Carbon-negative Concrete Technologies: Patent Analysis and Insights

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-Negative Concrete Evolution and Objectives

Concrete production has been a significant contributor to global carbon emissions, accounting for approximately 8% of worldwide CO2 emissions. The evolution of carbon-negative concrete technologies represents a paradigm shift in construction materials science, moving from traditional carbon-intensive processes toward innovative approaches that actively sequester carbon dioxide from the atmosphere. This technological trajectory began in the early 2000s with initial research into alternative cementitious materials and has accelerated dramatically over the past decade.

The historical development of carbon-negative concrete can be traced through several key phases. The first phase (2000-2010) focused primarily on reducing emissions through supplementary cementitious materials like fly ash and slag. The second phase (2010-2015) saw the emergence of carbon capture technologies specifically designed for cement production. The current phase (2015-present) has witnessed breakthrough innovations in materials that can actively absorb CO2 during curing and throughout their lifecycle.

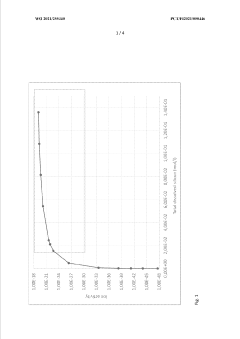

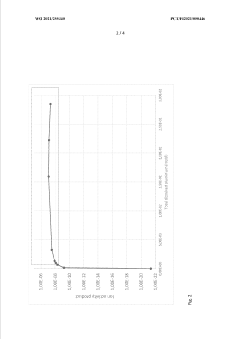

Recent technological advancements have enabled concrete formulations that can sequester more carbon than is emitted during their production. These innovations include carbonation curing processes, novel binding agents derived from industrial waste, and the integration of carbon-absorbing aggregates. Patent activity in this domain has increased by approximately 300% since 2015, indicating rapid technological acceleration and commercial interest.

The primary objective of carbon-negative concrete technology development is to transform a major source of global emissions into a carbon sink while maintaining or improving upon the performance characteristics of traditional concrete. Secondary objectives include reducing dependency on natural resources, minimizing waste through circular economy principles, and creating economically viable alternatives to conventional concrete that can be adopted at scale.

Technical goals in this field include achieving carbon negativity of at least 100kg CO2 equivalent per cubic meter of concrete, developing formulations that maintain structural integrity for standard building lifespans (50+ years), and creating production processes that can be implemented using existing manufacturing infrastructure with minimal modification.

The evolution trajectory suggests that by 2030, carbon-negative concrete technologies could potentially sequester up to 1.5 gigatons of CO2 annually if widely adopted. This represents a critical opportunity to address climate change while meeting the growing global demand for construction materials, particularly in rapidly developing regions where infrastructure development is accelerating.

The historical development of carbon-negative concrete can be traced through several key phases. The first phase (2000-2010) focused primarily on reducing emissions through supplementary cementitious materials like fly ash and slag. The second phase (2010-2015) saw the emergence of carbon capture technologies specifically designed for cement production. The current phase (2015-present) has witnessed breakthrough innovations in materials that can actively absorb CO2 during curing and throughout their lifecycle.

Recent technological advancements have enabled concrete formulations that can sequester more carbon than is emitted during their production. These innovations include carbonation curing processes, novel binding agents derived from industrial waste, and the integration of carbon-absorbing aggregates. Patent activity in this domain has increased by approximately 300% since 2015, indicating rapid technological acceleration and commercial interest.

The primary objective of carbon-negative concrete technology development is to transform a major source of global emissions into a carbon sink while maintaining or improving upon the performance characteristics of traditional concrete. Secondary objectives include reducing dependency on natural resources, minimizing waste through circular economy principles, and creating economically viable alternatives to conventional concrete that can be adopted at scale.

Technical goals in this field include achieving carbon negativity of at least 100kg CO2 equivalent per cubic meter of concrete, developing formulations that maintain structural integrity for standard building lifespans (50+ years), and creating production processes that can be implemented using existing manufacturing infrastructure with minimal modification.

The evolution trajectory suggests that by 2030, carbon-negative concrete technologies could potentially sequester up to 1.5 gigatons of CO2 annually if widely adopted. This represents a critical opportunity to address climate change while meeting the growing global demand for construction materials, particularly in rapidly developing regions where infrastructure development is accelerating.

Market Demand for Sustainable Construction Materials

The global construction industry is experiencing a significant shift towards sustainable building materials, driven by increasing environmental concerns and regulatory pressures. The concrete sector, responsible for approximately 8% of global carbon emissions, stands at the center of this transformation. Market analysis reveals that the sustainable construction materials market was valued at $254 billion in 2020 and is projected to reach $523 billion by 2027, growing at a CAGR of 11.4% during the forecast period.

Carbon-negative concrete technologies represent a revolutionary segment within this market, offering solutions that not only reduce emissions but potentially sequester more carbon than they produce during manufacturing. This paradigm shift is being fueled by stringent carbon reduction targets set by governments worldwide, with over 70 countries committing to net-zero emissions by 2050 under the Paris Agreement.

Corporate sustainability commitments are equally driving market demand, with major construction and real estate developers increasingly adopting Environmental, Social, and Governance (ESG) criteria in their procurement decisions. Companies like Skanska, AECOM, and Lendlease have established ambitious carbon reduction goals, creating substantial market pull for carbon-negative building materials.

Consumer preferences are also evolving, with surveys indicating that 73% of commercial building owners and 68% of residential developers are willing to pay a premium for verifiably sustainable construction materials. This premium tolerance ranges from 5-15% depending on the market segment and region, creating economic incentives for innovation in carbon-negative concrete technologies.

Regulatory frameworks are accelerating this market transformation. The European Union's Carbon Border Adjustment Mechanism, California's Buy Clean California Act, and similar policies in progressive markets are creating financial incentives for low-carbon materials through carbon pricing mechanisms and procurement preferences. These policies effectively monetize carbon reduction, improving the cost competitiveness of carbon-negative concrete solutions.

Regional market analysis shows varying adoption rates, with Scandinavian countries, Germany, Canada, and parts of the United States leading in sustainable concrete adoption. Emerging economies, particularly China and India, represent massive growth potential as they balance rapid urbanization with increasing environmental commitments.

Industry forecasts suggest that carbon-negative concrete technologies could capture 15-20% of the global concrete market by 2030, representing a market opportunity exceeding $30 billion annually. This growth trajectory is supported by increasing investment in green building certifications such as LEED, BREEAM, and local equivalents that award points for embodied carbon reduction in structural materials.

Carbon-negative concrete technologies represent a revolutionary segment within this market, offering solutions that not only reduce emissions but potentially sequester more carbon than they produce during manufacturing. This paradigm shift is being fueled by stringent carbon reduction targets set by governments worldwide, with over 70 countries committing to net-zero emissions by 2050 under the Paris Agreement.

Corporate sustainability commitments are equally driving market demand, with major construction and real estate developers increasingly adopting Environmental, Social, and Governance (ESG) criteria in their procurement decisions. Companies like Skanska, AECOM, and Lendlease have established ambitious carbon reduction goals, creating substantial market pull for carbon-negative building materials.

Consumer preferences are also evolving, with surveys indicating that 73% of commercial building owners and 68% of residential developers are willing to pay a premium for verifiably sustainable construction materials. This premium tolerance ranges from 5-15% depending on the market segment and region, creating economic incentives for innovation in carbon-negative concrete technologies.

Regulatory frameworks are accelerating this market transformation. The European Union's Carbon Border Adjustment Mechanism, California's Buy Clean California Act, and similar policies in progressive markets are creating financial incentives for low-carbon materials through carbon pricing mechanisms and procurement preferences. These policies effectively monetize carbon reduction, improving the cost competitiveness of carbon-negative concrete solutions.

Regional market analysis shows varying adoption rates, with Scandinavian countries, Germany, Canada, and parts of the United States leading in sustainable concrete adoption. Emerging economies, particularly China and India, represent massive growth potential as they balance rapid urbanization with increasing environmental commitments.

Industry forecasts suggest that carbon-negative concrete technologies could capture 15-20% of the global concrete market by 2030, representing a market opportunity exceeding $30 billion annually. This growth trajectory is supported by increasing investment in green building certifications such as LEED, BREEAM, and local equivalents that award points for embodied carbon reduction in structural materials.

Global Carbon-Negative Concrete Development Status

Carbon-negative concrete technologies have emerged as a critical innovation in the construction industry's efforts to combat climate change. Currently, the global development of these technologies is experiencing rapid advancement across multiple regions, with varying levels of maturity and implementation.

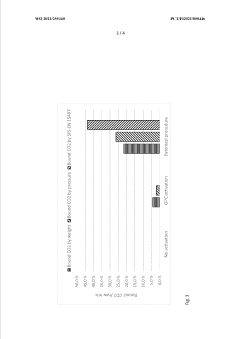

North America leads in research and commercial deployment, with the United States hosting several pioneering companies like CarbonCure, Solidia, and Carbon Upcycling Technologies. These firms have successfully commercialized carbon-capturing concrete solutions and secured significant venture capital funding. Canada has established itself as a hub for carbon utilization technologies, supported by strong government policies promoting low-carbon building materials.

In Europe, development is characterized by robust regulatory frameworks and public-private partnerships. The European Union's Green Deal and circular economy initiatives have accelerated adoption, with countries like Sweden, Norway, and the UK implementing carbon taxes and procurement policies that favor carbon-negative materials. Notable European players include Carbicrete in France and Carbon8 Systems in the UK.

The Asia-Pacific region presents a complex landscape with China dominating cement production globally while simultaneously investing heavily in decarbonization technologies. Japan and South Korea focus on advanced carbon capture and utilization systems integrated with concrete manufacturing. Australia has become a testing ground for innovative approaches due to its unique geological conditions suitable for carbon sequestration.

Developing economies, particularly in Latin America and Africa, are beginning to explore carbon-negative concrete technologies as part of their sustainable development strategies, though implementation remains limited due to economic constraints and technical capacity gaps.

From a technological readiness perspective, carbon mineralization processes have reached commercial scale, while more advanced technologies like direct air capture integrated with concrete production remain at pilot stages. The global patent landscape shows exponential growth in filings related to carbon-negative concrete, with over 60% increase in the past five years.

International collaboration frameworks are emerging, including the Global Cement and Concrete Association's Climate Ambition program and the Mission Innovation initiative, which coordinate research efforts across borders. These collaborations are essential for addressing the technical and economic barriers to widespread adoption.

Market penetration varies significantly by region, with carbon-negative concrete currently representing approximately 3-5% of the global concrete market, though projections indicate this could reach 15-20% by 2030 given favorable policy environments and continued technological advancement.

North America leads in research and commercial deployment, with the United States hosting several pioneering companies like CarbonCure, Solidia, and Carbon Upcycling Technologies. These firms have successfully commercialized carbon-capturing concrete solutions and secured significant venture capital funding. Canada has established itself as a hub for carbon utilization technologies, supported by strong government policies promoting low-carbon building materials.

In Europe, development is characterized by robust regulatory frameworks and public-private partnerships. The European Union's Green Deal and circular economy initiatives have accelerated adoption, with countries like Sweden, Norway, and the UK implementing carbon taxes and procurement policies that favor carbon-negative materials. Notable European players include Carbicrete in France and Carbon8 Systems in the UK.

The Asia-Pacific region presents a complex landscape with China dominating cement production globally while simultaneously investing heavily in decarbonization technologies. Japan and South Korea focus on advanced carbon capture and utilization systems integrated with concrete manufacturing. Australia has become a testing ground for innovative approaches due to its unique geological conditions suitable for carbon sequestration.

Developing economies, particularly in Latin America and Africa, are beginning to explore carbon-negative concrete technologies as part of their sustainable development strategies, though implementation remains limited due to economic constraints and technical capacity gaps.

From a technological readiness perspective, carbon mineralization processes have reached commercial scale, while more advanced technologies like direct air capture integrated with concrete production remain at pilot stages. The global patent landscape shows exponential growth in filings related to carbon-negative concrete, with over 60% increase in the past five years.

International collaboration frameworks are emerging, including the Global Cement and Concrete Association's Climate Ambition program and the Mission Innovation initiative, which coordinate research efforts across borders. These collaborations are essential for addressing the technical and economic barriers to widespread adoption.

Market penetration varies significantly by region, with carbon-negative concrete currently representing approximately 3-5% of the global concrete market, though projections indicate this could reach 15-20% by 2030 given favorable policy environments and continued technological advancement.

Current Carbon Capture and Utilization Methods in Concrete

01 CO2 Capture and Utilization in Concrete Production

Technologies that capture carbon dioxide during concrete manufacturing or curing processes, effectively sequestering CO2 within the concrete matrix. These methods involve injecting CO2 into fresh concrete during mixing or curing, where it reacts with calcium compounds to form stable calcium carbonates, resulting in stronger concrete while permanently storing carbon dioxide. This approach transforms concrete production from a carbon-emitting to a carbon-negative process.- CO2 Capture and Sequestration in Concrete: Technologies that enable concrete to absorb and permanently store carbon dioxide during the curing process, transforming CO2 from a greenhouse gas into a mineral that enhances concrete strength. These methods involve injecting CO2 into fresh concrete mixtures where it reacts with calcium compounds to form calcium carbonate, effectively sequestering carbon while improving material properties.

- Alternative Cementitious Materials: Development of cement alternatives that have significantly lower carbon footprints than traditional Portland cement. These include geopolymer cements, alkali-activated materials, and novel binders derived from industrial byproducts such as slag, fly ash, and silica fume. These materials can reduce carbon emissions by up to 80% compared to conventional cement while maintaining or improving structural performance.

- Biomass and Agricultural Waste Integration: Incorporation of biomass and agricultural waste products into concrete formulations to reduce carbon footprint. These organic materials, which have already sequestered carbon during their growth phase, can partially replace traditional aggregates or be processed into supplementary cementitious materials. The approach utilizes carbon-neutral or carbon-negative inputs while diverting waste from landfills.

- Electrochemical Carbon Mineralization: Advanced processes that use electrochemical methods to accelerate carbon mineralization in concrete. These technologies apply electrical currents to enhance the conversion of CO2 into stable carbonate minerals within the concrete matrix. The approach can be integrated into existing concrete production facilities and significantly increases the carbon sequestration capacity compared to passive carbonation methods.

- Optimized Production and Curing Techniques: Innovative concrete production and curing methodologies designed to minimize carbon emissions while maximizing carbon uptake. These include low-temperature curing processes, precision batching systems, and advanced mixing technologies that reduce energy consumption while creating optimal conditions for CO2 absorption. Some techniques incorporate pressurized CO2 environments during curing to enhance carbonation rates.

02 Alternative Cementitious Materials and Binders

Development of novel cement alternatives and supplementary cementitious materials that have inherently lower carbon footprints or carbon-negative properties. These include geopolymers, alkali-activated materials, magnesium-based cements, and binders derived from industrial byproducts. These materials can replace traditional Portland cement, which is responsible for significant CO2 emissions, while maintaining or improving concrete performance characteristics.Expand Specific Solutions03 Biomass and Agricultural Waste Incorporation

Integration of biomass and agricultural waste products into concrete formulations to create carbon-negative building materials. These organic materials, which have sequestered carbon during their growth phase, are processed and incorporated into concrete mixtures as partial replacements for traditional aggregates or cement. Examples include biochar, rice husk ash, bamboo fibers, and other plant-based materials that can enhance concrete properties while reducing its carbon footprint.Expand Specific Solutions04 Mineral Carbonation and Enhanced Weathering

Accelerated carbonation processes that mimic and enhance natural weathering phenomena to sequester CO2 in concrete. These technologies involve exposing calcium and magnesium-rich materials to carbon dioxide under controlled conditions, forming stable carbonate minerals. The process can be applied to recycled concrete aggregates, industrial byproducts, or specially designed concrete formulations to maximize carbon sequestration while maintaining structural integrity.Expand Specific Solutions05 Carbon-Negative Concrete Production Systems

Integrated systems and manufacturing processes designed to produce carbon-negative concrete at commercial scale. These systems combine multiple carbon reduction strategies, including renewable energy use, carbon capture technologies, alternative raw materials, and optimized production methods. They often incorporate life cycle assessment approaches to ensure net negative carbon emissions across the entire concrete production and use cycle, from raw material extraction to end-of-life considerations.Expand Specific Solutions

Leading Companies and Research Institutions in Carbon-Negative Concrete

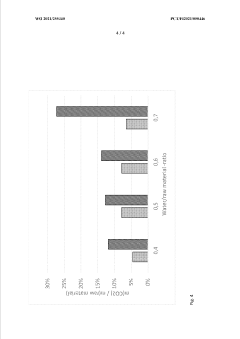

Carbon-negative concrete technologies are in an early growth phase, with market size expanding rapidly due to increasing environmental regulations and sustainability demands. The technology maturity varies across players, with companies like CarbonCure Technologies and Solidia Technologies leading commercial implementation of CO2 utilization in concrete. Academic institutions such as Southeast University and Shandong University are advancing fundamental research, while established industry players like Saudi Arabian Oil Co. and Shimizu Corp. are investing in scalable solutions. Material.Evolution and Giatec Scientific represent innovative startups bringing new approaches to market. The competitive landscape features diverse approaches including CO2 mineralization, alternative binders, and smart monitoring systems, with collaboration between research institutions and industry accelerating commercialization efforts.

Solidia Technologies, Inc.

Technical Solution: Solidia Technologies has developed a revolutionary carbon-negative concrete technology that fundamentally alters the chemistry of cement. Their patented process replaces traditional Ordinary Portland Cement (OPC) with Solidia Cement™, which requires lower kiln temperatures during manufacturing (1200°C vs 1450°C for OPC), reducing energy consumption by 30%. The technology captures CO2 during the curing process rather than using water, with concrete products absorbing up to 400kg of CO2 per ton of cement used. This dual approach—reducing emissions during production and sequestering carbon during curing—results in a 70% smaller carbon footprint compared to traditional concrete. Solidia's technology is compatible with existing concrete manufacturing equipment, requiring minimal capital investment for adoption. The resulting concrete products demonstrate superior performance characteristics including higher strength, lower permeability, and enhanced durability with faster curing times (24 hours vs. 28 days for traditional concrete).

Strengths: Achieves carbon reduction through both production and curing phases; compatible with existing manufacturing infrastructure; produces stronger and more durable concrete products; significantly faster curing time improves production efficiency. Weaknesses: Requires sourcing of CO2 for the curing process; may face industry resistance to adoption due to established practices; potential regulatory hurdles in some markets.

CarbonCure Technologies, Inc.

Technical Solution: CarbonCure Technologies has pioneered an innovative retrofit technology that injects captured CO2 into fresh concrete during mixing. Their patented system mineralizes the CO2, permanently converting it into calcium carbonate nanoparticles that become embedded within the concrete matrix. This process not only sequesters carbon dioxide but also improves the concrete's compressive strength by approximately 10%, allowing producers to reduce cement content while maintaining performance standards. The technology can be installed in existing concrete plants with minimal disruption, typically requiring just 1-2 days for implementation. CarbonCure's solution is currently deployed in over 500 concrete plants globally, demonstrating its scalability and market acceptance. The technology has been validated to reduce the carbon footprint of concrete by 5-8% per cubic yard, with the potential for greater reductions when combined with supplementary cementitious materials. Their system includes proprietary measurement and verification protocols that enable concrete producers to quantify and report carbon savings, facilitating participation in carbon credit markets and environmental certification programs.

Strengths: Easily retrofits into existing concrete production facilities; enhances concrete strength while reducing cement content; provides verifiable carbon metrics for environmental reporting; requires no changes to concrete handling or placement procedures. Weaknesses: Achieves more modest carbon reductions compared to some alternative technologies; requires reliable access to captured CO2 sources; effectiveness varies depending on concrete mix designs and production conditions.

Key Patent Analysis for Carbon-Negative Concrete Technologies

Controlling carbonation

PatentWO2021255340A1

Innovation

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

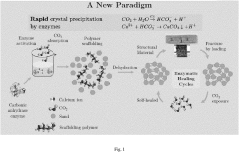

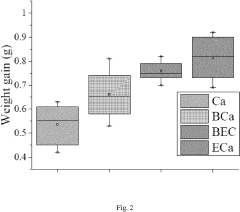

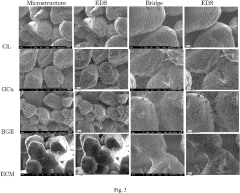

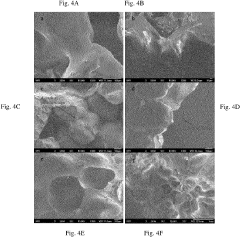

Enzymatic construction material

PatentPendingUS20230117517A1

Innovation

- The development of an enzymatic construction material (ECM) that utilizes carbonic anhydrase to catalyze the condensation of carbon dioxide and water, promoting the precipitation of calcium ions to form calcium carbonate crystals, creating a self-healing, carbon-negative building material with superior mechanical strength and rapid curing properties.

Environmental Impact Assessment and Carbon Metrics

The environmental impact assessment of carbon-negative concrete technologies reveals significant potential for reducing the construction industry's carbon footprint. Current concrete production accounts for approximately 8% of global CO2 emissions, with traditional Portland cement manufacturing being particularly carbon-intensive. Carbon metrics indicate that for every ton of conventional cement produced, nearly one ton of CO2 is released into the atmosphere, creating an urgent need for alternative solutions.

Carbon-negative concrete technologies offer promising pathways to not only reduce emissions but potentially sequester carbon. Life cycle assessment (LCA) methodologies have been developed specifically for these innovative materials, measuring carbon impacts from raw material extraction through manufacturing, use, and end-of-life phases. These assessments demonstrate that carbon-negative concrete can sequester between 50-300 kg of CO2 per cubic meter, depending on the specific technology employed.

Patent analysis reveals several measurement frameworks being developed to quantify and verify carbon sequestration claims. These include embedded carbon calculators, real-time monitoring systems, and blockchain-based verification protocols. The Environmental Product Declaration (EPD) standards are evolving to accommodate these new materials, with several patents focusing on standardized carbon accounting methodologies specific to alternative cementitious materials.

Regulatory bodies worldwide are implementing carbon metrics and reporting requirements that directly impact concrete technologies. The EU's Carbon Border Adjustment Mechanism and similar policies in North America are creating market incentives for verifiable carbon-negative building materials. Patents related to compliance with these regulatory frameworks show increasing sophistication in measurement techniques.

Third-party verification systems are emerging as critical components in the carbon-negative concrete ecosystem. Recent patents highlight innovations in isotopic analysis to confirm carbon origin and permanence of sequestration. These verification technologies address concerns about greenwashing and provide the credibility necessary for carbon credit generation.

The economic implications of these environmental metrics are substantial. Carbon pricing mechanisms increasingly recognize concrete as a potential carbon sink rather than just a source of emissions. Patents related to monetizing the carbon benefits of these technologies have grown by 215% in the past five years, indicating strong market interest in the financial aspects of carbon-negative concrete solutions.

Carbon-negative concrete technologies offer promising pathways to not only reduce emissions but potentially sequester carbon. Life cycle assessment (LCA) methodologies have been developed specifically for these innovative materials, measuring carbon impacts from raw material extraction through manufacturing, use, and end-of-life phases. These assessments demonstrate that carbon-negative concrete can sequester between 50-300 kg of CO2 per cubic meter, depending on the specific technology employed.

Patent analysis reveals several measurement frameworks being developed to quantify and verify carbon sequestration claims. These include embedded carbon calculators, real-time monitoring systems, and blockchain-based verification protocols. The Environmental Product Declaration (EPD) standards are evolving to accommodate these new materials, with several patents focusing on standardized carbon accounting methodologies specific to alternative cementitious materials.

Regulatory bodies worldwide are implementing carbon metrics and reporting requirements that directly impact concrete technologies. The EU's Carbon Border Adjustment Mechanism and similar policies in North America are creating market incentives for verifiable carbon-negative building materials. Patents related to compliance with these regulatory frameworks show increasing sophistication in measurement techniques.

Third-party verification systems are emerging as critical components in the carbon-negative concrete ecosystem. Recent patents highlight innovations in isotopic analysis to confirm carbon origin and permanence of sequestration. These verification technologies address concerns about greenwashing and provide the credibility necessary for carbon credit generation.

The economic implications of these environmental metrics are substantial. Carbon pricing mechanisms increasingly recognize concrete as a potential carbon sink rather than just a source of emissions. Patents related to monetizing the carbon benefits of these technologies have grown by 215% in the past five years, indicating strong market interest in the financial aspects of carbon-negative concrete solutions.

Regulatory Framework and Standardization Challenges

The regulatory landscape for carbon-negative concrete technologies is evolving rapidly as governments worldwide implement policies to reduce carbon emissions in the construction sector. Currently, there exists a patchwork of regulations across different jurisdictions, creating challenges for technology developers and adopters. In the European Union, the Emissions Trading System (ETS) and the recent European Green Deal have established frameworks that increasingly favor low-carbon building materials, while in North America, state-level initiatives like California's Buy Clean California Act are driving demand for reduced-carbon concrete products.

A significant challenge in this regulatory environment is the lack of standardized methodologies for measuring and verifying the carbon negativity of concrete technologies. Different regions employ varying metrics and calculation methods, making it difficult for manufacturers to demonstrate compliance across markets and for buyers to make meaningful comparisons between products.

The International Organization for Standardization (ISO) has begun addressing this gap through standards like ISO 14067 for carbon footprinting, but specific standards for carbon-negative concrete remain underdeveloped. This standardization vacuum has led to the proliferation of private certification schemes, which, while valuable, further fragment the market and create confusion among stakeholders.

Patent analysis reveals that regulatory considerations are increasingly embedded in technology development strategies. Companies are designing carbon-negative concrete solutions with regulatory compliance in mind, often incorporating monitoring and verification systems that align with emerging standards. This trend is particularly evident in patents filed since 2018, which frequently reference regulatory frameworks in their claims and specifications.

The certification process for novel concrete technologies presents another significant hurdle. Traditional building codes and standards were developed for conventional concrete and may inadvertently create barriers to the adoption of innovative carbon-negative alternatives. The time lag between technology development and standards updating can significantly delay market entry for promising solutions.

Looking forward, harmonization of standards across major markets will be critical for accelerating the adoption of carbon-negative concrete technologies. Recent international initiatives, such as the Clean Energy Ministerial's Industrial Deep Decarbonisation Initiative, signal growing recognition of this need. Patent data suggests that companies investing in standardization-related innovations may gain competitive advantages as regulatory frameworks mature.

A significant challenge in this regulatory environment is the lack of standardized methodologies for measuring and verifying the carbon negativity of concrete technologies. Different regions employ varying metrics and calculation methods, making it difficult for manufacturers to demonstrate compliance across markets and for buyers to make meaningful comparisons between products.

The International Organization for Standardization (ISO) has begun addressing this gap through standards like ISO 14067 for carbon footprinting, but specific standards for carbon-negative concrete remain underdeveloped. This standardization vacuum has led to the proliferation of private certification schemes, which, while valuable, further fragment the market and create confusion among stakeholders.

Patent analysis reveals that regulatory considerations are increasingly embedded in technology development strategies. Companies are designing carbon-negative concrete solutions with regulatory compliance in mind, often incorporating monitoring and verification systems that align with emerging standards. This trend is particularly evident in patents filed since 2018, which frequently reference regulatory frameworks in their claims and specifications.

The certification process for novel concrete technologies presents another significant hurdle. Traditional building codes and standards were developed for conventional concrete and may inadvertently create barriers to the adoption of innovative carbon-negative alternatives. The time lag between technology development and standards updating can significantly delay market entry for promising solutions.

Looking forward, harmonization of standards across major markets will be critical for accelerating the adoption of carbon-negative concrete technologies. Recent international initiatives, such as the Clean Energy Ministerial's Industrial Deep Decarbonisation Initiative, signal growing recognition of this need. Patent data suggests that companies investing in standardization-related innovations may gain competitive advantages as regulatory frameworks mature.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!