PEM vs AEM Catalyst Needs: Choosing Materials for Your Electrolyser Type

AUG 20, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PEM and AEM Electrolysis Background and Objectives

Electrolysis, the process of using electricity to split water into hydrogen and oxygen, has gained significant attention as a key technology for producing clean hydrogen fuel. Two prominent types of electrolysis have emerged as frontrunners in this field: Proton Exchange Membrane (PEM) electrolysis and Anion Exchange Membrane (AEM) electrolysis. Both technologies aim to efficiently produce hydrogen, but they differ in their underlying mechanisms and material requirements.

PEM electrolysis, developed in the 1960s, utilizes a solid polymer electrolyte membrane to conduct protons from the anode to the cathode. This technology has been widely adopted in various applications due to its high efficiency, compact design, and ability to operate at high current densities. PEM electrolyzers can quickly respond to fluctuating power inputs, making them suitable for integration with renewable energy sources.

AEM electrolysis, a more recent innovation, employs an anion-conducting membrane to facilitate the movement of hydroxide ions from the cathode to the anode. This technology has gained traction as a potential alternative to PEM electrolysis, offering the possibility of using less expensive catalyst materials and potentially lower overall system costs.

The primary objective in advancing both PEM and AEM electrolysis technologies is to improve their efficiency, durability, and cost-effectiveness. Researchers and industry players are focusing on developing novel materials for catalysts, membranes, and other components to enhance performance and reduce reliance on precious metals.

For PEM electrolysis, key goals include reducing the use of expensive platinum-group metal catalysts, improving membrane stability, and increasing the overall system efficiency. In AEM electrolysis, objectives center around enhancing the stability and conductivity of anion exchange membranes, developing more effective non-precious metal catalysts, and optimizing system designs for large-scale applications.

As the hydrogen economy continues to evolve, both PEM and AEM electrolysis technologies are expected to play crucial roles in clean hydrogen production. The choice between these technologies for specific applications will depend on factors such as scale, integration with renewable energy sources, and overall system economics. Ongoing research and development efforts aim to address the unique challenges and opportunities presented by each technology, driving innovation in materials science and electrochemistry.

PEM electrolysis, developed in the 1960s, utilizes a solid polymer electrolyte membrane to conduct protons from the anode to the cathode. This technology has been widely adopted in various applications due to its high efficiency, compact design, and ability to operate at high current densities. PEM electrolyzers can quickly respond to fluctuating power inputs, making them suitable for integration with renewable energy sources.

AEM electrolysis, a more recent innovation, employs an anion-conducting membrane to facilitate the movement of hydroxide ions from the cathode to the anode. This technology has gained traction as a potential alternative to PEM electrolysis, offering the possibility of using less expensive catalyst materials and potentially lower overall system costs.

The primary objective in advancing both PEM and AEM electrolysis technologies is to improve their efficiency, durability, and cost-effectiveness. Researchers and industry players are focusing on developing novel materials for catalysts, membranes, and other components to enhance performance and reduce reliance on precious metals.

For PEM electrolysis, key goals include reducing the use of expensive platinum-group metal catalysts, improving membrane stability, and increasing the overall system efficiency. In AEM electrolysis, objectives center around enhancing the stability and conductivity of anion exchange membranes, developing more effective non-precious metal catalysts, and optimizing system designs for large-scale applications.

As the hydrogen economy continues to evolve, both PEM and AEM electrolysis technologies are expected to play crucial roles in clean hydrogen production. The choice between these technologies for specific applications will depend on factors such as scale, integration with renewable energy sources, and overall system economics. Ongoing research and development efforts aim to address the unique challenges and opportunities presented by each technology, driving innovation in materials science and electrochemistry.

Market Analysis for PEM and AEM Electrolysers

The market for PEM (Proton Exchange Membrane) and AEM (Anion Exchange Membrane) electrolysers is experiencing significant growth, driven by the increasing demand for green hydrogen production. PEM electrolysers currently dominate the market, accounting for a larger share due to their technological maturity and established track record. However, AEM technology is rapidly gaining traction and is expected to capture a growing portion of the market in the coming years.

The global electrolyser market is projected to expand substantially, with estimates suggesting a compound annual growth rate (CAGR) of over 20% through 2030. This growth is primarily fueled by the global push for decarbonization and the transition to clean energy sources. Government initiatives, such as the European Union's Hydrogen Strategy and similar programs in other regions, are providing strong support for the adoption of electrolyser technologies.

PEM electrolysers are particularly well-suited for applications requiring rapid response times and variable loads, making them ideal for integration with renewable energy sources like wind and solar. They offer high efficiency and can produce high-purity hydrogen, which is crucial for certain industrial processes and fuel cell applications. The PEM market is expected to maintain its leading position in the short to medium term, benefiting from ongoing research and development efforts to improve catalyst materials and reduce costs.

AEM technology, while still emerging, is attracting significant interest due to its potential cost advantages and use of non-precious metal catalysts. The AEM market is anticipated to grow at a faster rate than PEM in percentage terms, albeit from a smaller base. This growth is driven by the technology's promise of lower capital costs and reduced reliance on scarce materials like platinum group metals.

Key market drivers for both PEM and AEM electrolysers include the increasing focus on sector coupling, where hydrogen plays a crucial role in integrating renewable energy across various industries. The transportation sector, particularly heavy-duty vehicles and maritime applications, represents a significant market opportunity. Additionally, the use of green hydrogen in industrial processes, such as ammonia production and steel manufacturing, is expected to drive demand for large-scale electrolyser installations.

Regional market dynamics vary, with Europe currently leading in electrolyser deployment, followed by Asia-Pacific and North America. However, emerging markets in Africa, the Middle East, and South America are showing increasing interest in hydrogen technologies, potentially opening new avenues for growth.

The global electrolyser market is projected to expand substantially, with estimates suggesting a compound annual growth rate (CAGR) of over 20% through 2030. This growth is primarily fueled by the global push for decarbonization and the transition to clean energy sources. Government initiatives, such as the European Union's Hydrogen Strategy and similar programs in other regions, are providing strong support for the adoption of electrolyser technologies.

PEM electrolysers are particularly well-suited for applications requiring rapid response times and variable loads, making them ideal for integration with renewable energy sources like wind and solar. They offer high efficiency and can produce high-purity hydrogen, which is crucial for certain industrial processes and fuel cell applications. The PEM market is expected to maintain its leading position in the short to medium term, benefiting from ongoing research and development efforts to improve catalyst materials and reduce costs.

AEM technology, while still emerging, is attracting significant interest due to its potential cost advantages and use of non-precious metal catalysts. The AEM market is anticipated to grow at a faster rate than PEM in percentage terms, albeit from a smaller base. This growth is driven by the technology's promise of lower capital costs and reduced reliance on scarce materials like platinum group metals.

Key market drivers for both PEM and AEM electrolysers include the increasing focus on sector coupling, where hydrogen plays a crucial role in integrating renewable energy across various industries. The transportation sector, particularly heavy-duty vehicles and maritime applications, represents a significant market opportunity. Additionally, the use of green hydrogen in industrial processes, such as ammonia production and steel manufacturing, is expected to drive demand for large-scale electrolyser installations.

Regional market dynamics vary, with Europe currently leading in electrolyser deployment, followed by Asia-Pacific and North America. However, emerging markets in Africa, the Middle East, and South America are showing increasing interest in hydrogen technologies, potentially opening new avenues for growth.

Current Challenges in Catalyst Materials

The development of efficient and cost-effective catalyst materials remains a significant challenge in both Proton Exchange Membrane (PEM) and Anion Exchange Membrane (AEM) electrolysers. For PEM electrolysers, the primary challenge lies in reducing the reliance on precious metal catalysts, particularly platinum and iridium, which are scarce and expensive. These materials are currently essential for achieving high catalytic activity and stability in the acidic environment of PEM cells.

In contrast, AEM electrolysers face challenges related to the stability and performance of non-precious metal catalysts in alkaline conditions. While AEM systems can potentially use more abundant and less expensive materials, such as nickel and iron, these catalysts often suffer from degradation and reduced efficiency over time. The development of stable, high-performance catalysts for AEM electrolysers is crucial for their widespread adoption.

Both PEM and AEM technologies struggle with catalyst poisoning and deactivation. In PEM systems, even trace amounts of contaminants can significantly impact catalyst performance, necessitating ultra-pure water and feed streams. AEM catalysts, while generally more tolerant to impurities, still face issues with carbonation and degradation in alkaline environments.

Another critical challenge is the optimization of catalyst loading and distribution. Reducing catalyst loading while maintaining performance is essential for cost reduction, but this often leads to decreased durability and efficiency. Achieving an optimal balance between catalyst utilization and longevity remains an ongoing research focus for both PEM and AEM systems.

The development of novel support materials for catalysts is also a key area of research. In PEM electrolysers, carbon-based supports are prone to corrosion in the highly oxidizing environment of the anode. For AEM systems, finding supports that enhance catalyst stability and conductivity in alkaline media is crucial for long-term performance.

Scalability and manufacturability of catalyst materials pose additional challenges. Developing processes for large-scale production of high-performance catalysts, while maintaining consistency and quality, is essential for the commercial viability of both PEM and AEM technologies. This includes addressing issues related to catalyst ink formulation, electrode fabrication, and integration with membrane materials.

Lastly, the need for accelerated durability testing and in-situ characterization techniques presents a significant challenge in catalyst development. Current testing methods often fail to accurately predict long-term performance under real-world operating conditions, hindering the rapid development and validation of new catalyst materials for both PEM and AEM electrolysers.

In contrast, AEM electrolysers face challenges related to the stability and performance of non-precious metal catalysts in alkaline conditions. While AEM systems can potentially use more abundant and less expensive materials, such as nickel and iron, these catalysts often suffer from degradation and reduced efficiency over time. The development of stable, high-performance catalysts for AEM electrolysers is crucial for their widespread adoption.

Both PEM and AEM technologies struggle with catalyst poisoning and deactivation. In PEM systems, even trace amounts of contaminants can significantly impact catalyst performance, necessitating ultra-pure water and feed streams. AEM catalysts, while generally more tolerant to impurities, still face issues with carbonation and degradation in alkaline environments.

Another critical challenge is the optimization of catalyst loading and distribution. Reducing catalyst loading while maintaining performance is essential for cost reduction, but this often leads to decreased durability and efficiency. Achieving an optimal balance between catalyst utilization and longevity remains an ongoing research focus for both PEM and AEM systems.

The development of novel support materials for catalysts is also a key area of research. In PEM electrolysers, carbon-based supports are prone to corrosion in the highly oxidizing environment of the anode. For AEM systems, finding supports that enhance catalyst stability and conductivity in alkaline media is crucial for long-term performance.

Scalability and manufacturability of catalyst materials pose additional challenges. Developing processes for large-scale production of high-performance catalysts, while maintaining consistency and quality, is essential for the commercial viability of both PEM and AEM technologies. This includes addressing issues related to catalyst ink formulation, electrode fabrication, and integration with membrane materials.

Lastly, the need for accelerated durability testing and in-situ characterization techniques presents a significant challenge in catalyst development. Current testing methods often fail to accurately predict long-term performance under real-world operating conditions, hindering the rapid development and validation of new catalyst materials for both PEM and AEM electrolysers.

Existing Catalyst Solutions for PEM and AEM

01 Novel catalyst materials for PEM electrolysers

Development of advanced catalyst materials specifically designed for Proton Exchange Membrane (PEM) electrolysers. These materials aim to improve efficiency, durability, and performance of PEM electrolysis systems for hydrogen production.- Novel catalyst materials for PEM electrolysers: Development of innovative catalyst materials specifically designed for Proton Exchange Membrane (PEM) electrolysers. These materials aim to enhance the efficiency and durability of PEM electrolysis systems, potentially including nanostructured catalysts or novel alloy compositions that improve the oxygen and hydrogen evolution reactions.

- AEM electrolyser catalyst advancements: Research into new catalyst materials for Anion Exchange Membrane (AEM) electrolysers. This includes the development of non-precious metal catalysts or modified surface structures that can operate effectively in alkaline environments, potentially reducing costs and improving the overall performance of AEM systems.

- Bimetallic and multi-component catalyst systems: Exploration of bimetallic or multi-component catalyst systems for both PEM and AEM electrolysers. These complex catalyst compositions aim to synergistically enhance catalytic activity, stability, and selectivity by combining the properties of different metals or incorporating supportive elements.

- Nanostructured and supported catalyst materials: Development of nanostructured catalysts and novel support materials for electrolyser applications. This includes the creation of high-surface-area catalyst structures, core-shell nanoparticles, and advanced carbon-based or ceramic supports that can improve catalyst utilization and longevity in both PEM and AEM systems.

- Catalyst layer design and fabrication techniques: Innovative methods for designing and fabricating catalyst layers in PEM and AEM electrolysers. This encompasses novel deposition techniques, 3D-structured electrode designs, and advanced manufacturing processes that optimize catalyst distribution, enhance mass transport, and improve the overall performance of electrolyser systems.

02 Innovative catalyst compositions for AEM electrolysers

Creation of new catalyst compositions tailored for Anion Exchange Membrane (AEM) electrolysers. These catalysts are designed to enhance the electrochemical performance and stability of AEM systems in alkaline environments.Expand Specific Solutions03 Nanostructured catalysts for improved electrolyser efficiency

Development of nanostructured catalyst materials for both PEM and AEM electrolysers. These nanostructured catalysts offer increased surface area and improved catalytic activity, leading to higher efficiency in water electrolysis processes.Expand Specific Solutions04 Precious metal-free catalysts for cost-effective electrolysis

Research and development of non-precious metal catalysts for PEM and AEM electrolysers. These alternative materials aim to reduce the reliance on expensive noble metals while maintaining high catalytic performance and durability.Expand Specific Solutions05 Hybrid catalyst systems for enhanced electrolyser performance

Creation of hybrid catalyst systems combining different materials or structures to optimize the performance of both PEM and AEM electrolysers. These hybrid catalysts aim to synergize the benefits of multiple components for improved efficiency and stability.Expand Specific Solutions

Key Players in Electrolyser Industry

The PEM vs AEM catalyst market is in a growth phase, driven by increasing demand for green hydrogen production. The market size is expanding rapidly, with projections indicating significant growth in the coming years. Technologically, both PEM and AEM catalysts are advancing, but PEM catalysts are currently more mature. Key players like Umicore, Johnson Matthey, and Plug Power are leading in PEM catalyst development, while companies such as Dioxide Materials and Enapter are making strides in AEM technology. The competitive landscape is dynamic, with established firms and innovative startups vying for market share through continuous R&D efforts and strategic partnerships.

Johnson Matthey Hydrogen Technologies Ltd.

Technical Solution: Johnson Matthey has developed advanced catalyst materials for both PEM and AEM electrolysers. For PEM, they offer high-performance iridium-based catalysts that achieve low overpotentials and high current densities[1]. Their PEM catalysts utilize a proprietary carbon support structure to enhance stability and conductivity. For AEM, Johnson Matthey has engineered novel non-precious metal catalysts based on nickel and iron that deliver comparable performance to precious metal catalysts at a fraction of the cost[2]. These catalysts are optimized for the high pH environment of AEM cells. Johnson Matthey's catalyst coatings can be customized and applied directly to membranes or gas diffusion layers to maximize electrolyser efficiency[3].

Strengths: Expertise in both PEM and AEM catalysts, proprietary support structures, customizable coatings. Weaknesses: Reliance on precious metals for PEM, AEM catalysts still less mature than PEM offerings.

Plug Power, Inc.

Technical Solution: Plug Power specializes in PEM fuel cell and electrolyser technology. For PEM electrolysers, they have developed a proprietary catalyst formulation using ultra-low loading of platinum group metals (PGMs) to reduce costs while maintaining high performance[4]. Their catalysts achieve over 2 A/cm2 at cell voltages below 2V. Plug Power's MEA design incorporates advanced ionomers and gas diffusion layers to optimize water management and gas transport. For hydrogen evolution, they utilize novel carbon supports with high surface area to maximize catalyst utilization. Plug Power is also exploring AEM technology, focusing on developing stable, hydroxide-conducting membranes and compatible non-PGM catalysts[5].

Strengths: Industry leader in PEM technology, low PGM catalyst loadings, optimized MEA designs. Weaknesses: Less experience with AEM systems, heavy focus on PEM may limit AEM development.

Innovative Catalyst Materials Research

Water-electrolyser anode, PEM water electrolyser, method of manufacture and method of water electrolysis

PatentWO2025114716A1

Innovation

- The use of transition metal oxychalcogenides as catalysts in the oxygen evolution reaction under acidic conditions, specifically in the form of ABxOy, where A is a transition metal and B is a chalcogenide, with 0 < x < 2 and 0 < y < 2, providing a cheaper and more scalable alternative.

Catalyst materials

PatentWO2024218486A1

Innovation

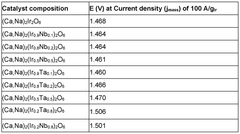

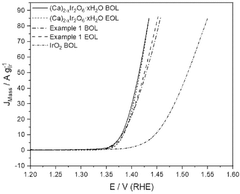

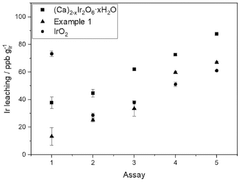

- Incorporating calcium, sodium, iridium, ruthenium, niobium, and tantalum into pyrochlore-type structured materials with specific molar ratios, forming catalysts with improved stability and activity, which can be formulated into inks for application on substrates to create catalyst layers for water electrolyzers and fuel cells.

Economic Feasibility of Catalyst Materials

The economic feasibility of catalyst materials for PEM and AEM electrolysers is a critical factor in determining the overall viability of hydrogen production systems. PEM electrolysers typically require precious metal catalysts, such as platinum and iridium, which contribute significantly to the system's capital costs. These materials, while highly effective, are expensive and subject to price volatility in the global market.

In contrast, AEM electrolysers can utilize non-precious metal catalysts, including nickel, iron, and cobalt-based materials. These alternatives are substantially more cost-effective and abundant, potentially reducing the overall system costs. However, the long-term stability and performance of these catalysts in AEM environments are still under investigation, which may impact their economic viability over extended operational periods.

The cost-benefit analysis of catalyst materials must consider not only the initial investment but also the long-term performance and durability. PEM catalysts, despite their higher upfront costs, have demonstrated excellent stability and efficiency over time. This longevity can offset the initial expense through reduced maintenance and replacement costs. Conversely, while AEM catalysts are less expensive initially, their potential degradation rates and performance losses over time must be factored into the economic assessment.

Market dynamics also play a crucial role in the economic feasibility of catalyst materials. The increasing demand for platinum group metals in various industries, including automotive and electronics, can lead to supply constraints and price increases. This trend may further incentivize the development and adoption of non-precious metal catalysts for AEM systems, potentially driving down costs through economies of scale and technological advancements.

The economic evaluation must also consider the scalability of catalyst production. PEM catalysts, being based on rare metals, face limitations in large-scale production, which can impact their availability and cost for mass deployment of electrolysers. AEM catalysts, derived from more abundant elements, offer greater potential for scalable production, which could lead to significant cost reductions as the technology matures and production volumes increase.

Ultimately, the economic feasibility of catalyst materials is closely tied to the overall system efficiency and hydrogen production costs. While PEM systems currently offer higher efficiency, the potential for AEM systems to achieve comparable performance with less expensive catalysts presents an attractive economic proposition. As research and development efforts continue to improve AEM catalyst performance and durability, the economic balance may shift, potentially making AEM electrolysers more competitive in the hydrogen production market.

In contrast, AEM electrolysers can utilize non-precious metal catalysts, including nickel, iron, and cobalt-based materials. These alternatives are substantially more cost-effective and abundant, potentially reducing the overall system costs. However, the long-term stability and performance of these catalysts in AEM environments are still under investigation, which may impact their economic viability over extended operational periods.

The cost-benefit analysis of catalyst materials must consider not only the initial investment but also the long-term performance and durability. PEM catalysts, despite their higher upfront costs, have demonstrated excellent stability and efficiency over time. This longevity can offset the initial expense through reduced maintenance and replacement costs. Conversely, while AEM catalysts are less expensive initially, their potential degradation rates and performance losses over time must be factored into the economic assessment.

Market dynamics also play a crucial role in the economic feasibility of catalyst materials. The increasing demand for platinum group metals in various industries, including automotive and electronics, can lead to supply constraints and price increases. This trend may further incentivize the development and adoption of non-precious metal catalysts for AEM systems, potentially driving down costs through economies of scale and technological advancements.

The economic evaluation must also consider the scalability of catalyst production. PEM catalysts, being based on rare metals, face limitations in large-scale production, which can impact their availability and cost for mass deployment of electrolysers. AEM catalysts, derived from more abundant elements, offer greater potential for scalable production, which could lead to significant cost reductions as the technology matures and production volumes increase.

Ultimately, the economic feasibility of catalyst materials is closely tied to the overall system efficiency and hydrogen production costs. While PEM systems currently offer higher efficiency, the potential for AEM systems to achieve comparable performance with less expensive catalysts presents an attractive economic proposition. As research and development efforts continue to improve AEM catalyst performance and durability, the economic balance may shift, potentially making AEM electrolysers more competitive in the hydrogen production market.

Environmental Impact of Catalyst Choices

The choice of catalysts for PEM (Proton Exchange Membrane) and AEM (Anion Exchange Membrane) electrolysers has significant environmental implications. These impacts extend beyond the immediate performance of the electrolyser and encompass the entire lifecycle of the catalyst materials.

For PEM electrolysers, platinum group metals (PGMs) are commonly used as catalysts. While highly effective, the environmental footprint of PGM extraction and processing is substantial. Mining operations for these rare metals often involve extensive land use, water consumption, and energy-intensive processes. The scarcity of PGMs also raises concerns about long-term sustainability and resource depletion.

In contrast, AEM electrolysers typically utilize non-precious metal catalysts, such as nickel-based materials. These are more abundant and generally have a lower environmental impact in terms of extraction and processing. However, the longevity and efficiency of these catalysts may be lower, potentially requiring more frequent replacement and thus increasing waste generation over the electrolyser's lifetime.

The production processes for both types of catalysts involve energy-intensive steps and the use of various chemicals. PGM catalysts often require more complex purification and preparation methods, leading to higher energy consumption and potential chemical waste. Non-precious metal catalysts for AEM systems may have simpler production processes but may require larger quantities to achieve comparable performance.

End-of-life considerations also differ between the two catalyst types. PGM catalysts have high recycling value due to their precious metal content, encouraging the development of efficient recycling processes. This can help mitigate some of the environmental impacts associated with their initial production. Non-precious metal catalysts, while less valuable, may still be recyclable but with potentially lower recovery rates and economic incentives.

The overall environmental impact of catalyst choices extends to the operational phase of electrolysers. Higher efficiency catalysts, often associated with PGM-based systems, can lead to reduced energy consumption over the electrolyser's lifetime. This operational efficiency can offset some of the initial environmental costs of PGM production. Conversely, while non-precious metal catalysts may have a lower initial environmental footprint, their potentially lower efficiency could result in higher cumulative energy consumption and associated emissions during operation.

When considering the environmental impact of catalyst choices, it's crucial to adopt a holistic, lifecycle approach. This should include factors such as resource availability, production processes, operational efficiency, durability, and end-of-life management. Balancing these aspects is key to minimizing the overall environmental footprint of electrolyser systems and advancing sustainable hydrogen production technologies.

For PEM electrolysers, platinum group metals (PGMs) are commonly used as catalysts. While highly effective, the environmental footprint of PGM extraction and processing is substantial. Mining operations for these rare metals often involve extensive land use, water consumption, and energy-intensive processes. The scarcity of PGMs also raises concerns about long-term sustainability and resource depletion.

In contrast, AEM electrolysers typically utilize non-precious metal catalysts, such as nickel-based materials. These are more abundant and generally have a lower environmental impact in terms of extraction and processing. However, the longevity and efficiency of these catalysts may be lower, potentially requiring more frequent replacement and thus increasing waste generation over the electrolyser's lifetime.

The production processes for both types of catalysts involve energy-intensive steps and the use of various chemicals. PGM catalysts often require more complex purification and preparation methods, leading to higher energy consumption and potential chemical waste. Non-precious metal catalysts for AEM systems may have simpler production processes but may require larger quantities to achieve comparable performance.

End-of-life considerations also differ between the two catalyst types. PGM catalysts have high recycling value due to their precious metal content, encouraging the development of efficient recycling processes. This can help mitigate some of the environmental impacts associated with their initial production. Non-precious metal catalysts, while less valuable, may still be recyclable but with potentially lower recovery rates and economic incentives.

The overall environmental impact of catalyst choices extends to the operational phase of electrolysers. Higher efficiency catalysts, often associated with PGM-based systems, can lead to reduced energy consumption over the electrolyser's lifetime. This operational efficiency can offset some of the initial environmental costs of PGM production. Conversely, while non-precious metal catalysts may have a lower initial environmental footprint, their potentially lower efficiency could result in higher cumulative energy consumption and associated emissions during operation.

When considering the environmental impact of catalyst choices, it's crucial to adopt a holistic, lifecycle approach. This should include factors such as resource availability, production processes, operational efficiency, durability, and end-of-life management. Balancing these aspects is key to minimizing the overall environmental footprint of electrolyser systems and advancing sustainable hydrogen production technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!