High loading sulfur electrodes for next-generation lithium-sulfur cells

OCT 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sulfur Electrode Technology Background and Objectives

Lithium-sulfur (Li-S) batteries have emerged as a promising next-generation energy storage technology due to their theoretical energy density of 2600 Wh/kg, which far exceeds that of conventional lithium-ion batteries (typically 100-265 Wh/kg). The development of this technology can be traced back to the 1960s, but significant research momentum has only built up in the past two decades as the limitations of lithium-ion technology became increasingly apparent for applications demanding higher energy density.

The evolution of sulfur electrode technology has progressed through several distinct phases. Initially, simple sulfur-carbon composites were utilized, followed by more sophisticated nanostructured materials designed to address the fundamental challenges of sulfur electrodes. Recent advances have focused on high-loading sulfur cathodes, which are essential for practical applications where high energy density at the cell level is required.

The primary technical objective in developing high-loading sulfur electrodes is to achieve areal capacities exceeding 6 mAh/cm², while maintaining good cycle stability and rate capability. This represents a significant challenge as traditional approaches to increasing sulfur loading often lead to deteriorated electrochemical performance due to increased electrode thickness and associated mass transport limitations.

Current research trends are moving toward multifunctional electrode architectures that can simultaneously address several challenges: accommodating the substantial volume changes during cycling (up to 80%), mitigating polysulfide dissolution and shuttle effects, and enhancing the poor electronic conductivity of sulfur and its discharge products. These advanced electrode designs often incorporate hierarchical porosity, functional interlayers, and novel binders.

The global push toward electrification of transportation and renewable energy integration has created an urgent need for batteries with higher energy density, lower cost, and reduced environmental impact. Lithium-sulfur technology, with its use of abundant and low-cost sulfur as the cathode material, aligns perfectly with these requirements, driving significant research investment worldwide.

The technical goals for next-generation Li-S cells include achieving practical energy densities above 500 Wh/kg at the cell level, cycle life exceeding 1000 cycles with minimal capacity fade, and cost reduction to below $100/kWh. Meeting these targets requires fundamental breakthroughs in sulfur electrode technology, particularly in developing high-loading electrodes that maintain excellent electrochemical performance.

Addressing these challenges necessitates a multidisciplinary approach combining materials science, electrochemistry, and engineering to develop innovative electrode architectures and manufacturing processes that can support high sulfur loading while mitigating the inherent limitations of the Li-S chemistry.

The evolution of sulfur electrode technology has progressed through several distinct phases. Initially, simple sulfur-carbon composites were utilized, followed by more sophisticated nanostructured materials designed to address the fundamental challenges of sulfur electrodes. Recent advances have focused on high-loading sulfur cathodes, which are essential for practical applications where high energy density at the cell level is required.

The primary technical objective in developing high-loading sulfur electrodes is to achieve areal capacities exceeding 6 mAh/cm², while maintaining good cycle stability and rate capability. This represents a significant challenge as traditional approaches to increasing sulfur loading often lead to deteriorated electrochemical performance due to increased electrode thickness and associated mass transport limitations.

Current research trends are moving toward multifunctional electrode architectures that can simultaneously address several challenges: accommodating the substantial volume changes during cycling (up to 80%), mitigating polysulfide dissolution and shuttle effects, and enhancing the poor electronic conductivity of sulfur and its discharge products. These advanced electrode designs often incorporate hierarchical porosity, functional interlayers, and novel binders.

The global push toward electrification of transportation and renewable energy integration has created an urgent need for batteries with higher energy density, lower cost, and reduced environmental impact. Lithium-sulfur technology, with its use of abundant and low-cost sulfur as the cathode material, aligns perfectly with these requirements, driving significant research investment worldwide.

The technical goals for next-generation Li-S cells include achieving practical energy densities above 500 Wh/kg at the cell level, cycle life exceeding 1000 cycles with minimal capacity fade, and cost reduction to below $100/kWh. Meeting these targets requires fundamental breakthroughs in sulfur electrode technology, particularly in developing high-loading electrodes that maintain excellent electrochemical performance.

Addressing these challenges necessitates a multidisciplinary approach combining materials science, electrochemistry, and engineering to develop innovative electrode architectures and manufacturing processes that can support high sulfur loading while mitigating the inherent limitations of the Li-S chemistry.

Market Analysis for High-Energy Lithium-Sulfur Batteries

The lithium-sulfur (Li-S) battery market is experiencing significant growth potential due to the inherent advantages of this technology over conventional lithium-ion batteries. Current market projections indicate that the global Li-S battery market could reach $2.1 billion by 2030, with a compound annual growth rate of approximately 35% from 2023 to 2030. This rapid growth is primarily driven by increasing demand for high-energy density storage solutions across multiple sectors.

The electric vehicle (EV) industry represents the largest potential market for Li-S batteries, accounting for nearly 45% of projected demand. With major automotive manufacturers committing to electrification targets, the need for batteries with higher energy density and lower weight is becoming critical. Li-S technology's theoretical energy density of 2,600 Wh/kg—significantly higher than current lithium-ion batteries (250-300 Wh/kg)—positions it as a compelling solution for extending EV range while reducing vehicle weight.

Aerospace and defense sectors constitute another significant market segment, representing approximately 20% of potential Li-S battery applications. These industries require lightweight, high-energy power sources for drones, satellites, and military equipment. Several aerospace companies have already begun testing Li-S prototypes, with promising results for specialized applications where weight considerations are paramount.

Consumer electronics manufacturers are also showing increased interest in Li-S technology, particularly for applications requiring longer runtime in compact devices. This segment represents about 15% of the potential market, with early adoption likely in premium portable devices where battery life is a key differentiator.

Grid storage applications account for roughly 12% of projected market demand, particularly for renewable energy storage systems where energy density and cycle life improvements could significantly reduce installation footprint and lifetime costs. The remaining market share is distributed across specialized applications including medical devices, remote sensors, and industrial equipment.

Regional analysis indicates that Asia-Pacific currently leads in Li-S battery development and manufacturing capacity, with China, South Korea, and Japan collectively accounting for 55% of global research activities and production capabilities. North America follows with 25% market share, driven primarily by U.S.-based startups and research institutions. Europe represents approximately 18% of the market, with significant research clusters in Germany, the UK, and France.

Customer demand analysis reveals that performance requirements vary significantly across applications, but three consistent priorities emerge: energy density improvement (cited by 78% of potential customers), cost reduction (65%), and cycle life extension (62%). High-loading sulfur electrodes directly address these market demands by potentially increasing energy density while reducing material costs per kWh.

The electric vehicle (EV) industry represents the largest potential market for Li-S batteries, accounting for nearly 45% of projected demand. With major automotive manufacturers committing to electrification targets, the need for batteries with higher energy density and lower weight is becoming critical. Li-S technology's theoretical energy density of 2,600 Wh/kg—significantly higher than current lithium-ion batteries (250-300 Wh/kg)—positions it as a compelling solution for extending EV range while reducing vehicle weight.

Aerospace and defense sectors constitute another significant market segment, representing approximately 20% of potential Li-S battery applications. These industries require lightweight, high-energy power sources for drones, satellites, and military equipment. Several aerospace companies have already begun testing Li-S prototypes, with promising results for specialized applications where weight considerations are paramount.

Consumer electronics manufacturers are also showing increased interest in Li-S technology, particularly for applications requiring longer runtime in compact devices. This segment represents about 15% of the potential market, with early adoption likely in premium portable devices where battery life is a key differentiator.

Grid storage applications account for roughly 12% of projected market demand, particularly for renewable energy storage systems where energy density and cycle life improvements could significantly reduce installation footprint and lifetime costs. The remaining market share is distributed across specialized applications including medical devices, remote sensors, and industrial equipment.

Regional analysis indicates that Asia-Pacific currently leads in Li-S battery development and manufacturing capacity, with China, South Korea, and Japan collectively accounting for 55% of global research activities and production capabilities. North America follows with 25% market share, driven primarily by U.S.-based startups and research institutions. Europe represents approximately 18% of the market, with significant research clusters in Germany, the UK, and France.

Customer demand analysis reveals that performance requirements vary significantly across applications, but three consistent priorities emerge: energy density improvement (cited by 78% of potential customers), cost reduction (65%), and cycle life extension (62%). High-loading sulfur electrodes directly address these market demands by potentially increasing energy density while reducing material costs per kWh.

Technical Challenges in High-Loading Sulfur Electrodes

Despite significant advancements in lithium-sulfur (Li-S) battery technology, high-loading sulfur electrodes face several critical technical challenges that impede their commercial viability. The primary obstacle remains the poor electronic conductivity of sulfur (5×10^-30 S/cm), which necessitates the incorporation of conductive additives. However, as sulfur loading increases, the required proportion of conductive materials also rises, creating a complex balance between active material content and electrode conductivity.

The volume expansion problem presents another significant hurdle. During discharge, sulfur undergoes approximately 80% volume expansion when converting to Li2S, causing mechanical stress that leads to electrode pulverization and delamination from current collectors. This issue becomes exponentially more severe in high-loading configurations, where the absolute volume change is substantially greater.

Polysulfide shuttling represents perhaps the most notorious challenge in Li-S systems. The intermediate lithium polysulfides (Li2Sx, 4≤x≤8) formed during cycling are highly soluble in conventional electrolytes. In high-loading electrodes, the increased concentration of these species exacerbates shuttling effects, leading to accelerated capacity fade, reduced coulombic efficiency, and self-discharge phenomena.

Electrolyte management presents unique difficulties in high-loading systems. The conventional electrolyte-to-sulfur (E/S) ratio of 10-15 μL/mg becomes impractical at high loadings, as it would require excessive electrolyte volumes. However, reducing this ratio introduces electrolyte starvation issues, particularly in the electrode's inner regions, limiting ion transport and reaction kinetics.

Mass transport limitations become increasingly prominent as electrode thickness increases with higher sulfur loadings. The diffusion of lithium ions and polysulfide species through thick electrodes creates concentration gradients that result in underutilization of active material and heterogeneous reaction distributions. This effect is particularly pronounced at high current densities, severely limiting rate capability.

The formation of insulating discharge products, primarily Li2S, creates passivation layers that impede electron transfer and lithium ion diffusion. In high-loading electrodes, these insulating layers are more extensive and difficult to decompose during charging, requiring higher overpotentials that accelerate electrolyte decomposition and lithium metal degradation.

Electrode manufacturing challenges also intensify with increased sulfur loading. Maintaining uniform distribution of sulfur throughout thicker electrodes becomes problematic, while achieving adequate adhesion to current collectors without excessive binder content presents a delicate balance that impacts both mechanical integrity and electrochemical performance.

The volume expansion problem presents another significant hurdle. During discharge, sulfur undergoes approximately 80% volume expansion when converting to Li2S, causing mechanical stress that leads to electrode pulverization and delamination from current collectors. This issue becomes exponentially more severe in high-loading configurations, where the absolute volume change is substantially greater.

Polysulfide shuttling represents perhaps the most notorious challenge in Li-S systems. The intermediate lithium polysulfides (Li2Sx, 4≤x≤8) formed during cycling are highly soluble in conventional electrolytes. In high-loading electrodes, the increased concentration of these species exacerbates shuttling effects, leading to accelerated capacity fade, reduced coulombic efficiency, and self-discharge phenomena.

Electrolyte management presents unique difficulties in high-loading systems. The conventional electrolyte-to-sulfur (E/S) ratio of 10-15 μL/mg becomes impractical at high loadings, as it would require excessive electrolyte volumes. However, reducing this ratio introduces electrolyte starvation issues, particularly in the electrode's inner regions, limiting ion transport and reaction kinetics.

Mass transport limitations become increasingly prominent as electrode thickness increases with higher sulfur loadings. The diffusion of lithium ions and polysulfide species through thick electrodes creates concentration gradients that result in underutilization of active material and heterogeneous reaction distributions. This effect is particularly pronounced at high current densities, severely limiting rate capability.

The formation of insulating discharge products, primarily Li2S, creates passivation layers that impede electron transfer and lithium ion diffusion. In high-loading electrodes, these insulating layers are more extensive and difficult to decompose during charging, requiring higher overpotentials that accelerate electrolyte decomposition and lithium metal degradation.

Electrode manufacturing challenges also intensify with increased sulfur loading. Maintaining uniform distribution of sulfur throughout thicker electrodes becomes problematic, while achieving adequate adhesion to current collectors without excessive binder content presents a delicate balance that impacts both mechanical integrity and electrochemical performance.

Current Solutions for Sulfur Loading Enhancement

01 High sulfur loading cathode structures

Advanced cathode structures that enable high sulfur loading are critical for improving the energy density of lithium-sulfur batteries. These structures typically incorporate porous carbon frameworks, conductive additives, or specialized binders to accommodate larger amounts of sulfur while maintaining electrical conductivity and structural integrity. High sulfur loading cathodes can achieve greater energy density but must be designed to address challenges like volume expansion and polysulfide dissolution.- High sulfur loading cathode structures: Advanced cathode structures have been developed to accommodate high sulfur loading in lithium-sulfur cells. These structures typically involve porous carbon frameworks, conductive matrices, or hierarchical designs that can hold larger amounts of sulfur while maintaining electrical conductivity. The high loading designs aim to increase the energy density of lithium-sulfur batteries while addressing challenges related to volume expansion during cycling.

- Sulfur-carbon composite materials: Sulfur-carbon composites are widely used to improve sulfur loading and utilization in lithium-sulfur cells. These composites typically involve sulfur impregnated into various carbon materials such as graphene, carbon nanotubes, or mesoporous carbon. The carbon component provides electrical conductivity and physical confinement for sulfur, helping to mitigate polysulfide dissolution and shuttle effect while enabling higher sulfur loading.

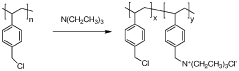

- Polymer binders and interlayers for high sulfur loading: Specialized polymer binders and interlayers are employed to enable higher sulfur loading in lithium-sulfur batteries. These materials help maintain structural integrity during cycling, improve adhesion between sulfur and current collectors, and create barriers to prevent polysulfide shuttling. Advanced polymer systems can accommodate the volume changes associated with high sulfur loading while maintaining electrical contact throughout the electrode.

- Electrolyte modifications for high sulfur loading: Modified electrolyte formulations are crucial for supporting high sulfur loading in lithium-sulfur cells. These electrolytes often contain additives that form protective films, suppress polysulfide dissolution, or enhance ionic conductivity. Specialized electrolyte systems can improve the cycling stability and capacity retention of high-loading sulfur cathodes by addressing the chemical and electrochemical challenges associated with the sulfur redox reactions.

- Manufacturing techniques for high-loading sulfur electrodes: Advanced manufacturing methods have been developed to produce high-loading sulfur electrodes for lithium-sulfur batteries. These techniques include specialized coating processes, controlled thermal treatments, and novel electrode assembly approaches. The manufacturing innovations focus on achieving uniform sulfur distribution, optimal porosity, and strong structural integrity to support high sulfur content while maintaining good electrochemical performance.

02 Sulfur-carbon composite materials

Sulfur-carbon composites are widely used in lithium-sulfur batteries to improve sulfur utilization and cycling stability. These composites typically involve sulfur impregnated into various carbon structures such as mesoporous carbon, carbon nanotubes, or graphene. The carbon host provides electrical conductivity and physical confinement to trap polysulfides, while allowing for higher sulfur loading than traditional cathodes. Different preparation methods and carbon morphologies significantly affect the electrochemical performance and sulfur loading capacity.Expand Specific Solutions03 Electrolyte modifications for high sulfur loading

Specialized electrolyte formulations are essential for supporting high sulfur loading in lithium-sulfur cells. These electrolytes often contain additives that suppress polysulfide shuttle effects, improve ionic conductivity, or enhance the stability of the solid-electrolyte interphase. Functional electrolytes can include lithium salts, solvents, and various additives designed specifically to address the challenges associated with high sulfur content cathodes, thereby improving capacity retention and cycle life.Expand Specific Solutions04 Interlayers and separators for polysulfide retention

Functional interlayers and modified separators are designed to physically block or chemically bind polysulfides that dissolve from high-loading sulfur cathodes. These components are positioned between the cathode and anode to prevent polysulfide shuttling, which is particularly problematic with increased sulfur content. Materials used include carbon-based films, polymer coatings with functional groups, or inorganic barriers that selectively allow lithium ion transport while blocking larger polysulfide molecules.Expand Specific Solutions05 Binder systems for high sulfur loading electrodes

Specialized binder systems are crucial for maintaining the structural integrity of high sulfur loading cathodes during cycling. These binders must accommodate the significant volume changes that occur as sulfur converts to lithium sulfide and back. Advanced polymer binders with strong adhesion properties, elasticity, or functional groups that interact with polysulfides can enable higher sulfur loading while preventing electrode pulverization. Some binder systems also contribute to improved ionic conductivity or polysulfide trapping.Expand Specific Solutions

Key Industry Players in Lithium-Sulfur Battery Development

The lithium-sulfur battery market is currently in an early growth phase, characterized by intensive R&D efforts to overcome technical challenges of high-loading sulfur electrodes. Market size is projected to expand significantly as this technology offers theoretical energy densities up to five times higher than conventional lithium-ion batteries. Key industry players include established battery manufacturers like LG Energy Solution and Samsung SDI who are investing heavily in commercialization, alongside specialized companies such as Lyten, Oxis Energy, and Honeycomb Battery focusing exclusively on lithium-sulfur technology. Academic institutions (MIT, Cornell, UC) and research organizations (KIST, AIST) are driving fundamental breakthroughs, while automotive companies like Toyota are exploring applications. Technical maturity remains moderate, with challenges in cycle life and sulfur utilization still requiring significant innovation before widespread commercial adoption.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced high-loading sulfur cathodes using a dual-confinement strategy that combines physical and chemical confinement mechanisms. Their approach utilizes carbon nanotubes (CNTs) as a conductive framework with high surface area (>1000 m²/g) to physically trap sulfur and polysulfides. This is complemented by nitrogen and oxygen co-doped carbon matrices that chemically bind with lithium polysulfides to prevent dissolution. The company has achieved sulfur loadings exceeding 6 mg/cm² while maintaining 80% capacity retention after 500 cycles. Their proprietary electrolyte formulation includes lithium nitrate and organic additives that form a stable solid electrolyte interphase (SEI) on the lithium anode, further suppressing the shuttle effect. Recent developments include hierarchical porous carbon structures that accommodate volumetric expansion during cycling.

Strengths: Industry-leading cycle stability with high sulfur loading; established manufacturing infrastructure allows for potential commercialization at scale; comprehensive approach addressing both cathode and anode issues. Weaknesses: Higher production costs compared to conventional lithium-ion batteries; energy density improvements still needed to reach theoretical potential; temperature sensitivity remains a challenge for wide application scenarios.

Oxis Energy Ltd.

Technical Solution: Oxis Energy pioneered a unique approach to high-loading sulfur electrodes through their patented "protected lithium technology" combined with high-surface-area carbon hosts. Their system employs a hierarchical porous carbon framework with sulfur loadings reaching 7-10 mg/cm², significantly higher than industry averages. The company developed a proprietary polymer binder system that maintains mechanical integrity during the substantial volumetric changes (up to 80%) that occur during cycling. Their cathode architecture incorporates a gradient distribution of sulfur, with higher concentration in the inner pores and lower at the surface, creating a buffering effect against polysulfide shuttling. Oxis also implemented a ceramic-based protective layer on lithium anodes that allows for stable cycling while preventing dendrite formation. Their cells demonstrated energy densities exceeding 400 Wh/kg at practical discharge rates, with some prototypes reaching 500 Wh/kg.

Strengths: Achieved among the highest practical sulfur loadings in the industry; comprehensive cell design addressing both cathode and anode issues; demonstrated scalable manufacturing processes. Weaknesses: Company faced financial challenges leading to bankruptcy in 2021, indicating commercialization difficulties; high-loading electrodes showed accelerated capacity fade at elevated temperatures; technology required specialized electrolyte formulations that increased overall cost.

Critical Patents and Research in Sulfur Electrode Design

Three dimensional ant-nest electrode structures for high loading and high sulfur ratio lithium-sulfur batteries

PatentWO2017127715A1

Innovation

- The development of a three-dimensional ant-nest electrode structure using a multiwall carbon nanotube framework with interconnected channels and a sacrificial household salt additive to create a porous morphology that facilitates fast ion and polysulfide transport, enhances sulfur utilization, and reduces polysulfide diffusion, while maintaining high conductivity and mechanical integrity.

Material Supply Chain Analysis for Li-S Battery Production

The lithium-sulfur (Li-S) battery supply chain presents unique challenges and opportunities compared to traditional lithium-ion batteries. Sulfur, the primary cathode material, offers significant advantages as it is abundant, inexpensive, and environmentally benign. Global sulfur production exceeds 70 million tons annually, with most derived as a byproduct from petroleum refining and natural gas processing, ensuring stable availability for battery production.

However, the supply chain for high-loading sulfur electrodes faces several critical bottlenecks. Carbon materials, essential for electrode conductivity and sulfur containment, require specialized manufacturing processes. High-quality carbon nanotubes, graphene, and mesoporous carbons needed for advanced Li-S batteries often have limited production capacity and higher costs compared to traditional battery materials.

Lithium metal, used as the anode in Li-S cells, presents another supply chain constraint. While lithium resources are generally sufficient, the high-purity lithium metal required for Li-S batteries demands additional processing steps beyond those needed for conventional lithium-ion batteries, potentially creating production bottlenecks as demand scales.

Electrolyte components represent perhaps the most significant supply chain vulnerability. Li-S batteries require specialized electrolyte additives such as lithium nitrate (LiNO₃) and lithium polysulfide mediators to mitigate the polysulfide shuttle effect. These specialty chemicals have limited production volumes currently, as they are not widely used in other applications.

Manufacturing equipment for high-loading sulfur electrodes presents additional challenges. The unique rheological properties of high-sulfur-content slurries require modifications to conventional coating equipment. The hygroscopic nature of many Li-S components also necessitates enhanced dry room facilities beyond those used for lithium-ion production.

Geographically, the supply chain shows significant concentration risks. China dominates carbon nanomaterial production, while specialty electrolyte components are primarily manufactured in East Asia and Europe. This geographic concentration could create vulnerabilities for manufacturers in other regions seeking to establish Li-S battery production.

Cost analysis indicates that while raw sulfur is inexpensive (~$150/ton), the total material cost for high-loading sulfur electrodes remains significant due to the specialized carbon materials ($50-200/kg) and electrolyte additives ($100-500/kg). As production scales, these costs are expected to decrease, but the initial supply chain development requires substantial investment to establish reliable material sourcing channels.

However, the supply chain for high-loading sulfur electrodes faces several critical bottlenecks. Carbon materials, essential for electrode conductivity and sulfur containment, require specialized manufacturing processes. High-quality carbon nanotubes, graphene, and mesoporous carbons needed for advanced Li-S batteries often have limited production capacity and higher costs compared to traditional battery materials.

Lithium metal, used as the anode in Li-S cells, presents another supply chain constraint. While lithium resources are generally sufficient, the high-purity lithium metal required for Li-S batteries demands additional processing steps beyond those needed for conventional lithium-ion batteries, potentially creating production bottlenecks as demand scales.

Electrolyte components represent perhaps the most significant supply chain vulnerability. Li-S batteries require specialized electrolyte additives such as lithium nitrate (LiNO₃) and lithium polysulfide mediators to mitigate the polysulfide shuttle effect. These specialty chemicals have limited production volumes currently, as they are not widely used in other applications.

Manufacturing equipment for high-loading sulfur electrodes presents additional challenges. The unique rheological properties of high-sulfur-content slurries require modifications to conventional coating equipment. The hygroscopic nature of many Li-S components also necessitates enhanced dry room facilities beyond those used for lithium-ion production.

Geographically, the supply chain shows significant concentration risks. China dominates carbon nanomaterial production, while specialty electrolyte components are primarily manufactured in East Asia and Europe. This geographic concentration could create vulnerabilities for manufacturers in other regions seeking to establish Li-S battery production.

Cost analysis indicates that while raw sulfur is inexpensive (~$150/ton), the total material cost for high-loading sulfur electrodes remains significant due to the specialized carbon materials ($50-200/kg) and electrolyte additives ($100-500/kg). As production scales, these costs are expected to decrease, but the initial supply chain development requires substantial investment to establish reliable material sourcing channels.

Environmental Impact and Sustainability Assessment

The development of high loading sulfur electrodes for lithium-sulfur batteries presents significant environmental implications that warrant comprehensive assessment. Traditional lithium-ion batteries rely heavily on cobalt and nickel, materials associated with substantial environmental degradation through mining operations and limited global reserves. In contrast, sulfur represents an abundant resource, often produced as a byproduct of petroleum refining processes, offering an opportunity to repurpose industrial waste into valuable battery materials.

The environmental footprint of lithium-sulfur cells with high loading electrodes demonstrates notable advantages in resource utilization efficiency. Preliminary life cycle assessments indicate potential reductions in greenhouse gas emissions by 25-30% compared to conventional lithium-ion technologies when accounting for manufacturing processes. This improvement stems primarily from the reduced energy requirements during sulfur electrode production and the elimination of energy-intensive metal oxide cathode synthesis.

Water consumption metrics also favor high loading sulfur electrodes, with studies suggesting up to 40% reduction in process water requirements. However, challenges remain regarding the environmental impact of electrolyte components, particularly the fluorinated salts and solvents that pose potential ecological risks if improperly managed during manufacturing or end-of-life processing.

The sustainability profile of next-generation lithium-sulfur cells extends beyond production considerations to end-of-life management. Current recycling infrastructure requires adaptation to efficiently recover materials from these novel battery architectures. The high sulfur content presents both opportunities and challenges - while sulfur itself is relatively benign environmentally, its recovery in pure form requires development of specialized recycling protocols to prevent formation of hydrogen sulfide during processing.

Land use impact assessments reveal mixed results. While sulfur extraction generally creates less ecological disruption than mining operations for traditional cathode materials, the potentially larger physical size of lithium-sulfur batteries (due to lower volumetric energy density in current iterations) may offset some spatial efficiency advantages in certain applications.

From a circular economy perspective, high loading sulfur electrodes represent a promising direction. The theoretical potential for closed-loop material flows exists, particularly if manufacturing processes can be optimized to utilize sulfur from industrial waste streams and if effective recycling pathways are established. This alignment with circular economy principles could significantly enhance the long-term sustainability proposition of lithium-sulfur technology as it matures toward commercial deployment.

The environmental footprint of lithium-sulfur cells with high loading electrodes demonstrates notable advantages in resource utilization efficiency. Preliminary life cycle assessments indicate potential reductions in greenhouse gas emissions by 25-30% compared to conventional lithium-ion technologies when accounting for manufacturing processes. This improvement stems primarily from the reduced energy requirements during sulfur electrode production and the elimination of energy-intensive metal oxide cathode synthesis.

Water consumption metrics also favor high loading sulfur electrodes, with studies suggesting up to 40% reduction in process water requirements. However, challenges remain regarding the environmental impact of electrolyte components, particularly the fluorinated salts and solvents that pose potential ecological risks if improperly managed during manufacturing or end-of-life processing.

The sustainability profile of next-generation lithium-sulfur cells extends beyond production considerations to end-of-life management. Current recycling infrastructure requires adaptation to efficiently recover materials from these novel battery architectures. The high sulfur content presents both opportunities and challenges - while sulfur itself is relatively benign environmentally, its recovery in pure form requires development of specialized recycling protocols to prevent formation of hydrogen sulfide during processing.

Land use impact assessments reveal mixed results. While sulfur extraction generally creates less ecological disruption than mining operations for traditional cathode materials, the potentially larger physical size of lithium-sulfur batteries (due to lower volumetric energy density in current iterations) may offset some spatial efficiency advantages in certain applications.

From a circular economy perspective, high loading sulfur electrodes represent a promising direction. The theoretical potential for closed-loop material flows exists, particularly if manufacturing processes can be optimized to utilize sulfur from industrial waste streams and if effective recycling pathways are established. This alignment with circular economy principles could significantly enhance the long-term sustainability proposition of lithium-sulfur technology as it matures toward commercial deployment.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!