Comparing Heat Exchanger vs Regenerator in Heat Recovery Systems

SEP 16, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Heat Recovery Technology Background and Objectives

Heat recovery systems have evolved significantly over the past decades, becoming a cornerstone technology in energy efficiency and sustainability efforts across various industries. The fundamental concept of heat recovery—capturing and reusing thermal energy that would otherwise be wasted—dates back to the early 20th century, but has seen accelerated development since the 1970s energy crisis, which highlighted the critical need for more efficient energy utilization.

The technological evolution in this field has been driven by increasing energy costs, stricter environmental regulations, and growing corporate sustainability initiatives. Heat exchangers, which transfer heat between fluids without mixing them, have traditionally dominated the market. These devices have progressed from simple shell-and-tube designs to complex plate, spiral, and microchannel configurations, offering increasingly efficient heat transfer capabilities.

Regenerators, by contrast, represent an alternative approach where a single passage is alternately exposed to hot and cold fluids, with a heat storage medium retaining and releasing thermal energy cyclically. This technology has seen renewed interest due to advancements in materials science and control systems, enabling higher temperature operations and better efficiency in specific applications.

The global push toward carbon neutrality has further accelerated innovation in heat recovery technologies. Industries ranging from power generation and manufacturing to HVAC and transportation are increasingly implementing these systems to reduce energy consumption and associated emissions. Recent technological trends include the integration of smart monitoring systems, the development of more compact and efficient designs, and the use of advanced materials capable of withstanding extreme conditions.

The primary objective of current heat recovery technology development is to maximize energy efficiency while minimizing capital and operational costs. This involves enhancing heat transfer rates, reducing pressure drops, extending equipment lifespan, and improving resistance to fouling and corrosion. Additionally, there is a growing focus on making these systems more adaptable to variable operating conditions and integrating them seamlessly with renewable energy sources.

Looking forward, the heat recovery technology landscape aims to address several key challenges: improving performance at lower temperature differentials, developing cost-effective solutions for small to medium-scale applications, and creating systems that can efficiently recover heat from complex waste streams containing particulates or corrosive components. The comparative analysis of heat exchangers versus regenerators represents a critical aspect of this technological evolution, as each approach offers distinct advantages depending on specific application requirements, operating conditions, and system constraints.

The technological evolution in this field has been driven by increasing energy costs, stricter environmental regulations, and growing corporate sustainability initiatives. Heat exchangers, which transfer heat between fluids without mixing them, have traditionally dominated the market. These devices have progressed from simple shell-and-tube designs to complex plate, spiral, and microchannel configurations, offering increasingly efficient heat transfer capabilities.

Regenerators, by contrast, represent an alternative approach where a single passage is alternately exposed to hot and cold fluids, with a heat storage medium retaining and releasing thermal energy cyclically. This technology has seen renewed interest due to advancements in materials science and control systems, enabling higher temperature operations and better efficiency in specific applications.

The global push toward carbon neutrality has further accelerated innovation in heat recovery technologies. Industries ranging from power generation and manufacturing to HVAC and transportation are increasingly implementing these systems to reduce energy consumption and associated emissions. Recent technological trends include the integration of smart monitoring systems, the development of more compact and efficient designs, and the use of advanced materials capable of withstanding extreme conditions.

The primary objective of current heat recovery technology development is to maximize energy efficiency while minimizing capital and operational costs. This involves enhancing heat transfer rates, reducing pressure drops, extending equipment lifespan, and improving resistance to fouling and corrosion. Additionally, there is a growing focus on making these systems more adaptable to variable operating conditions and integrating them seamlessly with renewable energy sources.

Looking forward, the heat recovery technology landscape aims to address several key challenges: improving performance at lower temperature differentials, developing cost-effective solutions for small to medium-scale applications, and creating systems that can efficiently recover heat from complex waste streams containing particulates or corrosive components. The comparative analysis of heat exchangers versus regenerators represents a critical aspect of this technological evolution, as each approach offers distinct advantages depending on specific application requirements, operating conditions, and system constraints.

Market Analysis for Heat Recovery Systems

The global heat recovery systems market is experiencing robust growth, valued at approximately $7.7 billion in 2023 and projected to reach $11.5 billion by 2028, representing a compound annual growth rate (CAGR) of 8.3%. This growth is primarily driven by increasing energy costs, stringent environmental regulations, and a growing emphasis on sustainable industrial practices across various sectors.

Industrial applications dominate the market, accounting for nearly 60% of the total market share. Manufacturing facilities, power generation plants, and chemical processing industries are the primary adopters of heat recovery technologies. The commercial building sector follows, representing about 25% of the market, with HVAC systems in large commercial buildings increasingly incorporating heat recovery solutions to improve energy efficiency.

Regionally, Europe leads the market with approximately 35% share, driven by strict energy efficiency regulations and sustainability targets. North America follows at 28%, with Asia-Pacific showing the fastest growth rate at 10.2% annually, primarily due to rapid industrialization in China and India.

When comparing heat exchangers and regenerators specifically, heat exchangers currently dominate the market with approximately 70% share due to their versatility, established technology, and wide range of applications. The market for plate heat exchangers is growing particularly fast at 9.1% annually due to their compact design and high efficiency. Regenerators hold about 30% of the market share but are growing at a faster rate of 11.3% annually, especially in applications requiring high-temperature heat recovery.

Key market drivers include the push for carbon neutrality goals, with many countries implementing policies that incentivize or mandate energy recovery systems. Rising energy prices globally have shortened the return on investment period for heat recovery systems from 5-7 years to 3-4 years in many applications, making them more attractive to businesses.

Market challenges include high initial capital costs, which remain a significant barrier particularly for small and medium enterprises. Technical challenges related to fouling, corrosion, and maintenance requirements also impact market penetration in certain industries. Additionally, the lack of awareness and technical expertise in emerging markets limits adoption rates.

Future market trends indicate a shift toward integrated systems that combine heat recovery with renewable energy sources. Smart heat recovery systems featuring IoT connectivity and predictive maintenance capabilities are expected to gain significant market share, growing at 15.2% annually through 2028.

Industrial applications dominate the market, accounting for nearly 60% of the total market share. Manufacturing facilities, power generation plants, and chemical processing industries are the primary adopters of heat recovery technologies. The commercial building sector follows, representing about 25% of the market, with HVAC systems in large commercial buildings increasingly incorporating heat recovery solutions to improve energy efficiency.

Regionally, Europe leads the market with approximately 35% share, driven by strict energy efficiency regulations and sustainability targets. North America follows at 28%, with Asia-Pacific showing the fastest growth rate at 10.2% annually, primarily due to rapid industrialization in China and India.

When comparing heat exchangers and regenerators specifically, heat exchangers currently dominate the market with approximately 70% share due to their versatility, established technology, and wide range of applications. The market for plate heat exchangers is growing particularly fast at 9.1% annually due to their compact design and high efficiency. Regenerators hold about 30% of the market share but are growing at a faster rate of 11.3% annually, especially in applications requiring high-temperature heat recovery.

Key market drivers include the push for carbon neutrality goals, with many countries implementing policies that incentivize or mandate energy recovery systems. Rising energy prices globally have shortened the return on investment period for heat recovery systems from 5-7 years to 3-4 years in many applications, making them more attractive to businesses.

Market challenges include high initial capital costs, which remain a significant barrier particularly for small and medium enterprises. Technical challenges related to fouling, corrosion, and maintenance requirements also impact market penetration in certain industries. Additionally, the lack of awareness and technical expertise in emerging markets limits adoption rates.

Future market trends indicate a shift toward integrated systems that combine heat recovery with renewable energy sources. Smart heat recovery systems featuring IoT connectivity and predictive maintenance capabilities are expected to gain significant market share, growing at 15.2% annually through 2028.

Technical Status and Challenges in Heat Recovery

Heat recovery technology has evolved significantly over the past decades, with global adoption accelerating due to increasing energy costs and environmental regulations. Currently, the market is dominated by two primary heat recovery technologies: heat exchangers and regenerators, each with distinct operational characteristics and application domains.

Heat exchangers represent the more mature technology, with widespread implementation across industries including HVAC, power generation, and manufacturing. These systems typically achieve 60-75% efficiency in standard applications, with advanced models reaching up to 85-90% in optimal conditions. The technology benefits from established manufacturing processes and standardized designs, contributing to its market dominance of approximately 70% of industrial heat recovery installations worldwide.

Regenerators, while less common (representing roughly 25% of installations), demonstrate superior performance in specific applications, particularly those involving high-temperature processes or contaminated gas streams. Modern ceramic regenerators can achieve thermal efficiencies exceeding 90% in metallurgical applications, though their implementation remains more specialized and technically complex.

A significant technical challenge facing both technologies is fouling and corrosion, which can reduce efficiency by 15-30% over operational lifespans. This is particularly problematic in applications involving particulate-laden or chemically aggressive process streams. Current research focuses on developing advanced materials with enhanced resistance to these degradation mechanisms, with recent innovations in ceramic composites and specialized metal alloys showing promising results in laboratory testing.

Geographical distribution of heat recovery technology development shows concentration in regions with strong industrial bases and stringent energy regulations. European countries, particularly Germany and Scandinavian nations, lead in high-efficiency heat exchanger development, while Japan and the United States demonstrate strength in advanced regenerator technology and materials science applications. China has emerged as a significant manufacturer of conventional heat recovery systems, though innovation remains concentrated in established industrial economies.

Integration challenges persist across both technologies, with system compatibility and control optimization representing significant barriers to wider adoption. The intermittent nature of many industrial processes creates operational difficulties for heat recovery systems designed for steady-state operation. Current research indicates that hybrid systems combining elements of both heat exchangers and regenerators may offer superior performance in variable-load applications, though such systems remain largely experimental.

Miniaturization and modularization represent emerging trends in heat recovery technology, with compact heat exchangers gaining market share in space-constrained applications. However, these designs often face efficiency trade-offs and increased maintenance requirements compared to their larger counterparts.

Heat exchangers represent the more mature technology, with widespread implementation across industries including HVAC, power generation, and manufacturing. These systems typically achieve 60-75% efficiency in standard applications, with advanced models reaching up to 85-90% in optimal conditions. The technology benefits from established manufacturing processes and standardized designs, contributing to its market dominance of approximately 70% of industrial heat recovery installations worldwide.

Regenerators, while less common (representing roughly 25% of installations), demonstrate superior performance in specific applications, particularly those involving high-temperature processes or contaminated gas streams. Modern ceramic regenerators can achieve thermal efficiencies exceeding 90% in metallurgical applications, though their implementation remains more specialized and technically complex.

A significant technical challenge facing both technologies is fouling and corrosion, which can reduce efficiency by 15-30% over operational lifespans. This is particularly problematic in applications involving particulate-laden or chemically aggressive process streams. Current research focuses on developing advanced materials with enhanced resistance to these degradation mechanisms, with recent innovations in ceramic composites and specialized metal alloys showing promising results in laboratory testing.

Geographical distribution of heat recovery technology development shows concentration in regions with strong industrial bases and stringent energy regulations. European countries, particularly Germany and Scandinavian nations, lead in high-efficiency heat exchanger development, while Japan and the United States demonstrate strength in advanced regenerator technology and materials science applications. China has emerged as a significant manufacturer of conventional heat recovery systems, though innovation remains concentrated in established industrial economies.

Integration challenges persist across both technologies, with system compatibility and control optimization representing significant barriers to wider adoption. The intermittent nature of many industrial processes creates operational difficulties for heat recovery systems designed for steady-state operation. Current research indicates that hybrid systems combining elements of both heat exchangers and regenerators may offer superior performance in variable-load applications, though such systems remain largely experimental.

Miniaturization and modularization represent emerging trends in heat recovery technology, with compact heat exchangers gaining market share in space-constrained applications. However, these designs often face efficiency trade-offs and increased maintenance requirements compared to their larger counterparts.

Current Heat Exchanger and Regenerator Solutions

01 Heat exchanger design optimization for improved efficiency

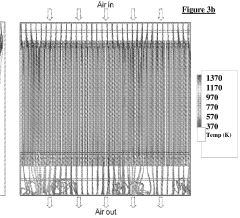

Various design optimizations can significantly improve heat recovery efficiency in heat exchangers. These include modifications to heat transfer surfaces, flow path configurations, and material selection. Advanced designs incorporate features like enhanced surface areas, turbulence promoters, and optimized flow distribution to maximize heat transfer while minimizing pressure drop. Computational fluid dynamics and thermal modeling are used to optimize these designs for specific applications.- Heat exchanger design optimization for efficiency improvement: Various design modifications can enhance heat recovery efficiency in heat exchangers. These include optimizing flow patterns, improving surface area-to-volume ratios, and implementing advanced geometrical configurations. Design innovations focus on reducing thermal resistance, minimizing pressure drops, and enhancing heat transfer coefficients. These optimizations can significantly improve the overall thermal efficiency of heat recovery systems.

- Regenerative heat recovery systems: Regenerative heat recovery systems utilize thermal storage materials to temporarily store and release heat energy. These systems typically involve cyclic operation where heat storage media alternately absorb heat from hot streams and release it to cold streams. The efficiency of regenerators depends on the thermal properties of storage materials, cycle timing, and flow distribution. Advanced regenerator designs incorporate innovative materials and flow control mechanisms to maximize heat recovery efficiency.

- Integration of heat recovery in industrial processes: Heat recovery systems can be integrated into various industrial processes to capture and reuse waste heat. This integration involves strategic placement of heat exchangers or regenerators at points where significant thermal energy would otherwise be lost. System-level approaches consider the entire process flow, identifying opportunities for cascading heat usage across different temperature requirements. Proper integration can substantially increase overall energy efficiency and reduce operational costs.

- Advanced control strategies for heat recovery systems: Sophisticated control strategies can significantly improve heat recovery efficiency. These include model predictive control, adaptive algorithms, and real-time optimization techniques that adjust system parameters based on changing conditions. Monitoring key performance indicators and implementing feedback control loops enable dynamic response to variations in flow rates, temperatures, and other operational parameters. Advanced control systems can optimize heat recovery under fluctuating conditions while maintaining process stability.

- Novel materials and surface treatments for enhanced heat transfer: Innovative materials and surface treatments can enhance heat transfer in recovery systems. These include high thermal conductivity materials, nano-enhanced surfaces, and specialized coatings that reduce fouling. Advanced manufacturing techniques enable the creation of complex geometries with enhanced heat transfer characteristics. These material innovations can improve heat transfer coefficients, reduce thermal resistance, and maintain performance over longer operational periods by minimizing degradation and contamination effects.

02 Regenerative heat recovery systems

Regenerative heat recovery systems utilize thermal storage media to capture and release heat energy cyclically. These systems are particularly effective in high-temperature applications where conventional recuperative heat exchangers may be less efficient. The thermal storage media absorbs heat from hot exhaust gases and later releases it to incoming cold air, achieving high thermal efficiency. Design considerations include selection of appropriate storage media, cycle timing, and flow distribution to maximize energy recovery.Expand Specific Solutions03 Control systems and monitoring for heat recovery efficiency

Advanced control and monitoring systems play a crucial role in optimizing heat recovery efficiency. These systems employ sensors, controllers, and algorithms to maintain optimal operating conditions under varying loads. Real-time monitoring of temperature differentials, flow rates, and pressure drops allows for dynamic adjustments to maximize efficiency. Predictive maintenance capabilities can identify performance degradation before efficiency is significantly impacted, while machine learning algorithms continuously optimize system parameters.Expand Specific Solutions04 Integration of heat recovery in industrial processes

Effective integration of heat recovery systems within broader industrial processes can substantially improve overall energy efficiency. This approach involves identifying waste heat sources and potential heat sinks within the process, then designing appropriate heat recovery systems to bridge them. Pinch analysis and process integration techniques help optimize the placement and sizing of heat exchangers. Cascading heat recovery systems can utilize waste heat at multiple temperature levels, maximizing the total energy recovered across the entire process.Expand Specific Solutions05 Novel materials and manufacturing techniques for heat recovery components

Innovative materials and manufacturing techniques are enhancing heat recovery efficiency through improved thermal conductivity, corrosion resistance, and structural integrity. Advanced materials such as specialized alloys, ceramics, and composites enable heat exchangers to operate at higher temperatures and in more corrosive environments. Additive manufacturing allows for complex geometries that optimize flow paths and heat transfer surfaces. Surface treatments and coatings can reduce fouling and scaling, maintaining efficiency over longer operational periods.Expand Specific Solutions

Major Manufacturers and Industry Competition

The heat recovery systems market is currently in a growth phase, with increasing emphasis on energy efficiency driving adoption across industries. The global market size for heat exchangers and regenerators is expanding, projected to reach significant value due to stringent environmental regulations and rising energy costs. Technologically, heat exchangers represent a more mature solution with widespread implementation, while regenerative systems are gaining traction for specific high-efficiency applications. Leading players like Modine Manufacturing and Air Liquide dominate the conventional heat exchanger segment, while companies such as Mitsubishi Power and Bloom Energy are advancing regenerator technologies. Toyota, Honeywell, and DENSO are investing in hybrid systems that combine both technologies, particularly for automotive and industrial applications, indicating a trend toward integrated thermal management solutions.

Modine Manufacturing Co.

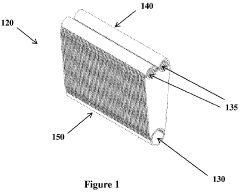

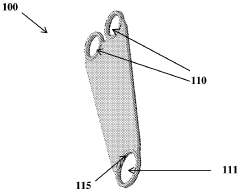

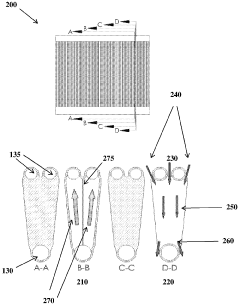

Technical Solution: Modine specializes in thermal management solutions with advanced heat exchanger technologies for various industries. Their heat exchanger systems utilize innovative designs including plate, shell-and-tube, and microchannel configurations to maximize heat transfer efficiency. Modine's heat exchangers feature proprietary fin designs and optimized flow paths that enhance thermal conductivity while minimizing pressure drop. Their systems achieve up to 90% heat recovery efficiency in industrial applications through continuous heat transfer processes. Modine's approach focuses on direct thermal exchange between fluid streams without intermediate storage, allowing for constant operation in steady-state conditions. Their heat exchangers are particularly effective in applications requiring continuous operation with minimal maintenance requirements.

Strengths: Higher instantaneous heat transfer efficiency; lower pressure drop; compact design with smaller footprint; no thermal mass limitations; continuous operation capability. Weaknesses: Less effective for intermittent operations; cannot store thermal energy; typically higher initial cost compared to simple regenerators.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed hybrid heat recovery systems that combine elements of both heat exchangers and regenerators to optimize energy efficiency. Their technology incorporates advanced ceramic heat exchange media in regenerative systems that can withstand temperatures exceeding 1000°C while maintaining structural integrity. Honeywell's systems feature proprietary control algorithms that dynamically adjust operation based on load conditions, optimizing the balance between heat exchange efficiency and pressure drop. For industrial applications, they've implemented rotary regenerative heat exchangers that combine continuous operation with thermal storage capabilities. Their systems incorporate self-cleaning mechanisms to address fouling issues common in regenerative systems, extending maintenance intervals and operational reliability in demanding environments.

Strengths: Versatility across multiple applications; advanced materials technology for high-temperature operation; sophisticated control systems; hybrid approaches that maximize benefits of both technologies. Weaknesses: Higher complexity requiring more sophisticated control systems; greater maintenance requirements for moving parts in rotary regenerative systems.

Key Patents and Innovations in Heat Recovery

Compact radial counterflow recuperator

PatentWO2010135648A1

Innovation

- A compact radial counterflow heat exchanger using ceramic wafers made from mullite, with peripheral walls defining interior and exterior flow channels, allowing for efficient gas-to-gas heat transfer and reduced thermal stresses, fabricated using techniques like laser-cutting and co-sintering for enhanced strength and corrosion resistance.

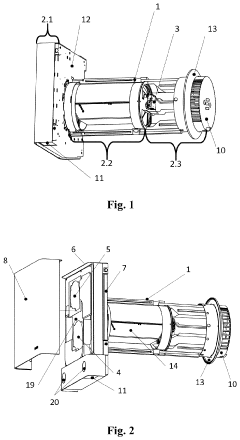

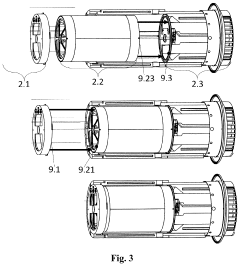

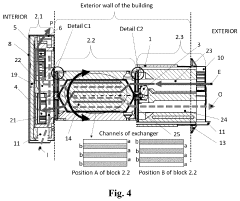

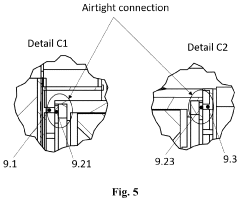

Heat recovery ventilation unit

PatentActiveUS20240060676A1

Innovation

- A ventilation unit design with a second block containing a heat recovery exchanger that can be inserted between other blocks, allowing for easy switching between fixed and rotating configurations to prevent icing, using a servo actuator for position adjustment and a split condensate collector for efficient moisture management, enabling effective heat recovery in cold climates without the need for complex damper systems.

Energy Efficiency Standards and Regulations

Energy efficiency regulations have become increasingly stringent worldwide, directly impacting the selection between heat exchangers and regenerators in heat recovery systems. The European Union's Ecodesign Directive (2009/125/EC) establishes a framework for setting mandatory energy efficiency requirements for energy-related products, including heat recovery systems. Under this directive, minimum efficiency requirements for ventilation units with heat recovery systems specify thermal efficiencies of at least 73% for regenerative systems and 68% for other heat recovery systems.

In the United States, ASHRAE Standard 90.1 provides minimum energy efficiency requirements for buildings and their systems. The 2019 version mandates heat recovery for certain HVAC systems where the supply airflow rate exceeds specific thresholds, with minimum effectiveness requirements that can influence the choice between heat exchangers and regenerators.

The International Energy Conservation Code (IECC) similarly requires heat recovery ventilation in certain applications, with performance metrics that may favor one technology over the other depending on climate zone and application. These standards typically evaluate systems based on effectiveness, pressure drop, and energy consumption metrics.

Energy Star certification programs in various countries provide additional voluntary standards that often exceed mandatory requirements. For heat recovery ventilation systems, Energy Star certification typically requires higher efficiency levels that may be more readily achieved with certain technologies.

Regulatory trends indicate a move toward life-cycle assessment approaches rather than point-of-use efficiency alone. The EU's circular economy initiatives and similar programs worldwide are beginning to consider embodied energy and material sustainability alongside operational efficiency. This shift may favor regenerators in some applications due to their potentially simpler construction and material composition.

Carbon reduction targets established under frameworks like the Paris Agreement are driving more stringent energy efficiency regulations. Several jurisdictions have established carbon pricing mechanisms that indirectly affect the economic viability of different heat recovery technologies based on their energy consumption profiles and associated emissions.

Building certification systems such as LEED, BREEAM, and Passive House include criteria for ventilation and heat recovery that can influence technology selection. Passive House certification, for example, requires heat recovery ventilation systems with at least 75% efficiency and low electricity consumption, parameters that must be considered when choosing between heat exchangers and regenerators.

In the United States, ASHRAE Standard 90.1 provides minimum energy efficiency requirements for buildings and their systems. The 2019 version mandates heat recovery for certain HVAC systems where the supply airflow rate exceeds specific thresholds, with minimum effectiveness requirements that can influence the choice between heat exchangers and regenerators.

The International Energy Conservation Code (IECC) similarly requires heat recovery ventilation in certain applications, with performance metrics that may favor one technology over the other depending on climate zone and application. These standards typically evaluate systems based on effectiveness, pressure drop, and energy consumption metrics.

Energy Star certification programs in various countries provide additional voluntary standards that often exceed mandatory requirements. For heat recovery ventilation systems, Energy Star certification typically requires higher efficiency levels that may be more readily achieved with certain technologies.

Regulatory trends indicate a move toward life-cycle assessment approaches rather than point-of-use efficiency alone. The EU's circular economy initiatives and similar programs worldwide are beginning to consider embodied energy and material sustainability alongside operational efficiency. This shift may favor regenerators in some applications due to their potentially simpler construction and material composition.

Carbon reduction targets established under frameworks like the Paris Agreement are driving more stringent energy efficiency regulations. Several jurisdictions have established carbon pricing mechanisms that indirectly affect the economic viability of different heat recovery technologies based on their energy consumption profiles and associated emissions.

Building certification systems such as LEED, BREEAM, and Passive House include criteria for ventilation and heat recovery that can influence technology selection. Passive House certification, for example, requires heat recovery ventilation systems with at least 75% efficiency and low electricity consumption, parameters that must be considered when choosing between heat exchangers and regenerators.

Lifecycle Cost Analysis and ROI Considerations

When evaluating heat exchangers versus regenerators for heat recovery systems, lifecycle cost analysis and return on investment (ROI) considerations are critical factors in the decision-making process. The initial capital expenditure for heat exchangers typically ranges from $50,000 to $500,000 depending on size, material, and complexity, while regenerators often require investments between $75,000 and $600,000 due to their more complex structure and refractory materials.

Operational costs present significant differences between these technologies. Heat exchangers generally consume less auxiliary power, requiring approximately 0.5-2% of the recovered energy for operation. In contrast, regenerators may demand 1-3% of recovered energy due to additional pressure drop and control systems. Maintenance expenses for heat exchangers average 2-5% of the initial investment annually, primarily for cleaning and occasional replacement of gaskets or plates. Regenerators typically incur higher maintenance costs at 3-7% annually due to the periodic replacement of heat storage media and more complex mechanical components.

The expected service life also differs substantially between these technologies. Well-maintained heat exchangers can operate effectively for 15-20 years, while regenerators often achieve 10-15 years before requiring significant refurbishment. This difference directly impacts the depreciation schedules and long-term financial planning for these systems.

Energy recovery efficiency significantly influences ROI calculations. Modern plate heat exchangers achieve 70-85% efficiency, while regenerative systems can reach 85-95% efficiency under optimal conditions. This efficiency differential can translate to annual energy savings of $10,000-$50,000 for medium-sized industrial applications, depending on energy costs and system utilization.

Payback periods vary based on application and energy prices. Heat exchangers typically offer payback periods of 2-4 years in high-temperature applications, while regenerators may achieve faster returns of 1.5-3 years in appropriate applications due to their higher efficiency, despite higher initial costs.

Environmental regulations and carbon pricing mechanisms increasingly affect ROI calculations. Heat recovery systems that deliver higher efficiency can provide additional financial benefits through carbon credit programs or by avoiding carbon taxes, potentially accelerating ROI by 10-15% in regions with stringent emissions regulations.

Total cost of ownership analysis reveals that while heat exchangers generally offer lower initial and maintenance costs, regenerators may provide better lifetime value in high-temperature applications where their superior efficiency offsets higher capital and maintenance expenses. A comprehensive 10-year TCO analysis typically shows regenerators becoming more economically advantageous when process temperatures exceed 900°C or when energy costs represent more than 15% of operational expenses.

Operational costs present significant differences between these technologies. Heat exchangers generally consume less auxiliary power, requiring approximately 0.5-2% of the recovered energy for operation. In contrast, regenerators may demand 1-3% of recovered energy due to additional pressure drop and control systems. Maintenance expenses for heat exchangers average 2-5% of the initial investment annually, primarily for cleaning and occasional replacement of gaskets or plates. Regenerators typically incur higher maintenance costs at 3-7% annually due to the periodic replacement of heat storage media and more complex mechanical components.

The expected service life also differs substantially between these technologies. Well-maintained heat exchangers can operate effectively for 15-20 years, while regenerators often achieve 10-15 years before requiring significant refurbishment. This difference directly impacts the depreciation schedules and long-term financial planning for these systems.

Energy recovery efficiency significantly influences ROI calculations. Modern plate heat exchangers achieve 70-85% efficiency, while regenerative systems can reach 85-95% efficiency under optimal conditions. This efficiency differential can translate to annual energy savings of $10,000-$50,000 for medium-sized industrial applications, depending on energy costs and system utilization.

Payback periods vary based on application and energy prices. Heat exchangers typically offer payback periods of 2-4 years in high-temperature applications, while regenerators may achieve faster returns of 1.5-3 years in appropriate applications due to their higher efficiency, despite higher initial costs.

Environmental regulations and carbon pricing mechanisms increasingly affect ROI calculations. Heat recovery systems that deliver higher efficiency can provide additional financial benefits through carbon credit programs or by avoiding carbon taxes, potentially accelerating ROI by 10-15% in regions with stringent emissions regulations.

Total cost of ownership analysis reveals that while heat exchangers generally offer lower initial and maintenance costs, regenerators may provide better lifetime value in high-temperature applications where their superior efficiency offsets higher capital and maintenance expenses. A comprehensive 10-year TCO analysis typically shows regenerators becoming more economically advantageous when process temperatures exceed 900°C or when energy costs represent more than 15% of operational expenses.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!