Carbon-negative Concrete: Pathways to Sustainability and Performance

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Evolution and Objectives

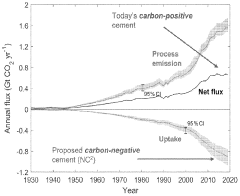

Concrete, the most widely used building material globally, has traditionally been a significant contributor to carbon emissions, accounting for approximately 8% of global CO2 emissions. The evolution of carbon-negative concrete represents a paradigm shift in construction materials science, moving from carbon-intensive processes toward solutions that actively remove carbon dioxide from the atmosphere. This technological trajectory began in the early 2000s with initial research into alternative cementitious materials and has accelerated dramatically over the past decade.

The historical development of concrete technology can be traced through several distinct phases. Traditional Portland cement, invented in the 19th century, dominated construction for over 150 years despite its high carbon footprint. The first significant shift toward sustainability occurred in the 1970s with the introduction of supplementary cementitious materials (SCMs) like fly ash and slag, which reduced cement content. The 2000s saw the emergence of geopolymer concretes, utilizing industrial byproducts to create binders with lower carbon footprints.

The concept of carbon-negative concrete emerged around 2010, when researchers began exploring methods to sequester CO2 within the concrete matrix itself. This approach represented a fundamental reconceptualization of concrete from a carbon source to a potential carbon sink. Key technological breakthroughs included carbonation curing processes, development of novel CO2-absorbing aggregates, and integration of carbon capture technologies directly into cement production.

Current technological objectives for carbon-negative concrete focus on several critical areas. Primary among these is achieving carbon negativity while maintaining or exceeding the performance characteristics of traditional concrete, including compressive strength, durability, and workability. Another crucial objective is scalability – developing solutions that can be implemented at industrial scale to make meaningful climate impact. Cost competitiveness remains a significant challenge, as carbon-negative solutions must approach price parity with conventional concrete to achieve widespread adoption.

Looking forward, the technical roadmap for carbon-negative concrete aims to optimize CO2 sequestration capacity, potentially reaching up to 100-300 kg of CO2 absorbed per cubic meter of concrete. Additional objectives include reducing energy requirements in production processes, developing standards and certification frameworks specific to carbon-negative materials, and creating closed-loop systems where concrete can serve as both a construction material and an effective carbon capture technology throughout its lifecycle.

The historical development of concrete technology can be traced through several distinct phases. Traditional Portland cement, invented in the 19th century, dominated construction for over 150 years despite its high carbon footprint. The first significant shift toward sustainability occurred in the 1970s with the introduction of supplementary cementitious materials (SCMs) like fly ash and slag, which reduced cement content. The 2000s saw the emergence of geopolymer concretes, utilizing industrial byproducts to create binders with lower carbon footprints.

The concept of carbon-negative concrete emerged around 2010, when researchers began exploring methods to sequester CO2 within the concrete matrix itself. This approach represented a fundamental reconceptualization of concrete from a carbon source to a potential carbon sink. Key technological breakthroughs included carbonation curing processes, development of novel CO2-absorbing aggregates, and integration of carbon capture technologies directly into cement production.

Current technological objectives for carbon-negative concrete focus on several critical areas. Primary among these is achieving carbon negativity while maintaining or exceeding the performance characteristics of traditional concrete, including compressive strength, durability, and workability. Another crucial objective is scalability – developing solutions that can be implemented at industrial scale to make meaningful climate impact. Cost competitiveness remains a significant challenge, as carbon-negative solutions must approach price parity with conventional concrete to achieve widespread adoption.

Looking forward, the technical roadmap for carbon-negative concrete aims to optimize CO2 sequestration capacity, potentially reaching up to 100-300 kg of CO2 absorbed per cubic meter of concrete. Additional objectives include reducing energy requirements in production processes, developing standards and certification frameworks specific to carbon-negative materials, and creating closed-loop systems where concrete can serve as both a construction material and an effective carbon capture technology throughout its lifecycle.

Market Demand Analysis for Sustainable Construction Materials

The global construction industry is experiencing a significant shift towards sustainable building materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly carbon-negative concrete, has shown remarkable growth in recent years. Current market valuations place the global green concrete market at approximately 26.2 billion USD in 2021, with projections indicating a compound annual growth rate (CAGR) of 9.1% through 2030, potentially reaching over 60 billion USD.

This growth is primarily fueled by stringent environmental regulations across major economies. The European Union's Green Deal aims for carbon neutrality by 2050, while the United States has rejoined the Paris Climate Agreement with ambitious emission reduction targets. China, the world's largest concrete producer, has pledged carbon neutrality by 2060, creating substantial market pressure for sustainable alternatives to traditional concrete.

Consumer demand patterns reveal increasing willingness among property developers and infrastructure project managers to pay premium prices for sustainable building materials. A 2022 industry survey indicated that 67% of large-scale construction projects now include sustainability criteria in material selection processes, compared to just 38% five years ago. This shift represents a fundamental change in market dynamics rather than a temporary trend.

The construction sector accounts for approximately 38% of global carbon emissions, with traditional concrete production responsible for 8% of worldwide CO2 emissions. This creates an urgent market need for carbon-negative alternatives that can maintain or exceed performance standards of conventional concrete while reducing environmental impact.

Market segmentation analysis shows varying adoption rates across different construction sectors. Commercial building construction leads adoption at 42%, followed by public infrastructure at 37%, residential construction at 28%, and industrial facilities at 23%. Geographically, Europe represents the most mature market for sustainable concrete solutions, followed by North America, while Asia-Pacific shows the highest growth potential due to rapid urbanization and infrastructure development.

Key market drivers include government incentives for green building practices, corporate sustainability commitments, LEED and other green building certification requirements, and increasing carbon pricing mechanisms. Barriers to wider adoption include higher initial costs (typically 15-30% premium over traditional concrete), technical performance concerns, and limited awareness among smaller contractors.

The market forecast indicates that carbon-negative concrete solutions could capture up to 25% of the global concrete market by 2035, representing a transformative shift in construction material usage and a critical pathway to reducing the industry's environmental footprint.

This growth is primarily fueled by stringent environmental regulations across major economies. The European Union's Green Deal aims for carbon neutrality by 2050, while the United States has rejoined the Paris Climate Agreement with ambitious emission reduction targets. China, the world's largest concrete producer, has pledged carbon neutrality by 2060, creating substantial market pressure for sustainable alternatives to traditional concrete.

Consumer demand patterns reveal increasing willingness among property developers and infrastructure project managers to pay premium prices for sustainable building materials. A 2022 industry survey indicated that 67% of large-scale construction projects now include sustainability criteria in material selection processes, compared to just 38% five years ago. This shift represents a fundamental change in market dynamics rather than a temporary trend.

The construction sector accounts for approximately 38% of global carbon emissions, with traditional concrete production responsible for 8% of worldwide CO2 emissions. This creates an urgent market need for carbon-negative alternatives that can maintain or exceed performance standards of conventional concrete while reducing environmental impact.

Market segmentation analysis shows varying adoption rates across different construction sectors. Commercial building construction leads adoption at 42%, followed by public infrastructure at 37%, residential construction at 28%, and industrial facilities at 23%. Geographically, Europe represents the most mature market for sustainable concrete solutions, followed by North America, while Asia-Pacific shows the highest growth potential due to rapid urbanization and infrastructure development.

Key market drivers include government incentives for green building practices, corporate sustainability commitments, LEED and other green building certification requirements, and increasing carbon pricing mechanisms. Barriers to wider adoption include higher initial costs (typically 15-30% premium over traditional concrete), technical performance concerns, and limited awareness among smaller contractors.

The market forecast indicates that carbon-negative concrete solutions could capture up to 25% of the global concrete market by 2035, representing a transformative shift in construction material usage and a critical pathway to reducing the industry's environmental footprint.

Current State and Challenges in Carbon-negative Concrete Technology

The global concrete industry currently contributes approximately 8% of worldwide CO2 emissions, making it a critical focus for decarbonization efforts. Carbon-negative concrete technology has emerged as a promising solution, with significant advancements in recent years. Currently, several approaches are being pursued, including carbon capture during production, alternative cementitious materials, and CO2 curing processes. Companies like CarbonCure, Solidia, and Carbon8 Systems have developed commercial-scale technologies that can reduce concrete's carbon footprint by 5-30%, though truly carbon-negative solutions remain limited in market penetration.

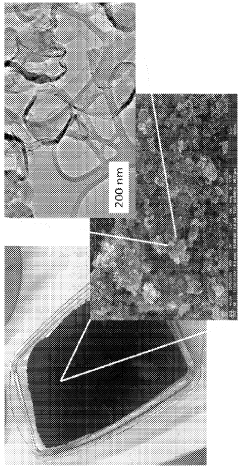

The most advanced carbon-negative concrete technologies utilize supplementary cementitious materials (SCMs) such as fly ash, slag, and natural pozzolans to replace portions of traditional Portland cement. These approaches have achieved up to 70% reduction in embodied carbon. Additionally, innovative carbon mineralization processes that permanently sequester CO2 within concrete during curing have demonstrated the ability to transform concrete from a carbon source to a carbon sink in laboratory settings.

Despite these advancements, significant challenges persist in scaling carbon-negative concrete technologies. Technical barriers include maintaining or improving mechanical properties while reducing cement content, as many alternative binders exhibit slower strength development or reduced durability under certain conditions. The long-term performance of novel formulations remains uncertain, with limited data on durability beyond 10-15 years, creating hesitation among structural engineers and building code authorities.

Economic challenges present another major obstacle. Most carbon-negative concrete solutions currently command a premium of 15-50% over conventional concrete, making widespread adoption difficult without regulatory incentives or carbon pricing mechanisms. The capital investment required to retrofit existing production facilities is substantial, estimated at $50-100 million for a typical cement plant conversion.

Regulatory and standardization issues further complicate advancement. Building codes and standards worldwide have been developed around Portland cement concrete properties, creating significant barriers for alternative formulations. The certification process for new concrete technologies can take 5-10 years in many jurisdictions, slowing market entry for innovative solutions.

Geographic disparities in technology development are notable, with North America, Europe, and parts of Asia (particularly China and Japan) leading research and commercialization efforts. However, the Global South, where concrete demand is projected to grow most rapidly in coming decades, lags significantly in both research infrastructure and implementation capacity for advanced concrete technologies.

The most advanced carbon-negative concrete technologies utilize supplementary cementitious materials (SCMs) such as fly ash, slag, and natural pozzolans to replace portions of traditional Portland cement. These approaches have achieved up to 70% reduction in embodied carbon. Additionally, innovative carbon mineralization processes that permanently sequester CO2 within concrete during curing have demonstrated the ability to transform concrete from a carbon source to a carbon sink in laboratory settings.

Despite these advancements, significant challenges persist in scaling carbon-negative concrete technologies. Technical barriers include maintaining or improving mechanical properties while reducing cement content, as many alternative binders exhibit slower strength development or reduced durability under certain conditions. The long-term performance of novel formulations remains uncertain, with limited data on durability beyond 10-15 years, creating hesitation among structural engineers and building code authorities.

Economic challenges present another major obstacle. Most carbon-negative concrete solutions currently command a premium of 15-50% over conventional concrete, making widespread adoption difficult without regulatory incentives or carbon pricing mechanisms. The capital investment required to retrofit existing production facilities is substantial, estimated at $50-100 million for a typical cement plant conversion.

Regulatory and standardization issues further complicate advancement. Building codes and standards worldwide have been developed around Portland cement concrete properties, creating significant barriers for alternative formulations. The certification process for new concrete technologies can take 5-10 years in many jurisdictions, slowing market entry for innovative solutions.

Geographic disparities in technology development are notable, with North America, Europe, and parts of Asia (particularly China and Japan) leading research and commercialization efforts. However, the Global South, where concrete demand is projected to grow most rapidly in coming decades, lags significantly in both research infrastructure and implementation capacity for advanced concrete technologies.

Current Carbon Capture and Utilization Solutions in Concrete

01 CO2 capture and sequestration in concrete

Carbon-negative concrete can be achieved through technologies that capture and sequester CO2 during the concrete manufacturing process. These methods involve injecting CO2 into concrete mixtures where it reacts with calcium compounds to form stable carbonates, effectively locking away carbon dioxide permanently. This process not only reduces the carbon footprint but can actually make concrete a carbon sink, absorbing more CO2 than is emitted during production.- Carbon capture and sequestration in concrete: Technologies that enable concrete to capture and store carbon dioxide during its lifecycle, making it carbon-negative. These methods involve incorporating materials that can absorb CO2 from the atmosphere and permanently sequester it within the concrete structure, effectively turning concrete from a carbon source into a carbon sink. This approach addresses the high carbon footprint traditionally associated with concrete production.

- Alternative cementitious materials for carbon reduction: Use of alternative materials to replace traditional Portland cement, which is responsible for significant CO2 emissions. These alternatives include supplementary cementitious materials like fly ash, slag, silica fume, and natural pozzolans that require less energy to produce and generate fewer emissions. Some formulations incorporate industrial byproducts, reducing waste while decreasing the carbon footprint of concrete production.

- CO2 curing and carbonation processes: Innovative curing methods that utilize carbon dioxide instead of water for the hardening process of concrete. These techniques accelerate the carbonation reaction, where CO2 reacts with calcium hydroxide in concrete to form calcium carbonate, effectively sequestering carbon while improving concrete properties. This process can be applied during manufacturing or throughout the concrete's service life, contributing to carbon negativity.

- Biomass incorporation and biogenic materials: Integration of biomass and biogenic materials into concrete formulations to reduce carbon footprint. These materials, derived from plants or other biological sources, have already sequestered carbon during their growth phase. When incorporated into concrete, they bring this stored carbon with them, offsetting emissions from other components. Examples include agricultural waste, wood products, and algae-based additives.

- Carbon accounting and lifecycle assessment systems: Methodologies and systems for measuring, verifying, and certifying the carbon negativity of concrete products. These systems account for all carbon emissions and sequestration throughout the concrete lifecycle, from raw material extraction to end-of-life scenarios. They provide frameworks for quantifying carbon benefits, enabling carbon credits, and supporting regulatory compliance for carbon-negative concrete technologies.

02 Alternative cementitious materials for carbon reduction

Using alternative cementitious materials such as supplementary cementitious materials (SCMs), geopolymers, or alkali-activated materials can significantly reduce the carbon footprint of concrete. These materials often replace traditional Portland cement, which is responsible for the majority of concrete's carbon emissions. Materials like fly ash, slag, calcined clays, and natural pozzolans can be incorporated into concrete mixtures to create carbon-negative or carbon-neutral building materials.Expand Specific Solutions03 Biomass incorporation and carbonation curing

Incorporating biomass or biogenic materials into concrete formulations can contribute to carbon negativity. These materials store carbon that was previously captured from the atmosphere through photosynthesis. Additionally, accelerated carbonation curing techniques expose fresh concrete to CO2-rich environments, promoting rapid CO2 uptake during the hardening process. This approach enhances mechanical properties while simultaneously sequestering carbon dioxide.Expand Specific Solutions04 Carbon-negative aggregate production

Developing carbon-negative aggregates involves processes that capture CO2 during the manufacturing of concrete components. These specialized aggregates can be produced using industrial waste materials that readily absorb CO2, or through innovative technologies that mineralize carbon dioxide into stable carbonate forms. When used in concrete, these aggregates contribute to the overall carbon negativity of the final product while maintaining or improving structural performance.Expand Specific Solutions05 Life cycle carbon accounting and certification systems

Comprehensive life cycle assessment methodologies and certification systems are being developed to accurately measure and verify the carbon negativity of concrete products. These systems account for all emissions throughout the concrete's life cycle, from raw material extraction to end-of-life scenarios, and quantify the amount of CO2 permanently sequestered. Such frameworks are essential for validating carbon-negative claims and incentivizing the adoption of truly sustainable concrete technologies.Expand Specific Solutions

Key Industry Players in Carbon-negative Concrete Development

Carbon-negative concrete technology is currently in the early growth phase, with a rapidly expanding market projected to reach $1.2 billion by 2030. The competitive landscape features diverse players across the value chain, including established cement manufacturers (Taiheiyo Cement, Huaxin Cement), construction companies (Kajima Corp., China Construction Eighth Bureau), innovative startups (Solidia Technologies, Concrete4Change), and research institutions (Shandong University, University of Michigan). Technical maturity varies significantly, with companies like Solidia Technologies and X Development leading with commercially viable solutions, while others remain in research phases. Academic-industry partnerships are accelerating development, with universities like HKUST and Worcester Polytechnic Institute collaborating with industry players to overcome scalability and performance challenges in this emerging sustainable construction technology.

Solidia Technologies, Inc.

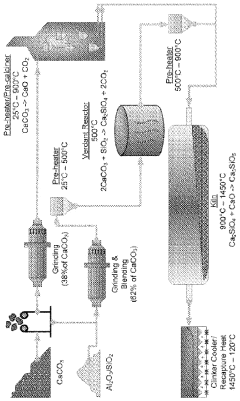

Technical Solution: Solidia Technologies has developed a revolutionary carbon-negative concrete technology that fundamentally alters the chemistry of cement production and curing. Their patented process replaces traditional Ordinary Portland Cement (OPC) with a low-lime content cement that requires lower kiln temperatures during manufacturing (1200°C vs 1450°C for OPC), reducing energy consumption by 30% and associated CO2 emissions by up to 40%[1]. The innovation continues in the curing phase, where instead of using water, Solidia concrete undergoes CO2 curing - actively sequestering carbon dioxide into the material structure. This process permanently converts and stores CO2 as solid calcium and magnesium carbonates within the concrete matrix, enabling up to 400kg of CO2 sequestration per ton of cement[2]. Their technology is compatible with existing concrete manufacturing equipment, requiring minimal retrofitting, and produces concrete with comparable or superior mechanical properties to traditional concrete, including higher early strength development and reduced efflorescence.

Strengths: Achieves carbon negativity through both reduced manufacturing emissions and active carbon sequestration; compatible with existing manufacturing infrastructure; produces concrete with enhanced durability and reduced efflorescence. Weaknesses: CO2 curing process requires controlled environments; potential scaling challenges for in-situ applications; depends on availability of captured CO2 sources for optimal carbon reduction benefits.

Taiheiyo Cement Corp.

Technical Solution: Taiheiyo Cement Corporation has developed an innovative carbon-negative concrete technology called "CO2-SUICOM" (CO2-Storage Under Infrastructure by Concrete Materials). This technology represents a significant breakthrough in sustainable construction by combining multiple approaches to achieve carbon negativity. The core innovation involves a special admixture containing calcium hydroxide and pozzolanic materials that actively absorb and mineralize CO2 during the curing process. When exposed to a CO2-rich environment in a specialized curing chamber, the concrete can sequester approximately 120kg of CO2 per cubic meter[9]. Taiheiyo's process also incorporates industrial by-products such as blast furnace slag and coal fly ash, replacing up to 60% of traditional cement content. Their manufacturing process utilizes renewable energy and waste-derived alternative fuels, reducing production emissions by approximately 40% compared to conventional methods. The company has further enhanced their technology by developing a carbon capture system at their cement plants that provides the CO2 needed for the concrete curing process, creating a closed-loop carbon utilization system. Independent lifecycle assessments have confirmed that Taiheiyo's CO2-SUICOM concrete achieves net carbon negativity while maintaining mechanical properties comparable to conventional concrete, with the added benefit of improved durability against chemical attack due to its densified microstructure[10].

Strengths: Achieves significant carbon sequestration through active CO2 absorption; creates closed-loop carbon utilization system; produces concrete with enhanced chemical resistance. Weaknesses: Requires specialized curing chambers limiting on-site applications; optimal performance depends on controlled curing conditions; higher initial production costs compared to conventional concrete.

Core Innovations in Carbon-negative Binding Materials

Cementitious materials and methods of making and using same

PatentPendingUS20250042811A1

Innovation

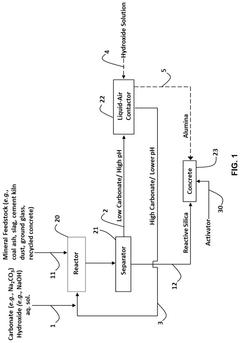

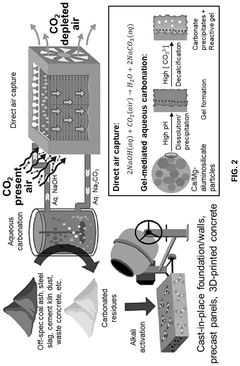

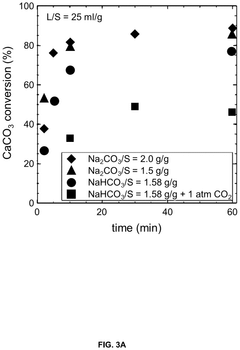

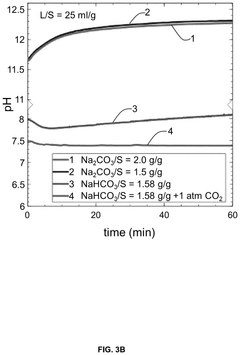

- A carbon mineralization-based direct-air capture process is used to produce carbon-negative cementitious materials by capturing CO2 from the air through an aqueous carbonation cycle, enhancing the pozzolanic reactivity of industrial mineral wastes, and incorporating the captured CO2 as solid carbonate in the concrete.

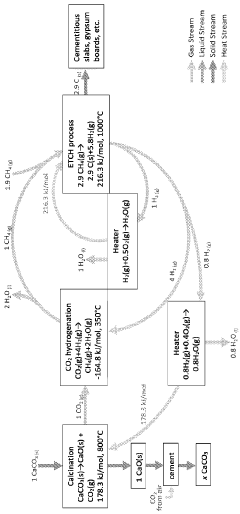

Negative-carbon cement (NC2) production

PatentWO2024059483A1

Innovation

- A process and system that calcines calcium carbonate to produce calcium oxide and carbon dioxide, which is then reacted with hydrogen gas to produce methane and water, followed by pyrolysis to convert methane into solid carbon, with the produced hydrogen gas used to offset energy needs in the process, thereby reducing carbon emissions.

Life Cycle Assessment Methodologies for Carbon-negative Materials

Life Cycle Assessment (LCA) methodologies are critical for evaluating the true environmental impact of carbon-negative concrete materials throughout their entire lifecycle. Traditional LCA approaches often fail to capture the unique carbon sequestration properties of innovative concrete formulations, necessitating specialized frameworks that account for both direct and indirect emissions across production, use, and end-of-life phases.

Current LCA methodologies for carbon-negative materials typically employ cradle-to-grave or cradle-to-cradle approaches, with system boundaries carefully defined to include raw material extraction, processing, manufacturing, transportation, installation, use phase, maintenance, and end-of-life scenarios. The functional unit selection proves particularly challenging for concrete applications, as performance characteristics must be balanced with environmental impact metrics.

Recent advancements in LCA frameworks have introduced dynamic carbon accounting models that track temporal aspects of carbon sequestration, addressing the time-dependent nature of carbon uptake in concrete materials. These models incorporate carbonation rates, service life predictions, and end-of-life scenarios to provide more accurate assessments of long-term carbon balance.

Allocation methods present significant challenges when evaluating carbon-negative concrete, particularly when industrial by-products or waste materials serve as precursors. The choice between mass-based, economic value-based, or system expansion allocation can dramatically influence assessment outcomes. Sensitivity analyses have demonstrated variations exceeding 30% in calculated global warming potential based solely on allocation methodology selection.

Data quality and availability remain persistent obstacles, with inventory databases often lacking comprehensive information on novel carbon-negative formulations. Primary data collection through industry partnerships has emerged as a best practice, supplemented by uncertainty analysis to address data gaps. Standardization efforts led by organizations such as the International Organization for Standardization (ISO) and the World Business Council for Sustainable Development (WBCSD) aim to establish consistent methodological approaches.

Impact assessment methods for carbon-negative materials have evolved to include not only global warming potential but also broader environmental indicators such as resource depletion, water usage, and toxicity. Multi-criteria decision analysis frameworks help stakeholders navigate trade-offs between carbon performance and other environmental impacts, preventing burden-shifting between impact categories.

Verification and certification systems specifically designed for carbon-negative building materials are emerging, with third-party verification becoming increasingly important for market acceptance and regulatory compliance. These systems typically require transparent documentation of assessment methodologies, data sources, and uncertainty analyses to validate carbon-negative claims.

Current LCA methodologies for carbon-negative materials typically employ cradle-to-grave or cradle-to-cradle approaches, with system boundaries carefully defined to include raw material extraction, processing, manufacturing, transportation, installation, use phase, maintenance, and end-of-life scenarios. The functional unit selection proves particularly challenging for concrete applications, as performance characteristics must be balanced with environmental impact metrics.

Recent advancements in LCA frameworks have introduced dynamic carbon accounting models that track temporal aspects of carbon sequestration, addressing the time-dependent nature of carbon uptake in concrete materials. These models incorporate carbonation rates, service life predictions, and end-of-life scenarios to provide more accurate assessments of long-term carbon balance.

Allocation methods present significant challenges when evaluating carbon-negative concrete, particularly when industrial by-products or waste materials serve as precursors. The choice between mass-based, economic value-based, or system expansion allocation can dramatically influence assessment outcomes. Sensitivity analyses have demonstrated variations exceeding 30% in calculated global warming potential based solely on allocation methodology selection.

Data quality and availability remain persistent obstacles, with inventory databases often lacking comprehensive information on novel carbon-negative formulations. Primary data collection through industry partnerships has emerged as a best practice, supplemented by uncertainty analysis to address data gaps. Standardization efforts led by organizations such as the International Organization for Standardization (ISO) and the World Business Council for Sustainable Development (WBCSD) aim to establish consistent methodological approaches.

Impact assessment methods for carbon-negative materials have evolved to include not only global warming potential but also broader environmental indicators such as resource depletion, water usage, and toxicity. Multi-criteria decision analysis frameworks help stakeholders navigate trade-offs between carbon performance and other environmental impacts, preventing burden-shifting between impact categories.

Verification and certification systems specifically designed for carbon-negative building materials are emerging, with third-party verification becoming increasingly important for market acceptance and regulatory compliance. These systems typically require transparent documentation of assessment methodologies, data sources, and uncertainty analyses to validate carbon-negative claims.

Policy Frameworks and Incentives for Green Construction Materials

The global shift towards sustainable construction has prompted governments worldwide to establish comprehensive policy frameworks that incentivize the adoption of carbon-negative concrete and other green building materials. These frameworks typically operate on multiple levels, from international agreements to local building codes, creating a regulatory environment that can either accelerate or impede innovation in sustainable construction materials.

Carbon pricing mechanisms represent one of the most direct policy tools for incentivizing green concrete adoption. Countries like Sweden, Finland, and Canada have implemented carbon taxes that make conventional cement production increasingly expensive, thereby improving the cost competitiveness of carbon-negative alternatives. The European Union's Emissions Trading System (ETS) similarly creates economic pressure for cement manufacturers to reduce their carbon footprint.

Public procurement policies have emerged as powerful market drivers for sustainable construction materials. Several jurisdictions, including California and the Netherlands, have established green public procurement requirements that specify maximum embodied carbon limits for concrete used in public infrastructure projects. These policies create guaranteed markets for innovative products while demonstrating their viability in real-world applications.

Building codes and standards are gradually evolving to accommodate and encourage carbon-negative concrete solutions. Countries like France have introduced regulations that require lifecycle carbon assessments for new buildings, while others are updating material performance standards to recognize alternative cementitious materials. However, many jurisdictions still maintain prescriptive standards that inadvertently create barriers to novel concrete formulations.

Financial incentives, including tax credits, grants, and low-interest loans, play a crucial role in supporting both research and market deployment of carbon-negative concrete. The US Infrastructure Investment and Jobs Act allocated significant funding for low-carbon construction materials, while the EU Innovation Fund supports large-scale demonstration projects for breakthrough technologies in cement production.

Industry partnerships and voluntary certification programs complement regulatory frameworks by establishing recognized standards for sustainable concrete. Programs like the Concrete Sustainability Council Certification System provide market recognition for producers who meet environmental performance criteria, helping to drive demand in the private sector.

Despite these advances, policy fragmentation remains a significant challenge. The lack of harmonized standards across jurisdictions creates market uncertainty and increases compliance costs for manufacturers. Moving forward, greater international coordination on performance-based standards, coupled with predictable long-term policy signals, will be essential to accelerate the transition to carbon-negative concrete solutions at scale.

Carbon pricing mechanisms represent one of the most direct policy tools for incentivizing green concrete adoption. Countries like Sweden, Finland, and Canada have implemented carbon taxes that make conventional cement production increasingly expensive, thereby improving the cost competitiveness of carbon-negative alternatives. The European Union's Emissions Trading System (ETS) similarly creates economic pressure for cement manufacturers to reduce their carbon footprint.

Public procurement policies have emerged as powerful market drivers for sustainable construction materials. Several jurisdictions, including California and the Netherlands, have established green public procurement requirements that specify maximum embodied carbon limits for concrete used in public infrastructure projects. These policies create guaranteed markets for innovative products while demonstrating their viability in real-world applications.

Building codes and standards are gradually evolving to accommodate and encourage carbon-negative concrete solutions. Countries like France have introduced regulations that require lifecycle carbon assessments for new buildings, while others are updating material performance standards to recognize alternative cementitious materials. However, many jurisdictions still maintain prescriptive standards that inadvertently create barriers to novel concrete formulations.

Financial incentives, including tax credits, grants, and low-interest loans, play a crucial role in supporting both research and market deployment of carbon-negative concrete. The US Infrastructure Investment and Jobs Act allocated significant funding for low-carbon construction materials, while the EU Innovation Fund supports large-scale demonstration projects for breakthrough technologies in cement production.

Industry partnerships and voluntary certification programs complement regulatory frameworks by establishing recognized standards for sustainable concrete. Programs like the Concrete Sustainability Council Certification System provide market recognition for producers who meet environmental performance criteria, helping to drive demand in the private sector.

Despite these advances, policy fragmentation remains a significant challenge. The lack of harmonized standards across jurisdictions creates market uncertainty and increases compliance costs for manufacturers. Moving forward, greater international coordination on performance-based standards, coupled with predictable long-term policy signals, will be essential to accelerate the transition to carbon-negative concrete solutions at scale.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!