Transparent Oxides in the Development of Robust Flexible Electronics

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Transparent Oxide Evolution and Objectives

Transparent oxides have evolved significantly over the past decades, transitioning from simple passive components to active elements in modern electronics. The journey began in the 1970s with the development of indium tin oxide (ITO), which revolutionized display technologies by providing both electrical conductivity and optical transparency. This dual functionality opened new possibilities for electronic devices, particularly in display applications where light transmission is crucial.

The evolution accelerated in the early 2000s with the emergence of amorphous oxide semiconductors (AOS), particularly indium gallium zinc oxide (IGZO), which offered superior electron mobility compared to traditional amorphous silicon. This breakthrough enabled the development of thin-film transistors (TFTs) with enhanced performance characteristics, including higher switching speeds and lower power consumption, while maintaining optical transparency.

Recent years have witnessed a paradigm shift toward flexible and stretchable electronics, driving research into transparent oxides that can withstand mechanical deformation without compromising their electrical properties. This has led to innovations in deposition techniques, material compositions, and device architectures designed specifically for flexible substrates. Solution-processed transparent oxides have gained particular attention for their compatibility with roll-to-roll manufacturing processes, offering pathways to cost-effective, large-area production.

The primary objective in transparent oxide research for flexible electronics is achieving an optimal balance between mechanical robustness and electrical performance. This includes developing materials that maintain conductivity under repeated bending, stretching, and folding operations while offering stability against environmental factors such as humidity and temperature fluctuations. Additionally, there is a focus on reducing the brittleness inherent to many oxide materials through novel composition engineering and structural modifications.

Another critical objective is enhancing the sustainability profile of transparent oxide technologies. This involves reducing dependence on scarce elements like indium and developing alternatives based on earth-abundant materials such as zinc tin oxide (ZTO) and aluminum-doped zinc oxide (AZO). These efforts align with broader industry goals of creating environmentally responsible electronic components with reduced ecological footprints.

Looking forward, the field aims to integrate transparent oxides into multifunctional devices that combine sensing, computing, and display capabilities within flexible form factors. This vision requires continued advancement in material science, particularly in understanding the fundamental relationships between atomic structure, processing conditions, and macroscopic properties of transparent oxides under mechanical stress.

The evolution accelerated in the early 2000s with the emergence of amorphous oxide semiconductors (AOS), particularly indium gallium zinc oxide (IGZO), which offered superior electron mobility compared to traditional amorphous silicon. This breakthrough enabled the development of thin-film transistors (TFTs) with enhanced performance characteristics, including higher switching speeds and lower power consumption, while maintaining optical transparency.

Recent years have witnessed a paradigm shift toward flexible and stretchable electronics, driving research into transparent oxides that can withstand mechanical deformation without compromising their electrical properties. This has led to innovations in deposition techniques, material compositions, and device architectures designed specifically for flexible substrates. Solution-processed transparent oxides have gained particular attention for their compatibility with roll-to-roll manufacturing processes, offering pathways to cost-effective, large-area production.

The primary objective in transparent oxide research for flexible electronics is achieving an optimal balance between mechanical robustness and electrical performance. This includes developing materials that maintain conductivity under repeated bending, stretching, and folding operations while offering stability against environmental factors such as humidity and temperature fluctuations. Additionally, there is a focus on reducing the brittleness inherent to many oxide materials through novel composition engineering and structural modifications.

Another critical objective is enhancing the sustainability profile of transparent oxide technologies. This involves reducing dependence on scarce elements like indium and developing alternatives based on earth-abundant materials such as zinc tin oxide (ZTO) and aluminum-doped zinc oxide (AZO). These efforts align with broader industry goals of creating environmentally responsible electronic components with reduced ecological footprints.

Looking forward, the field aims to integrate transparent oxides into multifunctional devices that combine sensing, computing, and display capabilities within flexible form factors. This vision requires continued advancement in material science, particularly in understanding the fundamental relationships between atomic structure, processing conditions, and macroscopic properties of transparent oxides under mechanical stress.

Market Analysis for Flexible Electronics

The flexible electronics market has experienced remarkable growth in recent years, driven by increasing demand for lightweight, portable, and bendable electronic devices. The global flexible electronics market was valued at approximately $29.28 billion in 2020 and is projected to reach $73.43 billion by 2027, growing at a CAGR of 14.2% during the forecast period. This substantial growth is attributed to the expanding applications across various industries including consumer electronics, healthcare, automotive, and aerospace.

Transparent oxide semiconductors, particularly indium gallium zinc oxide (IGZO) and zinc oxide (ZnO), have emerged as critical components in flexible display technologies. The market for transparent conductive oxides in flexible electronics is expected to grow at a CAGR of 17.6% through 2025, outpacing the overall flexible electronics market growth rate.

Consumer electronics represents the largest application segment, accounting for over 40% of the flexible electronics market share. Within this segment, smartphones and wearable devices are the primary drivers, with flexible OLED displays incorporating transparent oxides witnessing significant adoption. Major smartphone manufacturers have increasingly incorporated flexible display technologies in their flagship products, creating a steady demand for advanced transparent oxide materials.

The healthcare sector presents substantial growth opportunities for flexible electronics incorporating transparent oxides. The market for flexible medical sensors and monitoring devices is projected to grow at a CAGR of 19.3% through 2026. Transparent oxide-based flexible biosensors offer advantages in terms of biocompatibility, sensitivity, and durability, making them ideal for continuous health monitoring applications.

Regional analysis reveals that Asia Pacific dominates the flexible electronics market, accounting for approximately 45% of the global market share. This dominance is attributed to the strong presence of display manufacturers and electronic component suppliers in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow, with significant investments in R&D activities related to next-generation flexible electronic technologies.

The automotive industry represents an emerging market for flexible electronics, with applications in displays, lighting, and sensors. The integration of transparent oxide-based flexible displays in automotive dashboards and infotainment systems is expected to grow at a CAGR of 16.8% through 2025, driven by the increasing trend toward vehicle digitalization and enhanced user interfaces.

Despite promising growth prospects, market challenges include high production costs, technical limitations in achieving desired flexibility while maintaining electrical performance, and supply chain constraints for critical materials like indium. These factors may temporarily hinder market expansion but are expected to be addressed through ongoing technological advancements and material innovations.

Transparent oxide semiconductors, particularly indium gallium zinc oxide (IGZO) and zinc oxide (ZnO), have emerged as critical components in flexible display technologies. The market for transparent conductive oxides in flexible electronics is expected to grow at a CAGR of 17.6% through 2025, outpacing the overall flexible electronics market growth rate.

Consumer electronics represents the largest application segment, accounting for over 40% of the flexible electronics market share. Within this segment, smartphones and wearable devices are the primary drivers, with flexible OLED displays incorporating transparent oxides witnessing significant adoption. Major smartphone manufacturers have increasingly incorporated flexible display technologies in their flagship products, creating a steady demand for advanced transparent oxide materials.

The healthcare sector presents substantial growth opportunities for flexible electronics incorporating transparent oxides. The market for flexible medical sensors and monitoring devices is projected to grow at a CAGR of 19.3% through 2026. Transparent oxide-based flexible biosensors offer advantages in terms of biocompatibility, sensitivity, and durability, making them ideal for continuous health monitoring applications.

Regional analysis reveals that Asia Pacific dominates the flexible electronics market, accounting for approximately 45% of the global market share. This dominance is attributed to the strong presence of display manufacturers and electronic component suppliers in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow, with significant investments in R&D activities related to next-generation flexible electronic technologies.

The automotive industry represents an emerging market for flexible electronics, with applications in displays, lighting, and sensors. The integration of transparent oxide-based flexible displays in automotive dashboards and infotainment systems is expected to grow at a CAGR of 16.8% through 2025, driven by the increasing trend toward vehicle digitalization and enhanced user interfaces.

Despite promising growth prospects, market challenges include high production costs, technical limitations in achieving desired flexibility while maintaining electrical performance, and supply chain constraints for critical materials like indium. These factors may temporarily hinder market expansion but are expected to be addressed through ongoing technological advancements and material innovations.

Current Status and Barriers in Transparent Oxide Technology

Transparent oxide technology has witnessed significant advancements in recent years, particularly in the realm of flexible electronics. Currently, indium tin oxide (ITO) dominates the market as the most widely used transparent conductive oxide (TCO) due to its excellent combination of optical transparency and electrical conductivity. However, ITO's inherent brittleness presents a major limitation for flexible applications, with crack formation occurring at strain levels as low as 2-3%.

Alternative TCO materials have emerged to address these limitations, including fluorine-doped tin oxide (FTO), aluminum-doped zinc oxide (AZO), and more recently, amorphous indium gallium zinc oxide (a-IGZO). These materials offer varying degrees of flexibility, transparency, and conductivity, though none has fully matched ITO's performance across all parameters simultaneously.

The global research landscape shows concentrated efforts in East Asia (particularly Japan, South Korea, and China), North America, and Europe. Japanese companies like Sharp and research institutions have pioneered a-IGZO technology, while Korean manufacturers have focused on large-scale production techniques. Chinese research has emphasized cost-effective alternatives to reduce dependence on scarce indium resources.

Several technical barriers currently impede the widespread adoption of transparent oxides in flexible electronics. The trade-off between transparency, conductivity, and flexibility remains a fundamental challenge, with improvements in one property often coming at the expense of others. Material stability under repeated mechanical deformation represents another significant hurdle, as performance degradation occurs after multiple bending cycles.

Manufacturing scalability presents additional challenges, particularly for newer oxide formulations. While ITO benefits from established industrial processes, alternative materials often require specialized deposition techniques that are difficult to scale economically. The high-temperature processing traditionally required for optimal oxide performance conflicts with the temperature sensitivity of flexible substrates, necessitating the development of low-temperature processes.

Resource constraints also pose concerns, particularly regarding indium availability. As a relatively scarce element, indium's limited supply and geographic concentration create potential supply chain vulnerabilities for ITO-based technologies. Environmental considerations further complicate the picture, with some oxide manufacturing processes involving toxic precursors or generating hazardous waste.

Interface engineering between transparent oxides and other device layers represents another technical challenge. Achieving stable, low-resistance contacts while maintaining mechanical flexibility requires sophisticated surface treatments and careful materials selection. Additionally, encapsulation technologies must evolve to protect oxide layers from environmental degradation while preserving device flexibility.

Alternative TCO materials have emerged to address these limitations, including fluorine-doped tin oxide (FTO), aluminum-doped zinc oxide (AZO), and more recently, amorphous indium gallium zinc oxide (a-IGZO). These materials offer varying degrees of flexibility, transparency, and conductivity, though none has fully matched ITO's performance across all parameters simultaneously.

The global research landscape shows concentrated efforts in East Asia (particularly Japan, South Korea, and China), North America, and Europe. Japanese companies like Sharp and research institutions have pioneered a-IGZO technology, while Korean manufacturers have focused on large-scale production techniques. Chinese research has emphasized cost-effective alternatives to reduce dependence on scarce indium resources.

Several technical barriers currently impede the widespread adoption of transparent oxides in flexible electronics. The trade-off between transparency, conductivity, and flexibility remains a fundamental challenge, with improvements in one property often coming at the expense of others. Material stability under repeated mechanical deformation represents another significant hurdle, as performance degradation occurs after multiple bending cycles.

Manufacturing scalability presents additional challenges, particularly for newer oxide formulations. While ITO benefits from established industrial processes, alternative materials often require specialized deposition techniques that are difficult to scale economically. The high-temperature processing traditionally required for optimal oxide performance conflicts with the temperature sensitivity of flexible substrates, necessitating the development of low-temperature processes.

Resource constraints also pose concerns, particularly regarding indium availability. As a relatively scarce element, indium's limited supply and geographic concentration create potential supply chain vulnerabilities for ITO-based technologies. Environmental considerations further complicate the picture, with some oxide manufacturing processes involving toxic precursors or generating hazardous waste.

Interface engineering between transparent oxides and other device layers represents another technical challenge. Achieving stable, low-resistance contacts while maintaining mechanical flexibility requires sophisticated surface treatments and careful materials selection. Additionally, encapsulation technologies must evolve to protect oxide layers from environmental degradation while preserving device flexibility.

Existing Transparent Oxide Implementation Methods

01 Composition and structure of transparent conductive oxides

Transparent conductive oxides (TCOs) with enhanced robustness can be achieved through specific material compositions and structural designs. These include doped metal oxides like indium tin oxide (ITO), zinc oxide (ZnO), and gallium-doped zinc oxide (GZO). The robustness of these materials can be improved by controlling crystallinity, grain boundaries, and layer thickness. Multi-layered structures with buffer layers can also enhance mechanical and environmental stability while maintaining optical transparency and electrical conductivity.- Composition and structure of transparent conductive oxides: Transparent conductive oxides (TCOs) can be engineered with specific compositions and structures to enhance their robustness. These materials typically include indium tin oxide (ITO), zinc oxide (ZnO), and other metal oxides that combine optical transparency with electrical conductivity. The robustness of these oxides can be improved through careful control of their crystalline structure, grain boundaries, and stoichiometry. Various deposition techniques and post-treatment processes can be employed to optimize these properties.

- Doping strategies for enhanced stability: Doping transparent oxides with specific elements can significantly improve their mechanical and environmental stability. The introduction of dopants can strengthen the oxide lattice, reduce defect formation, and enhance resistance to environmental degradation. Common dopants include aluminum, gallium, and various transition metals that can be incorporated at controlled concentrations to optimize both transparency and robustness without compromising electrical properties.

- Protective layers and encapsulation techniques: Applying protective layers or encapsulation techniques can significantly enhance the robustness of transparent oxides against environmental factors such as moisture, oxygen, and mechanical stress. These protective strategies may include thin film barriers, passivation layers, or multilayer structures that shield the oxide while maintaining optical transparency. Advanced encapsulation methods can extend the lifetime and reliability of transparent oxide components in various applications.

- Processing methods for improved mechanical properties: Specific processing methods can enhance the mechanical properties and robustness of transparent oxides. These include annealing treatments, controlled cooling rates, and specialized deposition parameters that influence film density, adhesion, and stress distribution. Post-deposition treatments such as laser processing or thermal cycling can also be employed to relieve internal stresses and improve the overall durability of transparent oxide films without sacrificing their optical properties.

- Nanostructured transparent oxides for enhanced durability: Nanostructuring transparent oxides can lead to significant improvements in their robustness and durability. By engineering the material at the nanoscale through techniques such as nanoparticle incorporation, nanolaminates, or hierarchical structures, the mechanical flexibility and crack resistance can be enhanced. These nanostructured transparent oxides can better accommodate strain, resist fracture propagation, and maintain functionality under mechanical deformation, making them suitable for flexible electronics and other demanding applications.

02 Deposition techniques for robust transparent oxides

Various deposition methods can significantly impact the robustness of transparent oxide films. Techniques such as sputtering, atomic layer deposition (ALD), pulsed laser deposition (PLD), and chemical vapor deposition (CVD) offer different advantages for creating durable transparent oxide layers. Process parameters including temperature, pressure, gas flow rates, and post-deposition treatments like annealing can be optimized to enhance film adhesion, density, and resistance to environmental degradation, resulting in more robust transparent oxide coatings.Expand Specific Solutions03 Doping strategies to enhance transparent oxide stability

Doping transparent oxides with specific elements can significantly improve their robustness against environmental factors and mechanical stress. Strategic incorporation of dopants like aluminum, gallium, or rare earth elements can strengthen the oxide matrix while maintaining transparency. Co-doping approaches using multiple elements in precise ratios can create synergistic effects that enhance both electrical conductivity and structural stability. These doping strategies can lead to transparent oxides with improved resistance to humidity, temperature fluctuations, and mechanical abrasion.Expand Specific Solutions04 Surface treatments and passivation for improved durability

Surface treatments and passivation techniques can significantly enhance the robustness of transparent oxide materials. Methods such as plasma treatment, chemical passivation, and application of protective coatings can reduce surface defects and prevent degradation from environmental exposure. These treatments can create barrier layers that protect against moisture ingress, chemical corrosion, and mechanical damage while preserving optical transparency. Advanced passivation approaches using self-assembled monolayers or atomic layer deposited films can provide nanoscale protection that extends the lifetime and reliability of transparent oxide components.Expand Specific Solutions05 Testing and characterization methods for transparent oxide robustness

Specialized testing and characterization methods are essential for evaluating and improving the robustness of transparent oxide materials. These include accelerated aging tests, environmental stress testing (humidity, temperature cycling), mechanical stress tests (bending, scratch resistance), and chemical stability assessments. Advanced analytical techniques such as X-ray diffraction (XRD), scanning electron microscopy (SEM), atomic force microscopy (AFM), and spectroscopic ellipsometry can provide detailed insights into material properties and degradation mechanisms. These methods enable quantitative assessment of robustness parameters and help establish correlations between processing conditions and long-term stability.Expand Specific Solutions

Leading Companies and Research Institutions

Transparent oxide technology in flexible electronics is evolving rapidly, currently transitioning from research to early commercialization. The market is expanding significantly, driven by growing demand for bendable displays, wearable devices, and IoT applications. Leading companies like Samsung Electronics and Konica Minolta are advancing commercial applications, while research institutions such as KAIST, Arizona State University, and Carnegie Mellon University are developing next-generation materials with enhanced flexibility and transparency. The technology ecosystem shows collaboration between industrial players (Sumitomo Metal Mining, Eastman Chemical) focusing on scalable manufacturing processes and academic institutions exploring novel oxide compositions. The competitive landscape is characterized by regional innovation clusters in South Korea, Japan, and the United States, with increasing patent activity from companies like Intellectual Discovery and Merck Patent GmbH.

Sumitomo Metal Mining Co. Ltd.

Technical Solution: Sumitomo Metal Mining has developed advanced transparent conductive oxide (TCO) materials specifically engineered for flexible electronics applications. Their flagship technology centers on indium tin oxide (ITO) alternatives that maintain conductivity under mechanical stress. Sumitomo's proprietary zinc-based oxide systems incorporate carefully controlled dopants to achieve sheet resistances below 50 ohms/square while maintaining over 85% optical transparency in the visible spectrum. Their manufacturing process employs specialized sputtering techniques that create nanocrystalline structures with enhanced crack resistance during bending. The company has also pioneered composite oxide structures that combine different functional layers to simultaneously optimize conductivity, transparency, and mechanical durability, enabling over 100,000 bending cycles without significant performance degradation.

Strengths: Superior materials engineering expertise; established supply chain for rare metals; advanced manufacturing capabilities for high-quality TCO films. Weaknesses: Higher cost compared to some emerging alternatives; limited flexibility compared to newer carbon-based conductors; some formulations still require indium, facing potential supply constraints.

Korea Electronics Technology Institute

Technical Solution: KETI has developed advanced transparent oxide semiconductor technologies specifically optimized for flexible display and sensor applications. Their approach focuses on amorphous indium gallium zinc oxide (a-IGZO) systems with carefully engineered composition and microstructure to enhance mechanical flexibility. KETI's technology incorporates specialized buffer layers that improve adhesion between oxide semiconductors and plastic substrates while minimizing stress concentration during bending. They've pioneered low-temperature atomic layer deposition techniques that create highly uniform oxide films with precisely controlled thickness and composition, achieving TFTs with on/off ratios exceeding 10^8 and subthreshold swing below 0.3 V/decade. KETI has also developed innovative encapsulation technologies that protect oxide semiconductors from environmental degradation while maintaining the overall flexibility of the device structure.

Strengths: Strong focus on practical applications and commercialization; extensive experience in display technologies; well-established relationships with Korean electronics manufacturers. Weaknesses: Some dependence on rare elements like indium; technologies optimized primarily for display applications rather than broader flexible electronics; competition from organic semiconductor alternatives in ultra-flexible applications.

Key Patents and Innovations in Flexible TCO Materials

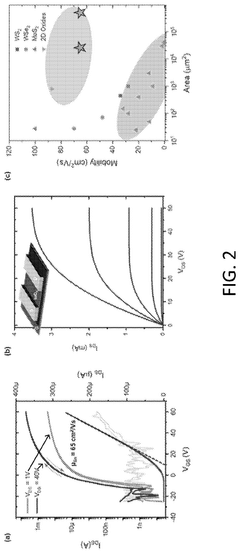

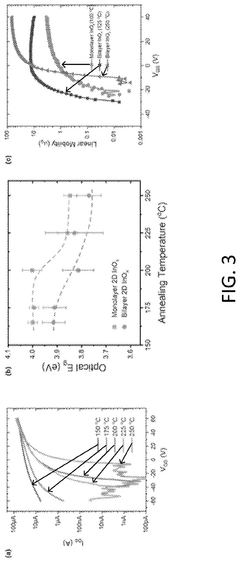

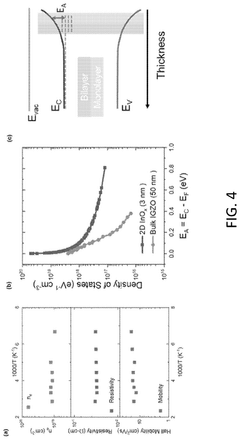

Liquid metal printed 2d ultrahigh mobility conducting oxide transistors

PatentPendingUS20240332017A1

Innovation

- A liquid metal printing method that operates at low temperatures (40° C to 450° C) to form alloyed oxide films, enabling the deposition of nanocrystalline ultrathin films with high conductivity and transparency, suitable for large-area flexible electronics, by using a dielectric and metal workpieces to form an alloyed oxide film with precise control over thickness and electronic properties.

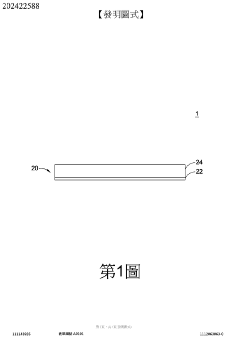

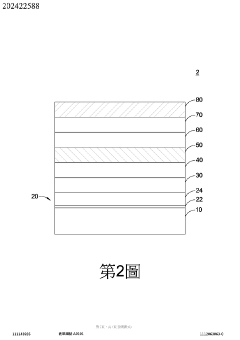

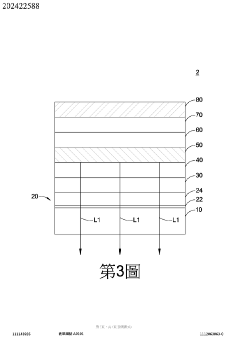

Flexible transparent electrode and flexible organic light-emitting diode structure using flexible transparent electrode capable of improving the whole conductivity of the first electrode layer by using a flexible transparent electrode disposed between the transparent substrate and the transparent metal oxide conductive layer

PatentActiveTW202422588A

Innovation

- A flexible transparent electrode is designed with a silver-chromium alloy layer doped with a small amount of high surface energy metal, sandwiched between a Mo-doped zinc oxide conductive layer and a transparent substrate, enhancing conductivity while maintaining light transmittance.

Manufacturing Scalability Challenges

The scaling of transparent oxide-based flexible electronics from laboratory prototypes to mass production presents significant manufacturing challenges. Current deposition methods like sputtering and atomic layer deposition (ALD) that work effectively for small-scale research samples face considerable limitations when adapted to high-throughput industrial processes. The primary challenge lies in maintaining uniform film properties across large substrate areas while ensuring consistent electrical performance, transparency, and mechanical flexibility.

Roll-to-roll (R2R) processing represents a promising approach for scaling transparent oxide production, but requires substantial process optimization. Temperature sensitivity poses a particular challenge, as many high-performance transparent oxides require processing temperatures exceeding 300°C, which is incompatible with most flexible polymer substrates that degrade at such temperatures. This necessitates the development of low-temperature deposition techniques that do not compromise material quality.

Defect control becomes increasingly critical at industrial scales. Pinholes, cracks, and compositional variations that might be tolerable in small research samples can lead to catastrophic yield losses in mass production. The industry requires advanced in-line metrology systems capable of detecting nanoscale defects across moving webs of material at production speeds, a capability that remains technically challenging and expensive to implement.

Material supply chain considerations further complicate scaling efforts. Some transparent oxide formulations rely on indium, which faces supply constraints and price volatility. Developing alternative compositions using more abundant elements while maintaining comparable performance represents an ongoing materials science challenge that directly impacts manufacturing economics.

Integration with existing electronics manufacturing infrastructure presents another hurdle. While silicon-based electronics benefit from decades of manufacturing optimization, transparent oxide processes must be adapted to work within established production lines or require entirely new dedicated facilities, both options involving significant capital investment and technical risk.

Equipment standardization remains underdeveloped for transparent oxide manufacturing. Unlike silicon semiconductor processing, where tool specifications and process parameters are highly standardized, equipment for flexible transparent oxide electronics varies significantly between manufacturers, complicating process transfer and scale-up efforts. Industry consortia are beginning to address this through collaborative development of manufacturing standards and best practices.

Roll-to-roll (R2R) processing represents a promising approach for scaling transparent oxide production, but requires substantial process optimization. Temperature sensitivity poses a particular challenge, as many high-performance transparent oxides require processing temperatures exceeding 300°C, which is incompatible with most flexible polymer substrates that degrade at such temperatures. This necessitates the development of low-temperature deposition techniques that do not compromise material quality.

Defect control becomes increasingly critical at industrial scales. Pinholes, cracks, and compositional variations that might be tolerable in small research samples can lead to catastrophic yield losses in mass production. The industry requires advanced in-line metrology systems capable of detecting nanoscale defects across moving webs of material at production speeds, a capability that remains technically challenging and expensive to implement.

Material supply chain considerations further complicate scaling efforts. Some transparent oxide formulations rely on indium, which faces supply constraints and price volatility. Developing alternative compositions using more abundant elements while maintaining comparable performance represents an ongoing materials science challenge that directly impacts manufacturing economics.

Integration with existing electronics manufacturing infrastructure presents another hurdle. While silicon-based electronics benefit from decades of manufacturing optimization, transparent oxide processes must be adapted to work within established production lines or require entirely new dedicated facilities, both options involving significant capital investment and technical risk.

Equipment standardization remains underdeveloped for transparent oxide manufacturing. Unlike silicon semiconductor processing, where tool specifications and process parameters are highly standardized, equipment for flexible transparent oxide electronics varies significantly between manufacturers, complicating process transfer and scale-up efforts. Industry consortia are beginning to address this through collaborative development of manufacturing standards and best practices.

Environmental Impact and Sustainability Considerations

The environmental footprint of transparent oxide-based flexible electronics represents a critical consideration in their development trajectory. Manufacturing processes for transparent conductive oxides (TCOs) like indium tin oxide (ITO) and emerging alternatives such as zinc oxide and indium gallium zinc oxide (IGZO) typically involve energy-intensive deposition techniques including sputtering, chemical vapor deposition, and sol-gel processes. These methods consume significant energy and often utilize rare earth elements, particularly indium, which faces supply constraints and geopolitical extraction challenges.

Life cycle assessments of flexible electronic devices incorporating transparent oxides reveal several environmental pressure points. The extraction of indium, primarily obtained as a by-product of zinc mining, generates substantial mining waste and habitat disruption. Additionally, the high-temperature annealing processes required for oxide crystallization contribute significantly to the carbon footprint of these technologies, with energy consumption ranging from 5-15 kWh per square meter of processed material.

Recent innovations are addressing these sustainability concerns through multiple pathways. Solution-processed oxide semiconductors that can be deposited at lower temperatures (below 200°C) reduce energy requirements by up to 60% compared to conventional methods. Furthermore, research into indium-free alternatives such as aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO) is advancing rapidly, with performance metrics approaching those of traditional ITO while utilizing more abundant elements.

The end-of-life management of flexible electronics presents both challenges and opportunities. The composite nature of these devices, with transparent oxides integrated into polymer substrates, complicates recycling efforts. However, emerging technologies for selective material recovery show promise, with pilot programs demonstrating up to 85% recovery rates for valuable elements like indium from end-of-life displays.

Water consumption represents another significant environmental consideration, with wet chemical processes in oxide preparation requiring 15-25 liters per square meter of material. Closed-loop water recycling systems and dry processing alternatives are being developed to address this concern, potentially reducing water usage by 70-80% in next-generation manufacturing facilities.

The transition to bio-based substrates compatible with transparent oxide deposition represents a promising frontier for sustainability. Cellulose-derived films and other biodegradable polymers are being engineered to withstand the thermal and chemical stresses of oxide deposition while maintaining end-of-life compostability, potentially reducing plastic waste from electronic devices by millions of tons annually.

Life cycle assessments of flexible electronic devices incorporating transparent oxides reveal several environmental pressure points. The extraction of indium, primarily obtained as a by-product of zinc mining, generates substantial mining waste and habitat disruption. Additionally, the high-temperature annealing processes required for oxide crystallization contribute significantly to the carbon footprint of these technologies, with energy consumption ranging from 5-15 kWh per square meter of processed material.

Recent innovations are addressing these sustainability concerns through multiple pathways. Solution-processed oxide semiconductors that can be deposited at lower temperatures (below 200°C) reduce energy requirements by up to 60% compared to conventional methods. Furthermore, research into indium-free alternatives such as aluminum-doped zinc oxide (AZO) and fluorine-doped tin oxide (FTO) is advancing rapidly, with performance metrics approaching those of traditional ITO while utilizing more abundant elements.

The end-of-life management of flexible electronics presents both challenges and opportunities. The composite nature of these devices, with transparent oxides integrated into polymer substrates, complicates recycling efforts. However, emerging technologies for selective material recovery show promise, with pilot programs demonstrating up to 85% recovery rates for valuable elements like indium from end-of-life displays.

Water consumption represents another significant environmental consideration, with wet chemical processes in oxide preparation requiring 15-25 liters per square meter of material. Closed-loop water recycling systems and dry processing alternatives are being developed to address this concern, potentially reducing water usage by 70-80% in next-generation manufacturing facilities.

The transition to bio-based substrates compatible with transparent oxide deposition represents a promising frontier for sustainability. Cellulose-derived films and other biodegradable polymers are being engineered to withstand the thermal and chemical stresses of oxide deposition while maintaining end-of-life compostability, potentially reducing plastic waste from electronic devices by millions of tons annually.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!