Research on the Energy-saving Potential of Carbon-negative Concrete

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Background and Objectives

Concrete production is one of the most carbon-intensive industrial processes, accounting for approximately 8% of global CO2 emissions. Traditional cement manufacturing releases significant amounts of carbon dioxide through both the chemical process of calcination and the energy-intensive heating required. As global construction continues to expand, particularly in developing economies, the environmental impact of concrete production presents a critical challenge for meeting climate goals established in the Paris Agreement and subsequent international accords.

Carbon-negative concrete represents a paradigm shift in construction materials technology, moving beyond carbon neutrality to actively remove CO2 from the atmosphere. This revolutionary approach has evolved from early carbon capture techniques to sophisticated materials science innovations that fundamentally alter the chemistry and production methods of concrete. The concept first emerged in the early 2000s but has gained significant momentum in the past decade as climate urgency has intensified.

The primary objective of research into carbon-negative concrete is to develop commercially viable construction materials that sequester more carbon dioxide than they emit throughout their lifecycle. This includes carbon absorption during manufacturing, curing, and the operational life of the concrete structure. Secondary objectives include maintaining or enhancing the structural performance characteristics of traditional concrete while reducing energy consumption in production processes.

Current technological approaches to carbon-negative concrete include CO2 mineralization, alternative binding materials such as geopolymers, and biomass incorporation. Each pathway offers distinct advantages and challenges regarding implementation scale, cost-effectiveness, and compatibility with existing construction practices. The energy-saving potential is particularly significant, as some carbon-negative formulations can cure at ambient temperatures, eliminating the energy-intensive heating required in traditional cement kilns.

Research goals in this field extend beyond laboratory proof-of-concept to industrial-scale implementation. This necessitates addressing challenges in supply chain development, regulatory approval, industry standards adaptation, and market acceptance. The timeline for widespread adoption is influenced by both technological maturation and policy frameworks that incentivize low-carbon building materials.

The energy-saving potential of carbon-negative concrete represents a dual environmental benefit: reducing operational energy requirements while simultaneously sequestering carbon. Preliminary studies suggest energy savings of 30-60% compared to conventional concrete production, with the additional benefit of potentially removing 100-300 kg of CO2 per cubic meter of concrete produced. These figures position carbon-negative concrete as a critical technology for meeting both energy efficiency targets and carbon neutrality goals in the construction sector.

Carbon-negative concrete represents a paradigm shift in construction materials technology, moving beyond carbon neutrality to actively remove CO2 from the atmosphere. This revolutionary approach has evolved from early carbon capture techniques to sophisticated materials science innovations that fundamentally alter the chemistry and production methods of concrete. The concept first emerged in the early 2000s but has gained significant momentum in the past decade as climate urgency has intensified.

The primary objective of research into carbon-negative concrete is to develop commercially viable construction materials that sequester more carbon dioxide than they emit throughout their lifecycle. This includes carbon absorption during manufacturing, curing, and the operational life of the concrete structure. Secondary objectives include maintaining or enhancing the structural performance characteristics of traditional concrete while reducing energy consumption in production processes.

Current technological approaches to carbon-negative concrete include CO2 mineralization, alternative binding materials such as geopolymers, and biomass incorporation. Each pathway offers distinct advantages and challenges regarding implementation scale, cost-effectiveness, and compatibility with existing construction practices. The energy-saving potential is particularly significant, as some carbon-negative formulations can cure at ambient temperatures, eliminating the energy-intensive heating required in traditional cement kilns.

Research goals in this field extend beyond laboratory proof-of-concept to industrial-scale implementation. This necessitates addressing challenges in supply chain development, regulatory approval, industry standards adaptation, and market acceptance. The timeline for widespread adoption is influenced by both technological maturation and policy frameworks that incentivize low-carbon building materials.

The energy-saving potential of carbon-negative concrete represents a dual environmental benefit: reducing operational energy requirements while simultaneously sequestering carbon. Preliminary studies suggest energy savings of 30-60% compared to conventional concrete production, with the additional benefit of potentially removing 100-300 kg of CO2 per cubic meter of concrete produced. These figures position carbon-negative concrete as a critical technology for meeting both energy efficiency targets and carbon neutrality goals in the construction sector.

Market Analysis for Sustainable Construction Materials

The sustainable construction materials market is experiencing unprecedented growth, driven by increasing environmental awareness and stringent regulations aimed at reducing carbon emissions in the construction industry. The global market for sustainable construction materials was valued at approximately $230 billion in 2022 and is projected to reach $425 billion by 2030, growing at a CAGR of around 9.2% during the forecast period. This growth trajectory is particularly significant for carbon-negative concrete, which represents one of the most promising segments within this market.

The demand for carbon-negative concrete is primarily fueled by the construction industry's substantial carbon footprint, which accounts for nearly 38% of global CO2 emissions. Traditional concrete production alone contributes about 8% of global carbon emissions, creating an urgent need for alternatives that can mitigate environmental impact while meeting performance requirements.

Regional analysis reveals varying adoption rates of sustainable construction materials. Europe leads the market with the most progressive policies and highest adoption rates, particularly in countries like Germany, France, and the Nordic nations where carbon taxes and green building certifications have become standard practice. North America follows closely, with the United States seeing increased demand driven by LEED certification requirements and corporate sustainability commitments.

The Asia-Pacific region represents the fastest-growing market for sustainable construction materials, with China and India at the forefront due to rapid urbanization and increasing government initiatives to combat air pollution and reduce carbon emissions. These emerging markets are expected to contribute significantly to the growth of carbon-negative concrete adoption in the coming years.

Consumer sentiment analysis indicates a growing willingness among property developers and individual homeowners to pay premium prices for sustainable building materials. Surveys show that approximately 65% of commercial construction projects now prioritize environmental impact in material selection, up from 40% five years ago.

Market segmentation reveals that public infrastructure projects currently constitute the largest application segment for carbon-negative concrete, accounting for about 45% of market demand. Commercial buildings represent 30%, while residential applications make up 20%, with the remaining 5% distributed across specialized applications.

The economic viability of carbon-negative concrete has improved significantly in recent years, with the price premium over traditional concrete decreasing from 70-80% to 30-40% in many markets. This trend is expected to continue as production scales up and technology advances, potentially reaching price parity in some applications within the next decade.

The demand for carbon-negative concrete is primarily fueled by the construction industry's substantial carbon footprint, which accounts for nearly 38% of global CO2 emissions. Traditional concrete production alone contributes about 8% of global carbon emissions, creating an urgent need for alternatives that can mitigate environmental impact while meeting performance requirements.

Regional analysis reveals varying adoption rates of sustainable construction materials. Europe leads the market with the most progressive policies and highest adoption rates, particularly in countries like Germany, France, and the Nordic nations where carbon taxes and green building certifications have become standard practice. North America follows closely, with the United States seeing increased demand driven by LEED certification requirements and corporate sustainability commitments.

The Asia-Pacific region represents the fastest-growing market for sustainable construction materials, with China and India at the forefront due to rapid urbanization and increasing government initiatives to combat air pollution and reduce carbon emissions. These emerging markets are expected to contribute significantly to the growth of carbon-negative concrete adoption in the coming years.

Consumer sentiment analysis indicates a growing willingness among property developers and individual homeowners to pay premium prices for sustainable building materials. Surveys show that approximately 65% of commercial construction projects now prioritize environmental impact in material selection, up from 40% five years ago.

Market segmentation reveals that public infrastructure projects currently constitute the largest application segment for carbon-negative concrete, accounting for about 45% of market demand. Commercial buildings represent 30%, while residential applications make up 20%, with the remaining 5% distributed across specialized applications.

The economic viability of carbon-negative concrete has improved significantly in recent years, with the price premium over traditional concrete decreasing from 70-80% to 30-40% in many markets. This trend is expected to continue as production scales up and technology advances, potentially reaching price parity in some applications within the next decade.

Current Status and Challenges in Carbon-negative Concrete

Carbon-negative concrete technology has seen significant advancements globally, though it remains in relatively early stages of commercial deployment. Currently, several pioneering companies have developed functional carbon-negative concrete solutions, with notable progress in North America, Europe, and parts of Asia. These technologies primarily utilize alternative cementitious materials, carbon capture during production, or innovative carbonation curing processes to achieve negative carbon emissions.

Despite promising developments, the industry faces substantial technical challenges. The most significant hurdle is maintaining or improving concrete performance characteristics while reducing carbon footprint. Many carbon-negative formulations struggle to match conventional concrete's strength, durability, and setting time, particularly in demanding structural applications. This performance gap remains a critical barrier to widespread adoption in high-specification construction projects.

Production scalability presents another major challenge. Current carbon-negative concrete manufacturing processes often require specialized equipment, precise control conditions, or novel raw materials that are not readily available in traditional concrete production facilities. The capital investment required for retrofitting existing plants or building new specialized facilities creates significant economic barriers to industry-wide implementation.

Raw material availability and consistency pose additional constraints. Many carbon-negative concrete formulations rely on industrial byproducts like fly ash or slag, which vary in composition and availability by region. As power generation shifts away from coal, the supply of fly ash is decreasing in many markets, creating uncertainty for concrete producers dependent on these materials.

Regulatory frameworks and standards represent another significant challenge. Most building codes and construction specifications were developed for traditional Portland cement concrete, creating compliance hurdles for innovative formulations. The lack of long-term performance data for carbon-negative concrete further complicates certification and acceptance by conservative construction industries and regulatory bodies.

Cost competitiveness remains a persistent challenge. Despite decreasing production costs as technologies mature, most carbon-negative concrete solutions still command price premiums over conventional concrete. Without carbon pricing mechanisms or regulatory mandates, this cost differential slows market penetration, particularly in price-sensitive construction segments.

Geographically, technology development is concentrated in regions with strong climate policies and research funding, creating uneven global distribution of expertise and implementation capacity. This disparity is particularly pronounced between developed and developing economies, despite the latter representing the fastest-growing concrete markets globally.

Despite promising developments, the industry faces substantial technical challenges. The most significant hurdle is maintaining or improving concrete performance characteristics while reducing carbon footprint. Many carbon-negative formulations struggle to match conventional concrete's strength, durability, and setting time, particularly in demanding structural applications. This performance gap remains a critical barrier to widespread adoption in high-specification construction projects.

Production scalability presents another major challenge. Current carbon-negative concrete manufacturing processes often require specialized equipment, precise control conditions, or novel raw materials that are not readily available in traditional concrete production facilities. The capital investment required for retrofitting existing plants or building new specialized facilities creates significant economic barriers to industry-wide implementation.

Raw material availability and consistency pose additional constraints. Many carbon-negative concrete formulations rely on industrial byproducts like fly ash or slag, which vary in composition and availability by region. As power generation shifts away from coal, the supply of fly ash is decreasing in many markets, creating uncertainty for concrete producers dependent on these materials.

Regulatory frameworks and standards represent another significant challenge. Most building codes and construction specifications were developed for traditional Portland cement concrete, creating compliance hurdles for innovative formulations. The lack of long-term performance data for carbon-negative concrete further complicates certification and acceptance by conservative construction industries and regulatory bodies.

Cost competitiveness remains a persistent challenge. Despite decreasing production costs as technologies mature, most carbon-negative concrete solutions still command price premiums over conventional concrete. Without carbon pricing mechanisms or regulatory mandates, this cost differential slows market penetration, particularly in price-sensitive construction segments.

Geographically, technology development is concentrated in regions with strong climate policies and research funding, creating uneven global distribution of expertise and implementation capacity. This disparity is particularly pronounced between developed and developing economies, despite the latter representing the fastest-growing concrete markets globally.

Current Energy-saving Solutions in Concrete Production

01 CO2 capture and sequestration in concrete

Carbon-negative concrete technologies that actively capture and sequester CO2 during the manufacturing process. These methods involve incorporating CO2 into the concrete mixture, where it reacts with calcium compounds to form stable carbonates, effectively locking away carbon dioxide while simultaneously improving concrete strength. This approach not only reduces the carbon footprint of concrete production but can potentially make concrete a carbon sink, contributing to negative emissions.- CO2 capture and utilization in concrete production: Carbon-negative concrete can be produced by capturing and utilizing CO2 during the manufacturing process. This approach involves injecting CO2 into concrete mixtures where it reacts with calcium compounds to form stable carbonates, effectively sequestering carbon dioxide while improving concrete properties. This technology reduces the carbon footprint of concrete production and contributes to energy savings by optimizing the curing process and potentially reducing the amount of cement required.

- Alternative cementitious materials and binders: Using alternative cementitious materials and binders can significantly reduce the carbon footprint of concrete. These alternatives include supplementary cementitious materials (SCMs) like fly ash, slag, and silica fume, as well as novel binders that require less energy to produce than traditional Portland cement. These materials not only reduce CO2 emissions during production but also improve concrete durability and performance, leading to energy savings throughout the lifecycle of concrete structures.

- Energy-efficient concrete curing technologies: Advanced curing technologies can significantly reduce the energy consumption in concrete production while enhancing carbon sequestration. These include ambient temperature curing, accelerated carbonation curing, and microwave curing methods that require less energy than conventional thermal curing. These technologies not only save energy but also accelerate the strength development of concrete, allowing for faster construction timelines and reduced overall energy use in building projects.

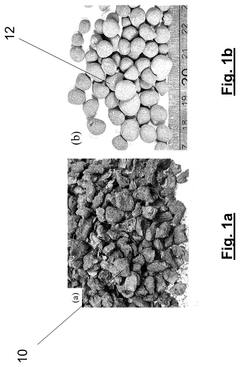

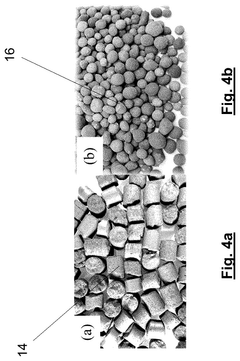

- Carbon-negative aggregates and fillers: Incorporating carbon-negative aggregates and fillers into concrete mixtures can significantly reduce the overall carbon footprint. These materials include recycled concrete aggregates, industrial by-products, and specially processed minerals that can absorb and store CO2. By replacing traditional aggregates with these carbon-negative alternatives, concrete can become a net carbon sink while maintaining or even improving its structural properties, leading to energy savings in both production and throughout the lifecycle of concrete structures.

- Smart concrete formulations for energy efficiency: Smart concrete formulations incorporate advanced additives and mix designs that optimize energy efficiency throughout the concrete lifecycle. These formulations include self-healing properties, enhanced thermal performance, and improved durability that reduce maintenance and replacement needs. By extending the service life of concrete structures and improving their thermal performance, these smart formulations contribute to significant long-term energy savings in buildings and infrastructure, despite potentially requiring similar energy inputs during initial production.

02 Alternative cementitious materials

The use of alternative cementitious materials to replace traditional Portland cement, which is responsible for significant CO2 emissions. These alternatives include supplementary cementitious materials (SCMs) like fly ash, slag, and natural pozzolans, as well as novel binders that require less energy to produce. These materials can significantly reduce the carbon footprint of concrete while maintaining or even enhancing performance characteristics, contributing to both carbon reduction and energy savings.Expand Specific Solutions03 Energy-efficient concrete curing methods

Advanced curing techniques that reduce the energy requirements for concrete production. These include ambient temperature curing, solar curing, and accelerated carbonation curing, which can significantly decrease the energy consumption compared to traditional steam or heat curing methods. These approaches not only save energy but also can enhance CO2 uptake during the curing process, further contributing to the carbon-negative potential of concrete.Expand Specific Solutions04 Carbon mineralization technologies

Technologies that accelerate the natural process of carbon mineralization in concrete, where CO2 reacts with calcium-rich materials to form stable mineral carbonates. These processes can be applied during concrete manufacturing or as a treatment for recycled concrete aggregate, effectively sequestering carbon while improving material properties. The mineralization process can be enhanced through various catalysts and reaction conditions, maximizing both carbon sequestration and energy efficiency.Expand Specific Solutions05 Waste material incorporation and recycling

Methods for incorporating industrial waste materials and recycled concrete into new concrete mixtures, reducing both the embodied energy and carbon footprint. These approaches include using construction and demolition waste, industrial by-products, and even captured carbon to create new concrete products. By reducing the need for virgin materials and energy-intensive processing, these methods contribute significantly to the energy-saving potential of carbon-negative concrete while promoting circular economy principles.Expand Specific Solutions

Key Industry Players in Carbon-negative Concrete Development

The carbon-negative concrete market is in its early growth phase, characterized by increasing research activities and emerging commercial applications. The global market size is projected to expand significantly as construction industries seek sustainable alternatives to traditional cement, which accounts for approximately 8% of global CO2 emissions. Technologically, carbon-negative concrete solutions are advancing through various approaches, with companies at different maturity levels. China Construction Commercial Concrete, China West Construction, and Huaxin Cement are leveraging their industrial scale to implement carbon capture technologies, while research institutions like MIT, Worcester Polytechnic Institute, and Central South University are developing innovative binding materials. Specialized players like Ecocem Materials and Procarbon Bio are pioneering alternative cementitious materials, creating a competitive landscape that balances established industry players with innovative startups and academic research centers.

Massachusetts Institute of Technology

Technical Solution: MIT has developed an innovative electrochemical process for producing carbon-negative concrete that captures CO2 during cement production. Their approach uses renewable electricity to drive a calcium extraction process from silicate minerals, which simultaneously captures atmospheric CO2 to form solid carbonates. This technology can reduce concrete's carbon footprint by up to 70% compared to traditional Portland cement production methods[1]. MIT researchers have also pioneered a method to strengthen concrete by incorporating calcium carbonate nanoparticles, which not only improves mechanical properties but also serves as a carbon sink. Their life cycle assessment demonstrates that this approach can transform concrete from a carbon source to a carbon sink when considering the entire production process[3]. Additionally, MIT has developed a concrete curing process that utilizes flue gases from industrial facilities, effectively sequestering CO2 that would otherwise be released into the atmosphere.

Strengths: MIT's electrochemical process achieves both carbon capture and cement production simultaneously, offering a truly carbon-negative solution. Their approach requires less energy than conventional methods and produces fewer emissions. Weaknesses: The technology requires significant capital investment for implementation at scale and depends on access to renewable electricity sources to maintain its carbon-negative profile. The process also introduces new material supply chains that may face adoption barriers in the conservative construction industry.

China National Building Material Group Co., Ltd.

Technical Solution: China National Building Material Group (CNBM) has developed a comprehensive carbon-negative concrete technology that integrates several innovative approaches. Their primary technology involves a calcium looping process that captures CO2 from cement kiln exhaust gases and converts it into calcium carbonate, which is then reincorporated into new concrete mixtures[1]. This closed-loop system can reduce carbon emissions by up to 60% compared to conventional methods. CNBM has also pioneered the use of alternative raw materials such as carbide slag, steel slag, and fly ash as substitutes for limestone in clinker production, significantly reducing the calcination emissions that account for approximately 60% of cement's carbon footprint[3]. Additionally, CNBM has developed a novel concrete curing technology that actively absorbs CO2 from the atmosphere during the hardening process, enhancing strength development while sequestering carbon. Their integrated approach includes the use of carbon-capturing admixtures that form stable carbonate compounds within the concrete matrix, providing long-term carbon storage[4].

Strengths: CNBM's integrated approach addresses multiple stages of concrete production, from raw material selection to manufacturing processes and curing techniques. Their scale of operations in China provides significant potential for widespread implementation and measurable climate impact. Weaknesses: Some of their technologies require substantial modifications to existing production facilities, creating adoption barriers. The carbon-negative performance is partially dependent on the availability of specific waste materials that may vary by region.

Core Patents and Research in Carbon Sequestration Concrete

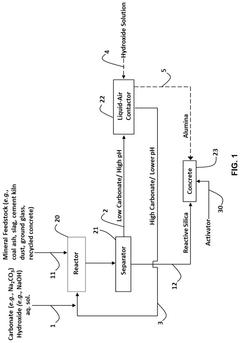

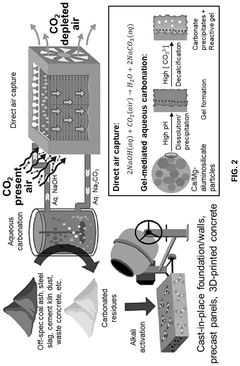

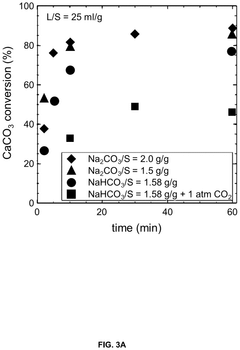

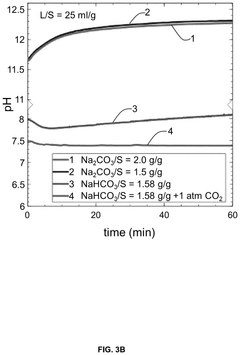

Cementitious materials and methods of making and using same

PatentPendingUS20250042811A1

Innovation

- A carbon mineralization-based direct-air capture process is used to produce carbon-negative cementitious materials by capturing CO2 from the air through an aqueous carbonation cycle, enhancing the pozzolanic reactivity of industrial mineral wastes, and incorporating the captured CO2 as solid carbonate in the concrete.

Aggregate, structural concrete with aggregate, and methods of forming same

PatentPendingUS20240376003A1

Innovation

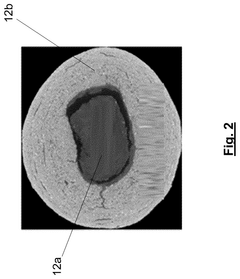

- An aggregate with a biochar core encapsulated in a shell made of cementitious or alkali-activated materials is developed, which improves the mechanical properties and carbon storage capacity of concrete.

Environmental Impact Assessment and Carbon Accounting Methods

The environmental impact assessment of carbon-negative concrete requires comprehensive methodologies to accurately quantify its carbon footprint throughout the entire lifecycle. Traditional carbon accounting methods often fail to capture the full complexity of concrete production, use, and end-of-life phases, necessitating more sophisticated approaches tailored to this innovative material.

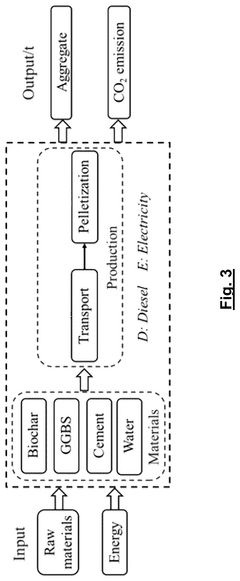

Life Cycle Assessment (LCA) serves as the foundation for evaluating carbon-negative concrete, encompassing raw material extraction, manufacturing processes, transportation, installation, operational life, and eventual disposal or recycling. This cradle-to-grave approach ensures all carbon emissions and sequestration potentials are properly accounted for, providing a holistic view of environmental performance.

Carbon accounting for concrete must address both direct and indirect emissions. Direct emissions primarily occur during cement production through limestone calcination, while indirect emissions stem from electricity consumption, transportation, and other auxiliary processes. For carbon-negative concrete specifically, accounting methods must also quantify carbon sequestration mechanisms, including carbonation processes and alternative binding materials that actively absorb CO₂.

Standardized protocols such as ISO 14067 and PAS 2050 offer frameworks for carbon footprint calculations, though they require adaptation for carbon-negative materials. The Greenhouse Gas Protocol provides additional guidance for organizational and product-level carbon accounting, establishing boundaries for emissions reporting across scopes 1, 2, and 3.

Emerging methodologies incorporate dynamic carbon accounting, recognizing that carbon sequestration in concrete occurs gradually over time. Time-dependent assessment models track the evolution of carbon balance throughout the concrete's service life, providing more accurate representations of long-term environmental benefits compared to static approaches.

Uncertainty analysis represents another critical component of environmental assessment for carbon-negative concrete. Monte Carlo simulations and sensitivity analyses help quantify the reliability of carbon accounting results, acknowledging variability in production processes, raw material sourcing, and operational conditions across different geographic regions and manufacturing facilities.

Digital technologies are increasingly integrated into carbon accounting systems, with blockchain and IoT sensors enabling real-time monitoring and verification of environmental claims. These technologies enhance transparency and traceability throughout the supply chain, supporting credible carbon credits and environmental product declarations for carbon-negative concrete products.

Life Cycle Assessment (LCA) serves as the foundation for evaluating carbon-negative concrete, encompassing raw material extraction, manufacturing processes, transportation, installation, operational life, and eventual disposal or recycling. This cradle-to-grave approach ensures all carbon emissions and sequestration potentials are properly accounted for, providing a holistic view of environmental performance.

Carbon accounting for concrete must address both direct and indirect emissions. Direct emissions primarily occur during cement production through limestone calcination, while indirect emissions stem from electricity consumption, transportation, and other auxiliary processes. For carbon-negative concrete specifically, accounting methods must also quantify carbon sequestration mechanisms, including carbonation processes and alternative binding materials that actively absorb CO₂.

Standardized protocols such as ISO 14067 and PAS 2050 offer frameworks for carbon footprint calculations, though they require adaptation for carbon-negative materials. The Greenhouse Gas Protocol provides additional guidance for organizational and product-level carbon accounting, establishing boundaries for emissions reporting across scopes 1, 2, and 3.

Emerging methodologies incorporate dynamic carbon accounting, recognizing that carbon sequestration in concrete occurs gradually over time. Time-dependent assessment models track the evolution of carbon balance throughout the concrete's service life, providing more accurate representations of long-term environmental benefits compared to static approaches.

Uncertainty analysis represents another critical component of environmental assessment for carbon-negative concrete. Monte Carlo simulations and sensitivity analyses help quantify the reliability of carbon accounting results, acknowledging variability in production processes, raw material sourcing, and operational conditions across different geographic regions and manufacturing facilities.

Digital technologies are increasingly integrated into carbon accounting systems, with blockchain and IoT sensors enabling real-time monitoring and verification of environmental claims. These technologies enhance transparency and traceability throughout the supply chain, supporting credible carbon credits and environmental product declarations for carbon-negative concrete products.

Policy Frameworks and Incentives for Green Building Materials

The policy landscape for green building materials, particularly carbon-negative concrete, has evolved significantly in recent years as governments worldwide recognize the critical role of the construction sector in achieving climate goals. Carbon-negative concrete represents a transformative opportunity to not only reduce emissions but potentially sequester carbon, making policy support crucial for market adoption.

At the international level, frameworks such as the Paris Agreement have catalyzed national policies targeting embodied carbon in construction materials. The European Union's Green Deal and Circular Economy Action Plan specifically incentivize low-carbon building materials through preferential procurement policies and carbon pricing mechanisms. Several EU member states have implemented carbon taxes that indirectly benefit carbon-negative concrete producers by making conventional high-emission alternatives less economically viable.

In North America, both Canada and the United States have developed green building incentive programs. The U.S. Inflation Reduction Act of 2022 allocates substantial funding for clean construction materials, including specific provisions for innovative concrete technologies. California's Buy Clean California Act represents a pioneering procurement policy that considers the carbon footprint of construction materials in state-funded projects.

Financial incentives play a crucial role in market transformation. These include tax credits for manufacturers of carbon-negative concrete, accelerated depreciation allowances for production facilities, and grants for research and commercialization. Several jurisdictions have established green banks or dedicated funds to provide low-interest financing for projects utilizing carbon-negative building materials.

Building codes and standards are evolving to accommodate and eventually mandate lower-carbon materials. Countries including France, Sweden, and Finland have introduced carbon limits in their building regulations, creating regulatory drivers for carbon-negative concrete adoption. The development of Environmental Product Declaration (EPD) requirements has improved transparency and comparability of environmental performance across different concrete formulations.

Public procurement policies represent perhaps the most powerful near-term driver for market development. Government construction projects account for a significant portion of concrete demand in most countries. By establishing preferential purchasing requirements or carbon performance thresholds, public agencies can create substantial demand for carbon-negative concrete products, helping manufacturers achieve economies of scale.

The effectiveness of these policy frameworks varies considerably across jurisdictions. The most successful approaches integrate multiple policy instruments—regulatory requirements, financial incentives, and market-based mechanisms—while providing clear, long-term signals to industry. As the technology matures, policy emphasis will likely shift from research and development support toward market-based mechanisms that value the carbon sequestration benefits of these innovative materials.

At the international level, frameworks such as the Paris Agreement have catalyzed national policies targeting embodied carbon in construction materials. The European Union's Green Deal and Circular Economy Action Plan specifically incentivize low-carbon building materials through preferential procurement policies and carbon pricing mechanisms. Several EU member states have implemented carbon taxes that indirectly benefit carbon-negative concrete producers by making conventional high-emission alternatives less economically viable.

In North America, both Canada and the United States have developed green building incentive programs. The U.S. Inflation Reduction Act of 2022 allocates substantial funding for clean construction materials, including specific provisions for innovative concrete technologies. California's Buy Clean California Act represents a pioneering procurement policy that considers the carbon footprint of construction materials in state-funded projects.

Financial incentives play a crucial role in market transformation. These include tax credits for manufacturers of carbon-negative concrete, accelerated depreciation allowances for production facilities, and grants for research and commercialization. Several jurisdictions have established green banks or dedicated funds to provide low-interest financing for projects utilizing carbon-negative building materials.

Building codes and standards are evolving to accommodate and eventually mandate lower-carbon materials. Countries including France, Sweden, and Finland have introduced carbon limits in their building regulations, creating regulatory drivers for carbon-negative concrete adoption. The development of Environmental Product Declaration (EPD) requirements has improved transparency and comparability of environmental performance across different concrete formulations.

Public procurement policies represent perhaps the most powerful near-term driver for market development. Government construction projects account for a significant portion of concrete demand in most countries. By establishing preferential purchasing requirements or carbon performance thresholds, public agencies can create substantial demand for carbon-negative concrete products, helping manufacturers achieve economies of scale.

The effectiveness of these policy frameworks varies considerably across jurisdictions. The most successful approaches integrate multiple policy instruments—regulatory requirements, financial incentives, and market-based mechanisms—while providing clear, long-term signals to industry. As the technology matures, policy emphasis will likely shift from research and development support toward market-based mechanisms that value the carbon sequestration benefits of these innovative materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!