Comparison of lithium-sulfur and lithium-ion battery performance metrics

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Battery Evolution and Research Objectives

The evolution of lithium-based battery technologies represents one of the most significant advancements in energy storage over the past three decades. Beginning with the commercialization of lithium-ion batteries (LIBs) by Sony in 1991, these energy storage devices have revolutionized portable electronics, electric vehicles, and grid-scale storage applications. The historical trajectory shows a consistent improvement in energy density from approximately 100 Wh/kg in early commercial cells to modern variants exceeding 250 Wh/kg, demonstrating the technology's maturation through incremental innovations.

While lithium-ion technology has dominated the market, fundamental limitations in energy density have prompted exploration of next-generation chemistries. Lithium-sulfur (Li-S) batteries have emerged as a promising alternative due to their theoretical energy density of 2,600 Wh/kg—nearly five times that of conventional lithium-ion systems. This substantial potential advantage has catalyzed significant research interest since the early 2000s, with accelerated development occurring over the past decade.

The current research landscape reflects a critical inflection point where conventional lithium-ion technology approaches its theoretical limits while lithium-sulfur systems overcome persistent challenges. Primary technical objectives in this comparative analysis include quantifying performance metrics across multiple dimensions: gravimetric and volumetric energy density, power capability, cycle life, temperature performance, safety characteristics, and economic viability.

Specifically, this investigation aims to establish standardized benchmarking methodologies that enable direct comparison between these disparate chemistries. Current literature reveals inconsistent testing protocols that complicate technology assessment, particularly regarding cycle life evaluation where lithium-ion cells routinely achieve thousands of cycles while lithium-sulfur systems typically demonstrate hundreds under comparable conditions.

Additionally, this research seeks to identify technological convergence opportunities where advances in one chemistry might benefit the other. For example, innovations in electrolyte formulations for lithium-ion systems may address polysulfide shuttle effects in lithium-sulfur batteries, while sulfur electrode architectures might inform high-loading cathode designs for conventional systems.

The ultimate objective extends beyond academic comparison to practical implementation pathways. By establishing application-specific performance requirements and mapping them against the capabilities of each technology, this research will provide strategic guidance for technology deployment across diverse sectors including transportation, consumer electronics, and stationary storage applications.

While lithium-ion technology has dominated the market, fundamental limitations in energy density have prompted exploration of next-generation chemistries. Lithium-sulfur (Li-S) batteries have emerged as a promising alternative due to their theoretical energy density of 2,600 Wh/kg—nearly five times that of conventional lithium-ion systems. This substantial potential advantage has catalyzed significant research interest since the early 2000s, with accelerated development occurring over the past decade.

The current research landscape reflects a critical inflection point where conventional lithium-ion technology approaches its theoretical limits while lithium-sulfur systems overcome persistent challenges. Primary technical objectives in this comparative analysis include quantifying performance metrics across multiple dimensions: gravimetric and volumetric energy density, power capability, cycle life, temperature performance, safety characteristics, and economic viability.

Specifically, this investigation aims to establish standardized benchmarking methodologies that enable direct comparison between these disparate chemistries. Current literature reveals inconsistent testing protocols that complicate technology assessment, particularly regarding cycle life evaluation where lithium-ion cells routinely achieve thousands of cycles while lithium-sulfur systems typically demonstrate hundreds under comparable conditions.

Additionally, this research seeks to identify technological convergence opportunities where advances in one chemistry might benefit the other. For example, innovations in electrolyte formulations for lithium-ion systems may address polysulfide shuttle effects in lithium-sulfur batteries, while sulfur electrode architectures might inform high-loading cathode designs for conventional systems.

The ultimate objective extends beyond academic comparison to practical implementation pathways. By establishing application-specific performance requirements and mapping them against the capabilities of each technology, this research will provide strategic guidance for technology deployment across diverse sectors including transportation, consumer electronics, and stationary storage applications.

Market Demand Analysis for Next-Generation Energy Storage

The global energy storage market is witnessing unprecedented growth, driven by the increasing adoption of renewable energy sources and the electrification of transportation. The demand for next-generation energy storage solutions has surged dramatically, with the global market projected to reach $546 billion by 2035, growing at a CAGR of 19.7% from 2023. Within this landscape, lithium-sulfur (Li-S) batteries are emerging as a promising alternative to conventional lithium-ion (Li-ion) batteries, particularly for applications requiring higher energy density and lower weight.

The electric vehicle (EV) sector represents the largest market opportunity for advanced battery technologies. With global EV sales exceeding 10 million units in 2022 and expected to reach 40 million by 2030, automotive manufacturers are actively seeking battery technologies that offer extended range, faster charging capabilities, and improved safety profiles. Li-S batteries, with their theoretical energy density of 2,600 Wh/kg (compared to Li-ion's 387 Wh/kg), present a compelling value proposition for this sector.

Consumer electronics constitutes another significant market segment, valued at $1.38 trillion in 2022. The demand for longer-lasting, lighter, and more powerful portable devices continues to grow, creating opportunities for Li-S batteries. The theoretical advantages of Li-S technology align perfectly with consumer preferences for devices with extended battery life and reduced weight.

Aerospace and defense applications represent a premium market segment where the weight-to-energy ratio is critical. The global aerospace battery market, valued at $7.8 billion in 2022, is projected to grow at 7.2% annually through 2030. Li-S batteries' superior gravimetric energy density makes them particularly attractive for drone, satellite, and military applications where weight reduction directly translates to extended operational capabilities.

Grid-scale energy storage represents another expanding market, driven by the integration of intermittent renewable energy sources. This sector is expected to grow from $4.4 billion in 2022 to $15.1 billion by 2027. While current Li-S technology faces challenges in cycle life that limit its immediate application in stationary storage, ongoing research addressing this limitation could unlock this substantial market segment.

Regional analysis indicates that Asia-Pacific, particularly China, South Korea, and Japan, leads in battery manufacturing capacity and technology development. However, significant investments in North America and Europe aim to establish regional supply chains and reduce dependence on Asian manufacturers. This geographical diversification creates opportunities for emerging technologies like Li-S batteries to gain market share through regional innovation ecosystems.

The electric vehicle (EV) sector represents the largest market opportunity for advanced battery technologies. With global EV sales exceeding 10 million units in 2022 and expected to reach 40 million by 2030, automotive manufacturers are actively seeking battery technologies that offer extended range, faster charging capabilities, and improved safety profiles. Li-S batteries, with their theoretical energy density of 2,600 Wh/kg (compared to Li-ion's 387 Wh/kg), present a compelling value proposition for this sector.

Consumer electronics constitutes another significant market segment, valued at $1.38 trillion in 2022. The demand for longer-lasting, lighter, and more powerful portable devices continues to grow, creating opportunities for Li-S batteries. The theoretical advantages of Li-S technology align perfectly with consumer preferences for devices with extended battery life and reduced weight.

Aerospace and defense applications represent a premium market segment where the weight-to-energy ratio is critical. The global aerospace battery market, valued at $7.8 billion in 2022, is projected to grow at 7.2% annually through 2030. Li-S batteries' superior gravimetric energy density makes them particularly attractive for drone, satellite, and military applications where weight reduction directly translates to extended operational capabilities.

Grid-scale energy storage represents another expanding market, driven by the integration of intermittent renewable energy sources. This sector is expected to grow from $4.4 billion in 2022 to $15.1 billion by 2027. While current Li-S technology faces challenges in cycle life that limit its immediate application in stationary storage, ongoing research addressing this limitation could unlock this substantial market segment.

Regional analysis indicates that Asia-Pacific, particularly China, South Korea, and Japan, leads in battery manufacturing capacity and technology development. However, significant investments in North America and Europe aim to establish regional supply chains and reduce dependence on Asian manufacturers. This geographical diversification creates opportunities for emerging technologies like Li-S batteries to gain market share through regional innovation ecosystems.

Technical Status and Challenges in Li-S vs Li-ion Technologies

Lithium-sulfur (Li-S) and lithium-ion (Li-ion) batteries represent two distinct technological approaches in energy storage, each with unique performance characteristics and development challenges. Currently, Li-ion technology dominates the commercial market with widespread implementation across consumer electronics, electric vehicles, and grid storage applications. This mature technology benefits from decades of research and manufacturing optimization, resulting in reliable performance metrics including energy densities of 100-265 Wh/kg, cycle life exceeding 1,000 cycles, and coulombic efficiencies above 99%.

In contrast, Li-S battery technology remains predominantly in the research and early commercialization phase. While theoretical energy density calculations suggest Li-S could achieve up to 2,600 Wh/kg (approximately five times that of Li-ion), practical implementations currently deliver only 300-500 Wh/kg. The primary technical challenges limiting Li-S advancement include the "shuttle effect" where polysulfide intermediates dissolve in the electrolyte and migrate between electrodes, causing rapid capacity fading and reduced cycle life (typically 100-200 cycles).

Geographically, Li-ion technology development is concentrated in East Asia (Japan, South Korea, China), North America, and Europe, with China currently leading in manufacturing capacity. Li-S research shows a more distributed pattern with significant contributions from academic institutions in Europe, North America, and increasingly China, though commercial development remains limited to specialized companies like Oxis Energy (UK), Sion Power (US), and PolyPlus (US).

The performance gap between theoretical potential and practical implementation represents the central challenge for Li-S technology. While Li-S offers advantages in specific energy, cost (sulfur being abundant and inexpensive), and environmental impact, it faces significant hurdles in cycle stability, rate capability, and self-discharge characteristics. Current Li-S batteries exhibit poor rate performance compared to Li-ion, with significant capacity loss at higher discharge rates.

Manufacturing scalability presents another critical challenge. Li-ion benefits from established, optimized production infrastructure, while Li-S requires novel manufacturing approaches to address issues like sulfur loading, electrode structure control, and electrolyte stability. The highly reactive nature of lithium metal anodes in Li-S systems also introduces safety concerns that require innovative protection strategies and advanced battery management systems.

Recent advancements in nanostructured carbon hosts, functional separators, and electrolyte additives have shown promise in addressing some Li-S limitations, but significant engineering challenges remain before Li-S can compete with Li-ion in mainstream applications. The technology readiness level (TRL) for Li-S currently stands at approximately 5-6, compared to Li-ion's 9.

In contrast, Li-S battery technology remains predominantly in the research and early commercialization phase. While theoretical energy density calculations suggest Li-S could achieve up to 2,600 Wh/kg (approximately five times that of Li-ion), practical implementations currently deliver only 300-500 Wh/kg. The primary technical challenges limiting Li-S advancement include the "shuttle effect" where polysulfide intermediates dissolve in the electrolyte and migrate between electrodes, causing rapid capacity fading and reduced cycle life (typically 100-200 cycles).

Geographically, Li-ion technology development is concentrated in East Asia (Japan, South Korea, China), North America, and Europe, with China currently leading in manufacturing capacity. Li-S research shows a more distributed pattern with significant contributions from academic institutions in Europe, North America, and increasingly China, though commercial development remains limited to specialized companies like Oxis Energy (UK), Sion Power (US), and PolyPlus (US).

The performance gap between theoretical potential and practical implementation represents the central challenge for Li-S technology. While Li-S offers advantages in specific energy, cost (sulfur being abundant and inexpensive), and environmental impact, it faces significant hurdles in cycle stability, rate capability, and self-discharge characteristics. Current Li-S batteries exhibit poor rate performance compared to Li-ion, with significant capacity loss at higher discharge rates.

Manufacturing scalability presents another critical challenge. Li-ion benefits from established, optimized production infrastructure, while Li-S requires novel manufacturing approaches to address issues like sulfur loading, electrode structure control, and electrolyte stability. The highly reactive nature of lithium metal anodes in Li-S systems also introduces safety concerns that require innovative protection strategies and advanced battery management systems.

Recent advancements in nanostructured carbon hosts, functional separators, and electrolyte additives have shown promise in addressing some Li-S limitations, but significant engineering challenges remain before Li-S can compete with Li-ion in mainstream applications. The technology readiness level (TRL) for Li-S currently stands at approximately 5-6, compared to Li-ion's 9.

Current Performance Metrics Comparison Methodologies

01 Energy density and capacity metrics

Lithium-sulfur batteries offer higher theoretical energy density compared to lithium-ion batteries, with potential to reach 2500-2600 Wh/kg versus 387 Wh/kg for conventional lithium-ion cells. This significant advantage makes lithium-sulfur batteries promising for applications requiring high energy storage in lightweight packages. The capacity metrics are typically measured in mAh/g, with lithium-sulfur batteries theoretically capable of delivering up to 1675 mAh/g compared to 150-200 mAh/g for typical lithium-ion cathode materials.- Energy density and capacity improvements in lithium-sulfur batteries: Lithium-sulfur batteries offer significantly higher theoretical energy density compared to conventional lithium-ion batteries. Various approaches have been developed to improve the practical capacity and energy density of lithium-sulfur batteries, including novel cathode structures, electrolyte formulations, and sulfur hosts. These improvements aim to address the challenges of sulfur utilization and polysulfide shuttling that typically limit the performance of lithium-sulfur batteries.

- Cycle life and stability enhancements: Improving the cycle life and stability of both lithium-ion and lithium-sulfur batteries is crucial for their commercial viability. Research focuses on addressing degradation mechanisms such as electrode material breakdown, electrolyte decomposition, and formation of unstable interfaces. Advanced materials and protective coatings have been developed to enhance the structural stability of electrodes during repeated charge-discharge cycles, leading to batteries with longer operational lifetimes.

- Rate capability and fast-charging performance: The rate capability of batteries determines their performance under high current loads and fast-charging conditions. Innovations in electrode architecture, ion transport pathways, and electrolyte conductivity have been implemented to improve the rate performance of both lithium-ion and lithium-sulfur batteries. These advancements enable batteries to maintain high capacity retention even at elevated charge-discharge rates, which is essential for applications requiring rapid energy delivery or recharging.

- Temperature performance and safety metrics: Operating temperature range and safety characteristics are critical performance metrics for battery technologies. Research has focused on developing battery components that maintain stable performance across wide temperature ranges and incorporate safety features to prevent thermal runaway, short circuits, and other failure modes. These developments include flame-retardant electrolytes, thermal management systems, and separator materials with enhanced mechanical and thermal stability.

- Comparative performance analysis between lithium-sulfur and lithium-ion technologies: Direct comparisons between lithium-sulfur and lithium-ion battery technologies reveal their respective advantages and limitations across various performance metrics. While lithium-sulfur batteries generally offer higher theoretical energy density and potentially lower cost due to abundant sulfur resources, lithium-ion batteries currently demonstrate superior cycle life, rate capability, and operational stability. These comparative analyses guide research directions and help identify the most suitable battery technology for specific applications based on their performance requirements.

02 Cycle life and degradation mechanisms

Lithium-sulfur batteries face significant challenges in cycle life compared to lithium-ion batteries. While commercial lithium-ion batteries can achieve 1000+ cycles with minimal capacity loss, lithium-sulfur batteries typically show rapid capacity fading within 100-200 cycles. The primary degradation mechanisms in lithium-sulfur batteries include polysulfide shuttling, lithium dendrite formation, and volume expansion during cycling. Various approaches to mitigate these issues include advanced electrolyte formulations, protective coatings for lithium anodes, and novel cathode architectures.Expand Specific Solutions03 Rate capability and power performance

Rate capability metrics measure how batteries perform under different charge/discharge rates. Lithium-ion batteries generally exhibit superior rate capability compared to lithium-sulfur batteries due to faster reaction kinetics and better electronic/ionic conductivity. Lithium-sulfur batteries suffer from poor electronic conductivity of sulfur and slow conversion reaction kinetics. Power density metrics show lithium-ion batteries typically achieving 300-1500 W/kg while lithium-sulfur batteries struggle to maintain performance at high current densities, though recent advancements with conductive additives and optimized electrode structures have shown improvements.Expand Specific Solutions04 Temperature performance and safety characteristics

Temperature performance metrics evaluate battery operation across various temperature ranges. Lithium-ion batteries typically operate optimally between 15-35°C but can function from -20°C to 60°C with reduced performance. Lithium-sulfur batteries often show poorer low-temperature performance due to increased electrolyte resistance and slower reaction kinetics. Safety characteristics differ significantly between the two technologies. Lithium-sulfur batteries offer potential safety advantages due to the absence of oxygen in the cathode structure, reducing thermal runaway risks compared to oxide-based lithium-ion cathodes, though they present unique challenges related to polysulfide reactions and lithium metal anodes.Expand Specific Solutions05 Cost and manufacturing considerations

Cost metrics for lithium-sulfur and lithium-ion batteries include raw material costs, manufacturing complexity, and production scalability. Lithium-sulfur batteries potentially offer cost advantages due to the abundance and low cost of sulfur compared to cobalt and nickel used in lithium-ion cathodes. However, manufacturing challenges for lithium-sulfur batteries include controlling the uniformity of sulfur distribution, managing electrolyte quantities, and implementing protective measures for lithium metal anodes. Current lithium-ion manufacturing benefits from decades of optimization and economies of scale, while lithium-sulfur production requires new manufacturing approaches to address unique material handling requirements.Expand Specific Solutions

Key Industry Players in Advanced Battery Manufacturing

The lithium-sulfur battery market is in an early growth phase, with significant potential to disrupt the mature lithium-ion battery industry due to theoretical energy density advantages (up to 5x higher). Market size remains relatively small but is projected to expand rapidly as technical challenges are addressed. Leading established players like Samsung SDI, LG Energy Solution, and Panasonic maintain dominance in the broader battery sector, while specialized companies such as Lyten and TDA Research are making significant advances in lithium-sulfur technology. Academic institutions including MIT, Fudan University, and Shanghai Jiao Tong University are contributing crucial research to overcome key technical barriers including sulfur cathode stability, polysulfide shuttle effect, and limited cycle life. The technology is approaching commercial viability for niche applications but requires further development for mainstream adoption.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced lithium-ion battery technologies while also conducting research into lithium-sulfur alternatives. Their current lithium-ion portfolio features high-nickel cathodes (NCM 811 and NCM 9½½) achieving energy densities of 250-300 Wh/kg with cycle life exceeding 2000 cycles. For lithium-sulfur research, they've focused on composite sulfur cathodes with conductive carbon matrices that mitigate polysulfide dissolution. Their comparative analysis shows lithium-sulfur batteries achieving theoretical energy densities up to 2600 Wh/kg compared to lithium-ion's 387 Wh/kg theoretical maximum. LG has also developed silicon-carbon composite anodes compatible with both chemistries to enhance energy density while maintaining structural stability during cycling.

Strengths: Established manufacturing infrastructure that could be adapted for lithium-sulfur production, strong battery management system expertise applicable to both chemistries, and extensive supply chain relationships. Weaknesses: Heavy investment in lithium-ion technology creates potential resistance to rapid lithium-sulfur adoption, and their lithium-sulfur solutions still face cycle life limitations compared to their mature lithium-ion offerings.

SAMSUNG SDI CO LTD

Technical Solution: Samsung SDI has developed comprehensive comparative frameworks for lithium-sulfur and lithium-ion technologies. Their research demonstrates lithium-sulfur cells achieving practical energy densities of 400-600 Wh/kg compared to their latest lithium-ion cells at 250-280 Wh/kg. Samsung's approach to lithium-sulfur batteries incorporates carbon-sulfur composites with specialized porous structures that accommodate sulfur volumetric expansion during cycling. Their proprietary electrolyte additives have shown to reduce polysulfide shuttling by forming stable interfaces between electrodes and electrolyte. Samsung has conducted extensive life cycle analysis showing lithium-sulfur batteries have approximately 25% lower carbon footprint during production compared to equivalent lithium-ion cells, primarily due to reduced transition metal requirements.

Strengths: Vertical integration capabilities from materials to cell manufacturing, strong intellectual property portfolio covering both battery chemistries, and established relationships with electronics and automotive customers. Weaknesses: Current lithium-sulfur prototypes still demonstrate lower cycle life (300-500 cycles) compared to their commercial lithium-ion offerings (1000+ cycles), and higher self-discharge rates remain a challenge.

Critical Patents and Breakthroughs in Li-S Battery Technology

Lithium-sulfur battery

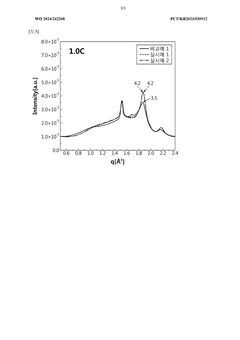

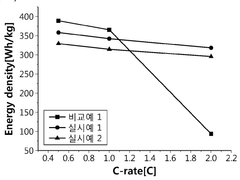

PatentWO2024242268A1

Innovation

- The development of a lithium sulfur battery with a sulfur-carbon composite positive electrode active material, optimized electrolyte composition, and specific structural features that maintain high output characteristics by ensuring efficient conversion reactions even at high discharge rates, such as a sulfur/carbon weight ratio of 2.7 g/g or more and a non-aqueous solvent-based electrolyte, enhancing energy density and capacity retention.

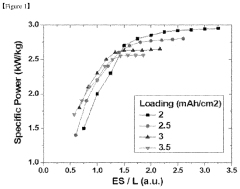

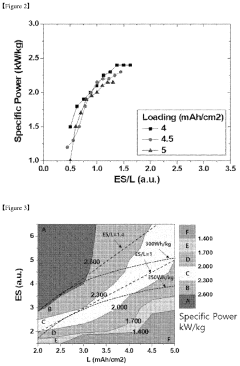

Lithium-sulfur battery with improved energy density and power

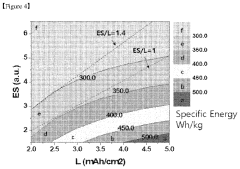

PatentPendingUS20240120479A1

Innovation

- A lithium-sulfur battery design with a specific ratio of sulfur mass in the positive electrode to electrolyte mass and sulfur loading value, within the range of 1≤ES/L≤1.4, where ES is the mass of electrolyte divided by sulfur mass and L is the sulfur loading value in mAh/cm², optimizing energy density and power performance.

Environmental Impact and Sustainability Assessment

The environmental footprint of battery technologies has become a critical consideration in their development and deployment. Lithium-sulfur (Li-S) batteries demonstrate significant environmental advantages over conventional lithium-ion (Li-ion) batteries in several key aspects. The raw material acquisition for Li-S batteries involves sulfur, an abundant by-product of petroleum refining, which substantially reduces the environmental impact compared to the cobalt and nickel mining required for Li-ion batteries. This difference translates to approximately 60% lower carbon emissions during the material extraction phase for Li-S batteries.

Manufacturing processes for Li-S batteries generally consume less energy and produce fewer toxic by-products than Li-ion counterparts. Research indicates that Li-S battery production can reduce energy consumption by up to 30% compared to conventional Li-ion manufacturing. Additionally, the absence of cobalt and nickel in Li-S batteries eliminates the ethical concerns associated with mining these materials, particularly in regions with questionable labor practices.

During the operational phase, both battery technologies demonstrate minimal direct environmental impact. However, the higher energy density of Li-S batteries (potentially reaching 500-600 Wh/kg compared to 250-300 Wh/kg for Li-ion) means fewer batteries are needed for equivalent energy storage, reducing the overall material footprint of energy storage systems.

End-of-life considerations reveal perhaps the most significant environmental advantage of Li-S technology. The recyclability of sulfur cathodes is substantially higher than the complex metal oxide cathodes in Li-ion batteries. Current recycling processes can recover up to 95% of sulfur from spent Li-S batteries, compared to approximately 50-70% recovery rates for critical materials in Li-ion batteries. This superior recyclability creates a more circular material economy and reduces waste.

Life cycle assessments (LCAs) comparing both technologies indicate that Li-S batteries can achieve a 25-30% reduction in global warming potential over their complete life cycle. Water usage metrics also favor Li-S technology, with approximately 40% less water consumption throughout the battery lifecycle compared to conventional Li-ion batteries.

Despite these advantages, challenges remain in scaling Li-S battery production while maintaining their environmental benefits. The shorter cycle life of current Li-S batteries (typically 300-500 cycles versus 1,000+ for Li-ion) potentially offsets some sustainability gains through more frequent replacement requirements. Ongoing research focuses on extending Li-S battery lifespan while preserving their inherent environmental advantages, with recent laboratory demonstrations achieving 700+ cycles without significant performance degradation.

Manufacturing processes for Li-S batteries generally consume less energy and produce fewer toxic by-products than Li-ion counterparts. Research indicates that Li-S battery production can reduce energy consumption by up to 30% compared to conventional Li-ion manufacturing. Additionally, the absence of cobalt and nickel in Li-S batteries eliminates the ethical concerns associated with mining these materials, particularly in regions with questionable labor practices.

During the operational phase, both battery technologies demonstrate minimal direct environmental impact. However, the higher energy density of Li-S batteries (potentially reaching 500-600 Wh/kg compared to 250-300 Wh/kg for Li-ion) means fewer batteries are needed for equivalent energy storage, reducing the overall material footprint of energy storage systems.

End-of-life considerations reveal perhaps the most significant environmental advantage of Li-S technology. The recyclability of sulfur cathodes is substantially higher than the complex metal oxide cathodes in Li-ion batteries. Current recycling processes can recover up to 95% of sulfur from spent Li-S batteries, compared to approximately 50-70% recovery rates for critical materials in Li-ion batteries. This superior recyclability creates a more circular material economy and reduces waste.

Life cycle assessments (LCAs) comparing both technologies indicate that Li-S batteries can achieve a 25-30% reduction in global warming potential over their complete life cycle. Water usage metrics also favor Li-S technology, with approximately 40% less water consumption throughout the battery lifecycle compared to conventional Li-ion batteries.

Despite these advantages, challenges remain in scaling Li-S battery production while maintaining their environmental benefits. The shorter cycle life of current Li-S batteries (typically 300-500 cycles versus 1,000+ for Li-ion) potentially offsets some sustainability gains through more frequent replacement requirements. Ongoing research focuses on extending Li-S battery lifespan while preserving their inherent environmental advantages, with recent laboratory demonstrations achieving 700+ cycles without significant performance degradation.

Scalability and Manufacturing Considerations

The scalability of lithium-sulfur (Li-S) batteries presents significant challenges compared to the well-established lithium-ion (Li-ion) manufacturing ecosystem. Current Li-ion production benefits from decades of optimization, with global manufacturing capacity exceeding 500 GWh annually across established facilities in Asia, Europe, and North America. In contrast, Li-S battery production remains largely confined to laboratory and pilot scales, with few facilities capable of consistent commercial-scale manufacturing.

Manufacturing complexity represents a critical differentiator between these technologies. Li-ion batteries utilize standardized production processes including electrode coating, calendering, and cell assembly that have been refined for high-throughput operations. Li-S batteries require specialized handling of sulfur cathodes, which are more sensitive to environmental conditions and exhibit greater batch-to-batch variability. The sulfur electrode preparation often demands precise temperature control and inert atmosphere processing that complicates scaling efforts.

Material supply chains further impact scalability considerations. Li-ion batteries rely on established supply networks for graphite, lithium metal oxides, and electrolyte materials. While some materials face supply constraints, the ecosystem is mature. Conversely, Li-S batteries require high-purity sulfur and specialized carbon hosts, with supply chains still developing. The lithium metal anodes often used in Li-S systems also present manufacturing challenges due to their reactivity and safety concerns during handling.

Cost structures differ significantly between technologies. Li-ion manufacturing benefits from economies of scale, with pack-level costs approaching $100/kWh in some applications. Li-S technology theoretically offers lower material costs due to sulfur's abundance and low price ($0.10-0.20/kg versus $15-20/kg for cobalt), but current manufacturing inefficiencies and lower production volumes result in higher overall costs. Industry analysts estimate commercial Li-S cells currently cost 2-3 times more than equivalent Li-ion cells.

Quality control and consistency present additional manufacturing hurdles for Li-S technology. Li-ion production employs sophisticated in-line monitoring systems that maintain tight tolerances across millions of cells. Li-S manufacturing faces challenges with polysulfide shuttle control, electrode microstructure consistency, and electrolyte stability that complicate quality assurance at scale. These factors contribute to higher rejection rates and reduced manufacturing yield compared to Li-ion production.

Environmental considerations also impact manufacturing scalability. Li-S battery production potentially offers reduced environmental footprint through elimination of transition metals and use of abundant sulfur. However, specialized processing requirements and current manufacturing inefficiencies partially offset these advantages until production scales mature.

Manufacturing complexity represents a critical differentiator between these technologies. Li-ion batteries utilize standardized production processes including electrode coating, calendering, and cell assembly that have been refined for high-throughput operations. Li-S batteries require specialized handling of sulfur cathodes, which are more sensitive to environmental conditions and exhibit greater batch-to-batch variability. The sulfur electrode preparation often demands precise temperature control and inert atmosphere processing that complicates scaling efforts.

Material supply chains further impact scalability considerations. Li-ion batteries rely on established supply networks for graphite, lithium metal oxides, and electrolyte materials. While some materials face supply constraints, the ecosystem is mature. Conversely, Li-S batteries require high-purity sulfur and specialized carbon hosts, with supply chains still developing. The lithium metal anodes often used in Li-S systems also present manufacturing challenges due to their reactivity and safety concerns during handling.

Cost structures differ significantly between technologies. Li-ion manufacturing benefits from economies of scale, with pack-level costs approaching $100/kWh in some applications. Li-S technology theoretically offers lower material costs due to sulfur's abundance and low price ($0.10-0.20/kg versus $15-20/kg for cobalt), but current manufacturing inefficiencies and lower production volumes result in higher overall costs. Industry analysts estimate commercial Li-S cells currently cost 2-3 times more than equivalent Li-ion cells.

Quality control and consistency present additional manufacturing hurdles for Li-S technology. Li-ion production employs sophisticated in-line monitoring systems that maintain tight tolerances across millions of cells. Li-S manufacturing faces challenges with polysulfide shuttle control, electrode microstructure consistency, and electrolyte stability that complicate quality assurance at scale. These factors contribute to higher rejection rates and reduced manufacturing yield compared to Li-ion production.

Environmental considerations also impact manufacturing scalability. Li-S battery production potentially offers reduced environmental footprint through elimination of transition metals and use of abundant sulfur. However, specialized processing requirements and current manufacturing inefficiencies partially offset these advantages until production scales mature.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!