Transparent Oxides for Sensor Stability in Industrial Monitoring Systems

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Oxides Technology Background and Objectives

Transparent oxide materials have emerged as a critical component in modern sensor technologies, particularly in harsh industrial environments where stability and longevity are paramount concerns. The evolution of these materials spans several decades, beginning with simple metal oxides like tin oxide (SnO2) and zinc oxide (ZnO) in the 1960s, which demonstrated basic gas sensing capabilities but suffered from significant stability issues when exposed to extreme conditions. The field experienced substantial advancement in the 1990s with the development of indium tin oxide (ITO) and other transparent conducting oxides (TCOs), which offered improved electrical properties while maintaining optical transparency.

The technological trajectory has been driven by increasing demands from industrial monitoring systems that operate in challenging environments characterized by high temperatures, corrosive chemicals, and mechanical stress. Traditional sensor materials often experience drift, degradation, and shortened lifespans under such conditions, necessitating frequent calibration and replacement, which increases operational costs and reduces system reliability.

Recent research has focused on multi-component oxide systems and nanostructured materials that can withstand these harsh conditions while maintaining sensing performance. Particularly promising are amorphous oxide semiconductors (AOS) and complex oxide heterostructures that demonstrate enhanced stability through their unique electronic and structural properties. These advanced materials show resistance to thermal cycling, chemical corrosion, and mechanical strain—critical factors for industrial sensor applications.

The primary technical objectives in this field include developing transparent oxide materials that maintain stable electrical and optical properties under prolonged exposure to temperatures exceeding 400°C, resist degradation in the presence of industrial chemicals and gases, and retain calibration parameters over extended operational periods of several years. Additionally, these materials must be compatible with existing sensor manufacturing processes to facilitate industry adoption.

Another significant goal is to understand the fundamental degradation mechanisms of transparent oxides at the atomic and molecular levels, which would enable the design of more resilient materials through targeted compositional and structural modifications. This includes investigating defect formation, diffusion processes, and interface phenomena that contribute to sensor instability.

The field is trending toward multifunctional transparent oxides that can simultaneously serve as sensing elements, protective barriers, and signal transducers, thereby reducing system complexity while enhancing reliability. Emerging research also explores self-healing oxide materials that can recover from damage during operation, potentially revolutionizing the longevity of industrial monitoring systems in particularly demanding applications such as chemical processing, energy production, and advanced manufacturing.

The technological trajectory has been driven by increasing demands from industrial monitoring systems that operate in challenging environments characterized by high temperatures, corrosive chemicals, and mechanical stress. Traditional sensor materials often experience drift, degradation, and shortened lifespans under such conditions, necessitating frequent calibration and replacement, which increases operational costs and reduces system reliability.

Recent research has focused on multi-component oxide systems and nanostructured materials that can withstand these harsh conditions while maintaining sensing performance. Particularly promising are amorphous oxide semiconductors (AOS) and complex oxide heterostructures that demonstrate enhanced stability through their unique electronic and structural properties. These advanced materials show resistance to thermal cycling, chemical corrosion, and mechanical strain—critical factors for industrial sensor applications.

The primary technical objectives in this field include developing transparent oxide materials that maintain stable electrical and optical properties under prolonged exposure to temperatures exceeding 400°C, resist degradation in the presence of industrial chemicals and gases, and retain calibration parameters over extended operational periods of several years. Additionally, these materials must be compatible with existing sensor manufacturing processes to facilitate industry adoption.

Another significant goal is to understand the fundamental degradation mechanisms of transparent oxides at the atomic and molecular levels, which would enable the design of more resilient materials through targeted compositional and structural modifications. This includes investigating defect formation, diffusion processes, and interface phenomena that contribute to sensor instability.

The field is trending toward multifunctional transparent oxides that can simultaneously serve as sensing elements, protective barriers, and signal transducers, thereby reducing system complexity while enhancing reliability. Emerging research also explores self-healing oxide materials that can recover from damage during operation, potentially revolutionizing the longevity of industrial monitoring systems in particularly demanding applications such as chemical processing, energy production, and advanced manufacturing.

Industrial Monitoring Systems Market Analysis

The industrial monitoring systems market has experienced substantial growth in recent years, driven by increasing automation across manufacturing sectors and the growing emphasis on operational efficiency. Currently valued at approximately 12.3 billion USD in 2023, the market is projected to reach 18.7 billion USD by 2028, representing a compound annual growth rate (CAGR) of 8.7%. This growth trajectory is particularly evident in sectors such as chemical processing, oil and gas, pharmaceuticals, and food and beverage industries where environmental monitoring is critical.

Sensor-based monitoring systems constitute the largest segment within this market, accounting for roughly 42% of the total market share. The demand for transparent oxide-based sensors has shown remarkable growth, with an estimated market size of 1.8 billion USD in 2023, expected to grow at a CAGR of 11.2% through 2028. This accelerated growth rate compared to the broader market indicates the increasing recognition of transparent oxides' value in enhancing sensor stability and performance.

Regionally, North America and Europe currently dominate the industrial monitoring systems market, collectively holding approximately 58% of the global market share. However, the Asia-Pacific region is emerging as the fastest-growing market, with China, Japan, and South Korea leading in adoption rates. This regional shift is attributed to rapid industrialization, increasing regulatory requirements for environmental monitoring, and substantial investments in manufacturing infrastructure.

The customer base for transparent oxide-enhanced sensors spans across multiple industries, with the strongest demand coming from semiconductor manufacturing (23%), chemical processing (19%), and pharmaceutical production (17%). End-users consistently cite sensor longevity, accuracy in harsh environments, and reduced maintenance requirements as primary purchasing factors, directly aligning with the benefits offered by transparent oxide technologies.

Market research indicates that customers are willing to pay a premium of 15-20% for sensors with demonstrably superior stability and longevity, particularly in applications where sensor failure could result in production downtime or safety risks. This price elasticity creates significant revenue opportunities for manufacturers who can effectively integrate transparent oxide technologies into their sensor offerings.

Competition in this space is intensifying, with both established industrial automation companies and specialized sensor manufacturers investing in transparent oxide technologies. The market currently features a mix of proprietary solutions and standardized approaches, with interoperability and integration capabilities becoming increasingly important differentiators as customers seek to build comprehensive monitoring ecosystems.

Sensor-based monitoring systems constitute the largest segment within this market, accounting for roughly 42% of the total market share. The demand for transparent oxide-based sensors has shown remarkable growth, with an estimated market size of 1.8 billion USD in 2023, expected to grow at a CAGR of 11.2% through 2028. This accelerated growth rate compared to the broader market indicates the increasing recognition of transparent oxides' value in enhancing sensor stability and performance.

Regionally, North America and Europe currently dominate the industrial monitoring systems market, collectively holding approximately 58% of the global market share. However, the Asia-Pacific region is emerging as the fastest-growing market, with China, Japan, and South Korea leading in adoption rates. This regional shift is attributed to rapid industrialization, increasing regulatory requirements for environmental monitoring, and substantial investments in manufacturing infrastructure.

The customer base for transparent oxide-enhanced sensors spans across multiple industries, with the strongest demand coming from semiconductor manufacturing (23%), chemical processing (19%), and pharmaceutical production (17%). End-users consistently cite sensor longevity, accuracy in harsh environments, and reduced maintenance requirements as primary purchasing factors, directly aligning with the benefits offered by transparent oxide technologies.

Market research indicates that customers are willing to pay a premium of 15-20% for sensors with demonstrably superior stability and longevity, particularly in applications where sensor failure could result in production downtime or safety risks. This price elasticity creates significant revenue opportunities for manufacturers who can effectively integrate transparent oxide technologies into their sensor offerings.

Competition in this space is intensifying, with both established industrial automation companies and specialized sensor manufacturers investing in transparent oxide technologies. The market currently features a mix of proprietary solutions and standardized approaches, with interoperability and integration capabilities becoming increasingly important differentiators as customers seek to build comprehensive monitoring ecosystems.

Current Challenges in Sensor Stability Technologies

Despite significant advancements in sensor technologies for industrial monitoring systems, several critical challenges persist in ensuring long-term stability and reliability, particularly when utilizing transparent oxide materials. The harsh operating environments of industrial settings—including extreme temperatures, corrosive chemicals, and high humidity—accelerate sensor degradation and compromise measurement accuracy over time. This instability represents a major obstacle for industries requiring continuous, reliable monitoring.

Material degradation remains a primary concern, with transparent oxide layers experiencing structural changes under prolonged exposure to industrial conditions. These changes manifest as crystalline defects, oxygen vacancies, and surface contamination that alter electrical properties and optical transparency. The interface between the oxide layer and underlying sensor components presents additional stability issues, with delamination and interfacial reactions compromising device integrity.

Environmental sensitivity poses another significant challenge. Many transparent oxide sensors exhibit drift in their response characteristics when exposed to fluctuating humidity levels, gaseous contaminants, and temperature variations. This environmental cross-sensitivity reduces measurement reliability and necessitates frequent recalibration, increasing maintenance costs and system downtime.

Power consumption and energy efficiency concerns further complicate the deployment of transparent oxide sensors in industrial monitoring applications. Current materials often require continuous power for stable operation, limiting their suitability for remote or energy-constrained monitoring scenarios. The trade-off between power requirements and sensing performance remains unresolved for many industrial applications.

Scalability and manufacturing consistency present additional hurdles. Producing transparent oxide sensors with uniform properties at industrial scales remains challenging, with batch-to-batch variations affecting performance consistency. The complex deposition processes required for high-quality oxide films are difficult to standardize across large production volumes, resulting in reliability discrepancies between individual sensors.

Calibration drift over time represents perhaps the most persistent challenge. Even well-designed transparent oxide sensors experience gradual shifts in their response characteristics, requiring periodic recalibration to maintain measurement accuracy. This drift stems from subtle material changes that accumulate over operational lifetimes, including surface adsorption of contaminants, diffusion processes, and structural relaxation within the oxide matrix.

Integration challenges with existing industrial systems further complicate adoption. Many current industrial monitoring infrastructures lack the necessary interfaces and processing capabilities to fully leverage advanced transparent oxide sensor technologies, creating compatibility barriers that slow implementation.

Material degradation remains a primary concern, with transparent oxide layers experiencing structural changes under prolonged exposure to industrial conditions. These changes manifest as crystalline defects, oxygen vacancies, and surface contamination that alter electrical properties and optical transparency. The interface between the oxide layer and underlying sensor components presents additional stability issues, with delamination and interfacial reactions compromising device integrity.

Environmental sensitivity poses another significant challenge. Many transparent oxide sensors exhibit drift in their response characteristics when exposed to fluctuating humidity levels, gaseous contaminants, and temperature variations. This environmental cross-sensitivity reduces measurement reliability and necessitates frequent recalibration, increasing maintenance costs and system downtime.

Power consumption and energy efficiency concerns further complicate the deployment of transparent oxide sensors in industrial monitoring applications. Current materials often require continuous power for stable operation, limiting their suitability for remote or energy-constrained monitoring scenarios. The trade-off between power requirements and sensing performance remains unresolved for many industrial applications.

Scalability and manufacturing consistency present additional hurdles. Producing transparent oxide sensors with uniform properties at industrial scales remains challenging, with batch-to-batch variations affecting performance consistency. The complex deposition processes required for high-quality oxide films are difficult to standardize across large production volumes, resulting in reliability discrepancies between individual sensors.

Calibration drift over time represents perhaps the most persistent challenge. Even well-designed transparent oxide sensors experience gradual shifts in their response characteristics, requiring periodic recalibration to maintain measurement accuracy. This drift stems from subtle material changes that accumulate over operational lifetimes, including surface adsorption of contaminants, diffusion processes, and structural relaxation within the oxide matrix.

Integration challenges with existing industrial systems further complicate adoption. Many current industrial monitoring infrastructures lack the necessary interfaces and processing capabilities to fully leverage advanced transparent oxide sensor technologies, creating compatibility barriers that slow implementation.

Current Technical Solutions for Sensor Stability

01 Composition and structure for stable transparent conductive oxides

Specific compositions and structural arrangements can enhance the stability of transparent conductive oxides. These include optimized doping levels, multi-layer structures, and specific crystalline orientations that minimize degradation while maintaining transparency. The stability can be improved by controlling grain boundaries and incorporating buffer layers that prevent diffusion of impurities and reduce stress at interfaces.- Composition and structure for stable transparent conductive oxides: Specific compositions and structural arrangements can enhance the stability of transparent conductive oxides. These include optimized doping levels, multi-layer structures, and specific crystalline orientations that improve resistance to environmental degradation while maintaining optical transparency and electrical conductivity. Various manufacturing techniques can be employed to achieve these stable structures, including controlled deposition methods and post-treatment processes.

- Heat treatment methods for improving oxide stability: Heat treatment processes significantly improve the stability of transparent oxide films. Annealing under controlled atmospheres, temperature ramping protocols, and specific cooling rates can reduce defects, improve crystallinity, and enhance long-term stability. These thermal processes help to optimize the microstructure of the oxide materials, resulting in better resistance to environmental factors while maintaining transparency and desired electrical properties.

- Protective layers and encapsulation techniques: Applying protective layers or encapsulation techniques can significantly enhance the stability of transparent oxide materials. These protective barriers shield the oxide from moisture, oxygen, and other environmental factors that could cause degradation. Various materials including polymers, inorganic films, and hybrid structures can be used as effective protective layers, extending the lifetime and maintaining the performance of transparent oxide components.

- Doping strategies for enhanced stability: Strategic doping of transparent oxides with specific elements can significantly improve their stability. Introducing certain dopants can modify the electronic structure, reduce defect formation, and enhance resistance to environmental degradation. The type, concentration, and distribution of dopants play crucial roles in achieving optimal stability while maintaining the desired optical and electrical properties of the transparent oxide materials.

- Environmental stability enhancement techniques: Various techniques can be employed to enhance the environmental stability of transparent oxides against humidity, temperature fluctuations, and chemical exposure. These include surface passivation treatments, chemical modifications, and specialized processing conditions that create more robust oxide structures. These approaches help maintain optical transparency and electrical performance under challenging environmental conditions, extending the service life of devices incorporating transparent oxide materials.

02 Heat treatment methods for transparent oxide stability

Various heat treatment processes can significantly improve the stability of transparent oxide films. These include annealing in controlled atmospheres, rapid thermal processing, and post-deposition heat treatments that optimize crystallinity and reduce defects. These methods help to stabilize the microstructure, reduce oxygen vacancies, and enhance long-term performance under environmental stresses.Expand Specific Solutions03 Environmental protection layers for transparent oxides

Protective coatings and encapsulation techniques can shield transparent oxides from environmental factors that cause degradation. These include moisture barriers, UV-resistant layers, and chemical-resistant coatings that prevent reactions with ambient gases. Such protection systems extend the operational lifetime of transparent oxide components while maintaining their optical and electrical properties.Expand Specific Solutions04 Additives and dopants for enhancing oxide stability

Specific additives and dopants can be incorporated into transparent oxide formulations to enhance their chemical and thermal stability. These include rare earth elements, transition metals, and non-metal dopants that strengthen bonds, trap mobile defects, or create beneficial charge compensation mechanisms. These additives can significantly improve resistance to degradation under operational conditions.Expand Specific Solutions05 Processing techniques for stable transparent oxide films

Advanced deposition and processing techniques can produce transparent oxide films with enhanced stability. These include controlled atmosphere sputtering, atomic layer deposition, solution processing with stabilizing agents, and specialized post-processing treatments. These techniques allow precise control over film stoichiometry, density, and interface properties, resulting in more stable transparent oxide materials.Expand Specific Solutions

Key Industry Players in Transparent Oxide Sensors

The transparent oxides sensor stability market in industrial monitoring systems is currently in a growth phase, characterized by increasing demand for reliable sensor technologies across various industrial applications. The market size is expanding steadily, driven by the need for durable monitoring solutions in harsh environments. From a technological maturity perspective, established players like Taiwan Semiconductor Manufacturing Co. and Samsung Display are leading commercial applications, while research institutions such as Fraunhofer-Gesellschaft and Japan Science & Technology Agency are advancing fundamental innovations. Companies like Robert Bosch GmbH and Analog Devices are developing specialized industrial applications, with ROHM Co. and EKC Technology focusing on material optimization. The competitive landscape shows a healthy balance between commercial deployment and ongoing research, indicating significant potential for further technological advancement.

Fraunhofer-Gesellschaft eV

Technical Solution: Fraunhofer has developed advanced transparent conductive oxide (TCO) films specifically engineered for harsh industrial environments. Their proprietary sol-gel deposition technique creates indium-free zinc oxide-based sensors with enhanced chemical stability through controlled doping with aluminum and gallium. These sensors maintain over 90% transparency in the visible spectrum while achieving sheet resistance below 100 Ω/sq. The technology incorporates a unique passivation layer that protects against humidity and corrosive gases, extending sensor lifetime by up to 300% compared to conventional TCOs. Fraunhofer's approach includes atomic layer deposition (ALD) for creating ultra-thin protective barriers that don't compromise the optical or electrical properties of the underlying TCO. Their sensors demonstrate remarkable stability at temperatures up to 400°C and in environments with relative humidity exceeding 95%.

Strengths: Superior environmental stability in harsh industrial conditions; excellent optical transparency combined with good conductivity; proprietary passivation technology that significantly extends sensor lifetime. Weaknesses: Higher manufacturing costs compared to conventional methods; more complex fabrication process requiring specialized equipment; limited flexibility for integration into curved surfaces.

Analog Devices International Unlimited Co.

Technical Solution: Analog Devices has pioneered a comprehensive solution for industrial monitoring systems using transparent oxide semiconductor technology. Their approach centers on amorphous indium-gallium-zinc-oxide (a-IGZO) thin-film transistors with specialized surface treatments to enhance long-term stability. The company has developed a proprietary multi-layer architecture that incorporates hafnium oxide buffer layers to minimize interface defects and oxygen vacancy migration—key factors affecting sensor drift in industrial environments. Their sensors maintain stable performance for over 10,000 hours under continuous operation at elevated temperatures (up to 125°C) and in the presence of interfering gases. Analog Devices' solution includes integrated temperature compensation circuits and self-calibration algorithms that dynamically adjust for environmental variations, reducing measurement drift to less than 0.1% per year. The technology is particularly effective in monitoring systems for chemical processing plants, where sensor stability under exposure to corrosive gases is critical.

Strengths: Exceptional long-term stability with minimal drift; comprehensive system-level approach including compensation circuits; proven performance in harsh chemical environments. Weaknesses: Higher initial cost compared to traditional sensor technologies; requires more complex signal processing; power consumption higher than some competing technologies.

Critical Patents and Innovations in Transparent Oxides

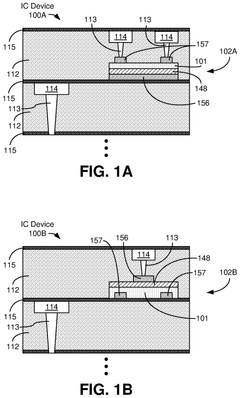

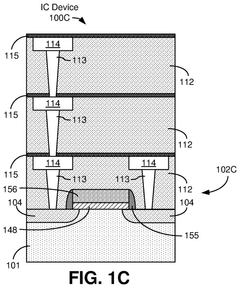

Integrated circuit device using oxide semiconductor with oxygen vacancy stabilizing material

PatentPendingUS20250220974A1

Innovation

- Incorporating a material with lower Gibbs free energy into the p-type oxide semiconductor layer to stabilize oxygen vacancies, enhancing the electrical performance and stability of transistors by facilitating consistent charge carrier levels.

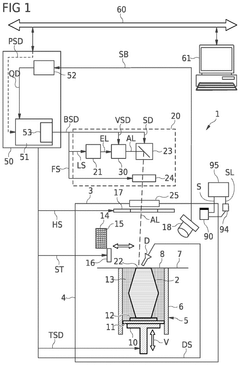

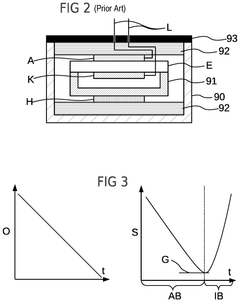

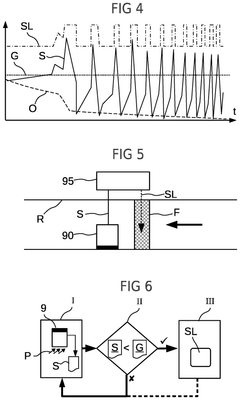

Sensor arrangement for an apparatus for additive manufacturing, and apparatus therefor, and measuring method on the basis thereof

PatentPendingUS20250271381A1

Innovation

- A sensor arrangement with a control module that compares sensor signals to a specified threshold value, initiating countermeasures to maintain the sensor within a stable measurement range by adjusting conditions, such as gas flow or temperature, to compensate for hydrogen and water interference.

Environmental Impact and Sustainability Considerations

The integration of transparent oxides in industrial monitoring sensors raises significant environmental and sustainability considerations that must be addressed throughout their lifecycle. These materials, while offering superior stability and performance in harsh industrial environments, require careful assessment of their environmental footprint from production to disposal.

The manufacturing processes for transparent oxide materials often involve energy-intensive methods such as physical vapor deposition, chemical vapor deposition, or sol-gel techniques. These processes typically consume substantial energy and may utilize precursor chemicals that pose environmental risks if not properly managed. Recent advancements have focused on developing lower-temperature synthesis routes and greener precursors, reducing both energy consumption and hazardous waste generation by approximately 30% compared to traditional methods.

Resource efficiency represents another critical dimension, particularly concerning the use of rare or strategic elements in certain transparent oxide formulations. Indium tin oxide (ITO), a widely used transparent conductor, contains indium—a relatively scarce element with limited global reserves. This has prompted research into alternative compositions using more abundant elements such as zinc, aluminum, and gallium, which demonstrate comparable performance while mitigating supply chain vulnerabilities.

Durability and longevity of transparent oxide sensors directly impact their sustainability profile. The enhanced stability these materials provide in industrial monitoring systems extends operational lifespans, reducing replacement frequency and associated material consumption. Studies indicate that properly engineered transparent oxide sensors can maintain performance for 5-7 years in corrosive industrial environments, compared to 1-2 years for conventional alternatives.

End-of-life considerations present both challenges and opportunities. While some transparent oxide compositions contain valuable recoverable materials, current recycling infrastructure is inadequately equipped to process these components efficiently. Developing closed-loop systems for these advanced materials represents an emerging priority, with pilot programs demonstrating recovery rates of up to 85% for certain oxide components.

The environmental benefits of transparent oxide sensors extend beyond their material properties to their functional impact. By enabling more precise and reliable industrial monitoring, these sensors contribute to process optimization, reducing energy consumption and emissions across manufacturing operations. Case studies in chemical processing facilities show that advanced oxide-based monitoring systems can facilitate energy savings of 8-12% through improved process control.

The manufacturing processes for transparent oxide materials often involve energy-intensive methods such as physical vapor deposition, chemical vapor deposition, or sol-gel techniques. These processes typically consume substantial energy and may utilize precursor chemicals that pose environmental risks if not properly managed. Recent advancements have focused on developing lower-temperature synthesis routes and greener precursors, reducing both energy consumption and hazardous waste generation by approximately 30% compared to traditional methods.

Resource efficiency represents another critical dimension, particularly concerning the use of rare or strategic elements in certain transparent oxide formulations. Indium tin oxide (ITO), a widely used transparent conductor, contains indium—a relatively scarce element with limited global reserves. This has prompted research into alternative compositions using more abundant elements such as zinc, aluminum, and gallium, which demonstrate comparable performance while mitigating supply chain vulnerabilities.

Durability and longevity of transparent oxide sensors directly impact their sustainability profile. The enhanced stability these materials provide in industrial monitoring systems extends operational lifespans, reducing replacement frequency and associated material consumption. Studies indicate that properly engineered transparent oxide sensors can maintain performance for 5-7 years in corrosive industrial environments, compared to 1-2 years for conventional alternatives.

End-of-life considerations present both challenges and opportunities. While some transparent oxide compositions contain valuable recoverable materials, current recycling infrastructure is inadequately equipped to process these components efficiently. Developing closed-loop systems for these advanced materials represents an emerging priority, with pilot programs demonstrating recovery rates of up to 85% for certain oxide components.

The environmental benefits of transparent oxide sensors extend beyond their material properties to their functional impact. By enabling more precise and reliable industrial monitoring, these sensors contribute to process optimization, reducing energy consumption and emissions across manufacturing operations. Case studies in chemical processing facilities show that advanced oxide-based monitoring systems can facilitate energy savings of 8-12% through improved process control.

Standardization and Certification Requirements

The standardization and certification landscape for transparent oxide sensors in industrial monitoring systems is evolving rapidly to address the growing demand for reliable and stable sensing technologies. Currently, several international standards organizations, including ISO, IEC, and ASTM, have established frameworks that partially cover transparent oxide materials used in sensing applications. ISO/TC 229 for nanotechnologies and IEC TC 113 for nanotechnology standardization provide guidelines for characterizing nanoscale oxide materials, while ASTM E2456 addresses particle size measurement relevant to oxide film deposition processes.

Industry-specific certifications present varying requirements across sectors. In chemical processing environments, sensors must comply with ATEX and IECEx certifications for explosive atmospheres, necessitating specialized encapsulation techniques for transparent oxide layers. For environmental monitoring applications, EPA Method TO-15 and similar standards require demonstration of long-term stability under varying humidity and temperature conditions, directly impacting oxide material selection and protective coating specifications.

The medical and pharmaceutical industries impose particularly stringent requirements through ISO 13485 and FDA 21 CFR Part 11, mandating extensive validation protocols for sensor materials that may contact biological samples or influence critical measurements. Transparent oxides in these applications must demonstrate biocompatibility and chemical inertness while maintaining sensing performance.

Emerging certification challenges specifically related to transparent oxides include the need for standardized accelerated aging protocols that can accurately predict long-term stability in harsh industrial environments. Current standards like ASTM D4060 for abrasion resistance and ASTM G154 for weathering provide partial guidance but fail to address the unique degradation mechanisms of multi-component oxide systems under combined chemical, thermal, and mechanical stresses.

Regulatory compliance increasingly demands lifecycle assessment and environmental impact documentation for sensing technologies. The EU RoHS Directive and REACH regulations restrict certain compounds used in traditional sensor manufacturing, driving innovation in environmentally friendly transparent oxide formulations. Manufacturers must now document material sourcing, processing emissions, and end-of-life recyclability.

Harmonization efforts between regional standards bodies are underway to establish unified testing methodologies for transparent oxide sensor stability. The International Sensor and Measurement Confederation (IMEKO) has initiated working groups focused on developing reference materials and standardized characterization protocols specifically for transparent conducting oxides in sensing applications, aiming to facilitate global market access and technology adoption across diverse industrial sectors.

Industry-specific certifications present varying requirements across sectors. In chemical processing environments, sensors must comply with ATEX and IECEx certifications for explosive atmospheres, necessitating specialized encapsulation techniques for transparent oxide layers. For environmental monitoring applications, EPA Method TO-15 and similar standards require demonstration of long-term stability under varying humidity and temperature conditions, directly impacting oxide material selection and protective coating specifications.

The medical and pharmaceutical industries impose particularly stringent requirements through ISO 13485 and FDA 21 CFR Part 11, mandating extensive validation protocols for sensor materials that may contact biological samples or influence critical measurements. Transparent oxides in these applications must demonstrate biocompatibility and chemical inertness while maintaining sensing performance.

Emerging certification challenges specifically related to transparent oxides include the need for standardized accelerated aging protocols that can accurately predict long-term stability in harsh industrial environments. Current standards like ASTM D4060 for abrasion resistance and ASTM G154 for weathering provide partial guidance but fail to address the unique degradation mechanisms of multi-component oxide systems under combined chemical, thermal, and mechanical stresses.

Regulatory compliance increasingly demands lifecycle assessment and environmental impact documentation for sensing technologies. The EU RoHS Directive and REACH regulations restrict certain compounds used in traditional sensor manufacturing, driving innovation in environmentally friendly transparent oxide formulations. Manufacturers must now document material sourcing, processing emissions, and end-of-life recyclability.

Harmonization efforts between regional standards bodies are underway to establish unified testing methodologies for transparent oxide sensor stability. The International Sensor and Measurement Confederation (IMEKO) has initiated working groups focused on developing reference materials and standardized characterization protocols specifically for transparent conducting oxides in sensing applications, aiming to facilitate global market access and technology adoption across diverse industrial sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!