Carbon-negative Concrete: Advancements in Composite Material Science

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Evolution and Objectives

Concrete, a fundamental building material in modern construction, has undergone significant evolution since its inception in ancient Rome. Traditional concrete production is highly carbon-intensive, contributing approximately 8% of global CO2 emissions primarily through the calcination process of limestone and the energy-intensive manufacturing of cement. This environmental impact has driven research toward carbon-negative alternatives over the past two decades, marking a paradigm shift in construction material science.

The evolution of carbon-negative concrete began in the early 2000s with initial explorations into supplementary cementitious materials (SCMs) like fly ash and slag to partially replace Portland cement. By 2010, researchers had developed the first generation of carbon-sequestering concrete technologies, utilizing industrial by-products and novel binding agents. The breakthrough period between 2015-2020 saw the emergence of commercial-scale carbon-negative concrete solutions, incorporating CO2 mineralization processes and innovative carbon capture mechanisms.

Recent advancements have focused on biomimetic approaches, drawing inspiration from natural processes like coral reef formation, which naturally sequester carbon in calcium carbonate structures. These developments represent a convergence of materials science, chemistry, and environmental engineering, demonstrating the interdisciplinary nature of modern concrete innovation.

The primary objective of carbon-negative concrete research is to transform a major source of carbon emissions into a carbon sink, effectively reversing its environmental impact. This ambitious goal requires concrete that can sequester more carbon during its lifecycle than is emitted during its production. Secondary objectives include maintaining or enhancing the mechanical properties of traditional concrete while improving durability and reducing costs to ensure market viability.

Technical targets include achieving carbon sequestration capacities exceeding 100kg CO2 per cubic meter of concrete, developing scalable production methods compatible with existing infrastructure, and ensuring long-term carbon storage stability over the material's lifetime. Performance objectives focus on maintaining compressive strength comparable to conventional concrete (30-50 MPa) while potentially offering improved resistance to chemical degradation and thermal cycling.

The trajectory of carbon-negative concrete development aligns with global sustainability initiatives, including the Paris Agreement and various national net-zero carbon commitments. As construction material demands continue to rise with global urbanization, the successful development and implementation of carbon-negative concrete technologies represent a critical pathway toward sustainable infrastructure development and climate change mitigation.

The evolution of carbon-negative concrete began in the early 2000s with initial explorations into supplementary cementitious materials (SCMs) like fly ash and slag to partially replace Portland cement. By 2010, researchers had developed the first generation of carbon-sequestering concrete technologies, utilizing industrial by-products and novel binding agents. The breakthrough period between 2015-2020 saw the emergence of commercial-scale carbon-negative concrete solutions, incorporating CO2 mineralization processes and innovative carbon capture mechanisms.

Recent advancements have focused on biomimetic approaches, drawing inspiration from natural processes like coral reef formation, which naturally sequester carbon in calcium carbonate structures. These developments represent a convergence of materials science, chemistry, and environmental engineering, demonstrating the interdisciplinary nature of modern concrete innovation.

The primary objective of carbon-negative concrete research is to transform a major source of carbon emissions into a carbon sink, effectively reversing its environmental impact. This ambitious goal requires concrete that can sequester more carbon during its lifecycle than is emitted during its production. Secondary objectives include maintaining or enhancing the mechanical properties of traditional concrete while improving durability and reducing costs to ensure market viability.

Technical targets include achieving carbon sequestration capacities exceeding 100kg CO2 per cubic meter of concrete, developing scalable production methods compatible with existing infrastructure, and ensuring long-term carbon storage stability over the material's lifetime. Performance objectives focus on maintaining compressive strength comparable to conventional concrete (30-50 MPa) while potentially offering improved resistance to chemical degradation and thermal cycling.

The trajectory of carbon-negative concrete development aligns with global sustainability initiatives, including the Paris Agreement and various national net-zero carbon commitments. As construction material demands continue to rise with global urbanization, the successful development and implementation of carbon-negative concrete technologies represent a critical pathway toward sustainable infrastructure development and climate change mitigation.

Market Demand for Sustainable Construction Materials

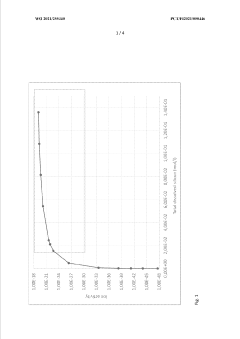

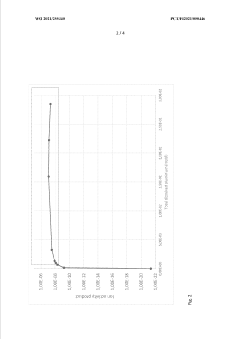

The global construction industry is experiencing a significant shift towards sustainable building materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly carbon-negative concrete, has witnessed remarkable growth in recent years. According to recent market analyses, the global green concrete market was valued at approximately $26.2 billion in 2021 and is projected to reach $65.8 billion by 2030, growing at a CAGR of 10.7% during the forecast period.

This growth is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions across industries. The construction sector alone accounts for nearly 40% of global CO2 emissions, with traditional concrete production contributing approximately 8% of worldwide carbon emissions. This alarming statistic has created an urgent demand for alternative, environmentally friendly concrete solutions that can mitigate the industry's carbon footprint.

Corporate sustainability commitments are also driving market demand, as major construction companies and property developers increasingly adopt green building standards such as LEED, BREEAM, and Green Star. These certifications require the use of sustainable materials, creating a substantial market pull for carbon-negative concrete products. Additionally, government incentives and subsidies for green building practices in regions like Europe, North America, and parts of Asia have further stimulated market growth.

Consumer awareness and preferences are evolving as well, with a growing segment of environmentally conscious buyers willing to pay premium prices for sustainable construction. This trend is particularly evident in residential and commercial building sectors, where marketing the environmental benefits of construction materials has become a competitive advantage.

The market demand varies significantly by region, with Europe leading in adoption rates due to its progressive environmental policies and carbon pricing mechanisms. North America follows closely, driven by corporate sustainability initiatives and green building certifications. The Asia-Pacific region, despite being the largest concrete consumer globally, shows varying adoption rates but represents the fastest-growing market for sustainable alternatives due to rapid urbanization and increasing environmental awareness.

Industry analysts predict that as production scales up and technology matures, the cost differential between traditional and carbon-negative concrete will narrow, further accelerating market adoption. The potential for carbon credits and environmental impact offsetting also presents additional value streams for producers of carbon-negative concrete, enhancing the overall market attractiveness of these innovative materials.

This growth is primarily fueled by stringent environmental regulations aimed at reducing carbon emissions across industries. The construction sector alone accounts for nearly 40% of global CO2 emissions, with traditional concrete production contributing approximately 8% of worldwide carbon emissions. This alarming statistic has created an urgent demand for alternative, environmentally friendly concrete solutions that can mitigate the industry's carbon footprint.

Corporate sustainability commitments are also driving market demand, as major construction companies and property developers increasingly adopt green building standards such as LEED, BREEAM, and Green Star. These certifications require the use of sustainable materials, creating a substantial market pull for carbon-negative concrete products. Additionally, government incentives and subsidies for green building practices in regions like Europe, North America, and parts of Asia have further stimulated market growth.

Consumer awareness and preferences are evolving as well, with a growing segment of environmentally conscious buyers willing to pay premium prices for sustainable construction. This trend is particularly evident in residential and commercial building sectors, where marketing the environmental benefits of construction materials has become a competitive advantage.

The market demand varies significantly by region, with Europe leading in adoption rates due to its progressive environmental policies and carbon pricing mechanisms. North America follows closely, driven by corporate sustainability initiatives and green building certifications. The Asia-Pacific region, despite being the largest concrete consumer globally, shows varying adoption rates but represents the fastest-growing market for sustainable alternatives due to rapid urbanization and increasing environmental awareness.

Industry analysts predict that as production scales up and technology matures, the cost differential between traditional and carbon-negative concrete will narrow, further accelerating market adoption. The potential for carbon credits and environmental impact offsetting also presents additional value streams for producers of carbon-negative concrete, enhancing the overall market attractiveness of these innovative materials.

Global Status and Barriers in Carbon-negative Concrete Development

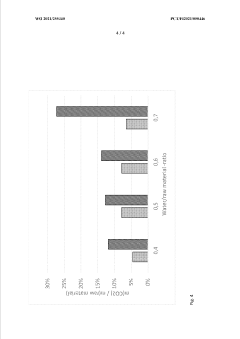

Carbon-negative concrete development has reached varying stages of maturity across different regions globally. In North America, particularly the United States and Canada, significant research investments have accelerated the development of carbon-sequestering cement alternatives. Companies like Carbicrete, CarbonCure, and Solidia have established commercial-scale operations, though market penetration remains below 5% of the total concrete industry. The regulatory environment in these regions increasingly favors low-carbon building materials through carbon pricing mechanisms and green building standards.

European nations lead in policy frameworks supporting carbon-negative construction materials, with countries like Sweden, Norway, and the Netherlands implementing carbon taxes and procurement policies that create market advantages for sustainable concrete alternatives. The EU's Circular Economy Action Plan and European Green Deal have established ambitious targets for embodied carbon reduction in construction materials, driving both research funding and market adoption.

The Asia-Pacific region presents a complex landscape, with China producing over 50% of global cement while simultaneously investing heavily in carbon capture technologies. Japan and South Korea have developed advanced supplementary cementitious materials that reduce carbon footprints, while India faces challenges balancing rapid infrastructure development with sustainability goals.

Despite these advancements, several critical barriers impede widespread adoption of carbon-negative concrete technologies. Technical challenges include durability concerns, as many novel formulations lack long-term performance data required by conservative construction codes and standards. The mechanical properties of carbon-negative alternatives often differ from traditional Portland cement concrete, necessitating adjustments in structural design methodologies and construction practices.

Economic barriers remain substantial, with production costs typically 15-30% higher than conventional concrete. The capital expenditure required to retrofit existing cement plants or build new facilities designed for carbon-negative production creates significant market entry barriers. Additionally, the fragmented nature of the construction industry, with numerous small and medium-sized concrete producers, complicates technology transfer and standardization efforts.

Regulatory frameworks present another significant obstacle, as building codes and material standards developed for traditional concrete often inadvertently exclude innovative carbon-negative alternatives. The certification process for new construction materials can take 5-10 years in many jurisdictions, creating a substantial lag between innovation and implementation.

Supply chain limitations also constrain scaling, particularly regarding the availability of alternative binding materials like calcined clays, volcanic ash, and industrial byproducts. The geographical distribution of these materials does not always align with centers of concrete production, creating logistical challenges and increasing embedded transportation emissions.

European nations lead in policy frameworks supporting carbon-negative construction materials, with countries like Sweden, Norway, and the Netherlands implementing carbon taxes and procurement policies that create market advantages for sustainable concrete alternatives. The EU's Circular Economy Action Plan and European Green Deal have established ambitious targets for embodied carbon reduction in construction materials, driving both research funding and market adoption.

The Asia-Pacific region presents a complex landscape, with China producing over 50% of global cement while simultaneously investing heavily in carbon capture technologies. Japan and South Korea have developed advanced supplementary cementitious materials that reduce carbon footprints, while India faces challenges balancing rapid infrastructure development with sustainability goals.

Despite these advancements, several critical barriers impede widespread adoption of carbon-negative concrete technologies. Technical challenges include durability concerns, as many novel formulations lack long-term performance data required by conservative construction codes and standards. The mechanical properties of carbon-negative alternatives often differ from traditional Portland cement concrete, necessitating adjustments in structural design methodologies and construction practices.

Economic barriers remain substantial, with production costs typically 15-30% higher than conventional concrete. The capital expenditure required to retrofit existing cement plants or build new facilities designed for carbon-negative production creates significant market entry barriers. Additionally, the fragmented nature of the construction industry, with numerous small and medium-sized concrete producers, complicates technology transfer and standardization efforts.

Regulatory frameworks present another significant obstacle, as building codes and material standards developed for traditional concrete often inadvertently exclude innovative carbon-negative alternatives. The certification process for new construction materials can take 5-10 years in many jurisdictions, creating a substantial lag between innovation and implementation.

Supply chain limitations also constrain scaling, particularly regarding the availability of alternative binding materials like calcined clays, volcanic ash, and industrial byproducts. The geographical distribution of these materials does not always align with centers of concrete production, creating logistical challenges and increasing embedded transportation emissions.

Current Carbon Capture and Utilization Methods in Concrete

01 Carbon capture and sequestration in concrete production

Technologies that capture and store carbon dioxide during the concrete manufacturing process, effectively making the concrete carbon-negative. These methods involve injecting CO2 into concrete during curing, where it becomes permanently mineralized and enhances concrete properties while reducing the carbon footprint of construction materials.- Carbon sequestration methods in concrete production: Various methods for carbon sequestration in concrete production involve capturing and storing CO2 during the manufacturing process. These techniques include mineralization processes where CO2 reacts with calcium-rich materials to form stable carbonates, effectively locking away carbon dioxide permanently. Advanced curing techniques using controlled CO2 exposure can enhance concrete strength while reducing the carbon footprint. These approaches not only reduce emissions but can make concrete production carbon-negative by storing more carbon than is emitted during manufacturing.

- Alternative binders and supplementary cementitious materials: The use of alternative binders and supplementary cementitious materials (SCMs) can significantly reduce the carbon footprint of concrete. These include geopolymers, alkali-activated materials, and industrial byproducts such as fly ash, slag, and silica fume. These materials can partially or completely replace traditional Portland cement, which is responsible for the majority of concrete's carbon emissions. The incorporation of these alternatives not only reduces CO2 emissions but can also enhance concrete properties such as durability and strength, contributing to carbon-negative concrete formulations.

- CO2 utilization in concrete curing and carbonation: CO2 utilization technologies involve the direct incorporation of carbon dioxide into concrete during the curing process. Through accelerated carbonation, CO2 is chemically converted into calcium carbonate within the concrete matrix. This process not only sequesters carbon but also improves concrete properties such as compressive strength and reduces permeability. Advanced curing chambers and specialized equipment enable precise control of CO2 exposure, optimizing both carbon sequestration and concrete performance, making the final product carbon-negative.

- Biomass and carbon-negative aggregates in concrete: Incorporating biomass-derived materials and carbon-negative aggregates into concrete formulations can significantly reduce its carbon footprint. These include biochar, agricultural waste products, and specially processed biomass that has sequestered carbon during its growth phase. When these materials are incorporated into concrete, they bring their sequestered carbon with them, offsetting emissions from other ingredients. Additionally, some novel aggregates are specifically designed to absorb CO2 from the atmosphere over the concrete's lifetime, further enhancing carbon negativity.

- Carbon capture and mineralization technologies: Advanced carbon capture and mineralization technologies enable the transformation of industrial CO2 emissions into valuable concrete ingredients. These processes involve capturing CO2 from industrial sources and converting it into solid carbonate minerals that can be used as aggregates or supplementary cementitious materials. Some technologies focus on enhancing natural carbonation processes, while others develop synthetic routes to create carbon-negative building materials. These approaches not only reduce the carbon footprint of concrete but can also improve its mechanical properties and durability.

02 Alternative cementitious materials for carbon reduction

Use of alternative materials to replace traditional Portland cement, which is responsible for significant carbon emissions. These alternatives include geopolymers, alkali-activated materials, and supplementary cementitious materials that require less energy to produce and can absorb CO2 during their lifecycle, resulting in carbon-negative concrete formulations.Expand Specific Solutions03 Biomass incorporation for carbon sequestration

Integration of biomass materials such as agricultural waste, wood products, or algae into concrete mixtures to increase carbon sequestration. These organic materials store carbon absorbed during their growth phase and, when incorporated into concrete, create a permanent carbon sink while potentially improving certain concrete properties.Expand Specific Solutions04 Enhanced carbonation techniques

Accelerated carbonation processes that promote the absorption of atmospheric CO2 by concrete throughout its lifecycle. These techniques involve specialized curing conditions, catalysts, or concrete formulations designed to maximize CO2 uptake, transforming concrete from a carbon source to a carbon sink over time.Expand Specific Solutions05 Carbon-negative concrete monitoring and certification systems

Methods and systems for measuring, verifying, and certifying the carbon-negative properties of concrete products. These include lifecycle assessment tools, carbon accounting frameworks, and monitoring technologies that quantify CO2 sequestration in concrete, enabling carbon credits and regulatory compliance for carbon-negative concrete applications.Expand Specific Solutions

Leading Organizations in Carbon-negative Concrete Innovation

Carbon-negative concrete technology is currently in an early growth phase, with the market expanding rapidly due to increasing environmental regulations and sustainability demands. The global market for green concrete is projected to reach $40 billion by 2030, driven by construction industry's push to reduce carbon footprints. Technologically, companies are at varying stages of maturity: Solidia Technologies and Carbon Limit Co. have developed commercial-ready carbon-capturing concrete solutions, while Heidelberg Materials and Lafarge are scaling industrial applications. Academic institutions like Washington State University and Southeast University are advancing fundamental research in composite materials. Emerging players like C2CNT are exploring novel approaches using carbon nanotubes, indicating a diversifying competitive landscape where both established cement manufacturers and innovative startups are competing to define industry standards.

Solidia Technologies, Inc.

Technical Solution: Solidia has developed a proprietary technology that uses non-hydraulic calcium silicate cement that cures by carbonation rather than hydration. Their process reduces CO2 emissions by up to 70% compared to traditional Portland cement manufacturing. The technology involves a lower temperature production process (1200°C vs 1450°C for traditional cement) and then actively absorbs CO2 during the curing phase. Solidia's concrete products can sequester up to 300kg of CO2 per ton of cement used, effectively creating a carbon sink. Their manufacturing process is compatible with existing cement production equipment, requiring minimal retrofitting of current plants. The company has partnered with LafargeHolcim to scale their technology globally and has received backing from major investors including BP Ventures and Occidental Petroleum.

Strengths: Compatible with existing manufacturing infrastructure; significantly lower carbon footprint; improved product performance including faster curing time and higher durability. Weaknesses: Requires pure CO2 stream for optimal curing; market adoption challenges due to industry's conservative nature; limited applications in certain construction scenarios requiring traditional hydraulic properties.

Carbon Limit Co.

Technical Solution: Carbon Limit has pioneered a carbon-negative admixture technology called "Carbon Capture Coating" (C3) that can be integrated into traditional concrete manufacturing processes. Their proprietary formulation contains reactive minerals that actively absorb CO2 from the atmosphere throughout the concrete's lifetime, not just during curing. The technology creates carbonate minerals within the concrete matrix, which enhances strength while permanently sequestering carbon. Independent testing has shown that concrete treated with Carbon Limit's admixture can absorb up to 400kg of CO2 per cubic meter over its lifetime. The company has developed various formulations optimized for different applications, including ready-mix concrete, precast elements, and concrete masonry units. Their solution requires no changes to existing concrete production equipment or processes, making it highly scalable and implementable with minimal disruption to established industry practices.

Strengths: Continuous carbon absorption throughout product lifecycle; enhances concrete durability and strength; drop-in solution requiring no changes to existing manufacturing processes. Weaknesses: Relatively new technology with limited long-term performance data; absorption rates vary depending on environmental exposure conditions; higher initial cost compared to traditional concrete admixtures.

Key Patents and Research in Carbon-negative Binding Materials

Controlling carbonation

PatentWO2021255340A1

Innovation

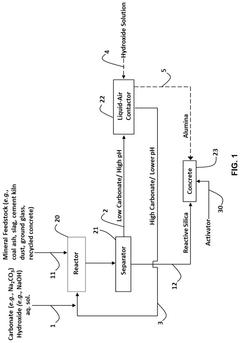

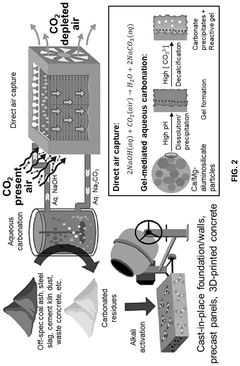

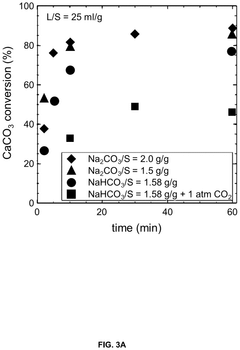

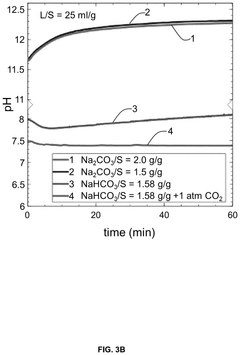

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

Cementitious materials and methods of making and using same

PatentPendingUS20250042811A1

Innovation

- A carbon mineralization-based direct-air capture process is used to produce carbon-negative cementitious materials by capturing CO2 from the air through an aqueous carbonation cycle, enhancing the pozzolanic reactivity of industrial mineral wastes, and incorporating the captured CO2 as solid carbonate in the concrete.

Life Cycle Assessment of Carbon-negative Concrete Solutions

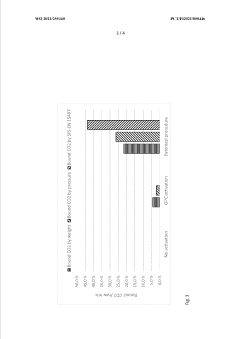

Life Cycle Assessment (LCA) provides a comprehensive framework for evaluating the environmental impacts of carbon-negative concrete solutions throughout their entire existence. This assessment begins with raw material extraction and continues through manufacturing, transportation, use, and end-of-life disposal or recycling. For carbon-negative concrete, the LCA reveals significant environmental advantages compared to traditional Portland cement concrete.

The extraction phase analysis demonstrates that carbon-negative concrete typically requires less energy-intensive mining operations. Many formulations incorporate industrial byproducts like fly ash, slag, and silica fume, which diverts these materials from landfills and reduces the need for virgin resource extraction. The manufacturing process evaluation shows substantially lower carbon emissions, with some innovative solutions achieving up to 70% reduction in CO2 emissions compared to conventional concrete production.

Transportation impacts vary depending on the locality of raw materials and production facilities. Research indicates that carbon-negative concrete often utilizes locally available materials, reducing transportation distances and associated emissions. The use phase assessment reveals comparable or superior durability characteristics in many carbon-negative formulations, potentially extending service life and reducing maintenance requirements.

End-of-life analysis demonstrates that carbon-negative concrete can continue absorbing CO2 even after demolition when crushed and exposed to atmospheric conditions. This creates an additional carbon sequestration opportunity not present in traditional concrete. Quantitative LCA studies indicate that while initial production costs may be higher, the total environmental cost over the full lifecycle is significantly lower for carbon-negative alternatives.

Water consumption metrics show varied results, with some formulations requiring more water during production but others demonstrating reduced water needs. Energy efficiency assessments consistently favor carbon-negative solutions, with energy requirements during manufacturing typically 20-40% lower than conventional concrete production processes.

The most promising carbon-negative concrete technologies achieve net carbon sequestration of 50-300 kg CO2 per cubic meter of concrete, depending on the specific formulation and application. This represents a paradigm shift from concrete as a carbon source to a carbon sink. Sensitivity analyses within these LCAs identify key variables affecting environmental performance, including transportation distances, energy sources used in production, and end-of-life handling procedures.

Recent advancements in LCA methodologies have improved the accuracy of these assessments by incorporating real-time monitoring of carbon sequestration rates and more precise modeling of long-term performance characteristics. These refined approaches provide stakeholders with more reliable data for decision-making regarding material selection and environmental impact mitigation strategies.

The extraction phase analysis demonstrates that carbon-negative concrete typically requires less energy-intensive mining operations. Many formulations incorporate industrial byproducts like fly ash, slag, and silica fume, which diverts these materials from landfills and reduces the need for virgin resource extraction. The manufacturing process evaluation shows substantially lower carbon emissions, with some innovative solutions achieving up to 70% reduction in CO2 emissions compared to conventional concrete production.

Transportation impacts vary depending on the locality of raw materials and production facilities. Research indicates that carbon-negative concrete often utilizes locally available materials, reducing transportation distances and associated emissions. The use phase assessment reveals comparable or superior durability characteristics in many carbon-negative formulations, potentially extending service life and reducing maintenance requirements.

End-of-life analysis demonstrates that carbon-negative concrete can continue absorbing CO2 even after demolition when crushed and exposed to atmospheric conditions. This creates an additional carbon sequestration opportunity not present in traditional concrete. Quantitative LCA studies indicate that while initial production costs may be higher, the total environmental cost over the full lifecycle is significantly lower for carbon-negative alternatives.

Water consumption metrics show varied results, with some formulations requiring more water during production but others demonstrating reduced water needs. Energy efficiency assessments consistently favor carbon-negative solutions, with energy requirements during manufacturing typically 20-40% lower than conventional concrete production processes.

The most promising carbon-negative concrete technologies achieve net carbon sequestration of 50-300 kg CO2 per cubic meter of concrete, depending on the specific formulation and application. This represents a paradigm shift from concrete as a carbon source to a carbon sink. Sensitivity analyses within these LCAs identify key variables affecting environmental performance, including transportation distances, energy sources used in production, and end-of-life handling procedures.

Recent advancements in LCA methodologies have improved the accuracy of these assessments by incorporating real-time monitoring of carbon sequestration rates and more precise modeling of long-term performance characteristics. These refined approaches provide stakeholders with more reliable data for decision-making regarding material selection and environmental impact mitigation strategies.

Regulatory Framework for Low-Carbon Building Materials

The regulatory landscape for low-carbon building materials has evolved significantly in recent years, driven by global climate commitments and the construction industry's substantial carbon footprint. National and international frameworks increasingly incorporate carbon metrics into building codes and standards, with pioneering legislation emerging in regions like the European Union, where the Construction Products Regulation now includes environmental performance requirements. The EU's Carbon Border Adjustment Mechanism further impacts imported construction materials, creating market pressure for low-carbon alternatives.

In North America, jurisdictions like California have implemented procurement policies favoring low-carbon concrete through Environmental Product Declaration (EPD) requirements. These policies establish maximum acceptable Global Warming Potential thresholds for different concrete strength classes, effectively creating market demand for carbon-negative solutions. Similarly, Canada's Greening Government Strategy mandates life-cycle assessment for major construction projects, prioritizing materials with lower embodied carbon.

Certification systems play a crucial role in the regulatory ecosystem, with programs like LEED, BREEAM, and the Living Building Challenge awarding points for carbon reduction strategies. The emergence of specialized certifications such as the Concrete Sustainability Council (CSC) certification provides industry-specific frameworks for evaluating environmental performance, including carbon metrics.

Financial incentives represent another regulatory approach, with tax credits for carbon capture technologies directly benefiting carbon-negative concrete development. The 45Q tax credit in the United States, enhanced by the Inflation Reduction Act, provides significant financial support for carbon capture projects, including those in the concrete sector. Green building funds and sustainable infrastructure grants further incentivize adoption of innovative materials.

Standardization bodies have responded to the need for consistent measurement methodologies, with ISO 14067 and EN 15804 providing frameworks for carbon footprint calculation. Technical committees are actively developing standards specifically for carbon-negative concrete, addressing performance requirements, testing protocols, and durability considerations. These standards are essential for market acceptance and regulatory compliance.

Looking forward, regulatory trends indicate movement toward mandatory carbon disclosure and limits for construction materials. Several jurisdictions are developing embodied carbon caps for new construction, creating clear market signals for carbon-negative solutions. The integration of whole-building life cycle assessment into building codes represents a significant shift toward comprehensive carbon accounting in construction regulation, potentially creating substantial market opportunities for carbon-negative concrete technologies.

In North America, jurisdictions like California have implemented procurement policies favoring low-carbon concrete through Environmental Product Declaration (EPD) requirements. These policies establish maximum acceptable Global Warming Potential thresholds for different concrete strength classes, effectively creating market demand for carbon-negative solutions. Similarly, Canada's Greening Government Strategy mandates life-cycle assessment for major construction projects, prioritizing materials with lower embodied carbon.

Certification systems play a crucial role in the regulatory ecosystem, with programs like LEED, BREEAM, and the Living Building Challenge awarding points for carbon reduction strategies. The emergence of specialized certifications such as the Concrete Sustainability Council (CSC) certification provides industry-specific frameworks for evaluating environmental performance, including carbon metrics.

Financial incentives represent another regulatory approach, with tax credits for carbon capture technologies directly benefiting carbon-negative concrete development. The 45Q tax credit in the United States, enhanced by the Inflation Reduction Act, provides significant financial support for carbon capture projects, including those in the concrete sector. Green building funds and sustainable infrastructure grants further incentivize adoption of innovative materials.

Standardization bodies have responded to the need for consistent measurement methodologies, with ISO 14067 and EN 15804 providing frameworks for carbon footprint calculation. Technical committees are actively developing standards specifically for carbon-negative concrete, addressing performance requirements, testing protocols, and durability considerations. These standards are essential for market acceptance and regulatory compliance.

Looking forward, regulatory trends indicate movement toward mandatory carbon disclosure and limits for construction materials. Several jurisdictions are developing embodied carbon caps for new construction, creating clear market signals for carbon-negative solutions. The integration of whole-building life cycle assessment into building codes represents a significant shift toward comprehensive carbon accounting in construction regulation, potentially creating substantial market opportunities for carbon-negative concrete technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!