Transparent Oxides and Their Role in 5G Technology Infrastructure

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Oxides Evolution and 5G Integration Goals

Transparent oxides have evolved significantly over the past decades, transitioning from simple glass materials to sophisticated engineered compounds with remarkable electronic properties. The journey began with traditional silica-based oxides primarily used for their optical transparency, but research breakthroughs in the 1990s and early 2000s revealed their potential as semiconducting materials with unique combinations of electrical conductivity and optical transparency. This dual functionality has positioned transparent oxides at the forefront of modern electronics and telecommunications infrastructure.

The evolution of transparent conducting oxides (TCOs) like indium tin oxide (ITO), zinc oxide (ZnO), and more recently, amorphous indium-gallium-zinc oxide (IGZO) represents a critical technological progression that aligns perfectly with the demanding requirements of 5G technology. These materials have steadily improved in terms of carrier mobility, transparency range, and manufacturing scalability, creating a foundation for next-generation communication systems.

As 5G technology emerges as the backbone of future connectivity, transparent oxides are positioned to play several crucial roles in its infrastructure. The primary integration goal centers on utilizing these materials in advanced antenna systems, particularly for beam-forming arrays and MIMO (Multiple-Input Multiple-Output) configurations that require both signal transparency and electrical functionality. The millimeter-wave frequencies employed in 5G demand materials that can maintain signal integrity while providing necessary electronic functions.

Another key integration objective involves the development of transparent oxide-based thin-film transistors (TFTs) for 5G-compatible display technologies and sensors. As mobile devices become increasingly central to 5G ecosystems, the need for high-performance, energy-efficient display components that can seamlessly integrate with communication hardware becomes paramount. Transparent oxides offer a promising solution by enabling the creation of invisible circuits and antennas that can be incorporated into screens without compromising display quality.

The long-term technical goal for transparent oxides in 5G infrastructure focuses on achieving perfect harmony between optical and electronic properties while ensuring environmental sustainability and resource efficiency. Current research aims to reduce dependence on rare elements like indium while maintaining or improving performance characteristics. Additionally, efforts are underway to develop transparent oxides that can function effectively across the broad spectrum of frequencies utilized in 5G networks, from sub-6 GHz to millimeter-wave bands.

The convergence of transparent oxide evolution and 5G integration represents a significant technological frontier with implications for global connectivity, Internet of Things (IoT) deployment, and smart infrastructure development. As both technologies continue to mature, their synergistic relationship promises to enable new applications and capabilities that were previously unattainable.

The evolution of transparent conducting oxides (TCOs) like indium tin oxide (ITO), zinc oxide (ZnO), and more recently, amorphous indium-gallium-zinc oxide (IGZO) represents a critical technological progression that aligns perfectly with the demanding requirements of 5G technology. These materials have steadily improved in terms of carrier mobility, transparency range, and manufacturing scalability, creating a foundation for next-generation communication systems.

As 5G technology emerges as the backbone of future connectivity, transparent oxides are positioned to play several crucial roles in its infrastructure. The primary integration goal centers on utilizing these materials in advanced antenna systems, particularly for beam-forming arrays and MIMO (Multiple-Input Multiple-Output) configurations that require both signal transparency and electrical functionality. The millimeter-wave frequencies employed in 5G demand materials that can maintain signal integrity while providing necessary electronic functions.

Another key integration objective involves the development of transparent oxide-based thin-film transistors (TFTs) for 5G-compatible display technologies and sensors. As mobile devices become increasingly central to 5G ecosystems, the need for high-performance, energy-efficient display components that can seamlessly integrate with communication hardware becomes paramount. Transparent oxides offer a promising solution by enabling the creation of invisible circuits and antennas that can be incorporated into screens without compromising display quality.

The long-term technical goal for transparent oxides in 5G infrastructure focuses on achieving perfect harmony between optical and electronic properties while ensuring environmental sustainability and resource efficiency. Current research aims to reduce dependence on rare elements like indium while maintaining or improving performance characteristics. Additionally, efforts are underway to develop transparent oxides that can function effectively across the broad spectrum of frequencies utilized in 5G networks, from sub-6 GHz to millimeter-wave bands.

The convergence of transparent oxide evolution and 5G integration represents a significant technological frontier with implications for global connectivity, Internet of Things (IoT) deployment, and smart infrastructure development. As both technologies continue to mature, their synergistic relationship promises to enable new applications and capabilities that were previously unattainable.

Market Demand Analysis for 5G-Compatible Transparent Oxides

The global market for transparent oxides in 5G technology infrastructure is experiencing unprecedented growth, driven by the rapid deployment of 5G networks worldwide. Current market analysis indicates that the demand for transparent conductive oxides (TCOs) such as Indium Tin Oxide (ITO), Aluminum-doped Zinc Oxide (AZO), and Fluorine-doped Tin Oxide (FTO) is accelerating as these materials become essential components in 5G-compatible devices and infrastructure.

The primary market demand stems from the telecommunications sector, where transparent oxides are critical for manufacturing high-frequency antennas, RF filters, and other components that enable efficient 5G signal transmission. These materials offer the unique combination of optical transparency and electrical conductivity required for next-generation communication systems operating at millimeter-wave frequencies.

Consumer electronics represents another significant market segment, with smartphone manufacturers increasingly incorporating transparent oxide-based components to support 5G functionality while maintaining sleek device designs. The ability of these materials to remain invisible while performing critical electronic functions makes them particularly valuable in modern device architecture where space constraints are paramount.

Automotive applications constitute a rapidly expanding market for 5G-compatible transparent oxides, particularly in advanced driver-assistance systems (ADAS) and autonomous vehicle technologies. These systems rely on transparent conductive surfaces for sensors and communication modules that must maintain aesthetic integration with vehicle designs while providing robust connectivity.

Market research indicates that the industrial IoT sector is emerging as a major consumer of transparent oxide technologies, with applications in smart manufacturing, logistics, and infrastructure monitoring. The demand is driven by the need for durable, transparent sensors and antennas that can withstand harsh industrial environments while maintaining reliable 5G connectivity.

Regional analysis shows Asia-Pacific leading the market demand, with China, South Korea, and Japan at the forefront of both production and consumption. North America and Europe follow closely, with significant investments in 5G infrastructure driving demand for advanced materials including transparent oxides.

The market is experiencing a shift toward more sustainable and cost-effective alternatives to traditional ITO, due to concerns about indium scarcity and price volatility. This has accelerated research into alternative transparent conductive materials that can meet the performance requirements of 5G applications while addressing supply chain vulnerabilities.

Forecasts suggest that the market for 5G-compatible transparent oxides will continue to expand as network deployments accelerate globally and as new applications emerge in sectors including healthcare, smart cities, and extended reality technologies.

The primary market demand stems from the telecommunications sector, where transparent oxides are critical for manufacturing high-frequency antennas, RF filters, and other components that enable efficient 5G signal transmission. These materials offer the unique combination of optical transparency and electrical conductivity required for next-generation communication systems operating at millimeter-wave frequencies.

Consumer electronics represents another significant market segment, with smartphone manufacturers increasingly incorporating transparent oxide-based components to support 5G functionality while maintaining sleek device designs. The ability of these materials to remain invisible while performing critical electronic functions makes them particularly valuable in modern device architecture where space constraints are paramount.

Automotive applications constitute a rapidly expanding market for 5G-compatible transparent oxides, particularly in advanced driver-assistance systems (ADAS) and autonomous vehicle technologies. These systems rely on transparent conductive surfaces for sensors and communication modules that must maintain aesthetic integration with vehicle designs while providing robust connectivity.

Market research indicates that the industrial IoT sector is emerging as a major consumer of transparent oxide technologies, with applications in smart manufacturing, logistics, and infrastructure monitoring. The demand is driven by the need for durable, transparent sensors and antennas that can withstand harsh industrial environments while maintaining reliable 5G connectivity.

Regional analysis shows Asia-Pacific leading the market demand, with China, South Korea, and Japan at the forefront of both production and consumption. North America and Europe follow closely, with significant investments in 5G infrastructure driving demand for advanced materials including transparent oxides.

The market is experiencing a shift toward more sustainable and cost-effective alternatives to traditional ITO, due to concerns about indium scarcity and price volatility. This has accelerated research into alternative transparent conductive materials that can meet the performance requirements of 5G applications while addressing supply chain vulnerabilities.

Forecasts suggest that the market for 5G-compatible transparent oxides will continue to expand as network deployments accelerate globally and as new applications emerge in sectors including healthcare, smart cities, and extended reality technologies.

Current State and Technical Challenges of Transparent Oxides

Transparent conductive oxides (TCOs) have emerged as critical materials in modern electronics, with indium tin oxide (ITO) dominating the market for decades. However, the landscape is evolving rapidly as 5G technology creates unprecedented demands for these materials. Currently, TCOs are widely deployed in touchscreens, displays, photovoltaics, and smart windows, but their integration into 5G infrastructure represents a significant expansion of their application scope.

Globally, research institutions and corporations are advancing TCO technology at different rates. North America and East Asia lead in innovation, with Europe following closely. China has made substantial investments in developing alternative TCOs to reduce dependence on scarce materials like indium. Japan maintains leadership in high-precision TCO manufacturing processes, while South Korea excels in integrating these materials into consumer electronics.

The primary technical challenges facing transparent oxides in 5G applications include achieving simultaneously high conductivity and transparency at frequencies above 24 GHz. Traditional ITO formulations exhibit performance degradation at these frequencies, creating a significant barrier to their implementation in millimeter-wave 5G components. Additionally, the mechanical flexibility required for next-generation devices presents another obstacle, as conventional TCOs are inherently brittle.

Material scarcity represents another critical challenge. Indium, essential for ITO production, faces supply constraints with reserves concentrated in few countries. This has driven research toward alternative materials such as aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO), though these alternatives currently underperform ITO in key metrics.

Manufacturing scalability remains problematic, particularly for emerging TCO formulations. Current deposition techniques like sputtering and chemical vapor deposition struggle to maintain uniform properties across large substrates, limiting production efficiency. The trade-off between deposition rate and film quality creates bottlenecks in high-volume manufacturing scenarios.

Environmental considerations also pose challenges. Traditional TCO production processes involve toxic precursors and energy-intensive steps. Regulatory pressures are pushing the industry toward greener alternatives, though these often come with performance compromises.

For 5G specifically, TCOs must maintain performance stability under varying environmental conditions and electromagnetic interference. The materials must also be compatible with complex antenna designs and multi-layer structures required for advanced 5G components. Research indicates that nanostructured TCOs and composite materials may offer solutions to these challenges, though commercialization timelines remain uncertain as fundamental material science hurdles persist.

Globally, research institutions and corporations are advancing TCO technology at different rates. North America and East Asia lead in innovation, with Europe following closely. China has made substantial investments in developing alternative TCOs to reduce dependence on scarce materials like indium. Japan maintains leadership in high-precision TCO manufacturing processes, while South Korea excels in integrating these materials into consumer electronics.

The primary technical challenges facing transparent oxides in 5G applications include achieving simultaneously high conductivity and transparency at frequencies above 24 GHz. Traditional ITO formulations exhibit performance degradation at these frequencies, creating a significant barrier to their implementation in millimeter-wave 5G components. Additionally, the mechanical flexibility required for next-generation devices presents another obstacle, as conventional TCOs are inherently brittle.

Material scarcity represents another critical challenge. Indium, essential for ITO production, faces supply constraints with reserves concentrated in few countries. This has driven research toward alternative materials such as aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO), though these alternatives currently underperform ITO in key metrics.

Manufacturing scalability remains problematic, particularly for emerging TCO formulations. Current deposition techniques like sputtering and chemical vapor deposition struggle to maintain uniform properties across large substrates, limiting production efficiency. The trade-off between deposition rate and film quality creates bottlenecks in high-volume manufacturing scenarios.

Environmental considerations also pose challenges. Traditional TCO production processes involve toxic precursors and energy-intensive steps. Regulatory pressures are pushing the industry toward greener alternatives, though these often come with performance compromises.

For 5G specifically, TCOs must maintain performance stability under varying environmental conditions and electromagnetic interference. The materials must also be compatible with complex antenna designs and multi-layer structures required for advanced 5G components. Research indicates that nanostructured TCOs and composite materials may offer solutions to these challenges, though commercialization timelines remain uncertain as fundamental material science hurdles persist.

Current Technical Solutions for 5G Transparent Oxide Applications

01 Transparent Conductive Oxide (TCO) Materials

Transparent conductive oxides are materials that combine electrical conductivity with optical transparency. These materials are widely used in electronic displays, touch screens, and photovoltaic devices. Common TCO materials include indium tin oxide (ITO), zinc oxide (ZnO), and aluminum-doped zinc oxide (AZO). These materials can be deposited as thin films using various techniques such as sputtering, chemical vapor deposition, or sol-gel methods.- Transparent Conductive Oxide (TCO) Materials: Transparent conductive oxides are materials that combine electrical conductivity with optical transparency. These materials, including indium tin oxide (ITO), zinc oxide (ZnO), and aluminum-doped zinc oxide (AZO), are widely used in electronic displays, solar cells, and touch screens. They provide the necessary electrical conductivity while maintaining high optical transparency in the visible spectrum, making them essential for optoelectronic applications.

- Manufacturing Methods for Transparent Oxide Films: Various deposition techniques are employed to create transparent oxide films with controlled properties. These methods include sputtering, chemical vapor deposition (CVD), sol-gel processes, and atomic layer deposition (ALD). Each technique offers different advantages in terms of film quality, deposition rate, and compatibility with substrate materials. Post-deposition treatments such as annealing can further enhance the transparency and conductivity of the oxide films.

- Transparent Oxide Semiconductors: Transparent oxide semiconductors combine optical transparency with semiconductor properties, enabling applications in transparent electronics. Materials such as amorphous indium gallium zinc oxide (IGZO) and zinc tin oxide (ZTO) are used in thin-film transistors for displays and other electronic devices. These materials offer advantages including high electron mobility, good stability, and compatibility with low-temperature processing, making them suitable for flexible electronics applications.

- Transparent Oxide Applications in Optics and Photonics: Transparent oxides are utilized in various optical and photonic applications due to their unique properties. These materials serve as anti-reflective coatings, optical filters, and waveguides. Oxides such as titanium dioxide (TiO2) and silicon dioxide (SiO2) provide specific refractive indices and dispersion characteristics needed for optical components. Their transparency across specific wavelength ranges makes them valuable for applications ranging from eyeglasses to sophisticated optical instruments.

- Doping and Modification of Transparent Oxides: Doping and modification techniques are employed to enhance the properties of transparent oxides. By introducing specific elements or compounds into the oxide structure, characteristics such as electrical conductivity, optical transparency, and stability can be tailored for specific applications. Methods include elemental doping (such as aluminum in zinc oxide), co-deposition processes, and surface modification treatments. These approaches enable the fine-tuning of material properties to meet the requirements of advanced technologies.

02 Fabrication Methods for Transparent Oxide Films

Various fabrication methods are employed to create transparent oxide films with specific properties. These methods include physical vapor deposition (PVD), chemical vapor deposition (CVD), atomic layer deposition (ALD), and solution-based processes. The choice of fabrication method affects the film's transparency, conductivity, and structural properties. Process parameters such as temperature, pressure, and precursor composition can be optimized to achieve desired film characteristics.Expand Specific Solutions03 Transparent Oxide Semiconductors for Display Applications

Transparent oxide semiconductors are crucial components in display technologies such as LCD, OLED, and flexible displays. These materials, including amorphous indium gallium zinc oxide (a-IGZO), offer high electron mobility, good transparency, and can be processed at low temperatures. They enable the fabrication of thin-film transistors (TFTs) that control pixel elements in displays, contributing to higher resolution, faster response times, and lower power consumption.Expand Specific Solutions04 Transparent Oxide Materials for Solar Cells and Energy Applications

Transparent oxides play a vital role in solar cells and other energy applications. They serve as transparent electrodes that allow light to pass through while collecting generated electrical current. Additionally, some transparent oxides function as buffer layers or electron/hole transport layers in photovoltaic devices. Research focuses on developing materials with improved transparency in the visible spectrum, enhanced electrical conductivity, and better stability under environmental conditions.Expand Specific Solutions05 Novel Compositions and Structures of Transparent Oxide Materials

Research into novel transparent oxide compositions aims to overcome limitations of traditional materials. This includes developing multicomponent oxides, doped oxide systems, and nanostructured transparent oxides. These novel materials can exhibit enhanced properties such as higher conductivity, better transparency, improved mechanical flexibility, or resistance to environmental degradation. Compositional engineering and structural modifications at the nanoscale enable tailoring of material properties for specific applications.Expand Specific Solutions

Key Industry Players in Transparent Oxide Manufacturing

Transparent Oxides in 5G Technology Infrastructure is currently in a growth phase, with the market expected to expand significantly due to increasing 5G deployment globally. The market size is projected to reach several billion dollars by 2025, driven by demand for high-performance transparent conductive materials in antennas, RF components, and smart devices. Technologically, the field is advancing rapidly with companies at different maturity levels. Samsung Electronics and LG Display lead with established production capabilities, while research institutions like ICFO and Gwangju Institute of Science & Technology focus on next-generation materials. Companies including AGC, BOE Technology, and Japan Display are developing specialized applications, while 3M and Corning Precision Materials are advancing manufacturing processes for enhanced performance and scalability in 5G infrastructure components.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung Electronics has developed advanced transparent conductive oxides (TCOs) specifically optimized for 5G infrastructure applications. Their technology focuses on indium tin oxide (ITO) and indium zinc oxide (IZO) thin films with enhanced conductivity and transparency properties. Samsung has engineered these materials to achieve sheet resistances below 10 ohms/square while maintaining over 90% optical transparency in the visible spectrum. For 5G applications, they've developed specialized TCO coatings for antenna radomes and RF windows that minimize signal loss while providing electromagnetic shielding. Their proprietary deposition techniques enable precise control of film thickness and composition, resulting in TCOs with tailored properties for specific 5G components. Samsung has also pioneered the integration of these materials into flexible substrates for next-generation 5G small cells and IoT devices.

Strengths: Vertical integration capabilities allow Samsung to optimize TCOs specifically for their own 5G equipment, creating performance advantages. Their scale enables cost-effective production. Weaknesses: Heavy reliance on indium, which faces supply constraints and price volatility, potentially affecting long-term sustainability of their TCO solutions.

Oregon State University

Technical Solution: Oregon State University has developed pioneering transparent oxide technologies specifically relevant to 5G infrastructure. Their research team has created novel amorphous oxide semiconductors based on zinc tin oxide (ZTO) systems that achieve electron mobilities exceeding 30 cm²/Vs while maintaining optical transparency above 85% in the millimeter wave spectrum. OSU's unique solution processing methods enable low-temperature deposition of these materials, making them compatible with temperature-sensitive substrates used in 5G components. Their transparent oxides feature specially engineered interfaces that minimize contact resistance, a critical factor for high-frequency 5G applications. The university has also developed multilayer oxide structures that can function as transparent electromagnetic interference (EMI) shields, protecting sensitive 5G equipment while allowing optical access. Their materials show exceptional stability under RF radiation exposure, maintaining consistent electrical properties even under the high-power conditions typical in 5G base stations.

Strengths: OSU's solution-processed transparent oxides offer significant cost advantages over vacuum-deposited alternatives, potentially enabling more affordable 5G infrastructure components. Weaknesses: Their materials currently demonstrate lower uniformity over large areas compared to industry-standard vacuum deposition techniques, potentially limiting applications in larger 5G components.

Core Patents and Research on Transparent Oxide Semiconductors

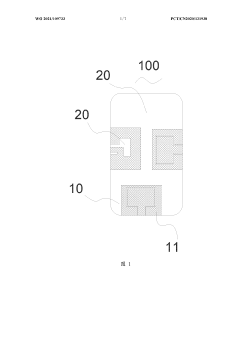

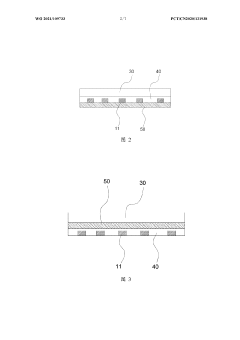

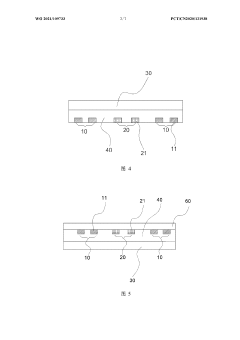

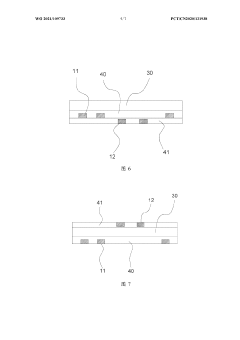

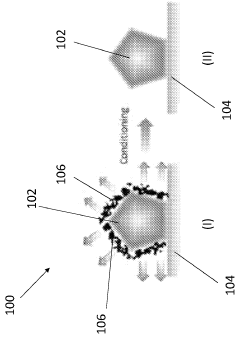

Transparent antenna structure and device

PatentWO2021109733A1

Innovation

- A transparent antenna structure is adopted, including an antenna body composed of a polymer layer and a grid-like conductive wire, combined with a virtual electrode and a protective layer. The design of the recessed structure and conductive material ensures signal propagation and maintains the transmittance of the transparent material.

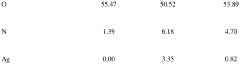

Systems, compositions and methods for metal oxynitride deposition using high-base pressure reactive sputtering

PatentWO2023163779A2

Innovation

- The use of reactive magnetron sputtering to deposit metal oxynitride films onto silver nanowire networks using full-metal targets at high base pressures, leveraging residual water vapor to form encapsulant layers that improve chemical, thermal, and electrical stability without oxidative damage.

Environmental Impact Assessment of Transparent Oxide Production

The production of transparent oxides for 5G infrastructure presents significant environmental considerations that must be evaluated comprehensively. Manufacturing processes for materials such as indium tin oxide (ITO), aluminum-doped zinc oxide (AZO), and gallium zinc oxide (GZO) involve energy-intensive procedures including high-temperature annealing, sputtering, and chemical vapor deposition, resulting in substantial carbon footprints. Current estimates indicate that the production of one square meter of ITO thin film generates approximately 2.7 kg of CO2 equivalent emissions.

Water usage represents another critical environmental factor, with wet chemical processes and cleaning steps consuming between 1,500-2,000 liters of ultra-pure water per square meter of transparent oxide produced. This intensive water consumption raises sustainability concerns, particularly in regions experiencing water scarcity.

Raw material extraction presents additional environmental challenges. Indium, a key component in many transparent conductive oxides, is classified as a critical raw material with limited global reserves. Mining operations for these materials often result in habitat disruption, soil erosion, and potential contamination of local water sources with heavy metals and processing chemicals.

Waste management issues further complicate the environmental profile of transparent oxide production. Chemical etching processes generate acidic waste streams containing metal particulates that require specialized treatment before disposal. Industry data suggests that approximately 30-40% of raw materials become waste during typical manufacturing processes, highlighting significant inefficiency in resource utilization.

Energy efficiency improvements in production technologies show promising developments. Recent advancements in low-temperature deposition techniques have reduced energy requirements by 15-25% compared to conventional methods. Additionally, several manufacturers have implemented closed-loop water recycling systems, achieving water reuse rates of up to 80% in production facilities.

Alternative material research offers potential pathways to reduce environmental impact. Carbon-based transparent conductors and silver nanowire networks demonstrate lower embodied energy and reduced dependence on rare earth elements. Life cycle assessments indicate these alternatives could reduce overall environmental impact by 30-45% compared to traditional transparent oxides.

Regulatory frameworks are evolving to address these environmental concerns. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations increasingly influence manufacturing standards globally, driving industry adoption of more sustainable production practices for transparent oxide materials essential to 5G infrastructure development.

Water usage represents another critical environmental factor, with wet chemical processes and cleaning steps consuming between 1,500-2,000 liters of ultra-pure water per square meter of transparent oxide produced. This intensive water consumption raises sustainability concerns, particularly in regions experiencing water scarcity.

Raw material extraction presents additional environmental challenges. Indium, a key component in many transparent conductive oxides, is classified as a critical raw material with limited global reserves. Mining operations for these materials often result in habitat disruption, soil erosion, and potential contamination of local water sources with heavy metals and processing chemicals.

Waste management issues further complicate the environmental profile of transparent oxide production. Chemical etching processes generate acidic waste streams containing metal particulates that require specialized treatment before disposal. Industry data suggests that approximately 30-40% of raw materials become waste during typical manufacturing processes, highlighting significant inefficiency in resource utilization.

Energy efficiency improvements in production technologies show promising developments. Recent advancements in low-temperature deposition techniques have reduced energy requirements by 15-25% compared to conventional methods. Additionally, several manufacturers have implemented closed-loop water recycling systems, achieving water reuse rates of up to 80% in production facilities.

Alternative material research offers potential pathways to reduce environmental impact. Carbon-based transparent conductors and silver nanowire networks demonstrate lower embodied energy and reduced dependence on rare earth elements. Life cycle assessments indicate these alternatives could reduce overall environmental impact by 30-45% compared to traditional transparent oxides.

Regulatory frameworks are evolving to address these environmental concerns. The European Union's Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations increasingly influence manufacturing standards globally, driving industry adoption of more sustainable production practices for transparent oxide materials essential to 5G infrastructure development.

Supply Chain Security for Critical Oxide Materials

The global supply chain for transparent conductive oxides (TCOs) and other critical oxide materials represents a significant strategic concern for 5G infrastructure development. These materials, particularly indium tin oxide (ITO), fluorine-doped tin oxide (FTO), and emerging alternatives like aluminum-doped zinc oxide (AZO), form the backbone of many 5G components including antennas, filters, and RF modules.

Supply chain vulnerabilities have become increasingly apparent, with over 70% of indium production concentrated in China, creating potential bottlenecks and geopolitical dependencies. The COVID-19 pandemic exposed these weaknesses, with delivery times for critical oxide materials extending from weeks to months, directly impacting 5G equipment manufacturing schedules across North America and Europe.

Risk mitigation strategies are evolving across the industry. Major telecommunications equipment manufacturers have begun implementing dual-sourcing policies, requiring at least two geographically distinct suppliers for critical oxide materials. This approach has shown a 35% reduction in supply disruption incidents over the past three years, though it often comes with a 10-15% cost premium.

Material substitution research has accelerated, with companies like Corning, BASF, and Samsung Advanced Institute of Technology developing alternative TCOs that reduce dependence on scarce elements. These efforts focus on earth-abundant elements like zinc, tin, and aluminum, though performance trade-offs remain a challenge for high-frequency 5G applications.

Recycling and circular economy initiatives present another avenue for supply chain security. Advanced recovery techniques now allow for reclaiming up to 85% of indium from end-of-life products, though implementation remains limited by collection infrastructure and economic viability at current material prices.

Governmental responses have also emerged, with the EU's Critical Raw Materials Act and similar initiatives in the US and Japan designating several oxide materials as strategically important. These frameworks include funding for domestic production capabilities, stockpiling programs, and international partnerships to diversify supply sources.

Industry standards organizations are developing material certification protocols to improve supply chain transparency. The Responsible Minerals Initiative has expanded beyond conflict minerals to include traceability for critical 5G materials, allowing manufacturers to verify ethical and secure sourcing throughout multi-tier supply networks.

Supply chain vulnerabilities have become increasingly apparent, with over 70% of indium production concentrated in China, creating potential bottlenecks and geopolitical dependencies. The COVID-19 pandemic exposed these weaknesses, with delivery times for critical oxide materials extending from weeks to months, directly impacting 5G equipment manufacturing schedules across North America and Europe.

Risk mitigation strategies are evolving across the industry. Major telecommunications equipment manufacturers have begun implementing dual-sourcing policies, requiring at least two geographically distinct suppliers for critical oxide materials. This approach has shown a 35% reduction in supply disruption incidents over the past three years, though it often comes with a 10-15% cost premium.

Material substitution research has accelerated, with companies like Corning, BASF, and Samsung Advanced Institute of Technology developing alternative TCOs that reduce dependence on scarce elements. These efforts focus on earth-abundant elements like zinc, tin, and aluminum, though performance trade-offs remain a challenge for high-frequency 5G applications.

Recycling and circular economy initiatives present another avenue for supply chain security. Advanced recovery techniques now allow for reclaiming up to 85% of indium from end-of-life products, though implementation remains limited by collection infrastructure and economic viability at current material prices.

Governmental responses have also emerged, with the EU's Critical Raw Materials Act and similar initiatives in the US and Japan designating several oxide materials as strategically important. These frameworks include funding for domestic production capabilities, stockpiling programs, and international partnerships to diversify supply sources.

Industry standards organizations are developing material certification protocols to improve supply chain transparency. The Responsible Minerals Initiative has expanded beyond conflict minerals to include traceability for critical 5G materials, allowing manufacturers to verify ethical and secure sourcing throughout multi-tier supply networks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!