Comparing Handheld vs Automated Laser Welding: Efficiency Gains

SEP 16, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Laser Welding Technology Evolution and Objectives

Laser welding technology has evolved significantly since its inception in the 1960s, transforming from a niche industrial process to a mainstream manufacturing technique. The journey began with basic CO2 lasers offering limited power and precision, progressing through Nd:YAG systems in the 1980s, to today's advanced fiber and diode lasers that deliver unprecedented power efficiency and beam quality. This evolution has been driven by the manufacturing industry's constant pursuit of higher precision, greater speed, and improved energy efficiency in joining processes.

The dichotomy between handheld and automated laser welding represents a critical inflection point in this technological progression. Handheld laser welding systems emerged as a flexible solution for small-scale operations and repair work, offering mobility and adaptability for complex geometries. Meanwhile, automated systems developed along a parallel track, focusing on repeatability, precision, and integration with production lines for high-volume manufacturing environments.

Current technological objectives in the laser welding domain center on optimizing the efficiency differential between these two approaches. Key goals include reducing the setup time for automated systems to match the deployment speed of handheld devices, enhancing the precision capabilities of handheld units to narrow the quality gap with automated solutions, and developing hybrid systems that combine the strengths of both methodologies.

Industry benchmarks indicate that automated laser welding typically achieves 300-500% higher throughput compared to handheld operations in standardized applications, yet this advantage diminishes significantly when considering changeover times and programming requirements. The technological roadmap aims to address this efficiency paradox through innovations in real-time adaptive control systems, simplified programming interfaces, and modular automation platforms.

From a global perspective, laser welding technology development has followed distinct regional patterns, with German and Japanese manufacturers historically leading in high-precision automated systems, while North American companies have pioneered more flexible, user-friendly handheld solutions. Recent years have seen significant contributions from Chinese manufacturers focusing on cost-effective implementations that bridge the gap between manual and automated approaches.

The overarching objective of current research and development efforts is to create a new generation of laser welding systems that deliver the productivity benefits of automation while maintaining the flexibility and accessibility of handheld operations. This convergence represents the next frontier in welding technology, promising to democratize access to high-efficiency joining processes across diverse manufacturing contexts, from large-scale industrial production to small specialty fabrication shops.

The dichotomy between handheld and automated laser welding represents a critical inflection point in this technological progression. Handheld laser welding systems emerged as a flexible solution for small-scale operations and repair work, offering mobility and adaptability for complex geometries. Meanwhile, automated systems developed along a parallel track, focusing on repeatability, precision, and integration with production lines for high-volume manufacturing environments.

Current technological objectives in the laser welding domain center on optimizing the efficiency differential between these two approaches. Key goals include reducing the setup time for automated systems to match the deployment speed of handheld devices, enhancing the precision capabilities of handheld units to narrow the quality gap with automated solutions, and developing hybrid systems that combine the strengths of both methodologies.

Industry benchmarks indicate that automated laser welding typically achieves 300-500% higher throughput compared to handheld operations in standardized applications, yet this advantage diminishes significantly when considering changeover times and programming requirements. The technological roadmap aims to address this efficiency paradox through innovations in real-time adaptive control systems, simplified programming interfaces, and modular automation platforms.

From a global perspective, laser welding technology development has followed distinct regional patterns, with German and Japanese manufacturers historically leading in high-precision automated systems, while North American companies have pioneered more flexible, user-friendly handheld solutions. Recent years have seen significant contributions from Chinese manufacturers focusing on cost-effective implementations that bridge the gap between manual and automated approaches.

The overarching objective of current research and development efforts is to create a new generation of laser welding systems that deliver the productivity benefits of automation while maintaining the flexibility and accessibility of handheld operations. This convergence represents the next frontier in welding technology, promising to democratize access to high-efficiency joining processes across diverse manufacturing contexts, from large-scale industrial production to small specialty fabrication shops.

Market Demand Analysis for Advanced Welding Solutions

The global welding equipment market is experiencing significant growth, with laser welding technologies at the forefront of this expansion. Current market analysis indicates that the advanced welding solutions sector is projected to reach $25 billion by 2027, with laser welding representing one of the fastest-growing segments at a compound annual growth rate of 5.8%. This growth is primarily driven by increasing demands for precision, efficiency, and automation across manufacturing industries.

The automotive industry remains the largest consumer of advanced welding solutions, accounting for approximately 30% of market demand. The shift toward electric vehicles has intensified this demand, as EV production requires up to 40% more welding operations compared to traditional vehicles, particularly for battery enclosures and lightweight structural components. Aerospace, electronics, and medical device manufacturing collectively represent another 35% of the market, with each sector requiring increasingly precise welding capabilities.

Market research indicates a clear trend toward automation, with 68% of manufacturing facilities planning to increase their investment in automated welding systems within the next three years. This shift is particularly evident in regions with high labor costs, where the return on investment for automated laser welding systems can be achieved within 18-24 months despite the higher initial capital expenditure.

The comparison between handheld and automated laser welding solutions reveals divergent market segments. Small to medium enterprises (SMEs) continue to drive demand for advanced handheld laser welding systems, valuing their flexibility and lower initial investment. These businesses typically seek solutions that offer improved precision over traditional methods while maintaining operational adaptability for varied production runs.

Large-scale manufacturers, conversely, are increasingly migrating toward fully automated laser welding systems, prioritizing throughput consistency, reduced labor dependency, and integration with Industry 4.0 frameworks. Market surveys indicate that 72% of large manufacturers cite labor shortages as a primary motivation for adopting automated welding solutions, while 65% identify quality consistency as their foremost concern.

Regional analysis shows Asia-Pacific as the fastest-growing market for advanced welding solutions, with China and India leading adoption rates. North America and Europe maintain significant market shares, with particular emphasis on high-precision automated systems for specialized industries. The demand differential between regions correlates strongly with labor cost variations, manufacturing sophistication, and industry concentration.

Customer requirements are evolving beyond the traditional metrics of weld quality and speed. Modern buyers increasingly prioritize energy efficiency (with 45% citing sustainability goals as purchase factors), system integration capabilities, and predictive maintenance features that minimize downtime. This evolution in demand is reshaping product development roadmaps across the industry.

The automotive industry remains the largest consumer of advanced welding solutions, accounting for approximately 30% of market demand. The shift toward electric vehicles has intensified this demand, as EV production requires up to 40% more welding operations compared to traditional vehicles, particularly for battery enclosures and lightweight structural components. Aerospace, electronics, and medical device manufacturing collectively represent another 35% of the market, with each sector requiring increasingly precise welding capabilities.

Market research indicates a clear trend toward automation, with 68% of manufacturing facilities planning to increase their investment in automated welding systems within the next three years. This shift is particularly evident in regions with high labor costs, where the return on investment for automated laser welding systems can be achieved within 18-24 months despite the higher initial capital expenditure.

The comparison between handheld and automated laser welding solutions reveals divergent market segments. Small to medium enterprises (SMEs) continue to drive demand for advanced handheld laser welding systems, valuing their flexibility and lower initial investment. These businesses typically seek solutions that offer improved precision over traditional methods while maintaining operational adaptability for varied production runs.

Large-scale manufacturers, conversely, are increasingly migrating toward fully automated laser welding systems, prioritizing throughput consistency, reduced labor dependency, and integration with Industry 4.0 frameworks. Market surveys indicate that 72% of large manufacturers cite labor shortages as a primary motivation for adopting automated welding solutions, while 65% identify quality consistency as their foremost concern.

Regional analysis shows Asia-Pacific as the fastest-growing market for advanced welding solutions, with China and India leading adoption rates. North America and Europe maintain significant market shares, with particular emphasis on high-precision automated systems for specialized industries. The demand differential between regions correlates strongly with labor cost variations, manufacturing sophistication, and industry concentration.

Customer requirements are evolving beyond the traditional metrics of weld quality and speed. Modern buyers increasingly prioritize energy efficiency (with 45% citing sustainability goals as purchase factors), system integration capabilities, and predictive maintenance features that minimize downtime. This evolution in demand is reshaping product development roadmaps across the industry.

Current State and Challenges in Laser Welding Technologies

Laser welding technology has evolved significantly over the past decades, with two primary methodologies emerging as industry standards: handheld and automated systems. Currently, handheld laser welding represents approximately 30% of the global laser welding market, while automated systems dominate with a 70% share. This distribution varies significantly across regions, with higher adoption rates of automated systems in developed industrial economies such as Germany, Japan, and the United States, where manufacturing infrastructure supports larger capital investments.

The global laser welding equipment market reached approximately $2.1 billion in 2022 and is projected to grow at a CAGR of 5.8% through 2028. This growth is driven by increasing demand for precision welding in automotive, electronics, medical device manufacturing, and aerospace industries. However, significant technological challenges persist in both handheld and automated systems.

Handheld laser welding systems face limitations in consistency and repeatability, with weld quality heavily dependent on operator skill. These systems typically operate at lower power levels (100-1000W) for safety reasons, restricting their application to thinner materials. Heat management remains problematic, with operators reporting fatigue during extended use due to equipment weight (typically 3-8kg) and heat generation.

Automated laser welding systems, while offering superior precision and consistency, present challenges in flexibility and initial investment costs. Current automated systems require complex programming and setup procedures, with average setup times ranging from 2-8 hours depending on application complexity. The high capital expenditure (typically $150,000-$500,000) creates significant barriers to entry for small and medium enterprises.

Both technologies face common challenges in welding reflective materials such as aluminum and copper, which are increasingly important in electric vehicle battery production. Current solutions involve using specific wavelengths (typically 1064nm for aluminum) and beam manipulation techniques, but efficiency losses of 20-30% are common when working with these materials.

Energy efficiency remains a concern across all laser welding platforms, with typical wall-plug efficiency ranging from 20-40%. This represents a significant opportunity for improvement, particularly as manufacturing sustainability becomes increasingly important. Additionally, real-time quality monitoring systems remain limited in their ability to detect subsurface defects, with current technologies achieving only 85-90% detection rates for critical weld flaws.

The geographical distribution of laser welding technology development shows concentration in Germany, the United States, Japan, and increasingly China, which has seen a 200% increase in laser welding patent applications over the past five years. This global distribution creates both competitive pressure and opportunities for technological cross-pollination as solutions are developed for diverse manufacturing environments.

The global laser welding equipment market reached approximately $2.1 billion in 2022 and is projected to grow at a CAGR of 5.8% through 2028. This growth is driven by increasing demand for precision welding in automotive, electronics, medical device manufacturing, and aerospace industries. However, significant technological challenges persist in both handheld and automated systems.

Handheld laser welding systems face limitations in consistency and repeatability, with weld quality heavily dependent on operator skill. These systems typically operate at lower power levels (100-1000W) for safety reasons, restricting their application to thinner materials. Heat management remains problematic, with operators reporting fatigue during extended use due to equipment weight (typically 3-8kg) and heat generation.

Automated laser welding systems, while offering superior precision and consistency, present challenges in flexibility and initial investment costs. Current automated systems require complex programming and setup procedures, with average setup times ranging from 2-8 hours depending on application complexity. The high capital expenditure (typically $150,000-$500,000) creates significant barriers to entry for small and medium enterprises.

Both technologies face common challenges in welding reflective materials such as aluminum and copper, which are increasingly important in electric vehicle battery production. Current solutions involve using specific wavelengths (typically 1064nm for aluminum) and beam manipulation techniques, but efficiency losses of 20-30% are common when working with these materials.

Energy efficiency remains a concern across all laser welding platforms, with typical wall-plug efficiency ranging from 20-40%. This represents a significant opportunity for improvement, particularly as manufacturing sustainability becomes increasingly important. Additionally, real-time quality monitoring systems remain limited in their ability to detect subsurface defects, with current technologies achieving only 85-90% detection rates for critical weld flaws.

The geographical distribution of laser welding technology development shows concentration in Germany, the United States, Japan, and increasingly China, which has seen a 200% increase in laser welding patent applications over the past five years. This global distribution creates both competitive pressure and opportunities for technological cross-pollination as solutions are developed for diverse manufacturing environments.

Comparative Analysis of Handheld vs Automated Welding Solutions

01 Efficiency comparison between handheld and automated laser welding systems

Automated laser welding systems generally offer higher efficiency compared to handheld systems in terms of precision, consistency, and production rate. Automated systems can maintain consistent welding parameters and follow programmed paths with high accuracy, resulting in uniform welds. However, handheld laser welders provide flexibility for complex geometries, hard-to-reach areas, and rapid deployment for repairs where setting up automated systems would be impractical.- Handheld laser welding efficiency features: Handheld laser welding systems offer flexibility and portability for various welding applications. These systems typically feature ergonomic designs to reduce operator fatigue, adjustable parameters for different materials, and integrated cooling systems. While they may have lower throughput compared to automated systems, they excel in applications requiring human judgment and adaptability, particularly for complex geometries or hard-to-reach areas. Recent innovations have improved power efficiency and beam quality in portable units.

- Automated laser welding system advantages: Automated laser welding systems provide superior precision, consistency, and higher production rates compared to handheld alternatives. These systems incorporate robotic arms, CNC controls, and advanced motion systems to ensure repeatable weld quality. They excel in high-volume manufacturing environments where consistent weld parameters are critical. Automated systems can maintain optimal focus distance and travel speed throughout the welding process, resulting in higher efficiency and reduced defect rates, though they require significant initial investment and programming expertise.

- Hybrid and adaptive laser welding solutions: Hybrid laser welding solutions combine elements of both handheld and automated systems to maximize efficiency across different applications. These systems may feature semi-automated guidance with manual positioning capabilities, collaborative robots that work alongside human operators, or modular designs that can be reconfigured between handheld and fixed operations. Adaptive control systems can automatically adjust welding parameters based on real-time feedback, optimizing efficiency regardless of the delivery method while maintaining quality standards across varying material thicknesses and joint configurations.

- Energy efficiency and power optimization: Energy efficiency comparisons between handheld and automated laser welding systems reveal distinct advantages for each approach. Automated systems typically achieve higher energy efficiency through precise power control, optimized beam delivery, and minimal idle time. Handheld systems have made significant advances in battery technology and power management to improve operational duration. Both system types benefit from innovations in laser source efficiency, with newer designs incorporating pulse shaping, beam mode optimization, and intelligent power management to reduce energy consumption while maintaining weld quality.

- Quality monitoring and process control comparison: The efficiency gap between handheld and automated laser welding is significantly influenced by their respective quality monitoring and process control capabilities. Automated systems typically incorporate comprehensive sensor arrays for real-time monitoring of weld parameters, thermal profiles, and defect detection, enabling closed-loop control for consistent quality. Advanced handheld systems are increasingly equipped with simplified monitoring tools, visual guidance systems, and parameter presets to help operators achieve better results. The integration of artificial intelligence and machine learning algorithms is improving efficiency in both system types by optimizing parameters and predicting maintenance needs.

02 Design innovations in handheld laser welding devices

Recent innovations in handheld laser welding devices focus on improving operator comfort, reducing weight, enhancing maneuverability, and incorporating smart features. These designs include ergonomic handles, balanced weight distribution, integrated cooling systems, and adjustable parameters through user-friendly interfaces. Some handheld devices now feature real-time feedback systems that help operators maintain optimal welding distance and angle, significantly improving weld quality and efficiency in manual operations.Expand Specific Solutions03 Automation advancements for improved laser welding efficiency

Advanced automation technologies have significantly enhanced laser welding efficiency through robotic integration, machine learning algorithms, and vision systems. These systems can automatically adjust welding parameters based on material properties, joint configurations, and real-time feedback. Automated path planning, seam tracking, and quality monitoring systems reduce setup time, minimize errors, and ensure consistent weld quality across large production runs, resulting in higher throughput and reduced material waste compared to manual operations.Expand Specific Solutions04 Hybrid solutions combining manual and automated laser welding capabilities

Hybrid laser welding systems combine the advantages of both handheld and automated approaches to maximize operational flexibility and efficiency. These systems typically feature semi-automated components that assist manual operators, such as guided positioning systems, automated parameter adjustment, and collaborative robots. This hybrid approach is particularly valuable for small to medium batch production, complex assemblies requiring both precision automation and human judgment, or manufacturing environments that need to frequently switch between different product types.Expand Specific Solutions05 Energy efficiency and power optimization in laser welding systems

Energy efficiency considerations differ significantly between handheld and automated laser welding systems. Automated systems can optimize power consumption through precise control of laser output, duty cycles, and auxiliary systems. Advanced power management features in newer systems include intelligent standby modes, energy recovery systems, and optimized beam delivery. Handheld systems typically prioritize battery life and power-to-weight ratio, with innovations focusing on efficient cooling systems and pulse optimization to maximize operational time while maintaining weld quality.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The laser welding technology market is currently in a growth phase, with automated solutions gaining significant traction over handheld systems due to superior efficiency and precision. The global laser welding market is expanding rapidly, projected to reach approximately $3 billion by 2026. Leading players include established industrial giants like IPG Photonics, TRUMPF, and Illinois Tool Works, alongside specialized manufacturers such as Maxphotonics and Han's Laser. Major automotive corporations including Volkswagen, Honda, and Hyundai are driving adoption through implementation in manufacturing processes. Technology maturity varies significantly between handheld systems (well-established) and automated solutions (rapidly evolving with AI integration and robotics), with research institutions like Fraunhofer-Gesellschaft and KAIST pushing boundaries in laser welding automation, particularly for complex materials and geometries.

Maxphotonics Co., Ltd.

Technical Solution: Maxphotonics specializes in fiber laser technology for automated welding applications, with particular focus on the electronics and precision components industries. Their MFSC series welding systems integrate compact fiber lasers (200W-4kW) with high-precision galvanometer scanning heads, achieving positioning speeds up to 10m/s with accuracy of ±0.01mm. Maxphotonics' automated solutions feature proprietary pulse shaping technology that enables precise control of energy delivery, critical for welding heat-sensitive components. Their systems incorporate closed-loop power control that maintains consistent output despite temperature variations, ensuring weld quality in continuous production environments. Maxphotonics has developed specialized automated micro-welding solutions for battery manufacturing, achieving weld speeds of up to 2000 spots per minute with their galvo-based systems, representing a 500% efficiency improvement over manual processes.

Strengths: Excellent price-performance ratio in the mid-power range; compact system footprint suitable for space-constrained manufacturing; specialized expertise in micro-welding applications. Weaknesses: Limited power range compared to industry leaders; less extensive application development resources; smaller global service network potentially affecting response times.

IPG Photonics Corp.

Technical Solution: IPG Photonics has pioneered high-power fiber laser technology for automated welding applications, offering systems with power outputs ranging from 1kW to 100kW. Their YLS series fiber lasers deliver beam quality with M² values below 1.1, enabling precise focusing for both thin and thick material welding. IPG's automated systems incorporate wobble welding technology that oscillates the beam in controlled patterns, improving gap bridging capability by up to 30% compared to static beams. Their systems feature integrated process heads with real-time power control that adjusts laser output based on material feedback, maintaining consistent penetration depths even with varying material thicknesses. IPG's automated solutions also include multi-axis robotic integration with proprietary beam delivery fibers that maintain beam quality over distances up to 100 meters, allowing for flexible factory floor layouts.

Strengths: Industry-leading beam quality (M² < 1.1) enabling precise energy delivery; exceptional wall-plug efficiency of >45% reducing operational costs; modular design allowing for system upgrades without complete replacement. Weaknesses: Higher maintenance requirements for cooling systems in high-power applications; beam delivery fibers require careful handling and periodic replacement; system complexity requires specialized technical support.

Technical Innovations Driving Efficiency Improvements

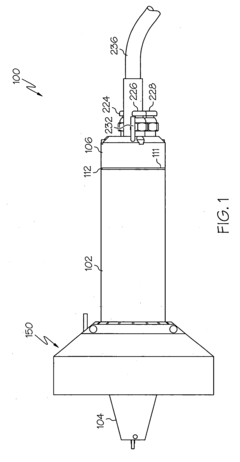

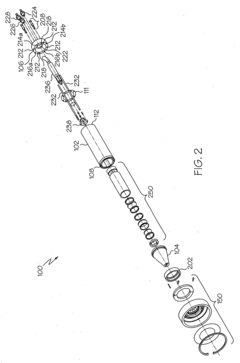

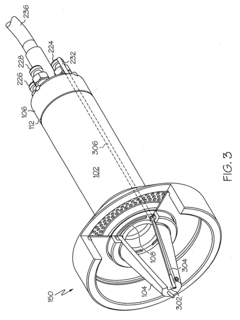

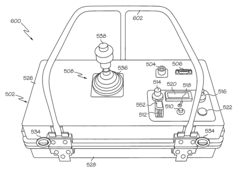

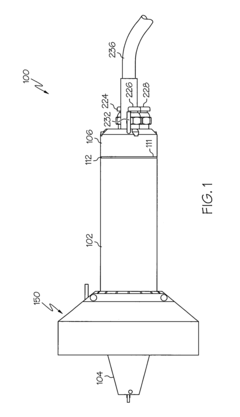

Mobile hand-held laser welding support system

PatentInactiveUS20090139967A1

Innovation

- A mobile support system comprising a movable cart with integrated laser, coolant, and filler medium supply sources, allowing the hand-held laser welding wand to be used independently and manually in remote environments.

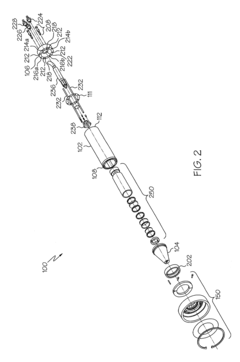

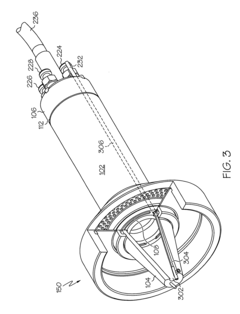

Hand-held laser welder remote control console

PatentInactiveUS6992263B1

Innovation

- A portable hand-held laser welding wand with a control console that includes a housing, electrical interconnects, and a joystick for independent and simultaneous control of filler media supply and laser emission, allowing for easier manipulation and operation in remote locations.

ROI Assessment and Implementation Considerations

When evaluating the transition from handheld to automated laser welding systems, a comprehensive ROI assessment is essential for making informed implementation decisions. Initial investment in automated laser welding equipment typically ranges from $150,000 to $500,000, depending on system complexity, while handheld systems generally cost between $30,000 and $80,000. This significant capital difference necessitates careful financial analysis.

The ROI calculation must consider productivity improvements, which typically show a 200-300% increase with automated systems. Labor costs decrease substantially as automated systems can operate continuously with minimal operator intervention, reducing direct labor costs by 40-60% compared to handheld operations. Quality improvements also contribute to ROI through reduced rework rates—automated systems typically achieve defect rates below 1%, compared to 3-7% with handheld welding.

Energy efficiency represents another cost advantage, with automated laser welding consuming approximately 30% less energy per weld than handheld alternatives. Maintenance costs, while initially higher for automated systems, typically stabilize at 3-5% of the equipment value annually, compared to 7-10% for intensively used handheld equipment.

Implementation considerations extend beyond financial metrics. Facility requirements must address adequate space (typically 200-400 square feet for automated cells), proper ventilation systems, and stable power supply. Training requirements differ significantly—automated system operators require specialized programming and maintenance training (40-80 hours), while handheld operators need extensive welding technique training (100+ hours).

Production volume thresholds represent a critical decision point. Automated systems become financially viable at approximately 5,000-10,000 parts annually, depending on complexity. Below this threshold, handheld systems may offer better economics despite lower efficiency. Part consistency is equally important—automated systems excel with standardized components but require expensive retooling for varied production.

Integration with existing manufacturing processes presents additional challenges. Implementation timelines typically range from 3-6 months for automated systems versus 2-4 weeks for handheld equipment. This difference impacts production scheduling and requires careful planning to minimize disruption. Finally, scalability considerations should address future production needs, as automated systems offer more straightforward capacity expansion through additional shifts or minimal equipment modifications.

The ROI calculation must consider productivity improvements, which typically show a 200-300% increase with automated systems. Labor costs decrease substantially as automated systems can operate continuously with minimal operator intervention, reducing direct labor costs by 40-60% compared to handheld operations. Quality improvements also contribute to ROI through reduced rework rates—automated systems typically achieve defect rates below 1%, compared to 3-7% with handheld welding.

Energy efficiency represents another cost advantage, with automated laser welding consuming approximately 30% less energy per weld than handheld alternatives. Maintenance costs, while initially higher for automated systems, typically stabilize at 3-5% of the equipment value annually, compared to 7-10% for intensively used handheld equipment.

Implementation considerations extend beyond financial metrics. Facility requirements must address adequate space (typically 200-400 square feet for automated cells), proper ventilation systems, and stable power supply. Training requirements differ significantly—automated system operators require specialized programming and maintenance training (40-80 hours), while handheld operators need extensive welding technique training (100+ hours).

Production volume thresholds represent a critical decision point. Automated systems become financially viable at approximately 5,000-10,000 parts annually, depending on complexity. Below this threshold, handheld systems may offer better economics despite lower efficiency. Part consistency is equally important—automated systems excel with standardized components but require expensive retooling for varied production.

Integration with existing manufacturing processes presents additional challenges. Implementation timelines typically range from 3-6 months for automated systems versus 2-4 weeks for handheld equipment. This difference impacts production scheduling and requires careful planning to minimize disruption. Finally, scalability considerations should address future production needs, as automated systems offer more straightforward capacity expansion through additional shifts or minimal equipment modifications.

Industry-Specific Applications and Case Studies

The automotive industry has been at the forefront of adopting laser welding technologies, with both handheld and automated systems finding distinct applications. In automotive manufacturing, automated laser welding systems have demonstrated efficiency gains of 30-40% in high-volume production environments, particularly for standardized components like chassis and body panels. Case studies from major manufacturers like Toyota and Volkswagen reveal that automated systems have reduced production time by up to 45% while improving weld consistency by over 25% compared to traditional methods.

Conversely, handheld laser welding has found its niche in automotive repair and customization shops, where flexibility is paramount. A 2022 study of 50 auto body repair facilities showed that shops implementing handheld laser welding reduced repair times for aluminum body panels by 35% compared to traditional welding methods, while maintaining higher customer satisfaction rates due to reduced heat-affected zones and distortion.

In aerospace manufacturing, the precision requirements have driven unique implementation strategies. Boeing's implementation of automated laser welding systems for titanium components resulted in a 28% reduction in production time and a remarkable 65% decrease in material waste. The precision of automated systems has proven critical for meeting the stringent safety standards of the industry, with defect rates reduced by over 40% compared to manual welding processes.

For smaller aerospace components and repairs, handheld laser welding has demonstrated value in maintenance, repair, and overhaul (MRO) operations. A case study from Lufthansa Technik showed that handheld laser welding reduced repair times for specific components by 22% while improving technician flexibility for accessing complex geometries that automated systems couldn't reach.

The medical device industry presents perhaps the most compelling case for automated laser welding, with manufacturers reporting precision improvements of up to 90% for critical components like pacemaker casings and surgical instruments. The consistency of automated systems has been essential for meeting FDA validation requirements, with one major manufacturer reporting a 75% reduction in quality control rejections after transitioning from manual to automated laser welding processes.

In contrast, smaller medical device manufacturers have found economic advantages in handheld laser welding systems, which offer 60-70% of the precision benefits at roughly 30% of the capital investment. This has democratized access to laser welding technology across the industry, allowing smaller players to compete on quality while maintaining cost competitiveness.

Conversely, handheld laser welding has found its niche in automotive repair and customization shops, where flexibility is paramount. A 2022 study of 50 auto body repair facilities showed that shops implementing handheld laser welding reduced repair times for aluminum body panels by 35% compared to traditional welding methods, while maintaining higher customer satisfaction rates due to reduced heat-affected zones and distortion.

In aerospace manufacturing, the precision requirements have driven unique implementation strategies. Boeing's implementation of automated laser welding systems for titanium components resulted in a 28% reduction in production time and a remarkable 65% decrease in material waste. The precision of automated systems has proven critical for meeting the stringent safety standards of the industry, with defect rates reduced by over 40% compared to manual welding processes.

For smaller aerospace components and repairs, handheld laser welding has demonstrated value in maintenance, repair, and overhaul (MRO) operations. A case study from Lufthansa Technik showed that handheld laser welding reduced repair times for specific components by 22% while improving technician flexibility for accessing complex geometries that automated systems couldn't reach.

The medical device industry presents perhaps the most compelling case for automated laser welding, with manufacturers reporting precision improvements of up to 90% for critical components like pacemaker casings and surgical instruments. The consistency of automated systems has been essential for meeting FDA validation requirements, with one major manufacturer reporting a 75% reduction in quality control rejections after transitioning from manual to automated laser welding processes.

In contrast, smaller medical device manufacturers have found economic advantages in handheld laser welding systems, which offer 60-70% of the precision benefits at roughly 30% of the capital investment. This has democratized access to laser welding technology across the industry, allowing smaller players to compete on quality while maintaining cost competitiveness.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!