Neodymium Magnets vs Ceramic: Cost-Benefit Analysis for Motors

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Magnet Technology Evolution and Performance Objectives

Magnetic technology has undergone significant evolution since the discovery of lodestone by ancient civilizations. The 20th century marked a pivotal era with the development of Alnico magnets in the 1920s, followed by ferrite (ceramic) magnets in the 1950s. The revolutionary breakthrough came in 1982 when neodymium magnets (NdFeB) were independently developed by General Motors and Sumitomo Special Metals, offering unprecedented magnetic strength in a compact form factor.

The performance trajectory of magnetic materials shows a clear trend toward higher energy products (BHmax), with neodymium magnets achieving up to 52 MGOe compared to ceramic magnets' modest 4 MGOe. This exponential improvement has enabled significant miniaturization and efficiency gains in motor applications across industries, from automotive to consumer electronics.

Current market dynamics reveal a growing tension between performance requirements and resource constraints. Neodymium, as a rare earth element, faces supply chain vulnerabilities with over 85% of global production concentrated in China. Meanwhile, ceramic magnets, composed primarily of iron oxide and strontium or barium carbonate, offer resource stability but with performance limitations.

The technical objectives for magnet selection in motor applications must balance multiple factors. Primary performance metrics include magnetic flux density (Tesla), coercivity (resistance to demagnetization), temperature stability (maximum operating temperature and reversible/irreversible losses), and mechanical properties (brittleness and machinability). Secondary considerations encompass corrosion resistance, manufacturing complexity, and environmental impact throughout the lifecycle.

For motor applications specifically, the performance objectives extend to power density (kW/kg), efficiency across operating ranges, thermal management capabilities, and reliability under various stress conditions. The ideal magnet solution must optimize these parameters while considering total cost of ownership rather than merely material costs.

Looking forward, the technology roadmap indicates several promising directions. These include development of reduced-dysprosium neodymium formulations to decrease reliance on the most supply-constrained rare earth elements, hybrid designs combining multiple magnetic materials to optimize performance/cost ratios, and novel manufacturing techniques such as additive manufacturing of magnets with customized field orientations.

The ultimate performance objective remains achieving the highest possible energy density at economically viable costs, with sufficient supply chain resilience to support mass production. This balance between technical performance, economic considerations, and strategic resource management defines the current landscape of magnet technology evolution for motor applications.

The performance trajectory of magnetic materials shows a clear trend toward higher energy products (BHmax), with neodymium magnets achieving up to 52 MGOe compared to ceramic magnets' modest 4 MGOe. This exponential improvement has enabled significant miniaturization and efficiency gains in motor applications across industries, from automotive to consumer electronics.

Current market dynamics reveal a growing tension between performance requirements and resource constraints. Neodymium, as a rare earth element, faces supply chain vulnerabilities with over 85% of global production concentrated in China. Meanwhile, ceramic magnets, composed primarily of iron oxide and strontium or barium carbonate, offer resource stability but with performance limitations.

The technical objectives for magnet selection in motor applications must balance multiple factors. Primary performance metrics include magnetic flux density (Tesla), coercivity (resistance to demagnetization), temperature stability (maximum operating temperature and reversible/irreversible losses), and mechanical properties (brittleness and machinability). Secondary considerations encompass corrosion resistance, manufacturing complexity, and environmental impact throughout the lifecycle.

For motor applications specifically, the performance objectives extend to power density (kW/kg), efficiency across operating ranges, thermal management capabilities, and reliability under various stress conditions. The ideal magnet solution must optimize these parameters while considering total cost of ownership rather than merely material costs.

Looking forward, the technology roadmap indicates several promising directions. These include development of reduced-dysprosium neodymium formulations to decrease reliance on the most supply-constrained rare earth elements, hybrid designs combining multiple magnetic materials to optimize performance/cost ratios, and novel manufacturing techniques such as additive manufacturing of magnets with customized field orientations.

The ultimate performance objective remains achieving the highest possible energy density at economically viable costs, with sufficient supply chain resilience to support mass production. This balance between technical performance, economic considerations, and strategic resource management defines the current landscape of magnet technology evolution for motor applications.

Market Demand Analysis for Motor Magnets

The global market for motor magnets has experienced significant growth over the past decade, primarily driven by the expanding electric vehicle (EV) industry, renewable energy systems, and industrial automation. The demand for high-performance motors has created a competitive landscape where manufacturers must balance cost considerations with performance requirements, placing magnet selection at the forefront of design decisions.

The motor magnet market was valued at approximately $15.7 billion in 2022 and is projected to reach $29.3 billion by 2030, growing at a CAGR of 8.1%. This growth is particularly pronounced in the automotive sector, where the transition to electric mobility has accelerated demand for efficient motor solutions. The EV market alone is expected to consume over 40% of all high-performance magnets produced globally by 2025.

When comparing neodymium and ceramic magnets specifically, market analysis reveals distinct demand patterns across different industries. Neodymium magnets command a premium segment of the market, with prices ranging from $50-120 per kilogram depending on grade and quantity, compared to ceramic magnets at $5-15 per kilogram. Despite this price differential, neodymium magnets maintain strong demand in applications where size and weight constraints are critical factors.

The renewable energy sector represents another significant market driver, with wind turbine generators requiring substantial quantities of permanent magnets. Industry reports indicate that a typical 3MW direct-drive wind turbine can contain up to 2 tons of neodymium magnets, highlighting the volume potential in this sector despite ongoing efforts to reduce rare earth dependency.

Regional market analysis shows China dominating the supply chain for neodymium magnets, controlling approximately 85% of global rare earth processing capacity. This concentration has prompted increased demand for ceramic magnets in price-sensitive markets and applications where geopolitical supply chain concerns outweigh performance requirements.

Consumer electronics and industrial automation sectors demonstrate a more balanced demand profile between the two magnet types. While premium products typically utilize neodymium solutions, mass-market applications often opt for ceramic alternatives to maintain competitive pricing. This segmentation is expected to continue, with neodymium magnets experiencing higher growth rates (9.3% CAGR) compared to ceramic magnets (6.2% CAGR).

Market surveys indicate that motor designers increasingly evaluate magnets based on total cost of ownership rather than initial acquisition cost. This trend favors neodymium magnets in applications where their superior magnetic properties enable smaller motor designs, reduced copper usage, and higher efficiency ratings that offset their higher initial cost through operational savings over the product lifecycle.

The motor magnet market was valued at approximately $15.7 billion in 2022 and is projected to reach $29.3 billion by 2030, growing at a CAGR of 8.1%. This growth is particularly pronounced in the automotive sector, where the transition to electric mobility has accelerated demand for efficient motor solutions. The EV market alone is expected to consume over 40% of all high-performance magnets produced globally by 2025.

When comparing neodymium and ceramic magnets specifically, market analysis reveals distinct demand patterns across different industries. Neodymium magnets command a premium segment of the market, with prices ranging from $50-120 per kilogram depending on grade and quantity, compared to ceramic magnets at $5-15 per kilogram. Despite this price differential, neodymium magnets maintain strong demand in applications where size and weight constraints are critical factors.

The renewable energy sector represents another significant market driver, with wind turbine generators requiring substantial quantities of permanent magnets. Industry reports indicate that a typical 3MW direct-drive wind turbine can contain up to 2 tons of neodymium magnets, highlighting the volume potential in this sector despite ongoing efforts to reduce rare earth dependency.

Regional market analysis shows China dominating the supply chain for neodymium magnets, controlling approximately 85% of global rare earth processing capacity. This concentration has prompted increased demand for ceramic magnets in price-sensitive markets and applications where geopolitical supply chain concerns outweigh performance requirements.

Consumer electronics and industrial automation sectors demonstrate a more balanced demand profile between the two magnet types. While premium products typically utilize neodymium solutions, mass-market applications often opt for ceramic alternatives to maintain competitive pricing. This segmentation is expected to continue, with neodymium magnets experiencing higher growth rates (9.3% CAGR) compared to ceramic magnets (6.2% CAGR).

Market surveys indicate that motor designers increasingly evaluate magnets based on total cost of ownership rather than initial acquisition cost. This trend favors neodymium magnets in applications where their superior magnetic properties enable smaller motor designs, reduced copper usage, and higher efficiency ratings that offset their higher initial cost through operational savings over the product lifecycle.

Current State and Challenges in Magnet Technologies

The global magnet technology landscape is currently dominated by two primary types for motor applications: neodymium (NdFeB) and ceramic (ferrite) magnets. Neodymium magnets, discovered in the 1980s, represent the strongest permanent magnets commercially available, offering magnetic energy products exceeding 50 MGOe. In contrast, ceramic magnets, developed in the 1950s, provide more modest magnetic properties with energy products typically below 5 MGOe.

The current market shows a clear dichotomy in application distribution. High-performance sectors including electric vehicles, wind turbines, and premium industrial motors predominantly utilize neodymium magnets despite their higher costs. Meanwhile, ceramic magnets maintain dominance in cost-sensitive applications such as household appliances, automotive sensors, and standard industrial motors where performance requirements are less stringent.

Supply chain dynamics present significant challenges for both technologies. Neodymium magnets face critical raw material constraints, with over 85% of rare earth mining and 90% of processing concentrated in China. Recent export restrictions and price volatility have intensified concerns about supply security. The average price of neodymium oxide has fluctuated between $50-120/kg in the past five years, creating significant cost uncertainties for motor manufacturers.

Environmental and sustainability challenges also differentiate these technologies. Neodymium extraction and processing generate substantial environmental impacts, including acidification, radioactive waste management issues, and high carbon emissions. The carbon footprint of neodymium magnet production is estimated at 20-30 kg CO₂ equivalent per kilogram, approximately five times higher than ceramic magnet production.

Technical limitations present ongoing challenges for both technologies. Neodymium magnets suffer from temperature sensitivity (typical maximum operating temperatures of 80-180°C depending on grade) and corrosion susceptibility, requiring protective coatings that add manufacturing complexity. Ceramic magnets, while thermally stable and corrosion-resistant, face limitations in miniaturization due to their lower energy density, creating design constraints for compact motor applications.

Manufacturing scalability presents divergent challenges. Ceramic magnet production utilizes abundant raw materials and established manufacturing processes, allowing for relatively straightforward scaling. Conversely, neodymium magnet production faces bottlenecks in specialized processing equipment, skilled labor requirements, and complex quality control procedures, limiting rapid production expansion.

Recent technological advancements have focused on addressing these limitations through grain boundary diffusion processes for neodymium magnets, improving their temperature stability, and developing advanced ceramic formulations with enhanced magnetic properties. However, the fundamental performance gap between these technologies remains a persistent challenge for motor designers seeking optimal cost-performance balance.

The current market shows a clear dichotomy in application distribution. High-performance sectors including electric vehicles, wind turbines, and premium industrial motors predominantly utilize neodymium magnets despite their higher costs. Meanwhile, ceramic magnets maintain dominance in cost-sensitive applications such as household appliances, automotive sensors, and standard industrial motors where performance requirements are less stringent.

Supply chain dynamics present significant challenges for both technologies. Neodymium magnets face critical raw material constraints, with over 85% of rare earth mining and 90% of processing concentrated in China. Recent export restrictions and price volatility have intensified concerns about supply security. The average price of neodymium oxide has fluctuated between $50-120/kg in the past five years, creating significant cost uncertainties for motor manufacturers.

Environmental and sustainability challenges also differentiate these technologies. Neodymium extraction and processing generate substantial environmental impacts, including acidification, radioactive waste management issues, and high carbon emissions. The carbon footprint of neodymium magnet production is estimated at 20-30 kg CO₂ equivalent per kilogram, approximately five times higher than ceramic magnet production.

Technical limitations present ongoing challenges for both technologies. Neodymium magnets suffer from temperature sensitivity (typical maximum operating temperatures of 80-180°C depending on grade) and corrosion susceptibility, requiring protective coatings that add manufacturing complexity. Ceramic magnets, while thermally stable and corrosion-resistant, face limitations in miniaturization due to their lower energy density, creating design constraints for compact motor applications.

Manufacturing scalability presents divergent challenges. Ceramic magnet production utilizes abundant raw materials and established manufacturing processes, allowing for relatively straightforward scaling. Conversely, neodymium magnet production faces bottlenecks in specialized processing equipment, skilled labor requirements, and complex quality control procedures, limiting rapid production expansion.

Recent technological advancements have focused on addressing these limitations through grain boundary diffusion processes for neodymium magnets, improving their temperature stability, and developing advanced ceramic formulations with enhanced magnetic properties. However, the fundamental performance gap between these technologies remains a persistent challenge for motor designers seeking optimal cost-performance balance.

Comparative Analysis of Neodymium vs Ceramic Solutions

01 Cost-benefit analysis of neodymium versus ceramic magnets

Neodymium magnets offer superior magnetic strength but at a higher cost compared to ceramic magnets. This cost-benefit analysis examines the economic trade-offs between using high-performance neodymium magnets versus more affordable ceramic alternatives. The analysis considers factors such as initial investment, long-term performance, and application-specific requirements to determine the most cost-effective solution for different use cases.- Manufacturing cost comparison between neodymium and ceramic magnets: Neodymium magnets generally have higher manufacturing costs compared to ceramic magnets due to the rare earth materials required for production. The manufacturing process for neodymium magnets involves more complex steps and higher energy consumption. Ceramic magnets, being made from iron oxide and strontium or barium carbonate, have lower raw material costs and simpler production processes, making them more economical for large-scale applications where extreme magnetic strength is not required.

- Performance characteristics and application suitability: Neodymium magnets offer superior magnetic strength and performance in compact sizes, making them ideal for applications requiring strong magnetic fields in limited spaces. Ceramic magnets, while less powerful, provide adequate performance for many standard applications and have better temperature stability and corrosion resistance in certain environments. The choice between these magnet types depends on specific application requirements, with neodymium magnets preferred for high-performance, space-constrained applications, and ceramic magnets for cost-sensitive, less demanding uses.

- Longevity and environmental considerations: Ceramic magnets typically offer better long-term stability in harsh environments compared to uncoated neodymium magnets, which are prone to corrosion. While neodymium magnets can be coated for protection, this adds to their cost. From an environmental perspective, ceramic magnets have advantages as they don't contain rare earth elements that involve environmentally problematic mining and processing. The production of neodymium magnets has higher environmental impact due to the extraction and processing of rare earth materials.

- Total cost of ownership analysis: When considering the total cost of ownership, factors beyond initial purchase price become significant. Neodymium magnets, despite higher upfront costs, may offer better value in applications where their superior magnetic strength reduces the overall system size or weight, or improves energy efficiency. Ceramic magnets present lower initial investment and may be more cost-effective for applications with less demanding magnetic requirements or where large volumes are needed. The decision should consider installation, maintenance, replacement frequency, and system efficiency impacts.

- Supply chain and market considerations: The supply chain for neodymium magnets faces challenges due to the concentration of rare earth mining and processing in specific regions, leading to potential price volatility and supply risks. Ceramic magnets have more stable pricing and wider manufacturing distribution globally. Market trends show increasing demand for both types, with neodymium magnets growing in high-tech sectors and ceramic magnets maintaining strong presence in traditional and cost-sensitive applications. Strategic sourcing decisions should consider these supply chain dynamics and potential future price trends.

02 Manufacturing processes and cost implications

The manufacturing processes for neodymium and ceramic magnets differ significantly, impacting their production costs. Neodymium magnets require rare earth materials and complex processing techniques, resulting in higher manufacturing expenses. Ceramic magnets utilize more abundant materials and simpler production methods, making them more economical to produce at scale. These manufacturing differences directly influence the market price and availability of both magnet types.Expand Specific Solutions03 Performance characteristics and application suitability

Neodymium magnets provide stronger magnetic fields in smaller sizes, making them ideal for applications requiring high performance in limited space. Ceramic magnets offer moderate magnetic strength but excel in high-temperature environments and resist demagnetization better than neodymium magnets. The selection between these magnet types depends on specific application requirements, including operating temperature, space constraints, and required magnetic field strength.Expand Specific Solutions04 Environmental and sustainability considerations

The environmental impact of neodymium and ceramic magnets differs significantly throughout their lifecycle. Neodymium magnet production involves mining rare earth elements, which can cause environmental degradation and generate toxic waste. Ceramic magnets use more abundant materials with generally lower environmental impact during extraction and processing. Recycling challenges and end-of-life considerations also factor into the overall sustainability assessment of both magnet types.Expand Specific Solutions05 Technological innovations affecting cost-benefit ratios

Recent technological advancements are changing the cost-benefit equation for both neodymium and ceramic magnets. Innovations in manufacturing processes are reducing production costs for neodymium magnets, while improvements in ceramic magnet formulations are enhancing their performance capabilities. These developments are narrowing the performance gap between the two magnet types while also affecting their relative cost positions, potentially altering optimal selection criteria for various applications.Expand Specific Solutions

Leading Manufacturers and Market Competition

The neodymium versus ceramic magnets market for motors is currently in a mature growth phase with increasing specialization. The global market size is estimated at $15-20 billion, driven by growing demand in automotive, consumer electronics, and renewable energy sectors. Technologically, neodymium magnets offer superior magnetic strength and performance but at significantly higher costs, while ceramic magnets provide cost-effective solutions with adequate performance for many applications. Leading companies like TDK, Shin-Etsu Chemical, JL MAG Rare-Earth, and Robert Bosch have established strong positions through vertical integration and R&D investments. Research institutions such as HRL Laboratories and CNRS are advancing material science to address neodymium's cost and supply chain vulnerabilities while improving ceramic magnet performance for specific applications.

JL MAG Rare-Earth Co., Ltd.

Technical Solution: JL MAG has developed a comprehensive technical approach to neodymium magnet production focused on sustainability and cost optimization. Their "grain boundary diffusion" process reduces heavy rare earth content while maintaining high-temperature performance, achieving coercivity improvements of up to 40% with minimal dysprosium usage. The company employs a vertical integration strategy controlling the entire supply chain from rare earth mining to finished magnets, which helps mitigate price volatility. Their sintered NdFeB magnets achieve energy products of 38-52 MGOe, with specialized grades designed for high-temperature motor applications (up to 180°C). JL MAG has also developed hybrid solutions that strategically combine neodymium and ceramic magnets in motor designs to optimize cost-performance ratios for specific applications, particularly in household appliances and mid-range automotive systems.

Strengths: Vertical integration provides supply chain stability and cost control; advanced manufacturing techniques reduce rare earth content while maintaining performance; ability to customize magnet properties for specific motor applications. Weaknesses: Still dependent on volatile rare earth markets despite mitigation strategies; higher initial investment costs compared to ceramic-only solutions; manufacturing complexity requires sophisticated quality control systems.

Shin-Etsu Chemical Co., Ltd.

Technical Solution: Shin-Etsu Chemical has developed advanced neodymium magnets with reduced dysprosium content while maintaining high coercivity and temperature stability. Their patented grain boundary diffusion technology allows for selective application of heavy rare earth elements only where needed, reducing overall rare earth usage by up to 30% compared to conventional methods. The company has also pioneered high-performance neodymium magnets with maximum energy products exceeding 50 MGOe, significantly outperforming ceramic alternatives (which typically offer 1-5 MGOe). Their manufacturing process includes vacuum melting, strip casting, hydrogen decrepitation, jet milling to sub-micron particle sizes, and precision alignment during pressing under strong magnetic fields to achieve optimal crystal orientation.

Strengths: Superior magnetic performance with energy products 10-15 times higher than ceramic magnets; better temperature stability with proper formulation; smaller size for equivalent performance allowing motor miniaturization. Weaknesses: Significantly higher raw material costs (5-10x more expensive than ceramic); greater susceptibility to corrosion requiring specialized coatings; price volatility due to rare earth supply chain concerns.

Key Technical Innovations in Magnetic Materials

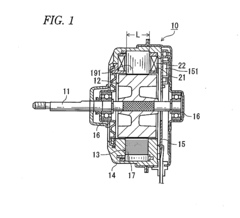

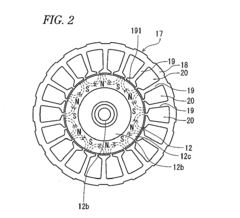

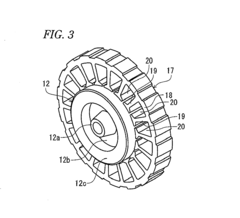

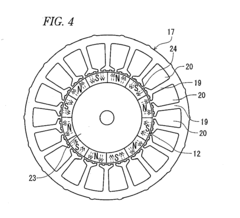

Permanent magnet motor

PatentInactiveEP2372871A2

Innovation

- A permanent magnet motor design utilizing a ferrite magnet with 18 slots and 12 poles, where the ferrite magnet is either a bond magnet or sintered magnet, integrated into the rotor, to achieve high efficiency at a lower cost by optimizing the stator core lamination thickness and magnetic field orientation.

Refrigeration lubricant composition and refrigerant working fluid composition

PatentActiveUS7794619B2

Innovation

- A refrigeration lubricant composition comprising an ester compound synthesized from a polyol and a fatty acid, combined with a five- or six-membered ring cyclic ether compound with an ester bonding, which provides excellent rustproof effects without the need for special processes like plating or coating, maintaining electrical insulation, compatibility with chlorine-free hydrofluorocarbons, and heat resistance.

Supply Chain Considerations and Raw Material Availability

The supply chain for motor magnets represents a critical factor in the cost-benefit analysis between neodymium and ceramic options. Neodymium magnets rely heavily on rare earth elements, primarily sourced from China, which controls approximately 85% of global rare earth production. This geographic concentration creates significant supply vulnerabilities, as evidenced by the 2010-2011 rare earth crisis when China restricted exports, causing neodymium prices to increase by over 750%. Such volatility continues to pose risks for manufacturers dependent on these materials.

Ceramic (ferrite) magnets, conversely, utilize iron oxide combined with strontium or barium carbonates - materials abundant globally with diversified supply sources. This widespread availability translates to more stable pricing and reduced geopolitical risk exposure. The supply chain for ceramic magnets demonstrates remarkable resilience against trade disputes and export restrictions that frequently impact rare earth elements.

Raw material extraction processes also differ substantially between these magnet types. Rare earth mining for neodymium involves extensive environmental challenges, including radioactive waste management and toxic chemical usage. These environmental concerns have led to stricter regulations in many regions, potentially constraining future supply. Ceramic magnet materials face fewer environmental restrictions, contributing to their more reliable availability.

Manufacturing capacity represents another critical consideration. While China dominates neodymium magnet production, ceramic magnet manufacturing capabilities exist across multiple regions including Europe, North America, and various Asian countries. This distributed manufacturing landscape provides motor designers with greater sourcing flexibility and reduced dependency on single-region suppliers.

Lead times and inventory management strategies also differ markedly between these technologies. Neodymium supply chains typically require longer lead times and more complex inventory management due to price volatility and supply uncertainties. Motor manufacturers using ceramic magnets generally benefit from more predictable procurement cycles and reduced working capital requirements for material stockpiling.

Future supply projections indicate continuing challenges for neodymium, with demand growth from electric vehicles and renewable energy potentially outpacing production capacity expansion. Several initiatives to develop alternative rare earth sources outside China are underway, though meaningful production diversification remains years away. Ceramic magnet raw materials face fewer supply constraints, with abundant reserves sufficient for decades of production at current consumption rates.

Ceramic (ferrite) magnets, conversely, utilize iron oxide combined with strontium or barium carbonates - materials abundant globally with diversified supply sources. This widespread availability translates to more stable pricing and reduced geopolitical risk exposure. The supply chain for ceramic magnets demonstrates remarkable resilience against trade disputes and export restrictions that frequently impact rare earth elements.

Raw material extraction processes also differ substantially between these magnet types. Rare earth mining for neodymium involves extensive environmental challenges, including radioactive waste management and toxic chemical usage. These environmental concerns have led to stricter regulations in many regions, potentially constraining future supply. Ceramic magnet materials face fewer environmental restrictions, contributing to their more reliable availability.

Manufacturing capacity represents another critical consideration. While China dominates neodymium magnet production, ceramic magnet manufacturing capabilities exist across multiple regions including Europe, North America, and various Asian countries. This distributed manufacturing landscape provides motor designers with greater sourcing flexibility and reduced dependency on single-region suppliers.

Lead times and inventory management strategies also differ markedly between these technologies. Neodymium supply chains typically require longer lead times and more complex inventory management due to price volatility and supply uncertainties. Motor manufacturers using ceramic magnets generally benefit from more predictable procurement cycles and reduced working capital requirements for material stockpiling.

Future supply projections indicate continuing challenges for neodymium, with demand growth from electric vehicles and renewable energy potentially outpacing production capacity expansion. Several initiatives to develop alternative rare earth sources outside China are underway, though meaningful production diversification remains years away. Ceramic magnet raw materials face fewer supply constraints, with abundant reserves sufficient for decades of production at current consumption rates.

Environmental Impact and Sustainability Assessment

The environmental impact of magnet production and usage represents a critical dimension in the comparative analysis between neodymium and ceramic magnets for motor applications. Neodymium magnets require extensive mining operations that cause significant land disruption, with approximately 20-25 tons of material processed for each ton of rare earth elements extracted. This mining process generates substantial amounts of toxic waste, including radioactive thorium and uranium compounds, which pose long-term environmental hazards if not properly managed.

Water consumption and contamination present another significant concern, particularly for neodymium production. The separation and refining processes typically consume 60-100 cubic meters of water per ton of rare earth concentrate, with wastewater often containing heavy metals and processing chemicals. By contrast, ceramic (ferrite) magnets utilize iron oxide as their primary component, which has a substantially lower environmental footprint during extraction and processing.

Carbon emissions across the lifecycle reveal notable differences between these magnet types. Neodymium magnet production generates approximately 12-15 kg CO2 equivalent per kilogram of finished magnet, whereas ceramic magnets produce only 3-5 kg CO2 equivalent per kilogram. This difference becomes particularly significant when considering large-scale motor manufacturing operations.

Recycling capabilities further differentiate these technologies from a sustainability perspective. Ceramic magnets, being simpler in composition, can be more readily recycled into new magnetic materials or repurposed for other applications. Neodymium magnets, despite their higher value, present recycling challenges due to their complex composition and the specialized processes required to separate the rare earth elements.

The operational environmental benefits must also be considered. Motors utilizing neodymium magnets typically achieve 10-15% higher energy efficiency compared to ceramic magnet alternatives, potentially offsetting their higher production environmental costs over the operational lifetime. For applications with continuous operation, this efficiency advantage can translate to substantial energy savings and reduced carbon emissions.

Regulatory considerations increasingly influence material selection decisions. Several jurisdictions have implemented or are developing regulations regarding rare earth element mining and processing, potentially affecting the supply chain stability and compliance requirements for neodymium magnets. The European Union's classification of certain rare earth elements as Critical Raw Materials exemplifies this regulatory trend, encouraging manufacturers to consider alternative solutions or improved recycling systems.

Water consumption and contamination present another significant concern, particularly for neodymium production. The separation and refining processes typically consume 60-100 cubic meters of water per ton of rare earth concentrate, with wastewater often containing heavy metals and processing chemicals. By contrast, ceramic (ferrite) magnets utilize iron oxide as their primary component, which has a substantially lower environmental footprint during extraction and processing.

Carbon emissions across the lifecycle reveal notable differences between these magnet types. Neodymium magnet production generates approximately 12-15 kg CO2 equivalent per kilogram of finished magnet, whereas ceramic magnets produce only 3-5 kg CO2 equivalent per kilogram. This difference becomes particularly significant when considering large-scale motor manufacturing operations.

Recycling capabilities further differentiate these technologies from a sustainability perspective. Ceramic magnets, being simpler in composition, can be more readily recycled into new magnetic materials or repurposed for other applications. Neodymium magnets, despite their higher value, present recycling challenges due to their complex composition and the specialized processes required to separate the rare earth elements.

The operational environmental benefits must also be considered. Motors utilizing neodymium magnets typically achieve 10-15% higher energy efficiency compared to ceramic magnet alternatives, potentially offsetting their higher production environmental costs over the operational lifetime. For applications with continuous operation, this efficiency advantage can translate to substantial energy savings and reduced carbon emissions.

Regulatory considerations increasingly influence material selection decisions. Several jurisdictions have implemented or are developing regulations regarding rare earth element mining and processing, potentially affecting the supply chain stability and compliance requirements for neodymium magnets. The European Union's classification of certain rare earth elements as Critical Raw Materials exemplifies this regulatory trend, encouraging manufacturers to consider alternative solutions or improved recycling systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!