Evaluating Transparent Oxides for Flexible Display Technologies

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Oxide Evolution and Objectives

Transparent conductive oxides (TCOs) have evolved significantly since their initial discovery in the early 20th century. The journey began with tin oxide (SnO2) in the 1930s, followed by indium tin oxide (ITO) in the 1950s, which revolutionized display technologies due to its exceptional combination of optical transparency and electrical conductivity. The evolution accelerated in the 1990s with the emergence of zinc oxide (ZnO) based materials, offering more earth-abundant alternatives to the increasingly scarce indium.

The past decade has witnessed remarkable advancements in amorphous oxide semiconductors, particularly indium gallium zinc oxide (IGZO), which has enabled high-resolution displays with improved electron mobility. This progression has been driven by the growing demand for flexible, lightweight, and energy-efficient display technologies across consumer electronics, automotive interfaces, and wearable devices.

Current technical objectives in transparent oxide development focus on several critical parameters. First, achieving enhanced flexibility without compromising electrical performance remains paramount, as conventional TCOs like ITO tend to develop microcracks under bending stress, leading to conductivity degradation. Second, researchers aim to reduce indium dependency by developing alternative compositions using more abundant elements while maintaining comparable performance metrics.

Another significant objective involves lowering the processing temperature to enable compatibility with temperature-sensitive flexible substrates such as polyethylene terephthalate (PET) and polyimide. Traditional high-temperature annealing processes often exceed the thermal stability limits of these polymer substrates, necessitating novel low-temperature deposition techniques.

Improving the trade-off between transparency and conductivity represents another crucial goal. The fundamental physics of these materials creates an inherent inverse relationship between optical transparency and electrical conductivity, challenging researchers to develop innovative doping strategies and nanostructured architectures to overcome this limitation.

Long-term stability under mechanical stress and environmental conditions constitutes a further technical objective. Transparent oxides in flexible displays must maintain their properties through thousands of bending cycles and resist degradation from moisture and oxygen exposure, particularly in applications without hermetic sealing.

The ultimate aim is to develop transparent oxide technologies that enable truly rollable and foldable displays with zero-radius bending capabilities, maintaining performance integrity through multiple folding cycles while supporting high-resolution, fast-response display requirements of next-generation consumer electronics.

The past decade has witnessed remarkable advancements in amorphous oxide semiconductors, particularly indium gallium zinc oxide (IGZO), which has enabled high-resolution displays with improved electron mobility. This progression has been driven by the growing demand for flexible, lightweight, and energy-efficient display technologies across consumer electronics, automotive interfaces, and wearable devices.

Current technical objectives in transparent oxide development focus on several critical parameters. First, achieving enhanced flexibility without compromising electrical performance remains paramount, as conventional TCOs like ITO tend to develop microcracks under bending stress, leading to conductivity degradation. Second, researchers aim to reduce indium dependency by developing alternative compositions using more abundant elements while maintaining comparable performance metrics.

Another significant objective involves lowering the processing temperature to enable compatibility with temperature-sensitive flexible substrates such as polyethylene terephthalate (PET) and polyimide. Traditional high-temperature annealing processes often exceed the thermal stability limits of these polymer substrates, necessitating novel low-temperature deposition techniques.

Improving the trade-off between transparency and conductivity represents another crucial goal. The fundamental physics of these materials creates an inherent inverse relationship between optical transparency and electrical conductivity, challenging researchers to develop innovative doping strategies and nanostructured architectures to overcome this limitation.

Long-term stability under mechanical stress and environmental conditions constitutes a further technical objective. Transparent oxides in flexible displays must maintain their properties through thousands of bending cycles and resist degradation from moisture and oxygen exposure, particularly in applications without hermetic sealing.

The ultimate aim is to develop transparent oxide technologies that enable truly rollable and foldable displays with zero-radius bending capabilities, maintaining performance integrity through multiple folding cycles while supporting high-resolution, fast-response display requirements of next-generation consumer electronics.

Flexible Display Market Analysis

The flexible display market has experienced remarkable growth over the past decade, evolving from a niche technology to a mainstream component in consumer electronics. Current market valuations place the global flexible display sector at approximately 23.1 billion USD as of 2022, with projections indicating growth to reach 42.5 billion USD by 2027, representing a compound annual growth rate (CAGR) of 12.9%. This substantial growth trajectory is primarily driven by increasing consumer demand for more durable, lightweight, and innovative display solutions across multiple device categories.

Smartphones remain the dominant application segment, accounting for nearly 60% of the flexible display market share. Major manufacturers including Samsung, Apple, and Huawei have integrated flexible display technologies into their flagship products, with Samsung's foldable series demonstrating particular commercial success. The wearable technology segment follows as the second-largest application area, with smartwatches and fitness trackers incorporating curved and flexible displays to enhance user experience and device functionality.

Regional analysis reveals Asia-Pacific as the market leader, holding approximately 45% of the global market share, attributed to the concentration of display manufacturers and electronics production facilities in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow with 25% and 20% market shares respectively, with adoption primarily in premium consumer electronics segments.

Consumer preference surveys indicate strong interest in flexible display features, with 72% of smartphone users expressing willingness to pay premium prices for devices with foldable or rollable displays. Durability concerns remain the primary barrier to wider adoption, with 65% of potential consumers citing concerns about screen longevity and resistance to repeated folding or bending.

The transparent oxide semiconductor market segment specifically related to flexible displays is growing at 15.3% CAGR, outpacing the overall flexible display market. Indium gallium zinc oxide (IGZO) currently dominates this segment with approximately 70% market share, though emerging alternatives including zinc tin oxide (ZTO) are gaining traction due to indium supply constraints and cost considerations.

Industry forecasts suggest that flexible display penetration in the smartphone market will increase from current levels of 3.5% to approximately 20% by 2028, representing a significant shift in display technology adoption. This growth is contingent upon continued improvements in transparent oxide semiconductor performance, particularly regarding electron mobility and stability under mechanical stress conditions.

Smartphones remain the dominant application segment, accounting for nearly 60% of the flexible display market share. Major manufacturers including Samsung, Apple, and Huawei have integrated flexible display technologies into their flagship products, with Samsung's foldable series demonstrating particular commercial success. The wearable technology segment follows as the second-largest application area, with smartwatches and fitness trackers incorporating curved and flexible displays to enhance user experience and device functionality.

Regional analysis reveals Asia-Pacific as the market leader, holding approximately 45% of the global market share, attributed to the concentration of display manufacturers and electronics production facilities in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow with 25% and 20% market shares respectively, with adoption primarily in premium consumer electronics segments.

Consumer preference surveys indicate strong interest in flexible display features, with 72% of smartphone users expressing willingness to pay premium prices for devices with foldable or rollable displays. Durability concerns remain the primary barrier to wider adoption, with 65% of potential consumers citing concerns about screen longevity and resistance to repeated folding or bending.

The transparent oxide semiconductor market segment specifically related to flexible displays is growing at 15.3% CAGR, outpacing the overall flexible display market. Indium gallium zinc oxide (IGZO) currently dominates this segment with approximately 70% market share, though emerging alternatives including zinc tin oxide (ZTO) are gaining traction due to indium supply constraints and cost considerations.

Industry forecasts suggest that flexible display penetration in the smartphone market will increase from current levels of 3.5% to approximately 20% by 2028, representing a significant shift in display technology adoption. This growth is contingent upon continued improvements in transparent oxide semiconductor performance, particularly regarding electron mobility and stability under mechanical stress conditions.

Current Challenges in Transparent Oxide Implementation

Despite the promising potential of transparent oxides in flexible display technologies, several significant challenges impede their widespread implementation. The primary obstacle lies in the inherent brittleness of most oxide materials, which fundamentally contradicts the flexibility requirement. When subjected to bending stresses, conventional transparent conducting oxides (TCOs) like indium tin oxide (ITO) develop microcracks that dramatically reduce conductivity and optical transparency, severely compromising device performance.

Manufacturing scalability presents another substantial hurdle. Current deposition techniques for high-quality transparent oxides often require high temperatures (>300°C) that are incompatible with flexible polymer substrates, which typically deform or degrade above 150-200°C. This temperature mismatch necessitates the development of low-temperature deposition processes without sacrificing material quality.

Material stability under repeated mechanical stress constitutes a critical challenge for long-term device reliability. Flexible displays undergo thousands of bending cycles during their operational lifetime, and transparent oxide layers must maintain consistent electrical and optical properties throughout these mechanical deformations. Current materials exhibit performance degradation after relatively few bending cycles, limiting device longevity.

Interface adhesion issues between transparent oxides and flexible substrates further complicate implementation. The significant difference in mechanical properties between rigid oxide layers and soft polymer substrates creates stress concentration at interfaces, leading to delamination during flexing. This adhesion failure represents a major reliability concern for commercial applications.

Cost considerations also present barriers to widespread adoption. The industry standard ITO contains indium, a relatively scarce and expensive element. Alternative oxide formulations often involve complex compositions requiring precise stoichiometric control during manufacturing, increasing production costs and complexity.

Environmental stability poses additional challenges, as many promising transparent oxide formulations demonstrate sensitivity to moisture and oxygen. When exposed to ambient conditions, these materials can undergo gradual degradation that affects both electrical conductivity and optical transparency. This necessitates effective encapsulation strategies that must themselves remain flexible and transparent.

The trade-off between transparency and conductivity remains a fundamental materials science challenge. Enhancing electrical conductivity typically requires higher carrier concentrations, which often reduces optical transparency in the visible spectrum. Finding the optimal balance for specific display applications requires careful materials engineering and often involves compromises in performance metrics.

Manufacturing scalability presents another substantial hurdle. Current deposition techniques for high-quality transparent oxides often require high temperatures (>300°C) that are incompatible with flexible polymer substrates, which typically deform or degrade above 150-200°C. This temperature mismatch necessitates the development of low-temperature deposition processes without sacrificing material quality.

Material stability under repeated mechanical stress constitutes a critical challenge for long-term device reliability. Flexible displays undergo thousands of bending cycles during their operational lifetime, and transparent oxide layers must maintain consistent electrical and optical properties throughout these mechanical deformations. Current materials exhibit performance degradation after relatively few bending cycles, limiting device longevity.

Interface adhesion issues between transparent oxides and flexible substrates further complicate implementation. The significant difference in mechanical properties between rigid oxide layers and soft polymer substrates creates stress concentration at interfaces, leading to delamination during flexing. This adhesion failure represents a major reliability concern for commercial applications.

Cost considerations also present barriers to widespread adoption. The industry standard ITO contains indium, a relatively scarce and expensive element. Alternative oxide formulations often involve complex compositions requiring precise stoichiometric control during manufacturing, increasing production costs and complexity.

Environmental stability poses additional challenges, as many promising transparent oxide formulations demonstrate sensitivity to moisture and oxygen. When exposed to ambient conditions, these materials can undergo gradual degradation that affects both electrical conductivity and optical transparency. This necessitates effective encapsulation strategies that must themselves remain flexible and transparent.

The trade-off between transparency and conductivity remains a fundamental materials science challenge. Enhancing electrical conductivity typically requires higher carrier concentrations, which often reduces optical transparency in the visible spectrum. Finding the optimal balance for specific display applications requires careful materials engineering and often involves compromises in performance metrics.

Contemporary Transparent Oxide Solutions

01 Transparent Conductive Oxide (TCO) Materials

Transparent conductive oxides are materials that combine electrical conductivity with optical transparency. These materials, such as indium tin oxide (ITO), zinc oxide (ZnO), and aluminum-doped zinc oxide (AZO), are widely used in electronic displays, solar cells, and touch screens. The transparency of these oxides can be optimized through careful control of composition, doping levels, and deposition parameters to achieve high visible light transmission while maintaining electrical conductivity.- Transparent Conductive Oxide (TCO) Materials: Transparent conductive oxides are materials that combine electrical conductivity with optical transparency. These materials, such as indium tin oxide (ITO), zinc oxide (ZnO), and aluminum-doped zinc oxide (AZO), are widely used in electronic displays, solar cells, and touch screens. The transparency of these oxides can be optimized through controlling the deposition parameters, doping levels, and post-treatment processes to achieve high visible light transmission while maintaining good electrical conductivity.

- Deposition Methods for Transparent Oxide Films: Various deposition techniques are employed to create transparent oxide films with optimal transparency. These methods include sputtering, chemical vapor deposition (CVD), atomic layer deposition (ALD), and sol-gel processes. Each technique offers different advantages in terms of film uniformity, thickness control, and optical properties. Post-deposition treatments such as annealing can further enhance the transparency by improving crystallinity and reducing defects in the oxide structure.

- Nanostructured Transparent Oxides: Nanostructuring of transparent oxides can significantly enhance their optical properties. By creating nanoparticles, nanowires, or nanoporous structures, the light scattering and absorption characteristics can be tailored. These nanostructured transparent oxides exhibit improved transparency across broader wavelength ranges and can be engineered to have specific optical responses. The controlled morphology at the nanoscale allows for optimization of transparency while maintaining other functional properties.

- Multi-layer Transparent Oxide Structures: Multi-layered structures incorporating different transparent oxides can achieve enhanced optical performance. By carefully designing the thickness and composition of each layer, these structures can minimize reflection, maximize transmission, and provide specific wavelength filtering. These multi-layer systems are particularly important in applications requiring high transparency combined with other functional properties such as heat reflection, UV blocking, or electromagnetic shielding.

- Doping Strategies for Enhanced Transparency: Doping is a critical approach to enhance the transparency of oxide materials. By introducing specific elements into the oxide lattice, the electronic structure can be modified to reduce absorption in the visible spectrum. Common dopants include aluminum, gallium, and fluorine for zinc oxide, or niobium and tantalum for titanium dioxide. The concentration and distribution of dopants must be precisely controlled to achieve optimal transparency without compromising other properties such as electrical conductivity or mechanical stability.

02 Deposition Methods for Transparent Oxide Films

Various deposition techniques are employed to create transparent oxide films with optimal transparency. These methods include sputtering, chemical vapor deposition (CVD), atomic layer deposition (ALD), and sol-gel processes. Each technique offers different advantages in terms of film uniformity, crystallinity, and optical properties. Process parameters such as temperature, pressure, and gas composition during deposition significantly impact the transparency of the resulting oxide films.Expand Specific Solutions03 Post-Processing Treatments to Enhance Transparency

Post-deposition treatments can significantly improve the transparency of oxide films. These treatments include thermal annealing, plasma treatment, and surface modification techniques. Annealing in specific atmospheres can reduce oxygen vacancies and improve crystallinity, leading to enhanced optical transparency. Surface treatments can reduce light scattering at interfaces, while etching processes can create anti-reflective structures that increase overall transparency of the oxide layers.Expand Specific Solutions04 Nanostructured Transparent Oxides

Nanostructuring of transparent oxides can enhance their optical properties. By creating nanoparticles, nanowires, or nanoporous structures, the light interaction with the material can be controlled at the nanoscale. These nanostructured transparent oxides exhibit unique optical properties including reduced reflection, enhanced transmission, and controlled light scattering. The size, shape, and arrangement of nanostructures can be tailored to optimize transparency across specific wavelength ranges.Expand Specific Solutions05 Applications of Transparent Oxides in Optoelectronic Devices

Transparent oxides are crucial components in various optoelectronic devices. They serve as transparent electrodes in displays, solar cells, and smart windows. The transparency of these oxides directly impacts device performance, with higher transparency leading to improved efficiency in photovoltaics, better visibility in displays, and enhanced light transmission in optical components. Balancing transparency with other functional properties such as conductivity, durability, and processability is essential for optimizing device performance.Expand Specific Solutions

Leading Companies in Flexible Display Ecosystem

The transparent oxide market for flexible display technologies is currently in a growth phase, with increasing demand driven by the expanding flexible electronics sector. The market size is projected to reach significant scale as major players like Samsung Electronics, LG Display, and BOE Technology Group intensify their R&D efforts. Technologically, the field is approaching maturity with established players demonstrating commercial viability, while research institutions like Oregon State University and KAIST continue to advance fundamental innovations. Companies including TCL China Star Optoelectronics and Semiconductor Energy Laboratory are developing proprietary transparent oxide formulations, while materials specialists such as Sumitomo Metal Mining and Merck Patent GmbH are enhancing performance characteristics for next-generation flexible displays, creating a competitive landscape balanced between established manufacturers and innovative materials developers.

LG Display Co., Ltd.

Technical Solution: LG Display has pioneered advanced transparent oxide semiconductor (TOS) technology for flexible displays, particularly focusing on Indium Gallium Zinc Oxide (IGZO) and Indium Tin Oxide (ITO) implementations. Their proprietary Metal Oxide TFT technology enables ultra-high resolution flexible OLED panels with significantly improved electron mobility (>10 cm²/Vs) compared to conventional amorphous silicon. LG has developed a unique low-temperature deposition process that allows oxide semiconductors to be applied to flexible polymer substrates without degradation. Their latest innovation includes incorporating hydrogen doping in IGZO films to enhance stability and reduce oxygen vacancy-related degradation, resulting in flexible displays with bend radii below 1mm while maintaining electrical performance. LG has also commercialized oxide TFT backplanes that demonstrate exceptional uniformity across large areas, critical for mass production of flexible displays.

Strengths: Superior electron mobility and stability in flexible form factors; established mass production capabilities; excellent uniformity across large display areas. Weaknesses: Higher manufacturing costs compared to a-Si technologies; some remaining challenges with long-term reliability under repeated mechanical stress; requires specialized encapsulation to prevent moisture ingress affecting oxide performance.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive transparent oxide semiconductor platform specifically for flexible display applications. Their technology centers on optimized IGZO formulations with carefully controlled oxygen stoichiometry to balance performance and stability. BOE's approach includes a proprietary low-temperature sputtering process that achieves high-quality oxide films on flexible substrates at temperatures below 200°C. Their latest innovation involves multi-component oxide systems (In-Ga-Zn-Sn-O) that demonstrate enhanced mechanical flexibility while maintaining electrical performance under strain. BOE has also pioneered specialized passivation layers that protect oxide semiconductors from environmental factors while remaining compatible with flexible substrates. Their manufacturing process incorporates in-situ monitoring systems that ensure precise control of oxygen partial pressure during deposition, critical for oxide semiconductor performance. BOE has successfully commercialized flexible AMOLED displays using their oxide semiconductor technology with demonstrated lifetimes exceeding industry standards.

Strengths: Highly optimized multi-component oxide formulations; excellent scalability to large-area production; strong integration with flexible substrate technologies. Weaknesses: Somewhat lower electron mobility compared to industry leaders; challenges with uniformity in very large panels; requires specialized equipment for precise oxygen control during manufacturing.

Critical Patents in Transparent Oxide Technology

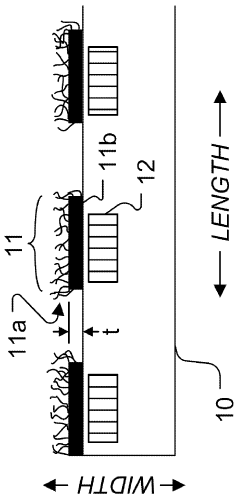

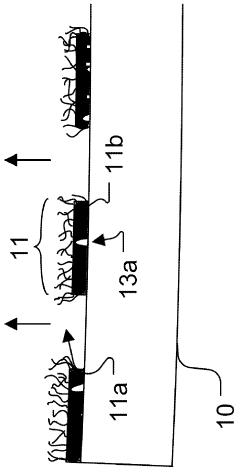

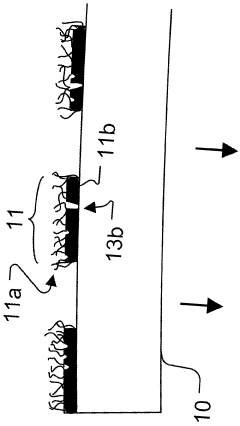

Flexible transparent electrodes via nanowires and sacrificial conductive layer

PatentWO2008089401A9

Innovation

- A flexible assembly comprising a patterned layer with a conducting oxide layer and a second conductive layer of nanowires, where the nanowires are directly formed on the conducting oxide layer with a line spacing of less than 25 μm, allowing for flexible and transparent electrodes.

Transparent electrode and a production method therefor

PatentWO2011162461A1

Innovation

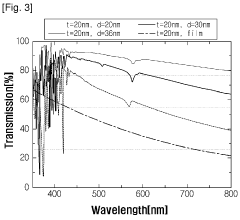

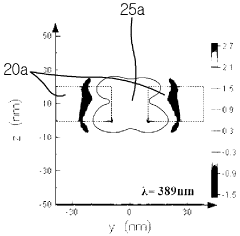

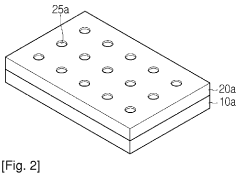

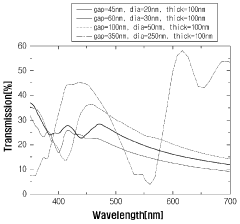

- A metal film with fine holes arranged at predetermined intervals is used to enhance light transmittance and electrical conductivity through surface plasmon resonance, reducing manufacturing costs and enabling flexible display applications.

Manufacturing Scalability Assessment

The scalability of manufacturing processes for transparent oxide materials represents a critical factor in their commercial viability for flexible display technologies. Current production methods for indium tin oxide (ITO) and alternative transparent conductive oxides (TCOs) demonstrate varying degrees of scalability across different deposition techniques. Magnetron sputtering, the industry standard for ITO deposition, offers excellent throughput capabilities with established infrastructure in major display manufacturing facilities, though adaptation for flexible substrates requires significant process modifications to prevent thermal damage.

Roll-to-roll (R2R) processing emerges as the most promising approach for high-volume production of flexible displays incorporating transparent oxides. This continuous manufacturing method enables substantial throughput improvements compared to batch processing, with production speeds potentially reaching 30-50 meters per minute for certain oxide materials. However, maintaining uniform electrical and optical properties across large areas remains challenging, with thickness variations typically limited to ±5% for commercial viability.

Solution-based deposition methods, including sol-gel and spray pyrolysis techniques, offer cost advantages for certain alternative TCOs such as aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO). These approaches require lower capital investment than vacuum-based systems but currently demonstrate lower throughput and less consistent performance metrics. Recent advancements in precursor chemistry have improved film quality, though industrial implementation remains limited.

Equipment compatibility presents another significant consideration, as existing display manufacturing lines require substantial modification to accommodate flexible substrates and alternative oxide materials. The transition costs for major manufacturers can range from $50-200 million per production line, necessitating careful economic analysis before widespread adoption. Several leading display manufacturers have established pilot lines specifically for flexible display production, indicating growing commitment to scaling these technologies.

Material supply chains also impact manufacturing scalability, particularly for indium-based compounds due to limited global reserves and price volatility. Alternative materials like AZO and indium-free compounds such as SiO2/Ag/SiO2 multilayers face fewer supply constraints but require process refinement to match ITO's performance characteristics at scale. Recent industry consortia have formed to address these supply chain vulnerabilities through material recycling programs and development of standardized manufacturing protocols.

Yield rates for transparent oxide deposition on flexible substrates currently lag behind those for rigid glass, with typical production yields of 70-85% compared to 90-95% for conventional displays. Continued process optimization and defect reduction strategies will be essential to improve economic viability as production volumes increase.

Roll-to-roll (R2R) processing emerges as the most promising approach for high-volume production of flexible displays incorporating transparent oxides. This continuous manufacturing method enables substantial throughput improvements compared to batch processing, with production speeds potentially reaching 30-50 meters per minute for certain oxide materials. However, maintaining uniform electrical and optical properties across large areas remains challenging, with thickness variations typically limited to ±5% for commercial viability.

Solution-based deposition methods, including sol-gel and spray pyrolysis techniques, offer cost advantages for certain alternative TCOs such as aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO). These approaches require lower capital investment than vacuum-based systems but currently demonstrate lower throughput and less consistent performance metrics. Recent advancements in precursor chemistry have improved film quality, though industrial implementation remains limited.

Equipment compatibility presents another significant consideration, as existing display manufacturing lines require substantial modification to accommodate flexible substrates and alternative oxide materials. The transition costs for major manufacturers can range from $50-200 million per production line, necessitating careful economic analysis before widespread adoption. Several leading display manufacturers have established pilot lines specifically for flexible display production, indicating growing commitment to scaling these technologies.

Material supply chains also impact manufacturing scalability, particularly for indium-based compounds due to limited global reserves and price volatility. Alternative materials like AZO and indium-free compounds such as SiO2/Ag/SiO2 multilayers face fewer supply constraints but require process refinement to match ITO's performance characteristics at scale. Recent industry consortia have formed to address these supply chain vulnerabilities through material recycling programs and development of standardized manufacturing protocols.

Yield rates for transparent oxide deposition on flexible substrates currently lag behind those for rigid glass, with typical production yields of 70-85% compared to 90-95% for conventional displays. Continued process optimization and defect reduction strategies will be essential to improve economic viability as production volumes increase.

Environmental Impact and Sustainability Considerations

The environmental footprint of transparent oxide materials in flexible display technologies represents a critical consideration for sustainable technological advancement. Traditional transparent conductive oxides (TCOs) like Indium Tin Oxide (ITO) pose significant environmental challenges due to the scarcity of indium, with reserves potentially depleting within decades at current consumption rates. The mining and extraction processes for these rare elements generate substantial carbon emissions and often involve environmentally destructive practices in ecologically sensitive regions.

Manufacturing processes for transparent oxides typically require high-temperature deposition techniques that consume considerable energy, contributing to their overall carbon footprint. Solution-based deposition methods being developed for newer oxide materials like zinc oxide and IGZO (Indium Gallium Zinc Oxide) offer promising reductions in energy consumption, potentially decreasing environmental impact by 30-45% compared to conventional vacuum-based processes.

End-of-life considerations present another environmental dimension, as flexible displays incorporating these materials often prove difficult to recycle due to their complex multi-layer structures. Current recycling rates for electronic displays remain below 20% globally, with transparent oxide components frequently lost during processing. Research into design-for-disassembly approaches and specialized recycling technologies specifically targeting transparent oxide recovery could significantly improve material circularity.

Water usage represents an often overlooked environmental concern, with production of high-purity oxide materials requiring substantial quantities of ultra-pure water. A single manufacturing facility can consume millions of gallons daily, with potential for contamination of local water sources if waste streams are improperly managed. Advanced water recycling systems and closed-loop manufacturing processes are being implemented by industry leaders to address this challenge.

Alternative materials development offers promising pathways toward sustainability. Carbon-based alternatives like graphene and carbon nanotubes, while still facing scalability challenges, present potentially renewable alternatives with lower environmental impact. Metal nanowire networks and hybrid organic-inorganic systems also demonstrate promising environmental profiles when assessed through comprehensive life cycle analysis methodologies.

Regulatory frameworks increasingly influence material selection, with legislation like the European Union's Restriction of Hazardous Substances (RoHS) directive and Extended Producer Responsibility (EPR) programs driving manufacturers toward more environmentally benign transparent conductor options. Companies developing flexible display technologies must now consider these environmental factors alongside traditional performance metrics to ensure market access and regulatory compliance.

Manufacturing processes for transparent oxides typically require high-temperature deposition techniques that consume considerable energy, contributing to their overall carbon footprint. Solution-based deposition methods being developed for newer oxide materials like zinc oxide and IGZO (Indium Gallium Zinc Oxide) offer promising reductions in energy consumption, potentially decreasing environmental impact by 30-45% compared to conventional vacuum-based processes.

End-of-life considerations present another environmental dimension, as flexible displays incorporating these materials often prove difficult to recycle due to their complex multi-layer structures. Current recycling rates for electronic displays remain below 20% globally, with transparent oxide components frequently lost during processing. Research into design-for-disassembly approaches and specialized recycling technologies specifically targeting transparent oxide recovery could significantly improve material circularity.

Water usage represents an often overlooked environmental concern, with production of high-purity oxide materials requiring substantial quantities of ultra-pure water. A single manufacturing facility can consume millions of gallons daily, with potential for contamination of local water sources if waste streams are improperly managed. Advanced water recycling systems and closed-loop manufacturing processes are being implemented by industry leaders to address this challenge.

Alternative materials development offers promising pathways toward sustainability. Carbon-based alternatives like graphene and carbon nanotubes, while still facing scalability challenges, present potentially renewable alternatives with lower environmental impact. Metal nanowire networks and hybrid organic-inorganic systems also demonstrate promising environmental profiles when assessed through comprehensive life cycle analysis methodologies.

Regulatory frameworks increasingly influence material selection, with legislation like the European Union's Restriction of Hazardous Substances (RoHS) directive and Extended Producer Responsibility (EPR) programs driving manufacturers toward more environmentally benign transparent conductor options. Companies developing flexible display technologies must now consider these environmental factors alongside traditional performance metrics to ensure market access and regulatory compliance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!