Best Practices for Recycling Neodymium Magnets in Electronics

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neodymium Magnet Recycling Background and Objectives

Neodymium magnets, discovered in the 1980s by General Motors and Sumitomo Special Metals, represent a critical component in modern electronics due to their exceptional magnetic properties. These rare earth magnets, primarily composed of neodymium, iron, and boron (NdFeB), have revolutionized electronic device miniaturization while maintaining powerful performance characteristics. As global electronic waste continues to grow at an alarming rate of approximately 50 million tons annually, the recovery and recycling of these valuable materials has become increasingly urgent from both economic and environmental perspectives.

The evolution of neodymium magnet technology has followed a trajectory of increasing magnetic strength and thermal stability, with contemporary magnets achieving energy products exceeding 50 MGOe (megagauss-oersteds). This technological advancement has enabled the proliferation of smaller, more efficient electronic devices across numerous sectors including consumer electronics, automotive systems, renewable energy infrastructure, and medical equipment.

Current global production of neodymium magnets exceeds 170,000 tons annually, with China dominating approximately 85% of the market. This concentration of production presents significant supply chain vulnerabilities for many nations, particularly as demand continues to accelerate with the expansion of electric vehicle and renewable energy markets. Industry projections suggest demand could increase by 200-300% by 2030, creating potential critical material shortages without improved recycling infrastructure.

The primary objective of neodymium magnet recycling initiatives is to establish closed-loop material recovery systems that can significantly reduce dependence on primary mining operations. Current recycling rates remain disappointingly low, with less than 1% of rare earth elements effectively recovered from end-of-life products. This represents an enormous untapped resource, particularly considering that recycled neodymium can maintain equivalent magnetic properties to virgin material when properly processed.

Technical challenges in recycling these magnets stem from their integration into complex electronic assemblies, corrosion protection coatings, and the energy-intensive separation processes required to isolate individual rare earth elements. Traditional recycling approaches have focused on pyrometallurgical and hydrometallurgical techniques, though emerging technologies including hydrogen decrepitation and ionic liquid extraction show promising efficiency improvements.

The development of standardized best practices for neodymium magnet recycling aims to address these challenges through a combination of design-for-disassembly principles, automated separation technologies, and advanced metallurgical recovery processes. Success in this domain would simultaneously mitigate environmental damage from mining operations, reduce geopolitical supply vulnerabilities, and establish sustainable material flows for critical technology sectors.

The evolution of neodymium magnet technology has followed a trajectory of increasing magnetic strength and thermal stability, with contemporary magnets achieving energy products exceeding 50 MGOe (megagauss-oersteds). This technological advancement has enabled the proliferation of smaller, more efficient electronic devices across numerous sectors including consumer electronics, automotive systems, renewable energy infrastructure, and medical equipment.

Current global production of neodymium magnets exceeds 170,000 tons annually, with China dominating approximately 85% of the market. This concentration of production presents significant supply chain vulnerabilities for many nations, particularly as demand continues to accelerate with the expansion of electric vehicle and renewable energy markets. Industry projections suggest demand could increase by 200-300% by 2030, creating potential critical material shortages without improved recycling infrastructure.

The primary objective of neodymium magnet recycling initiatives is to establish closed-loop material recovery systems that can significantly reduce dependence on primary mining operations. Current recycling rates remain disappointingly low, with less than 1% of rare earth elements effectively recovered from end-of-life products. This represents an enormous untapped resource, particularly considering that recycled neodymium can maintain equivalent magnetic properties to virgin material when properly processed.

Technical challenges in recycling these magnets stem from their integration into complex electronic assemblies, corrosion protection coatings, and the energy-intensive separation processes required to isolate individual rare earth elements. Traditional recycling approaches have focused on pyrometallurgical and hydrometallurgical techniques, though emerging technologies including hydrogen decrepitation and ionic liquid extraction show promising efficiency improvements.

The development of standardized best practices for neodymium magnet recycling aims to address these challenges through a combination of design-for-disassembly principles, automated separation technologies, and advanced metallurgical recovery processes. Success in this domain would simultaneously mitigate environmental damage from mining operations, reduce geopolitical supply vulnerabilities, and establish sustainable material flows for critical technology sectors.

Market Demand Analysis for Rare Earth Element Recovery

The global market for rare earth element (REE) recovery, particularly neodymium from electronic waste, has witnessed substantial growth driven by increasing environmental concerns and supply chain vulnerabilities. Current market valuation for rare earth recycling stands at approximately $3.3 billion, with projections indicating a compound annual growth rate of 7.2% through 2028, highlighting the economic potential of neodymium magnet recycling initiatives.

The demand for neodymium magnets has surged dramatically across multiple industries, with electronics manufacturing consuming nearly 30% of global production. Hard disk drives, speakers, and electric motors represent the largest application segments within consumer electronics. This demand is further amplified by the rapid expansion of electric vehicles and renewable energy technologies, which rely heavily on high-performance neodymium magnets for efficient operation.

Supply chain vulnerabilities present a critical market driver, as over 85% of rare earth processing capacity remains concentrated in China. Recent geopolitical tensions and export restrictions have created significant price volatility, with neodymium prices fluctuating by up to 40% in the past two years. This instability has accelerated interest in recycling as a strategic approach to secure domestic supply chains in North America, Europe, and Japan.

Environmental regulations are increasingly shaping market dynamics, with the European Union's WEEE Directive and similar legislation in other regions mandating higher recovery rates for electronic waste. These regulatory frameworks create both compliance requirements and market opportunities for companies developing efficient recycling technologies for neodymium magnets.

Consumer electronics represent the most accessible source of recyclable neodymium, with an estimated 700,000 tons of recoverable rare earth elements currently embedded in discarded devices globally. However, collection infrastructure remains underdeveloped, with recovery rates averaging below 20% in most developed economies.

The economic viability of recycling operations has improved significantly with technological advancements. Recent innovations in hydrometallurgical and pyrometallurgical processes have reduced processing costs by approximately 30% compared to traditional methods, narrowing the price gap between recycled and virgin materials.

Market segmentation reveals distinct approaches across regions, with Asian markets focusing on high-volume processing of manufacturing waste, while European initiatives target post-consumer electronics with advanced sorting technologies. North American companies have pioneered specialized extraction techniques for specific applications like wind turbine generators and electric vehicle motors.

The demand for neodymium magnets has surged dramatically across multiple industries, with electronics manufacturing consuming nearly 30% of global production. Hard disk drives, speakers, and electric motors represent the largest application segments within consumer electronics. This demand is further amplified by the rapid expansion of electric vehicles and renewable energy technologies, which rely heavily on high-performance neodymium magnets for efficient operation.

Supply chain vulnerabilities present a critical market driver, as over 85% of rare earth processing capacity remains concentrated in China. Recent geopolitical tensions and export restrictions have created significant price volatility, with neodymium prices fluctuating by up to 40% in the past two years. This instability has accelerated interest in recycling as a strategic approach to secure domestic supply chains in North America, Europe, and Japan.

Environmental regulations are increasingly shaping market dynamics, with the European Union's WEEE Directive and similar legislation in other regions mandating higher recovery rates for electronic waste. These regulatory frameworks create both compliance requirements and market opportunities for companies developing efficient recycling technologies for neodymium magnets.

Consumer electronics represent the most accessible source of recyclable neodymium, with an estimated 700,000 tons of recoverable rare earth elements currently embedded in discarded devices globally. However, collection infrastructure remains underdeveloped, with recovery rates averaging below 20% in most developed economies.

The economic viability of recycling operations has improved significantly with technological advancements. Recent innovations in hydrometallurgical and pyrometallurgical processes have reduced processing costs by approximately 30% compared to traditional methods, narrowing the price gap between recycled and virgin materials.

Market segmentation reveals distinct approaches across regions, with Asian markets focusing on high-volume processing of manufacturing waste, while European initiatives target post-consumer electronics with advanced sorting technologies. North American companies have pioneered specialized extraction techniques for specific applications like wind turbine generators and electric vehicle motors.

Current Recycling Technologies and Barriers

The recycling of neodymium magnets from electronic waste currently employs several technological approaches, each with varying degrees of efficiency and environmental impact. The predominant method is pyrometallurgical processing, which involves high-temperature treatment to separate rare earth elements from other materials. This process typically achieves recovery rates of 75-85% but consumes significant energy and produces harmful emissions, including greenhouse gases and toxic particulates.

Hydrometallurgical processes represent a more environmentally friendly alternative, utilizing acid leaching to selectively dissolve rare earth elements from crushed electronic waste. While this method can achieve recovery rates exceeding 90% under optimal conditions, it generates substantial volumes of acidic wastewater requiring treatment before disposal. Recent innovations in this area include the development of bio-leaching techniques using microorganisms to extract rare earth elements, though these remain primarily experimental.

Physical separation methods constitute the initial stage in most recycling workflows. These include manual disassembly, mechanical shredding, magnetic separation, and density-based sorting. The effectiveness of these methods varies significantly based on the design of electronic products, with recovery rates ranging from 40% to 70%. Products designed without consideration for end-of-life disassembly present particular challenges.

Direct reuse represents the most energy-efficient approach, where intact magnets are extracted and redeployed in new applications with minimal processing. However, this method faces significant barriers including the labor-intensive nature of manual disassembly and the lack of standardization in magnet specifications across different electronic products.

Several critical barriers impede widespread adoption of neodymium magnet recycling. Economic challenges include high processing costs relative to primary mining, volatile rare earth element prices, and insufficient economies of scale in recycling operations. The complex and heterogeneous nature of electronic waste streams further complicates efficient recovery, with magnets often embedded deeply within devices or bonded with adhesives that complicate separation.

Technological limitations persist in achieving high-purity recovery without cross-contamination from other elements present in electronic waste. Additionally, the absence of standardized methods for assessing the quality and performance of recycled magnets creates market uncertainty. Regulatory frameworks remain inconsistent across regions, with inadequate incentives for manufacturers to design products for recyclability or incorporate recycled materials.

Infrastructure deficiencies represent another significant barrier, with limited collection networks for end-of-life electronics and insufficient specialized processing facilities capable of handling neodymium magnets. These challenges collectively contribute to the current situation where less than 1% of rare earth elements in electronic waste are effectively recycled globally.

Hydrometallurgical processes represent a more environmentally friendly alternative, utilizing acid leaching to selectively dissolve rare earth elements from crushed electronic waste. While this method can achieve recovery rates exceeding 90% under optimal conditions, it generates substantial volumes of acidic wastewater requiring treatment before disposal. Recent innovations in this area include the development of bio-leaching techniques using microorganisms to extract rare earth elements, though these remain primarily experimental.

Physical separation methods constitute the initial stage in most recycling workflows. These include manual disassembly, mechanical shredding, magnetic separation, and density-based sorting. The effectiveness of these methods varies significantly based on the design of electronic products, with recovery rates ranging from 40% to 70%. Products designed without consideration for end-of-life disassembly present particular challenges.

Direct reuse represents the most energy-efficient approach, where intact magnets are extracted and redeployed in new applications with minimal processing. However, this method faces significant barriers including the labor-intensive nature of manual disassembly and the lack of standardization in magnet specifications across different electronic products.

Several critical barriers impede widespread adoption of neodymium magnet recycling. Economic challenges include high processing costs relative to primary mining, volatile rare earth element prices, and insufficient economies of scale in recycling operations. The complex and heterogeneous nature of electronic waste streams further complicates efficient recovery, with magnets often embedded deeply within devices or bonded with adhesives that complicate separation.

Technological limitations persist in achieving high-purity recovery without cross-contamination from other elements present in electronic waste. Additionally, the absence of standardized methods for assessing the quality and performance of recycled magnets creates market uncertainty. Regulatory frameworks remain inconsistent across regions, with inadequate incentives for manufacturers to design products for recyclability or incorporate recycled materials.

Infrastructure deficiencies represent another significant barrier, with limited collection networks for end-of-life electronics and insufficient specialized processing facilities capable of handling neodymium magnets. These challenges collectively contribute to the current situation where less than 1% of rare earth elements in electronic waste are effectively recycled globally.

Established Extraction and Recovery Techniques

01 Chemical extraction methods for neodymium recovery

Various chemical processes can be used to extract neodymium from waste magnets, including acid leaching, solvent extraction, and precipitation techniques. These methods involve dissolving the magnetic material in acids or other solvents to separate the rare earth elements from other components. The extracted neodymium can then be purified through additional chemical treatments and recovered in forms suitable for reuse in new magnet production.- Chemical extraction methods for neodymium recovery: Various chemical processes can be used to extract neodymium from waste magnets, including acid leaching, solvent extraction, and precipitation techniques. These methods involve dissolving the magnetic material in acids or other solvents, followed by selective extraction of rare earth elements. Chemical extraction enables high purity recovery of neodymium and other valuable rare earth elements from end-of-life magnets, allowing for their reuse in new magnet production.

- Physical separation and processing techniques: Physical methods for recycling neodymium magnets include demagnetization, crushing, grinding, and various separation techniques such as magnetic separation and sieving. These processes aim to separate the neodymium-containing components from other materials in waste magnets. Physical processing is often used as a pre-treatment step before chemical extraction to increase efficiency and reduce processing costs in the recycling workflow.

- Direct reuse and remanufacturing of magnets: Direct reuse methods involve collecting end-of-life magnets, particularly from electronic devices and motors, and reprocessing them with minimal chemical treatment. This approach includes demagnetization, cleaning, re-magnetization, and size adjustment to prepare the magnets for new applications. Direct reuse is considered environmentally friendly as it requires less energy and produces fewer waste products compared to complete recycling processes.

- Hydrogen processing for magnet recycling: Hydrogen decrepitation is an innovative technique for recycling neodymium magnets where hydrogen gas is used to break down the magnetic material into powder. The process involves exposing the magnets to hydrogen, causing them to expand and disintegrate into fine particles that can be more easily processed. This method allows for efficient separation of rare earth elements while maintaining their magnetic properties, making it particularly valuable for producing new high-performance magnets from recycled materials.

- Urban mining and collection systems: Urban mining refers to systematic collection and processing of neodymium magnets from consumer electronics, industrial equipment, and other end-of-life products. This approach includes developing efficient collection networks, sorting technologies, and logistics systems to gather waste magnets from various sources. Effective urban mining systems are crucial for ensuring a steady supply of recyclable neodymium magnets and reducing dependence on primary mining of rare earth elements.

02 Physical separation and processing techniques

Physical methods for recycling neodymium magnets include crushing, milling, sieving, and magnetic separation. These techniques focus on breaking down end-of-life products containing neodymium magnets and separating the magnetic material from other components. The process typically involves demagnetization, size reduction, and sorting to obtain concentrated neodymium-containing fractions that can be further processed for metal recovery.Expand Specific Solutions03 Direct recycling and reuse of intact magnets

Direct recycling approaches focus on recovering intact or minimally processed neodymium magnets from end-of-life products for immediate reuse. These methods involve careful disassembly of devices, demagnetization when necessary, cleaning, and remagnetization of the recovered magnets. This approach preserves the original microstructure and properties of the magnets, reducing energy consumption compared to complete reprocessing methods.Expand Specific Solutions04 Hydrogen-based recycling processes

Hydrogen decrepitation is an innovative method for recycling neodymium magnets that uses hydrogen gas to break down the magnetic material into powder. When exposed to hydrogen, the neodymium magnet alloy absorbs the gas and expands, causing it to disintegrate into fine particles. This process preserves the chemical composition of the material while changing its physical form, making it easier to separate rare earth elements from other components and reprocess into new magnets.Expand Specific Solutions05 Pyrometallurgical recovery methods

Pyrometallurgical techniques involve high-temperature processes such as smelting, roasting, and electroslag refining to recover neodymium from waste magnets. These methods use thermal energy to separate rare earth elements from other materials through melting and phase separation. The processes often include reduction-oxidation reactions to isolate the neodymium and other valuable elements, which can then be cast into ingots or further refined for reuse in magnet production.Expand Specific Solutions

Key Industry Players in Electronics Recycling

The recycling of neodymium magnets in electronics is currently in a growth phase, with the market expanding due to increasing electronic waste volumes and critical raw material concerns. The global market for rare earth recycling is projected to reach $6-8 billion by 2030, driven by sustainability initiatives and supply chain security. Technologically, the field shows varying maturity levels across different recovery methods. Leading players include specialized recycling firms like RarEarth Srl and established materials companies such as NEOMAX and Toshiba. Academic institutions including Beijing University of Technology and University of Birmingham are advancing innovative extraction techniques, while research organizations like Centre National de la Recherche Scientifique are developing more efficient recycling processes. Chinese companies like Jiangsu Guoyuan and Fujian Changting Golden Dragon dominate in commercial-scale operations, reflecting China's strategic position in the rare earth value chain.

NEOMAX Co., Ltd.

Technical Solution: NEOMAX Co., Ltd. has implemented a commercial-scale direct recycling process specifically designed for neodymium magnets from consumer electronics and industrial equipment. Their "Magnet-to-Magnet" recycling system employs a combination of thermal demagnetization, mechanical pulverization, and hydrogen decrepitation to process end-of-life magnets. The recovered material undergoes a proprietary re-sintering process that restores magnetic properties without complete chemical separation of the rare earth elements. This approach preserves the microstructure advantages of the original high-performance magnets. NEOMAX's process can handle magnets with varying compositions and has been optimized to manage common contaminants found in electronic waste. Their industrial facility in Japan processes approximately 500 tons of magnet material annually with recovery yields exceeding 92%. The company has established collection partnerships with major electronics manufacturers to ensure a steady supply of end-of-life magnets, creating a closed-loop system for rare earth materials in electronics.

Strengths: Fully commercialized process with proven economic viability; direct magnet-to-magnet recycling preserves valuable microstructure; established collection network ensures consistent feedstock supply. Weaknesses: Process optimization required for each different magnet composition; some performance loss in recycled magnets compared to virgin material; requires relatively clean magnet input with limited contamination.

University of Birmingham

Technical Solution: The University of Birmingham has developed the HPMS (Hydrogen Processing of Magnet Scrap) technology for recycling neodymium magnets from electronic waste. This process uses hydrogen to decrepitate the magnets, breaking them down into a demagnetized powder that can be directly reprocessed into new magnets. The technology can process mixed feedstocks of different magnet compositions and does not require prior demagnetization or removal of coatings. Their process achieves recovery rates of over 90% of rare earth elements from end-of-life electronics while maintaining magnetic properties comparable to those made from virgin materials. The university has also established a pilot plant demonstrating the commercial viability of this approach, processing several hundred kilograms of magnet waste per day. Their research has shown that recycled magnets can retain up to 97% of the magnetic properties of original magnets, making this a highly efficient recycling method.

Strengths: Energy-efficient process requiring 88% less energy than primary production; handles mixed and coated magnets without pre-processing; produces high-quality recycled magnets with minimal property loss. Weaknesses: Requires careful handling of hydrogen gas; initial capital investment for hydrogen processing equipment; limited to processing only NdFeB magnets rather than all rare earth materials.

Critical Patents and Innovations in Magnet Recycling

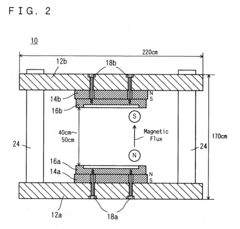

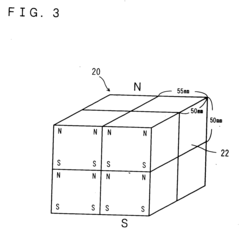

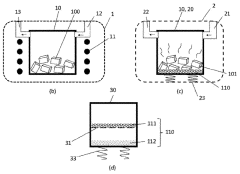

Recycling method for magnetic field generator

PatentInactiveUS20060168799A1

Innovation

- A method involving heating the magnetic field generator to a temperature range of 200° C. to 1000° C. to demagnetize and reduce adhesive strength, allowing safe removal of neodymium magnets while minimizing structural deterioration, and using a controlled heating process to facilitate recycling and re-magnetization.

Method for recycling neodymium (Nd), iron (Fe), boron (B) (NdFeB) type magnets, anisotropic powder obtained from the recycling, and method for producing permanent magnets from said powder

PatentPendingJP2024520299A

Innovation

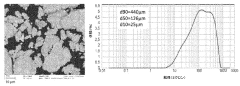

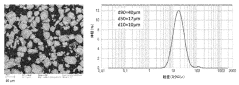

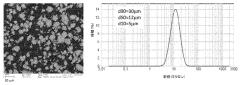

- A method for recycling NdFeB solid magnets involves preheating waste magnets to 300°C to 500°C, followed by hydrogen decrepitation under controlled hydrogen pressure to produce a powder with magnetic main and secondary phases, which is then sieved and ground to specific sizes, and optionally enriched with additional compounds to enhance properties for additive manufacturing.

Environmental Impact Assessment

The recycling of neodymium magnets from electronic devices presents significant environmental implications that must be thoroughly assessed. The extraction and processing of rare earth elements, particularly neodymium, generates substantial environmental burdens including habitat destruction, soil contamination, and the release of toxic chemicals. When these magnets are improperly disposed of in landfills, they contribute to long-term environmental degradation as the neodymium slowly leaches into soil and groundwater systems.

Current recycling practices for neodymium magnets vary considerably in their environmental footprint. Traditional pyrometallurgical processes consume large amounts of energy and produce greenhouse gas emissions that contribute to climate change. These methods often require temperatures exceeding 1000°C, resulting in significant carbon dioxide emissions—approximately 12kg CO2 per kilogram of recycled neodymium. Additionally, these processes generate slag containing heavy metals and other contaminants that require careful management.

Hydrometallurgical approaches offer a potentially lower-impact alternative, reducing energy consumption by up to 40% compared to pyrometallurgical methods. However, these processes utilize strong acids and organic solvents that present their own environmental hazards if not properly contained and treated. Recent life cycle assessments indicate that recycling neodymium magnets can reduce environmental impact by 95% compared to primary mining when optimal techniques are employed.

Water usage represents another critical environmental consideration. Primary mining of rare earth elements typically consumes 200-400 liters of water per kilogram of material produced, while advanced recycling methods can reduce this to 50-100 liters per kilogram. This reduction becomes increasingly significant as water scarcity affects more regions globally.

The establishment of regional recycling centers could substantially reduce the carbon footprint associated with transporting end-of-life electronics containing neodymium magnets. Studies suggest that localized recycling infrastructure could decrease transportation-related emissions by up to 70% compared to centralized facilities requiring long-distance shipping.

Emerging technologies such as bioleaching and supercritical fluid extraction show promise for further reducing the environmental impact of neodymium recycling. Bioleaching utilizes microorganisms to extract metals, potentially reducing chemical usage by 80% compared to conventional methods. These innovative approaches remain in developmental stages but represent important pathways toward more environmentally sustainable recycling practices.

Ultimately, comprehensive environmental impact assessment must consider the entire lifecycle of neodymium magnets, from initial extraction through recycling and reuse. When properly implemented, best practices for recycling these components can significantly mitigate environmental damage while conserving valuable resources for future technological applications.

Current recycling practices for neodymium magnets vary considerably in their environmental footprint. Traditional pyrometallurgical processes consume large amounts of energy and produce greenhouse gas emissions that contribute to climate change. These methods often require temperatures exceeding 1000°C, resulting in significant carbon dioxide emissions—approximately 12kg CO2 per kilogram of recycled neodymium. Additionally, these processes generate slag containing heavy metals and other contaminants that require careful management.

Hydrometallurgical approaches offer a potentially lower-impact alternative, reducing energy consumption by up to 40% compared to pyrometallurgical methods. However, these processes utilize strong acids and organic solvents that present their own environmental hazards if not properly contained and treated. Recent life cycle assessments indicate that recycling neodymium magnets can reduce environmental impact by 95% compared to primary mining when optimal techniques are employed.

Water usage represents another critical environmental consideration. Primary mining of rare earth elements typically consumes 200-400 liters of water per kilogram of material produced, while advanced recycling methods can reduce this to 50-100 liters per kilogram. This reduction becomes increasingly significant as water scarcity affects more regions globally.

The establishment of regional recycling centers could substantially reduce the carbon footprint associated with transporting end-of-life electronics containing neodymium magnets. Studies suggest that localized recycling infrastructure could decrease transportation-related emissions by up to 70% compared to centralized facilities requiring long-distance shipping.

Emerging technologies such as bioleaching and supercritical fluid extraction show promise for further reducing the environmental impact of neodymium recycling. Bioleaching utilizes microorganisms to extract metals, potentially reducing chemical usage by 80% compared to conventional methods. These innovative approaches remain in developmental stages but represent important pathways toward more environmentally sustainable recycling practices.

Ultimately, comprehensive environmental impact assessment must consider the entire lifecycle of neodymium magnets, from initial extraction through recycling and reuse. When properly implemented, best practices for recycling these components can significantly mitigate environmental damage while conserving valuable resources for future technological applications.

Supply Chain Considerations for Recycled Materials

The recycling of neodymium magnets from electronic waste presents unique supply chain challenges that require strategic planning and coordination. Traditional linear supply chains must be transformed into circular systems capable of efficiently collecting, processing, and redistributing recycled magnetic materials. Currently, the reverse logistics infrastructure for neodymium magnets remains underdeveloped, with collection points often scattered and transportation costs prohibitively high due to the relatively small quantities of recoverable materials per device.

Material sorting represents another critical supply chain bottleneck. Electronic devices containing neodymium magnets arrive in recycling facilities in various conditions, necessitating sophisticated identification and separation technologies. Companies pioneering in this space have developed automated systems using spectroscopic techniques to identify magnetic components, though implementation costs remain significant barriers for smaller recycling operations.

The geographical distribution of recycling capabilities creates additional complexity. Most advanced neodymium recycling facilities are concentrated in regions with established rare earth processing infrastructure, primarily China, with emerging capabilities in Europe and North America. This concentration creates potential vulnerabilities in the recycled materials supply chain, particularly during global disruptions as witnessed during recent pandemic-related supply chain crises.

Quality assurance protocols for recycled neodymium materials require standardization across the supply chain. Recycled magnets often exhibit varying performance characteristics depending on their source and processing methods. Leading manufacturers have begun implementing rigorous testing regimes and material certification systems to ensure recycled materials meet performance specifications, though industry-wide standards remain in development.

Inventory management presents unique challenges for recycled neodymium materials due to supply unpredictability. Unlike virgin material production, which can be scheduled according to demand forecasts, recycled material availability depends on collection rates and processing efficiency. Forward-thinking companies have implemented buffer inventory systems and developed predictive analytics to better forecast recycled material availability.

Economic viability remains perhaps the most significant supply chain consideration. The cost structure for recycled neodymium often exceeds that of newly mined materials, particularly when rare earth prices are low. However, companies implementing full lifecycle accounting methods have demonstrated that when environmental externalities and supply security benefits are properly valued, recycled materials can achieve cost competitiveness, especially in applications where material provenance and sustainability credentials command premium pricing.

Material sorting represents another critical supply chain bottleneck. Electronic devices containing neodymium magnets arrive in recycling facilities in various conditions, necessitating sophisticated identification and separation technologies. Companies pioneering in this space have developed automated systems using spectroscopic techniques to identify magnetic components, though implementation costs remain significant barriers for smaller recycling operations.

The geographical distribution of recycling capabilities creates additional complexity. Most advanced neodymium recycling facilities are concentrated in regions with established rare earth processing infrastructure, primarily China, with emerging capabilities in Europe and North America. This concentration creates potential vulnerabilities in the recycled materials supply chain, particularly during global disruptions as witnessed during recent pandemic-related supply chain crises.

Quality assurance protocols for recycled neodymium materials require standardization across the supply chain. Recycled magnets often exhibit varying performance characteristics depending on their source and processing methods. Leading manufacturers have begun implementing rigorous testing regimes and material certification systems to ensure recycled materials meet performance specifications, though industry-wide standards remain in development.

Inventory management presents unique challenges for recycled neodymium materials due to supply unpredictability. Unlike virgin material production, which can be scheduled according to demand forecasts, recycled material availability depends on collection rates and processing efficiency. Forward-thinking companies have implemented buffer inventory systems and developed predictive analytics to better forecast recycled material availability.

Economic viability remains perhaps the most significant supply chain consideration. The cost structure for recycled neodymium often exceeds that of newly mined materials, particularly when rare earth prices are low. However, companies implementing full lifecycle accounting methods have demonstrated that when environmental externalities and supply security benefits are properly valued, recycled materials can achieve cost competitiveness, especially in applications where material provenance and sustainability credentials command premium pricing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!