Regulating Transparent Oxides for Environmental Safety Compliance

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Oxide Regulation Background and Objectives

Transparent conductive oxides (TCOs) have emerged as critical materials in modern technology, finding applications in touchscreens, solar cells, smart windows, and various optoelectronic devices. The evolution of these materials spans several decades, beginning with the discovery of tin-doped indium oxide (ITO) in the 1950s and progressing through various alternative materials including fluorine-doped tin oxide (FTO), aluminum-doped zinc oxide (AZO), and more recently, amorphous oxide semiconductors like indium-gallium-zinc oxide (IGZO).

The regulatory landscape surrounding transparent oxides has evolved in response to growing environmental and health concerns. Early applications of these materials occurred in a relatively unregulated environment, but increasing awareness of potential environmental impacts has led to more stringent oversight. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have significantly impacted the development and deployment of transparent oxide technologies, particularly those containing indium, a scarce and potentially toxic element.

Current technological trends indicate a shift toward more sustainable and environmentally benign transparent oxide formulations. Research is increasingly focused on earth-abundant alternatives to indium-based compounds, as well as manufacturing processes that minimize waste and energy consumption. The development of solution-processable oxides represents a promising direction for reducing environmental impact while maintaining performance characteristics.

The primary objective of regulating transparent oxides is to ensure environmental safety compliance throughout the material lifecycle—from raw material extraction through manufacturing, use, and eventual disposal or recycling. This includes minimizing resource depletion, reducing toxic emissions during production, eliminating hazardous components, and facilitating end-of-life management.

Secondary objectives include promoting innovation in sustainable materials science, establishing standardized testing and certification protocols for environmental safety assessment, and harmonizing international regulatory frameworks to facilitate global trade while maintaining environmental protection standards. These objectives align with broader sustainability goals such as the United Nations Sustainable Development Goals and various national green technology initiatives.

The technical challenges in achieving these objectives are substantial, requiring advances in materials science, manufacturing technology, and analytical methods for safety assessment. Balancing performance requirements with environmental considerations remains a central tension in the field, particularly as applications in energy-efficient technologies themselves contribute to environmental sustainability goals.

The regulatory landscape surrounding transparent oxides has evolved in response to growing environmental and health concerns. Early applications of these materials occurred in a relatively unregulated environment, but increasing awareness of potential environmental impacts has led to more stringent oversight. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have significantly impacted the development and deployment of transparent oxide technologies, particularly those containing indium, a scarce and potentially toxic element.

Current technological trends indicate a shift toward more sustainable and environmentally benign transparent oxide formulations. Research is increasingly focused on earth-abundant alternatives to indium-based compounds, as well as manufacturing processes that minimize waste and energy consumption. The development of solution-processable oxides represents a promising direction for reducing environmental impact while maintaining performance characteristics.

The primary objective of regulating transparent oxides is to ensure environmental safety compliance throughout the material lifecycle—from raw material extraction through manufacturing, use, and eventual disposal or recycling. This includes minimizing resource depletion, reducing toxic emissions during production, eliminating hazardous components, and facilitating end-of-life management.

Secondary objectives include promoting innovation in sustainable materials science, establishing standardized testing and certification protocols for environmental safety assessment, and harmonizing international regulatory frameworks to facilitate global trade while maintaining environmental protection standards. These objectives align with broader sustainability goals such as the United Nations Sustainable Development Goals and various national green technology initiatives.

The technical challenges in achieving these objectives are substantial, requiring advances in materials science, manufacturing technology, and analytical methods for safety assessment. Balancing performance requirements with environmental considerations remains a central tension in the field, particularly as applications in energy-efficient technologies themselves contribute to environmental sustainability goals.

Market Analysis of Environmentally Compliant Transparent Oxides

The global market for environmentally compliant transparent oxides is experiencing significant growth, driven by increasing regulatory pressures and growing consumer awareness about environmental safety. The market size was valued at approximately $4.2 billion in 2022 and is projected to reach $7.8 billion by 2028, representing a compound annual growth rate (CAGR) of 10.9%. This growth trajectory is primarily fueled by stringent environmental regulations across major economies, particularly in Europe and North America.

The electronics sector currently dominates the application landscape, accounting for nearly 42% of the total market share. Transparent conductive oxides like indium tin oxide (ITO) remain essential components in touchscreens, displays, and photovoltaic cells. However, concerns regarding indium scarcity and its environmental impact have accelerated the search for alternative materials.

Construction and architectural applications represent the fastest-growing segment, with a projected CAGR of 13.7% through 2028. This surge is attributed to the increasing adoption of smart windows, energy-efficient glazing, and sustainable building materials that incorporate environmentally compliant transparent oxides.

Regional analysis reveals that Asia-Pacific holds the largest market share at 38%, followed by Europe (29%) and North America (24%). China dominates the manufacturing landscape, but faces increasing pressure to comply with international environmental standards. Meanwhile, European manufacturers are leveraging their early adoption of sustainable practices as a competitive advantage in premium market segments.

Consumer preferences are shifting decisively toward products with demonstrated environmental credentials. A recent industry survey indicated that 67% of institutional buyers now include environmental compliance in their procurement criteria for materials containing transparent oxides. This trend is particularly pronounced in medical devices, consumer electronics, and automotive applications.

Price sensitivity remains a significant market constraint, with environmentally compliant alternatives typically commanding a 15-30% premium over conventional options. However, this price gap is narrowing as production scales up and new synthesis methods emerge. Market forecasts suggest price parity could be achieved in select applications by 2026.

Emerging applications in renewable energy, particularly in next-generation solar cells and energy storage systems, represent substantial growth opportunities. The photovoltaic segment alone is expected to create a $1.2 billion market opportunity for compliant transparent oxides by 2027, driven by global decarbonization initiatives and renewable energy targets.

The electronics sector currently dominates the application landscape, accounting for nearly 42% of the total market share. Transparent conductive oxides like indium tin oxide (ITO) remain essential components in touchscreens, displays, and photovoltaic cells. However, concerns regarding indium scarcity and its environmental impact have accelerated the search for alternative materials.

Construction and architectural applications represent the fastest-growing segment, with a projected CAGR of 13.7% through 2028. This surge is attributed to the increasing adoption of smart windows, energy-efficient glazing, and sustainable building materials that incorporate environmentally compliant transparent oxides.

Regional analysis reveals that Asia-Pacific holds the largest market share at 38%, followed by Europe (29%) and North America (24%). China dominates the manufacturing landscape, but faces increasing pressure to comply with international environmental standards. Meanwhile, European manufacturers are leveraging their early adoption of sustainable practices as a competitive advantage in premium market segments.

Consumer preferences are shifting decisively toward products with demonstrated environmental credentials. A recent industry survey indicated that 67% of institutional buyers now include environmental compliance in their procurement criteria for materials containing transparent oxides. This trend is particularly pronounced in medical devices, consumer electronics, and automotive applications.

Price sensitivity remains a significant market constraint, with environmentally compliant alternatives typically commanding a 15-30% premium over conventional options. However, this price gap is narrowing as production scales up and new synthesis methods emerge. Market forecasts suggest price parity could be achieved in select applications by 2026.

Emerging applications in renewable energy, particularly in next-generation solar cells and energy storage systems, represent substantial growth opportunities. The photovoltaic segment alone is expected to create a $1.2 billion market opportunity for compliant transparent oxides by 2027, driven by global decarbonization initiatives and renewable energy targets.

Current Regulatory Challenges for Transparent Oxide Materials

Transparent oxide materials have gained significant prominence in various industries due to their unique electrical and optical properties. However, their widespread application has led to complex regulatory challenges that manufacturers, researchers, and policymakers must navigate. The current regulatory landscape for transparent oxides is characterized by fragmentation across different jurisdictions, with varying standards and compliance requirements that create significant barriers for global market access.

In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes strict documentation and testing requirements for transparent oxide materials, particularly those containing heavy metals such as indium, tin, and cadmium. The classification of certain transparent conducting oxides (TCOs) as potential substances of very high concern (SVHCs) has created uncertainty for manufacturers developing next-generation display technologies and photovoltaic applications.

The United States regulatory framework presents a different set of challenges, with the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA) increasingly scrutinizing nanomaterials, including nano-structured transparent oxides. Recent amendments to TSCA have expanded reporting requirements for novel applications of these materials, creating additional compliance burdens for technology developers.

Asian markets, particularly China and Japan, have implemented their own regulatory frameworks that often diverge significantly from Western standards. China's recent environmental protection initiatives have imposed stricter controls on manufacturing processes involving transparent oxides, while Japan's focus on recyclability and end-of-life management creates additional design considerations for products incorporating these materials.

A particularly challenging aspect of current regulations is the lack of standardized testing protocols for assessing the environmental and health impacts of transparent oxides across their lifecycle. The absence of harmonized methodologies for evaluating leaching potential, nanoparticle release, and bioaccumulation has led to inconsistent safety assessments and market barriers.

Emerging regulations around critical raw materials add another layer of complexity. Many transparent oxides rely on scarce elements like indium, which are increasingly subject to supply chain due diligence requirements and conflict mineral regulations. This creates additional reporting and verification burdens for manufacturers utilizing these materials in consumer electronics and renewable energy applications.

The rapid pace of innovation in transparent oxide technologies has outstripped regulatory frameworks, creating significant gaps in oversight. Novel compositions and manufacturing processes often fall into regulatory gray areas, leaving companies uncertain about compliance pathways and potentially exposing consumers and the environment to unassessed risks.

In the European Union, the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes strict documentation and testing requirements for transparent oxide materials, particularly those containing heavy metals such as indium, tin, and cadmium. The classification of certain transparent conducting oxides (TCOs) as potential substances of very high concern (SVHCs) has created uncertainty for manufacturers developing next-generation display technologies and photovoltaic applications.

The United States regulatory framework presents a different set of challenges, with the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA) increasingly scrutinizing nanomaterials, including nano-structured transparent oxides. Recent amendments to TSCA have expanded reporting requirements for novel applications of these materials, creating additional compliance burdens for technology developers.

Asian markets, particularly China and Japan, have implemented their own regulatory frameworks that often diverge significantly from Western standards. China's recent environmental protection initiatives have imposed stricter controls on manufacturing processes involving transparent oxides, while Japan's focus on recyclability and end-of-life management creates additional design considerations for products incorporating these materials.

A particularly challenging aspect of current regulations is the lack of standardized testing protocols for assessing the environmental and health impacts of transparent oxides across their lifecycle. The absence of harmonized methodologies for evaluating leaching potential, nanoparticle release, and bioaccumulation has led to inconsistent safety assessments and market barriers.

Emerging regulations around critical raw materials add another layer of complexity. Many transparent oxides rely on scarce elements like indium, which are increasingly subject to supply chain due diligence requirements and conflict mineral regulations. This creates additional reporting and verification burdens for manufacturers utilizing these materials in consumer electronics and renewable energy applications.

The rapid pace of innovation in transparent oxide technologies has outstripped regulatory frameworks, creating significant gaps in oversight. Novel compositions and manufacturing processes often fall into regulatory gray areas, leaving companies uncertain about compliance pathways and potentially exposing consumers and the environment to unassessed risks.

Existing Compliance Frameworks for Transparent Oxides

01 Environmental compliance monitoring for transparent oxide manufacturing

Systems and methods for monitoring environmental compliance in the manufacturing of transparent oxides. These systems track emissions, waste management, and resource usage to ensure adherence to environmental regulations. They include real-time monitoring capabilities, data analytics for compliance reporting, and alert mechanisms for potential violations, helping manufacturers maintain sustainable production practices while meeting regulatory requirements.- Environmental compliance monitoring for transparent oxide manufacturing: Systems and methods for monitoring environmental compliance in the production of transparent oxides. These technologies enable real-time tracking of emissions, waste management, and resource utilization during manufacturing processes. The monitoring systems help manufacturers adhere to regulatory standards while maintaining production efficiency, reducing environmental impact, and ensuring transparency in compliance reporting.

- Safety assessment frameworks for transparent oxide materials: Comprehensive frameworks for assessing the safety of transparent oxide materials throughout their lifecycle. These frameworks include methodologies for hazard identification, exposure assessment, and risk characterization specific to transparent oxides used in various applications. The assessment tools help manufacturers evaluate potential health and environmental impacts, implement appropriate safety measures, and develop safer alternatives when necessary.

- Regulatory compliance management systems for oxide-based products: Digital platforms and management systems designed to streamline regulatory compliance for products containing transparent oxides. These systems facilitate documentation, certification, and reporting processes required by environmental regulations across different jurisdictions. The platforms help track changing regulatory requirements, manage compliance documentation, and ensure products meet all applicable environmental and safety standards before market entry.

- Eco-friendly formulations of transparent oxide materials: Innovative formulations of transparent oxide materials designed to minimize environmental impact while maintaining functional properties. These formulations incorporate sustainable sourcing practices, reduced toxicity profiles, and improved biodegradability. The eco-friendly approaches include modified synthesis methods, alternative precursors, and novel additives that enhance environmental compatibility without compromising material performance or transparency.

- Supply chain verification for environmentally compliant transparent oxides: Systems and methodologies for verifying environmental compliance throughout the transparent oxide supply chain. These approaches include traceability technologies, supplier certification programs, and audit frameworks that ensure all components meet environmental standards. The verification systems help manufacturers document the origin of materials, validate sustainable practices of suppliers, and provide assurance to customers regarding environmental compliance of final products.

02 Safety assessment frameworks for transparent oxide materials

Comprehensive frameworks for assessing the safety of transparent oxide materials throughout their lifecycle. These frameworks evaluate potential hazards during production, use, and disposal phases. They incorporate toxicological testing protocols, exposure assessment methodologies, and risk characterization approaches specific to transparent oxide materials, enabling manufacturers to demonstrate product safety compliance while protecting human health and the environment.Expand Specific Solutions03 Regulatory compliance management systems for oxide-based products

Digital platforms and management systems designed to streamline regulatory compliance for transparent oxide-based products across multiple jurisdictions. These systems maintain up-to-date regulatory databases, automate compliance documentation, track product certifications, and manage regulatory submissions. They help manufacturers navigate complex and evolving environmental regulations while reducing compliance costs and administrative burden.Expand Specific Solutions04 Eco-friendly transparent oxide formulations

Innovative formulations of transparent oxides designed to meet environmental safety standards while maintaining optical and functional performance. These formulations minimize or eliminate hazardous substances, reduce environmental impact during production and disposal, and optimize resource efficiency. They incorporate alternative precursors, green synthesis methods, and sustainable additives to create environmentally compliant transparent oxide materials for various applications.Expand Specific Solutions05 Testing and certification protocols for environmental compliance

Standardized testing and certification protocols specifically developed for verifying the environmental safety compliance of transparent oxide materials. These protocols include analytical methods for detecting regulated substances, leaching tests for environmental fate assessment, and performance validation under various conditions. They establish consistent evaluation criteria that enable transparent oxide manufacturers to demonstrate compliance with environmental regulations and obtain necessary certifications.Expand Specific Solutions

Leading Organizations in Transparent Oxide Regulation

The transparent oxide regulation landscape is evolving rapidly as the industry transitions from early development to commercial scaling. The market is projected to reach significant growth due to increasing environmental compliance requirements across electronics, semiconductor, and chemical sectors. Technologically, companies demonstrate varying maturity levels: established players like Merck Patent GmbH, GLOBALFOUNDRIES, and Bayer AG lead with advanced commercial solutions, while research institutions such as Beijing University of Technology and Oregon State University drive fundamental innovation. Mid-tier companies including Advanced Nano Products and Umicore are developing specialized applications. The competitive environment is characterized by cross-sector collaboration between chemical manufacturers, semiconductor producers, and research organizations to address environmental safety challenges while maintaining performance requirements.

Umicore SA

Technical Solution: Umicore has developed advanced transparent conductive oxide (TCO) materials with reduced environmental impact through their proprietary "EcoTCO" technology. This approach focuses on indium-free and indium-reduced formulations to address the scarcity and toxicity concerns of traditional indium tin oxide (ITO). Their solution incorporates aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO) materials manufactured using low-temperature deposition processes that significantly reduce energy consumption. Umicore's regulatory compliance framework includes comprehensive lifecycle assessment (LCA) methodologies that track environmental impacts from raw material extraction through manufacturing to end-of-life disposal. Their materials undergo rigorous testing for leachability of heavy metals and VOC emissions to ensure compliance with RoHS, REACH, and regional environmental safety standards. Additionally, Umicore has implemented closed-loop recycling systems for TCO manufacturing waste, recovering up to 90% of valuable metals while minimizing hazardous waste generation.

Strengths: Industry-leading expertise in materials recycling and circular economy approaches; strong regulatory compliance knowledge across global markets; reduced dependence on scarce indium resources. Weaknesses: Some alternative TCO formulations may exhibit slightly lower conductivity than traditional ITO; higher initial implementation costs for manufacturing partners; requires specialized deposition equipment for optimal performance.

Advanced Nano Products Co., Ltd.

Technical Solution: Advanced Nano Products has pioneered environmentally compliant transparent conductive oxide (TCO) solutions through their "GreenTCO" platform. Their technology centers on nanoparticle-based TCO formulations that achieve high transparency and conductivity while eliminating or minimizing hazardous substances. The company has developed water-based TCO nanoparticle dispersions that can be applied using low-temperature processes (below 150°C), significantly reducing energy consumption and associated carbon emissions during manufacturing. Their proprietary surface modification techniques enable strong adhesion to various substrates without requiring toxic adhesion promoters. Advanced Nano Products' regulatory approach includes comprehensive material safety data sheets (MSDS) that detail the environmental and health impacts of their TCO materials, with third-party verification of compliance with global standards including RoHS, REACH, and California Proposition 65. Their manufacturing processes incorporate closed-system production methods that capture and neutralize potentially harmful byproducts, with documented reduction of waste generation by approximately 65% compared to conventional TCO production methods.

Strengths: Innovative nanoparticle-based formulations enable low-temperature processing; water-based systems reduce VOC emissions and environmental impact; comprehensive regulatory documentation and third-party certifications. Weaknesses: Relatively new technology with limited long-term performance data; may require modifications to existing manufacturing equipment; slightly higher cost structure compared to conventional TCO materials.

Key Technical Innovations in Eco-friendly Oxide Development

Substrate with transparent electrode and its manufacturing method

PatentInactiveJP2010160917A

Innovation

- Addition of 0.5-10.0 wt.% of niobium oxide (II, IV, or V) as a conductive doping agent in zinc oxide-based transparent conductive oxide to improve conductivity.

- Incorporation of 0.5-3.0 wt.% of silicon dioxide to enhance humidity and heat endurance of the transparent conductive oxide electrode.

- Development of a manufacturing method that effectively integrates both niobium oxide and silicon dioxide into zinc oxide to create a transparent electrode with superior properties.

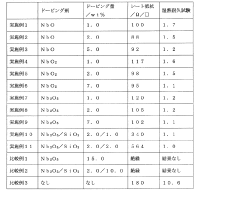

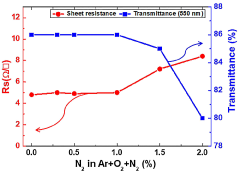

A transparent conducting oxide thin film based on n2-doped oxide and mothod for manufacturing the same

PatentInactiveKR1020200127426A

Innovation

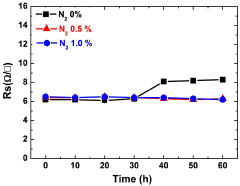

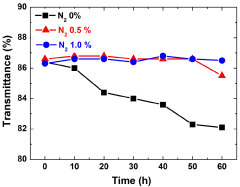

- A nitrogen-doped Zn x Sn 1-x O 2 transparent conductive oxide thin film with a multilayer structure, including a metal layer sandwiched between oxide layers, is deposited at room temperature, using a specific nitrogen partial pressure in the deposition gas, enhancing stability and mechanical strength.

International Policy Harmonization for Oxide Materials

The global nature of transparent oxide materials production and application necessitates coordinated international regulatory approaches. Currently, significant disparities exist between regulatory frameworks across major manufacturing regions including the EU, North America, and Asia-Pacific. The EU's REACH regulation imposes stringent requirements for oxide materials, particularly those containing potentially hazardous elements such as indium, cadmium, or lead. In contrast, the United States EPA focuses more on end-of-life management and workplace exposure limits rather than comprehensive material regulation.

These regulatory divergences create substantial compliance challenges for multinational manufacturers who must navigate complex and sometimes contradictory requirements. For instance, a transparent conductive oxide formulation approved in Japan may require significant reformulation to meet EU standards, increasing production costs and delaying market entry.

Recent efforts toward policy harmonization have shown promising developments. The International Conference on Chemicals Management (ICCM) has established working groups specifically addressing inorganic oxide materials used in electronics and construction. These initiatives aim to develop standardized testing protocols and shared classification systems for transparent oxide materials based on their environmental and health impacts.

Industry consortia have also emerged as important drivers of harmonization. The Transparent Oxide Safety Coalition, comprising major manufacturers from 17 countries, has developed voluntary standards that often serve as precursors to formal regulations. Their 2022 framework for indium tin oxide (ITO) safety assessment has been partially adopted by regulatory bodies in South Korea, Canada, and Germany.

Bilateral agreements between major manufacturing nations represent another avenue for harmonization. The 2023 US-EU Memorandum of Understanding on Critical Materials includes provisions for aligned approaches to oxide materials used in renewable energy applications, potentially creating a transatlantic regulatory zone with common standards.

Challenges to harmonization persist, including differing national priorities, varying technical capabilities for enforcement, and protection of domestic industries. Developing nations often lack the infrastructure to implement sophisticated materials regulation, creating potential "regulatory havens" that undermine global standards.

The path forward likely involves tiered approaches that establish core universal principles while allowing regional flexibility in implementation timelines and enforcement mechanisms. Digital tracking systems and materials passports are emerging as technological enablers of harmonization, allowing transparent verification of compliance across jurisdictional boundaries.

These regulatory divergences create substantial compliance challenges for multinational manufacturers who must navigate complex and sometimes contradictory requirements. For instance, a transparent conductive oxide formulation approved in Japan may require significant reformulation to meet EU standards, increasing production costs and delaying market entry.

Recent efforts toward policy harmonization have shown promising developments. The International Conference on Chemicals Management (ICCM) has established working groups specifically addressing inorganic oxide materials used in electronics and construction. These initiatives aim to develop standardized testing protocols and shared classification systems for transparent oxide materials based on their environmental and health impacts.

Industry consortia have also emerged as important drivers of harmonization. The Transparent Oxide Safety Coalition, comprising major manufacturers from 17 countries, has developed voluntary standards that often serve as precursors to formal regulations. Their 2022 framework for indium tin oxide (ITO) safety assessment has been partially adopted by regulatory bodies in South Korea, Canada, and Germany.

Bilateral agreements between major manufacturing nations represent another avenue for harmonization. The 2023 US-EU Memorandum of Understanding on Critical Materials includes provisions for aligned approaches to oxide materials used in renewable energy applications, potentially creating a transatlantic regulatory zone with common standards.

Challenges to harmonization persist, including differing national priorities, varying technical capabilities for enforcement, and protection of domestic industries. Developing nations often lack the infrastructure to implement sophisticated materials regulation, creating potential "regulatory havens" that undermine global standards.

The path forward likely involves tiered approaches that establish core universal principles while allowing regional flexibility in implementation timelines and enforcement mechanisms. Digital tracking systems and materials passports are emerging as technological enablers of harmonization, allowing transparent verification of compliance across jurisdictional boundaries.

Life Cycle Assessment Methods for Transparent Oxides

Life Cycle Assessment (LCA) provides a comprehensive framework for evaluating the environmental impacts of transparent oxide materials throughout their entire existence. The methodology typically encompasses four distinct phases: goal and scope definition, inventory analysis, impact assessment, and interpretation. For transparent oxides used in various applications such as electronics, solar panels, and architectural glass, these assessments must account for raw material extraction, manufacturing processes, use phase, and end-of-life management.

The extraction phase analysis focuses on mining activities for metals like indium, tin, and zinc, which form the basis of many transparent conductive oxides (TCOs). This stage evaluates energy consumption, water usage, land disturbance, and emissions associated with obtaining these often rare and dispersed elements. Particular attention must be paid to indium extraction, as its limited availability raises sustainability concerns for indium tin oxide (ITO) applications.

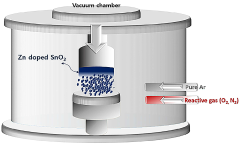

Manufacturing assessment examines energy-intensive deposition processes such as sputtering, chemical vapor deposition, and sol-gel methods. These processes often require high temperatures and vacuum conditions, resulting in significant energy consumption. The analysis quantifies direct emissions, chemical usage, and waste generation during fabrication of transparent oxide thin films and bulk materials.

Use phase evaluation considers the operational benefits of transparent oxides, including energy savings from smart windows, efficiency improvements in solar cells, and extended device lifespans. These positive environmental contributions must be weighed against potential degradation mechanisms and maintenance requirements over the product lifetime.

End-of-life assessment addresses recycling potential, disposal challenges, and environmental fate of transparent oxide materials. Current limitations in recycling technologies for many TCOs present significant challenges, particularly for recovering indium from complex electronic waste streams. Leaching behavior and potential toxicity of metal oxides in landfill environments must be carefully evaluated.

Emerging LCA methodologies are incorporating advanced impact categories specifically relevant to transparent oxides, including resource depletion metrics for critical elements, nanomaterial-specific toxicity pathways, and circular economy indicators. Standardization efforts through ISO 14040/14044 frameworks are being adapted to address the unique characteristics of these advanced materials, enabling more consistent comparison across different transparent oxide formulations and applications.

The extraction phase analysis focuses on mining activities for metals like indium, tin, and zinc, which form the basis of many transparent conductive oxides (TCOs). This stage evaluates energy consumption, water usage, land disturbance, and emissions associated with obtaining these often rare and dispersed elements. Particular attention must be paid to indium extraction, as its limited availability raises sustainability concerns for indium tin oxide (ITO) applications.

Manufacturing assessment examines energy-intensive deposition processes such as sputtering, chemical vapor deposition, and sol-gel methods. These processes often require high temperatures and vacuum conditions, resulting in significant energy consumption. The analysis quantifies direct emissions, chemical usage, and waste generation during fabrication of transparent oxide thin films and bulk materials.

Use phase evaluation considers the operational benefits of transparent oxides, including energy savings from smart windows, efficiency improvements in solar cells, and extended device lifespans. These positive environmental contributions must be weighed against potential degradation mechanisms and maintenance requirements over the product lifetime.

End-of-life assessment addresses recycling potential, disposal challenges, and environmental fate of transparent oxide materials. Current limitations in recycling technologies for many TCOs present significant challenges, particularly for recovering indium from complex electronic waste streams. Leaching behavior and potential toxicity of metal oxides in landfill environments must be carefully evaluated.

Emerging LCA methodologies are incorporating advanced impact categories specifically relevant to transparent oxides, including resource depletion metrics for critical elements, nanomaterial-specific toxicity pathways, and circular economy indicators. Standardization efforts through ISO 14040/14044 frameworks are being adapted to address the unique characteristics of these advanced materials, enabling more consistent comparison across different transparent oxide formulations and applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!