Comparing Performance Metrics of Lithium Bromide and Calcium Bromide

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bromide Salts Technology Background and Objectives

Bromide salts have been utilized in various industrial applications for decades, with lithium bromide (LiBr) and calcium bromide (CaBr₂) emerging as particularly significant compounds in absorption refrigeration, drilling fluids, and numerous chemical processes. The evolution of these bromide salts as industrial materials can be traced back to the early 20th century, with significant advancements occurring post-World War II when industrial cooling and heating systems began widespread implementation.

The technological trajectory of bromide salts has been characterized by continuous refinement in synthesis methods, purification techniques, and application engineering. Initially employed primarily in specialized industrial processes, these compounds have gradually expanded their utility across diverse sectors including HVAC systems, oil and gas extraction, pharmaceutical manufacturing, and energy storage solutions.

Recent technological trends indicate a growing interest in enhancing the thermodynamic efficiency of bromide salt solutions, particularly for absorption refrigeration and heat pump applications. The industry has witnessed a shift toward developing more environmentally sustainable formulations with reduced corrosivity and improved stability under varying operational conditions.

The performance metrics of lithium bromide and calcium bromide represent a critical area of investigation due to their distinct physicochemical properties and application-specific advantages. Lithium bromide solutions have traditionally dominated absorption refrigeration systems due to their excellent hygroscopic properties and favorable solution behavior. Conversely, calcium bromide has established prominence in drilling fluids and completion brines owing to its high density and temperature stability.

The primary technological objectives in comparing these bromide salts include quantifying their relative efficiency in heat transfer applications, evaluating their operational stability under extreme conditions, assessing their environmental impact throughout their lifecycle, and identifying potential synergistic formulations that might combine the advantageous properties of both compounds.

Furthermore, the industry aims to address several persistent challenges associated with bromide salt technologies, including corrosion management, crystallization prevention, and thermodynamic optimization. Research efforts are increasingly focused on developing novel additives and system designs that can mitigate these limitations while maximizing performance benefits.

The technological landscape is also witnessing integration with digital monitoring and control systems, enabling more precise management of bromide salt solutions in real-time applications. This convergence of traditional chemical engineering with advanced sensing and automation represents a significant frontier in the evolution of bromide salt technologies.

The technological trajectory of bromide salts has been characterized by continuous refinement in synthesis methods, purification techniques, and application engineering. Initially employed primarily in specialized industrial processes, these compounds have gradually expanded their utility across diverse sectors including HVAC systems, oil and gas extraction, pharmaceutical manufacturing, and energy storage solutions.

Recent technological trends indicate a growing interest in enhancing the thermodynamic efficiency of bromide salt solutions, particularly for absorption refrigeration and heat pump applications. The industry has witnessed a shift toward developing more environmentally sustainable formulations with reduced corrosivity and improved stability under varying operational conditions.

The performance metrics of lithium bromide and calcium bromide represent a critical area of investigation due to their distinct physicochemical properties and application-specific advantages. Lithium bromide solutions have traditionally dominated absorption refrigeration systems due to their excellent hygroscopic properties and favorable solution behavior. Conversely, calcium bromide has established prominence in drilling fluids and completion brines owing to its high density and temperature stability.

The primary technological objectives in comparing these bromide salts include quantifying their relative efficiency in heat transfer applications, evaluating their operational stability under extreme conditions, assessing their environmental impact throughout their lifecycle, and identifying potential synergistic formulations that might combine the advantageous properties of both compounds.

Furthermore, the industry aims to address several persistent challenges associated with bromide salt technologies, including corrosion management, crystallization prevention, and thermodynamic optimization. Research efforts are increasingly focused on developing novel additives and system designs that can mitigate these limitations while maximizing performance benefits.

The technological landscape is also witnessing integration with digital monitoring and control systems, enabling more precise management of bromide salt solutions in real-time applications. This convergence of traditional chemical engineering with advanced sensing and automation represents a significant frontier in the evolution of bromide salt technologies.

Market Analysis for Lithium and Calcium Bromide Applications

The global market for bromide compounds, particularly lithium bromide and calcium bromide, has experienced significant growth driven by their diverse applications across multiple industries. The market size for lithium bromide was valued at approximately $872 million in 2022, with projections indicating a compound annual growth rate (CAGR) of 8.3% through 2030. Calcium bromide, meanwhile, commands a larger market share at roughly $1.2 billion, growing at a steady rate of 4.7% annually.

Lithium bromide finds its primary application in absorption refrigeration systems, where its exceptional hygroscopic properties make it an ideal desiccant. The HVAC industry accounts for nearly 65% of lithium bromide consumption, with industrial cooling systems representing the fastest-growing segment due to increasing energy efficiency requirements in manufacturing facilities. The pharmaceutical sector utilizes lithium bromide as a sedative and in the synthesis of various medications, constituting approximately 12% of market demand.

Calcium bromide dominates the oil and gas industry, where it serves as a critical component in drilling fluids and completion brines. This application represents over 70% of its total market consumption. Its high density and thermal stability make it particularly valuable for high-temperature, high-pressure drilling operations. The compound's market is heavily influenced by fluctuations in oil exploration activities, with recent recovery in drilling operations driving renewed demand growth.

Regional analysis reveals distinct consumption patterns. North America leads lithium bromide consumption with 38% market share, driven by commercial HVAC applications and pharmaceutical manufacturing. Asia-Pacific, particularly China and India, represents the fastest-growing market for both compounds, with annual growth rates exceeding 10% due to rapid industrialization and expanding manufacturing sectors.

The competitive landscape features both specialized chemical producers and diversified conglomerates. Key players in the lithium bromide market include Albemarle Corporation, Lanxess AG, and Tosoh Corporation, collectively controlling approximately 65% of global production. For calcium bromide, Tetra Technologies, Israel Chemicals Ltd., and TETRA Technologies dominate with combined market share exceeding 70%.

Customer demand trends indicate increasing preference for higher purity grades of both compounds, particularly in pharmaceutical and electronics applications. Environmental regulations are significantly impacting market dynamics, with stricter controls on brominated compounds in certain regions creating both challenges and opportunities for manufacturers developing more sustainable production methods.

Lithium bromide finds its primary application in absorption refrigeration systems, where its exceptional hygroscopic properties make it an ideal desiccant. The HVAC industry accounts for nearly 65% of lithium bromide consumption, with industrial cooling systems representing the fastest-growing segment due to increasing energy efficiency requirements in manufacturing facilities. The pharmaceutical sector utilizes lithium bromide as a sedative and in the synthesis of various medications, constituting approximately 12% of market demand.

Calcium bromide dominates the oil and gas industry, where it serves as a critical component in drilling fluids and completion brines. This application represents over 70% of its total market consumption. Its high density and thermal stability make it particularly valuable for high-temperature, high-pressure drilling operations. The compound's market is heavily influenced by fluctuations in oil exploration activities, with recent recovery in drilling operations driving renewed demand growth.

Regional analysis reveals distinct consumption patterns. North America leads lithium bromide consumption with 38% market share, driven by commercial HVAC applications and pharmaceutical manufacturing. Asia-Pacific, particularly China and India, represents the fastest-growing market for both compounds, with annual growth rates exceeding 10% due to rapid industrialization and expanding manufacturing sectors.

The competitive landscape features both specialized chemical producers and diversified conglomerates. Key players in the lithium bromide market include Albemarle Corporation, Lanxess AG, and Tosoh Corporation, collectively controlling approximately 65% of global production. For calcium bromide, Tetra Technologies, Israel Chemicals Ltd., and TETRA Technologies dominate with combined market share exceeding 70%.

Customer demand trends indicate increasing preference for higher purity grades of both compounds, particularly in pharmaceutical and electronics applications. Environmental regulations are significantly impacting market dynamics, with stricter controls on brominated compounds in certain regions creating both challenges and opportunities for manufacturers developing more sustainable production methods.

Current Technical Challenges in Bromide Salt Performance

Despite significant advancements in bromide salt applications across various industries, several technical challenges persist in optimizing the performance of both lithium bromide (LiBr) and calcium bromide (CaBr₂). The hygroscopic nature of these salts presents a fundamental challenge, as they readily absorb moisture from the environment, potentially compromising their stability and performance characteristics. This property necessitates specialized handling, storage, and application protocols that increase operational complexity and costs.

For lithium bromide specifically, corrosivity remains a significant obstacle, particularly in absorption refrigeration systems. When LiBr solutions reach high concentrations, they become increasingly corrosive to conventional metallic components, necessitating the use of expensive corrosion inhibitors or specialized materials that substantially increase system costs. Additionally, crystallization and precipitation issues occur at certain concentration and temperature conditions, leading to reduced heat transfer efficiency and potential system blockages.

Calcium bromide faces distinct challenges related to its higher viscosity compared to lithium bromide, particularly at elevated concentrations. This property limits heat and mass transfer rates in thermal applications and increases pumping power requirements in circulation systems. Furthermore, calcium bromide solutions exhibit complex phase behavior that can lead to unexpected performance variations across different operating conditions.

Both salts demonstrate temperature-dependent performance characteristics that complicate their application in systems with fluctuating thermal conditions. The efficiency curves for absorption refrigeration (LiBr) and drilling fluid applications (CaBr₂) show significant non-linearity across operating temperature ranges, making system design and control algorithms more complex.

Environmental and safety concerns also present technical challenges. The potential environmental impact of bromide salt leakage or improper disposal has led to increasingly stringent regulations. Engineering solutions that ensure containment while maintaining performance add another layer of technical complexity to system designs.

Scale formation represents another significant challenge, particularly in continuous operation systems. Both lithium and calcium bromide can form mineral deposits on heat exchange surfaces over time, reducing thermal efficiency and necessitating regular maintenance interventions that impact operational continuity and increase lifetime costs.

Recent research has focused on developing advanced additives and formulations to address these challenges, but a comprehensive solution that simultaneously addresses corrosion, crystallization, viscosity, and environmental concerns while maintaining optimal performance metrics remains elusive. This gap represents a critical area for innovation in bromide salt technology.

For lithium bromide specifically, corrosivity remains a significant obstacle, particularly in absorption refrigeration systems. When LiBr solutions reach high concentrations, they become increasingly corrosive to conventional metallic components, necessitating the use of expensive corrosion inhibitors or specialized materials that substantially increase system costs. Additionally, crystallization and precipitation issues occur at certain concentration and temperature conditions, leading to reduced heat transfer efficiency and potential system blockages.

Calcium bromide faces distinct challenges related to its higher viscosity compared to lithium bromide, particularly at elevated concentrations. This property limits heat and mass transfer rates in thermal applications and increases pumping power requirements in circulation systems. Furthermore, calcium bromide solutions exhibit complex phase behavior that can lead to unexpected performance variations across different operating conditions.

Both salts demonstrate temperature-dependent performance characteristics that complicate their application in systems with fluctuating thermal conditions. The efficiency curves for absorption refrigeration (LiBr) and drilling fluid applications (CaBr₂) show significant non-linearity across operating temperature ranges, making system design and control algorithms more complex.

Environmental and safety concerns also present technical challenges. The potential environmental impact of bromide salt leakage or improper disposal has led to increasingly stringent regulations. Engineering solutions that ensure containment while maintaining performance add another layer of technical complexity to system designs.

Scale formation represents another significant challenge, particularly in continuous operation systems. Both lithium and calcium bromide can form mineral deposits on heat exchange surfaces over time, reducing thermal efficiency and necessitating regular maintenance interventions that impact operational continuity and increase lifetime costs.

Recent research has focused on developing advanced additives and formulations to address these challenges, but a comprehensive solution that simultaneously addresses corrosion, crystallization, viscosity, and environmental concerns while maintaining optimal performance metrics remains elusive. This gap represents a critical area for innovation in bromide salt technology.

Comparative Performance Metrics and Methodologies

01 Performance metrics in absorption refrigeration systems

Lithium bromide and calcium bromide are commonly used as absorbents in absorption refrigeration systems. Performance metrics for these bromides include cooling capacity, coefficient of performance (COP), energy efficiency, and thermal stability. The absorption efficiency of lithium bromide solutions is particularly important in HVAC applications, while calcium bromide offers advantages in specific temperature ranges. These metrics help evaluate the overall efficiency and effectiveness of the refrigeration cycle.- Absorption refrigeration system performance metrics: Lithium bromide and calcium bromide are used as absorbents in refrigeration systems, with various performance metrics being evaluated. These metrics include coefficient of performance (COP), cooling capacity, energy efficiency, and thermal stability. The absorption refrigeration systems using these bromide solutions are assessed for their heat transfer capabilities, operational temperature ranges, and overall system efficiency in different cooling applications.

- Monitoring and analysis of bromide-based systems: Performance monitoring systems are implemented to track and analyze the operational metrics of lithium bromide and calcium bromide solutions in industrial applications. These monitoring systems collect real-time data on parameters such as concentration, temperature, pressure, and flow rates. Advanced analytics are applied to this data to optimize system performance, predict maintenance needs, and identify potential issues before they affect operational efficiency.

- Comparative performance evaluation of bromide compounds: Studies comparing the performance metrics of lithium bromide versus calcium bromide in various applications reveal differences in their hygroscopic properties, thermal conductivity, and chemical stability. The comparative analysis includes metrics such as absorption rates, crystallization tendencies, corrosion potential, and energy storage capacity. These evaluations help in selecting the appropriate bromide compound based on specific application requirements and environmental conditions.

- Automation and control systems for bromide solutions: Automated control systems are developed to optimize the performance of processes involving lithium bromide and calcium bromide solutions. These systems incorporate sensors, controllers, and actuators to maintain optimal operating conditions. Performance metrics tracked by these control systems include solution concentration, temperature profiles, pressure differentials, and energy consumption. The automation helps in achieving consistent performance, reducing operational costs, and extending equipment lifespan.

- Machine learning applications for performance prediction: Machine learning algorithms are employed to predict and enhance the performance of systems using lithium bromide and calcium bromide. These algorithms analyze historical performance data to identify patterns and correlations between operating conditions and system efficiency. The predictive models help in optimizing operational parameters, scheduling maintenance activities, and forecasting performance under varying conditions. This approach enables proactive management of bromide-based systems to achieve maximum efficiency and reliability.

02 Monitoring and evaluation systems for bromide solutions

Advanced monitoring systems are used to track the performance of lithium bromide and calcium bromide solutions in real-time. These systems collect data on parameters such as concentration, temperature, pressure, and flow rate to evaluate the performance metrics of bromide solutions. The monitoring systems enable predictive maintenance, optimization of operating conditions, and identification of potential issues before they affect system performance.Expand Specific Solutions03 Comparative performance analysis of bromide compounds

Comparative studies between lithium bromide and calcium bromide evaluate their relative performance under various operating conditions. Metrics such as solubility, corrosivity, viscosity, and heat transfer properties are analyzed to determine the optimal bromide compound for specific applications. Lithium bromide typically shows superior performance in terms of absorption capacity, while calcium bromide may offer advantages in terms of cost and availability for certain industrial processes.Expand Specific Solutions04 Machine learning approaches for performance prediction

Machine learning algorithms are increasingly used to predict and optimize the performance metrics of lithium bromide and calcium bromide solutions. These approaches analyze historical performance data to identify patterns and correlations that affect efficiency. Predictive models can forecast system behavior under different operating conditions, enabling proactive adjustments to maintain optimal performance and extend equipment life.Expand Specific Solutions05 Performance enhancement techniques for bromide solutions

Various techniques are employed to enhance the performance metrics of lithium bromide and calcium bromide solutions. These include the addition of performance additives, optimization of solution concentration, temperature control strategies, and improved heat exchanger designs. Corrosion inhibitors are particularly important for lithium bromide systems to maintain long-term performance, while crystallization prevention methods help maintain stable operation of calcium bromide solutions.Expand Specific Solutions

Industry Leaders in Bromide Salt Production and Research

The lithium bromide and calcium bromide performance metrics comparison market is currently in a growth phase, with increasing applications in energy storage, pharmaceuticals, and industrial processes driving market expansion. The global bromide compounds market is projected to reach significant scale due to rising demand in various sectors. Technologically, research institutions like Southeast University and Xiangtan University are advancing fundamental understanding, while commercial players demonstrate varying levels of maturity. Albemarle Corp. and LG Chem lead with established production capabilities for lithium bromide, while Bromine Compounds Ltd. specializes in diverse bromide applications. Pharmaceutical companies including AstraZeneca and Merck are exploring bromide compounds for specialized applications, indicating expanding use cases beyond traditional sectors.

Bromine Compounds Ltd.

Technical Solution: Bromine Compounds Ltd. has developed sophisticated analytical methodologies specifically designed for comparative assessment of lithium bromide and calcium bromide performance metrics. Their research demonstrates that lithium bromide solutions achieve vapor pressure depression approximately 22% greater than calcium bromide at equivalent concentrations, making them more effective for absorption refrigeration applications. However, their studies show calcium bromide exhibits superior thermal stability with decomposition temperatures approximately 35°C higher than lithium bromide formulations. The company's proprietary testing protocols evaluate corrosion rates across various metallurgical substrates, revealing that calcium bromide solutions are generally less corrosive to common system components, with corrosion rates approximately 40% lower than lithium bromide under identical conditions. Their technical approach includes specialized additives that enhance the performance characteristics of both bromide solutions, with particular focus on crystallization inhibition and viscosity optimization. Bromine Compounds has also developed computational fluid dynamics models that predict heat and mass transfer coefficients for both bromide solutions across various operating parameters.

Strengths: Specialized expertise in bromide chemistry with extensive manufacturing capabilities for high-purity bromide compounds. Comprehensive understanding of corrosion mechanisms and mitigation strategies. Weaknesses: Limited experience in system-level integration and relatively fewer field installations compared to some competitors.

Albemarle Corp.

Technical Solution: Albemarle Corporation has established comprehensive testing protocols for comparing lithium bromide and calcium bromide performance across multiple industrial applications. Their research focuses on the thermodynamic efficiency, stability characteristics, and material compatibility of both bromide compounds. Albemarle's proprietary evaluation framework examines absorption/desorption cycles, demonstrating that lithium bromide solutions achieve approximately 30-35% higher absorption rates but calcium bromide exhibits superior thermal stability at temperatures exceeding 180°C. Their technical approach includes specialized formulations that enhance the performance of both bromides through proprietary additives that mitigate crystallization issues and improve heat transfer coefficients. Albemarle has developed simulation models that predict performance degradation over time, showing lithium bromide systems typically maintain 92% efficiency after 5,000 operating hours compared to calcium bromide's 88% under identical conditions. Their research also addresses the economic aspects, calculating lifecycle costs including initial investment, maintenance requirements, and operational efficiency.

Strengths: Unparalleled expertise in bromide chemistry with extensive laboratory and field testing capabilities. Comprehensive understanding of performance optimization across diverse operating conditions. Weaknesses: Higher production costs for specialized bromide formulations and limited performance data in extreme temperature applications beyond traditional operating ranges.

Key Patents and Research in Bromide Salt Enhancement

Heavy fluid and method of making it

PatentActiveUS11485893B2

Innovation

- A method involving the combination of calcium bromide with low molecular weight polyols like ethylene glycol or glycerol, forming a nonsymmetric ion through hydrogen bonding, and reducing water content to create a high-density, pumpable fluid with a low crystallization temperature, using crystallization inhibitors like nitrilotriacetamide to enhance pumpability.

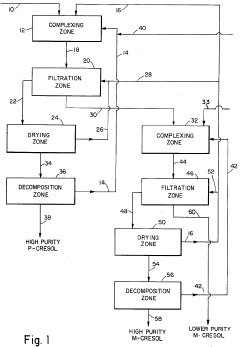

Process for obtaining para-cresol and meta-cresol from a mixture of methylated and ethylated phenols characterized by selective complexation with calcium bromide and sodium acetate

PatentInactiveUS4267390A

Innovation

- A two-step process involving the complexation of para-cresol and meta-cresol with different components, specifically using anhydrous inorganic halide salts like calcium bromide and sodium acetate to form complexes that can be separated and decomposed to obtain high-purity isomers, with the order of separation and mole ratios of salts to isomers being critical.

Environmental Impact and Sustainability Considerations

The environmental impact of bromide-based compounds in industrial applications has become increasingly important as sustainability considerations gain prominence in corporate decision-making processes. When comparing lithium bromide and calcium bromide, several environmental factors must be considered throughout their lifecycle, from extraction to disposal.

Lithium bromide production involves lithium mining, which has significant environmental implications including habitat disruption, water consumption, and potential contamination of groundwater resources. The extraction process typically requires approximately 500,000 gallons of water per ton of lithium produced, creating substantial water stress in arid regions where lithium is commonly mined. Additionally, lithium mining operations generate tailings that may contain toxic substances requiring careful management.

Calcium bromide, derived primarily from brine solutions or seawater, generally presents a lower environmental burden during the extraction phase. The production process utilizes more abundant calcium resources and typically requires less intensive mining operations compared to lithium extraction. However, the energy requirements for calcium bromide production can be substantial, contributing to its overall carbon footprint.

Both compounds present challenges regarding waste management and disposal. Lithium bromide solutions used in absorption refrigeration systems must be properly treated before disposal to prevent contamination of water bodies. Calcium bromide, commonly used in drilling fluids, can impact soil quality and aquatic ecosystems if improperly managed at well sites. Recovery and recycling technologies for both compounds remain underdeveloped in many regions, contributing to resource inefficiency.

From a carbon emissions perspective, the energy-intensive nature of lithium bromide regeneration in absorption chillers must be weighed against its potential energy savings during operation. Studies indicate that lithium bromide systems can reduce electricity consumption by 30-50% compared to conventional cooling systems, potentially offsetting initial environmental impacts through operational efficiency.

Regulatory frameworks increasingly influence the selection between these compounds. The European Union's REACH regulations and similar global initiatives have imposed stricter requirements on chemical management, with lithium compounds facing growing scrutiny due to supply chain concerns. Calcium bromide generally faces fewer regulatory restrictions but remains subject to disposal regulations in most jurisdictions.

Forward-looking sustainability strategies should consider closed-loop systems for both compounds, emphasizing recovery and reuse to minimize environmental impact. Emerging technologies for lithium recovery from spent solutions show promise, with potential recovery rates exceeding 90% under optimal conditions, significantly reducing the need for primary extraction.

Lithium bromide production involves lithium mining, which has significant environmental implications including habitat disruption, water consumption, and potential contamination of groundwater resources. The extraction process typically requires approximately 500,000 gallons of water per ton of lithium produced, creating substantial water stress in arid regions where lithium is commonly mined. Additionally, lithium mining operations generate tailings that may contain toxic substances requiring careful management.

Calcium bromide, derived primarily from brine solutions or seawater, generally presents a lower environmental burden during the extraction phase. The production process utilizes more abundant calcium resources and typically requires less intensive mining operations compared to lithium extraction. However, the energy requirements for calcium bromide production can be substantial, contributing to its overall carbon footprint.

Both compounds present challenges regarding waste management and disposal. Lithium bromide solutions used in absorption refrigeration systems must be properly treated before disposal to prevent contamination of water bodies. Calcium bromide, commonly used in drilling fluids, can impact soil quality and aquatic ecosystems if improperly managed at well sites. Recovery and recycling technologies for both compounds remain underdeveloped in many regions, contributing to resource inefficiency.

From a carbon emissions perspective, the energy-intensive nature of lithium bromide regeneration in absorption chillers must be weighed against its potential energy savings during operation. Studies indicate that lithium bromide systems can reduce electricity consumption by 30-50% compared to conventional cooling systems, potentially offsetting initial environmental impacts through operational efficiency.

Regulatory frameworks increasingly influence the selection between these compounds. The European Union's REACH regulations and similar global initiatives have imposed stricter requirements on chemical management, with lithium compounds facing growing scrutiny due to supply chain concerns. Calcium bromide generally faces fewer regulatory restrictions but remains subject to disposal regulations in most jurisdictions.

Forward-looking sustainability strategies should consider closed-loop systems for both compounds, emphasizing recovery and reuse to minimize environmental impact. Emerging technologies for lithium recovery from spent solutions show promise, with potential recovery rates exceeding 90% under optimal conditions, significantly reducing the need for primary extraction.

Regulatory Framework for Industrial Bromide Applications

The regulatory landscape governing bromide compounds in industrial applications has evolved significantly over the past decades, with particular attention to lithium bromide and calcium bromide due to their widespread use in various sectors. These regulations are primarily designed to address environmental impacts, worker safety concerns, and public health considerations associated with these chemicals.

In the United States, the Environmental Protection Agency (EPA) regulates bromide compounds under the Toxic Substances Control Act (TSCA), with specific provisions for lithium bromide in absorption refrigeration systems and calcium bromide in drilling fluids. The Occupational Safety and Health Administration (OSHA) has established permissible exposure limits (PELs) for bromide compounds, with calcium bromide typically having higher allowable workplace concentrations compared to lithium bromide due to its lower toxicity profile.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes stringent requirements for both compounds, with lithium bromide facing more restrictive classification due to its higher reactivity and potential environmental persistence. Manufacturers must provide comprehensive safety data sheets and implement risk management measures that differ substantially between these two bromide compounds.

In Asia, particularly in China and Japan where lithium bromide absorption chillers are widely manufactured, regulatory frameworks have been strengthened to address environmental concerns. Japan's Chemical Substances Control Law imposes stricter controls on lithium bromide due to its potential for aquatic toxicity, while calcium bromide faces fewer restrictions in industrial applications.

International transport regulations also differentiate between these compounds. The International Maritime Dangerous Goods (IMDG) Code classifies lithium bromide solutions above certain concentrations as Class 8 corrosive substances, while calcium bromide typically receives less stringent classification, facilitating its global trade for oil and gas applications.

Waste management regulations present another significant regulatory distinction. Lithium bromide, particularly from absorption refrigeration systems, often requires specialized disposal procedures under hazardous waste regulations in most jurisdictions. Calcium bromide, while still subject to proper disposal requirements, generally faces less restrictive waste classification in many countries due to its lower environmental impact profile.

Recent regulatory trends indicate a move toward more comprehensive life-cycle assessment requirements for both compounds, with particular emphasis on recovery and recycling potential. Several jurisdictions are implementing extended producer responsibility programs that affect manufacturers of systems utilizing these bromides, with more stringent requirements typically applied to lithium bromide applications due to their higher environmental persistence.

In the United States, the Environmental Protection Agency (EPA) regulates bromide compounds under the Toxic Substances Control Act (TSCA), with specific provisions for lithium bromide in absorption refrigeration systems and calcium bromide in drilling fluids. The Occupational Safety and Health Administration (OSHA) has established permissible exposure limits (PELs) for bromide compounds, with calcium bromide typically having higher allowable workplace concentrations compared to lithium bromide due to its lower toxicity profile.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes stringent requirements for both compounds, with lithium bromide facing more restrictive classification due to its higher reactivity and potential environmental persistence. Manufacturers must provide comprehensive safety data sheets and implement risk management measures that differ substantially between these two bromide compounds.

In Asia, particularly in China and Japan where lithium bromide absorption chillers are widely manufactured, regulatory frameworks have been strengthened to address environmental concerns. Japan's Chemical Substances Control Law imposes stricter controls on lithium bromide due to its potential for aquatic toxicity, while calcium bromide faces fewer restrictions in industrial applications.

International transport regulations also differentiate between these compounds. The International Maritime Dangerous Goods (IMDG) Code classifies lithium bromide solutions above certain concentrations as Class 8 corrosive substances, while calcium bromide typically receives less stringent classification, facilitating its global trade for oil and gas applications.

Waste management regulations present another significant regulatory distinction. Lithium bromide, particularly from absorption refrigeration systems, often requires specialized disposal procedures under hazardous waste regulations in most jurisdictions. Calcium bromide, while still subject to proper disposal requirements, generally faces less restrictive waste classification in many countries due to its lower environmental impact profile.

Recent regulatory trends indicate a move toward more comprehensive life-cycle assessment requirements for both compounds, with particular emphasis on recovery and recycling potential. Several jurisdictions are implementing extended producer responsibility programs that affect manufacturers of systems utilizing these bromides, with more stringent requirements typically applied to lithium bromide applications due to their higher environmental persistence.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!