Carbon-negative Concrete: A Comparison with Limestone-based Solutions

OCT 1, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Background and Objectives

Concrete production has been a significant contributor to global carbon emissions, accounting for approximately 8% of worldwide CO2 emissions. Traditional Portland cement, the primary binding agent in conventional concrete, requires high-temperature kilns that release substantial amounts of carbon dioxide through both the chemical process of limestone calcination and the burning of fossil fuels. This environmental impact has driven researchers and industry stakeholders to explore alternative concrete formulations that could reduce or even reverse this carbon footprint.

Carbon-negative concrete represents a revolutionary approach to construction materials, designed not only to minimize emissions but to actively sequester carbon dioxide from the atmosphere. The concept has evolved significantly over the past decade, with early experimental formulations giving way to commercially viable products. Unlike traditional concrete which remains carbon-positive throughout its lifecycle, carbon-negative variants incorporate materials and processes that enable net carbon sequestration.

The development trajectory of carbon-negative concrete has been marked by several technological breakthroughs, including the use of alternative cementitious materials, carbon capture during curing, and the incorporation of industrial byproducts as supplementary cementitious materials. These innovations have collectively transformed concrete from an environmental liability to a potential climate solution.

Limestone-based solutions have played a pivotal role in this evolution. Traditional limestone usage in cement production involves calcination, which releases CO2. However, newer approaches utilize limestone in ways that avoid this chemical reaction or incorporate carbonated limestone that has already sequestered atmospheric carbon. These methods represent an important subset of carbon-negative concrete technologies worthy of comparative analysis.

The primary objective of this technical research is to comprehensively evaluate carbon-negative concrete technologies with particular emphasis on limestone-based solutions. This evaluation aims to quantify the actual carbon sequestration potential, assess mechanical performance relative to traditional concrete, analyze economic viability at scale, and identify regulatory and standardization challenges that may impact widespread adoption.

Secondary objectives include mapping the technological readiness levels of various carbon-negative concrete formulations, identifying key patents and intellectual property landscapes, and forecasting potential market penetration scenarios based on current adoption trends and policy environments. The research also seeks to establish clear metrics for comparing different carbon-negative approaches, particularly distinguishing between truly carbon-negative solutions and those that merely reduce emissions without achieving net carbon sequestration.

Through this analysis, we aim to provide actionable insights for strategic investment in concrete technologies that offer the greatest potential for addressing climate challenges while meeting the construction industry's performance and economic requirements.

Carbon-negative concrete represents a revolutionary approach to construction materials, designed not only to minimize emissions but to actively sequester carbon dioxide from the atmosphere. The concept has evolved significantly over the past decade, with early experimental formulations giving way to commercially viable products. Unlike traditional concrete which remains carbon-positive throughout its lifecycle, carbon-negative variants incorporate materials and processes that enable net carbon sequestration.

The development trajectory of carbon-negative concrete has been marked by several technological breakthroughs, including the use of alternative cementitious materials, carbon capture during curing, and the incorporation of industrial byproducts as supplementary cementitious materials. These innovations have collectively transformed concrete from an environmental liability to a potential climate solution.

Limestone-based solutions have played a pivotal role in this evolution. Traditional limestone usage in cement production involves calcination, which releases CO2. However, newer approaches utilize limestone in ways that avoid this chemical reaction or incorporate carbonated limestone that has already sequestered atmospheric carbon. These methods represent an important subset of carbon-negative concrete technologies worthy of comparative analysis.

The primary objective of this technical research is to comprehensively evaluate carbon-negative concrete technologies with particular emphasis on limestone-based solutions. This evaluation aims to quantify the actual carbon sequestration potential, assess mechanical performance relative to traditional concrete, analyze economic viability at scale, and identify regulatory and standardization challenges that may impact widespread adoption.

Secondary objectives include mapping the technological readiness levels of various carbon-negative concrete formulations, identifying key patents and intellectual property landscapes, and forecasting potential market penetration scenarios based on current adoption trends and policy environments. The research also seeks to establish clear metrics for comparing different carbon-negative approaches, particularly distinguishing between truly carbon-negative solutions and those that merely reduce emissions without achieving net carbon sequestration.

Through this analysis, we aim to provide actionable insights for strategic investment in concrete technologies that offer the greatest potential for addressing climate challenges while meeting the construction industry's performance and economic requirements.

Market Analysis for Sustainable Construction Materials

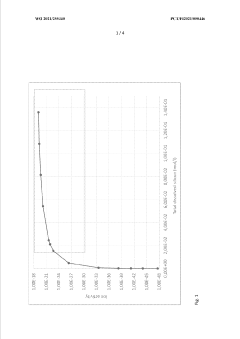

The sustainable construction materials market is experiencing unprecedented growth, driven by increasing environmental concerns and regulatory pressures to reduce carbon emissions in the building sector. Currently valued at approximately $299 billion globally, this market is projected to reach $641 billion by 2030, with a compound annual growth rate of 11.4% between 2023 and 2030. Carbon-negative concrete solutions represent one of the fastest-growing segments within this market, with projected growth rates exceeding 15% annually.

The demand for carbon-negative concrete is primarily fueled by the construction industry's significant carbon footprint, which accounts for nearly 40% of global CO2 emissions, with traditional concrete production alone responsible for 8% of global emissions. This has created an urgent market need for alternative solutions that can reduce or even reverse this environmental impact.

Regional analysis reveals varying adoption rates of sustainable construction materials. Europe leads the market with the most progressive policies and highest adoption rates, particularly in Scandinavian countries and Germany. North America follows with growing demand driven by green building certifications like LEED and WELL. The Asia-Pacific region, despite being the largest concrete consumer globally, shows uneven adoption but represents the highest growth potential, especially in China and India where urbanization continues at rapid rates.

Market segmentation indicates that commercial construction currently dominates the sustainable materials adoption, accounting for approximately 45% of the market share. Residential construction follows at 30%, with infrastructure projects representing 25%. However, infrastructure is expected to be the fastest-growing segment due to government-led green infrastructure initiatives worldwide.

Customer analysis reveals three primary buyer segments: large construction firms seeking to meet ESG goals and regulatory requirements; government entities implementing green procurement policies; and eco-conscious property developers targeting premium market segments. Price sensitivity varies significantly across these segments, with public projects often more constrained by budgetary considerations despite sustainability mandates.

Competitive landscape assessment shows traditional cement manufacturers increasingly investing in carbon-negative technologies, while specialized startups are bringing innovative solutions to market. The limestone-based solutions market is more mature and consolidated, dominated by established players, whereas carbon-negative concrete represents a more fragmented and emerging competitive space with significant opportunity for new entrants and technological differentiation.

Market barriers include higher initial costs compared to traditional concrete (typically 15-30% premium), technical performance concerns among conservative industry stakeholders, and regulatory frameworks that are still evolving. However, these barriers are gradually diminishing as scale economies improve, performance data accumulates, and policy support strengthens.

The demand for carbon-negative concrete is primarily fueled by the construction industry's significant carbon footprint, which accounts for nearly 40% of global CO2 emissions, with traditional concrete production alone responsible for 8% of global emissions. This has created an urgent market need for alternative solutions that can reduce or even reverse this environmental impact.

Regional analysis reveals varying adoption rates of sustainable construction materials. Europe leads the market with the most progressive policies and highest adoption rates, particularly in Scandinavian countries and Germany. North America follows with growing demand driven by green building certifications like LEED and WELL. The Asia-Pacific region, despite being the largest concrete consumer globally, shows uneven adoption but represents the highest growth potential, especially in China and India where urbanization continues at rapid rates.

Market segmentation indicates that commercial construction currently dominates the sustainable materials adoption, accounting for approximately 45% of the market share. Residential construction follows at 30%, with infrastructure projects representing 25%. However, infrastructure is expected to be the fastest-growing segment due to government-led green infrastructure initiatives worldwide.

Customer analysis reveals three primary buyer segments: large construction firms seeking to meet ESG goals and regulatory requirements; government entities implementing green procurement policies; and eco-conscious property developers targeting premium market segments. Price sensitivity varies significantly across these segments, with public projects often more constrained by budgetary considerations despite sustainability mandates.

Competitive landscape assessment shows traditional cement manufacturers increasingly investing in carbon-negative technologies, while specialized startups are bringing innovative solutions to market. The limestone-based solutions market is more mature and consolidated, dominated by established players, whereas carbon-negative concrete represents a more fragmented and emerging competitive space with significant opportunity for new entrants and technological differentiation.

Market barriers include higher initial costs compared to traditional concrete (typically 15-30% premium), technical performance concerns among conservative industry stakeholders, and regulatory frameworks that are still evolving. However, these barriers are gradually diminishing as scale economies improve, performance data accumulates, and policy support strengthens.

Current Status and Challenges in Carbon-negative Concrete

Carbon-negative concrete technology has made significant strides globally, with several pilot projects demonstrating its technical feasibility. Currently, the most advanced carbon-negative concrete solutions utilize alternative binding materials such as geopolymers, alkali-activated materials, and magnesium-based cements that can sequester more CO2 than they emit during production. Companies like Carbicrete, CarbonCure, and Solidia have developed commercial-scale technologies that have been implemented in limited production settings.

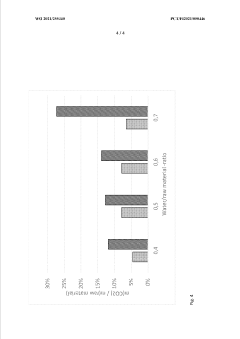

Despite these advancements, carbon-negative concrete faces substantial challenges for widespread adoption. The primary technical hurdle remains achieving consistent performance characteristics comparable to traditional Portland cement concrete across various applications and environmental conditions. Long-term durability data is still limited, creating uncertainty about structural integrity over decades-long timeframes required for infrastructure projects.

Cost factors present another significant barrier, with carbon-negative alternatives typically commanding a 20-40% premium over conventional concrete. This price differential stems from higher material costs, specialized production requirements, and the current lack of economies of scale. Without carbon pricing mechanisms or regulatory mandates, market penetration remains constrained by economic considerations.

The regulatory landscape presents additional complications, as building codes and construction standards worldwide are predominantly designed around Portland cement concrete properties. The certification process for new concrete formulations is lengthy and varies significantly across jurisdictions, creating market fragmentation and impeding standardization efforts.

When comparing with limestone-based solutions, carbon-negative concrete demonstrates superior environmental performance but faces challenges in matching the established supply chain efficiencies. Traditional limestone-based cement benefits from over a century of industrial optimization, extensive distribution networks, and deeply entrenched industry practices. Carbon-negative alternatives require substantial changes to existing production facilities and workforce training.

Geographic disparities in technology adoption are evident, with the most advanced implementations concentrated in North America and Northern Europe. Developing economies, despite having the highest projected concrete demand growth, lag in carbon-negative concrete adoption due to cost sensitivities and technical capacity limitations.

The technology readiness level (TRL) of carbon-negative concrete varies significantly across different formulations, ranging from TRL 4-5 for newer approaches to TRL 7-8 for the most established alternatives. This variation creates market confusion and complicates investment decisions for concrete producers considering technology transitions.

Despite these advancements, carbon-negative concrete faces substantial challenges for widespread adoption. The primary technical hurdle remains achieving consistent performance characteristics comparable to traditional Portland cement concrete across various applications and environmental conditions. Long-term durability data is still limited, creating uncertainty about structural integrity over decades-long timeframes required for infrastructure projects.

Cost factors present another significant barrier, with carbon-negative alternatives typically commanding a 20-40% premium over conventional concrete. This price differential stems from higher material costs, specialized production requirements, and the current lack of economies of scale. Without carbon pricing mechanisms or regulatory mandates, market penetration remains constrained by economic considerations.

The regulatory landscape presents additional complications, as building codes and construction standards worldwide are predominantly designed around Portland cement concrete properties. The certification process for new concrete formulations is lengthy and varies significantly across jurisdictions, creating market fragmentation and impeding standardization efforts.

When comparing with limestone-based solutions, carbon-negative concrete demonstrates superior environmental performance but faces challenges in matching the established supply chain efficiencies. Traditional limestone-based cement benefits from over a century of industrial optimization, extensive distribution networks, and deeply entrenched industry practices. Carbon-negative alternatives require substantial changes to existing production facilities and workforce training.

Geographic disparities in technology adoption are evident, with the most advanced implementations concentrated in North America and Northern Europe. Developing economies, despite having the highest projected concrete demand growth, lag in carbon-negative concrete adoption due to cost sensitivities and technical capacity limitations.

The technology readiness level (TRL) of carbon-negative concrete varies significantly across different formulations, ranging from TRL 4-5 for newer approaches to TRL 7-8 for the most established alternatives. This variation creates market confusion and complicates investment decisions for concrete producers considering technology transitions.

Existing Carbon-negative Concrete Solutions vs. Limestone

01 Carbon capture and sequestration in concrete

Technologies that enable concrete to absorb and permanently store carbon dioxide during the curing process, transforming it from a carbon source to a carbon sink. These methods involve injecting CO2 into concrete mixtures where it reacts with calcium compounds to form stable carbonates, effectively sequestering carbon while simultaneously improving concrete strength and durability.- Carbon capture and sequestration in concrete: Technologies that enable concrete to capture and store carbon dioxide during its lifecycle, effectively making it carbon-negative. These methods involve incorporating materials that can absorb CO2 from the atmosphere or using CO2 in the curing process, which permanently sequesters carbon within the concrete structure. This approach not only reduces the carbon footprint of concrete production but can actually make concrete a carbon sink.

- Alternative cementitious materials for reduced emissions: The use of alternative materials to replace traditional Portland cement, which is responsible for significant carbon emissions. These alternatives include supplementary cementitious materials like fly ash, slag, silica fume, and natural pozzolans, as well as novel binders that require less energy to produce. By substituting these materials for conventional cement, the carbon footprint of concrete production can be substantially reduced.

- Carbon mineralization processes in concrete: Processes that accelerate the natural carbonation of concrete through enhanced mineralization techniques. These methods involve the conversion of calcium compounds in concrete into stable calcium carbonates by reacting with CO2. The mineralization process can be applied during manufacturing or throughout the concrete's lifecycle, effectively locking away carbon dioxide in a stable mineral form while potentially improving concrete properties.

- Monitoring and certification systems for carbon-negative concrete: Systems and methods for measuring, monitoring, and certifying the carbon footprint of concrete products. These include technologies for tracking CO2 emissions throughout the concrete lifecycle, verification protocols for carbon sequestration claims, and certification frameworks that enable concrete producers to quantify and market their carbon reduction achievements. Such systems are essential for validating carbon-negative concrete products and supporting carbon credit markets.

- Energy-efficient concrete production methods: Innovative production techniques that reduce the energy requirements and associated carbon emissions in concrete manufacturing. These include low-temperature cement production, efficient kiln designs, alternative fuels, and optimized mixing and curing processes. By minimizing energy consumption throughout the production chain, these methods significantly reduce the carbon footprint of concrete while maintaining or enhancing its performance characteristics.

02 Alternative cementitious materials for reduced emissions

Development of cement alternatives that produce significantly lower carbon emissions compared to traditional Portland cement. These include geopolymers, alkali-activated materials, and supplementary cementitious materials derived from industrial byproducts such as fly ash, slag, and silica fume. These alternatives can reduce the carbon footprint of concrete by up to 80% while maintaining or enhancing performance characteristics.Expand Specific Solutions03 Carbon accounting and emissions monitoring systems

Advanced systems for accurately measuring, tracking, and reporting carbon emissions throughout the concrete production lifecycle. These technologies include digital platforms that integrate IoT sensors, blockchain verification, and AI analytics to provide transparent carbon accounting, enabling concrete producers to optimize their processes for carbon reduction and comply with increasingly stringent environmental regulations.Expand Specific Solutions04 Biomass incorporation and biogenic materials

Integration of biomass and biogenic materials into concrete formulations to reduce carbon footprint. These approaches include incorporating agricultural waste, wood products, or algae-based additives that naturally sequester carbon during their growth phase. When these materials are included in concrete, they bring their embedded carbon benefits while often providing additional performance advantages such as improved insulation or reduced weight.Expand Specific Solutions05 Energy-efficient concrete production methods

Innovative manufacturing processes that significantly reduce the energy requirements and associated carbon emissions in concrete production. These include low-temperature clinker formation, electric kiln technologies, renewable energy integration, and advanced grinding techniques that minimize the energy-intensive aspects of traditional concrete manufacturing while maintaining product quality and performance specifications.Expand Specific Solutions

Key Industry Players in Sustainable Concrete Development

The carbon-negative concrete market is in an early growth phase, characterized by increasing demand for sustainable construction materials amid global decarbonization efforts. The market size is projected to expand significantly as regulatory pressures and corporate sustainability commitments drive adoption. Technologically, solutions are advancing from research to commercial implementation, with varying maturity levels across players. Leading cement manufacturers like Heidelberg Materials, Holcim Technology, and Huaxin Cement are investing heavily in carbon capture and alternative binding technologies. Academic institutions including University of California and Sichuan University are pioneering fundamental research, while specialized companies like Lixivia and ST Equipment & Technology are developing innovative processes for mineral carbonation and cement alternatives. Traditional players are increasingly partnering with technology startups to accelerate commercialization of limestone-based carbon-negative solutions.

Heidelberg Materials AG

Technical Solution: Heidelberg Materials has developed a carbon-negative concrete solution called "ReConcrete-360°" that utilizes carbon capture and mineralization technology. Their approach involves capturing CO2 emissions during cement production and then using this captured carbon to cure concrete, effectively sequestering it permanently in the building material. The company has implemented a circular economy model where demolition concrete waste is recycled and used as aggregates in new concrete production, further reducing the carbon footprint. Their limestone-based solutions have been enhanced with supplementary cementitious materials (SCMs) like fly ash and slag to reduce the clinker factor, which is responsible for most CO2 emissions in traditional cement. Heidelberg has also pioneered the use of alternative fuels in their kilns, replacing fossil fuels with waste-derived fuels, reducing production emissions by up to 30%. Their concrete formulations incorporate novel binders that require less energy during production while maintaining or improving performance characteristics.

Strengths: Comprehensive approach combining carbon capture, recycling, and alternative materials; established global infrastructure for implementation; significant R&D resources. Weaknesses: Higher initial production costs compared to traditional concrete; requires specialized equipment for carbon capture; performance data for long-term durability still being collected; implementation dependent on regional availability of alternative materials.

Vicat SA

Technical Solution: Vicat has developed an innovative carbon-negative concrete solution called "Ciment Prompt" that leverages natural quick-setting properties of specific limestone deposits found in the French Alps. Their technology involves a lower-temperature production process (around 800°C compared to traditional cement's 1450°C), significantly reducing energy consumption and associated CO2 emissions. Vicat's approach incorporates biomass-derived alternative fuels in their production process, further reducing the carbon footprint. Their limestone-based solution includes a novel clinker formulation with optimized calcium silicate ratios that requires less limestone decarbonation while maintaining structural performance. The company has also implemented carbon capture technology at production facilities, with the captured CO2 being utilized in algae cultivation for biofuel production, creating a circular carbon economy. Vicat's concrete formulations incorporate significant percentages of supplementary cementitious materials like metakaolin and calcined clays, further reducing the carbon intensity while enhancing durability properties such as sulfate resistance and reduced alkali-silica reaction potential.

Strengths: Unique natural raw material source provides inherent advantages; lower production temperatures reduce energy requirements; integrated carbon capture and utilization approach. Weaknesses: Limited scalability due to dependence on specific limestone deposits; higher production costs; regional availability constraints; requires adaptation of construction practices due to different setting properties.

Technical Analysis of Carbon Sequestration Mechanisms

Cementitious materials and methods of making and using same

PatentPendingUS20250042811A1

Innovation

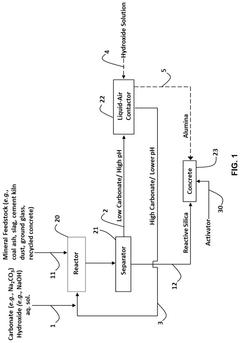

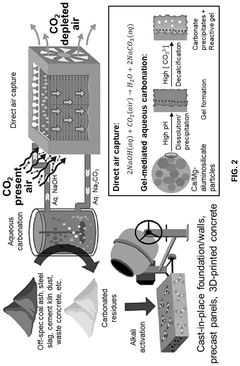

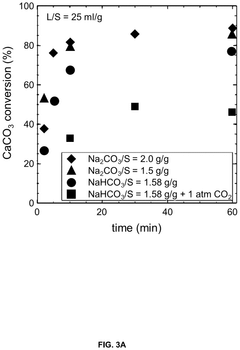

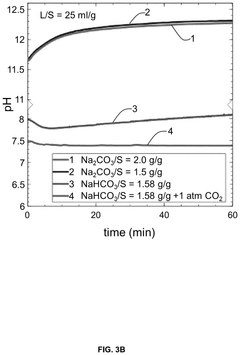

- A carbon mineralization-based direct-air capture process is used to produce carbon-negative cementitious materials by capturing CO2 from the air through an aqueous carbonation cycle, enhancing the pozzolanic reactivity of industrial mineral wastes, and incorporating the captured CO2 as solid carbonate in the concrete.

Controlling carbonation

PatentWO2021255340A1

Innovation

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

Environmental Impact Assessment and Life Cycle Analysis

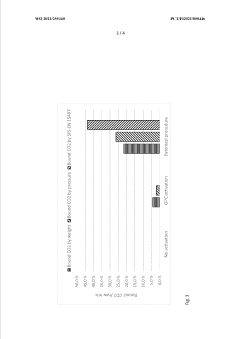

The environmental impact assessment of carbon-negative concrete compared to traditional limestone-based solutions reveals significant differences across their life cycles. Carbon-negative concrete technologies, such as those utilizing industrial waste materials like fly ash and slag, demonstrate potential to sequester more carbon dioxide than they emit during production. This contrasts sharply with conventional concrete which accounts for approximately 8% of global CO2 emissions, primarily from the energy-intensive calcination process of limestone.

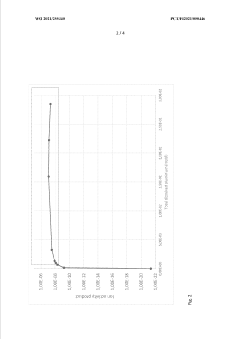

Life cycle analysis (LCA) studies indicate that carbon-negative concrete can achieve net carbon sequestration of 50-300 kg CO2 per cubic meter, depending on the specific formulation and manufacturing process. The most promising variants incorporate novel binders that actively absorb atmospheric carbon during curing and throughout the product lifetime. These technologies effectively transform concrete from a major carbon emitter to a potential carbon sink.

Water consumption metrics also favor carbon-negative alternatives, with some formulations requiring up to 60% less water than traditional concrete production. This represents a crucial advantage in regions facing water scarcity challenges. Additionally, the reduced mining impact associated with alternative material sourcing diminishes habitat disruption and biodiversity loss compared to limestone quarrying operations.

Durability assessments indicate comparable or superior performance for many carbon-negative formulations, with laboratory testing showing resistance to freeze-thaw cycles, chemical attack, and mechanical stress equivalent to conventional concrete. This longevity factor significantly enhances the lifetime environmental benefits by reducing replacement frequency and associated resource consumption.

End-of-life considerations further differentiate these solutions. Carbon-negative concrete often demonstrates enhanced recyclability, with crushed material serving as effective aggregate in new concrete mixes. Some formulations even continue carbon sequestration processes after demolition when properly processed, creating additional environmental benefits beyond the primary use phase.

Energy efficiency comparisons reveal that advanced carbon-negative production methods can reduce embodied energy by 15-40% compared to Portland cement concrete. This reduction stems from lower kiln temperatures, alternative curing methods, and the incorporation of waste materials that would otherwise require energy-intensive disposal processes.

Regional impact variations must be considered when evaluating these technologies. The carbon benefits of alternative concrete solutions depend significantly on local electricity grid emissions, transportation distances for raw materials, and available waste stream compositions. This necessitates location-specific LCA modeling to accurately quantify environmental advantages in different implementation contexts.

Life cycle analysis (LCA) studies indicate that carbon-negative concrete can achieve net carbon sequestration of 50-300 kg CO2 per cubic meter, depending on the specific formulation and manufacturing process. The most promising variants incorporate novel binders that actively absorb atmospheric carbon during curing and throughout the product lifetime. These technologies effectively transform concrete from a major carbon emitter to a potential carbon sink.

Water consumption metrics also favor carbon-negative alternatives, with some formulations requiring up to 60% less water than traditional concrete production. This represents a crucial advantage in regions facing water scarcity challenges. Additionally, the reduced mining impact associated with alternative material sourcing diminishes habitat disruption and biodiversity loss compared to limestone quarrying operations.

Durability assessments indicate comparable or superior performance for many carbon-negative formulations, with laboratory testing showing resistance to freeze-thaw cycles, chemical attack, and mechanical stress equivalent to conventional concrete. This longevity factor significantly enhances the lifetime environmental benefits by reducing replacement frequency and associated resource consumption.

End-of-life considerations further differentiate these solutions. Carbon-negative concrete often demonstrates enhanced recyclability, with crushed material serving as effective aggregate in new concrete mixes. Some formulations even continue carbon sequestration processes after demolition when properly processed, creating additional environmental benefits beyond the primary use phase.

Energy efficiency comparisons reveal that advanced carbon-negative production methods can reduce embodied energy by 15-40% compared to Portland cement concrete. This reduction stems from lower kiln temperatures, alternative curing methods, and the incorporation of waste materials that would otherwise require energy-intensive disposal processes.

Regional impact variations must be considered when evaluating these technologies. The carbon benefits of alternative concrete solutions depend significantly on local electricity grid emissions, transportation distances for raw materials, and available waste stream compositions. This necessitates location-specific LCA modeling to accurately quantify environmental advantages in different implementation contexts.

Regulatory Framework and Green Building Standards

The regulatory landscape for concrete production and construction is rapidly evolving to address climate change concerns, creating both challenges and opportunities for carbon-negative concrete technologies. At the international level, the Paris Agreement has established frameworks that increasingly influence national building codes and standards, with many countries implementing carbon reduction targets that directly impact construction materials. The European Union's Green Deal and Circular Economy Action Plan have introduced stringent requirements for embodied carbon in building materials, while the United States has implemented programs such as the Buy Clean initiative that prioritizes low-carbon construction materials in federal projects.

Green building certification systems have become powerful market drivers for sustainable concrete adoption. LEED (Leadership in Energy and Environmental Design) has updated its materials credits to reward carbon-negative solutions, offering additional points for products with verified Environmental Product Declarations (EPDs) demonstrating negative carbon footprints. Similarly, BREEAM (Building Research Establishment Environmental Assessment Method) has enhanced its recognition of innovative materials that sequester carbon, creating market incentives for limestone-based carbon-negative concrete alternatives.

The regulatory framework is increasingly focusing on whole-life carbon assessments rather than operational emissions alone. Several jurisdictions, including California and parts of Scandinavia, have introduced carbon intensity limits for concrete used in public projects, with progressive reduction targets over time. These regulations typically employ performance-based approaches that measure outcomes rather than prescribing specific materials, allowing innovative solutions like carbon-negative concrete to compete based on environmental performance rather than traditional specifications.

Industry standards organizations are adapting to accommodate these new technologies. ASTM International and the European Committee for Standardization (CEN) have developed testing protocols specifically for alternative cementitious materials, including limestone-based solutions. These standards address durability, strength development, and long-term performance considerations unique to carbon-negative concrete formulations, providing the technical foundation necessary for widespread adoption.

Procurement policies are increasingly incorporating carbon metrics as evaluation criteria. Several major municipalities have implemented carbon-based procurement requirements that favor materials with lower embodied carbon, creating market pull for carbon-negative concrete solutions. These policies often include financial incentives such as tax benefits or expedited permitting for projects utilizing carbon-negative materials, further accelerating market transformation toward sustainable construction practices.

The regulatory landscape continues to evolve with increasing emphasis on transparency and verification. Carbon labeling requirements and mandatory environmental product declarations are becoming more common, requiring manufacturers to disclose the carbon footprint of their products. This transparency enables meaningful comparisons between traditional concrete and innovative limestone-based carbon-negative alternatives, helping to drive market adoption based on verified environmental performance rather than marketing claims.

Green building certification systems have become powerful market drivers for sustainable concrete adoption. LEED (Leadership in Energy and Environmental Design) has updated its materials credits to reward carbon-negative solutions, offering additional points for products with verified Environmental Product Declarations (EPDs) demonstrating negative carbon footprints. Similarly, BREEAM (Building Research Establishment Environmental Assessment Method) has enhanced its recognition of innovative materials that sequester carbon, creating market incentives for limestone-based carbon-negative concrete alternatives.

The regulatory framework is increasingly focusing on whole-life carbon assessments rather than operational emissions alone. Several jurisdictions, including California and parts of Scandinavia, have introduced carbon intensity limits for concrete used in public projects, with progressive reduction targets over time. These regulations typically employ performance-based approaches that measure outcomes rather than prescribing specific materials, allowing innovative solutions like carbon-negative concrete to compete based on environmental performance rather than traditional specifications.

Industry standards organizations are adapting to accommodate these new technologies. ASTM International and the European Committee for Standardization (CEN) have developed testing protocols specifically for alternative cementitious materials, including limestone-based solutions. These standards address durability, strength development, and long-term performance considerations unique to carbon-negative concrete formulations, providing the technical foundation necessary for widespread adoption.

Procurement policies are increasingly incorporating carbon metrics as evaluation criteria. Several major municipalities have implemented carbon-based procurement requirements that favor materials with lower embodied carbon, creating market pull for carbon-negative concrete solutions. These policies often include financial incentives such as tax benefits or expedited permitting for projects utilizing carbon-negative materials, further accelerating market transformation toward sustainable construction practices.

The regulatory landscape continues to evolve with increasing emphasis on transparency and verification. Carbon labeling requirements and mandatory environmental product declarations are becoming more common, requiring manufacturers to disclose the carbon footprint of their products. This transparency enables meaningful comparisons between traditional concrete and innovative limestone-based carbon-negative alternatives, helping to drive market adoption based on verified environmental performance rather than marketing claims.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!