Comparing OLED Transparency Metrics for Automotive Heads-Up Displays

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED HUD Technology Background and Objectives

Heads-Up Display (HUD) technology has evolved significantly since its inception in military aviation during the 1940s. Initially designed to project critical flight information onto a transparent surface in the pilot's line of sight, this technology has gradually transitioned into automotive applications over the past three decades. The integration of HUD systems in vehicles began with simple speed and warning indicators but has now expanded to include navigation guidance, advanced driver assistance information, and augmented reality features.

OLED (Organic Light Emitting Diode) technology represents a revolutionary advancement in display technology that has recently been adapted for automotive HUD applications. Unlike traditional LCD-based HUD systems that require complex optical arrangements and backlighting, OLED displays are self-emissive, offering superior contrast ratios, wider viewing angles, and the potential for transparency—a critical feature for automotive HUD implementations.

The evolution of OLED technology for HUD applications has been driven by increasing consumer demand for more immersive and informative driving experiences, as well as automotive manufacturers' pursuit of differentiation through advanced technology integration. The global automotive HUD market is projected to grow at a CAGR of approximately 23% between 2021 and 2026, with transparent OLED technology positioned as a key enabler for next-generation systems.

Transparency in OLED displays represents a particularly significant technical challenge and opportunity for automotive HUD applications. The ability to create displays that can selectively present information while maintaining visibility through the display to the road beyond is fundamental to HUD functionality and safety. However, the industry currently lacks standardized metrics and measurement methodologies for OLED transparency in automotive contexts.

The primary objective of this technical research is to establish a comprehensive comparative framework for evaluating OLED transparency metrics specifically tailored to automotive HUD applications. This includes analyzing existing transparency measurement standards, identifying their limitations in automotive contexts, and proposing enhanced methodologies that account for the unique optical requirements of in-vehicle displays.

Additionally, this research aims to explore the relationship between OLED transparency and other critical performance parameters such as brightness, power consumption, color accuracy, and operational temperature range—all of which significantly impact the viability of OLED HUD implementations in real-world automotive environments. The ultimate goal is to provide automotive engineers and product developers with actionable insights and standardized evaluation criteria to accelerate the adoption of transparent OLED technology in next-generation HUD systems.

OLED (Organic Light Emitting Diode) technology represents a revolutionary advancement in display technology that has recently been adapted for automotive HUD applications. Unlike traditional LCD-based HUD systems that require complex optical arrangements and backlighting, OLED displays are self-emissive, offering superior contrast ratios, wider viewing angles, and the potential for transparency—a critical feature for automotive HUD implementations.

The evolution of OLED technology for HUD applications has been driven by increasing consumer demand for more immersive and informative driving experiences, as well as automotive manufacturers' pursuit of differentiation through advanced technology integration. The global automotive HUD market is projected to grow at a CAGR of approximately 23% between 2021 and 2026, with transparent OLED technology positioned as a key enabler for next-generation systems.

Transparency in OLED displays represents a particularly significant technical challenge and opportunity for automotive HUD applications. The ability to create displays that can selectively present information while maintaining visibility through the display to the road beyond is fundamental to HUD functionality and safety. However, the industry currently lacks standardized metrics and measurement methodologies for OLED transparency in automotive contexts.

The primary objective of this technical research is to establish a comprehensive comparative framework for evaluating OLED transparency metrics specifically tailored to automotive HUD applications. This includes analyzing existing transparency measurement standards, identifying their limitations in automotive contexts, and proposing enhanced methodologies that account for the unique optical requirements of in-vehicle displays.

Additionally, this research aims to explore the relationship between OLED transparency and other critical performance parameters such as brightness, power consumption, color accuracy, and operational temperature range—all of which significantly impact the viability of OLED HUD implementations in real-world automotive environments. The ultimate goal is to provide automotive engineers and product developers with actionable insights and standardized evaluation criteria to accelerate the adoption of transparent OLED technology in next-generation HUD systems.

Automotive HUD Market Demand Analysis

The automotive Heads-Up Display (HUD) market is experiencing significant growth, driven by increasing consumer demand for advanced driver assistance systems and enhanced in-vehicle experiences. Current market projections indicate the global automotive HUD market will reach approximately $4.6 billion by 2025, with a compound annual growth rate (CAGR) of 28.5% from 2020 to 2025. This remarkable growth trajectory underscores the critical importance of transparent display technologies, particularly OLED solutions.

Consumer preferences are shifting dramatically toward vehicles equipped with advanced safety features and intuitive information display systems. Market research reveals that 67% of new car buyers consider advanced display technologies as a significant factor in their purchasing decisions. The integration of augmented reality (AR) capabilities with HUD systems has further accelerated market demand, with AR-HUD installations expected to grow by 350% over the next five years.

Transparency metrics for OLED displays have become a crucial differentiator in the automotive HUD market. Premium automotive manufacturers are increasingly specifying minimum transparency requirements of 45-50% for windshield-integrated HUD systems, creating significant technical challenges for display manufacturers. This demand is particularly pronounced in the luxury vehicle segment, where the market penetration of advanced HUD systems has already reached 38% and is projected to exceed 65% by 2026.

Regional analysis indicates varying adoption rates and preferences. European markets show the highest demand for transparent OLED HUD systems, with German manufacturers leading implementation. The North American market follows closely, with Japanese and Korean markets showing accelerated adoption rates in recent years. The Chinese automotive market, while currently focused on cost-effective solutions, is projected to become the largest growth market for premium HUD systems by 2027.

Vehicle type segmentation reveals that SUVs and luxury sedans currently represent 72% of all automotive HUD installations. However, mid-range vehicle segments are showing the fastest growth rate at 34% annually, indicating a democratization of this technology across price points. This expansion into broader market segments is creating new technical requirements for OLED transparency, as cost constraints become more significant while performance expectations remain high.

Consumer feedback indicates that display clarity under varying lighting conditions remains the most critical performance metric, with 83% of users rating this as "extremely important." This highlights the need for OLED transparency solutions that maintain optimal visibility across diverse environmental conditions, from bright sunlight to nighttime driving scenarios.

Consumer preferences are shifting dramatically toward vehicles equipped with advanced safety features and intuitive information display systems. Market research reveals that 67% of new car buyers consider advanced display technologies as a significant factor in their purchasing decisions. The integration of augmented reality (AR) capabilities with HUD systems has further accelerated market demand, with AR-HUD installations expected to grow by 350% over the next five years.

Transparency metrics for OLED displays have become a crucial differentiator in the automotive HUD market. Premium automotive manufacturers are increasingly specifying minimum transparency requirements of 45-50% for windshield-integrated HUD systems, creating significant technical challenges for display manufacturers. This demand is particularly pronounced in the luxury vehicle segment, where the market penetration of advanced HUD systems has already reached 38% and is projected to exceed 65% by 2026.

Regional analysis indicates varying adoption rates and preferences. European markets show the highest demand for transparent OLED HUD systems, with German manufacturers leading implementation. The North American market follows closely, with Japanese and Korean markets showing accelerated adoption rates in recent years. The Chinese automotive market, while currently focused on cost-effective solutions, is projected to become the largest growth market for premium HUD systems by 2027.

Vehicle type segmentation reveals that SUVs and luxury sedans currently represent 72% of all automotive HUD installations. However, mid-range vehicle segments are showing the fastest growth rate at 34% annually, indicating a democratization of this technology across price points. This expansion into broader market segments is creating new technical requirements for OLED transparency, as cost constraints become more significant while performance expectations remain high.

Consumer feedback indicates that display clarity under varying lighting conditions remains the most critical performance metric, with 83% of users rating this as "extremely important." This highlights the need for OLED transparency solutions that maintain optimal visibility across diverse environmental conditions, from bright sunlight to nighttime driving scenarios.

OLED Transparency Challenges in Automotive Applications

OLED technology in automotive heads-up displays (HUDs) faces significant transparency challenges that impact performance and user experience. Traditional transparency metrics often fail to adequately characterize the unique optical properties of OLED displays in automotive environments. The primary challenge lies in achieving sufficient transparency while maintaining image quality and visibility across diverse lighting conditions encountered in vehicles.

The fundamental transparency issue stems from OLED's layered structure. Unlike conventional display technologies, OLEDs require multiple thin-film layers that inherently reduce light transmission. Each additional layer—including electrodes, organic materials, and encapsulation—contributes to light absorption and reflection, diminishing overall transparency. This creates a direct trade-off between display functionality and optical clarity.

Environmental factors significantly compound these challenges in automotive applications. Windshield reflections, varying ambient light conditions (from bright sunlight to night driving), and changing viewing angles create complex optical scenarios that static transparency metrics fail to capture. Standard laboratory measurements often don't translate to real-world automotive environments where dynamic lighting conditions prevail.

Temperature variations present another critical challenge. Automotive environments experience extreme temperature fluctuations that affect OLED material properties and transparency characteristics. Cold temperatures can increase material rigidity and alter optical properties, while high temperatures may accelerate degradation of organic materials, affecting long-term transparency stability.

Measurement standardization remains problematic across the industry. Different manufacturers employ varying methodologies to quantify transparency, making direct comparisons difficult. Some focus on direct light transmission percentages, while others emphasize contrast ratio maintenance or color accuracy through transparent sections. This inconsistency creates confusion when evaluating competing OLED solutions for automotive HUDs.

Power consumption considerations further complicate transparency optimization. Higher transparency often requires increased brightness to maintain visibility, directly impacting power requirements. In automotive applications where energy efficiency is paramount, this creates additional engineering constraints that must be balanced against optical performance.

Durability concerns also affect transparency solutions. Automotive-grade displays must maintain optical properties over extended periods despite exposure to UV radiation, temperature cycling, and vibration. Many transparency-enhancing treatments or materials that work well initially may degrade prematurely under these harsh conditions, limiting their practical application in vehicles.

The fundamental transparency issue stems from OLED's layered structure. Unlike conventional display technologies, OLEDs require multiple thin-film layers that inherently reduce light transmission. Each additional layer—including electrodes, organic materials, and encapsulation—contributes to light absorption and reflection, diminishing overall transparency. This creates a direct trade-off between display functionality and optical clarity.

Environmental factors significantly compound these challenges in automotive applications. Windshield reflections, varying ambient light conditions (from bright sunlight to night driving), and changing viewing angles create complex optical scenarios that static transparency metrics fail to capture. Standard laboratory measurements often don't translate to real-world automotive environments where dynamic lighting conditions prevail.

Temperature variations present another critical challenge. Automotive environments experience extreme temperature fluctuations that affect OLED material properties and transparency characteristics. Cold temperatures can increase material rigidity and alter optical properties, while high temperatures may accelerate degradation of organic materials, affecting long-term transparency stability.

Measurement standardization remains problematic across the industry. Different manufacturers employ varying methodologies to quantify transparency, making direct comparisons difficult. Some focus on direct light transmission percentages, while others emphasize contrast ratio maintenance or color accuracy through transparent sections. This inconsistency creates confusion when evaluating competing OLED solutions for automotive HUDs.

Power consumption considerations further complicate transparency optimization. Higher transparency often requires increased brightness to maintain visibility, directly impacting power requirements. In automotive applications where energy efficiency is paramount, this creates additional engineering constraints that must be balanced against optical performance.

Durability concerns also affect transparency solutions. Automotive-grade displays must maintain optical properties over extended periods despite exposure to UV radiation, temperature cycling, and vibration. Many transparency-enhancing treatments or materials that work well initially may degrade prematurely under these harsh conditions, limiting their practical application in vehicles.

Current Transparency Measurement Methodologies

01 Transparency measurement methods for OLED displays

Various methods and metrics are used to measure and quantify the transparency of OLED displays. These include optical transmittance measurements, light transmission ratio calculations, and specialized testing equipment to evaluate transparency under different lighting conditions. These metrics help manufacturers standardize transparency specifications and ensure consistent quality across transparent OLED products.- Transparency measurement methods for OLED displays: Various methods and systems are used to measure and quantify the transparency of OLED displays. These include optical instruments that measure light transmission rates, contrast ratios in different lighting conditions, and specialized metrics that account for the unique properties of transparent displays. These measurement techniques help standardize transparency evaluation across different OLED technologies and applications.

- Transparent electrode materials and structures: Transparent electrode materials significantly impact the overall transparency of OLED displays. Innovations include ultra-thin metal layers, conductive polymers, metal nanowires, and indium tin oxide (ITO) alternatives. The structure and composition of these electrodes are designed to maximize light transmission while maintaining electrical conductivity, directly affecting transparency metrics.

- Transparency-enhancing layer configurations: Specific layer configurations and materials are developed to enhance OLED transparency. These include anti-reflection coatings, specialized encapsulation layers, and optical matching layers that reduce internal reflection and increase light transmission. The strategic arrangement of these layers within the OLED stack can significantly improve transparency metrics while maintaining display performance.

- Transparency control and adjustment technologies: Technologies that enable dynamic control of OLED transparency allow displays to adjust their transparency levels based on user needs or environmental conditions. These include electrochromic materials, liquid crystal layers integrated with OLEDs, and pixel designs that can modulate transparency. These systems often include sensors and algorithms to automatically optimize transparency metrics in real-time.

- Transparency optimization for specific applications: OLED transparency metrics are optimized differently depending on the intended application. For automotive displays, transparency is balanced with sunlight readability. For augmented reality devices, transparency is optimized for seamless integration of digital content with the real world. For architectural applications, transparency is maximized while maintaining display visibility. Each application requires specific transparency metrics and measurement standards.

02 Transparent electrode materials and structures

The choice of electrode materials significantly impacts OLED transparency. Transparent conductive materials like ITO (Indium Tin Oxide), graphene, silver nanowires, and metal mesh structures are used to create electrodes that allow light to pass through while maintaining electrical conductivity. The thickness, pattern, and composition of these electrodes are optimized to balance transparency with electrical performance.Expand Specific Solutions03 Transparent OLED panel structure design

The overall structure of transparent OLED panels is designed to maximize light transmission. This includes the arrangement of transparent and semi-transparent layers, minimizing light-blocking components, and optimizing the thickness of each layer. Special attention is given to the placement of non-transparent components like driving circuits to minimize their impact on the display's overall transparency.Expand Specific Solutions04 Transparency control and adjustment technologies

Technologies that allow for dynamic control of OLED transparency enable displays to switch between transparent, semi-transparent, and opaque states. These include adjustable opacity layers, switchable materials that change transparency with applied voltage, and pixel designs that can modulate light transmission. Such technologies are particularly valuable for applications requiring variable transparency based on user needs or ambient conditions.Expand Specific Solutions05 Transparency enhancement techniques

Various techniques are employed to enhance the transparency of OLED displays beyond basic material selection. These include anti-reflection coatings to reduce glare, optical matching layers to minimize light refraction between different materials, microlens arrays to improve light extraction, and specialized encapsulation methods that maintain transparency while protecting the OLED components from environmental factors.Expand Specific Solutions

Key Manufacturers in Automotive OLED HUD Industry

The OLED transparency market for automotive heads-up displays is currently in an early growth phase, with significant expansion potential as automotive manufacturers increasingly adopt advanced display technologies. The global automotive HUD market is projected to reach approximately $5 billion by 2025, with transparent OLED technology representing an emerging segment. Technical maturity varies significantly among key players, with established display manufacturers like LG Display, Samsung Display, and BOE Technology leading innovation in transparency metrics and standardization. Continental Automotive and Nippon Seiki dominate the automotive integration space, while luxury automakers like BMW are driving adoption. Research institutions including CEA and North Carolina State University are advancing fundamental transparency enhancement technologies, creating a competitive landscape balanced between display manufacturers and automotive technology integrators.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive transparent OLED solution for automotive HUD applications featuring their proprietary "Crystal Clear" technology. Their panels achieve transparency rates of 38-42% with specialized pixel arrangements that optimize the balance between display visibility and see-through clarity. BOE's approach incorporates variable transparency control, allowing dynamic adjustment based on ambient light conditions and driver preferences. Their transparent OLED panels utilize advanced TFT backplane technology with reduced trace visibility, minimizing the "grid effect" that can compromise transparency quality. BOE has established a multi-parameter transparency measurement framework that evaluates not just light transmission percentage but also haze factors, clarity indices, and color neutrality metrics - providing a more comprehensive assessment of real-world transparency performance. Their automotive HUD solutions also feature specialized optical bonding techniques that eliminate internal reflections between layers, enhancing overall transparency while reducing ghosting effects.

Strengths: Comprehensive transparency measurement framework providing more nuanced performance metrics; dynamic transparency adjustment capabilities; excellent optical bonding minimizing internal reflections. Weaknesses: Slightly lower peak transparency compared to industry leaders; more complex driver electronics required for variable transparency control; higher initial development costs for automotive qualification.

Continental Automotive GmbH

Technical Solution: Continental has developed an integrated transparent OLED HUD system that focuses on optimizing the complete optical path rather than just panel transparency. Their solution combines transparent OLED technology with specialized projection optics and windshield integration to create a comprehensive HUD experience. Continental's approach emphasizes transparency consistency across the entire display area, achieving uniform transparency rates of 35-38% with less than 3% variation across the panel. Their system incorporates advanced ambient light sensors that dynamically adjust display parameters to maintain optimal transparency perception under varying driving conditions. Continental has pioneered standardized transparency measurement protocols specifically for automotive applications, accounting for factors like windshield angle, driver position, and sunlight conditions. Their transparent OLED HUD system features specialized anti-glare coatings that maintain transparency while reducing reflections to below 1.5%, significantly enhancing daytime visibility. Continental's solution also addresses transparency consistency during temperature fluctuations through active thermal management systems.

Strengths: Holistic system approach optimizing the entire optical path; industry-leading anti-glare performance; comprehensive environmental testing ensuring real-world transparency performance. Weaknesses: Slightly lower raw transparency specifications compared to panel manufacturers; more complex integration requirements; higher system-level costs due to additional optical components.

Critical Patents in OLED Transparency Enhancement

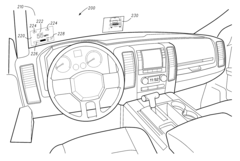

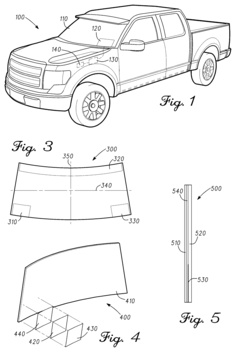

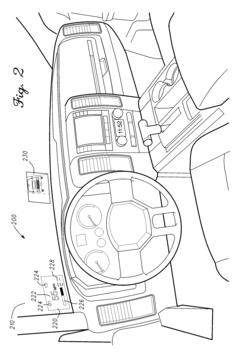

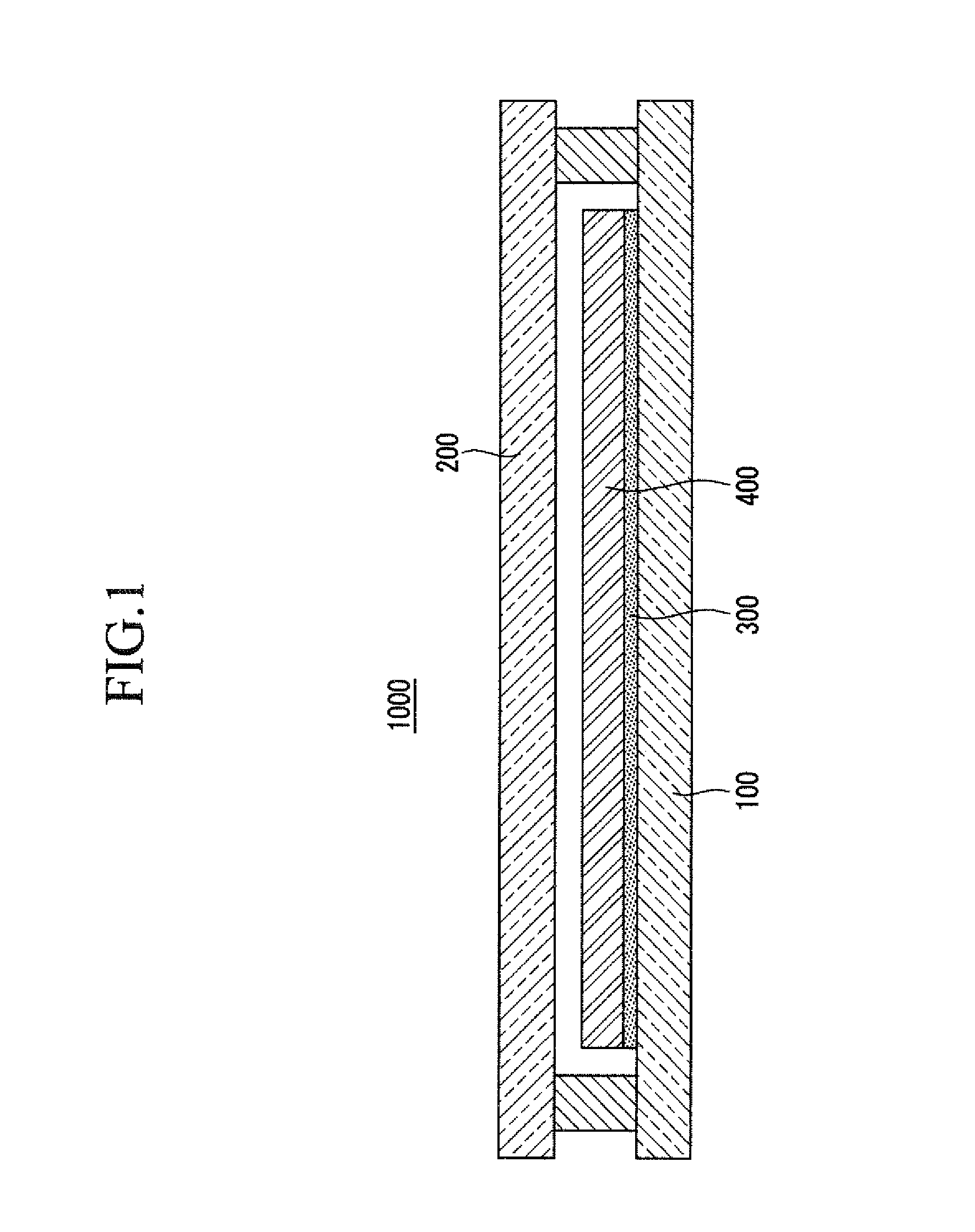

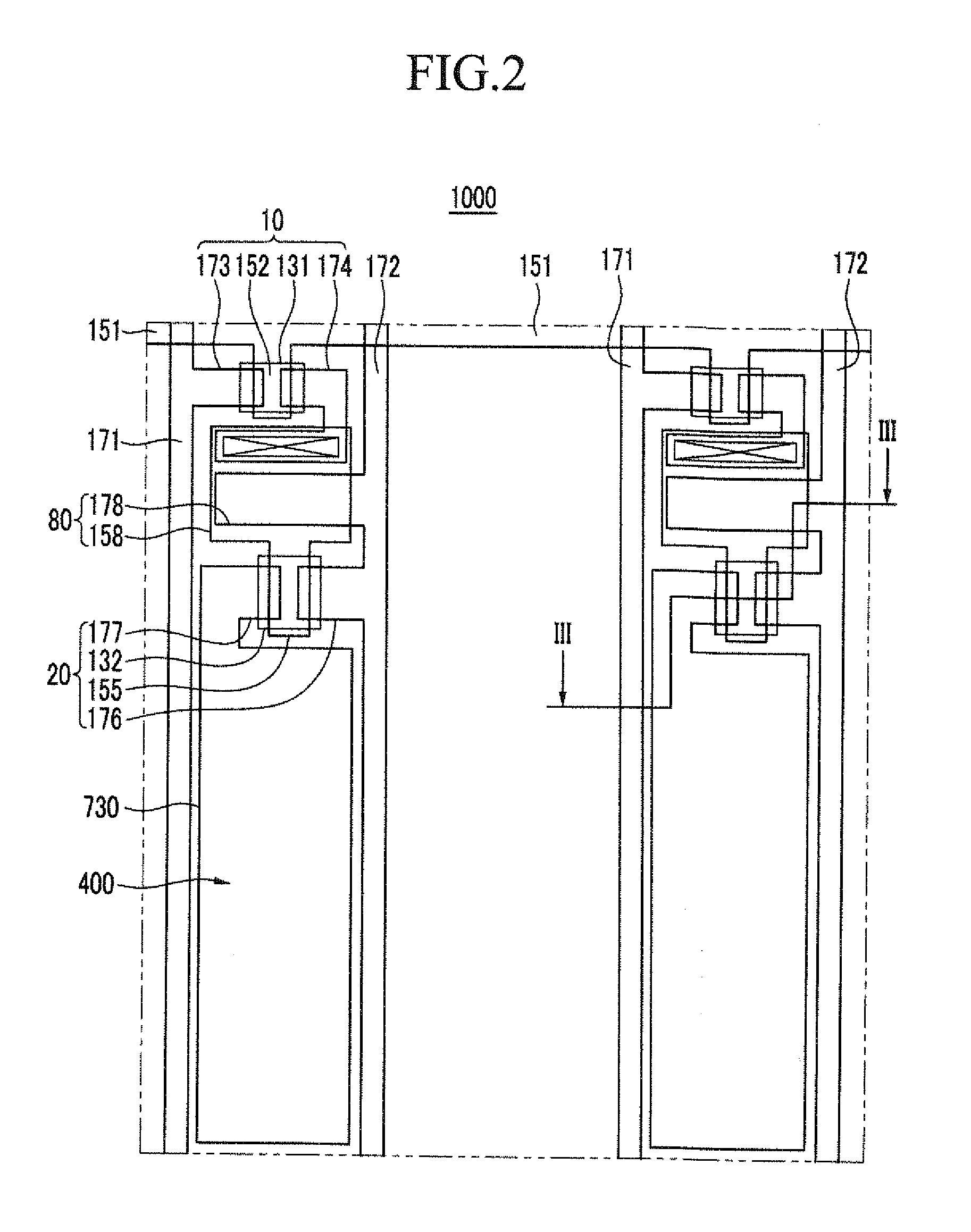

Light-emitting diode heads-up display for a vehicle

PatentInactiveUS20110025584A1

Innovation

- The implementation of a substantially transparent organic light-emitting diode (OLED) display system coupled to the windshield, operated by a control device to present information to the vehicle operator, offering a more compact and cost-effective alternative by using OLED displays positioned between glass layers or a film layer and the windshield.

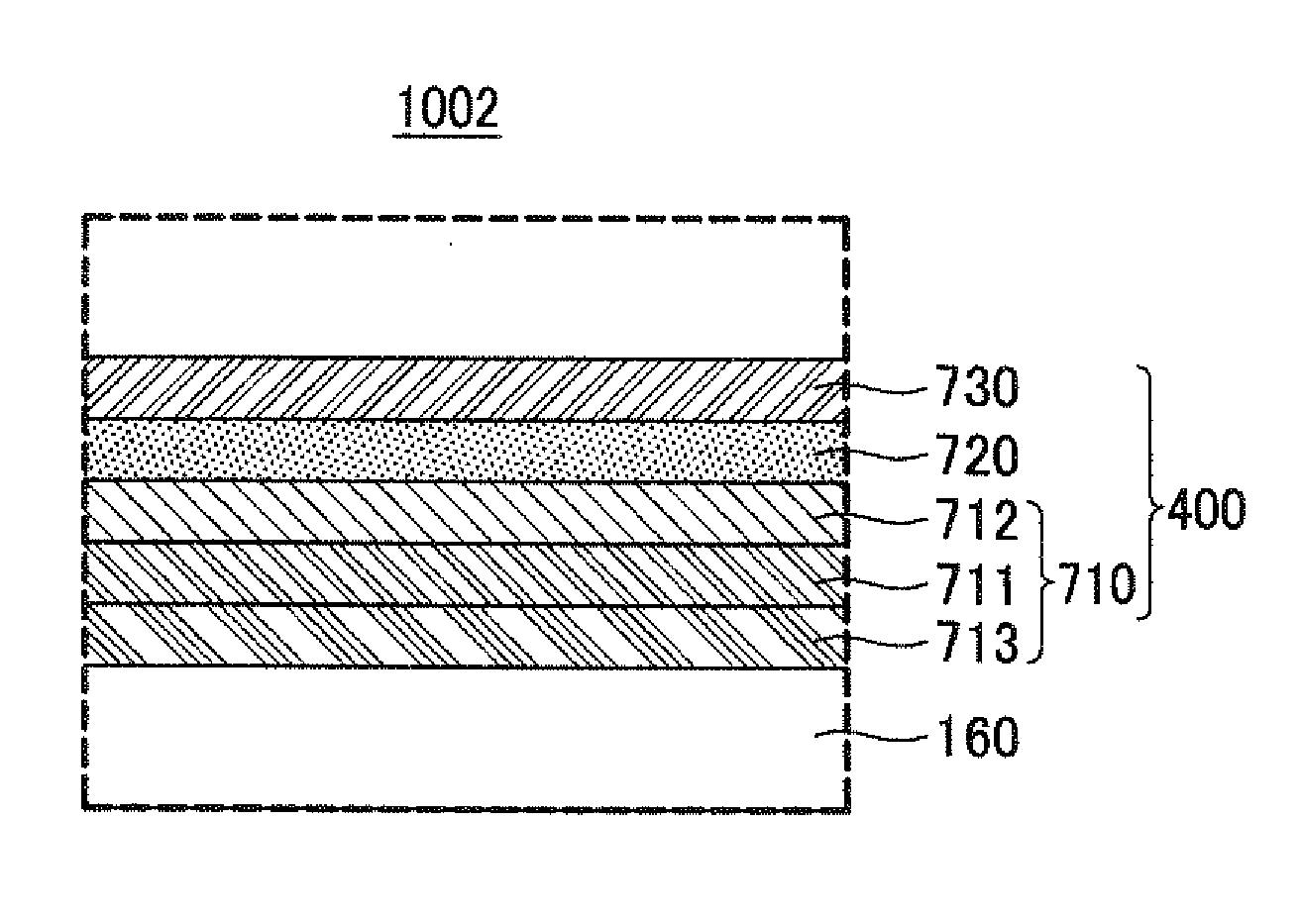

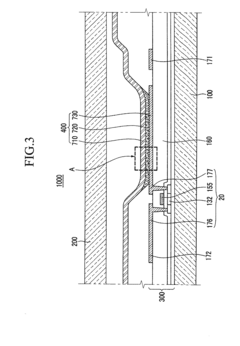

Organic Light Emitting Diode Display

PatentActiveUS20120138966A1

Innovation

- The OLED display incorporates a first electrode with a conductive black layer and a thinner, light-reflective first conductive layer between the organic emission layer and the conductive black layer, where the conductive black layer is formed by heat-treating silver under a sulfur atmosphere, and the first conductive layer has a higher work function than the second electrode, enhancing light absorption and transmission.

Safety Standards for Automotive Display Systems

Safety standards for automotive display systems, particularly those related to OLED transparent heads-up displays (HUDs), are governed by stringent regulations to ensure driver safety while maximizing the benefits of advanced visual interfaces. The primary regulatory frameworks include ISO 15008, which establishes legibility requirements for visual information presentation in vehicles, and ECE Regulation 21, which addresses interior fittings and impact protection.

For OLED transparent displays in automotive applications, safety standards specifically address luminance requirements, with minimum values of 10,000 cd/m² necessary for adequate visibility in bright daylight conditions. Contrast ratio standards mandate minimum values of 3:1 under direct sunlight to ensure information remains discernible in challenging lighting environments.

Distraction mitigation is another critical safety aspect, with regulations limiting the complexity of information presented and mandating that critical driving information must be displayed within a 5° cone of the driver's primary field of view. The ISO 2575 standard further specifies standardized symbols for automotive displays to ensure universal recognition and minimize cognitive load.

Electromagnetic compatibility standards (ECE Regulation 10) are particularly relevant for OLED HUDs, requiring that these systems neither emit harmful interference nor be susceptible to external electromagnetic disturbances. This is essential for maintaining display integrity and preventing safety-critical malfunctions.

Transparency metrics for OLED displays must comply with visibility regulations that specify minimum windshield clarity. ECE Regulation 43 mandates that automotive glazing, including areas with integrated displays, must maintain at least 70% light transmission in areas critical for driving visibility. This directly impacts the design parameters for transparent OLED technology in HUDs.

Failure mode requirements stipulate that HUD systems must include fail-safe mechanisms ensuring that display failures don't compromise driver visibility or create dangerous distractions. These standards require redundant systems and graceful degradation protocols that maintain basic functionality even during partial system failures.

Recent regulatory developments have begun addressing augmented reality (AR) HUD systems, with emerging standards focusing on preventing cognitive overload and ensuring that virtual elements don't obscure critical real-world objects. The SAE J3134 standard provides guidelines specifically for augmented reality automotive displays, including recommendations for registration accuracy between virtual elements and the physical environment.

For OLED transparent displays in automotive applications, safety standards specifically address luminance requirements, with minimum values of 10,000 cd/m² necessary for adequate visibility in bright daylight conditions. Contrast ratio standards mandate minimum values of 3:1 under direct sunlight to ensure information remains discernible in challenging lighting environments.

Distraction mitigation is another critical safety aspect, with regulations limiting the complexity of information presented and mandating that critical driving information must be displayed within a 5° cone of the driver's primary field of view. The ISO 2575 standard further specifies standardized symbols for automotive displays to ensure universal recognition and minimize cognitive load.

Electromagnetic compatibility standards (ECE Regulation 10) are particularly relevant for OLED HUDs, requiring that these systems neither emit harmful interference nor be susceptible to external electromagnetic disturbances. This is essential for maintaining display integrity and preventing safety-critical malfunctions.

Transparency metrics for OLED displays must comply with visibility regulations that specify minimum windshield clarity. ECE Regulation 43 mandates that automotive glazing, including areas with integrated displays, must maintain at least 70% light transmission in areas critical for driving visibility. This directly impacts the design parameters for transparent OLED technology in HUDs.

Failure mode requirements stipulate that HUD systems must include fail-safe mechanisms ensuring that display failures don't compromise driver visibility or create dangerous distractions. These standards require redundant systems and graceful degradation protocols that maintain basic functionality even during partial system failures.

Recent regulatory developments have begun addressing augmented reality (AR) HUD systems, with emerging standards focusing on preventing cognitive overload and ensuring that virtual elements don't obscure critical real-world objects. The SAE J3134 standard provides guidelines specifically for augmented reality automotive displays, including recommendations for registration accuracy between virtual elements and the physical environment.

Environmental Impact of OLED HUD Manufacturing

The manufacturing of OLED-based Heads-Up Display systems for automotive applications presents significant environmental considerations that warrant thorough examination. The production process involves several energy-intensive stages, including substrate preparation, thin-film deposition, encapsulation, and integration with automotive systems. These processes collectively contribute to a substantial carbon footprint, with estimates suggesting that OLED panel production generates approximately 25-40 kg CO2 equivalent per square meter of display area.

Material extraction represents another critical environmental concern. OLED displays require rare earth elements such as indium, which faces potential supply constraints. The mining and processing of these materials result in habitat disruption, water pollution, and energy consumption. Additionally, the organic compounds used in OLED manufacturing often involve toxic precursors and solvents that require careful handling and disposal protocols.

Water usage in OLED manufacturing is particularly intensive, with estimates indicating consumption of 5-7 cubic meters per square meter of display area. This water footprint becomes especially problematic in regions facing water scarcity. Furthermore, the ultrapure water required for semiconductor-grade manufacturing necessitates additional energy-intensive purification processes.

Chemical waste management presents ongoing challenges for OLED manufacturers. The production process generates various hazardous byproducts, including heavy metals, organic solvents, and photoresist residues. While leading manufacturers have implemented closed-loop recycling systems that recover approximately 70-85% of solvents, the remaining waste requires specialized treatment and disposal.

End-of-life considerations for automotive OLED HUDs reveal additional environmental implications. The complex integration of organic materials with electronic components complicates recycling efforts. Current recycling rates for automotive display components remain below 20%, with the majority entering landfills or incineration streams. The presence of potentially harmful substances further exacerbates environmental risks if not properly managed.

Several manufacturers have begun implementing more sustainable practices, including reduced-emission manufacturing facilities, solvent recovery systems, and design-for-recycling approaches. Companies like Samsung Display and LG Display have reported 15-30% reductions in carbon emissions per unit area through process optimization and renewable energy adoption. These initiatives demonstrate the industry's growing recognition of environmental responsibilities while highlighting the significant challenges that remain in creating truly sustainable OLED HUD manufacturing processes.

Material extraction represents another critical environmental concern. OLED displays require rare earth elements such as indium, which faces potential supply constraints. The mining and processing of these materials result in habitat disruption, water pollution, and energy consumption. Additionally, the organic compounds used in OLED manufacturing often involve toxic precursors and solvents that require careful handling and disposal protocols.

Water usage in OLED manufacturing is particularly intensive, with estimates indicating consumption of 5-7 cubic meters per square meter of display area. This water footprint becomes especially problematic in regions facing water scarcity. Furthermore, the ultrapure water required for semiconductor-grade manufacturing necessitates additional energy-intensive purification processes.

Chemical waste management presents ongoing challenges for OLED manufacturers. The production process generates various hazardous byproducts, including heavy metals, organic solvents, and photoresist residues. While leading manufacturers have implemented closed-loop recycling systems that recover approximately 70-85% of solvents, the remaining waste requires specialized treatment and disposal.

End-of-life considerations for automotive OLED HUDs reveal additional environmental implications. The complex integration of organic materials with electronic components complicates recycling efforts. Current recycling rates for automotive display components remain below 20%, with the majority entering landfills or incineration streams. The presence of potentially harmful substances further exacerbates environmental risks if not properly managed.

Several manufacturers have begun implementing more sustainable practices, including reduced-emission manufacturing facilities, solvent recovery systems, and design-for-recycling approaches. Companies like Samsung Display and LG Display have reported 15-30% reductions in carbon emissions per unit area through process optimization and renewable energy adoption. These initiatives demonstrate the industry's growing recognition of environmental responsibilities while highlighting the significant challenges that remain in creating truly sustainable OLED HUD manufacturing processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!