Electrolyte formulation strategies for high-energy lithium-sulfur batteries

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Li-S Battery Electrolyte Development Background and Objectives

Lithium-sulfur (Li-S) batteries have emerged as promising candidates for next-generation energy storage systems due to their theoretical energy density of 2600 Wh/kg, which far exceeds that of conventional lithium-ion batteries (typically 250-300 Wh/kg). The development of Li-S battery technology can be traced back to the 1960s, but significant research momentum has only built up in the past two decades as the demand for high-energy density storage solutions has intensified across various sectors including electric vehicles, portable electronics, and grid storage.

The evolution of Li-S battery technology has been characterized by several distinct phases. Initial research focused on understanding the fundamental electrochemistry of sulfur cathodes and lithium anodes. This was followed by efforts to address the "shuttle effect" - the dissolution of lithium polysulfides in the electrolyte causing capacity fading and short cycle life. Recent years have witnessed a shift toward electrolyte engineering as a critical approach to overcome these challenges.

Electrolyte formulation has emerged as a pivotal factor in Li-S battery performance, with research trends moving from conventional carbonate-based electrolytes toward ether-based systems, and more recently, to advanced functional electrolytes incorporating additives, ionic liquids, and solid-state configurations. This evolution reflects the growing recognition that electrolyte chemistry directly impacts sulfur utilization, polysulfide dissolution, and lithium anode stability.

Current technical objectives in Li-S electrolyte development focus on several key areas: minimizing the shuttle effect through electrolyte modification, enhancing ionic conductivity while reducing polysulfide solubility, protecting the lithium anode from dendrite formation and parasitic reactions, and ensuring long-term cycling stability under practical conditions. Additionally, there is increasing emphasis on developing electrolytes that enable high sulfur loading and lean electrolyte conditions to achieve commercially viable energy densities.

The field is now witnessing convergence toward multifunctional electrolyte systems that simultaneously address multiple challenges. These include localized high-concentration electrolytes, dual-salt strategies, and electrolytes with self-healing properties. The ultimate goal is to develop electrolyte formulations that enable Li-S batteries to achieve energy densities above 500 Wh/kg at the cell level with cycle life exceeding 1000 cycles - metrics considered necessary for commercial viability.

As global energy demands continue to rise and climate concerns intensify, the development of high-energy Li-S batteries represents a strategic technological priority. Success in electrolyte formulation could potentially revolutionize energy storage capabilities across multiple industries and accelerate the transition toward renewable energy systems and electrified transportation.

The evolution of Li-S battery technology has been characterized by several distinct phases. Initial research focused on understanding the fundamental electrochemistry of sulfur cathodes and lithium anodes. This was followed by efforts to address the "shuttle effect" - the dissolution of lithium polysulfides in the electrolyte causing capacity fading and short cycle life. Recent years have witnessed a shift toward electrolyte engineering as a critical approach to overcome these challenges.

Electrolyte formulation has emerged as a pivotal factor in Li-S battery performance, with research trends moving from conventional carbonate-based electrolytes toward ether-based systems, and more recently, to advanced functional electrolytes incorporating additives, ionic liquids, and solid-state configurations. This evolution reflects the growing recognition that electrolyte chemistry directly impacts sulfur utilization, polysulfide dissolution, and lithium anode stability.

Current technical objectives in Li-S electrolyte development focus on several key areas: minimizing the shuttle effect through electrolyte modification, enhancing ionic conductivity while reducing polysulfide solubility, protecting the lithium anode from dendrite formation and parasitic reactions, and ensuring long-term cycling stability under practical conditions. Additionally, there is increasing emphasis on developing electrolytes that enable high sulfur loading and lean electrolyte conditions to achieve commercially viable energy densities.

The field is now witnessing convergence toward multifunctional electrolyte systems that simultaneously address multiple challenges. These include localized high-concentration electrolytes, dual-salt strategies, and electrolytes with self-healing properties. The ultimate goal is to develop electrolyte formulations that enable Li-S batteries to achieve energy densities above 500 Wh/kg at the cell level with cycle life exceeding 1000 cycles - metrics considered necessary for commercial viability.

As global energy demands continue to rise and climate concerns intensify, the development of high-energy Li-S batteries represents a strategic technological priority. Success in electrolyte formulation could potentially revolutionize energy storage capabilities across multiple industries and accelerate the transition toward renewable energy systems and electrified transportation.

Market Analysis for High-Energy Battery Technologies

The high-energy battery market is experiencing unprecedented growth, driven by increasing demand for electric vehicles (EVs), renewable energy storage systems, and portable electronics. The global market for advanced batteries reached $95.7 billion in 2022 and is projected to grow at a CAGR of 15.9% through 2030, with lithium-sulfur (Li-S) batteries positioned as a promising next-generation technology within this expanding sector.

Lithium-sulfur batteries represent a significant market opportunity due to their theoretical energy density of 2600 Wh/kg, which far exceeds the 600 Wh/kg limit of conventional lithium-ion batteries. This dramatic improvement addresses the critical "range anxiety" barrier in EV adoption and enables longer-lasting portable electronics, creating substantial market pull for this technology.

The EV segment demonstrates the most immediate commercial potential for Li-S batteries, with the global electric vehicle market expected to reach $802.8 billion by 2027. Major automotive manufacturers including Tesla, Volkswagen, and Toyota have established research initiatives exploring sulfur-based cathode technologies, indicating strong industry interest in commercializing these high-energy systems.

Stationary energy storage represents another significant market opportunity, projected to grow to $31.2 billion by 2029. The high energy density and potentially lower cost of Li-S batteries (due to sulfur's natural abundance) align perfectly with grid-scale storage requirements, particularly for renewable energy integration where energy density constraints are less critical than in mobile applications.

Consumer electronics constitutes the third major market segment, with manufacturers seeking higher-capacity batteries to support increasingly power-hungry devices. This market values the combination of high energy density and lightweight characteristics that Li-S technology promises to deliver.

Market barriers for Li-S battery adoption include competition from established lithium-ion technologies, which benefit from mature manufacturing infrastructure and continuous incremental improvements. Additionally, emerging technologies like solid-state batteries and sodium-ion systems are competing for R&D resources and market attention.

The electrolyte formulation segment within the Li-S battery market is particularly valuable, as specialized electrolytes are essential to overcome the "shuttle effect" and other technical challenges. Companies developing proprietary electrolyte solutions could capture significant market share, with the global battery electrolyte market alone valued at $6.3 billion in 2022.

Regional analysis shows Asia-Pacific leading Li-S battery development, with China, South Korea, and Japan hosting major research centers and manufacturing capabilities. North America and Europe follow closely, with significant government funding supporting advanced battery research initiatives in these regions.

Lithium-sulfur batteries represent a significant market opportunity due to their theoretical energy density of 2600 Wh/kg, which far exceeds the 600 Wh/kg limit of conventional lithium-ion batteries. This dramatic improvement addresses the critical "range anxiety" barrier in EV adoption and enables longer-lasting portable electronics, creating substantial market pull for this technology.

The EV segment demonstrates the most immediate commercial potential for Li-S batteries, with the global electric vehicle market expected to reach $802.8 billion by 2027. Major automotive manufacturers including Tesla, Volkswagen, and Toyota have established research initiatives exploring sulfur-based cathode technologies, indicating strong industry interest in commercializing these high-energy systems.

Stationary energy storage represents another significant market opportunity, projected to grow to $31.2 billion by 2029. The high energy density and potentially lower cost of Li-S batteries (due to sulfur's natural abundance) align perfectly with grid-scale storage requirements, particularly for renewable energy integration where energy density constraints are less critical than in mobile applications.

Consumer electronics constitutes the third major market segment, with manufacturers seeking higher-capacity batteries to support increasingly power-hungry devices. This market values the combination of high energy density and lightweight characteristics that Li-S technology promises to deliver.

Market barriers for Li-S battery adoption include competition from established lithium-ion technologies, which benefit from mature manufacturing infrastructure and continuous incremental improvements. Additionally, emerging technologies like solid-state batteries and sodium-ion systems are competing for R&D resources and market attention.

The electrolyte formulation segment within the Li-S battery market is particularly valuable, as specialized electrolytes are essential to overcome the "shuttle effect" and other technical challenges. Companies developing proprietary electrolyte solutions could capture significant market share, with the global battery electrolyte market alone valued at $6.3 billion in 2022.

Regional analysis shows Asia-Pacific leading Li-S battery development, with China, South Korea, and Japan hosting major research centers and manufacturing capabilities. North America and Europe follow closely, with significant government funding supporting advanced battery research initiatives in these regions.

Current Challenges in Li-S Electrolyte Formulation

Despite significant advancements in lithium-sulfur (Li-S) battery technology, electrolyte formulation remains one of the most critical challenges hindering commercial viability. The conventional carbonate-based electrolytes that work well for lithium-ion batteries prove incompatible with Li-S systems due to irreversible reactions with polysulfide intermediates. This fundamental incompatibility necessitates the development of specialized electrolyte formulations.

The "polysulfide shuttle effect" represents the most significant challenge in Li-S electrolyte design. During cycling, soluble lithium polysulfides (Li2Sx, 4≤x≤8) dissolve into the electrolyte and shuttle between electrodes, causing rapid capacity fading, low Coulombic efficiency, and self-discharge. Current electrolyte formulations struggle to effectively suppress this phenomenon without compromising other performance metrics.

Lithium metal anode protection presents another major hurdle. The highly reactive lithium metal anode in Li-S batteries suffers from dendrite formation and continuous SEI layer breakdown when in contact with most electrolytes. This leads to safety concerns and poor cycling stability that current formulations have not adequately addressed.

The viscosity paradox further complicates electrolyte development. While high-concentration electrolytes can suppress polysulfide dissolution, they simultaneously increase viscosity, reducing ion transport and rate capability. Conversely, low-viscosity electrolytes enhance ion mobility but exacerbate polysulfide dissolution. Finding the optimal balance remains elusive.

Temperature sensitivity adds another layer of complexity. Most current Li-S electrolyte formulations exhibit poor performance at low temperatures due to increased viscosity and reduced ionic conductivity. Simultaneously, they may become unstable at elevated temperatures, limiting the practical operating range of Li-S batteries.

The sulfur loading dilemma represents a significant barrier to commercialization. While high sulfur loading is essential for achieving competitive energy density, it intensifies all the aforementioned challenges. Current electrolyte formulations that work reasonably well at low sulfur loadings (≤2 mg/cm²) often fail dramatically when sulfur loading increases to commercially relevant levels (>5 mg/cm²).

Lastly, the sustainability and cost considerations cannot be overlooked. Many promising electrolyte additives and solvents that show excellent performance in laboratory settings are expensive, toxic, or environmentally problematic, making them unsuitable for large-scale production. Developing green, cost-effective electrolyte formulations that maintain high performance remains a significant challenge for the Li-S battery community.

The "polysulfide shuttle effect" represents the most significant challenge in Li-S electrolyte design. During cycling, soluble lithium polysulfides (Li2Sx, 4≤x≤8) dissolve into the electrolyte and shuttle between electrodes, causing rapid capacity fading, low Coulombic efficiency, and self-discharge. Current electrolyte formulations struggle to effectively suppress this phenomenon without compromising other performance metrics.

Lithium metal anode protection presents another major hurdle. The highly reactive lithium metal anode in Li-S batteries suffers from dendrite formation and continuous SEI layer breakdown when in contact with most electrolytes. This leads to safety concerns and poor cycling stability that current formulations have not adequately addressed.

The viscosity paradox further complicates electrolyte development. While high-concentration electrolytes can suppress polysulfide dissolution, they simultaneously increase viscosity, reducing ion transport and rate capability. Conversely, low-viscosity electrolytes enhance ion mobility but exacerbate polysulfide dissolution. Finding the optimal balance remains elusive.

Temperature sensitivity adds another layer of complexity. Most current Li-S electrolyte formulations exhibit poor performance at low temperatures due to increased viscosity and reduced ionic conductivity. Simultaneously, they may become unstable at elevated temperatures, limiting the practical operating range of Li-S batteries.

The sulfur loading dilemma represents a significant barrier to commercialization. While high sulfur loading is essential for achieving competitive energy density, it intensifies all the aforementioned challenges. Current electrolyte formulations that work reasonably well at low sulfur loadings (≤2 mg/cm²) often fail dramatically when sulfur loading increases to commercially relevant levels (>5 mg/cm²).

Lastly, the sustainability and cost considerations cannot be overlooked. Many promising electrolyte additives and solvents that show excellent performance in laboratory settings are expensive, toxic, or environmentally problematic, making them unsuitable for large-scale production. Developing green, cost-effective electrolyte formulations that maintain high performance remains a significant challenge for the Li-S battery community.

Current Electrolyte Formulation Strategies and Solutions

01 Solid electrolyte formulations for lithium-sulfur batteries

Solid electrolytes can be used in lithium-sulfur batteries to address the polysulfide shuttle effect, which is a major challenge in these battery systems. These solid electrolytes typically consist of polymer matrices, ceramic materials, or composite structures that provide ionic conductivity while physically blocking polysulfide migration. The solid electrolyte formulations improve cycle life and capacity retention of lithium-sulfur batteries by preventing the dissolution and migration of sulfur species.- Solid-state electrolytes for lithium-sulfur batteries: Solid-state electrolytes offer advantages for lithium-sulfur batteries by preventing polysulfide shuttling and enhancing safety. These electrolytes typically consist of ceramic materials, polymer matrices, or composite structures that provide ionic conductivity while physically blocking polysulfide migration. The solid barrier helps maintain capacity over multiple charge-discharge cycles and improves the overall stability of the battery system.

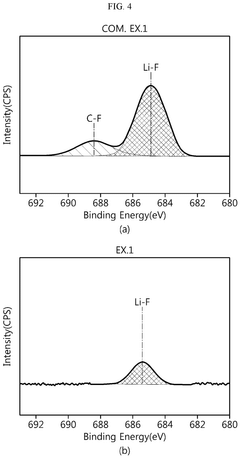

- Liquid electrolyte additives for polysulfide suppression: Various additives can be incorporated into liquid electrolytes to suppress polysulfide dissolution and shuttling in lithium-sulfur batteries. These additives include lithium nitrate, fluorinated compounds, and specific salts that form protective layers on electrodes or chemically bind with polysulfides. By mitigating the shuttle effect, these formulations help maintain capacity retention and coulombic efficiency during cycling.

- Ionic liquid-based electrolytes: Ionic liquid-based electrolytes provide unique advantages for lithium-sulfur batteries due to their negligible vapor pressure, wide electrochemical window, and ability to dissolve lithium salts. These electrolytes can be formulated with specific cations and anions to optimize interactions with sulfur species and lithium metal. The non-volatile nature of ionic liquids also enhances the safety profile of the battery system.

- Gel polymer electrolytes: Gel polymer electrolytes combine the high ionic conductivity of liquid electrolytes with the mechanical stability of solid polymers. These electrolytes typically consist of a polymer matrix (such as PEO, PVDF, or PAN) swollen with a liquid electrolyte solution. The gel structure helps immobilize polysulfides while maintaining good contact with electrodes, addressing key challenges in lithium-sulfur battery performance.

- Electrolyte salt concentration effects: The concentration of lithium salts in electrolytes significantly impacts lithium-sulfur battery performance. High-concentration or localized high-concentration electrolytes can suppress polysulfide dissolution through the common-ion effect and altered solvation structures. Optimizing salt concentration helps balance ionic conductivity, viscosity, and polysulfide solubility to achieve improved cycling stability and rate capability.

02 Liquid electrolyte additives for polysulfide suppression

Various additives can be incorporated into liquid electrolytes to suppress the polysulfide shuttle effect in lithium-sulfur batteries. These additives include lithium nitrate, lithium salts with fluorinated anions, and specific solvents that can form a stable solid electrolyte interphase (SEI) on the lithium anode. By incorporating these additives, the dissolution of polysulfides is reduced, leading to improved cycling stability and coulombic efficiency of lithium-sulfur batteries.Expand Specific Solutions03 Gel polymer electrolytes for lithium-sulfur batteries

Gel polymer electrolytes represent a hybrid approach between solid and liquid electrolytes for lithium-sulfur batteries. These electrolytes typically consist of a polymer matrix swollen with a liquid electrolyte solution. The polymer component provides mechanical stability and helps to trap polysulfides, while the liquid component ensures high ionic conductivity. Common polymers used include polyethylene oxide (PEO), polyvinylidene fluoride (PVDF), and their derivatives, which can be combined with various lithium salts and solvents.Expand Specific Solutions04 Ionic liquid-based electrolytes for lithium-sulfur batteries

Ionic liquids can be used as electrolyte components in lithium-sulfur batteries due to their unique properties such as negligible vapor pressure, high thermal stability, and wide electrochemical window. These electrolytes typically consist of an ionic liquid, a lithium salt, and sometimes additional solvents or additives. The ionic liquid-based electrolytes can effectively suppress the dissolution of polysulfides and improve the cycling performance of lithium-sulfur batteries by forming a protective layer on the electrode surfaces.Expand Specific Solutions05 Functional electrolyte systems with redox mediators

Functional electrolyte systems incorporating redox mediators can enhance the performance of lithium-sulfur batteries by facilitating the conversion of polysulfides during the charge-discharge process. These redox mediators can accelerate the redox reactions of sulfur species, improving the utilization of active materials and rate capability. Additionally, some functional electrolytes contain compounds that can chemically bind with polysulfides, preventing their dissolution and migration. This approach leads to improved energy density and cycling stability of lithium-sulfur batteries.Expand Specific Solutions

Key Industry Players in Li-S Battery Electrolyte Research

The lithium-sulfur battery market is currently in an early growth phase, with significant R&D activity focused on electrolyte formulation strategies to overcome inherent challenges. The global market is projected to expand rapidly as this technology offers higher theoretical energy density than conventional lithium-ion batteries. Major players include established battery manufacturers like Samsung SDI, LG Energy Solution, and Panasonic, alongside automotive companies such as Tesla and Geely pursuing integration opportunities. Research institutions including MIT, Central South University, and Beijing Institute of Technology are driving fundamental innovations, while specialized companies like Wildcat Discovery Technologies focus on high-throughput material development. The competitive landscape reflects varying levels of technological maturity, with most commercial applications still emerging as companies work to address electrolyte stability, polysulfide shuttle effect, and cycle life limitations.

SAMSUNG SDI CO LTD

Technical Solution: Samsung SDI has developed advanced electrolyte formulations for lithium-sulfur batteries focusing on addressing the polysulfide shuttle effect. Their approach incorporates functional additives such as lithium nitrate (LiNO3) and lithium difluoro(oxalato)borate (LiDFOB) that form protective layers on the lithium anode surface. Samsung's electrolyte system combines ether-based solvents (typically DOL/DME mixtures) with optimized salt concentrations to enhance ionic conductivity while suppressing polysulfide dissolution. They've pioneered dual-salt electrolyte systems that combine conventional LiTFSI with LiFSI to improve the stability of the solid electrolyte interphase. Samsung has also integrated flame-retardant additives like trimethyl phosphate to enhance the safety profile of their high-energy lithium-sulfur batteries without compromising electrochemical performance[1][2].

Strengths: Superior polysulfide suppression through optimized additive combinations, excellent cycle stability (>500 cycles with <0.1% capacity fade per cycle), and enhanced safety features. Weaknesses: Higher production costs due to specialty additives, potential challenges in low-temperature performance, and relatively complex manufacturing processes requiring precise control of electrolyte composition.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a multi-functional electrolyte system for lithium-sulfur batteries that addresses multiple challenges simultaneously. Their approach features a high-concentration electrolyte (HCE) strategy using fluorinated ether solvents combined with LiTFSI salt at molar ratios exceeding 1:3 (salt:solvent). This formulation significantly reduces polysulfide solubility while maintaining adequate ionic conductivity. LG's electrolyte incorporates a proprietary blend of additives including lithium polysulfides (Li2Sx, x=4-8) as "mediators" that facilitate sulfur utilization and redox kinetics. They've implemented a dual-phase electrolyte concept where a localized high-viscosity phase near the cathode traps polysulfides while a low-viscosity phase maintains fast lithium-ion transport. Additionally, LG has integrated ionic liquid components to extend the electrochemical stability window and enhance thermal safety characteristics of their lithium-sulfur battery systems[3][4].

Strengths: Exceptional energy density (>500 Wh/kg at cell level), superior high-temperature stability, and effective polysulfide containment without complex cathode modifications. Weaknesses: Higher cost structure due to fluorinated solvents and specialty additives, potential challenges with low-temperature performance, and increased electrolyte viscosity affecting power capabilities.

Critical Patents and Innovations in Li-S Electrolyte Chemistry

Electrolyte for lithium-sulfur battery, and lithium-sulfur battery including same

PatentWO2025159593A1

Innovation

- An electrolyte composition for lithium-sulfur batteries comprising a non-aqueous solvent with specific aryl derivatives, a nitrate, and a glycol ether, which alters the reduction reaction path of sulfur to control polysulfide elution and enhance discharge capacity.

Electrolyte for lithium-sulfur battery and lithium-sulfur battery containing same

PatentPendingEP4571924A1

Innovation

- An electrolyte solution for lithium-sulfur batteries is developed, comprising a lithium salt, a nitric acid compound, a nonaqueous solvent, and a Lewis acidic additive, with a total concentration of 2 M or less, which suppresses lithium polysulfide dissociation and enhances ionic conductivity.

Environmental and Safety Considerations for Li-S Electrolytes

The environmental and safety aspects of lithium-sulfur battery electrolytes present significant challenges that must be addressed for commercial viability. Traditional Li-S electrolytes often contain volatile organic solvents such as dimethyl ether (DME) and dioxolane (DOL), which pose considerable flammability risks. These solvents have low flash points and can readily ignite under thermal runaway conditions, creating serious safety hazards in consumer applications.

Beyond flammability concerns, many conventional electrolyte additives like lithium nitrate (LiNO₃) present toxicity issues. When exposed to moisture, these compounds can generate harmful byproducts that pose environmental contamination risks during manufacturing, usage, and disposal phases of battery life cycles. The potential for groundwater contamination from improper disposal represents a particular environmental concern.

The polysulfide shuttle effect, while primarily a performance issue, also creates safety vulnerabilities. The migration of polysulfides can lead to lithium dendrite formation, increasing the risk of internal short circuits and thermal events. This phenomenon necessitates careful electrolyte engineering to simultaneously address performance and safety considerations.

Recent research has focused on developing inherently safer electrolyte formulations. Ionic liquids have emerged as promising alternatives due to their negligible vapor pressure and high thermal stability. Though currently limited by cost and ionic conductivity challenges, their non-flammable nature offers significant safety advantages over conventional organic solvents.

Solid-state and gel polymer electrolytes represent another promising direction, effectively eliminating leakage risks while providing physical barriers against dendrite growth. These systems can significantly reduce the environmental footprint of Li-S batteries while enhancing operational safety margins.

Regulatory frameworks worldwide are increasingly emphasizing the importance of lifecycle assessment for battery technologies. The European Union's Battery Directive and similar regulations in North America and Asia are driving manufacturers toward greener electrolyte formulations with reduced environmental impact. This regulatory landscape is accelerating research into biodegradable solvents and environmentally benign salt systems.

Future electrolyte development must balance the technical requirements for high energy density with increasingly stringent environmental and safety standards. Promising approaches include water-in-salt electrolytes that maintain performance while dramatically reducing flammability, and fluorine-free salt systems that minimize persistent environmental contaminants while maintaining electrochemical stability.

Beyond flammability concerns, many conventional electrolyte additives like lithium nitrate (LiNO₃) present toxicity issues. When exposed to moisture, these compounds can generate harmful byproducts that pose environmental contamination risks during manufacturing, usage, and disposal phases of battery life cycles. The potential for groundwater contamination from improper disposal represents a particular environmental concern.

The polysulfide shuttle effect, while primarily a performance issue, also creates safety vulnerabilities. The migration of polysulfides can lead to lithium dendrite formation, increasing the risk of internal short circuits and thermal events. This phenomenon necessitates careful electrolyte engineering to simultaneously address performance and safety considerations.

Recent research has focused on developing inherently safer electrolyte formulations. Ionic liquids have emerged as promising alternatives due to their negligible vapor pressure and high thermal stability. Though currently limited by cost and ionic conductivity challenges, their non-flammable nature offers significant safety advantages over conventional organic solvents.

Solid-state and gel polymer electrolytes represent another promising direction, effectively eliminating leakage risks while providing physical barriers against dendrite growth. These systems can significantly reduce the environmental footprint of Li-S batteries while enhancing operational safety margins.

Regulatory frameworks worldwide are increasingly emphasizing the importance of lifecycle assessment for battery technologies. The European Union's Battery Directive and similar regulations in North America and Asia are driving manufacturers toward greener electrolyte formulations with reduced environmental impact. This regulatory landscape is accelerating research into biodegradable solvents and environmentally benign salt systems.

Future electrolyte development must balance the technical requirements for high energy density with increasingly stringent environmental and safety standards. Promising approaches include water-in-salt electrolytes that maintain performance while dramatically reducing flammability, and fluorine-free salt systems that minimize persistent environmental contaminants while maintaining electrochemical stability.

Scalability and Manufacturing Challenges for Li-S Electrolytes

The transition from laboratory-scale electrolyte formulations to mass production represents a significant hurdle in the commercialization of lithium-sulfur (Li-S) batteries. Current electrolyte systems that demonstrate promising performance in research settings often employ costly materials and complex preparation methods that are impractical for industrial-scale manufacturing.

A primary challenge lies in the high cost of specialty solvents and lithium salts commonly used in Li-S electrolytes. For instance, 1,3-dioxolane (DOL) and 1,2-dimethoxyethane (DME) solvent mixtures, while effective, are significantly more expensive than carbonates used in conventional lithium-ion batteries. Additionally, lithium bis(trifluoromethanesulfonyl)imide (LiTFSI) salt costs approximately 5-10 times more than lithium hexafluorophosphate (LiPF6) used in commercial lithium-ion cells.

The manufacturing environment presents additional complications. Many Li-S electrolyte additives, such as lithium nitrate (LiNO3), are highly sensitive to moisture and air, necessitating stringent manufacturing conditions. This requirement for ultra-dry processing environments (<10 ppm H2O) increases production costs and complexity compared to conventional battery manufacturing facilities.

Batch-to-batch consistency poses another significant challenge. The performance of Li-S batteries is highly dependent on precise electrolyte formulations, where even minor variations in composition can dramatically affect cycling stability and capacity retention. Achieving consistent quality across large production volumes remains problematic, particularly when scaling up complex multi-component electrolyte systems.

Safety considerations further complicate manufacturing processes. Many solvents used in Li-S electrolytes have low flash points and present fire hazards during large-scale handling. For example, DME has a flash point of -2°C, creating significant safety risks in manufacturing environments that must be mitigated through specialized equipment and protocols.

The environmental impact of electrolyte production also presents challenges for sustainable manufacturing. Current formulations often contain fluorinated compounds that pose environmental concerns regarding disposal and potential contamination. Developing greener alternatives that maintain performance while reducing environmental footprint remains an ongoing challenge.

Supply chain stability represents another obstacle, as specialized electrolyte components often have limited suppliers, creating potential bottlenecks in production scaling. This dependency on niche materials increases vulnerability to supply disruptions and price volatility, complicating long-term manufacturing planning and cost projections for commercial Li-S battery production.

A primary challenge lies in the high cost of specialty solvents and lithium salts commonly used in Li-S electrolytes. For instance, 1,3-dioxolane (DOL) and 1,2-dimethoxyethane (DME) solvent mixtures, while effective, are significantly more expensive than carbonates used in conventional lithium-ion batteries. Additionally, lithium bis(trifluoromethanesulfonyl)imide (LiTFSI) salt costs approximately 5-10 times more than lithium hexafluorophosphate (LiPF6) used in commercial lithium-ion cells.

The manufacturing environment presents additional complications. Many Li-S electrolyte additives, such as lithium nitrate (LiNO3), are highly sensitive to moisture and air, necessitating stringent manufacturing conditions. This requirement for ultra-dry processing environments (<10 ppm H2O) increases production costs and complexity compared to conventional battery manufacturing facilities.

Batch-to-batch consistency poses another significant challenge. The performance of Li-S batteries is highly dependent on precise electrolyte formulations, where even minor variations in composition can dramatically affect cycling stability and capacity retention. Achieving consistent quality across large production volumes remains problematic, particularly when scaling up complex multi-component electrolyte systems.

Safety considerations further complicate manufacturing processes. Many solvents used in Li-S electrolytes have low flash points and present fire hazards during large-scale handling. For example, DME has a flash point of -2°C, creating significant safety risks in manufacturing environments that must be mitigated through specialized equipment and protocols.

The environmental impact of electrolyte production also presents challenges for sustainable manufacturing. Current formulations often contain fluorinated compounds that pose environmental concerns regarding disposal and potential contamination. Developing greener alternatives that maintain performance while reducing environmental footprint remains an ongoing challenge.

Supply chain stability represents another obstacle, as specialized electrolyte components often have limited suppliers, creating potential bottlenecks in production scaling. This dependency on niche materials increases vulnerability to supply disruptions and price volatility, complicating long-term manufacturing planning and cost projections for commercial Li-S battery production.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!