Ceramic Thermal Spray Coatings in Energy Systems

OCT 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ceramic Coating Evolution and Objectives

Ceramic thermal spray coatings have evolved significantly over the past seven decades, transforming from rudimentary surface treatments to sophisticated engineered solutions critical for modern energy systems. The journey began in the 1950s with simple flame-sprayed ceramic applications primarily focused on wear resistance, but limited in their thermal capabilities and adhesion strength.

The 1970s marked a pivotal shift with the introduction of plasma spray technology, enabling higher particle velocities and temperatures that dramatically improved coating density and bonding. This advancement coincided with the growing demands of the aerospace and power generation industries, where thermal barrier coatings (TBCs) became essential for protecting superalloys in high-temperature environments.

By the 1990s, the development of suspension and solution precursor thermal spray methods revolutionized the field, allowing for the deposition of nanostructured coatings with enhanced thermal insulation properties and strain tolerance. These innovations addressed the critical need for improved efficiency in gas turbines and other energy conversion systems operating at increasingly extreme temperatures.

The early 2000s witnessed the integration of computational modeling with experimental approaches, enabling the prediction of coating performance and failure mechanisms. This scientific foundation facilitated the tailoring of microstructures for specific operational conditions, significantly extending component lifespans in harsh environments.

Current ceramic thermal spray coating technology aims to achieve multiple functionalities simultaneously—thermal insulation, oxidation resistance, and mechanical durability—while maintaining coating integrity under thermal cycling and mechanical stresses. The industry is now pursuing coatings with self-healing capabilities and adaptive properties that can respond to changing operational conditions.

Looking forward, the primary objectives for ceramic thermal spray coatings in energy systems include: reducing thermal conductivity below 1 W/m·K while maintaining structural stability above 1400°C; developing environmentally resistant coatings capable of withstanding hot corrosion in next-generation power plants; and creating manufacturing processes that ensure consistent quality at reduced costs for large-scale industrial implementation.

Another critical goal is the development of ceramic coatings compatible with renewable energy technologies, particularly concentrated solar power systems and high-temperature electrolysis for hydrogen production. These applications demand coatings with exceptional thermal stability and resistance to thermal shock under fluctuating operating conditions.

The 1970s marked a pivotal shift with the introduction of plasma spray technology, enabling higher particle velocities and temperatures that dramatically improved coating density and bonding. This advancement coincided with the growing demands of the aerospace and power generation industries, where thermal barrier coatings (TBCs) became essential for protecting superalloys in high-temperature environments.

By the 1990s, the development of suspension and solution precursor thermal spray methods revolutionized the field, allowing for the deposition of nanostructured coatings with enhanced thermal insulation properties and strain tolerance. These innovations addressed the critical need for improved efficiency in gas turbines and other energy conversion systems operating at increasingly extreme temperatures.

The early 2000s witnessed the integration of computational modeling with experimental approaches, enabling the prediction of coating performance and failure mechanisms. This scientific foundation facilitated the tailoring of microstructures for specific operational conditions, significantly extending component lifespans in harsh environments.

Current ceramic thermal spray coating technology aims to achieve multiple functionalities simultaneously—thermal insulation, oxidation resistance, and mechanical durability—while maintaining coating integrity under thermal cycling and mechanical stresses. The industry is now pursuing coatings with self-healing capabilities and adaptive properties that can respond to changing operational conditions.

Looking forward, the primary objectives for ceramic thermal spray coatings in energy systems include: reducing thermal conductivity below 1 W/m·K while maintaining structural stability above 1400°C; developing environmentally resistant coatings capable of withstanding hot corrosion in next-generation power plants; and creating manufacturing processes that ensure consistent quality at reduced costs for large-scale industrial implementation.

Another critical goal is the development of ceramic coatings compatible with renewable energy technologies, particularly concentrated solar power systems and high-temperature electrolysis for hydrogen production. These applications demand coatings with exceptional thermal stability and resistance to thermal shock under fluctuating operating conditions.

Energy Sector Market Analysis for Thermal Spray Coatings

The global market for ceramic thermal spray coatings in the energy sector is experiencing robust growth, driven by increasing demand for efficient and durable components in power generation systems. Currently valued at approximately 2.3 billion USD, this market segment is projected to grow at a compound annual growth rate of 6.8% through 2028, significantly outpacing the broader industrial coatings market.

Power generation represents the largest application segment, accounting for nearly 42% of the total ceramic thermal spray coating market in energy systems. Within this segment, gas turbines constitute the primary application area, where thermal barrier coatings (TBCs) are essential for enhancing operational efficiency and component longevity under extreme temperature conditions.

Renewable energy applications are emerging as the fastest-growing segment, with an estimated growth rate of 9.2% annually. Solar thermal systems and concentrated solar power plants increasingly utilize ceramic coatings to improve heat absorption and transfer efficiency. Similarly, wind energy systems benefit from wear-resistant coatings that extend the operational life of critical components exposed to harsh environmental conditions.

Regional analysis reveals that North America and Europe currently dominate the market with a combined share of 58%, primarily due to their established energy infrastructure and stringent efficiency regulations. However, the Asia-Pacific region is witnessing the most rapid market expansion, driven by China and India's aggressive development of both conventional and renewable energy capacity.

The oil and gas sector represents another significant market segment, particularly for applications in offshore platforms, refineries, and processing facilities. Here, ceramic coatings provide critical protection against corrosion, erosion, and high-temperature degradation, extending equipment lifespan in harsh operating environments.

Market penetration analysis indicates varying adoption rates across different energy subsectors. While thermal spray coatings have achieved near-universal adoption in advanced gas turbine systems, their implementation in hydroelectric, geothermal, and biomass energy systems remains relatively limited, presenting substantial growth opportunities.

Customer demand patterns show increasing preference for customized coating solutions that address specific operational challenges rather than generic products. This trend is particularly evident in the nuclear energy sector, where specialized coatings must meet stringent safety and performance requirements while withstanding radiation exposure.

Market forecasts suggest that technological advancements in nano-structured ceramic coatings will drive the next wave of market expansion, potentially opening new application areas in emerging energy technologies such as hydrogen production and storage systems, fuel cells, and advanced battery thermal management systems.

Power generation represents the largest application segment, accounting for nearly 42% of the total ceramic thermal spray coating market in energy systems. Within this segment, gas turbines constitute the primary application area, where thermal barrier coatings (TBCs) are essential for enhancing operational efficiency and component longevity under extreme temperature conditions.

Renewable energy applications are emerging as the fastest-growing segment, with an estimated growth rate of 9.2% annually. Solar thermal systems and concentrated solar power plants increasingly utilize ceramic coatings to improve heat absorption and transfer efficiency. Similarly, wind energy systems benefit from wear-resistant coatings that extend the operational life of critical components exposed to harsh environmental conditions.

Regional analysis reveals that North America and Europe currently dominate the market with a combined share of 58%, primarily due to their established energy infrastructure and stringent efficiency regulations. However, the Asia-Pacific region is witnessing the most rapid market expansion, driven by China and India's aggressive development of both conventional and renewable energy capacity.

The oil and gas sector represents another significant market segment, particularly for applications in offshore platforms, refineries, and processing facilities. Here, ceramic coatings provide critical protection against corrosion, erosion, and high-temperature degradation, extending equipment lifespan in harsh operating environments.

Market penetration analysis indicates varying adoption rates across different energy subsectors. While thermal spray coatings have achieved near-universal adoption in advanced gas turbine systems, their implementation in hydroelectric, geothermal, and biomass energy systems remains relatively limited, presenting substantial growth opportunities.

Customer demand patterns show increasing preference for customized coating solutions that address specific operational challenges rather than generic products. This trend is particularly evident in the nuclear energy sector, where specialized coatings must meet stringent safety and performance requirements while withstanding radiation exposure.

Market forecasts suggest that technological advancements in nano-structured ceramic coatings will drive the next wave of market expansion, potentially opening new application areas in emerging energy technologies such as hydrogen production and storage systems, fuel cells, and advanced battery thermal management systems.

Global Ceramic Coating Technology Assessment

Ceramic thermal spray coatings have emerged as a critical technology in modern energy systems, offering enhanced performance, durability, and efficiency across multiple applications. The global ceramic coating market has experienced significant growth, valued at approximately $10.2 billion in 2022 and projected to reach $15.3 billion by 2027, with a compound annual growth rate of 8.4%. This growth is primarily driven by increasing demands in power generation, aerospace, automotive, and renewable energy sectors.

The technology landscape is characterized by regional specialization, with North America and Europe leading in research and development, while Asia-Pacific dominates in production volume and implementation. Japan, Germany, and the United States maintain technological leadership through substantial investments in advanced materials science and application techniques. China has rapidly emerged as a significant player, particularly in thermal barrier coatings for power generation equipment.

Recent technological advancements have focused on nano-structured ceramic coatings, which demonstrate superior thermal resistance and mechanical properties compared to conventional coatings. These innovations have enabled operating temperature increases of up to 150°C in gas turbines, translating to efficiency improvements of 2-5% - a significant gain in energy production systems.

The competitive landscape features established multinational corporations such as Oerlikon Metco, Praxair Surface Technologies, and H.C. Starck, alongside specialized regional players. Market concentration remains moderate, with the top five companies controlling approximately 35% of the global market share. Strategic partnerships between coating technology providers and energy system manufacturers have become increasingly common, accelerating technology transfer and application-specific developments.

Environmental regulations, particularly those targeting emissions reduction and energy efficiency, have become significant market drivers. The European Union's Industrial Emissions Directive and similar regulations in North America have accelerated adoption of advanced ceramic coatings that enable compliance while maintaining or improving system performance.

The technology assessment indicates a transition from traditional alumina and zirconia-based coatings toward multi-component ceramic systems with tailored properties. These advanced formulations incorporate rare earth elements and complex oxides to achieve specific performance characteristics such as thermal cycling resistance, corrosion protection, and reduced thermal conductivity.

Return on investment analyses demonstrate that despite higher initial costs (typically 30-50% premium over conventional coatings), advanced ceramic thermal spray coatings deliver lifecycle cost reductions of 15-25% through extended component lifespans, reduced maintenance requirements, and improved energy efficiency.

The technology landscape is characterized by regional specialization, with North America and Europe leading in research and development, while Asia-Pacific dominates in production volume and implementation. Japan, Germany, and the United States maintain technological leadership through substantial investments in advanced materials science and application techniques. China has rapidly emerged as a significant player, particularly in thermal barrier coatings for power generation equipment.

Recent technological advancements have focused on nano-structured ceramic coatings, which demonstrate superior thermal resistance and mechanical properties compared to conventional coatings. These innovations have enabled operating temperature increases of up to 150°C in gas turbines, translating to efficiency improvements of 2-5% - a significant gain in energy production systems.

The competitive landscape features established multinational corporations such as Oerlikon Metco, Praxair Surface Technologies, and H.C. Starck, alongside specialized regional players. Market concentration remains moderate, with the top five companies controlling approximately 35% of the global market share. Strategic partnerships between coating technology providers and energy system manufacturers have become increasingly common, accelerating technology transfer and application-specific developments.

Environmental regulations, particularly those targeting emissions reduction and energy efficiency, have become significant market drivers. The European Union's Industrial Emissions Directive and similar regulations in North America have accelerated adoption of advanced ceramic coatings that enable compliance while maintaining or improving system performance.

The technology assessment indicates a transition from traditional alumina and zirconia-based coatings toward multi-component ceramic systems with tailored properties. These advanced formulations incorporate rare earth elements and complex oxides to achieve specific performance characteristics such as thermal cycling resistance, corrosion protection, and reduced thermal conductivity.

Return on investment analyses demonstrate that despite higher initial costs (typically 30-50% premium over conventional coatings), advanced ceramic thermal spray coatings deliver lifecycle cost reductions of 15-25% through extended component lifespans, reduced maintenance requirements, and improved energy efficiency.

Current Ceramic Coating Application Techniques

01 Composition of ceramic thermal spray coatings

Ceramic thermal spray coatings can be composed of various materials to achieve specific properties. These compositions may include aluminum oxide, zirconium oxide, titanium oxide, and other ceramic materials. The specific composition affects the coating's thermal resistance, durability, and other functional properties. Different ceramic materials can be combined to create composite coatings with enhanced performance characteristics for specific industrial applications.- Composition of ceramic thermal spray coatings: Ceramic thermal spray coatings are composed of various materials that provide specific properties such as thermal resistance, wear resistance, and corrosion protection. These compositions typically include metal oxides, carbides, and other ceramic materials that are formulated to withstand high temperatures and harsh environments. The specific composition can be tailored to meet the requirements of different applications, with additives incorporated to enhance particular properties such as adhesion, hardness, or thermal conductivity.

- Application methods for ceramic thermal spray coatings: Various techniques are employed for applying ceramic thermal spray coatings, including plasma spraying, high-velocity oxy-fuel (HVOF) spraying, and flame spraying. These methods involve heating ceramic materials to a molten or semi-molten state and propelling them onto a substrate surface where they solidify to form a coating. The choice of application method affects the coating's microstructure, adhesion strength, porosity, and overall performance. Process parameters such as spray distance, particle velocity, and substrate temperature are carefully controlled to achieve desired coating characteristics.

- Thermal barrier applications of ceramic coatings: Ceramic thermal spray coatings are widely used as thermal barriers in high-temperature applications such as gas turbine engines, combustion chambers, and industrial furnaces. These coatings provide thermal insulation, protecting underlying metal components from extreme temperatures and thermal cycling. The coatings typically feature low thermal conductivity while maintaining structural integrity at elevated temperatures. Multi-layer systems may be employed to optimize both thermal insulation and mechanical properties, with different ceramic materials used in each layer to address specific thermal management requirements.

- Wear and corrosion resistant ceramic coatings: Ceramic thermal spray coatings provide excellent wear and corrosion resistance for components operating in aggressive environments. These coatings protect surfaces from abrasion, erosion, and chemical attack, significantly extending component service life. The ceramic materials used in these applications typically feature high hardness, chemical stability, and resistance to oxidation. The coatings can be engineered with specific microstructures to optimize tribological properties and minimize friction, making them suitable for applications in industries such as oil and gas, chemical processing, and power generation.

- Advanced ceramic coating systems with enhanced properties: Recent developments in ceramic thermal spray coatings focus on creating advanced systems with enhanced properties through novel material combinations and processing techniques. These innovations include nanostructured coatings, functionally graded materials, and composite ceramic coatings that offer superior performance characteristics. Self-healing capabilities, improved thermal cycling resistance, and enhanced mechanical properties are achieved through careful control of coating microstructure and composition. Advanced manufacturing methods, such as suspension plasma spraying and solution precursor plasma spraying, enable the production of coatings with refined microstructures and tailored properties for demanding applications.

02 Application methods for ceramic thermal spray coatings

Various methods can be used to apply ceramic thermal spray coatings, including plasma spraying, high-velocity oxy-fuel (HVOF) spraying, and flame spraying. These techniques involve heating ceramic materials to a molten or semi-molten state and propelling them onto a substrate surface. The choice of application method affects coating properties such as density, adhesion strength, and microstructure. Process parameters like spray distance, powder feed rate, and substrate temperature are critical for achieving optimal coating quality.Expand Specific Solutions03 Thermal and electrical properties of ceramic coatings

Ceramic thermal spray coatings provide excellent thermal insulation and can withstand high temperatures, making them suitable for applications in extreme environments. These coatings can be engineered to have specific thermal conductivity, thermal expansion coefficients, and electrical resistivity properties. Some ceramic coatings also offer electrical insulation capabilities, which is valuable in electronic components and electrical systems. The microstructure of the coating, including porosity and phase composition, significantly influences these thermal and electrical properties.Expand Specific Solutions04 Surface preparation and post-coating treatments

Proper surface preparation is essential for achieving strong adhesion between ceramic thermal spray coatings and substrates. This may involve cleaning, grit blasting, or chemical treatments to create an optimal surface profile. Post-coating treatments such as sealing, heat treatment, or machining can enhance coating performance by reducing porosity, improving microstructure, or achieving specific dimensional requirements. These treatments can significantly affect the final properties of the coating, including wear resistance, corrosion protection, and service life.Expand Specific Solutions05 Industrial applications of ceramic thermal spray coatings

Ceramic thermal spray coatings find applications across various industries due to their exceptional properties. In aerospace, they protect engine components from high temperatures and corrosive environments. In power generation, these coatings extend the life of turbine components. Medical implants benefit from biocompatible ceramic coatings that enhance integration with biological tissues. In electronics, they provide electrical insulation and thermal management. The automotive industry uses these coatings to improve wear resistance and thermal efficiency of engine components.Expand Specific Solutions

Leading Manufacturers and Research Institutions

Ceramic thermal spray coatings in energy systems are currently in a growth phase, with the market expanding due to increasing demand for high-performance materials in power generation, aerospace, and industrial applications. The global market is estimated to reach several billion dollars by 2025, driven by energy efficiency requirements and sustainability goals. Technologically, the field shows varying maturity levels, with companies like Praxair S.T. Technology and Oerlikon Metco leading in advanced coating solutions, while RTX Corp. (formerly United Technologies) and Rolls-Royce focus on specialized aerospace and power generation applications. Siemens Energy and Toshiba Energy Systems are advancing coatings for turbine components, while research institutions like Xi'an Jiaotong University and Forschungszentrum Jülich are developing next-generation ceramic coating technologies for enhanced thermal efficiency and durability in extreme environments.

Praxair S.T. Technology, Inc.

Technical Solution: Praxair S.T. Technology has developed advanced ceramic thermal spray coating solutions utilizing their proprietary HVOF (High Velocity Oxy-Fuel) and plasma spray technologies. Their approach focuses on creating dense, highly adherent ceramic coatings with controlled microstructure for energy system applications. The company has pioneered suspension and solution precursor plasma spray techniques that enable the deposition of nanostructured ceramic coatings with enhanced thermal properties and durability. Their thermal barrier coating (TBC) systems incorporate yttria-stabilized zirconia (YSZ) with advanced architectures including columnar structures and strain-tolerant designs that significantly improve thermal cycling resistance in high-temperature energy applications[1][3]. Praxair's coatings demonstrate exceptional performance in gas turbine components, achieving temperature reductions of up to 150°C at the metal substrate.

Strengths: Superior microstructure control allowing customization for specific energy applications; proprietary spray technologies enabling nanostructured coatings with enhanced durability. Weaknesses: Higher implementation costs compared to conventional coating methods; requires specialized equipment and expertise for application.

Rolls-Royce Corp.

Technical Solution: Rolls-Royce has developed sophisticated ceramic thermal spray coating technologies specifically engineered for aerospace and industrial gas turbine applications. Their approach centers on multi-layer coating systems that combine metallic bond coats with ceramic top layers to maximize thermal protection and component life. The company utilizes electron beam physical vapor deposition (EB-PVD) alongside advanced plasma spray techniques to create columnar microstructures in their thermal barrier coatings, which provide superior strain tolerance during thermal cycling[2]. Rolls-Royce's ceramic coatings incorporate gadolinium zirconate and other rare earth elements to enhance phase stability and reduce thermal conductivity by up to 40% compared to conventional YSZ coatings[4]. Their integrated coating design methodology considers the entire component lifecycle, with specialized solutions for high-pressure turbine blades that can withstand temperatures exceeding 1600°C while maintaining structural integrity.

Strengths: Exceptional high-temperature performance in extreme aerospace environments; sophisticated multi-layer designs optimized for specific component requirements. Weaknesses: Complex manufacturing process with high precision requirements; significant R&D investment needed for new coating formulations.

Key Patents and Innovations in Thermal Spray Technology

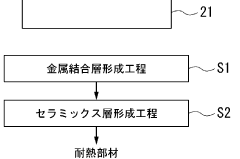

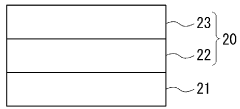

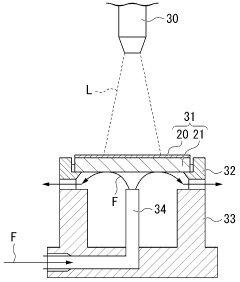

Ceramic thermal sprayed-film coated member, and member for semiconductor manufacturing device

PatentWO2015151573A1

Innovation

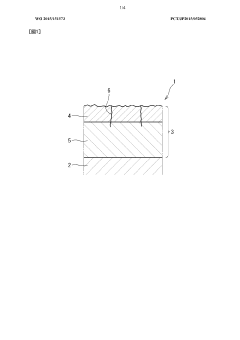

- A ceramic thermal spray coating with a densified surface layer formed by high-energy beam irradiation, accompanied by a crack suppression layer composed of dispersed thermal spray materials, which changes the direction of cracks and prevents their propagation, enhancing corrosion resistance and electrical insulation.

Ceramic thermal spray particles and method for forming thermal barrier coating layer

PatentWO2023248784A1

Innovation

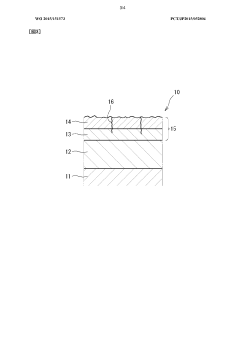

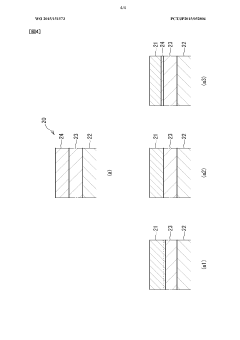

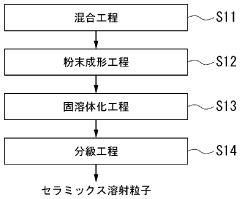

- The method involves forming ceramic spray particles composed of ZrO2 and Yb2O3 with a standard deviation of 2% to 7% by mass, which are then used to create a thermal barrier coating layer with a metal bonding layer, achieving low thermal conductivity and enhanced thermal cycle durability through specific manufacturing processes like plasma spraying.

Environmental Impact and Sustainability Factors

Ceramic thermal spray coatings in energy systems present significant environmental implications that must be considered alongside their technical benefits. The production process of these coatings involves substantial energy consumption, particularly during powder preparation and the high-temperature spraying operations. This energy footprint varies considerably depending on the specific ceramic materials used and the complexity of the coating architecture required for different energy applications.

The raw material extraction for ceramic coatings presents another environmental consideration. Many advanced ceramics require rare earth elements or other minerals whose mining operations can lead to habitat disruption, water pollution, and soil degradation. However, when compared to traditional coating methods that often utilize heavy metals or toxic compounds, ceramic thermal spray coatings generally exhibit lower toxicity profiles and reduced environmental hazards during application.

Lifecycle assessment studies indicate that despite the initial environmental costs, ceramic coatings contribute positively to sustainability through operational efficiency improvements. By enhancing thermal efficiency and extending component lifespans in energy systems, these coatings reduce the overall resource consumption and emissions associated with energy generation. For instance, thermal barrier coatings in gas turbines can improve fuel efficiency by 1-2%, translating to significant carbon emission reductions over the operational lifetime.

Waste management represents a critical sustainability factor in the ceramic coating industry. Overspray material, spent abrasives, and end-of-life coated components require proper disposal or recycling protocols. Recent innovations have focused on developing closed-loop recycling systems for ceramic coating materials, with some manufacturers achieving recovery rates of up to 60% for overspray powders, substantially reducing waste streams.

The durability of ceramic coatings directly impacts their sustainability profile. Modern zirconia-based thermal barrier coatings can extend component lifespans by 2-4 times compared to uncoated parts, reducing the environmental burden associated with manufacturing replacement components. This longevity effect is particularly valuable in renewable energy applications such as concentrated solar power systems, where harsh operating conditions typically accelerate material degradation.

Regulatory frameworks worldwide are increasingly emphasizing environmental performance in industrial coatings. The European Union's REACH regulations and similar initiatives in North America and Asia have prompted coating manufacturers to develop formulations with reduced environmental impact. This regulatory pressure has accelerated research into water-based ceramic slurries and powder formulations with lower volatile organic compound (VOC) emissions during application and curing processes.

The raw material extraction for ceramic coatings presents another environmental consideration. Many advanced ceramics require rare earth elements or other minerals whose mining operations can lead to habitat disruption, water pollution, and soil degradation. However, when compared to traditional coating methods that often utilize heavy metals or toxic compounds, ceramic thermal spray coatings generally exhibit lower toxicity profiles and reduced environmental hazards during application.

Lifecycle assessment studies indicate that despite the initial environmental costs, ceramic coatings contribute positively to sustainability through operational efficiency improvements. By enhancing thermal efficiency and extending component lifespans in energy systems, these coatings reduce the overall resource consumption and emissions associated with energy generation. For instance, thermal barrier coatings in gas turbines can improve fuel efficiency by 1-2%, translating to significant carbon emission reductions over the operational lifetime.

Waste management represents a critical sustainability factor in the ceramic coating industry. Overspray material, spent abrasives, and end-of-life coated components require proper disposal or recycling protocols. Recent innovations have focused on developing closed-loop recycling systems for ceramic coating materials, with some manufacturers achieving recovery rates of up to 60% for overspray powders, substantially reducing waste streams.

The durability of ceramic coatings directly impacts their sustainability profile. Modern zirconia-based thermal barrier coatings can extend component lifespans by 2-4 times compared to uncoated parts, reducing the environmental burden associated with manufacturing replacement components. This longevity effect is particularly valuable in renewable energy applications such as concentrated solar power systems, where harsh operating conditions typically accelerate material degradation.

Regulatory frameworks worldwide are increasingly emphasizing environmental performance in industrial coatings. The European Union's REACH regulations and similar initiatives in North America and Asia have prompted coating manufacturers to develop formulations with reduced environmental impact. This regulatory pressure has accelerated research into water-based ceramic slurries and powder formulations with lower volatile organic compound (VOC) emissions during application and curing processes.

Cost-Benefit Analysis of Ceramic Coating Implementation

The implementation of ceramic thermal spray coatings in energy systems requires careful financial evaluation to justify the initial investment. When conducting a comprehensive cost-benefit analysis, organizations must consider both direct and indirect economic factors across the coating's entire lifecycle.

Initial implementation costs represent a significant investment, including material expenses for high-quality ceramic powders, specialized equipment acquisition, facility modifications, and training for technical personnel. These upfront costs typically range from $50,000 to $300,000 depending on the scale of operations and existing infrastructure. However, these expenses must be weighed against the substantial long-term benefits.

Operational cost reductions constitute the primary financial advantage of ceramic coatings. Energy systems with properly applied ceramic thermal barriers demonstrate 15-25% improved thermal efficiency, translating to proportional fuel savings. Maintenance intervals typically extend by 2-3 times compared to uncoated components, with documented reductions in downtime of approximately 30-40% across various energy applications.

Lifecycle economic analysis reveals that most ceramic coating implementations achieve return on investment within 12-36 months, depending on operating conditions and energy costs. For high-temperature applications such as gas turbines, the payback period can be as short as 8-10 months due to dramatic improvements in component longevity and performance efficiency.

Environmental compliance benefits also contribute significantly to the economic equation. Reduced emissions resulting from improved combustion efficiency and extended equipment life can translate to carbon credit savings or avoidance of regulatory penalties, adding $10,000-$50,000 annually to the benefit column depending on regional regulations.

Risk mitigation represents another economic advantage, though more difficult to quantify. The reduced probability of catastrophic failure in critical components provides insurance-like value, with some organizations reporting 15-20% reductions in risk-related financial provisions after implementing comprehensive ceramic coating programs.

When evaluating total cost of ownership, ceramic coatings typically reduce lifetime costs by 30-45% compared to uncoated alternatives in demanding energy applications. This calculation incorporates all factors including initial investment, operational savings, maintenance reduction, and extended service life.

For optimal economic outcomes, organizations should develop implementation strategies that prioritize high-impact applications first, allowing initial successes to fund broader deployment while refining application techniques and material selections to maximize return on investment.

Initial implementation costs represent a significant investment, including material expenses for high-quality ceramic powders, specialized equipment acquisition, facility modifications, and training for technical personnel. These upfront costs typically range from $50,000 to $300,000 depending on the scale of operations and existing infrastructure. However, these expenses must be weighed against the substantial long-term benefits.

Operational cost reductions constitute the primary financial advantage of ceramic coatings. Energy systems with properly applied ceramic thermal barriers demonstrate 15-25% improved thermal efficiency, translating to proportional fuel savings. Maintenance intervals typically extend by 2-3 times compared to uncoated components, with documented reductions in downtime of approximately 30-40% across various energy applications.

Lifecycle economic analysis reveals that most ceramic coating implementations achieve return on investment within 12-36 months, depending on operating conditions and energy costs. For high-temperature applications such as gas turbines, the payback period can be as short as 8-10 months due to dramatic improvements in component longevity and performance efficiency.

Environmental compliance benefits also contribute significantly to the economic equation. Reduced emissions resulting from improved combustion efficiency and extended equipment life can translate to carbon credit savings or avoidance of regulatory penalties, adding $10,000-$50,000 annually to the benefit column depending on regional regulations.

Risk mitigation represents another economic advantage, though more difficult to quantify. The reduced probability of catastrophic failure in critical components provides insurance-like value, with some organizations reporting 15-20% reductions in risk-related financial provisions after implementing comprehensive ceramic coating programs.

When evaluating total cost of ownership, ceramic coatings typically reduce lifetime costs by 30-45% compared to uncoated alternatives in demanding energy applications. This calculation incorporates all factors including initial investment, operational savings, maintenance reduction, and extended service life.

For optimal economic outcomes, organizations should develop implementation strategies that prioritize high-impact applications first, allowing initial successes to fund broader deployment while refining application techniques and material selections to maximize return on investment.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!