Catalyst-Scale Manufacturing: Quality Metrics and Inline Characterization Methods

AUG 20, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Catalyst Manufacturing Background and Objectives

Catalyst manufacturing has been a cornerstone of industrial processes for over a century, playing a crucial role in various sectors including petrochemicals, pharmaceuticals, and environmental technologies. The evolution of catalyst production has been driven by the increasing demand for more efficient, selective, and environmentally friendly chemical processes. As global industries strive for sustainability and cost-effectiveness, the importance of high-quality catalyst manufacturing has become paramount.

The primary objective of catalyst-scale manufacturing is to produce catalysts with consistent quality, optimal performance, and scalability. This involves developing robust production methods that can maintain the desired catalyst properties across different batch sizes and production scales. Quality metrics in catalyst manufacturing encompass a wide range of parameters, including particle size distribution, surface area, pore structure, chemical composition, and catalytic activity.

Historically, catalyst quality assessment relied heavily on offline characterization techniques, which often resulted in time-consuming and costly production cycles. However, the advent of advanced inline characterization methods has revolutionized the field, enabling real-time monitoring and control of catalyst properties during the manufacturing process. These inline techniques aim to provide immediate feedback on critical quality attributes, allowing for rapid adjustments and optimizations in the production line.

The development of inline characterization methods for catalyst manufacturing faces several challenges. One of the primary hurdles is the need for non-invasive techniques that can accurately measure catalyst properties in situ, without disrupting the production process. Additionally, these methods must be capable of handling the complex and often harsh environments typical in catalyst synthesis, such as high temperatures, pressures, and corrosive chemicals.

Recent technological advancements have led to the emergence of various inline characterization tools, including spectroscopic techniques (e.g., Raman, NIR, and UV-Vis), particle size analyzers, and advanced imaging systems. These technologies offer the potential for continuous monitoring of catalyst properties, enabling manufacturers to implement real-time quality control and process optimization strategies.

The integration of inline characterization methods with advanced data analytics and machine learning algorithms represents a significant step towards achieving "smart" catalyst manufacturing. This approach not only enhances quality control but also facilitates the development of predictive models for catalyst performance, ultimately leading to more efficient and cost-effective production processes.

As the catalyst industry continues to evolve, the focus on quality metrics and inline characterization methods is expected to intensify. The ultimate goal is to establish a comprehensive framework for catalyst manufacturing that ensures consistent product quality, reduces waste, and accelerates the development of novel catalytic materials to meet the growing demands of various industrial sectors.

The primary objective of catalyst-scale manufacturing is to produce catalysts with consistent quality, optimal performance, and scalability. This involves developing robust production methods that can maintain the desired catalyst properties across different batch sizes and production scales. Quality metrics in catalyst manufacturing encompass a wide range of parameters, including particle size distribution, surface area, pore structure, chemical composition, and catalytic activity.

Historically, catalyst quality assessment relied heavily on offline characterization techniques, which often resulted in time-consuming and costly production cycles. However, the advent of advanced inline characterization methods has revolutionized the field, enabling real-time monitoring and control of catalyst properties during the manufacturing process. These inline techniques aim to provide immediate feedback on critical quality attributes, allowing for rapid adjustments and optimizations in the production line.

The development of inline characterization methods for catalyst manufacturing faces several challenges. One of the primary hurdles is the need for non-invasive techniques that can accurately measure catalyst properties in situ, without disrupting the production process. Additionally, these methods must be capable of handling the complex and often harsh environments typical in catalyst synthesis, such as high temperatures, pressures, and corrosive chemicals.

Recent technological advancements have led to the emergence of various inline characterization tools, including spectroscopic techniques (e.g., Raman, NIR, and UV-Vis), particle size analyzers, and advanced imaging systems. These technologies offer the potential for continuous monitoring of catalyst properties, enabling manufacturers to implement real-time quality control and process optimization strategies.

The integration of inline characterization methods with advanced data analytics and machine learning algorithms represents a significant step towards achieving "smart" catalyst manufacturing. This approach not only enhances quality control but also facilitates the development of predictive models for catalyst performance, ultimately leading to more efficient and cost-effective production processes.

As the catalyst industry continues to evolve, the focus on quality metrics and inline characterization methods is expected to intensify. The ultimate goal is to establish a comprehensive framework for catalyst manufacturing that ensures consistent product quality, reduces waste, and accelerates the development of novel catalytic materials to meet the growing demands of various industrial sectors.

Market Analysis for Catalyst Production

The catalyst production market has experienced significant growth in recent years, driven by increasing demand across various industries such as petrochemicals, automotive, and environmental applications. The global catalyst market size was valued at approximately $33.9 billion in 2020 and is projected to reach $47.8 billion by 2027, growing at a CAGR of 5.1% during the forecast period.

The automotive sector remains a key driver for catalyst demand, particularly in emission control applications. Stringent environmental regulations worldwide have led to increased adoption of catalytic converters, boosting the market for precious metal catalysts. The petrochemical industry also continues to be a major consumer of catalysts, with growing demand for plastics and other chemical products driving market growth.

Emerging trends in the catalyst market include the shift towards sustainable and eco-friendly catalysts, as well as the development of novel materials for improved efficiency and selectivity. Zeolites and metal-organic frameworks (MOFs) are gaining traction as promising catalyst materials due to their unique properties and versatility.

Geographically, Asia-Pacific dominates the catalyst market, accounting for over 40% of global demand. This is primarily due to rapid industrialization and economic growth in countries like China and India. North America and Europe follow, with mature markets focused on innovation and high-performance catalysts.

Key players in the catalyst production market include BASF SE, Johnson Matthey, Clariant AG, and Albemarle Corporation. These companies are investing heavily in research and development to maintain their competitive edge and meet evolving market demands.

The market for catalyst characterization and quality control is also expanding, driven by the need for more efficient and reliable production processes. Inline characterization methods and advanced quality metrics are becoming increasingly important for manufacturers to ensure consistent product quality and optimize production yields.

Challenges in the catalyst market include raw material price volatility, particularly for precious metals used in automotive catalysts, and the need for continuous innovation to meet stricter environmental regulations and improve catalyst performance. Additionally, the COVID-19 pandemic has disrupted supply chains and temporarily slowed market growth, although recovery is expected in the coming years.

Overall, the catalyst production market presents significant opportunities for growth and innovation, particularly in the areas of sustainable catalysts, advanced materials, and improved manufacturing processes. The development of more sophisticated quality metrics and inline characterization methods will be crucial for manufacturers to maintain competitiveness and meet the evolving demands of various industries.

The automotive sector remains a key driver for catalyst demand, particularly in emission control applications. Stringent environmental regulations worldwide have led to increased adoption of catalytic converters, boosting the market for precious metal catalysts. The petrochemical industry also continues to be a major consumer of catalysts, with growing demand for plastics and other chemical products driving market growth.

Emerging trends in the catalyst market include the shift towards sustainable and eco-friendly catalysts, as well as the development of novel materials for improved efficiency and selectivity. Zeolites and metal-organic frameworks (MOFs) are gaining traction as promising catalyst materials due to their unique properties and versatility.

Geographically, Asia-Pacific dominates the catalyst market, accounting for over 40% of global demand. This is primarily due to rapid industrialization and economic growth in countries like China and India. North America and Europe follow, with mature markets focused on innovation and high-performance catalysts.

Key players in the catalyst production market include BASF SE, Johnson Matthey, Clariant AG, and Albemarle Corporation. These companies are investing heavily in research and development to maintain their competitive edge and meet evolving market demands.

The market for catalyst characterization and quality control is also expanding, driven by the need for more efficient and reliable production processes. Inline characterization methods and advanced quality metrics are becoming increasingly important for manufacturers to ensure consistent product quality and optimize production yields.

Challenges in the catalyst market include raw material price volatility, particularly for precious metals used in automotive catalysts, and the need for continuous innovation to meet stricter environmental regulations and improve catalyst performance. Additionally, the COVID-19 pandemic has disrupted supply chains and temporarily slowed market growth, although recovery is expected in the coming years.

Overall, the catalyst production market presents significant opportunities for growth and innovation, particularly in the areas of sustainable catalysts, advanced materials, and improved manufacturing processes. The development of more sophisticated quality metrics and inline characterization methods will be crucial for manufacturers to maintain competitiveness and meet the evolving demands of various industries.

Current Challenges in Catalyst Quality Control

The catalyst manufacturing industry faces several significant challenges in quality control, primarily due to the complex nature of catalyst materials and the stringent requirements for their performance in various applications. One of the foremost challenges is achieving consistent particle size distribution and morphology across large-scale production batches. Variations in these parameters can significantly impact catalyst activity, selectivity, and overall performance in industrial processes.

Another critical challenge lies in maintaining uniform chemical composition and active site distribution throughout the catalyst material. Even minor deviations in elemental ratios or the spatial arrangement of active sites can lead to substantial differences in catalytic efficiency. This issue is particularly pronounced in multi-component catalysts, where precise control over the interaction between different active species is crucial.

The detection and control of impurities present a persistent challenge in catalyst quality control. Trace contaminants, often introduced during raw material processing or manufacturing steps, can have disproportionate effects on catalyst performance and lifespan. Developing and implementing sensitive analytical techniques capable of detecting and quantifying these impurities at extremely low concentrations remains an ongoing challenge for the industry.

Surface area and porosity control are additional areas of concern in catalyst manufacturing. These properties directly influence the accessibility of active sites and the diffusion of reactants and products, thereby affecting the overall catalytic performance. Maintaining consistent surface characteristics across large production volumes is technically demanding and requires sophisticated process control mechanisms.

The development of robust and reliable in-line characterization methods poses another significant challenge. While offline analysis techniques are well-established, real-time monitoring of catalyst properties during the manufacturing process is still limited. This gap hinders the ability to make rapid adjustments to process parameters, potentially leading to quality inconsistencies and increased production costs.

Furthermore, the industry faces challenges in developing standardized quality metrics that accurately predict catalyst performance in real-world applications. The correlation between laboratory-scale quality tests and actual industrial performance is not always straightforward, necessitating the development of more representative testing protocols and performance indicators.

Lastly, the increasing demand for custom and high-performance catalysts introduces additional complexity to quality control processes. Manufacturers must adapt their quality assurance strategies to accommodate a wider range of catalyst formulations and specifications, often with limited historical data to guide their efforts. This requires a more flexible and adaptive approach to quality control, balancing standardization with the need for customization.

Another critical challenge lies in maintaining uniform chemical composition and active site distribution throughout the catalyst material. Even minor deviations in elemental ratios or the spatial arrangement of active sites can lead to substantial differences in catalytic efficiency. This issue is particularly pronounced in multi-component catalysts, where precise control over the interaction between different active species is crucial.

The detection and control of impurities present a persistent challenge in catalyst quality control. Trace contaminants, often introduced during raw material processing or manufacturing steps, can have disproportionate effects on catalyst performance and lifespan. Developing and implementing sensitive analytical techniques capable of detecting and quantifying these impurities at extremely low concentrations remains an ongoing challenge for the industry.

Surface area and porosity control are additional areas of concern in catalyst manufacturing. These properties directly influence the accessibility of active sites and the diffusion of reactants and products, thereby affecting the overall catalytic performance. Maintaining consistent surface characteristics across large production volumes is technically demanding and requires sophisticated process control mechanisms.

The development of robust and reliable in-line characterization methods poses another significant challenge. While offline analysis techniques are well-established, real-time monitoring of catalyst properties during the manufacturing process is still limited. This gap hinders the ability to make rapid adjustments to process parameters, potentially leading to quality inconsistencies and increased production costs.

Furthermore, the industry faces challenges in developing standardized quality metrics that accurately predict catalyst performance in real-world applications. The correlation between laboratory-scale quality tests and actual industrial performance is not always straightforward, necessitating the development of more representative testing protocols and performance indicators.

Lastly, the increasing demand for custom and high-performance catalysts introduces additional complexity to quality control processes. Manufacturers must adapt their quality assurance strategies to accommodate a wider range of catalyst formulations and specifications, often with limited historical data to guide their efforts. This requires a more flexible and adaptive approach to quality control, balancing standardization with the need for customization.

Existing Quality Metrics for Catalysts

01 Image quality assessment for catalyst analysis

Methods for assessing image quality in catalyst analysis, including techniques for evaluating sharpness, contrast, and other visual parameters. These methods can help in determining the effectiveness of imaging systems used in catalyst characterization and quality control.- Image quality assessment for catalyst analysis: Methods for assessing image quality in catalyst analysis, including techniques for evaluating and improving the clarity, resolution, and accuracy of images used in catalyst characterization. This involves advanced image processing algorithms and machine learning techniques to enhance the quality of microscopic and spectroscopic images of catalysts.

- Catalyst performance metrics in video encoding: Techniques for measuring and optimizing catalyst performance in video encoding processes. This includes methods for evaluating encoding efficiency, compression ratios, and output quality. The approach involves real-time analysis of encoding parameters and adaptive adjustments to maximize catalyst effectiveness in video processing applications.

- Catalyst quality assessment in chemical processes: Systems and methods for evaluating catalyst quality in chemical processes, focusing on parameters such as activity, selectivity, and stability. This involves advanced analytical techniques, including spectroscopy and chromatography, to measure catalyst performance and identify degradation factors in real-time industrial applications.

- Data-driven catalyst optimization: Approaches for using big data analytics and machine learning to optimize catalyst performance. This includes methods for collecting, analyzing, and interpreting large datasets related to catalyst behavior under various conditions, enabling predictive modeling and continuous improvement of catalyst formulations and process parameters.

- Catalyst quality monitoring in energy applications: Techniques for monitoring and maintaining catalyst quality in energy-related applications, such as fuel cells and renewable energy systems. This involves real-time sensor systems, predictive maintenance algorithms, and performance tracking methods to ensure optimal catalyst function and longevity in demanding operational environments.

02 Catalyst performance evaluation using data analytics

Utilization of data analytics and machine learning techniques to evaluate catalyst performance metrics. This approach involves analyzing large datasets to identify trends, predict catalyst behavior, and optimize catalyst formulations for improved efficiency and selectivity.Expand Specific Solutions03 Real-time monitoring of catalyst quality

Development of systems for real-time monitoring of catalyst quality during production or operation. These systems may include sensors, spectroscopic techniques, and data processing algorithms to provide immediate feedback on catalyst performance and detect any deviations from desired quality metrics.Expand Specific Solutions04 Catalyst characterization using advanced microscopy techniques

Application of advanced microscopy techniques, such as electron microscopy and atomic force microscopy, for detailed characterization of catalyst morphology, surface area, and active site distribution. These methods provide crucial information for assessing catalyst quality and predicting performance.Expand Specific Solutions05 Standardization of catalyst quality metrics

Development and implementation of standardized quality metrics for catalyst evaluation across different industries and applications. This includes establishing benchmarks, testing protocols, and reporting standards to ensure consistency in catalyst quality assessment and comparison.Expand Specific Solutions

Key Players in Catalyst Industry

The catalyst-scale manufacturing landscape is characterized by a competitive and evolving market, currently in a growth phase. Major players like China Petroleum & Chemical Corp., PetroChina Co., Ltd., and ExxonMobil Chemical Patents, Inc. are driving innovation in quality metrics and inline characterization methods. The market size is expanding due to increasing demand for efficient and sustainable catalyst production. Technological maturity varies, with established companies like Siemens AG and Toyota Motor Corp. leveraging their expertise, while newer entrants like Univation Technologies LLC and hte AG are introducing cutting-edge solutions. Research institutions such as the Dalian Institute of Chemical Physics and Beijing University of Chemical Technology are contributing to advancements in the field, fostering collaboration between industry and academia.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced catalyst manufacturing techniques focusing on quality control and inline characterization. Their approach includes the use of high-throughput experimentation (HTE) platforms for rapid catalyst screening and optimization[1]. They have implemented advanced process analytical technology (PAT) systems for real-time monitoring of catalyst properties during production[2]. Sinopec's manufacturing process incorporates in-situ spectroscopic techniques, such as Raman and FTIR, to monitor catalyst composition and structure throughout the production line[3]. They have also developed machine learning algorithms to predict catalyst performance based on manufacturing parameters, enabling proactive quality control[4].

Strengths: Large-scale production capabilities, extensive R&D resources, and integration of advanced technologies. Weaknesses: Potential challenges in adapting quickly to new catalyst technologies due to the scale of operations.

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil has pioneered innovative approaches to catalyst-scale manufacturing quality control. They have developed a proprietary Rapid Catalyst Testing (RCT) system that allows for high-throughput screening of catalysts under industrially relevant conditions[5]. Their manufacturing process incorporates inline Near-Infrared (NIR) spectroscopy for real-time monitoring of catalyst properties such as particle size distribution and chemical composition[6]. ExxonMobil has also implemented advanced statistical process control (SPC) techniques, including multivariate analysis, to detect and correct deviations in catalyst quality during production[7]. Additionally, they have developed novel microreactor technologies for rapid catalyst evaluation, enabling faster optimization of manufacturing parameters[8].

Strengths: Cutting-edge research capabilities, proprietary technologies, and global manufacturing presence. Weaknesses: Potential higher costs associated with implementing advanced technologies across all production facilities.

Innovative Inline Characterization Techniques

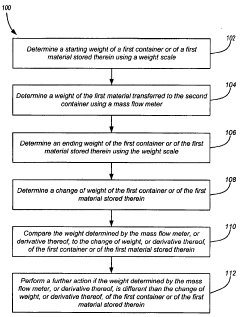

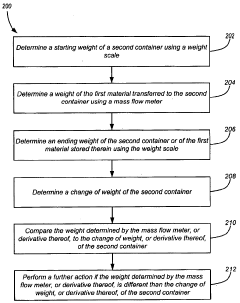

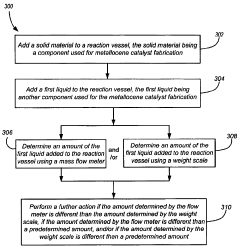

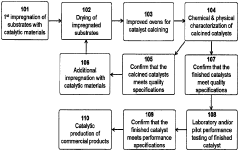

Systems and methods for manufacturing a catalyst and monitoring fabrication of a catalyst

PatentWO2008103145A1

Innovation

- The implementation of a system using weight scales and mass flow meters to monitor and control the transfer of catalyst components, ensuring accurate measurement and adjustment of material additions to maintain consistent catalyst composition and quality.

Process for the commercial production of high-quality catalyst material

PatentActiveUS11994345B2

Innovation

- A calcining process that precisely controls heating and gas flow rates, using a system with recirculation fans and thermostatically controlled heat sources to maintain uniform temperature and gas circulation, ensuring consistent catalyst quality across batches.

Regulatory Framework for Catalyst Manufacturing

The regulatory framework for catalyst manufacturing is a critical aspect of ensuring quality, safety, and compliance in the production of catalysts for various industrial applications. This framework encompasses a range of standards, guidelines, and regulations set forth by governmental agencies and industry organizations to govern the manufacturing processes, quality control measures, and environmental impact of catalyst production.

At the international level, organizations such as the International Organization for Standardization (ISO) play a crucial role in establishing standardized practices for catalyst manufacturing. ISO standards, such as ISO 9001 for quality management systems and ISO 14001 for environmental management systems, provide a foundation for consistent and reliable catalyst production across different regions and manufacturers.

In the United States, the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) are key regulatory bodies overseeing catalyst manufacturing. The EPA's regulations focus on environmental protection, emissions control, and waste management in the production process. OSHA, on the other hand, sets standards for workplace safety and health, addressing issues such as exposure to hazardous materials and proper handling of chemicals used in catalyst production.

The European Union has established the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which significantly impacts catalyst manufacturers operating in or exporting to the EU market. REACH requires companies to register chemical substances used in their products and demonstrate their safe use, promoting transparency and risk management in the catalyst industry.

Quality metrics and inline characterization methods are integral components of the regulatory framework for catalyst manufacturing. Regulatory bodies often require manufacturers to implement robust quality control systems, including in-process testing and final product analysis. These metrics may include parameters such as particle size distribution, surface area, pore volume, and chemical composition, which are critical for ensuring catalyst performance and consistency.

Inline characterization methods, such as X-ray diffraction (XRD), X-ray fluorescence (XRF), and particle size analysis, are increasingly being incorporated into regulatory requirements. These techniques allow for real-time monitoring of catalyst properties during the manufacturing process, enabling rapid adjustments and ensuring compliance with quality standards throughout production.

As the catalyst industry continues to evolve, regulatory frameworks are adapting to address emerging challenges and technologies. This includes the development of guidelines for the production of novel catalyst materials, such as those used in renewable energy applications and emission control systems. Additionally, there is a growing emphasis on sustainability and circular economy principles in catalyst manufacturing, with regulations encouraging the use of recycled materials and the implementation of more environmentally friendly production processes.

At the international level, organizations such as the International Organization for Standardization (ISO) play a crucial role in establishing standardized practices for catalyst manufacturing. ISO standards, such as ISO 9001 for quality management systems and ISO 14001 for environmental management systems, provide a foundation for consistent and reliable catalyst production across different regions and manufacturers.

In the United States, the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) are key regulatory bodies overseeing catalyst manufacturing. The EPA's regulations focus on environmental protection, emissions control, and waste management in the production process. OSHA, on the other hand, sets standards for workplace safety and health, addressing issues such as exposure to hazardous materials and proper handling of chemicals used in catalyst production.

The European Union has established the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which significantly impacts catalyst manufacturers operating in or exporting to the EU market. REACH requires companies to register chemical substances used in their products and demonstrate their safe use, promoting transparency and risk management in the catalyst industry.

Quality metrics and inline characterization methods are integral components of the regulatory framework for catalyst manufacturing. Regulatory bodies often require manufacturers to implement robust quality control systems, including in-process testing and final product analysis. These metrics may include parameters such as particle size distribution, surface area, pore volume, and chemical composition, which are critical for ensuring catalyst performance and consistency.

Inline characterization methods, such as X-ray diffraction (XRD), X-ray fluorescence (XRF), and particle size analysis, are increasingly being incorporated into regulatory requirements. These techniques allow for real-time monitoring of catalyst properties during the manufacturing process, enabling rapid adjustments and ensuring compliance with quality standards throughout production.

As the catalyst industry continues to evolve, regulatory frameworks are adapting to address emerging challenges and technologies. This includes the development of guidelines for the production of novel catalyst materials, such as those used in renewable energy applications and emission control systems. Additionally, there is a growing emphasis on sustainability and circular economy principles in catalyst manufacturing, with regulations encouraging the use of recycled materials and the implementation of more environmentally friendly production processes.

Environmental Impact of Catalyst Production

The environmental impact of catalyst production is a critical consideration in the development and implementation of catalyst-scale manufacturing processes. As the demand for catalysts continues to grow across various industries, it becomes increasingly important to assess and mitigate the ecological footprint associated with their production.

Catalyst manufacturing often involves energy-intensive processes and the use of potentially hazardous materials. The extraction and processing of raw materials, such as precious metals and rare earth elements, can lead to significant environmental degradation, including habitat destruction, soil erosion, and water pollution. Additionally, the refining and purification steps in catalyst production may generate substantial greenhouse gas emissions and contribute to air pollution.

Water consumption is another significant environmental concern in catalyst production. Many manufacturing processes require large volumes of water for cooling, cleaning, and chemical reactions. This can strain local water resources, particularly in water-scarce regions, and may lead to the discharge of contaminated wastewater if not properly treated.

The use of toxic chemicals and solvents in catalyst synthesis poses potential risks to both human health and the environment. Proper handling, storage, and disposal of these substances are essential to prevent accidental releases and minimize long-term environmental impacts. Furthermore, the production of catalysts often generates hazardous waste streams that require specialized treatment and disposal methods.

To address these environmental challenges, the catalyst manufacturing industry is increasingly focusing on developing more sustainable production methods. This includes the implementation of cleaner technologies, such as green chemistry principles and process intensification techniques, to reduce energy consumption and minimize waste generation. Recycling and recovery of precious metals from spent catalysts are also becoming more prevalent, helping to conserve resources and reduce the need for primary raw material extraction.

Advanced quality metrics and inline characterization methods play a crucial role in improving the environmental performance of catalyst production. By enabling real-time monitoring and control of manufacturing processes, these techniques can help optimize resource utilization, reduce waste, and enhance overall process efficiency. For example, inline spectroscopic methods can provide immediate feedback on catalyst composition and structure, allowing for rapid adjustments to process parameters and minimizing off-spec production.

As environmental regulations become more stringent, catalyst manufacturers are increasingly adopting life cycle assessment (LCA) approaches to evaluate and improve the sustainability of their products. This holistic view considers the environmental impacts throughout the entire life cycle of a catalyst, from raw material extraction to end-of-life disposal or recycling. By identifying hotspots of environmental burden, manufacturers can prioritize areas for improvement and develop more eco-friendly catalyst formulations and production methods.

Catalyst manufacturing often involves energy-intensive processes and the use of potentially hazardous materials. The extraction and processing of raw materials, such as precious metals and rare earth elements, can lead to significant environmental degradation, including habitat destruction, soil erosion, and water pollution. Additionally, the refining and purification steps in catalyst production may generate substantial greenhouse gas emissions and contribute to air pollution.

Water consumption is another significant environmental concern in catalyst production. Many manufacturing processes require large volumes of water for cooling, cleaning, and chemical reactions. This can strain local water resources, particularly in water-scarce regions, and may lead to the discharge of contaminated wastewater if not properly treated.

The use of toxic chemicals and solvents in catalyst synthesis poses potential risks to both human health and the environment. Proper handling, storage, and disposal of these substances are essential to prevent accidental releases and minimize long-term environmental impacts. Furthermore, the production of catalysts often generates hazardous waste streams that require specialized treatment and disposal methods.

To address these environmental challenges, the catalyst manufacturing industry is increasingly focusing on developing more sustainable production methods. This includes the implementation of cleaner technologies, such as green chemistry principles and process intensification techniques, to reduce energy consumption and minimize waste generation. Recycling and recovery of precious metals from spent catalysts are also becoming more prevalent, helping to conserve resources and reduce the need for primary raw material extraction.

Advanced quality metrics and inline characterization methods play a crucial role in improving the environmental performance of catalyst production. By enabling real-time monitoring and control of manufacturing processes, these techniques can help optimize resource utilization, reduce waste, and enhance overall process efficiency. For example, inline spectroscopic methods can provide immediate feedback on catalyst composition and structure, allowing for rapid adjustments to process parameters and minimizing off-spec production.

As environmental regulations become more stringent, catalyst manufacturers are increasingly adopting life cycle assessment (LCA) approaches to evaluate and improve the sustainability of their products. This holistic view considers the environmental impacts throughout the entire life cycle of a catalyst, from raw material extraction to end-of-life disposal or recycling. By identifying hotspots of environmental burden, manufacturers can prioritize areas for improvement and develop more eco-friendly catalyst formulations and production methods.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!