Repair Applications Using Thermal Spray Ceramic Coatings

OCT 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermal Spray Ceramic Coating Evolution and Objectives

Thermal spray ceramic coating technology has evolved significantly over the past century, transforming from rudimentary flame spray methods to sophisticated high-velocity oxygen fuel (HVOF) and plasma spray techniques. The journey began in the early 1900s with Dr. Max Ulrich Schoop's pioneering work on metal spraying, which laid the foundation for thermal spray technology. By the 1950s, plasma spray processes emerged, enabling the application of ceramic materials with higher melting points, thus expanding the potential applications dramatically.

The 1980s witnessed a technological revolution with the development of HVOF systems, which significantly improved coating density and adhesion strength. This advancement was crucial for repair applications, as it allowed for more durable and reliable ceramic coatings. The subsequent decades saw further refinements in spray parameters, powder characteristics, and equipment design, leading to enhanced coating performance and reproducibility.

Recent developments have focused on nanostructured ceramic coatings, which offer superior properties compared to their conventional counterparts. These advancements include improved wear resistance, thermal insulation, and corrosion protection, making them ideal for repair applications in demanding environments. The integration of computational modeling and simulation tools has also accelerated the optimization of spray parameters and coating designs, reducing the empirical trial-and-error approach traditionally employed.

The primary objective of thermal spray ceramic coatings in repair applications is to restore component functionality while extending service life beyond that of the original part. This involves not only replicating the original surface properties but often enhancing them to prevent recurrence of failure. Specific goals include achieving excellent adhesion to the substrate, minimizing residual stresses, and ensuring coating homogeneity across complex geometries.

Another critical objective is to develop cost-effective repair solutions that reduce downtime and replacement costs in industries such as aerospace, power generation, and manufacturing. This economic imperative drives research toward more efficient deposition processes, material utilization, and quality control methods. Additionally, there is a growing emphasis on environmentally sustainable coating solutions that minimize waste and energy consumption during the repair process.

Looking forward, the field aims to advance toward adaptive repair systems that can tailor coating properties to specific damage mechanisms and operating conditions. This includes the development of multi-layer and functionally graded coatings that can address multiple failure modes simultaneously. The integration of in-situ monitoring and real-time control systems represents another frontier, potentially enabling automated repair processes with unprecedented precision and reliability.

The 1980s witnessed a technological revolution with the development of HVOF systems, which significantly improved coating density and adhesion strength. This advancement was crucial for repair applications, as it allowed for more durable and reliable ceramic coatings. The subsequent decades saw further refinements in spray parameters, powder characteristics, and equipment design, leading to enhanced coating performance and reproducibility.

Recent developments have focused on nanostructured ceramic coatings, which offer superior properties compared to their conventional counterparts. These advancements include improved wear resistance, thermal insulation, and corrosion protection, making them ideal for repair applications in demanding environments. The integration of computational modeling and simulation tools has also accelerated the optimization of spray parameters and coating designs, reducing the empirical trial-and-error approach traditionally employed.

The primary objective of thermal spray ceramic coatings in repair applications is to restore component functionality while extending service life beyond that of the original part. This involves not only replicating the original surface properties but often enhancing them to prevent recurrence of failure. Specific goals include achieving excellent adhesion to the substrate, minimizing residual stresses, and ensuring coating homogeneity across complex geometries.

Another critical objective is to develop cost-effective repair solutions that reduce downtime and replacement costs in industries such as aerospace, power generation, and manufacturing. This economic imperative drives research toward more efficient deposition processes, material utilization, and quality control methods. Additionally, there is a growing emphasis on environmentally sustainable coating solutions that minimize waste and energy consumption during the repair process.

Looking forward, the field aims to advance toward adaptive repair systems that can tailor coating properties to specific damage mechanisms and operating conditions. This includes the development of multi-layer and functionally graded coatings that can address multiple failure modes simultaneously. The integration of in-situ monitoring and real-time control systems represents another frontier, potentially enabling automated repair processes with unprecedented precision and reliability.

Market Analysis for Repair-Focused Thermal Spray Applications

The global market for thermal spray ceramic coatings in repair applications has experienced significant growth over the past decade, driven primarily by increasing demand across aerospace, automotive, energy, and manufacturing sectors. Current market valuation stands at approximately 8.2 billion USD, with repair-focused applications representing about 35% of this total. The compound annual growth rate (CAGR) for this segment is projected at 6.7% through 2028, outpacing the broader thermal spray market's growth of 5.3%.

Aerospace remains the dominant end-user segment, accounting for nearly 40% of repair-focused thermal spray ceramic coating applications. This is largely attributed to the critical need for extending component life in high-value aircraft engines and turbine parts, where replacement costs can be prohibitively expensive. The automotive sector follows at 25%, with increasing adoption in repairing engine components, cylinder liners, and transmission parts.

Regional analysis reveals North America currently leads the market with 38% share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is demonstrating the fastest growth trajectory at 8.9% CAGR, driven by rapid industrialization in China and India, alongside expanding aerospace and automotive manufacturing bases.

Customer demand patterns show a clear shift toward cost-effective maintenance solutions that extend component life while reducing downtime. This trend is particularly pronounced in industries with high operational costs, where preventive maintenance using thermal spray ceramic coatings delivers compelling return on investment. Market research indicates that repair applications using these coatings typically reduce component replacement costs by 40-60% while extending service life by 2-3 times.

Competitive landscape analysis identifies three distinct market segments: global industrial conglomerates offering comprehensive coating solutions (35% market share), specialized thermal spray service providers (42% market share), and equipment manufacturers with integrated service offerings (23% market share). The market demonstrates moderate fragmentation, with the top five players controlling approximately 47% of global revenue.

Pricing trends reveal increasing customer willingness to pay premium rates for advanced ceramic coating repairs that deliver documented performance improvements. Average service pricing has increased by 12% over the past three years, reflecting both higher material costs and greater recognition of value proposition. Profit margins in repair-focused applications average 18-22%, significantly higher than the 12-15% seen in new component coating applications.

Future market growth will likely be driven by technological advancements in nano-ceramic formulations, automation of spray processes, and expanded applications in emerging industries such as renewable energy and medical devices. These developments are expected to further strengthen the value proposition of thermal spray ceramic coatings in repair applications.

Aerospace remains the dominant end-user segment, accounting for nearly 40% of repair-focused thermal spray ceramic coating applications. This is largely attributed to the critical need for extending component life in high-value aircraft engines and turbine parts, where replacement costs can be prohibitively expensive. The automotive sector follows at 25%, with increasing adoption in repairing engine components, cylinder liners, and transmission parts.

Regional analysis reveals North America currently leads the market with 38% share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region is demonstrating the fastest growth trajectory at 8.9% CAGR, driven by rapid industrialization in China and India, alongside expanding aerospace and automotive manufacturing bases.

Customer demand patterns show a clear shift toward cost-effective maintenance solutions that extend component life while reducing downtime. This trend is particularly pronounced in industries with high operational costs, where preventive maintenance using thermal spray ceramic coatings delivers compelling return on investment. Market research indicates that repair applications using these coatings typically reduce component replacement costs by 40-60% while extending service life by 2-3 times.

Competitive landscape analysis identifies three distinct market segments: global industrial conglomerates offering comprehensive coating solutions (35% market share), specialized thermal spray service providers (42% market share), and equipment manufacturers with integrated service offerings (23% market share). The market demonstrates moderate fragmentation, with the top five players controlling approximately 47% of global revenue.

Pricing trends reveal increasing customer willingness to pay premium rates for advanced ceramic coating repairs that deliver documented performance improvements. Average service pricing has increased by 12% over the past three years, reflecting both higher material costs and greater recognition of value proposition. Profit margins in repair-focused applications average 18-22%, significantly higher than the 12-15% seen in new component coating applications.

Future market growth will likely be driven by technological advancements in nano-ceramic formulations, automation of spray processes, and expanded applications in emerging industries such as renewable energy and medical devices. These developments are expected to further strengthen the value proposition of thermal spray ceramic coatings in repair applications.

Technical Challenges in Ceramic Coating Repair Technologies

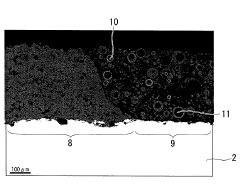

Despite significant advancements in thermal spray ceramic coating technologies, numerous technical challenges persist that limit their widespread application in repair scenarios. The primary challenge lies in achieving optimal adhesion between the ceramic coating and the substrate material. The thermal expansion coefficient mismatch between ceramics and metal substrates creates residual stresses during cooling, often leading to delamination or cracking at the interface. This issue becomes particularly pronounced in repair applications where surface preparation of worn components may be inconsistent or compromised.

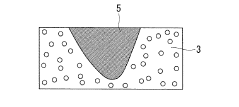

Porosity control represents another significant technical hurdle. While some level of porosity is desirable for thermal barrier applications, excessive or uncontrolled porosity can dramatically reduce coating durability and performance. Current spray technologies struggle to achieve consistent porosity distribution, especially when dealing with complex geometries typical in repair scenarios. The irregular surfaces of components requiring repair further complicate the deposition process, creating variations in coating thickness and quality.

Thermal management during the spraying process presents additional challenges. The high temperatures involved in thermal spraying can cause substrate distortion, particularly in thin-walled components or those with complex geometries. Controlling heat input while maintaining adequate particle melting requires sophisticated parameter control that many repair facilities find difficult to implement consistently.

Material selection and compatibility issues further complicate repair applications. The ceramic coating must be chemically compatible with both the substrate and any remaining original coating material. Interdiffusion between layers can lead to the formation of brittle intermetallic compounds that compromise coating integrity. Additionally, many advanced ceramic formulations require precise control of spray parameters that may be difficult to maintain in field repair environments.

Quality control and inspection of repaired components present significant technical barriers. Non-destructive evaluation techniques for ceramic coatings remain limited in their ability to detect subsurface defects or weak interfacial bonding. This uncertainty increases risk, particularly in critical applications where coating failure could lead to catastrophic consequences.

Environmental factors also pose challenges for ceramic coating repairs. Humidity, temperature variations, and atmospheric contaminants can significantly impact coating quality. Controlling these variables in field repair scenarios is often impractical, leading to inconsistent results and reduced reliability compared to coatings applied in controlled manufacturing environments.

Addressing these technical challenges requires interdisciplinary approaches combining materials science, process engineering, and advanced monitoring technologies. Development of adaptive spray systems capable of real-time parameter adjustment based on substrate conditions represents a promising direction for overcoming many of these limitations.

Porosity control represents another significant technical hurdle. While some level of porosity is desirable for thermal barrier applications, excessive or uncontrolled porosity can dramatically reduce coating durability and performance. Current spray technologies struggle to achieve consistent porosity distribution, especially when dealing with complex geometries typical in repair scenarios. The irregular surfaces of components requiring repair further complicate the deposition process, creating variations in coating thickness and quality.

Thermal management during the spraying process presents additional challenges. The high temperatures involved in thermal spraying can cause substrate distortion, particularly in thin-walled components or those with complex geometries. Controlling heat input while maintaining adequate particle melting requires sophisticated parameter control that many repair facilities find difficult to implement consistently.

Material selection and compatibility issues further complicate repair applications. The ceramic coating must be chemically compatible with both the substrate and any remaining original coating material. Interdiffusion between layers can lead to the formation of brittle intermetallic compounds that compromise coating integrity. Additionally, many advanced ceramic formulations require precise control of spray parameters that may be difficult to maintain in field repair environments.

Quality control and inspection of repaired components present significant technical barriers. Non-destructive evaluation techniques for ceramic coatings remain limited in their ability to detect subsurface defects or weak interfacial bonding. This uncertainty increases risk, particularly in critical applications where coating failure could lead to catastrophic consequences.

Environmental factors also pose challenges for ceramic coating repairs. Humidity, temperature variations, and atmospheric contaminants can significantly impact coating quality. Controlling these variables in field repair scenarios is often impractical, leading to inconsistent results and reduced reliability compared to coatings applied in controlled manufacturing environments.

Addressing these technical challenges requires interdisciplinary approaches combining materials science, process engineering, and advanced monitoring technologies. Development of adaptive spray systems capable of real-time parameter adjustment based on substrate conditions represents a promising direction for overcoming many of these limitations.

Current Ceramic Coating Repair Methodologies

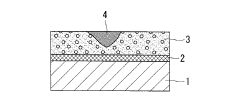

01 Composition of thermal spray ceramic coatings

Thermal spray ceramic coatings can be composed of various materials to achieve specific properties. These compositions typically include ceramic materials such as alumina, zirconia, or titanium oxide, which provide high temperature resistance and wear protection. The composition may also include binding agents or additives that enhance adhesion to the substrate and improve overall coating performance. Different ceramic compositions can be tailored for specific applications requiring thermal insulation, wear resistance, or corrosion protection.- Composition of thermal spray ceramic coatings: Thermal spray ceramic coatings can be composed of various materials to achieve specific properties. These compositions typically include ceramic materials such as alumina, zirconia, or titanium oxide, which provide high temperature resistance and wear protection. The composition may also include binding agents or additives that enhance adhesion to the substrate and improve overall coating performance. The specific formulation depends on the intended application and desired properties such as thermal insulation, wear resistance, or corrosion protection.

- Application methods for thermal spray ceramic coatings: Various application methods can be used for thermal spray ceramic coatings, including plasma spraying, high-velocity oxy-fuel (HVOF) spraying, and flame spraying. These methods involve heating ceramic powder particles to a molten or semi-molten state and propelling them onto a substrate surface. The choice of application method affects coating properties such as density, adhesion strength, and microstructure. Process parameters like spray distance, gas flow rates, and powder feed rates can be optimized to achieve desired coating characteristics.

- Thermal and mechanical properties of ceramic coatings: Thermal spray ceramic coatings offer excellent thermal and mechanical properties, making them suitable for high-temperature applications. These coatings provide thermal insulation, reducing heat transfer to the substrate material. They also exhibit high hardness, wear resistance, and can withstand thermal cycling. The microstructure of the coating, including porosity level and crack distribution, significantly influences these properties. By controlling the spray parameters and post-treatment processes, the thermal and mechanical properties can be tailored for specific applications.

- Surface preparation and post-treatment processes: Proper surface preparation and post-treatment processes are crucial for the performance of thermal spray ceramic coatings. Surface preparation techniques include grit blasting, chemical cleaning, and application of bond coats to enhance adhesion. Post-treatment processes such as sealing, heat treatment, and surface finishing can improve coating properties by reducing porosity, relieving residual stresses, and enhancing surface smoothness. These processes significantly affect the coating's durability, corrosion resistance, and service life in various operating environments.

- Applications and performance in harsh environments: Thermal spray ceramic coatings are widely used in harsh operating environments where materials are exposed to extreme conditions. Applications include gas turbine components, aerospace parts, automotive components, and industrial equipment subjected to high temperatures, corrosive media, or abrasive wear. These coatings provide protection against oxidation, hot corrosion, erosion, and thermal fatigue. The performance of ceramic coatings in such environments depends on factors like coating thickness, composition, microstructure, and the specific environmental conditions they are exposed to.

02 Thermal spray application methods

Various methods can be employed for applying thermal spray ceramic coatings, including plasma spraying, high-velocity oxy-fuel (HVOF), flame spraying, and cold spraying. Each method offers different advantages in terms of coating density, adhesion strength, and microstructure. The selection of the appropriate thermal spray method depends on factors such as the substrate material, desired coating thickness, and intended application environment. These methods involve heating ceramic particles to a molten or semi-molten state and propelling them onto the substrate surface where they solidify to form a coating.Expand Specific Solutions03 Thermal and mechanical properties enhancement

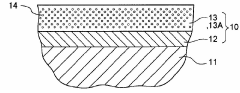

Thermal spray ceramic coatings can be engineered to enhance thermal and mechanical properties of the substrate. These coatings provide thermal barrier effects, reducing heat transfer to the underlying material, which is crucial in high-temperature applications. The coatings can also improve mechanical properties such as wear resistance, erosion resistance, and hardness. By controlling the microstructure, porosity, and thickness of the coating, specific thermal and mechanical properties can be achieved to meet the requirements of various industrial applications.Expand Specific Solutions04 Multi-layer and composite ceramic coatings

Multi-layer and composite ceramic coating systems can be developed using thermal spray techniques to achieve enhanced performance characteristics. These systems typically consist of different ceramic materials or ceramic-metal combinations applied in layers, each serving a specific function. For example, a base layer might provide adhesion to the substrate, while subsequent layers offer thermal insulation, wear resistance, or chemical protection. The combination of different materials in a layered structure allows for the optimization of multiple properties simultaneously, resulting in superior overall performance compared to single-layer coatings.Expand Specific Solutions05 Surface preparation and post-treatment processes

Proper surface preparation and post-treatment processes are essential for ensuring the quality and durability of thermal spray ceramic coatings. Surface preparation techniques include grit blasting, chemical cleaning, and pre-heating to enhance coating adhesion. Post-treatment processes such as sealing, heat treatment, and surface finishing can improve coating properties by reducing porosity, enhancing cohesion, and modifying surface characteristics. These processes significantly influence the coating's performance in terms of adhesion strength, wear resistance, and service life in various operating environments.Expand Specific Solutions

Leading Companies in Thermal Spray Ceramic Coating Industry

The thermal spray ceramic coatings repair market is currently in a growth phase, with increasing adoption across aerospace, automotive, and industrial sectors. The global market size is estimated to be expanding at a CAGR of 6-8%, driven by demand for extended component lifecycles and reduced maintenance costs. Technology maturity varies across applications, with companies like Praxair Technology (Linde) and TOCALO leading innovation in high-performance coatings. Major industrial players including MTU Aero Engines, Caterpillar, and Airbus are implementing these solutions, while specialized coating providers such as Seram Coatings and Fujimi are developing advanced formulations. Academic institutions like Wuhan University of Technology and Harbin Institute of Technology are contributing significant research to advance ceramic coating performance and application methods.

Praxair S.T. Technology, Inc.

Technical Solution: Praxair S.T. Technology has developed advanced thermal spray ceramic coating systems specifically designed for repair applications. Their HVOF (High Velocity Oxy-Fuel) and plasma spray technologies enable the application of ceramic coatings with exceptional bond strength and low porosity. Their proprietary ceramic powder formulations include yttria-stabilized zirconia (YSZ), alumina, and chromia-based materials engineered for specific repair scenarios. The company's DuraCoat™ process combines optimized spray parameters with specialized surface preparation techniques to achieve coating adhesion strengths exceeding 10,000 psi in many applications[1]. Their thermal spray systems incorporate real-time monitoring capabilities that adjust spray parameters based on substrate temperature and coating thickness to ensure consistent quality across complex geometries[3].

Strengths: Superior bond strength and wear resistance compared to conventional coatings; highly customizable material compositions for specific repair environments; excellent thermal barrier properties. Weaknesses: Higher initial equipment investment; requires specialized operator training; some limitations in repairing highly intricate geometries.

TOCALO Co., Ltd.

Technical Solution: TOCALO has pioneered ceramic coating repair technologies through their advanced thermal spray systems. Their proprietary CeraTough™ process utilizes a combination of atmospheric plasma spraying (APS) and suspension plasma spraying (SPS) to create multi-layered ceramic coatings with exceptional adhesion and durability. The company has developed specialized alumina-titania and zirconia-based ceramic formulations that can be applied at lower temperatures (reducing thermal stress on substrates) while maintaining excellent mechanical properties. TOCALO's repair systems incorporate precision robotic application technology that can restore worn components to within ±0.05mm of original specifications[2]. Their ceramic coatings demonstrate exceptional corrosion resistance in aggressive environments, with documented service life extensions of 200-300% for industrial components in chemical processing applications[4].

Strengths: Exceptional precision in dimensional restoration; superior corrosion resistance in aggressive chemical environments; advanced robotic application systems for consistent quality. Weaknesses: Higher cost compared to conventional repair methods; limited application for components requiring high electrical conductivity; requires specialized equipment.

Key Patents and Innovations in Thermal Spray Repair Technology

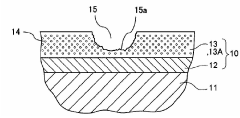

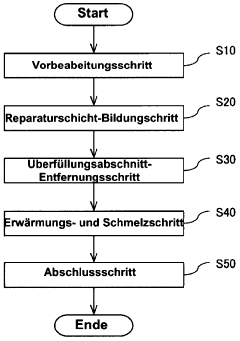

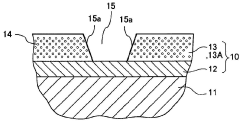

Method for repairing thermal barrier coating

PatentActiveJP2012180550A

Innovation

- A method involving the application of a paste material containing a resin that decomposes and vaporizes during heat treatment, forming a repair film with pores to enhance heat shielding properties and thermal cycle durability, and using thermally sprayed ceramic powder to match the appearance of the undamaged portion.

PROCEDURE FOR REPAIRING A CERAMIC COATING, CERAMIC COATING, TURBINE ELEMENT AND GAS TURBINE

PatentInactiveDE102019001482A1

Innovation

- A method involving the formation of a second ceramic layer by thermally spraying ceramic spray particles onto a repair area, followed by heating and melting the interface between the first and second ceramic layers to improve adhesiveness, while maintaining thermal shock resistance, thermal conductivity, and wear resistance.

Sustainability Aspects of Thermal Spray Ceramic Repair Solutions

Thermal spray ceramic coating repair technologies offer significant sustainability advantages that align with modern environmental and economic priorities. These solutions substantially extend component lifespans, reducing the frequency of replacement and consequently decreasing raw material consumption and manufacturing energy requirements. The repair-versus-replace approach can reduce carbon footprints by up to 80% for certain industrial components, representing a substantial contribution to emission reduction targets across sectors.

From a resource efficiency perspective, thermal spray ceramic repairs typically utilize only 10-15% of the material required for complete component replacement. This material efficiency translates directly to conservation of finite mineral resources, particularly critical materials like chromium, nickel, and rare earth elements that face supply constraints. Additionally, the localized nature of thermal spray processes minimizes waste generation compared to traditional manufacturing methods.

Energy consumption analysis reveals that thermal spray repair processes generally require 30-60% less energy than manufacturing new components, depending on component complexity and size. When combined with the emerging integration of renewable energy sources to power thermal spray equipment, the overall environmental impact continues to decrease. Several leading manufacturers have reported energy savings of 40-50% through implementation of systematic repair programs utilizing ceramic thermal spray technologies.

The circular economy benefits are particularly noteworthy, as thermal spray repairs create closed-loop material cycles where components undergo multiple repair-reuse cycles before eventual recycling. This approach has been documented to extend component lifecycles by 200-300% in demanding applications such as aerospace turbines and industrial processing equipment, significantly improving resource utilization efficiency.

Water conservation represents another sustainability advantage, as thermal spray repair processes typically consume 70-85% less water than conventional manufacturing. This aspect becomes increasingly important in water-stressed regions where industrial operations face growing constraints on water usage.

Economic sustainability metrics also favor thermal spray ceramic repairs, with cost analyses demonstrating 40-70% savings compared to component replacement, depending on the application. These savings enable organizations to allocate resources to other sustainability initiatives while maintaining operational excellence.

Looking forward, ongoing research focuses on developing bio-based binder systems, reducing harmful emissions during application, and improving energy efficiency of thermal spray equipment. These advancements promise to further enhance the sustainability profile of thermal spray ceramic coating repair technologies in the coming decade.

From a resource efficiency perspective, thermal spray ceramic repairs typically utilize only 10-15% of the material required for complete component replacement. This material efficiency translates directly to conservation of finite mineral resources, particularly critical materials like chromium, nickel, and rare earth elements that face supply constraints. Additionally, the localized nature of thermal spray processes minimizes waste generation compared to traditional manufacturing methods.

Energy consumption analysis reveals that thermal spray repair processes generally require 30-60% less energy than manufacturing new components, depending on component complexity and size. When combined with the emerging integration of renewable energy sources to power thermal spray equipment, the overall environmental impact continues to decrease. Several leading manufacturers have reported energy savings of 40-50% through implementation of systematic repair programs utilizing ceramic thermal spray technologies.

The circular economy benefits are particularly noteworthy, as thermal spray repairs create closed-loop material cycles where components undergo multiple repair-reuse cycles before eventual recycling. This approach has been documented to extend component lifecycles by 200-300% in demanding applications such as aerospace turbines and industrial processing equipment, significantly improving resource utilization efficiency.

Water conservation represents another sustainability advantage, as thermal spray repair processes typically consume 70-85% less water than conventional manufacturing. This aspect becomes increasingly important in water-stressed regions where industrial operations face growing constraints on water usage.

Economic sustainability metrics also favor thermal spray ceramic repairs, with cost analyses demonstrating 40-70% savings compared to component replacement, depending on the application. These savings enable organizations to allocate resources to other sustainability initiatives while maintaining operational excellence.

Looking forward, ongoing research focuses on developing bio-based binder systems, reducing harmful emissions during application, and improving energy efficiency of thermal spray equipment. These advancements promise to further enhance the sustainability profile of thermal spray ceramic coating repair technologies in the coming decade.

Cost-Benefit Analysis of Ceramic Coating Repair vs. Replacement

When evaluating thermal spray ceramic coating repair versus component replacement, a comprehensive cost-benefit analysis reveals significant economic advantages for repair strategies. Initial investment for ceramic coating repair typically ranges from 30-60% of replacement costs, depending on component complexity and damage extent. This substantial upfront saving is particularly evident in high-value components such as turbine blades, industrial rollers, and specialized manufacturing equipment.

Operational downtime represents another critical cost factor. Replacement often requires 3-5 times longer equipment downtime compared to on-site coating repair, translating to considerable production loss savings. For instance, in power generation facilities, each day of unplanned downtime can cost $50,000-$200,000 in lost revenue, making rapid repair solutions economically attractive.

Long-term durability metrics further strengthen the repair case. Modern ceramic coatings demonstrate service life extensions of 1.5-3 times compared to uncoated components, with some advanced formulations achieving up to 5-fold improvements in harsh environments. This extended service interval creates compounding cost benefits over multiple maintenance cycles.

Environmental impact assessments reveal that ceramic coating repair typically generates 70-85% less carbon footprint compared to manufacturing new components. This environmental advantage increasingly translates to tangible financial benefits through carbon credits, regulatory compliance, and corporate sustainability initiatives that enhance market positioning.

Resource utilization efficiency shows coating repair consumes significantly fewer raw materials—approximately 5-15% of what complete replacement requires. This resource conservation becomes particularly valuable for components containing rare earth elements or strategic materials subject to supply chain vulnerabilities and price volatility.

Return on investment calculations demonstrate that ceramic coating repair typically achieves breakeven within 1-3 maintenance cycles, with subsequent cycles delivering pure cost advantage. This ROI improves further when factoring in the coating's performance-enhancing properties that may reduce energy consumption or increase operational efficiency.

Risk assessment models indicate that while coating repair carries some technical uncertainty regarding bond strength and service life prediction, these risks are quantifiably lower than supply chain disruptions and lead time uncertainties associated with replacement strategies, particularly for specialized or legacy equipment components.

Operational downtime represents another critical cost factor. Replacement often requires 3-5 times longer equipment downtime compared to on-site coating repair, translating to considerable production loss savings. For instance, in power generation facilities, each day of unplanned downtime can cost $50,000-$200,000 in lost revenue, making rapid repair solutions economically attractive.

Long-term durability metrics further strengthen the repair case. Modern ceramic coatings demonstrate service life extensions of 1.5-3 times compared to uncoated components, with some advanced formulations achieving up to 5-fold improvements in harsh environments. This extended service interval creates compounding cost benefits over multiple maintenance cycles.

Environmental impact assessments reveal that ceramic coating repair typically generates 70-85% less carbon footprint compared to manufacturing new components. This environmental advantage increasingly translates to tangible financial benefits through carbon credits, regulatory compliance, and corporate sustainability initiatives that enhance market positioning.

Resource utilization efficiency shows coating repair consumes significantly fewer raw materials—approximately 5-15% of what complete replacement requires. This resource conservation becomes particularly valuable for components containing rare earth elements or strategic materials subject to supply chain vulnerabilities and price volatility.

Return on investment calculations demonstrate that ceramic coating repair typically achieves breakeven within 1-3 maintenance cycles, with subsequent cycles delivering pure cost advantage. This ROI improves further when factoring in the coating's performance-enhancing properties that may reduce energy consumption or increase operational efficiency.

Risk assessment models indicate that while coating repair carries some technical uncertainty regarding bond strength and service life prediction, these risks are quantifiably lower than supply chain disruptions and lead time uncertainties associated with replacement strategies, particularly for specialized or legacy equipment components.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!