Carbon-negative Concrete: The Path to Reinventing Infrastructure Design

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Evolution and Objectives

Concrete, the most widely used building material globally, has traditionally been a significant contributor to carbon emissions. The evolution of carbon-negative concrete represents a paradigm shift in construction technology, moving from environmentally harmful practices toward sustainable infrastructure solutions. This technological trajectory began in the early 2000s when researchers first identified the potential for carbon sequestration in concrete production, marking the initial conceptualization phase of carbon-negative concrete.

The mid-2010s witnessed accelerated development as environmental concerns intensified and regulatory pressures mounted. During this period, several breakthrough technologies emerged, including alternative cementitious materials, carbon capture methodologies specifically designed for concrete manufacturing, and novel curing techniques that enhance carbon absorption. These innovations laid the foundation for what would eventually become commercially viable carbon-negative concrete solutions.

By 2020, the technology entered its implementation phase, with pilot projects demonstrating the feasibility of carbon-negative concrete in real-world applications. The COVID-19 pandemic, despite its economic challenges, paradoxically accelerated interest in sustainable construction materials as governments worldwide incorporated green infrastructure initiatives into economic recovery plans.

Current technological objectives for carbon-negative concrete focus on several critical areas. First, achieving scalability remains paramount—transitioning from successful demonstration projects to widespread commercial adoption requires production processes that can meet global demand while maintaining carbon-negative properties. Second, cost competitiveness with traditional concrete is essential for market penetration, necessitating optimization of manufacturing processes and supply chains.

Performance enhancement represents another key objective, as carbon-negative concrete must meet or exceed the durability, strength, and versatility of conventional concrete to gain industry acceptance. Additionally, standardization efforts are underway to establish universal metrics for carbon negativity claims, ensuring transparency and preventing greenwashing in the marketplace.

Looking forward, the technology aims to achieve deeper carbon negativity—moving from modest carbon sequestration to substantial atmospheric carbon removal per unit volume. Integration with other sustainable building technologies, such as mass timber and recycled materials, represents another frontier, potentially creating hybrid construction systems with multiplied environmental benefits.

The ultimate objective extends beyond mere carbon neutrality to position concrete as an active climate solution—transforming infrastructure development from an environmental liability into a mechanism for large-scale carbon drawdown while meeting the growing global demand for resilient built environments.

The mid-2010s witnessed accelerated development as environmental concerns intensified and regulatory pressures mounted. During this period, several breakthrough technologies emerged, including alternative cementitious materials, carbon capture methodologies specifically designed for concrete manufacturing, and novel curing techniques that enhance carbon absorption. These innovations laid the foundation for what would eventually become commercially viable carbon-negative concrete solutions.

By 2020, the technology entered its implementation phase, with pilot projects demonstrating the feasibility of carbon-negative concrete in real-world applications. The COVID-19 pandemic, despite its economic challenges, paradoxically accelerated interest in sustainable construction materials as governments worldwide incorporated green infrastructure initiatives into economic recovery plans.

Current technological objectives for carbon-negative concrete focus on several critical areas. First, achieving scalability remains paramount—transitioning from successful demonstration projects to widespread commercial adoption requires production processes that can meet global demand while maintaining carbon-negative properties. Second, cost competitiveness with traditional concrete is essential for market penetration, necessitating optimization of manufacturing processes and supply chains.

Performance enhancement represents another key objective, as carbon-negative concrete must meet or exceed the durability, strength, and versatility of conventional concrete to gain industry acceptance. Additionally, standardization efforts are underway to establish universal metrics for carbon negativity claims, ensuring transparency and preventing greenwashing in the marketplace.

Looking forward, the technology aims to achieve deeper carbon negativity—moving from modest carbon sequestration to substantial atmospheric carbon removal per unit volume. Integration with other sustainable building technologies, such as mass timber and recycled materials, represents another frontier, potentially creating hybrid construction systems with multiplied environmental benefits.

The ultimate objective extends beyond mere carbon neutrality to position concrete as an active climate solution—transforming infrastructure development from an environmental liability into a mechanism for large-scale carbon drawdown while meeting the growing global demand for resilient built environments.

Market Demand Analysis for Sustainable Construction Materials

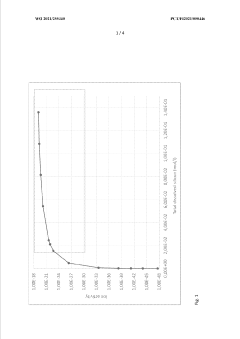

The global construction industry is experiencing a significant shift towards sustainable building materials, driven by increasing environmental concerns and regulatory pressures. The market for sustainable construction materials, particularly carbon-negative concrete, is projected to grow substantially over the next decade. Current estimates value the global green concrete market at approximately $30 billion, with expectations to reach $60 billion by 2030, representing a compound annual growth rate of 9.1%.

This growth is primarily fueled by stringent environmental regulations across major economies. The European Union's Green Deal aims for carbon neutrality by 2050, while the United States has rejoined the Paris Climate Agreement with ambitious emission reduction targets. China, despite being the largest concrete producer globally, has pledged to achieve carbon neutrality by 2060, creating enormous potential for sustainable alternatives in its massive construction sector.

Consumer preferences are also evolving rapidly, with increasing demand for environmentally responsible buildings. LEED and BREEAM certifications have become standard requirements for premium commercial properties, directly influencing material selection decisions. According to recent surveys, 73% of commercial property developers now consider sustainability credentials when selecting construction materials, compared to just 41% five years ago.

The economic case for carbon-negative concrete is strengthening as carbon pricing mechanisms mature worldwide. With carbon taxes ranging from $25 to $140 per ton across different jurisdictions, traditional concrete's carbon footprint represents a growing financial liability. This economic pressure is accelerating adoption of sustainable alternatives, particularly in infrastructure projects with long lifecycles.

Infrastructure renewal programs present a substantial market opportunity. The United States' $1.2 trillion infrastructure bill, Europe's €750 billion recovery package, and similar initiatives in Asia allocate significant funding for sustainable infrastructure development. These programs explicitly prioritize materials with reduced environmental impact, creating immediate market demand for carbon-negative concrete solutions.

Residential construction represents another growth segment, with eco-conscious homebuyers willing to pay premium prices for sustainable homes. Market research indicates that properties built with environmentally friendly materials command 4-8% higher prices than conventional counterparts, providing economic incentives for developers to adopt carbon-negative concrete.

Despite this promising outlook, market penetration faces challenges including higher initial costs, technical performance concerns, and established procurement patterns. The price premium for carbon-negative concrete currently ranges from 15-40% above traditional concrete, though this gap is narrowing as production scales and carbon pricing mechanisms evolve. Industry adoption will likely follow an S-curve pattern, with accelerated uptake occurring once price parity is achieved and performance reliability is firmly established.

This growth is primarily fueled by stringent environmental regulations across major economies. The European Union's Green Deal aims for carbon neutrality by 2050, while the United States has rejoined the Paris Climate Agreement with ambitious emission reduction targets. China, despite being the largest concrete producer globally, has pledged to achieve carbon neutrality by 2060, creating enormous potential for sustainable alternatives in its massive construction sector.

Consumer preferences are also evolving rapidly, with increasing demand for environmentally responsible buildings. LEED and BREEAM certifications have become standard requirements for premium commercial properties, directly influencing material selection decisions. According to recent surveys, 73% of commercial property developers now consider sustainability credentials when selecting construction materials, compared to just 41% five years ago.

The economic case for carbon-negative concrete is strengthening as carbon pricing mechanisms mature worldwide. With carbon taxes ranging from $25 to $140 per ton across different jurisdictions, traditional concrete's carbon footprint represents a growing financial liability. This economic pressure is accelerating adoption of sustainable alternatives, particularly in infrastructure projects with long lifecycles.

Infrastructure renewal programs present a substantial market opportunity. The United States' $1.2 trillion infrastructure bill, Europe's €750 billion recovery package, and similar initiatives in Asia allocate significant funding for sustainable infrastructure development. These programs explicitly prioritize materials with reduced environmental impact, creating immediate market demand for carbon-negative concrete solutions.

Residential construction represents another growth segment, with eco-conscious homebuyers willing to pay premium prices for sustainable homes. Market research indicates that properties built with environmentally friendly materials command 4-8% higher prices than conventional counterparts, providing economic incentives for developers to adopt carbon-negative concrete.

Despite this promising outlook, market penetration faces challenges including higher initial costs, technical performance concerns, and established procurement patterns. The price premium for carbon-negative concrete currently ranges from 15-40% above traditional concrete, though this gap is narrowing as production scales and carbon pricing mechanisms evolve. Industry adoption will likely follow an S-curve pattern, with accelerated uptake occurring once price parity is achieved and performance reliability is firmly established.

Current State and Challenges in Carbon-negative Concrete Technology

Carbon-negative concrete technology has emerged as a promising solution to address the significant carbon footprint of conventional concrete production, which accounts for approximately 8% of global CO2 emissions. Currently, several approaches are being explored globally, with varying degrees of technological maturity and commercial viability. The most advanced carbon-negative concrete technologies utilize alternative cementitious materials such as supplementary cementitious materials (SCMs), geopolymers, and novel binders that can sequester CO2 during the curing process.

Leading research institutions in North America, Europe, and Asia have demonstrated carbon-negative concrete formulations that can absorb between 5-10% of their weight in CO2, representing a significant improvement over traditional Portland cement concrete. Companies like CarbonCure, Solidia, and Carbon8 Systems have developed proprietary technologies that have achieved commercial implementation, albeit at limited scales. These technologies typically involve injecting captured CO2 into concrete during mixing or curing phases, where it mineralizes and becomes permanently sequestered.

Despite these advancements, carbon-negative concrete faces substantial technical challenges. Scalability remains a primary concern, as current production capacities cannot meet global construction demands. The performance characteristics of carbon-negative formulations, particularly long-term durability under various environmental conditions, require further validation through accelerated aging tests and real-world implementations. Many carbon-negative concrete technologies also demonstrate reduced early-stage strength development, which can extend construction timelines and increase project costs.

The geographical distribution of carbon-negative concrete technology development shows concentration in industrialized nations, with significant research clusters in California, Massachusetts, Germany, the UK, and Japan. However, implementation in developing countries, where concrete demand is rapidly growing, remains limited due to technological barriers and economic constraints.

Supply chain challenges present another significant hurdle. Many carbon-negative concrete formulations rely on industrial byproducts such as fly ash and slag, which have inconsistent availability and quality. The infrastructure for carbon capture, necessary for CO2 injection technologies, is still in its nascent stages globally, creating bottlenecks in the production process.

Regulatory frameworks and industry standards for carbon-negative concrete are underdeveloped in most regions, creating uncertainty for manufacturers and limiting market adoption. Current building codes and specifications often do not accommodate these innovative materials, requiring extensive testing and certification processes that delay commercial implementation.

Cost remains perhaps the most significant barrier to widespread adoption. Current carbon-negative concrete technologies typically command a 15-30% price premium over conventional concrete, though this gap is narrowing as production scales and carbon pricing mechanisms evolve in various markets.

Leading research institutions in North America, Europe, and Asia have demonstrated carbon-negative concrete formulations that can absorb between 5-10% of their weight in CO2, representing a significant improvement over traditional Portland cement concrete. Companies like CarbonCure, Solidia, and Carbon8 Systems have developed proprietary technologies that have achieved commercial implementation, albeit at limited scales. These technologies typically involve injecting captured CO2 into concrete during mixing or curing phases, where it mineralizes and becomes permanently sequestered.

Despite these advancements, carbon-negative concrete faces substantial technical challenges. Scalability remains a primary concern, as current production capacities cannot meet global construction demands. The performance characteristics of carbon-negative formulations, particularly long-term durability under various environmental conditions, require further validation through accelerated aging tests and real-world implementations. Many carbon-negative concrete technologies also demonstrate reduced early-stage strength development, which can extend construction timelines and increase project costs.

The geographical distribution of carbon-negative concrete technology development shows concentration in industrialized nations, with significant research clusters in California, Massachusetts, Germany, the UK, and Japan. However, implementation in developing countries, where concrete demand is rapidly growing, remains limited due to technological barriers and economic constraints.

Supply chain challenges present another significant hurdle. Many carbon-negative concrete formulations rely on industrial byproducts such as fly ash and slag, which have inconsistent availability and quality. The infrastructure for carbon capture, necessary for CO2 injection technologies, is still in its nascent stages globally, creating bottlenecks in the production process.

Regulatory frameworks and industry standards for carbon-negative concrete are underdeveloped in most regions, creating uncertainty for manufacturers and limiting market adoption. Current building codes and specifications often do not accommodate these innovative materials, requiring extensive testing and certification processes that delay commercial implementation.

Cost remains perhaps the most significant barrier to widespread adoption. Current carbon-negative concrete technologies typically command a 15-30% price premium over conventional concrete, though this gap is narrowing as production scales and carbon pricing mechanisms evolve in various markets.

Current Carbon-negative Concrete Formulations and Methods

01 Carbon capture and sequestration in concrete

Technologies that enable concrete to capture and store carbon dioxide during its lifecycle, effectively making it carbon-negative. These methods involve incorporating materials that can absorb CO2 from the atmosphere and chemically bind it within the concrete structure, turning the concrete into a carbon sink rather than a source of emissions. This approach helps offset the carbon emissions typically associated with concrete production.- Carbon capture and sequestration in concrete: Technologies that enable concrete to capture and store carbon dioxide during its lifecycle, effectively making it carbon-negative. These methods involve incorporating materials that can absorb CO2 from the atmosphere and chemically bind it within the concrete structure, reducing the overall carbon footprint of construction projects. This approach transforms concrete from a carbon source to a carbon sink.

- Alternative cementitious materials for reduced emissions: The use of alternative materials to replace traditional Portland cement, which is responsible for significant carbon emissions in concrete production. These alternatives include supplementary cementitious materials like fly ash, slag, silica fume, and natural pozzolans that require less energy to produce and generate fewer emissions. Some formulations also incorporate novel binders derived from industrial byproducts or naturally occurring minerals.

- CO2 curing and carbonation processes: Innovative curing methods that utilize carbon dioxide instead of water to harden concrete, resulting in carbon sequestration within the material. These processes accelerate the carbonation reaction, improving concrete strength while simultaneously reducing its carbon footprint. The technology can be applied during manufacturing or post-production stages, offering flexibility in implementation across different concrete applications.

- Biomass and waste incorporation in concrete: Methods for incorporating biomass and waste materials into concrete formulations to reduce carbon emissions. These approaches utilize agricultural residues, wood waste, plastic waste, and other carbon-containing materials as partial replacements for traditional concrete ingredients. The organic materials can be processed into biochar or other forms that sequester carbon while maintaining or enhancing concrete performance properties.

- Carbon accounting and monitoring systems for concrete: Systems and methods for measuring, tracking, and verifying the carbon footprint of concrete throughout its lifecycle. These technologies enable accurate assessment of carbon emissions and sequestration in concrete production and use, facilitating carbon credits, regulatory compliance, and sustainability reporting. The systems may include sensors, data analytics, blockchain verification, and other tools to ensure transparent carbon accounting in the concrete industry.

02 Alternative cementitious materials for reduced carbon footprint

The use of alternative materials to replace traditional Portland cement, which is responsible for significant carbon emissions in concrete production. These alternatives include supplementary cementitious materials like fly ash, slag, silica fume, and natural pozzolans that require less energy to produce and generate fewer emissions. Some innovative formulations can achieve carbon-negative status by combining these materials with carbon sequestration techniques.Expand Specific Solutions03 CO2 curing and carbonation processes

Specialized curing processes that inject CO2 into concrete during the hardening phase, promoting carbonation reactions that strengthen the material while permanently storing carbon dioxide. These techniques accelerate the natural carbonation process that occurs in concrete over time and can significantly reduce the carbon footprint of concrete products. The CO2 used can be sourced from industrial emissions, creating a circular carbon economy.Expand Specific Solutions04 Monitoring and verification systems for carbon-negative concrete

Technologies and methodologies for measuring, reporting, and verifying the carbon sequestration capabilities of carbon-negative concrete. These systems include sensors, testing protocols, and digital platforms that track the amount of CO2 captured and stored in concrete structures throughout their lifecycle. Such verification is crucial for carbon credit certification and ensuring the environmental claims of carbon-negative concrete products are accurate and transparent.Expand Specific Solutions05 Industrial processes for scaling carbon-negative concrete production

Manufacturing techniques and industrial processes designed to scale up the production of carbon-negative concrete while maintaining economic viability. These innovations include modified production lines, specialized equipment for CO2 injection, and optimized mixing procedures that enable the mass production of carbon-negative concrete products. The focus is on making carbon-negative concrete commercially competitive with traditional concrete while significantly reducing the construction industry's carbon footprint.Expand Specific Solutions

Key Industry Players in Sustainable Concrete Innovation

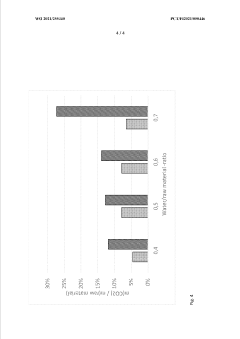

Carbon-negative concrete technology is in an early growth phase, with market size expanding as construction industries seek sustainable solutions. The technology is gaining traction but remains in development, with varying degrees of maturity across key players. Academic institutions like MIT, Worcester Polytechnic Institute, and Colorado School of Mines are driving fundamental research, while companies such as Carbon Limit Co., Ecocem Materials, and Taiheiyo Cement are commercializing applications. Established construction firms like Holcim Technology and Fujita Corp are integrating these innovations into their portfolios. The competitive landscape shows a collaborative ecosystem between research institutions and industry partners, with significant investment in scaling carbon capture technologies for concrete production.

Taiheiyo Cement Corp.

Technical Solution: Taiheiyo Cement has developed an innovative carbon-negative concrete technology called "CO2-SUICOM" (CO2-Storage Under Infrastructure by Concrete Materials). This system actively absorbs and permanently stores CO2 during the curing process through a special admixture containing calcium hydroxide. The concrete can absorb approximately 120kg of CO2 per cubic meter, effectively making it carbon-negative. Their process also incorporates industrial by-products like blast furnace slag and fly ash to replace portions of traditional cement, further reducing the carbon footprint. Taiheiyo has implemented a specialized curing chamber where concrete products are exposed to concentrated CO2 environments, accelerating carbonation and improving mechanical properties simultaneously.

Strengths: Proven carbon absorption capabilities verified through field implementations; technology can be integrated into existing concrete manufacturing facilities with minimal modifications; improved durability and reduced cracking compared to conventional concrete. Weaknesses: Requires specialized curing conditions for optimal carbon sequestration; higher production costs; limited scalability for certain applications requiring rapid construction timelines.

Massachusetts Institute of Technology

Technical Solution: MIT researchers have developed an electrochemical process for producing carbon-negative concrete that eliminates limestone calcination, the primary source of CO2 emissions in cement production. Their approach uses an electrolyzer with selective membranes to extract calcium from limestone without releasing CO2. This electrolysis-driven process produces calcium hydroxide for cement while generating hydrogen as a valuable by-product. MIT's technology can reduce concrete's carbon footprint by over 100% when renewable electricity powers the process. Additionally, they've pioneered a complementary technique that uses bacteria to strengthen concrete and heal cracks autonomously. The bacteria, embedded in the concrete matrix, precipitate calcium carbonate when exposed to water, effectively sealing cracks and increasing structural durability by up to 40%.

Strengths: Revolutionary approach that eliminates the fundamental carbon emission source in cement production; produces valuable hydrogen by-product that can offset operational costs; potential for complete decarbonization of concrete production. Weaknesses: Currently at laboratory/pilot scale; requires significant electricity input; necessitates substantial changes to existing cement production infrastructure; higher production costs until scaled.

Core Patents and Research in CO2 Sequestration Technologies

Controlling carbonation

PatentWO2021255340A1

Innovation

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

Carbon negative concrete production through the use of sustainable materials

PatentInactiveUS20230002276A1

Innovation

- Incorporating biochar, a high-carbon residue produced through low-oxygen pyrolysis, into concrete mixtures to sequester carbon and reduce emissions, while optimizing pyrolysis processes to power plants using syngas for self-sustainability and carbon neutrality.

Regulatory Framework and Carbon Credit Opportunities

The regulatory landscape for carbon-negative concrete is rapidly evolving as governments worldwide implement policies to reduce carbon emissions in the construction sector. The European Union's Carbon Border Adjustment Mechanism (CBAM) represents a significant development, imposing carbon tariffs on imported cement and concrete products that don't meet EU emissions standards. This mechanism creates strong economic incentives for manufacturers to adopt carbon-negative technologies. Similarly, the United States has introduced the Low Carbon Concrete Standards in federal procurement policies, while Canada's Clean Fuel Standard provides regulatory support for carbon-negative building materials.

These regulatory frameworks are complemented by carbon pricing mechanisms that directly influence the economic viability of carbon-negative concrete. Currently, over 40 countries have implemented some form of carbon pricing, with prices ranging from $5 to $130 per ton of CO2. For carbon-negative concrete producers, these pricing structures represent potential revenue streams through carbon credits, as each ton of CO2 sequestered can generate tradable credits in compliance or voluntary markets.

The voluntary carbon market presents particularly promising opportunities for carbon-negative concrete technologies. Projects that permanently sequester carbon dioxide can qualify for premium carbon credits, which currently trade at $20-75 per ton depending on verification standards and sequestration permanence. Leading verification standards such as Verra and Gold Standard have developed specific methodologies for evaluating carbon sequestration in building materials, providing the necessary framework for credit generation.

Corporate net-zero commitments are driving significant demand for high-quality carbon removal credits. Major technology companies and financial institutions have pledged billions in carbon credit purchases over the coming decades, creating a robust market for carbon-negative concrete producers. The Architecture, Engineering, and Construction (AEC) sector itself is increasingly adopting internal carbon pricing, further incentivizing the specification of carbon-negative materials.

Emerging policy innovations include Carbon Take-Back Obligations, requiring fossil fuel companies to permanently sequester a percentage of the emissions from their products, and Carbon Storage Obligations in building codes, mandating minimum levels of carbon sequestration in new construction. These regulatory developments, combined with expanding carbon credit opportunities, are creating a favorable economic environment for scaling carbon-negative concrete technologies and accelerating their market adoption.

These regulatory frameworks are complemented by carbon pricing mechanisms that directly influence the economic viability of carbon-negative concrete. Currently, over 40 countries have implemented some form of carbon pricing, with prices ranging from $5 to $130 per ton of CO2. For carbon-negative concrete producers, these pricing structures represent potential revenue streams through carbon credits, as each ton of CO2 sequestered can generate tradable credits in compliance or voluntary markets.

The voluntary carbon market presents particularly promising opportunities for carbon-negative concrete technologies. Projects that permanently sequester carbon dioxide can qualify for premium carbon credits, which currently trade at $20-75 per ton depending on verification standards and sequestration permanence. Leading verification standards such as Verra and Gold Standard have developed specific methodologies for evaluating carbon sequestration in building materials, providing the necessary framework for credit generation.

Corporate net-zero commitments are driving significant demand for high-quality carbon removal credits. Major technology companies and financial institutions have pledged billions in carbon credit purchases over the coming decades, creating a robust market for carbon-negative concrete producers. The Architecture, Engineering, and Construction (AEC) sector itself is increasingly adopting internal carbon pricing, further incentivizing the specification of carbon-negative materials.

Emerging policy innovations include Carbon Take-Back Obligations, requiring fossil fuel companies to permanently sequester a percentage of the emissions from their products, and Carbon Storage Obligations in building codes, mandating minimum levels of carbon sequestration in new construction. These regulatory developments, combined with expanding carbon credit opportunities, are creating a favorable economic environment for scaling carbon-negative concrete technologies and accelerating their market adoption.

Life Cycle Assessment of Carbon-negative Concrete Solutions

Life Cycle Assessment (LCA) provides a comprehensive framework for evaluating the environmental impacts of carbon-negative concrete solutions throughout their entire lifecycle. This assessment methodology examines impacts from raw material extraction through manufacturing, transportation, use, and end-of-life disposal or recycling. For carbon-negative concrete, LCA reveals significant advantages compared to traditional Portland cement concrete.

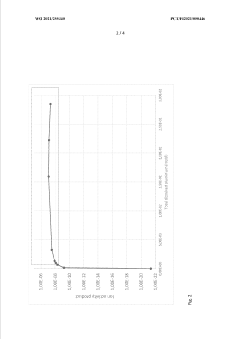

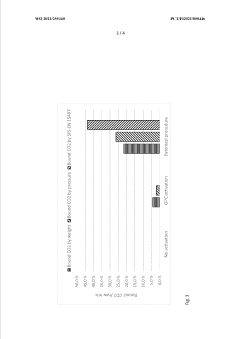

The cradle-to-gate analysis of carbon-negative concrete demonstrates substantial carbon sequestration capabilities. While conventional concrete production emits approximately 410 kg CO2e per cubic meter, innovative carbon-negative formulations can sequester between 75-150 kg CO2e per cubic meter. This transformation from a carbon source to a carbon sink represents a paradigm shift in construction materials.

Raw material acquisition for carbon-negative concrete often involves industrial byproducts like fly ash, slag, and silica fume, which diverts these materials from landfills. The manufacturing process typically requires 60-80% less energy than traditional concrete production, primarily due to lower calcination temperatures and reduced clinker content. Transportation impacts remain comparable to conventional concrete, though local sourcing of alternative binders can provide additional carbon benefits.

During the use phase, carbon-negative concrete continues to absorb CO2 through carbonation processes. Research indicates that over a 50-year service life, these formulations can sequester an additional 10-25% carbon beyond their initial negative carbon footprint. This ongoing carbon capture represents a unique advantage in the built environment.

End-of-life considerations reveal further benefits. When demolished, carbon-negative concrete can be crushed and used as aggregate, continuing its carbon sequestration properties in secondary applications. This circular approach extends the material's environmental benefits beyond its primary use.

Sensitivity analysis within LCAs indicates that the carbon benefits of these innovative concretes are most influenced by binder composition, curing conditions, and transportation distances. Regional variations in electricity grid carbon intensity also significantly impact the overall carbon footprint, with renewable energy-powered production offering the most substantial benefits.

Comparative LCAs between various carbon-negative formulations show that those incorporating biomass-derived supplementary cementitious materials often achieve the highest carbon sequestration rates, while those using captured carbon in mineralization processes offer the most consistent performance across different environmental impact categories.

The cradle-to-gate analysis of carbon-negative concrete demonstrates substantial carbon sequestration capabilities. While conventional concrete production emits approximately 410 kg CO2e per cubic meter, innovative carbon-negative formulations can sequester between 75-150 kg CO2e per cubic meter. This transformation from a carbon source to a carbon sink represents a paradigm shift in construction materials.

Raw material acquisition for carbon-negative concrete often involves industrial byproducts like fly ash, slag, and silica fume, which diverts these materials from landfills. The manufacturing process typically requires 60-80% less energy than traditional concrete production, primarily due to lower calcination temperatures and reduced clinker content. Transportation impacts remain comparable to conventional concrete, though local sourcing of alternative binders can provide additional carbon benefits.

During the use phase, carbon-negative concrete continues to absorb CO2 through carbonation processes. Research indicates that over a 50-year service life, these formulations can sequester an additional 10-25% carbon beyond their initial negative carbon footprint. This ongoing carbon capture represents a unique advantage in the built environment.

End-of-life considerations reveal further benefits. When demolished, carbon-negative concrete can be crushed and used as aggregate, continuing its carbon sequestration properties in secondary applications. This circular approach extends the material's environmental benefits beyond its primary use.

Sensitivity analysis within LCAs indicates that the carbon benefits of these innovative concretes are most influenced by binder composition, curing conditions, and transportation distances. Regional variations in electricity grid carbon intensity also significantly impact the overall carbon footprint, with renewable energy-powered production offering the most substantial benefits.

Comparative LCAs between various carbon-negative formulations show that those incorporating biomass-derived supplementary cementitious materials often achieve the highest carbon sequestration rates, while those using captured carbon in mineralization processes offer the most consistent performance across different environmental impact categories.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!