Neodymium Magnets vs Rare Earth: Environmental Impact Assessment

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neodymium Magnet Technology Background and Objectives

Neodymium magnets, discovered in the 1980s by General Motors and Sumitomo Special Metals, represent a significant advancement in permanent magnet technology. These magnets belong to the rare earth magnet family, specifically classified as Nd2Fe14B (neodymium-iron-boron) compounds. Their emergence revolutionized numerous industries due to their exceptional magnetic properties, offering magnetic field strengths up to ten times greater than traditional ferrite magnets while maintaining a significantly smaller size.

The evolution of neodymium magnet technology has followed a trajectory of continuous improvement in performance characteristics and manufacturing processes. Initially developed to address energy efficiency concerns following the 1970s oil crisis, these magnets have since become integral components in various high-tech applications, from computer hard drives and headphones to electric vehicles and wind turbines. The technology has progressed from basic formulations to sophisticated compositions incorporating dysprosium and other elements to enhance temperature stability and resistance to demagnetization.

Current technological trends in the field focus on optimizing the balance between magnetic performance and environmental sustainability. Research efforts are increasingly directed toward reducing the dependence on heavy rare earth elements like dysprosium, which present significant environmental challenges during extraction and processing. Innovations in grain boundary diffusion and microstructure control represent promising avenues for maintaining or improving magnetic properties while minimizing environmental impact.

The global demand for neodymium magnets has grown exponentially, driven primarily by the rapid expansion of green technologies. This growth trajectory is expected to continue as industries worldwide transition toward electrification and renewable energy solutions. However, this increasing demand has raised concerns about the sustainability of rare earth element supply chains and the environmental consequences of their extraction and processing.

The primary technical objective of this assessment is to comprehensively evaluate the environmental impact of neodymium magnets compared to other rare earth magnetic materials throughout their entire lifecycle. This includes analyzing extraction processes, manufacturing methods, in-use efficiency, and end-of-life management options. The assessment aims to identify critical environmental hotspots in the production and use of these materials and explore potential mitigation strategies.

Secondary objectives include mapping the technological pathways for developing more environmentally sustainable magnetic materials, evaluating the potential for recycling and circular economy approaches, and assessing the trade-offs between magnetic performance and environmental impact. This analysis will provide a foundation for informed decision-making regarding the future development and application of magnetic technologies in an increasingly sustainability-conscious global context.

The evolution of neodymium magnet technology has followed a trajectory of continuous improvement in performance characteristics and manufacturing processes. Initially developed to address energy efficiency concerns following the 1970s oil crisis, these magnets have since become integral components in various high-tech applications, from computer hard drives and headphones to electric vehicles and wind turbines. The technology has progressed from basic formulations to sophisticated compositions incorporating dysprosium and other elements to enhance temperature stability and resistance to demagnetization.

Current technological trends in the field focus on optimizing the balance between magnetic performance and environmental sustainability. Research efforts are increasingly directed toward reducing the dependence on heavy rare earth elements like dysprosium, which present significant environmental challenges during extraction and processing. Innovations in grain boundary diffusion and microstructure control represent promising avenues for maintaining or improving magnetic properties while minimizing environmental impact.

The global demand for neodymium magnets has grown exponentially, driven primarily by the rapid expansion of green technologies. This growth trajectory is expected to continue as industries worldwide transition toward electrification and renewable energy solutions. However, this increasing demand has raised concerns about the sustainability of rare earth element supply chains and the environmental consequences of their extraction and processing.

The primary technical objective of this assessment is to comprehensively evaluate the environmental impact of neodymium magnets compared to other rare earth magnetic materials throughout their entire lifecycle. This includes analyzing extraction processes, manufacturing methods, in-use efficiency, and end-of-life management options. The assessment aims to identify critical environmental hotspots in the production and use of these materials and explore potential mitigation strategies.

Secondary objectives include mapping the technological pathways for developing more environmentally sustainable magnetic materials, evaluating the potential for recycling and circular economy approaches, and assessing the trade-offs between magnetic performance and environmental impact. This analysis will provide a foundation for informed decision-making regarding the future development and application of magnetic technologies in an increasingly sustainability-conscious global context.

Market Demand Analysis for Rare Earth Magnets

The global market for rare earth magnets has experienced substantial growth over the past decade, driven primarily by increasing applications in renewable energy technologies, electric vehicles, and consumer electronics. The market value reached approximately $20 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.5% through 2030, potentially reaching $40 billion by the end of the decade.

Demand for neodymium magnets, the strongest type of permanent magnets, has been particularly robust. These magnets are critical components in wind turbine generators, electric vehicle motors, hard disk drives, and various consumer electronic devices. The electric vehicle sector alone has created unprecedented demand, with each EV requiring approximately 1-2 kg of rare earth magnets, compared to about 0.1 kg in conventional vehicles.

Geographically, Asia-Pacific dominates both production and consumption of rare earth magnets, with China controlling approximately 85% of global rare earth processing capacity. However, concerns about supply chain vulnerabilities have prompted significant market shifts. The United States, European Union, Japan, and Australia have all implemented strategic initiatives to reduce dependence on Chinese supplies, including investments in alternative mining operations and recycling technologies.

Industry analysis reveals a growing preference for environmentally sustainable sourcing options. A 2023 survey of manufacturing companies indicated that 67% are willing to pay premium prices for rare earth magnets produced with reduced environmental impact. This trend is particularly pronounced among automotive and renewable energy companies, where corporate sustainability commitments are driving procurement decisions.

The recycling segment of the market is experiencing the fastest growth, with a CAGR exceeding 12%. Recovery of neodymium and other rare earth elements from end-of-life products represents a significant opportunity to address both environmental concerns and supply constraints. Current recycling rates remain low at approximately 1% of total rare earth materials, indicating substantial room for market expansion.

Price volatility remains a significant market factor. Historical data shows price fluctuations of up to 600% during supply disruptions, highlighting the strategic importance of these materials. This volatility has accelerated research into alternative magnet technologies, including iron nitride and samarium-cobalt systems, though these alternatives currently lack the performance characteristics of neodymium-based magnets in most applications.

Consumer electronics and industrial automation sectors are expected to emerge as the next major growth drivers for rare earth magnets, with particular emphasis on miniaturized high-performance applications requiring strong magnetic fields in compact designs.

Demand for neodymium magnets, the strongest type of permanent magnets, has been particularly robust. These magnets are critical components in wind turbine generators, electric vehicle motors, hard disk drives, and various consumer electronic devices. The electric vehicle sector alone has created unprecedented demand, with each EV requiring approximately 1-2 kg of rare earth magnets, compared to about 0.1 kg in conventional vehicles.

Geographically, Asia-Pacific dominates both production and consumption of rare earth magnets, with China controlling approximately 85% of global rare earth processing capacity. However, concerns about supply chain vulnerabilities have prompted significant market shifts. The United States, European Union, Japan, and Australia have all implemented strategic initiatives to reduce dependence on Chinese supplies, including investments in alternative mining operations and recycling technologies.

Industry analysis reveals a growing preference for environmentally sustainable sourcing options. A 2023 survey of manufacturing companies indicated that 67% are willing to pay premium prices for rare earth magnets produced with reduced environmental impact. This trend is particularly pronounced among automotive and renewable energy companies, where corporate sustainability commitments are driving procurement decisions.

The recycling segment of the market is experiencing the fastest growth, with a CAGR exceeding 12%. Recovery of neodymium and other rare earth elements from end-of-life products represents a significant opportunity to address both environmental concerns and supply constraints. Current recycling rates remain low at approximately 1% of total rare earth materials, indicating substantial room for market expansion.

Price volatility remains a significant market factor. Historical data shows price fluctuations of up to 600% during supply disruptions, highlighting the strategic importance of these materials. This volatility has accelerated research into alternative magnet technologies, including iron nitride and samarium-cobalt systems, though these alternatives currently lack the performance characteristics of neodymium-based magnets in most applications.

Consumer electronics and industrial automation sectors are expected to emerge as the next major growth drivers for rare earth magnets, with particular emphasis on miniaturized high-performance applications requiring strong magnetic fields in compact designs.

Current State and Challenges in Rare Earth Magnet Production

The global rare earth magnet industry is currently dominated by China, which controls approximately 85% of the world's rare earth processing capacity. This concentration presents significant geopolitical and supply chain risks for other nations, particularly as demand for these materials continues to rise with the growth of green technologies. The production of neodymium magnets, which represent the most powerful permanent magnets commercially available, faces several critical challenges that impact both economic viability and environmental sustainability.

Mining and extraction processes for rare earth elements present substantial environmental concerns. Traditional methods generate large volumes of toxic waste, including radioactive materials like thorium and uranium that occur naturally alongside rare earth deposits. The processing of one ton of rare earth elements typically produces 2,000 tons of toxic waste, creating significant environmental management challenges. Water contamination from acid leaching and chemical processing represents another major environmental hazard in production regions.

Energy consumption in rare earth magnet production is exceptionally high, contributing to its carbon footprint. The separation and purification of individual rare earth elements require multiple chemical processes that are both energy-intensive and chemically demanding. The sintering process used to create the final magnet products operates at temperatures exceeding 1,000°C, further increasing energy requirements.

Resource depletion presents a long-term sustainability challenge. While rare earth elements are not actually rare in the Earth's crust, economically viable concentrations are limited. Current extraction rates, particularly for critical elements like neodymium and dysprosium, raise concerns about future availability as demand continues to accelerate with the expansion of electric vehicles and renewable energy technologies.

Recycling infrastructure for rare earth magnets remains underdeveloped globally. Less than 1% of rare earth elements are currently recovered through recycling processes, representing a significant missed opportunity for circular economy approaches. Technical challenges in separating these elements from end-of-life products, combined with insufficient collection systems, hamper recycling efforts.

Regulatory frameworks governing rare earth mining and processing vary widely across jurisdictions, creating an uneven playing field for environmental compliance. Countries with stricter environmental regulations often find themselves at an economic disadvantage compared to regions with more lenient standards, driving production toward areas with fewer environmental protections.

Recent technological innovations are beginning to address some of these challenges. Hydrometallurgical processes that reduce chemical usage, direct extraction methods that minimize waste generation, and advanced recycling technologies show promise for improving the environmental profile of rare earth magnet production, though widespread implementation remains limited.

Mining and extraction processes for rare earth elements present substantial environmental concerns. Traditional methods generate large volumes of toxic waste, including radioactive materials like thorium and uranium that occur naturally alongside rare earth deposits. The processing of one ton of rare earth elements typically produces 2,000 tons of toxic waste, creating significant environmental management challenges. Water contamination from acid leaching and chemical processing represents another major environmental hazard in production regions.

Energy consumption in rare earth magnet production is exceptionally high, contributing to its carbon footprint. The separation and purification of individual rare earth elements require multiple chemical processes that are both energy-intensive and chemically demanding. The sintering process used to create the final magnet products operates at temperatures exceeding 1,000°C, further increasing energy requirements.

Resource depletion presents a long-term sustainability challenge. While rare earth elements are not actually rare in the Earth's crust, economically viable concentrations are limited. Current extraction rates, particularly for critical elements like neodymium and dysprosium, raise concerns about future availability as demand continues to accelerate with the expansion of electric vehicles and renewable energy technologies.

Recycling infrastructure for rare earth magnets remains underdeveloped globally. Less than 1% of rare earth elements are currently recovered through recycling processes, representing a significant missed opportunity for circular economy approaches. Technical challenges in separating these elements from end-of-life products, combined with insufficient collection systems, hamper recycling efforts.

Regulatory frameworks governing rare earth mining and processing vary widely across jurisdictions, creating an uneven playing field for environmental compliance. Countries with stricter environmental regulations often find themselves at an economic disadvantage compared to regions with more lenient standards, driving production toward areas with fewer environmental protections.

Recent technological innovations are beginning to address some of these challenges. Hydrometallurgical processes that reduce chemical usage, direct extraction methods that minimize waste generation, and advanced recycling technologies show promise for improving the environmental profile of rare earth magnet production, though widespread implementation remains limited.

Current Environmental Solutions in Magnet Manufacturing

01 Environmental impact of rare earth mining and extraction

The mining and extraction of rare earth elements, including neodymium used in magnets, has significant environmental impacts. These processes generate toxic waste, contaminate soil and water, and release radioactive materials. The conventional extraction methods involve harsh chemicals and energy-intensive processes that contribute to environmental degradation. Innovations in this area focus on developing more sustainable mining practices and reducing the ecological footprint of rare earth element production.- Environmental impact of rare earth mining and extraction: The mining and extraction of rare earth elements, including neodymium used in magnets, has significant environmental consequences. These processes generate toxic waste, contaminate soil and water sources, and can release radioactive materials. The conventional extraction methods involve harsh chemicals and energy-intensive processes that contribute to environmental degradation. Innovations in this area focus on developing more sustainable mining practices and reducing the ecological footprint of rare earth element production.

- Recycling and recovery methods for neodymium magnets: Recycling technologies for neodymium magnets and other rare earth elements help mitigate environmental impacts by reducing the need for new mining operations. These methods include hydrometallurgical processes, pyrometallurgical techniques, and direct reuse approaches that can recover valuable materials from end-of-life products. Advanced recycling methods aim to separate and purify rare earth elements efficiently while minimizing waste generation and energy consumption, creating a more circular economy for these critical materials.

- Sustainable manufacturing processes for neodymium magnets: Innovations in manufacturing processes for neodymium magnets focus on reducing environmental impact through cleaner production methods. These include techniques that minimize waste generation, reduce energy consumption, and limit the use of harmful chemicals. Some approaches involve alternative sintering methods, near-net-shape manufacturing to reduce material waste, and process optimizations that improve resource efficiency. These sustainable manufacturing processes aim to maintain the high performance of neodymium magnets while decreasing their environmental footprint.

- Alternative materials and magnet compositions with reduced environmental impact: Research into alternative materials and modified compositions aims to reduce dependence on rare earth elements with high environmental impact. These innovations include developing magnets with lower rare earth content, exploring substitute materials with similar magnetic properties, and creating hybrid designs that optimize performance while minimizing environmental concerns. Some approaches focus on reducing or eliminating heavy rare earth elements like dysprosium, which have particularly problematic supply chains and environmental impacts, while maintaining necessary magnetic properties for various applications.

- Life cycle assessment and environmental regulations for rare earth industries: Life cycle assessment methodologies evaluate the environmental impact of neodymium magnets throughout their entire life cycle, from mining to disposal. These assessments help identify environmental hotspots and guide improvement efforts. Additionally, evolving environmental regulations worldwide are imposing stricter standards on rare earth mining, processing, and waste management. Compliance with these regulations drives innovation in cleaner technologies and more sustainable practices across the rare earth element supply chain, including the production and disposal of neodymium magnets.

02 Recycling and recovery methods for neodymium magnets

Recycling technologies for neodymium magnets and other rare earth elements help mitigate environmental impacts by reducing the need for primary mining. These methods include hydrometallurgical processes, pyrometallurgical techniques, and direct reuse approaches. Advanced recycling technologies can recover rare earth elements from end-of-life products such as motors, generators, and electronic devices, creating a more circular economy for these critical materials while reducing waste and environmental contamination.Expand Specific Solutions03 Cleaner production technologies for rare earth magnets

Innovations in manufacturing processes for neodymium magnets focus on reducing environmental impacts through cleaner production technologies. These include improved sintering methods, reduced use of hazardous chemicals, energy-efficient processing, and waste minimization techniques. Alternative production pathways that require fewer toxic inputs and generate less pollution are being developed to make the manufacturing of rare earth magnets more environmentally sustainable while maintaining their performance characteristics.Expand Specific Solutions04 Alternative materials and reduced rare earth content

Research into alternative magnetic materials and designs aims to reduce dependence on rare earth elements with high environmental impacts. This includes developing magnets with lower neodymium content, finding substitute materials with similar magnetic properties, and creating composite magnets that maintain performance while using fewer critical elements. These approaches help minimize the environmental footprint associated with rare earth mining and processing while addressing supply chain vulnerabilities.Expand Specific Solutions05 Life cycle assessment and environmental management

Life cycle assessment methodologies evaluate the environmental impacts of neodymium magnets from raw material extraction through manufacturing, use, and disposal. These assessments help identify environmental hotspots and guide improvements in production processes. Environmental management systems for rare earth element processing include pollution control technologies, waste treatment methods, and monitoring protocols to minimize ecological damage and ensure regulatory compliance throughout the magnet production chain.Expand Specific Solutions

Key Industry Players in Rare Earth Magnet Supply Chain

The neodymium magnets versus rare earth environmental impact assessment landscape is currently in a mature development phase, with growing market demand driven by clean energy technologies and electronics. The global market for rare earth magnets exceeds $15 billion annually, with projected growth rates of 8-10%. Leading companies like Shin-Etsu Chemical, TDK Corp, and Beijing Zhong Ke San Huan High-Tech are advancing recycling technologies to address environmental concerns, while Guangdong Bangpu and Cyclic Materials are pioneering innovative recovery methods. Research institutions including University of Birmingham and Worcester Polytechnic Institute are developing more sustainable extraction processes. The competitive landscape is shifting toward circular economy approaches as companies respond to increasing regulatory pressure and consumer demand for environmentally responsible rare earth magnet production.

Beijing Zhong Ke San Huan High-Tech Co., Ltd.

Technical Solution: Beijing Zhong Ke San Huan has developed a comprehensive environmental impact reduction strategy for neodymium magnet production. Their approach includes a patented hydrometallurgical process that reduces acid consumption by approximately 30% compared to traditional methods. The company has implemented a closed-loop recycling system that recovers up to 95% of rare earth elements from production waste and end-of-life magnets. Their manufacturing facilities utilize energy-efficient sintering processes that reduce energy consumption by 25% while maintaining magnetic performance. Additionally, they've pioneered water recycling technologies that decrease freshwater usage by 40% in the production process. The company has also invested in emission control systems that capture over 98% of harmful gases and particulates, significantly reducing air pollution compared to industry standards.

Strengths: Advanced recycling capabilities with high recovery rates; significant reduction in chemical usage; comprehensive waste management system. Weaknesses: Still dependent on mining for primary materials; recycling processes require substantial energy input; higher production costs compared to less environmentally conscious competitors.

Shin-Etsu Chemical Co., Ltd.

Technical Solution: Shin-Etsu Chemical has developed an innovative "grain boundary diffusion" process for neodymium magnets that significantly reduces the amount of heavy rare earth elements required while maintaining high coercivity. This technology allows for up to 60% reduction in dysprosium usage, a particularly critical and environmentally problematic rare earth element. Their manufacturing facilities implement strict water purification systems that remove over 99% of contaminants before discharge. The company has pioneered a molten salt electrolysis method that reduces CO2 emissions by approximately 35% compared to conventional extraction processes. Additionally, Shin-Etsu has established a comprehensive life cycle assessment program that tracks environmental impacts from mining through disposal, allowing for targeted improvements throughout the value chain. Their facilities in Japan operate under some of the world's strictest environmental regulations, with emissions well below mandated limits.

Strengths: Significant reduction in critical heavy rare earth usage; advanced manufacturing processes with lower environmental footprint; comprehensive environmental monitoring systems. Weaknesses: Still requires mining operations for raw materials; energy-intensive production processes; higher production costs compared to competitors with less stringent environmental controls.

Critical Patents and Innovations in Sustainable Magnet Production

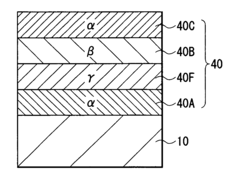

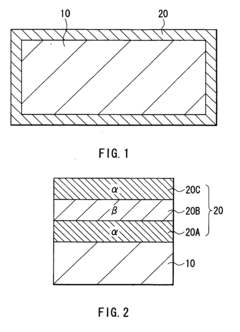

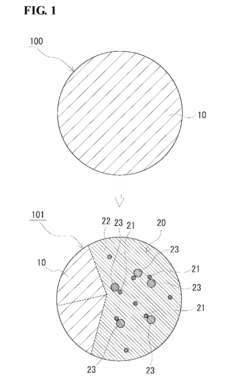

Rare-earth magnet

PatentActiveUS20070077454A1

Innovation

- A rare-earth magnet with a protective film comprising three or more layers of different crystalline structures, including polycrystalline and columnar-crystalline structures, which enhances the compactness and corrosion resistance by preventing the spread of corrosion materials across grain boundaries.

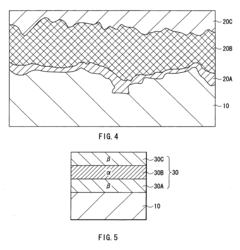

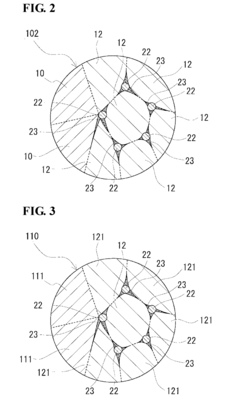

Rare-earth magnet and method for producing rare-earth magnet

PatentInactiveUS20180342338A1

Innovation

- A rare-earth magnet with a nanocomposite microstructure containing an Fe phase, a SmFeN phase, and an MeB phase, where the Me represents elements from groups 4, 5, and 6 of the periodic table, is produced using a method involving hydrogenation-disproportionation, pressure-forming, desorption-recombination, and nitriding treatments to refine the microstructure and enhance magnetic properties.

Regulatory Framework for Rare Earth Mining and Processing

The regulatory landscape governing rare earth mining and processing has evolved significantly over the past decades, reflecting growing awareness of environmental impacts. In the United States, the Environmental Protection Agency (EPA) enforces the Resource Conservation and Recovery Act (RCRA) and the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), which regulate waste management and remediation of contaminated sites. These regulations directly impact neodymium magnet production by imposing strict requirements on the handling of toxic byproducts like thorium and uranium.

The European Union has implemented the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which requires manufacturers to register chemical substances and evaluate their risks. Additionally, the EU's Restriction of Hazardous Substances (RoHS) Directive limits the use of certain hazardous substances in electrical and electronic equipment, affecting downstream applications of rare earth magnets.

China, as the dominant producer of rare earth elements, has established a comprehensive regulatory framework through its Rare Earth Industry Development Plan. This includes production quotas, resource taxes, and environmental standards specific to rare earth mining and processing. The Chinese government has consolidated the industry under six state-owned enterprises to better enforce environmental regulations and combat illegal mining operations that previously caused significant environmental damage.

International frameworks also play a crucial role in shaping regulatory approaches. The Basel Convention regulates transboundary movements of hazardous wastes, while the Minamata Convention addresses mercury emissions—a significant concern in some rare earth processing methods. The International Organization for Standardization (ISO) has developed standards for environmental management systems that many rare earth producers are adopting to demonstrate compliance.

Emerging regulatory trends include life-cycle assessment requirements, extended producer responsibility, and circular economy principles. These approaches aim to address environmental impacts throughout the entire supply chain of rare earth magnets, from mining to end-of-life management. Several jurisdictions are developing traceability systems to verify that rare earth materials are sourced from environmentally responsible operations.

The regulatory disparities between major producing regions create challenges for global supply chains. Companies operating in multiple jurisdictions must navigate complex compliance requirements, while those in regions with less stringent regulations may gain short-term competitive advantages at the expense of environmental protection. Harmonization efforts through international agreements and industry standards are gradually addressing these disparities.

The European Union has implemented the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which requires manufacturers to register chemical substances and evaluate their risks. Additionally, the EU's Restriction of Hazardous Substances (RoHS) Directive limits the use of certain hazardous substances in electrical and electronic equipment, affecting downstream applications of rare earth magnets.

China, as the dominant producer of rare earth elements, has established a comprehensive regulatory framework through its Rare Earth Industry Development Plan. This includes production quotas, resource taxes, and environmental standards specific to rare earth mining and processing. The Chinese government has consolidated the industry under six state-owned enterprises to better enforce environmental regulations and combat illegal mining operations that previously caused significant environmental damage.

International frameworks also play a crucial role in shaping regulatory approaches. The Basel Convention regulates transboundary movements of hazardous wastes, while the Minamata Convention addresses mercury emissions—a significant concern in some rare earth processing methods. The International Organization for Standardization (ISO) has developed standards for environmental management systems that many rare earth producers are adopting to demonstrate compliance.

Emerging regulatory trends include life-cycle assessment requirements, extended producer responsibility, and circular economy principles. These approaches aim to address environmental impacts throughout the entire supply chain of rare earth magnets, from mining to end-of-life management. Several jurisdictions are developing traceability systems to verify that rare earth materials are sourced from environmentally responsible operations.

The regulatory disparities between major producing regions create challenges for global supply chains. Companies operating in multiple jurisdictions must navigate complex compliance requirements, while those in regions with less stringent regulations may gain short-term competitive advantages at the expense of environmental protection. Harmonization efforts through international agreements and industry standards are gradually addressing these disparities.

Life Cycle Assessment of Neodymium vs Other Magnetic Materials

The life cycle assessment (LCA) of neodymium magnets compared to other magnetic materials reveals significant environmental distinctions across their entire existence - from raw material extraction to disposal. Neodymium magnets, belonging to the rare earth magnet family, demonstrate superior magnetic properties but come with considerable environmental costs.

Mining and extraction processes for neodymium involve extensive land disruption, with approximately 1 ton of rare earth elements requiring the processing of 1,200 tons of ore. This process generates substantial amounts of toxic waste including radioactive materials like thorium and uranium. Water consumption in neodymium processing exceeds 200 cubic meters per ton of material, significantly higher than ferrite magnet production.

Energy consumption represents another critical environmental factor. The production of neodymium magnets requires approximately 30-40% more energy than traditional ferrite magnets. Manufacturing one kilogram of neodymium magnets consumes roughly 30-40 kWh of electricity compared to 5-10 kWh for ferrite alternatives.

Carbon footprint analysis indicates that neodymium magnets generate 12-15 kg CO2 equivalent per kilogram of finished product, whereas ferrite magnets produce only 2-4 kg CO2 equivalent. Alnico magnets fall between these values at 6-9 kg CO2 equivalent per kilogram.

Chemical processing during neodymium production utilizes hazardous substances including strong acids, organic solvents, and heavy metals. These processes generate approximately 2,000 cubic meters of acidic wastewater and 1 ton of radioactive waste per ton of rare earth elements produced.

The use phase presents a more favorable environmental profile for neodymium magnets. Their superior magnetic strength allows for smaller, more efficient devices that consume less energy during operation. Electric motors utilizing neodymium magnets typically demonstrate 5-15% higher efficiency than those using ferrite magnets, potentially offsetting initial production impacts over extended product lifespans.

End-of-life considerations reveal additional complexities. Recycling rates for neodymium magnets remain below 1% globally, compared to approximately 50-60% for ferrite magnets. The complex metallurgical structure of neodymium magnets complicates recycling processes, though emerging hydrometallurgical and pyrometallurgical techniques show promise for improving recovery rates.

When comparing overall environmental impact across complete life cycles, neodymium magnets demonstrate higher initial environmental costs but potential long-term benefits through operational efficiency. The environmental break-even point typically occurs after 3-7 years of operation, depending on the specific application and usage intensity.

Mining and extraction processes for neodymium involve extensive land disruption, with approximately 1 ton of rare earth elements requiring the processing of 1,200 tons of ore. This process generates substantial amounts of toxic waste including radioactive materials like thorium and uranium. Water consumption in neodymium processing exceeds 200 cubic meters per ton of material, significantly higher than ferrite magnet production.

Energy consumption represents another critical environmental factor. The production of neodymium magnets requires approximately 30-40% more energy than traditional ferrite magnets. Manufacturing one kilogram of neodymium magnets consumes roughly 30-40 kWh of electricity compared to 5-10 kWh for ferrite alternatives.

Carbon footprint analysis indicates that neodymium magnets generate 12-15 kg CO2 equivalent per kilogram of finished product, whereas ferrite magnets produce only 2-4 kg CO2 equivalent. Alnico magnets fall between these values at 6-9 kg CO2 equivalent per kilogram.

Chemical processing during neodymium production utilizes hazardous substances including strong acids, organic solvents, and heavy metals. These processes generate approximately 2,000 cubic meters of acidic wastewater and 1 ton of radioactive waste per ton of rare earth elements produced.

The use phase presents a more favorable environmental profile for neodymium magnets. Their superior magnetic strength allows for smaller, more efficient devices that consume less energy during operation. Electric motors utilizing neodymium magnets typically demonstrate 5-15% higher efficiency than those using ferrite magnets, potentially offsetting initial production impacts over extended product lifespans.

End-of-life considerations reveal additional complexities. Recycling rates for neodymium magnets remain below 1% globally, compared to approximately 50-60% for ferrite magnets. The complex metallurgical structure of neodymium magnets complicates recycling processes, though emerging hydrometallurgical and pyrometallurgical techniques show promise for improving recovery rates.

When comparing overall environmental impact across complete life cycles, neodymium magnets demonstrate higher initial environmental costs but potential long-term benefits through operational efficiency. The environmental break-even point typically occurs after 3-7 years of operation, depending on the specific application and usage intensity.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!