Emerging Applications of Transparent Oxides in Nanostructured Coatings

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Oxides Evolution and Research Objectives

Transparent oxide materials have undergone significant evolution since their initial discovery in the early 20th century. The journey began with simple metal oxides like tin oxide and zinc oxide, which demonstrated basic transparency and conductivity properties. The 1970s marked a pivotal moment with the development of indium tin oxide (ITO), which revolutionized display technologies due to its exceptional combination of optical transparency and electrical conductivity. This breakthrough catalyzed extensive research into transparent conducting oxides (TCOs) as essential components in optoelectronic devices.

The last two decades have witnessed an acceleration in transparent oxide research, driven by the exponential growth of mobile devices, touch screens, and solar technologies. Beyond traditional TCOs, researchers have expanded into complex oxide systems, including amorphous oxide semiconductors like indium gallium zinc oxide (IGZO), which has transformed thin-film transistor technology. More recently, the field has evolved toward nanostructured transparent oxides, offering unprecedented control over optical, electrical, and mechanical properties at the nanoscale.

Current research objectives in transparent oxide nanostructured coatings focus on several critical directions. First, developing sustainable alternatives to indium-based materials remains paramount due to indium's scarcity and cost. Zinc-based and titanium-based oxide systems show particular promise as environmentally friendly and abundant alternatives. Second, researchers aim to enhance multifunctionality by engineering transparent oxides that simultaneously deliver multiple properties—such as self-cleaning capabilities, antimicrobial activity, and energy efficiency—within a single coating system.

Another key objective involves improving the scalability and cost-effectiveness of fabrication processes for nanostructured transparent oxide coatings. While lab-scale demonstrations have shown remarkable performance, transitioning these technologies to industrial-scale production presents significant challenges. Research efforts are targeting solution-based deposition methods, atmospheric pressure techniques, and roll-to-roll processing to enable widespread commercial adoption.

The integration of transparent oxide nanostructures with emerging technologies represents another frontier. This includes their application in flexible electronics, wearable devices, smart windows, and building-integrated photovoltaics. Researchers are particularly focused on developing oxide systems that maintain performance under mechanical stress, extreme temperatures, and prolonged environmental exposure.

Finally, computational modeling and artificial intelligence approaches are increasingly being employed to accelerate materials discovery and optimization. These tools enable researchers to predict structure-property relationships and identify promising new transparent oxide compositions and nanostructures without exhaustive experimental testing, potentially shortening development cycles from years to months.

The last two decades have witnessed an acceleration in transparent oxide research, driven by the exponential growth of mobile devices, touch screens, and solar technologies. Beyond traditional TCOs, researchers have expanded into complex oxide systems, including amorphous oxide semiconductors like indium gallium zinc oxide (IGZO), which has transformed thin-film transistor technology. More recently, the field has evolved toward nanostructured transparent oxides, offering unprecedented control over optical, electrical, and mechanical properties at the nanoscale.

Current research objectives in transparent oxide nanostructured coatings focus on several critical directions. First, developing sustainable alternatives to indium-based materials remains paramount due to indium's scarcity and cost. Zinc-based and titanium-based oxide systems show particular promise as environmentally friendly and abundant alternatives. Second, researchers aim to enhance multifunctionality by engineering transparent oxides that simultaneously deliver multiple properties—such as self-cleaning capabilities, antimicrobial activity, and energy efficiency—within a single coating system.

Another key objective involves improving the scalability and cost-effectiveness of fabrication processes for nanostructured transparent oxide coatings. While lab-scale demonstrations have shown remarkable performance, transitioning these technologies to industrial-scale production presents significant challenges. Research efforts are targeting solution-based deposition methods, atmospheric pressure techniques, and roll-to-roll processing to enable widespread commercial adoption.

The integration of transparent oxide nanostructures with emerging technologies represents another frontier. This includes their application in flexible electronics, wearable devices, smart windows, and building-integrated photovoltaics. Researchers are particularly focused on developing oxide systems that maintain performance under mechanical stress, extreme temperatures, and prolonged environmental exposure.

Finally, computational modeling and artificial intelligence approaches are increasingly being employed to accelerate materials discovery and optimization. These tools enable researchers to predict structure-property relationships and identify promising new transparent oxide compositions and nanostructures without exhaustive experimental testing, potentially shortening development cycles from years to months.

Market Analysis for Nanostructured Transparent Coatings

The global market for nanostructured transparent coatings has experienced significant growth in recent years, driven by increasing demand across multiple industries. The market value reached approximately $4.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.3% through 2028, potentially reaching $8.5 billion by the end of the forecast period.

Electronics and optoelectronics represent the largest application segment, accounting for nearly 38% of the total market share. This dominance stems from the critical role transparent oxide nanostructured coatings play in touchscreens, displays, and photovoltaic cells. The construction industry follows closely, comprising about 25% of market demand, primarily for energy-efficient windows and self-cleaning surfaces.

Automotive applications constitute approximately 18% of the market, with growing implementation in smart windows, displays, and sensors. The healthcare sector, though smaller at 10% of market share, is experiencing the fastest growth rate at 15.7% annually, driven by antimicrobial coatings and biomedical devices.

Regionally, Asia-Pacific dominates the market with 42% share, led by manufacturing powerhouses China, Japan, and South Korea. North America and Europe follow with 28% and 24% respectively, while emerging markets in Latin America and Africa show promising growth potential despite currently representing only 6% combined.

Consumer preferences are increasingly shifting toward multifunctional coatings that offer combinations of properties such as self-cleaning, anti-reflection, and antimicrobial capabilities. This trend has accelerated product development cycles and fostered industry partnerships between material suppliers and end-product manufacturers.

Supply chain challenges remain significant, particularly regarding the sourcing of rare earth elements and specialized precursor materials. Price volatility of raw materials has impacted profit margins, with indium tin oxide (ITO) experiencing price fluctuations of up to 30% in recent years.

Regulatory frameworks are evolving rapidly, with environmental regulations in Europe and North America imposing stricter controls on manufacturing processes and chemical compositions. The EU's REACH regulations and similar frameworks have accelerated the development of more environmentally friendly coating alternatives.

Market consolidation is evident through strategic acquisitions and partnerships, with major players expanding their technological portfolios. The competitive landscape features established companies like Nippon Sheet Glass, Saint-Gobain, and PPG Industries alongside emerging specialized firms focused on novel transparent oxide formulations and application techniques.

Electronics and optoelectronics represent the largest application segment, accounting for nearly 38% of the total market share. This dominance stems from the critical role transparent oxide nanostructured coatings play in touchscreens, displays, and photovoltaic cells. The construction industry follows closely, comprising about 25% of market demand, primarily for energy-efficient windows and self-cleaning surfaces.

Automotive applications constitute approximately 18% of the market, with growing implementation in smart windows, displays, and sensors. The healthcare sector, though smaller at 10% of market share, is experiencing the fastest growth rate at 15.7% annually, driven by antimicrobial coatings and biomedical devices.

Regionally, Asia-Pacific dominates the market with 42% share, led by manufacturing powerhouses China, Japan, and South Korea. North America and Europe follow with 28% and 24% respectively, while emerging markets in Latin America and Africa show promising growth potential despite currently representing only 6% combined.

Consumer preferences are increasingly shifting toward multifunctional coatings that offer combinations of properties such as self-cleaning, anti-reflection, and antimicrobial capabilities. This trend has accelerated product development cycles and fostered industry partnerships between material suppliers and end-product manufacturers.

Supply chain challenges remain significant, particularly regarding the sourcing of rare earth elements and specialized precursor materials. Price volatility of raw materials has impacted profit margins, with indium tin oxide (ITO) experiencing price fluctuations of up to 30% in recent years.

Regulatory frameworks are evolving rapidly, with environmental regulations in Europe and North America imposing stricter controls on manufacturing processes and chemical compositions. The EU's REACH regulations and similar frameworks have accelerated the development of more environmentally friendly coating alternatives.

Market consolidation is evident through strategic acquisitions and partnerships, with major players expanding their technological portfolios. The competitive landscape features established companies like Nippon Sheet Glass, Saint-Gobain, and PPG Industries alongside emerging specialized firms focused on novel transparent oxide formulations and application techniques.

Global Status and Technical Barriers in Transparent Oxide Nanocoatings

The global landscape of transparent oxide nanocoatings has evolved significantly over the past decade, with major research centers in North America, Europe, and East Asia leading technological advancements. The United States maintains a strong position through university-industry collaborations, particularly at institutions like MIT, Stanford, and national laboratories. European research excellence is concentrated in Germany, France, and the UK, with substantial EU funding supporting collaborative projects across member states.

In Asia, Japan has historically dominated with companies like Asahi Glass and Nippon Sheet Glass, while China has rapidly expanded its research capacity, now producing the highest volume of academic publications in this field. South Korea maintains specialized expertise through companies like Samsung and LG, focusing on display applications.

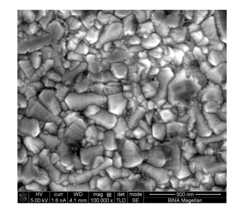

Despite global progress, several critical technical barriers persist in transparent oxide nanocoating development. Scalability remains a primary challenge, as laboratory-scale synthesis methods often fail to translate to industrial production. Techniques like atomic layer deposition (ALD) offer excellent control but suffer from low throughput, while more scalable methods like spray pyrolysis struggle with uniformity and reproducibility.

Durability presents another significant obstacle, particularly in harsh environments. Current transparent oxide nanocoatings frequently demonstrate degradation under UV exposure, chemical attack, and mechanical abrasion. The trade-off between transparency and functionality continues to challenge researchers, as increasing the concentration of functional additives typically reduces optical clarity.

Energy efficiency in manufacturing processes represents a growing concern. Many high-performance coatings require energy-intensive deposition methods and high-temperature annealing, contradicting sustainability goals. The industry faces increasing pressure to develop low-temperature, energy-efficient production techniques.

Material compatibility issues arise when integrating transparent oxide nanocoatings with diverse substrates. Thermal expansion mismatches, interfacial adhesion problems, and chemical incompatibilities can lead to delamination, cracking, or performance degradation over time.

Standardization remains underdeveloped, with inconsistent testing protocols and performance metrics across different regions and applications. This hampers comparative analysis and slows commercial adoption. Additionally, the cost-performance ratio continues to limit widespread implementation, as high-performance transparent oxide nanocoatings often require expensive precursors and sophisticated deposition equipment.

Addressing these technical barriers requires coordinated international research efforts, increased industry-academia collaboration, and targeted funding initiatives. Recent advances in computational materials science and high-throughput experimentation offer promising approaches to accelerate innovation in this field.

In Asia, Japan has historically dominated with companies like Asahi Glass and Nippon Sheet Glass, while China has rapidly expanded its research capacity, now producing the highest volume of academic publications in this field. South Korea maintains specialized expertise through companies like Samsung and LG, focusing on display applications.

Despite global progress, several critical technical barriers persist in transparent oxide nanocoating development. Scalability remains a primary challenge, as laboratory-scale synthesis methods often fail to translate to industrial production. Techniques like atomic layer deposition (ALD) offer excellent control but suffer from low throughput, while more scalable methods like spray pyrolysis struggle with uniformity and reproducibility.

Durability presents another significant obstacle, particularly in harsh environments. Current transparent oxide nanocoatings frequently demonstrate degradation under UV exposure, chemical attack, and mechanical abrasion. The trade-off between transparency and functionality continues to challenge researchers, as increasing the concentration of functional additives typically reduces optical clarity.

Energy efficiency in manufacturing processes represents a growing concern. Many high-performance coatings require energy-intensive deposition methods and high-temperature annealing, contradicting sustainability goals. The industry faces increasing pressure to develop low-temperature, energy-efficient production techniques.

Material compatibility issues arise when integrating transparent oxide nanocoatings with diverse substrates. Thermal expansion mismatches, interfacial adhesion problems, and chemical incompatibilities can lead to delamination, cracking, or performance degradation over time.

Standardization remains underdeveloped, with inconsistent testing protocols and performance metrics across different regions and applications. This hampers comparative analysis and slows commercial adoption. Additionally, the cost-performance ratio continues to limit widespread implementation, as high-performance transparent oxide nanocoatings often require expensive precursors and sophisticated deposition equipment.

Addressing these technical barriers requires coordinated international research efforts, increased industry-academia collaboration, and targeted funding initiatives. Recent advances in computational materials science and high-throughput experimentation offer promising approaches to accelerate innovation in this field.

Current Fabrication Methods for Transparent Oxide Nanostructures

01 Transparent Conductive Oxide (TCO) nanostructures for electronic applications

Transparent conductive oxides formed as nanostructured coatings are widely used in electronic devices such as displays, solar cells, and touch screens. These materials combine optical transparency with electrical conductivity, making them ideal for applications requiring both properties. Common TCO materials include indium tin oxide (ITO), zinc oxide, and aluminum-doped zinc oxide. The nanostructured form enhances performance by increasing surface area and improving charge transport properties while maintaining transparency.- Transparent Conductive Oxide (TCO) nanostructures for electronic applications: Transparent conductive oxides formed into nanostructured coatings are widely used in electronic and optoelectronic devices. These materials combine high electrical conductivity with optical transparency, making them ideal for applications such as touch screens, displays, and solar cells. Common TCO materials include indium tin oxide (ITO), zinc oxide, and aluminum-doped zinc oxide. The nanostructuring of these oxides enhances their performance by increasing surface area and improving charge transport properties while maintaining transparency.

- Metal oxide nanoparticles for protective and functional coatings: Metal oxide nanoparticles are incorporated into coatings to provide enhanced protection against environmental factors while maintaining transparency. These nanostructured coatings offer improved scratch resistance, UV protection, and self-cleaning properties. The nanoscale dimensions of the oxide particles allow for transparency as they are smaller than the wavelength of visible light. Various metal oxides such as titanium dioxide, silicon dioxide, and aluminum oxide are commonly used in these applications, with the specific oxide selection depending on the desired functional properties.

- Transparent oxide thin films with controlled nanostructure: Thin films of transparent oxides with precisely controlled nanostructures are developed for optical and electronic applications. These films are fabricated using techniques such as sol-gel processing, atomic layer deposition, and sputtering to achieve specific nanostructures including nanoporous, nanocolumnar, or multilayered architectures. The controlled nanostructure allows for tuning of properties such as refractive index, optical transmittance, and electrical conductivity. Applications include anti-reflective coatings, smart windows, and sensors where both transparency and specific functional properties are required.

- Doped transparent oxide nanocoatings for enhanced functionality: Doping of transparent oxide nanocoatings with various elements enhances their electrical, optical, and catalytic properties. By introducing controlled amounts of dopants into the oxide matrix, properties such as electrical conductivity, photocatalytic activity, and optical absorption can be precisely tuned while maintaining transparency. Common dopants include metals such as aluminum, gallium, and silver, as well as non-metals like nitrogen. These doped nanostructured coatings find applications in smart windows, photocatalytic surfaces, and transparent electronics.

- Transparent oxide nanocomposites for multifunctional coatings: Nanocomposite coatings combining transparent oxides with other materials offer multifunctional properties not achievable with single-component systems. These nanostructured composites typically incorporate transparent oxides such as silica, titania, or zinc oxide with polymers, other inorganic materials, or carbon-based nanomaterials. The resulting coatings exhibit combinations of properties including transparency, mechanical strength, electrical conductivity, and environmental stability. Applications range from self-cleaning architectural glass to flexible electronics and protective coatings for sensitive devices.

02 Nanostructured metal oxide coatings for photocatalytic and self-cleaning applications

Transparent metal oxide nanostructures, particularly titanium dioxide (TiO2), are formulated into coatings with photocatalytic properties. When exposed to light, these nanostructured coatings break down organic contaminants and provide self-cleaning functionality. The transparency allows these coatings to be applied to windows, building facades, and other surfaces without affecting their appearance. The nanostructure enhances the photocatalytic efficiency by increasing the active surface area and improving light absorption.Expand Specific Solutions03 Transparent oxide nanocoatings for enhanced optical properties

Nanostructured transparent oxide coatings are engineered to modify optical properties such as anti-reflection, light transmission, and selective wavelength filtering. These coatings utilize materials like silicon dioxide, titanium dioxide, and zirconium oxide in precisely controlled nanostructures to manipulate light. Applications include high-performance optics, solar panels, and specialized glass with enhanced functionality. The nanostructure allows for tuning of refractive index and optical behavior beyond what is possible with conventional coatings.Expand Specific Solutions04 Nanostructured transparent oxides for energy applications

Transparent oxide nanostructures play a crucial role in energy generation and storage technologies. These materials are formulated into coatings for solar cells, fuel cells, and energy-efficient windows. The nanostructured nature enhances energy conversion efficiency while maintaining optical transparency. Materials such as doped zinc oxide, tin oxide, and titanium dioxide are commonly used in these applications. The coatings can be engineered to have specific band gaps and electronic properties tailored for particular energy applications.Expand Specific Solutions05 Manufacturing methods for transparent oxide nanostructured coatings

Various specialized techniques have been developed for depositing transparent oxide nanostructured coatings with precise control over composition, thickness, and nanostructure. These methods include sol-gel processing, chemical vapor deposition, atomic layer deposition, and magnetron sputtering. Each technique offers different advantages in terms of scalability, cost-effectiveness, and the ability to create specific nanostructures. Post-deposition treatments such as annealing and plasma processing are often employed to optimize the properties of the transparent oxide nanocoatings.Expand Specific Solutions

Industry Leaders in Transparent Oxide Nanocoating Sector

The transparent oxides in nanostructured coatings market is currently in a growth phase, with increasing applications across electronics, displays, and photovoltaics sectors. The global market is expanding rapidly, driven by demand for high-performance transparent conductive materials. Technologically, the field shows varying maturity levels, with established players like Samsung Electronics and Applied Materials leading commercial development, while academic institutions such as Nanjing Tech University and University of Michigan drive fundamental research. Companies like Cambrios Technologies and C3 Nano have developed specialized silver nanowire solutions, while BASF and 3M focus on broader materials integration. The competitive landscape features collaboration between industry leaders and research institutions, with Asian manufacturers (particularly Korean and Chinese entities) gaining significant market share alongside traditional Western technology companies.

BASF Corp.

Technical Solution: BASF has developed innovative transparent oxide nanostructured coatings through their proprietary sol-gel synthesis approach. Their technology focuses on creating multi-functional metal oxide nanoparticles (primarily TiO2, ZnO, and SiO2) dispersed in specialized polymer matrices to form transparent protective coatings. These coatings feature controlled porosity at the nanoscale, enabling properties such as self-cleaning, anti-fogging, and UV protection while maintaining over 95% visible light transmission. BASF's approach incorporates dopants into the oxide structures to enhance specific properties - such as antimicrobial silver ions in ZnO matrices or rare earth elements for enhanced photocatalytic activity. Their coatings are applied through conventional methods like spray coating or roll-to-roll processing, making them compatible with existing manufacturing infrastructure. Recent developments include thermochromic vanadium dioxide (VO2) nanoparticles in their transparent oxide systems for smart window applications with energy-saving capabilities.

Strengths: Extensive chemical expertise allowing precise control of nanoparticle synthesis; established global distribution network; ability to customize formulations for specific industry requirements; compatibility with existing application methods. Weaknesses: Lower electrical conductivity compared to ITO-based alternatives; potential for nanoparticle agglomeration affecting optical clarity; more complex quality control requirements for consistent performance.

Cambrios Film Solutions Corporation

Technical Solution: Cambrios Film Solutions has developed ClearOhm® technology, a breakthrough in transparent conductive materials using silver nanowire networks embedded in metal oxide matrices. Their approach combines solution-processed silver nanowires with transparent metal oxide overcoats (primarily zinc oxide and aluminum-doped zinc oxide) to create highly conductive, transparent, and flexible films. The company's proprietary synthesis methods produce silver nanowires with aspect ratios exceeding 1000:1, enabling percolation networks that achieve sheet resistance below 10 ohms/square with optical transparency above 95%. Their hybrid metal oxide-nanowire structures are deposited using standard coating techniques like slot-die coating and are compatible with roll-to-roll manufacturing processes. Cambrios' technology enables transparent electrodes that maintain conductivity after more than 100,000 bending cycles, making them ideal for flexible displays and touch sensors. Recent innovations include patternable formulations that eliminate traditional photolithography steps, reducing manufacturing complexity and environmental impact.

Strengths: Industry-leading combination of optical transparency and electrical conductivity; excellent mechanical flexibility for bendable applications; compatibility with existing manufacturing infrastructure; solution-processable at relatively low temperatures. Weaknesses: Higher material costs compared to traditional TCO materials; potential for silver migration under certain environmental conditions; requires careful handling during manufacturing to prevent nanowire aggregation.

Key Patents and Innovations in Transparent Oxide Nanocoatings

Transparent conductive oxides having a nanostructured surface and uses thereof

PatentInactiveUS20120181573A1

Innovation

- A nickel-cobalt alloy is deposited on a nanostructured TCO surface, created by reducing the upper layer of the TCO and optionally etching the metal nanoparticles, resulting in a surface with nano-holes, nano-grooves, and metal nano-islands, significantly improving the adhesion and conductivity of the metal or alloy layer.

Method for manufacturing transparent conducting oxides

PatentInactiveUS8834748B2

Innovation

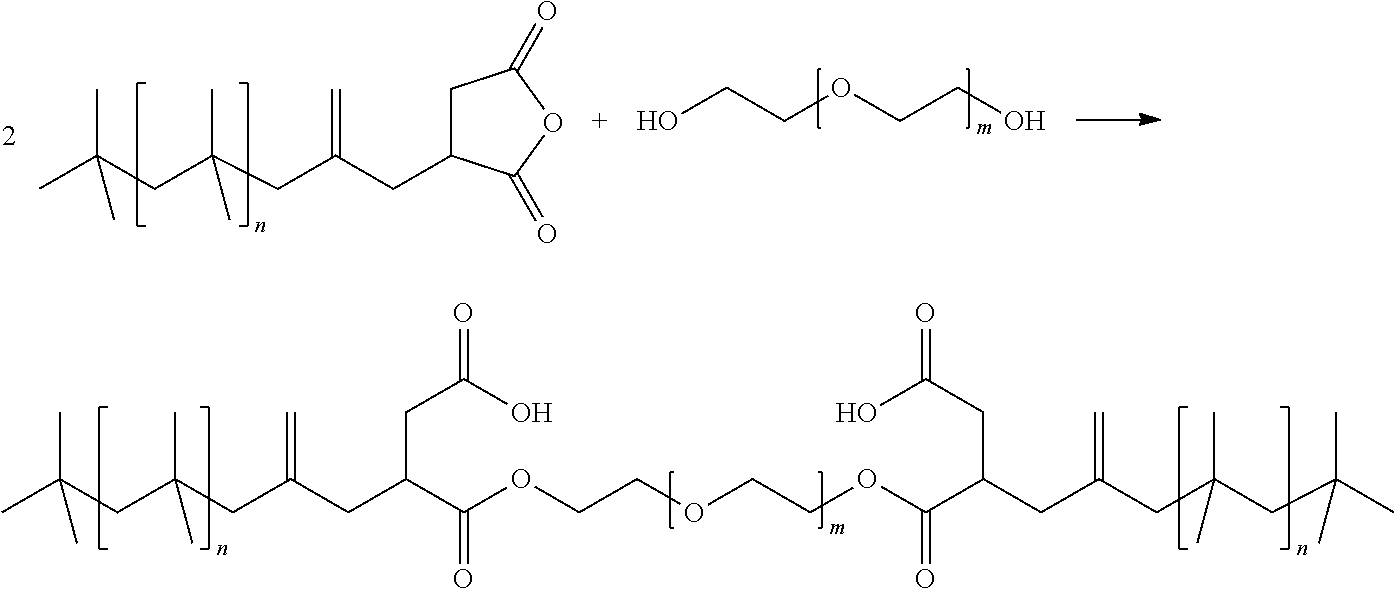

- A process involving a reaction of metal or semimetal compounds with a block copolymer comprising alkylene oxide and isobutylene blocks, followed by application to a substrate and heating to at least 350°C, to form mesoporous, crystalline, and conductive oxide layers with improved stability and adhesion.

Environmental Impact and Sustainability Considerations

The environmental impact of transparent oxide nanostructured coatings represents a critical consideration in their development and deployment. These materials offer significant sustainability advantages compared to traditional coating technologies. Notably, many transparent oxide materials such as TiO2, ZnO, and SnO2 exhibit photocatalytic properties that enable self-cleaning and air-purifying functionalities, reducing the need for chemical cleaners and improving indoor air quality in architectural applications.

Manufacturing processes for transparent oxide nanocoatings have evolved toward more environmentally friendly methods. Sol-gel techniques and hydrothermal synthesis approaches require lower processing temperatures than conventional methods, resulting in reduced energy consumption and carbon footprint. Additionally, advances in atomic layer deposition (ALD) have enabled precise material deposition with minimal waste, addressing previous concerns about material efficiency in nanomaterial production.

Life cycle assessment (LCA) studies indicate that the extended durability of transparent oxide nanocoatings can offset their initial production impacts. Buildings and devices coated with these materials typically require less frequent replacement or maintenance, reducing waste generation and resource consumption over time. For instance, self-cleaning facades reduce water usage and maintenance requirements by up to 70% compared to conventional surfaces.

However, challenges remain regarding the potential environmental risks of nanoparticle release during weathering and end-of-life disposal. Recent research has identified potential aquatic toxicity from certain metal oxide nanoparticles, necessitating careful consideration of formulation and application methods. Encapsulation strategies and improved binding technologies are being developed to mitigate these risks by preventing nanoparticle leaching into the environment.

Regulatory frameworks worldwide are increasingly addressing nanomaterial safety, with the EU's REACH regulations and similar initiatives in North America and Asia establishing guidelines for responsible development. Industry leaders are responding with green chemistry approaches that minimize hazardous substances in formulations and manufacturing processes. Closed-loop recycling systems for coating materials are also emerging as promising solutions for reducing waste.

The sustainability profile of transparent oxide nanocoatings is further enhanced by their contribution to energy efficiency. When applied to windows and building envelopes, these coatings can significantly reduce heating and cooling demands, potentially decreasing building energy consumption by 5-15% depending on climate conditions and application specifics. This energy-saving potential represents one of the most substantial environmental benefits of widespread adoption.

Manufacturing processes for transparent oxide nanocoatings have evolved toward more environmentally friendly methods. Sol-gel techniques and hydrothermal synthesis approaches require lower processing temperatures than conventional methods, resulting in reduced energy consumption and carbon footprint. Additionally, advances in atomic layer deposition (ALD) have enabled precise material deposition with minimal waste, addressing previous concerns about material efficiency in nanomaterial production.

Life cycle assessment (LCA) studies indicate that the extended durability of transparent oxide nanocoatings can offset their initial production impacts. Buildings and devices coated with these materials typically require less frequent replacement or maintenance, reducing waste generation and resource consumption over time. For instance, self-cleaning facades reduce water usage and maintenance requirements by up to 70% compared to conventional surfaces.

However, challenges remain regarding the potential environmental risks of nanoparticle release during weathering and end-of-life disposal. Recent research has identified potential aquatic toxicity from certain metal oxide nanoparticles, necessitating careful consideration of formulation and application methods. Encapsulation strategies and improved binding technologies are being developed to mitigate these risks by preventing nanoparticle leaching into the environment.

Regulatory frameworks worldwide are increasingly addressing nanomaterial safety, with the EU's REACH regulations and similar initiatives in North America and Asia establishing guidelines for responsible development. Industry leaders are responding with green chemistry approaches that minimize hazardous substances in formulations and manufacturing processes. Closed-loop recycling systems for coating materials are also emerging as promising solutions for reducing waste.

The sustainability profile of transparent oxide nanocoatings is further enhanced by their contribution to energy efficiency. When applied to windows and building envelopes, these coatings can significantly reduce heating and cooling demands, potentially decreasing building energy consumption by 5-15% depending on climate conditions and application specifics. This energy-saving potential represents one of the most substantial environmental benefits of widespread adoption.

Scalability and Commercial Implementation Challenges

The scaling of transparent oxide nanostructured coating technologies from laboratory to industrial production presents significant challenges that must be addressed for commercial viability. Current deposition methods such as atomic layer deposition (ALD) and pulsed laser deposition (PLD), while offering precise control over film thickness and composition, face substantial throughput limitations when considered for large-scale manufacturing. The inherently slow deposition rates of these techniques—often measured in angstroms per minute—create a fundamental bottleneck for mass production scenarios.

Cost considerations represent another major hurdle in commercialization efforts. The high-purity precursors required for transparent oxide synthesis, particularly for advanced materials like indium tin oxide (ITO) and aluminum-doped zinc oxide (AZO), contribute significantly to production expenses. Additionally, the specialized equipment necessary for controlled deposition environments demands substantial capital investment, with maintenance costs further impacting the overall economic equation.

Process consistency across large substrate areas remains problematic for many deposition techniques. Achieving uniform optical and electrical properties over surfaces measuring several square meters—as required for architectural glass or large display applications—necessitates sophisticated engineering solutions that are still being developed. Variations in thickness and composition can lead to inconsistent performance that undermines product reliability.

Environmental and regulatory considerations also impact implementation pathways. Some deposition processes utilize hazardous precursors or generate waste streams that require specialized handling and disposal procedures. As global manufacturing regulations become increasingly stringent, developing environmentally sustainable production methods has become a critical factor in technology adoption decisions.

Integration with existing manufacturing infrastructure presents another dimension of the scalability challenge. New coating technologies must demonstrate compatibility with established production lines to minimize implementation costs. This often requires adaptation of novel deposition techniques to work within the constraints of current manufacturing systems, potentially compromising optimal performance parameters.

Market adoption barriers extend beyond technical considerations to include industry inertia and risk aversion. Conservative sectors like construction and automotive manufacturing typically require extensive validation periods before adopting new materials technologies. The development of industry standards and certification protocols for transparent oxide nanostructured coatings lags behind the pace of laboratory innovation, creating uncertainty that slows commercial implementation.

Cost considerations represent another major hurdle in commercialization efforts. The high-purity precursors required for transparent oxide synthesis, particularly for advanced materials like indium tin oxide (ITO) and aluminum-doped zinc oxide (AZO), contribute significantly to production expenses. Additionally, the specialized equipment necessary for controlled deposition environments demands substantial capital investment, with maintenance costs further impacting the overall economic equation.

Process consistency across large substrate areas remains problematic for many deposition techniques. Achieving uniform optical and electrical properties over surfaces measuring several square meters—as required for architectural glass or large display applications—necessitates sophisticated engineering solutions that are still being developed. Variations in thickness and composition can lead to inconsistent performance that undermines product reliability.

Environmental and regulatory considerations also impact implementation pathways. Some deposition processes utilize hazardous precursors or generate waste streams that require specialized handling and disposal procedures. As global manufacturing regulations become increasingly stringent, developing environmentally sustainable production methods has become a critical factor in technology adoption decisions.

Integration with existing manufacturing infrastructure presents another dimension of the scalability challenge. New coating technologies must demonstrate compatibility with established production lines to minimize implementation costs. This often requires adaptation of novel deposition techniques to work within the constraints of current manufacturing systems, potentially compromising optimal performance parameters.

Market adoption barriers extend beyond technical considerations to include industry inertia and risk aversion. Conservative sectors like construction and automotive manufacturing typically require extensive validation periods before adopting new materials technologies. The development of industry standards and certification protocols for transparent oxide nanostructured coatings lags behind the pace of laboratory innovation, creating uncertainty that slows commercial implementation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!