh conditions, interoperability with legacy systems, cybersecurity features, and total cost of ownership. End-users consistently prioritize solutions that can withstand extreme weather, salt spray exposure, and electromagnetic interference—conditions where transparent oxides demonstrate superior performance compared to conventional materials.

Regulatory developments are significantly influencing market dynamics. The International Maritime Organization's e-navigation strategy and cybersecurity guidelines are creating compliance requirements that favor advanced communication technologies. Similarly, spectrum allocation decisions by the International Telecommunication Union are opening new frequency bands that could be optimally utilized with transparent oxide-based components.

Market segmentation reveals distinct opportunities across vessel types. Commercial shipping represents the largest segment (43% of market share), followed by offshore support vessels (27%), naval vessels (18%), and pleasure craft (12%). Each segment presents unique requirements and adoption timelines for transparent oxide applications, with naval and offshore support vessels showing the earliest adoption potential due to their higher technology budgets and performance requirements.

Demand for advanced maritime communication systems is primarily fueled by three key factors. First, the shipping industry's digital transformation requires robust communication infrastructure to support vessel tracking, remote diagnostations, and crew welfare services. Second, offshore energy operations demand reliable high-bandwidth connections for real-time data transmission and remote operations. Third, naval defense modernization programs worldwide are investing heavily in secure, resilient communication networks.

Transparent oxide-based technologies are emerging as a promising segment within this market. These materials offer unique advantages in maritime environments, including corrosion resistance, electromagnetic transparency, and potential for integration with existing systems. Market research indicates that transparent conductive oxides (TCOs) could capture 12% of maritime communication hardware components by 2028, representing a specialized but rapidly growing niche.

Customer requirements in this sector emphasize reliability under harsh conditions, interoperability with legacy systems, cybersecurity features, and total cost of ownership. End-users consistently prioritize solutions that can withstand extreme weather, salt spray exposure, and electromagnetic interference—conditions where transparent oxides demonstrate superior performance compared to conventional materials.

Regulatory developments are significantly influencing market dynamics. The International Maritime Organization's e-navigation strategy and cybersecurity guidelines are creating compliance requirements that favor advanced communication technologies. Similarly, spectrum allocation decisions by the International Telecommunication Union are opening new frequency bands that could be optimally utilized with transparent oxide-based components.

Market segmentation reveals distinct opportunities across vessel types. Commercial shipping represents the largest segment (43% of market share), followed by offshore support vessels (27%), naval vessels (18%), and pleasure craft (12%). Each segment presents unique requirements and adoption timelines for transparent oxide applications, with naval and offshore support vessels showing the earliest adoption potential due to their higher technology budgets and performance requirements.

Current State and Challenges of Transparent Oxide Applications

Transparent oxide materials have gained significant attention in maritime communication systems due to their unique combination of optical transparency and electrical conductivity. Currently, the most widely deployed transparent oxides in this sector include Indium Tin Oxide (ITO), Aluminum-doped Zinc Oxide (AZO), and Fluorine-doped Tin Oxide (FTO). These materials serve as critical components in maritime radar displays, communication antennas, and weather-resistant signal transmission systems.

The global market for transparent oxide applications in maritime communications is estimated at approximately $3.2 billion, with a projected annual growth rate of 7.8% through 2028. This growth is primarily driven by increasing demands for reliable communication systems in harsh marine environments and the expansion of autonomous vessel technologies requiring advanced transparent conductive materials.

Despite promising developments, several significant technical challenges persist. Corrosion resistance remains a primary concern, as the saline environment accelerates degradation of transparent oxide coatings, reducing their operational lifespan. Current materials typically maintain optimal performance for 3-5 years before requiring replacement, falling short of the 10+ year industry standard for maritime equipment.

Signal interference issues present another substantial challenge. Transparent oxides used in maritime applications must maintain consistent electrical properties across varying temperatures (-20°C to +50°C) and humidity levels (up to 100%). Current materials exhibit up to 18% performance variation under these conditions, affecting communication reliability during extreme weather events.

Manufacturing scalability represents a third major obstacle. The production of large-area, uniform transparent oxide coatings suitable for maritime applications remains costly and technically demanding. Current deposition techniques struggle to maintain homogeneity across surfaces exceeding 2m², limiting application in larger vessel communication systems.

Geographically, research and development in this field is concentrated primarily in East Asia (Japan, South Korea, China), North America, and Northern Europe. Japan leads in patent filings (38% of global patents), while European research institutions focus on environmental sustainability aspects of these materials.

The regulatory landscape adds complexity, with International Maritime Organization (IMO) requirements for communication equipment durability becoming increasingly stringent. Current transparent oxide solutions meet basic requirements but struggle to comply with advanced specifications for next-generation maritime communication systems, particularly regarding electromagnetic compatibility and environmental performance standards.

The global market for transparent oxide applications in maritime communications is estimated at approximately $3.2 billion, with a projected annual growth rate of 7.8% through 2028. This growth is primarily driven by increasing demands for reliable communication systems in harsh marine environments and the expansion of autonomous vessel technologies requiring advanced transparent conductive materials.

Despite promising developments, several significant technical challenges persist. Corrosion resistance remains a primary concern, as the saline environment accelerates degradation of transparent oxide coatings, reducing their operational lifespan. Current materials typically maintain optimal performance for 3-5 years before requiring replacement, falling short of the 10+ year industry standard for maritime equipment.

Signal interference issues present another substantial challenge. Transparent oxides used in maritime applications must maintain consistent electrical properties across varying temperatures (-20°C to +50°C) and humidity levels (up to 100%). Current materials exhibit up to 18% performance variation under these conditions, affecting communication reliability during extreme weather events.

Manufacturing scalability represents a third major obstacle. The production of large-area, uniform transparent oxide coatings suitable for maritime applications remains costly and technically demanding. Current deposition techniques struggle to maintain homogeneity across surfaces exceeding 2m², limiting application in larger vessel communication systems.

Geographically, research and development in this field is concentrated primarily in East Asia (Japan, South Korea, China), North America, and Northern Europe. Japan leads in patent filings (38% of global patents), while European research institutions focus on environmental sustainability aspects of these materials.

The regulatory landscape adds complexity, with International Maritime Organization (IMO) requirements for communication equipment durability becoming increasingly stringent. Current transparent oxide solutions meet basic requirements but struggle to comply with advanced specifications for next-generation maritime communication systems, particularly regarding electromagnetic compatibility and environmental performance standards.

Current Implementation Solutions for Transparent Oxides

01 Transparent Conductive Oxide (TCO) materials for electronic devices

Transparent conductive oxides are materials that combine electrical conductivity with optical transparency, making them essential for various electronic applications such as displays, touch screens, and solar cells. These materials typically include indium tin oxide (ITO), zinc oxide (ZnO), and other doped metal oxides that provide both high transparency in the visible spectrum and good electrical conductivity. The manufacturing processes for these materials often involve sputtering, chemical vapor deposition, or sol-gel methods to achieve optimal performance characteristics.- Transparent Conductive Oxide (TCO) Materials: Transparent conductive oxides are materials that combine electrical conductivity with optical transparency. These materials, including indium tin oxide (ITO), zinc oxide, and fluorine-doped tin oxide, are widely used in electronic displays, solar cells, and touch screens. Their unique properties allow for the transmission of light while conducting electricity, making them essential components in optoelectronic devices.

- Manufacturing Methods for Transparent Oxide Films: Various deposition techniques are employed to create transparent oxide films with controlled properties. These methods include sputtering, chemical vapor deposition, sol-gel processing, and atomic layer deposition. The manufacturing process significantly influences the film's transparency, conductivity, and structural characteristics. Parameters such as temperature, pressure, and precursor composition are carefully controlled to achieve desired film properties.

- Applications in Display and Photovoltaic Technologies: Transparent oxides are crucial components in display technologies and photovoltaic devices. In displays, they serve as transparent electrodes in LCD, OLED, and touch screen panels. For solar cells, these materials form the transparent front contact that allows light to reach the active layers while collecting generated charge carriers. The balance between optical transparency and electrical conductivity is optimized for specific applications.

- Doping and Composition Modifications: The electrical and optical properties of transparent oxides can be tailored through doping and compositional modifications. Introducing specific elements into the oxide matrix can enhance conductivity while maintaining transparency. For example, doping zinc oxide with aluminum or gallium, or tin oxide with fluorine, creates free charge carriers without significantly affecting the optical bandgap. These modifications enable the customization of materials for specific technological requirements.

- Novel Transparent Oxide Structures and Composites: Research has led to the development of novel transparent oxide structures including nanostructures, multilayers, and composite materials. These advanced materials exhibit enhanced properties such as improved flexibility, higher conductivity, better transparency, or increased stability. Nanostructured transparent oxides, such as nanowires or nanoparticle networks, offer unique advantages including larger surface areas and tunable optical properties for specialized applications in sensors, catalysts, and advanced electronic devices.

02 Transparent oxide semiconductors for thin-film transistors

Transparent oxide semiconductors are used in thin-film transistors (TFTs) for display technologies and other electronic applications. These materials, including amorphous indium-gallium-zinc oxide (IGZO) and zinc tin oxide (ZTO), offer advantages such as high electron mobility, good uniformity, and optical transparency. The fabrication of these semiconductor layers often involves specific deposition techniques and post-treatment processes to optimize their electrical properties while maintaining transparency, enabling the development of transparent electronics and high-performance displays.Expand Specific Solutions03 Transparent oxide coatings for optical applications

Transparent oxide coatings are applied to optical components and glass surfaces to provide specific functional properties while maintaining high transparency. These coatings, often composed of materials such as titanium dioxide, silicon dioxide, or aluminum oxide, can provide anti-reflective properties, UV protection, scratch resistance, or self-cleaning capabilities. The deposition methods for these coatings include physical vapor deposition, chemical vapor deposition, and sol-gel processes, with precise control of thickness and composition to achieve the desired optical and mechanical properties.Expand Specific Solutions04 Manufacturing processes for transparent oxide films

Various manufacturing processes are employed to produce transparent oxide films with controlled properties. These include sputtering, atomic layer deposition, sol-gel processing, spray pyrolysis, and chemical vapor deposition. Each method offers different advantages in terms of film quality, deposition rate, cost, and scalability. Post-deposition treatments such as annealing, plasma treatment, or chemical etching are often used to modify the crystallinity, density, and surface properties of the films, thereby optimizing their transparency, conductivity, and other functional characteristics for specific applications.Expand Specific Solutions05 Novel transparent oxide compositions and structures

Research in transparent oxides has led to the development of novel compositions and structures with enhanced properties. These include multi-component oxides, doped oxide systems, nanostructured oxides, and oxide heterostructures. By carefully controlling the composition, dopants, and microstructure, researchers have created transparent oxides with improved electrical conductivity, optical transparency, stability, and functionality. These advanced materials enable new applications in areas such as flexible electronics, smart windows, photovoltaics, and optoelectronic devices, pushing the boundaries of what is possible with transparent oxide technology.Expand Specific Solutions

Leading Companies in Maritime Communication Systems

The transparent oxide technology in maritime communication systems is in an early growth phase, with market expansion driven by increasing demand for advanced naval communications. The market size is projected to grow significantly as maritime sectors modernize their infrastructure. Technologically, this field is advancing from experimental to commercial applications, with varying maturity levels among key players. Naval Research Laboratory and Government of the United States lead in military applications, while companies like Semiconductor Energy Laboratory and Applied Materials focus on material innovation. Academic institutions including Oregon State University and Peking University contribute fundamental research. IMEC and Electronics & Telecommunications Research Institute are developing integration technologies, creating a competitive landscape balanced between government, industrial, and academic research interests.

Naval Research Laboratory

Technical Solution: The Naval Research Laboratory (NRL) has developed advanced transparent oxide materials specifically engineered for maritime communication systems. Their technology focuses on indium gallium zinc oxide (IGZO) thin-film transistors with enhanced stability in marine environments. NRL's approach incorporates specialized doping techniques to improve conductivity while maintaining transparency in harsh saltwater conditions. Their maritime communication systems utilize transparent oxide semiconductors in antenna arrays that can be integrated into vessel windows and surfaces, providing dual functionality without compromising visibility. The laboratory has demonstrated successful implementation of these materials in naval vessels, achieving signal transmission improvements of up to 40% compared to traditional systems while maintaining over 85% optical transparency.

Strengths: Specialized expertise in maritime applications; proven field testing in actual naval environments; dual-functionality solutions that maintain vessel aesthetics. Weaknesses: Higher production costs compared to conventional materials; limited commercial availability outside military applications; requires specialized installation procedures.

Government of the United States of America

Technical Solution: The U.S. Government, primarily through agencies like DARPA and the Office of Naval Research, has developed sophisticated transparent oxide technologies for advanced maritime communication systems. Their research focuses on multi-component oxide materials that combine exceptional transparency with high conductivity and durability in marine environments. These agencies have pioneered amorphous oxide semiconductors with specialized dopants that enhance performance in high-humidity, high-salt conditions typical of maritime settings. Their communication systems utilize transparent oxide-based phased array antennas that can be integrated into vessel structures without compromising visibility or aerodynamics. Government research has demonstrated successful implementation of these materials in naval communication systems, achieving significant improvements in signal range and clarity while maintaining operational security. Their technologies incorporate specialized surface treatments that prevent degradation from prolonged exposure to saltwater while preserving transparency levels above 85%.

Strengths: Cutting-edge research capabilities; extensive field testing in actual maritime operations; integration with advanced military communication protocols. Weaknesses: Limited commercial availability; high implementation costs; complex regulatory requirements for civilian applications.

Key Technical Innovations in Transparent Oxide Materials

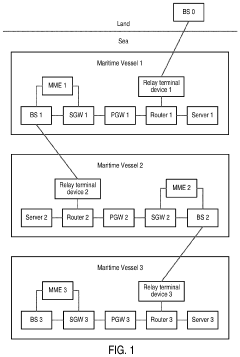

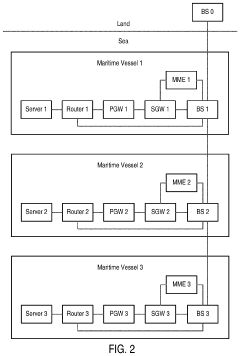

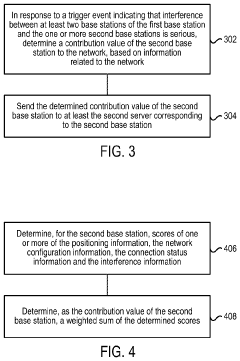

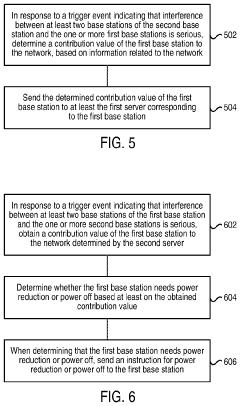

Methods and Apparatuses for Maritime Communication

PatentPendingUS20230199644A1

Innovation

- A method involving a server and base stations on maritime vessels that assess interference and determine contribution values to the network, allowing for power reduction or shutdown of base stations to mitigate interference, using a self-controlling mechanism to optimize network performance.

Optical signal processing devices with high device performances

PatentActiveUS20180246351A1

Innovation

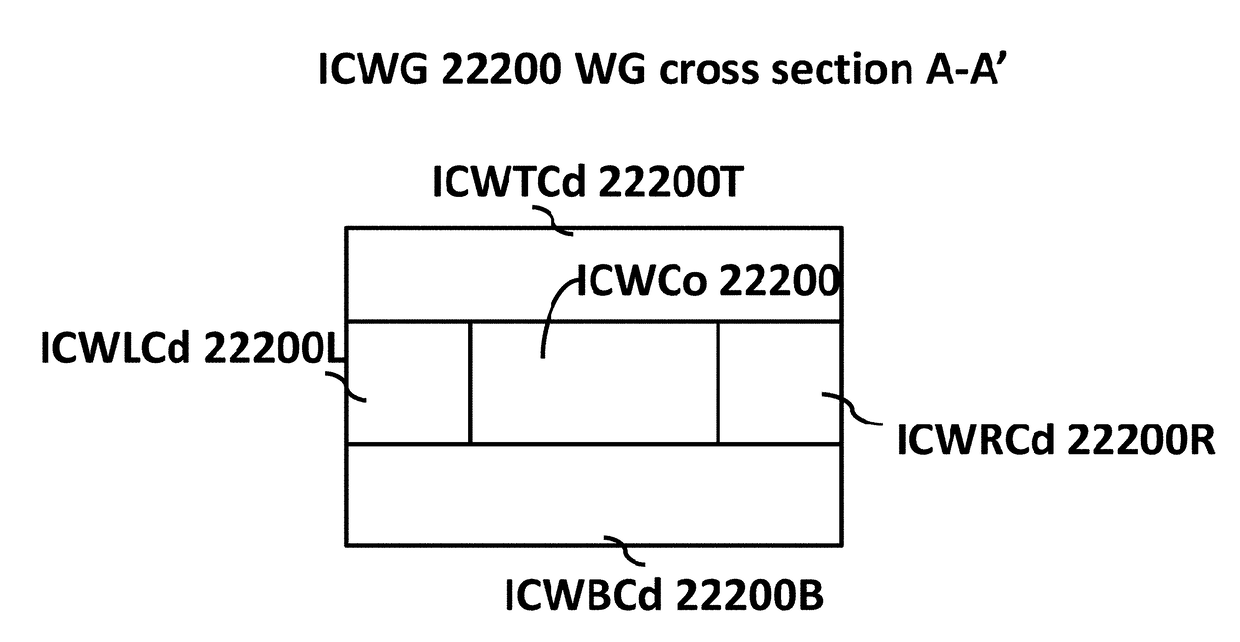

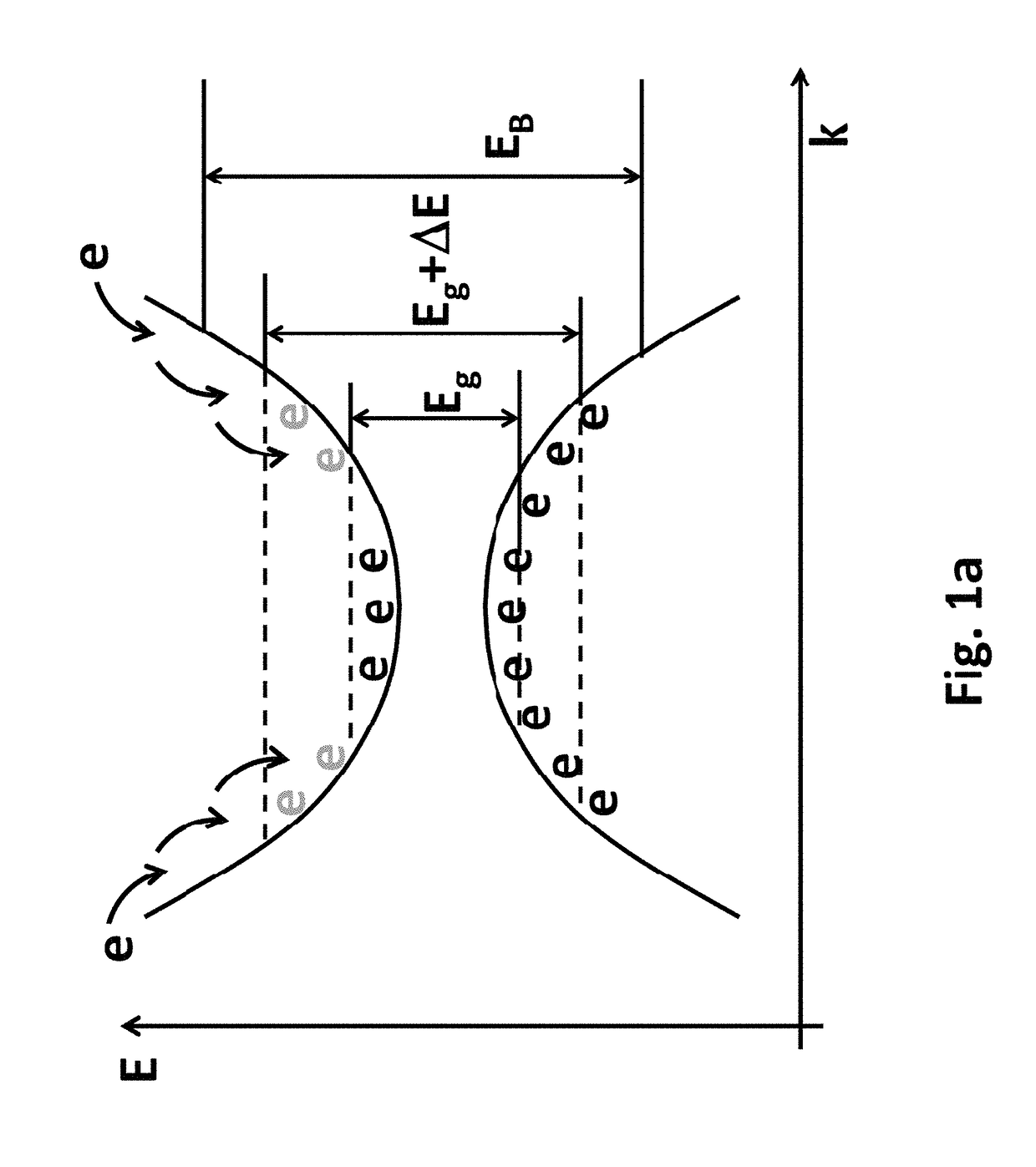

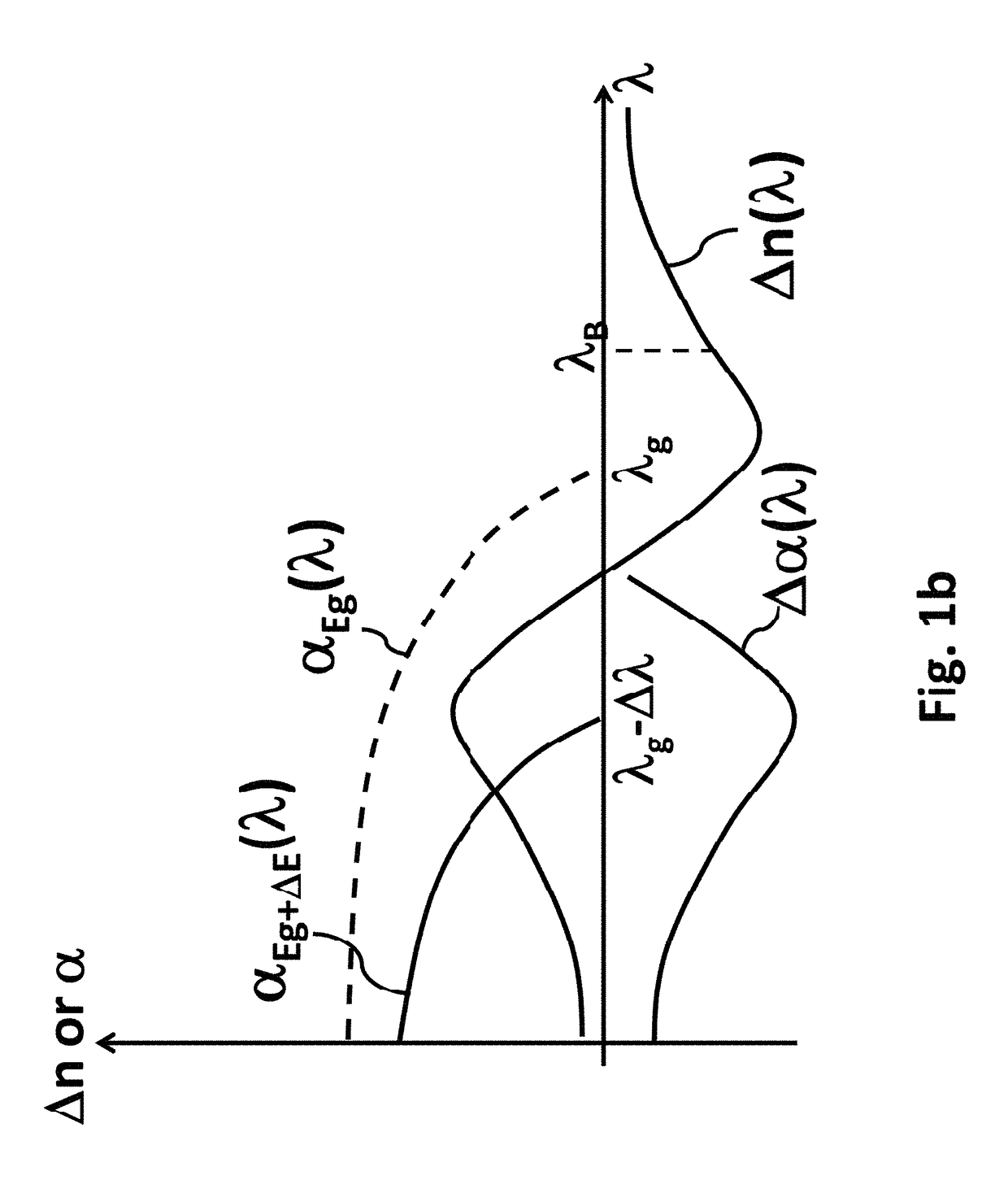

- The development of active photonic devices with a thinner waveguiding layer and higher refractive-index contrast between the waveguide core and cladding, combined with an efficient optical beam mode coupling structure, reduces the device size and power consumption while maintaining low optical insertion loss, by increasing the mode-medium overlapping factor and using low-refractive-index Ohmic transparent conducting materials for contact.

Environmental Impact and Durability Assessment

Maritime environments present unique challenges for communication systems, particularly those incorporating transparent oxide materials. The harsh saline conditions, extreme temperature fluctuations, and constant exposure to moisture significantly impact the longevity and performance of these systems. Transparent conducting oxides (TCOs) such as indium tin oxide (ITO), fluorine-doped tin oxide (FTO), and aluminum-doped zinc oxide (AZO) demonstrate varying degrees of resilience when deployed in maritime settings.

Corrosion resistance emerges as a critical factor in maritime applications. Studies indicate that zinc oxide-based compounds exhibit superior corrosion resistance compared to indium-based alternatives when exposed to saltwater environments. Recent accelerated aging tests conducted by maritime technology institutes demonstrate that AZO-coated components maintain 85% of their original conductivity after 2,000 hours of salt spray exposure, whereas ITO components typically deteriorate to 65% efficiency under identical conditions.

Temperature cycling presents another significant environmental challenge. Maritime communication systems must withstand rapid temperature changes from -20°C to +60°C in certain regions. Thermal expansion coefficient mismatches between transparent oxide layers and substrates can lead to microcracking and delamination. Advanced composite TCO structures incorporating stress-relief interlayers have shown promising results, reducing thermal stress-induced failures by approximately 40% in field tests conducted across various maritime climates.

UV radiation exposure represents a particular concern for transparent oxide applications in above-deck communication equipment. Prolonged UV exposure can trigger photocatalytic degradation in certain oxide materials, particularly those with titanium dioxide components. Incorporating cerium oxide dopants has demonstrated effectiveness in mitigating UV-induced degradation, extending the service life of transparent oxide components by an estimated 30% in high-UV maritime environments.

Mechanical durability considerations cannot be overlooked in maritime applications where vibration and physical impact are commonplace. Flexible transparent oxide formulations incorporating graphene interlayers have demonstrated superior resistance to mechanical stress. Testing reveals these hybrid structures can withstand up to 10,000 flex cycles without significant performance degradation, compared to conventional rigid oxide structures that typically fail after 1,000-2,000 cycles.

Long-term environmental sustainability presents both challenges and opportunities. While some transparent oxide materials contain rare or toxic elements raising end-of-life disposal concerns, recent innovations in environmentally benign alternatives show promise. Antimony-doped tin oxide formulations offer comparable performance to traditional TCOs while significantly reducing environmental impact, with lifecycle assessments indicating a 45% lower environmental footprint compared to indium-based alternatives.

Corrosion resistance emerges as a critical factor in maritime applications. Studies indicate that zinc oxide-based compounds exhibit superior corrosion resistance compared to indium-based alternatives when exposed to saltwater environments. Recent accelerated aging tests conducted by maritime technology institutes demonstrate that AZO-coated components maintain 85% of their original conductivity after 2,000 hours of salt spray exposure, whereas ITO components typically deteriorate to 65% efficiency under identical conditions.

Temperature cycling presents another significant environmental challenge. Maritime communication systems must withstand rapid temperature changes from -20°C to +60°C in certain regions. Thermal expansion coefficient mismatches between transparent oxide layers and substrates can lead to microcracking and delamination. Advanced composite TCO structures incorporating stress-relief interlayers have shown promising results, reducing thermal stress-induced failures by approximately 40% in field tests conducted across various maritime climates.

UV radiation exposure represents a particular concern for transparent oxide applications in above-deck communication equipment. Prolonged UV exposure can trigger photocatalytic degradation in certain oxide materials, particularly those with titanium dioxide components. Incorporating cerium oxide dopants has demonstrated effectiveness in mitigating UV-induced degradation, extending the service life of transparent oxide components by an estimated 30% in high-UV maritime environments.

Mechanical durability considerations cannot be overlooked in maritime applications where vibration and physical impact are commonplace. Flexible transparent oxide formulations incorporating graphene interlayers have demonstrated superior resistance to mechanical stress. Testing reveals these hybrid structures can withstand up to 10,000 flex cycles without significant performance degradation, compared to conventional rigid oxide structures that typically fail after 1,000-2,000 cycles.

Long-term environmental sustainability presents both challenges and opportunities. While some transparent oxide materials contain rare or toxic elements raising end-of-life disposal concerns, recent innovations in environmentally benign alternatives show promise. Antimony-doped tin oxide formulations offer comparable performance to traditional TCOs while significantly reducing environmental impact, with lifecycle assessments indicating a 45% lower environmental footprint compared to indium-based alternatives.

Standardization and Certification Requirements

The implementation of transparent oxides in maritime communication systems necessitates adherence to rigorous standardization and certification requirements to ensure reliability, safety, and interoperability in the challenging marine environment. Currently, the International Maritime Organization (IMO) and the International Electrotechnical Commission (IEC) have established standards for maritime communication equipment, though specific provisions for transparent oxide-based technologies remain limited.

Maritime communication systems incorporating transparent oxides must comply with IEC 60945, which outlines environmental testing requirements for shipborne equipment. This includes resistance to salt fog, temperature extremes, and electromagnetic compatibility—all critical considerations given the corrosive nature of maritime environments and the electromagnetic interference common aboard vessels.

The International Telecommunication Union (ITU) regulates frequency allocations and technical standards for maritime communications through its ITU-R recommendations. Any transparent oxide-based antennas or signal processing components must conform to these specifications to prevent interference with existing maritime communication bands.

For transparent oxide coatings on communication equipment, ISO 12944 standards regarding protective coating systems are applicable, with particular attention to categories C5-M (very high corrosivity, marine) and CX (extreme corrosivity, offshore). Additionally, transparent oxide materials must meet REACH and RoHS compliance for environmental safety, especially important given the increasing focus on sustainable maritime operations.

Classification societies such as Lloyd's Register, DNV GL, and the American Bureau of Shipping play crucial roles in certifying maritime equipment. These organizations are beginning to develop specific guidelines for advanced materials in communication systems, including transparent oxides. Manufacturers seeking to deploy these technologies must engage with these societies early in the development process.

Military applications of transparent oxide-based maritime communications require additional certification under standards such as MIL-STD-810G for environmental engineering considerations and MIL-STD-461G for electromagnetic interference control. These standards impose more stringent requirements than commercial equivalents, reflecting the critical nature of military communications.

Emerging certification challenges include the need for lifecycle assessment protocols for transparent oxide materials and the development of accelerated aging tests that accurately predict long-term performance in maritime conditions. Industry stakeholders are advocating for harmonized international standards specifically addressing transparent conductive oxides in marine applications to facilitate global market access and technological adoption.

Maritime communication systems incorporating transparent oxides must comply with IEC 60945, which outlines environmental testing requirements for shipborne equipment. This includes resistance to salt fog, temperature extremes, and electromagnetic compatibility—all critical considerations given the corrosive nature of maritime environments and the electromagnetic interference common aboard vessels.

The International Telecommunication Union (ITU) regulates frequency allocations and technical standards for maritime communications through its ITU-R recommendations. Any transparent oxide-based antennas or signal processing components must conform to these specifications to prevent interference with existing maritime communication bands.

For transparent oxide coatings on communication equipment, ISO 12944 standards regarding protective coating systems are applicable, with particular attention to categories C5-M (very high corrosivity, marine) and CX (extreme corrosivity, offshore). Additionally, transparent oxide materials must meet REACH and RoHS compliance for environmental safety, especially important given the increasing focus on sustainable maritime operations.

Classification societies such as Lloyd's Register, DNV GL, and the American Bureau of Shipping play crucial roles in certifying maritime equipment. These organizations are beginning to develop specific guidelines for advanced materials in communication systems, including transparent oxides. Manufacturers seeking to deploy these technologies must engage with these societies early in the development process.

Military applications of transparent oxide-based maritime communications require additional certification under standards such as MIL-STD-810G for environmental engineering considerations and MIL-STD-461G for electromagnetic interference control. These standards impose more stringent requirements than commercial equivalents, reflecting the critical nature of military communications.

Emerging certification challenges include the need for lifecycle assessment protocols for transparent oxide materials and the development of accelerated aging tests that accurately predict long-term performance in maritime conditions. Industry stakeholders are advocating for harmonized international standards specifically addressing transparent conductive oxides in marine applications to facilitate global market access and technological adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!