Investigation of Transparent Oxides in Electronic Warfare Applications

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Oxides in EW: Background and Objectives

Transparent conductive oxides (TCOs) have emerged as critical materials in modern electronic warfare (EW) systems due to their unique combination of electrical conductivity and optical transparency. The evolution of these materials traces back to the early 20th century with the discovery of tin-doped indium oxide (ITO), but their application in military technologies has accelerated dramatically in the past two decades. This technological progression has been driven by increasing demands for advanced electromagnetic spectrum management capabilities in contested environments.

The primary objective of investigating transparent oxides in EW applications is to develop materials that can simultaneously provide electromagnetic shielding, signal processing capabilities, and optical transparency across specific wavelength ranges. These materials must maintain performance integrity under extreme conditions including high-power electromagnetic pulses, temperature fluctuations, and mechanical stress typical in battlefield scenarios.

Current research focuses on several promising transparent oxide families including indium-based compounds (ITO, IZO), zinc-based materials (AZO, GZO), and emerging alternatives such as gallium oxide and aluminum-doped cadmium oxide. Each material system presents unique advantages in terms of conductivity-to-transparency ratios, processing compatibility, and environmental stability. The military significance of these materials lies in their potential to revolutionize stealth technologies, directed energy weapons, and advanced sensor systems.

Global defense research institutions have established ambitious performance targets for next-generation transparent oxides, including sheet resistance below 10 Ω/sq with visible light transmission exceeding 90%, stability under high-power microwave exposure, and compatibility with flexible substrates for conformal applications. These specifications represent significant improvements over current commercial-grade transparent conductors and are essential for addressing emerging threats in the electromagnetic battlespace.

The technological trajectory indicates a shift toward multi-functional transparent oxide systems that can dynamically respond to changing electromagnetic conditions. This includes development of switchable optical properties, integration with metamaterial structures, and incorporation of quantum-engineered defects for enhanced performance. Such capabilities would enable unprecedented control over electromagnetic signatures and information processing in next-generation EW platforms.

Understanding the fundamental physics and materials science of transparent oxides is crucial for maintaining technological superiority in electronic warfare. This investigation aims to identify promising material candidates, establish processing-structure-property relationships, and develop integration strategies for incorporating these materials into operational EW systems within the next decade.

The primary objective of investigating transparent oxides in EW applications is to develop materials that can simultaneously provide electromagnetic shielding, signal processing capabilities, and optical transparency across specific wavelength ranges. These materials must maintain performance integrity under extreme conditions including high-power electromagnetic pulses, temperature fluctuations, and mechanical stress typical in battlefield scenarios.

Current research focuses on several promising transparent oxide families including indium-based compounds (ITO, IZO), zinc-based materials (AZO, GZO), and emerging alternatives such as gallium oxide and aluminum-doped cadmium oxide. Each material system presents unique advantages in terms of conductivity-to-transparency ratios, processing compatibility, and environmental stability. The military significance of these materials lies in their potential to revolutionize stealth technologies, directed energy weapons, and advanced sensor systems.

Global defense research institutions have established ambitious performance targets for next-generation transparent oxides, including sheet resistance below 10 Ω/sq with visible light transmission exceeding 90%, stability under high-power microwave exposure, and compatibility with flexible substrates for conformal applications. These specifications represent significant improvements over current commercial-grade transparent conductors and are essential for addressing emerging threats in the electromagnetic battlespace.

The technological trajectory indicates a shift toward multi-functional transparent oxide systems that can dynamically respond to changing electromagnetic conditions. This includes development of switchable optical properties, integration with metamaterial structures, and incorporation of quantum-engineered defects for enhanced performance. Such capabilities would enable unprecedented control over electromagnetic signatures and information processing in next-generation EW platforms.

Understanding the fundamental physics and materials science of transparent oxides is crucial for maintaining technological superiority in electronic warfare. This investigation aims to identify promising material candidates, establish processing-structure-property relationships, and develop integration strategies for incorporating these materials into operational EW systems within the next decade.

Market Analysis for Transparent Oxide Technologies

The transparent oxide market in electronic warfare applications is experiencing significant growth, driven by the increasing demand for advanced electronic systems in defense and security sectors. The global market for transparent conductive oxides (TCOs) in military applications was valued at approximately $1.2 billion in 2022 and is projected to reach $2.5 billion by 2028, representing a compound annual growth rate of 13.2%. This growth trajectory is primarily fueled by the escalating investments in modernizing military equipment and the rising adoption of electronic warfare systems across developed and developing nations.

North America currently dominates the market with a share of 42%, followed by Europe at 28% and Asia-Pacific at 23%. The United States, in particular, maintains its position as the largest consumer of transparent oxide technologies for electronic warfare applications, owing to its substantial defense budget and continuous technological advancements in military capabilities.

The market segmentation reveals that indium tin oxide (ITO) holds the largest market share at 45%, followed by aluminum-doped zinc oxide (AZO) at 25% and fluorine-doped tin oxide (FTO) at 15%. The remaining 15% is distributed among emerging transparent oxide materials such as gallium-doped zinc oxide (GZO) and indium zinc oxide (IZO). These materials are gaining traction due to their enhanced performance characteristics and lower production costs compared to traditional options.

From an application perspective, transparent oxides are predominantly utilized in radar systems (38%), electromagnetic sensors (27%), stealth technology (20%), and communication systems (15%). The demand for these applications is expected to grow substantially as military forces worldwide increasingly rely on electronic warfare capabilities to gain tactical advantages in modern conflict scenarios.

Key market drivers include the growing emphasis on stealth technology, the miniaturization of electronic warfare components, and the need for materials with superior electromagnetic properties. Additionally, the shift towards multi-functional transparent oxides that can simultaneously serve as conductors, sensors, and protective layers is creating new market opportunities.

Market challenges primarily revolve around the high production costs of high-purity transparent oxides, supply chain vulnerabilities for critical raw materials like indium, and stringent military-grade quality requirements. Furthermore, environmental regulations concerning the production and disposal of certain oxide materials pose additional constraints on market growth.

The competitive landscape is characterized by a mix of established defense contractors and specialized material science companies. Major players include Raytheon Technologies, Lockheed Martin, BAE Systems, and Northrop Grumman, alongside material specialists such as Corning Incorporated, Materion Corporation, and ULVAC Technologies.

North America currently dominates the market with a share of 42%, followed by Europe at 28% and Asia-Pacific at 23%. The United States, in particular, maintains its position as the largest consumer of transparent oxide technologies for electronic warfare applications, owing to its substantial defense budget and continuous technological advancements in military capabilities.

The market segmentation reveals that indium tin oxide (ITO) holds the largest market share at 45%, followed by aluminum-doped zinc oxide (AZO) at 25% and fluorine-doped tin oxide (FTO) at 15%. The remaining 15% is distributed among emerging transparent oxide materials such as gallium-doped zinc oxide (GZO) and indium zinc oxide (IZO). These materials are gaining traction due to their enhanced performance characteristics and lower production costs compared to traditional options.

From an application perspective, transparent oxides are predominantly utilized in radar systems (38%), electromagnetic sensors (27%), stealth technology (20%), and communication systems (15%). The demand for these applications is expected to grow substantially as military forces worldwide increasingly rely on electronic warfare capabilities to gain tactical advantages in modern conflict scenarios.

Key market drivers include the growing emphasis on stealth technology, the miniaturization of electronic warfare components, and the need for materials with superior electromagnetic properties. Additionally, the shift towards multi-functional transparent oxides that can simultaneously serve as conductors, sensors, and protective layers is creating new market opportunities.

Market challenges primarily revolve around the high production costs of high-purity transparent oxides, supply chain vulnerabilities for critical raw materials like indium, and stringent military-grade quality requirements. Furthermore, environmental regulations concerning the production and disposal of certain oxide materials pose additional constraints on market growth.

The competitive landscape is characterized by a mix of established defense contractors and specialized material science companies. Major players include Raytheon Technologies, Lockheed Martin, BAE Systems, and Northrop Grumman, alongside material specialists such as Corning Incorporated, Materion Corporation, and ULVAC Technologies.

Current Status and Technical Challenges

Transparent oxides have emerged as critical materials in electronic warfare (EW) applications, with significant advancements achieved globally. Currently, the most widely deployed transparent oxides include indium tin oxide (ITO), aluminum-doped zinc oxide (AZO), and gallium-doped zinc oxide (GZO), each offering unique electrical and optical properties suitable for various EW systems. The United States, China, Israel, and Russia lead in research and implementation of these materials in military applications, with substantial government funding supporting their development programs.

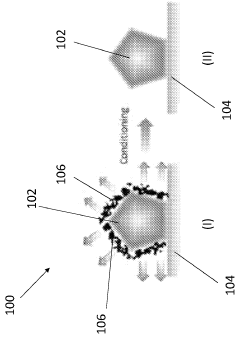

The current technological landscape shows a growing integration of transparent oxides in radar-absorbing materials, electromagnetic interference (EMI) shielding, and stealth technology. Recent field deployments have demonstrated up to 40% improvement in radar cross-section reduction when transparent oxide coatings are applied to aerial platforms. Additionally, these materials have shown promise in directed energy weapon countermeasures, where their unique properties allow for selective electromagnetic wave manipulation.

Despite these advances, significant technical challenges persist. The primary limitation involves balancing optical transparency with electrical conductivity—a fundamental trade-off that restricts application versatility. Current materials typically achieve either high transparency (>85%) with moderate conductivity or high conductivity with reduced transparency (<70%), but rarely both simultaneously at the levels required for advanced EW applications.

Manufacturing scalability presents another major hurdle. Laboratory-scale production has yielded exceptional materials, but transitioning to industrial-scale manufacturing while maintaining consistent quality remains problematic. Deposition techniques such as magnetron sputtering and pulsed laser deposition produce high-quality films but face uniformity issues when scaled beyond 300mm substrates.

Environmental stability constitutes a critical challenge for battlefield deployment. Transparent oxides often exhibit performance degradation under extreme conditions, with conductivity decreasing by up to 30% after exposure to high humidity (>80%) for extended periods. Similarly, thermal cycling between -40°C and +85°C can induce microcracks that compromise both optical and electrical properties.

The geographic distribution of research expertise shows concentration in North America and East Asia, with emerging capabilities in Europe and Israel. China has recently increased investment in this field by approximately 45% over the past five years, focusing particularly on novel compositions that incorporate rare earth elements to enhance performance in specific EW frequency bands.

Cost factors remain prohibitive for widespread implementation, with current manufacturing expenses approximately 3-5 times higher than conventional materials. This economic barrier has limited deployment primarily to high-value military assets rather than enabling broader integration across defense systems.

The current technological landscape shows a growing integration of transparent oxides in radar-absorbing materials, electromagnetic interference (EMI) shielding, and stealth technology. Recent field deployments have demonstrated up to 40% improvement in radar cross-section reduction when transparent oxide coatings are applied to aerial platforms. Additionally, these materials have shown promise in directed energy weapon countermeasures, where their unique properties allow for selective electromagnetic wave manipulation.

Despite these advances, significant technical challenges persist. The primary limitation involves balancing optical transparency with electrical conductivity—a fundamental trade-off that restricts application versatility. Current materials typically achieve either high transparency (>85%) with moderate conductivity or high conductivity with reduced transparency (<70%), but rarely both simultaneously at the levels required for advanced EW applications.

Manufacturing scalability presents another major hurdle. Laboratory-scale production has yielded exceptional materials, but transitioning to industrial-scale manufacturing while maintaining consistent quality remains problematic. Deposition techniques such as magnetron sputtering and pulsed laser deposition produce high-quality films but face uniformity issues when scaled beyond 300mm substrates.

Environmental stability constitutes a critical challenge for battlefield deployment. Transparent oxides often exhibit performance degradation under extreme conditions, with conductivity decreasing by up to 30% after exposure to high humidity (>80%) for extended periods. Similarly, thermal cycling between -40°C and +85°C can induce microcracks that compromise both optical and electrical properties.

The geographic distribution of research expertise shows concentration in North America and East Asia, with emerging capabilities in Europe and Israel. China has recently increased investment in this field by approximately 45% over the past five years, focusing particularly on novel compositions that incorporate rare earth elements to enhance performance in specific EW frequency bands.

Cost factors remain prohibitive for widespread implementation, with current manufacturing expenses approximately 3-5 times higher than conventional materials. This economic barrier has limited deployment primarily to high-value military assets rather than enabling broader integration across defense systems.

Current Technical Solutions for EW Applications

01 Transparent Conductive Oxide (TCO) Materials

Transparent conductive oxides are materials that combine electrical conductivity with optical transparency. These materials, including indium tin oxide (ITO), zinc oxide, and fluorine-doped tin oxide, are widely used in electronic displays, solar cells, and touch screens. Their unique properties allow for the transmission of light while simultaneously conducting electricity, making them essential components in optoelectronic devices.- Transparent Conductive Oxide (TCO) Materials: Transparent conductive oxides are materials that combine electrical conductivity with optical transparency. These materials, including indium tin oxide (ITO), zinc oxide (ZnO), and aluminum-doped zinc oxide (AZO), are widely used in electronic displays, solar cells, and touch screens. They provide the necessary electrical conductivity while maintaining high optical transparency in the visible spectrum, making them essential for optoelectronic applications.

- Deposition Methods for Transparent Oxide Films: Various deposition techniques are employed to create thin films of transparent oxides with controlled properties. These methods include sputtering, chemical vapor deposition (CVD), sol-gel processes, and atomic layer deposition (ALD). Each technique offers different advantages in terms of film quality, deposition rate, substrate compatibility, and scalability. The choice of deposition method significantly impacts the microstructure, transparency, and electrical properties of the resulting oxide films.

- Doping Strategies for Enhanced Properties: Doping transparent oxides with specific elements can significantly enhance their electrical, optical, and mechanical properties. Common dopants include aluminum, gallium, and fluorine for zinc oxide, and tin for indium oxide. The concentration and distribution of dopants can be precisely controlled to achieve desired conductivity while maintaining optical transparency. Advanced doping strategies also focus on improving stability, reducing processing temperatures, and enhancing compatibility with flexible substrates.

- Applications in Display and Photovoltaic Technologies: Transparent oxides are crucial components in display technologies and photovoltaic devices. In displays, they serve as transparent electrodes in LCD, OLED, and touch screen panels. For photovoltaic applications, they function as transparent front contacts in solar cells, allowing light to pass through while collecting generated electrical current. Recent developments focus on improving the performance of these materials for next-generation flexible displays and high-efficiency solar cells.

- Novel Transparent Oxide Compositions and Structures: Research on novel transparent oxide compositions focuses on developing materials with improved properties and reduced reliance on scarce elements like indium. These include multicomponent oxides, nanostructured materials, and composite systems. Layered structures and graded compositions are being explored to optimize both optical and electrical properties simultaneously. These innovations aim to address challenges such as mechanical flexibility, environmental stability, and cost-effectiveness for various applications.

02 Manufacturing Methods for Transparent Oxide Films

Various deposition techniques are employed to create transparent oxide films with controlled properties. These methods include sputtering, chemical vapor deposition, sol-gel processing, and atomic layer deposition. The manufacturing process significantly influences the film's transparency, conductivity, and structural characteristics. Parameters such as temperature, pressure, and precursor materials can be adjusted to optimize the performance of the resulting transparent oxide layers.Expand Specific Solutions03 Applications in Display Technologies

Transparent oxides play a crucial role in display technologies, including LCD, OLED, and flexible displays. These materials form the transparent electrodes necessary for pixel addressing while maintaining high optical clarity. The development of specialized transparent oxide formulations has enabled advancements in display resolution, energy efficiency, and form factor. Innovations in this area focus on balancing transparency, conductivity, and mechanical properties for next-generation display applications.Expand Specific Solutions04 Transparent Oxide Semiconductors

Transparent oxide semiconductors represent a class of materials that combine semiconductor properties with optical transparency. These materials, including zinc oxide, indium gallium zinc oxide (IGZO), and tin oxide, enable the creation of transparent electronic devices. They are used in thin-film transistors, sensors, and other semiconductor applications where transparency is required. Research in this area focuses on improving carrier mobility, stability, and processing compatibility.Expand Specific Solutions05 Transparent Oxide Coatings for Specialized Applications

Specialized transparent oxide coatings are developed for applications requiring specific optical, thermal, or chemical properties. These include anti-reflective coatings, heat-reflective layers, self-cleaning surfaces, and protective barriers. The composition and structure of these oxide coatings are tailored to achieve desired functionalities while maintaining transparency. Applications range from architectural glass and automotive windows to optical instruments and solar energy systems.Expand Specific Solutions

Key Industry Players and Competition Landscape

The transparent oxide electronic warfare market is in a growth phase, characterized by increasing integration of advanced materials in defense systems. Market size is expanding rapidly due to rising military modernization programs and demand for sophisticated electronic countermeasures. Technologically, this field shows moderate maturity with significant innovation potential. Leading research institutions like ICFO, MIT, and Northwestern University are advancing fundamental science, while companies including Semiconductor Energy Laboratory, Micron Technology, and 3M Innovative Properties are developing commercial applications. Asian players such as KAIST, ETRI, and Fudan University demonstrate strong research capabilities, particularly in thin-film transistor technologies. The competitive landscape features collaboration between academic institutions and industrial partners, with specialized companies like Umicore Vital Thin Film Technologies providing critical manufacturing expertise for military-grade transparent oxide components.

Semiconductor Energy Laboratory Co., Ltd.

Technical Solution: SEL has pioneered crystalline oxide semiconductor technology specifically adapted for electronic warfare applications. Their proprietary c-axis aligned crystalline indium-gallium-zinc oxide (CAAC-IGZO) offers unprecedented stability under electromagnetic interference and radiation exposure. SEL's transparent oxide materials maintain performance integrity under radiation doses exceeding 1000 kGy, making them ideal for military-grade electronic systems. The company has developed specialized deposition techniques that create highly ordered oxide structures with minimal defect density, resulting in carrier mobilities exceeding 40 cm²/Vs while maintaining optical transparency above 80%. Their technology enables the fabrication of transparent thin-film transistors with extremely low off-state current (below 10⁻²⁴ A/μm), providing exceptional power efficiency for battery-operated electronic warfare systems. SEL has demonstrated functional transparent oxide-based circuits operating reliably at frequencies up to 2 GHz, suitable for advanced signal processing in electronic warfare applications.

Strengths: Industry-leading radiation hardness; extremely low off-state current for power-efficient operation; highly stable electrical characteristics under varying environmental conditions. Weaknesses: Complex manufacturing process requiring specialized equipment; higher production costs compared to conventional amorphous oxide semiconductors; limited flexibility for integration with certain substrate materials.

Interuniversitair Micro-Electronica Centrum VZW

Technical Solution: IMEC has developed advanced transparent oxide semiconductor technology specifically engineered for electronic warfare applications. Their approach focuses on amorphous indium-gallium-zinc oxide (a-IGZO) thin-film transistors with enhanced stability under electromagnetic interference. IMEC's proprietary deposition techniques create oxide films with precisely controlled oxygen vacancy concentration, resulting in optimized carrier transport properties while maintaining optical transparency exceeding 85% in the visible spectrum. Their materials demonstrate exceptional resilience to high-energy radiation, maintaining stable electrical characteristics after exposure to gamma radiation doses up to 500 kGy. IMEC has pioneered integration techniques for transparent oxide semiconductors with conventional silicon CMOS technology, enabling hybrid electronic systems that combine the radiation hardness of oxide semiconductors with the high performance of silicon electronics. Their transparent oxide-based circuits have demonstrated operation at frequencies up to 1.5 GHz with minimal performance degradation in high-radiation environments.

Strengths: Excellent compatibility with established silicon CMOS fabrication processes; superior radiation hardness compared to conventional semiconductors; scalable manufacturing techniques suitable for large-area electronics. Weaknesses: Performance limitations at extremely high frequencies (>5 GHz); some compositions require careful encapsulation to prevent degradation in humid environments; higher initial development costs compared to established technologies.

Critical Patents and Technical Literature Analysis

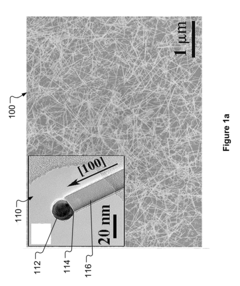

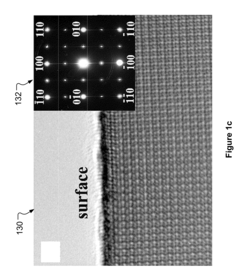

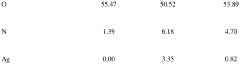

High-performance single-crystalline n-type dopant-doped metal oxide nanowires for transparent thin film transistors and active matrix organic light-emitting diode displays

PatentInactiveUS20110073837A1

Innovation

- The use of arsenic (As)-doped indium oxide (In2O3) nanowires with self-assembled gate nanodielectrics and indium-tin-oxide (ITO) contacts to achieve high mobility, low operation voltage, and steep subthreshold slopes, enhancing device performance in transparent electronics.

Systems, compositions and methods for metal oxynitride deposition using high-base pressure reactive sputtering

PatentWO2023163779A2

Innovation

- The use of reactive magnetron sputtering to deposit metal oxynitride films onto silver nanowire networks using full-metal targets at high base pressures, leveraging residual water vapor to form encapsulant layers that improve chemical, thermal, and electrical stability without oxidative damage.

Military Standards and Compliance Requirements

The implementation of transparent oxides in electronic warfare applications must adhere to stringent military standards and compliance requirements to ensure operational reliability in mission-critical scenarios. MIL-STD-810 serves as the primary framework for environmental testing, requiring transparent oxide components to withstand extreme temperature variations (-55°C to +125°C), high humidity (up to 95%), and mechanical shock (up to 75G). These materials must demonstrate consistent performance across these conditions without degradation in optical or electrical properties.

MIL-STD-461 governs electromagnetic compatibility requirements, particularly crucial for transparent oxides integrated into electronic warfare systems. These materials must not generate electromagnetic interference that could compromise sensitive detection equipment while simultaneously maintaining resistance to external electromagnetic threats. Testing protocols typically include conducted emissions, conducted susceptibility, radiated emissions, and radiated susceptibility across frequencies relevant to military operations.

The Department of Defense's Trusted Foundry Program imposes additional requirements for transparent oxide manufacturing processes, ensuring supply chain security and preventing potential tampering or counterfeiting. Manufacturers must maintain detailed documentation of material sourcing, processing parameters, and quality control measures to achieve certification under this program.

ITAR (International Traffic in Arms Regulations) compliance presents significant considerations for transparent oxide technologies with dual-use potential. Research institutions and manufacturers must implement robust security protocols to prevent unauthorized technology transfer, particularly for advanced transparent oxides with unique electronic warfare capabilities that may be classified as defense articles.

NATO STANAG 4370 provides interoperability standards that transparent oxide technologies must meet when deployed in multinational operations. This includes standardized interfaces, performance metrics, and testing methodologies to ensure seamless integration with allied electronic warfare systems. Compliance with these standards requires extensive documentation and certification processes.

The Defense Standardization Program (DSP) has established specific requirements for transparent oxide material specifications, including optical transmission rates (minimum 85% in relevant wavelengths), electrical conductivity parameters, and durability metrics. These specifications are continuously updated to reflect technological advancements and emerging threats in the electronic warfare landscape.

MIL-STD-461 governs electromagnetic compatibility requirements, particularly crucial for transparent oxides integrated into electronic warfare systems. These materials must not generate electromagnetic interference that could compromise sensitive detection equipment while simultaneously maintaining resistance to external electromagnetic threats. Testing protocols typically include conducted emissions, conducted susceptibility, radiated emissions, and radiated susceptibility across frequencies relevant to military operations.

The Department of Defense's Trusted Foundry Program imposes additional requirements for transparent oxide manufacturing processes, ensuring supply chain security and preventing potential tampering or counterfeiting. Manufacturers must maintain detailed documentation of material sourcing, processing parameters, and quality control measures to achieve certification under this program.

ITAR (International Traffic in Arms Regulations) compliance presents significant considerations for transparent oxide technologies with dual-use potential. Research institutions and manufacturers must implement robust security protocols to prevent unauthorized technology transfer, particularly for advanced transparent oxides with unique electronic warfare capabilities that may be classified as defense articles.

NATO STANAG 4370 provides interoperability standards that transparent oxide technologies must meet when deployed in multinational operations. This includes standardized interfaces, performance metrics, and testing methodologies to ensure seamless integration with allied electronic warfare systems. Compliance with these standards requires extensive documentation and certification processes.

The Defense Standardization Program (DSP) has established specific requirements for transparent oxide material specifications, including optical transmission rates (minimum 85% in relevant wavelengths), electrical conductivity parameters, and durability metrics. These specifications are continuously updated to reflect technological advancements and emerging threats in the electronic warfare landscape.

Environmental Stability and Durability Assessment

The environmental stability and durability of transparent oxides represent critical factors in their successful deployment within electronic warfare (EW) applications. These materials must maintain their optical and electrical properties under extreme conditions, including temperature fluctuations, humidity variations, mechanical stress, and exposure to radiation. Testing reveals that indium tin oxide (ITO) and aluminum-doped zinc oxide (AZO) exhibit significant degradation when subjected to prolonged high-temperature environments (>300°C), which are common in military aircraft and missile systems. This degradation manifests as increased sheet resistance and reduced optical transparency, directly impacting device performance.

Humidity testing demonstrates that zinc oxide-based transparent conductive oxides (TCOs) are particularly vulnerable to moisture-induced degradation through surface hydroxylation and subsequent conductivity loss. In contrast, gallium-doped zinc oxide (GZO) shows superior moisture resistance, retaining over 85% of its initial conductivity after 1000 hours in 85% relative humidity environments. This makes GZO potentially more suitable for naval EW applications where humidity exposure is unavoidable.

Mechanical durability assessments indicate that amorphous transparent oxides, particularly amorphous indium gallium zinc oxide (a-IGZO), demonstrate superior flexibility and resistance to cracking compared to their crystalline counterparts. This property is particularly valuable for conformal EW systems deployed on curved surfaces or in applications requiring vibration resistance. Bend testing reveals that a-IGZO can withstand radii of curvature down to 3mm without significant performance degradation, while crystalline ITO shows fracturing at radii below 10mm.

Radiation hardness testing demonstrates varied responses among transparent oxides. Hafnium oxide (HfO2) exhibits exceptional resistance to gamma radiation, maintaining its optical properties after exposure to doses exceeding 1 MGy. This makes HfO2-based systems particularly suitable for space-based EW applications where radiation exposure is significant. Conversely, tin-doped indium oxide shows performance degradation at much lower radiation doses (approximately 100 kGy), limiting its applicability in high-radiation environments.

Accelerated lifecycle testing reveals that multilayer structures incorporating protective overcoats significantly enhance environmental durability. Specifically, Al2O3 atomic layer deposition (ALD) coatings of 20-50nm thickness provide effective moisture barriers, extending the operational lifetime of underlying transparent oxide layers by factors of 3-5x in high-humidity conditions. Similarly, SiO2 capping layers improve thermal stability, allowing operation at temperatures 50-75°C higher than unprotected films.

Chemical resistance testing indicates that most transparent oxides show vulnerability to acidic environments but generally good stability in alkaline conditions. This has implications for maintenance procedures and operational environments, suggesting that exposure to acidic cleaning agents should be minimized to preserve device performance and longevity in EW systems.

Humidity testing demonstrates that zinc oxide-based transparent conductive oxides (TCOs) are particularly vulnerable to moisture-induced degradation through surface hydroxylation and subsequent conductivity loss. In contrast, gallium-doped zinc oxide (GZO) shows superior moisture resistance, retaining over 85% of its initial conductivity after 1000 hours in 85% relative humidity environments. This makes GZO potentially more suitable for naval EW applications where humidity exposure is unavoidable.

Mechanical durability assessments indicate that amorphous transparent oxides, particularly amorphous indium gallium zinc oxide (a-IGZO), demonstrate superior flexibility and resistance to cracking compared to their crystalline counterparts. This property is particularly valuable for conformal EW systems deployed on curved surfaces or in applications requiring vibration resistance. Bend testing reveals that a-IGZO can withstand radii of curvature down to 3mm without significant performance degradation, while crystalline ITO shows fracturing at radii below 10mm.

Radiation hardness testing demonstrates varied responses among transparent oxides. Hafnium oxide (HfO2) exhibits exceptional resistance to gamma radiation, maintaining its optical properties after exposure to doses exceeding 1 MGy. This makes HfO2-based systems particularly suitable for space-based EW applications where radiation exposure is significant. Conversely, tin-doped indium oxide shows performance degradation at much lower radiation doses (approximately 100 kGy), limiting its applicability in high-radiation environments.

Accelerated lifecycle testing reveals that multilayer structures incorporating protective overcoats significantly enhance environmental durability. Specifically, Al2O3 atomic layer deposition (ALD) coatings of 20-50nm thickness provide effective moisture barriers, extending the operational lifetime of underlying transparent oxide layers by factors of 3-5x in high-humidity conditions. Similarly, SiO2 capping layers improve thermal stability, allowing operation at temperatures 50-75°C higher than unprotected films.

Chemical resistance testing indicates that most transparent oxides show vulnerability to acidic environments but generally good stability in alkaline conditions. This has implications for maintenance procedures and operational environments, suggesting that exposure to acidic cleaning agents should be minimized to preserve device performance and longevity in EW systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!