Evaluation of Hydrogen storage materials patents and licensing strategies

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hydrogen Storage Materials Evolution and Research Objectives

Hydrogen storage has evolved significantly over the past century, with major advancements occurring in response to global energy challenges. Initially, hydrogen storage research focused on conventional methods such as high-pressure gas cylinders and cryogenic liquid storage. These approaches, while functional, presented significant safety concerns and energy inefficiencies that limited widespread adoption.

The 1970s energy crisis marked a pivotal moment in hydrogen storage research, catalyzing interest in alternative storage methods. This period saw the emergence of metal hydrides as promising storage materials, with scientists discovering that certain metals could absorb hydrogen atoms within their crystal lattice structures, enabling storage at lower pressures and ambient temperatures.

By the 1990s, research expanded to include complex hydrides and chemical hydrogen storage materials, offering higher theoretical storage capacities. The early 2000s witnessed a paradigm shift with the introduction of nanomaterials and engineered structures, including carbon nanotubes, metal-organic frameworks (MOFs), and covalent organic frameworks (COFs), which demonstrated enhanced hydrogen adsorption properties.

Current research objectives center on developing materials that meet the U.S. Department of Energy's technical targets for onboard hydrogen storage systems: 6.5 wt% system gravimetric capacity and 50 g/L volumetric capacity, with operating temperatures between -40°C and 60°C and refueling times under 3 minutes. These benchmarks represent the minimum performance requirements for competitive hydrogen-powered vehicles.

The technological trajectory indicates several promising research directions. Advanced metal hydrides with improved kinetics and reduced operating temperatures represent one avenue, while nanoporous materials with optimized pore structures and binding energies offer another. Liquid organic hydrogen carriers (LOHCs) are gaining attention for their potential in stationary applications and hydrogen transport infrastructure.

Patent landscapes reveal concentrated innovation clusters in solid-state storage materials, particularly in reversible metal hydrides and composite materials that combine physical and chemical storage mechanisms. Leading research institutions and corporations are increasingly focusing on materials that enable ambient-temperature operation and rapid hydrogen release kinetics.

The ultimate objective remains developing cost-effective, safe, and efficient hydrogen storage solutions that enable the transition to a hydrogen-based economy, particularly in transportation and grid-scale energy storage applications. Success in this domain would significantly accelerate the adoption of hydrogen as a clean energy carrier and contribute to global decarbonization efforts.

The 1970s energy crisis marked a pivotal moment in hydrogen storage research, catalyzing interest in alternative storage methods. This period saw the emergence of metal hydrides as promising storage materials, with scientists discovering that certain metals could absorb hydrogen atoms within their crystal lattice structures, enabling storage at lower pressures and ambient temperatures.

By the 1990s, research expanded to include complex hydrides and chemical hydrogen storage materials, offering higher theoretical storage capacities. The early 2000s witnessed a paradigm shift with the introduction of nanomaterials and engineered structures, including carbon nanotubes, metal-organic frameworks (MOFs), and covalent organic frameworks (COFs), which demonstrated enhanced hydrogen adsorption properties.

Current research objectives center on developing materials that meet the U.S. Department of Energy's technical targets for onboard hydrogen storage systems: 6.5 wt% system gravimetric capacity and 50 g/L volumetric capacity, with operating temperatures between -40°C and 60°C and refueling times under 3 minutes. These benchmarks represent the minimum performance requirements for competitive hydrogen-powered vehicles.

The technological trajectory indicates several promising research directions. Advanced metal hydrides with improved kinetics and reduced operating temperatures represent one avenue, while nanoporous materials with optimized pore structures and binding energies offer another. Liquid organic hydrogen carriers (LOHCs) are gaining attention for their potential in stationary applications and hydrogen transport infrastructure.

Patent landscapes reveal concentrated innovation clusters in solid-state storage materials, particularly in reversible metal hydrides and composite materials that combine physical and chemical storage mechanisms. Leading research institutions and corporations are increasingly focusing on materials that enable ambient-temperature operation and rapid hydrogen release kinetics.

The ultimate objective remains developing cost-effective, safe, and efficient hydrogen storage solutions that enable the transition to a hydrogen-based economy, particularly in transportation and grid-scale energy storage applications. Success in this domain would significantly accelerate the adoption of hydrogen as a clean energy carrier and contribute to global decarbonization efforts.

Market Analysis for Hydrogen Storage Technologies

The global hydrogen storage market is experiencing significant growth, driven by the increasing focus on clean energy solutions and the transition away from fossil fuels. Current market valuations place the hydrogen storage technologies sector at approximately 15 billion USD in 2023, with projections indicating a compound annual growth rate (CAGR) of 11.3% through 2030. This growth trajectory is supported by substantial government investments worldwide, with the European Union allocating 470 billion euros to hydrogen infrastructure development by 2050 and the United States committing 9.5 billion USD through the Infrastructure Investment and Jobs Act.

Market segmentation reveals distinct categories within hydrogen storage technologies, including physical-based storage (compressed gas, liquid hydrogen, cryo-compressed), material-based storage (metal hydrides, chemical hydrides, adsorbents), and emerging technologies (liquid organic hydrogen carriers). Currently, compressed gas storage dominates the commercial market with a 65% share due to its technological maturity and established infrastructure, despite its lower volumetric efficiency compared to newer alternatives.

Regional analysis shows Asia-Pacific leading market growth at 13.2% CAGR, particularly driven by China, Japan, and South Korea's aggressive hydrogen economy strategies. North America and Europe follow closely, with significant market activity centered around transportation applications, industrial processes, and grid-scale energy storage solutions.

Key market drivers include decarbonization policies, renewable energy integration challenges, and the growing hydrogen mobility sector. The transportation segment represents the fastest-growing application area, with hydrogen fuel cell vehicles projected to reach 10 million units globally by 2030. Industrial applications remain the largest market segment by volume, accounting for 43% of hydrogen consumption.

Market barriers persist, including high infrastructure costs, with hydrogen refueling stations costing between 1-2 million USD each, and technological limitations in storage density and efficiency. The cost of hydrogen storage systems remains a significant hurdle, currently ranging from 14-30 USD/kWh depending on the technology, substantially higher than the US Department of Energy's target of 8 USD/kWh for widespread commercial viability.

Consumer adoption trends indicate increasing acceptance in commercial vehicle fleets and industrial applications, while personal transportation adoption remains limited by infrastructure availability and vehicle costs. Market forecasts suggest material-based storage technologies will experience the highest growth rate (15.7% CAGR) as research advances improve their commercial viability and cost-effectiveness.

Market segmentation reveals distinct categories within hydrogen storage technologies, including physical-based storage (compressed gas, liquid hydrogen, cryo-compressed), material-based storage (metal hydrides, chemical hydrides, adsorbents), and emerging technologies (liquid organic hydrogen carriers). Currently, compressed gas storage dominates the commercial market with a 65% share due to its technological maturity and established infrastructure, despite its lower volumetric efficiency compared to newer alternatives.

Regional analysis shows Asia-Pacific leading market growth at 13.2% CAGR, particularly driven by China, Japan, and South Korea's aggressive hydrogen economy strategies. North America and Europe follow closely, with significant market activity centered around transportation applications, industrial processes, and grid-scale energy storage solutions.

Key market drivers include decarbonization policies, renewable energy integration challenges, and the growing hydrogen mobility sector. The transportation segment represents the fastest-growing application area, with hydrogen fuel cell vehicles projected to reach 10 million units globally by 2030. Industrial applications remain the largest market segment by volume, accounting for 43% of hydrogen consumption.

Market barriers persist, including high infrastructure costs, with hydrogen refueling stations costing between 1-2 million USD each, and technological limitations in storage density and efficiency. The cost of hydrogen storage systems remains a significant hurdle, currently ranging from 14-30 USD/kWh depending on the technology, substantially higher than the US Department of Energy's target of 8 USD/kWh for widespread commercial viability.

Consumer adoption trends indicate increasing acceptance in commercial vehicle fleets and industrial applications, while personal transportation adoption remains limited by infrastructure availability and vehicle costs. Market forecasts suggest material-based storage technologies will experience the highest growth rate (15.7% CAGR) as research advances improve their commercial viability and cost-effectiveness.

Global Landscape and Technical Barriers in Hydrogen Storage

The global hydrogen storage landscape is characterized by significant regional variations in research focus, technological maturity, and commercial deployment. North America, particularly the United States, leads in fundamental research through initiatives like the Department of Energy's Hydrogen and Fuel Cell Technologies Office, which has established ambitious targets for storage systems. The European Union demonstrates strong commitment through its Hydrogen Strategy, emphasizing green hydrogen production and storage as part of its climate neutrality goals, with Germany and the Netherlands emerging as key innovation hubs.

Asia presents a diverse landscape with Japan focusing on hydrogen as a cornerstone of its energy security strategy, investing heavily in metal hydride storage technologies. South Korea prioritizes hydrogen for transportation applications, while China rapidly scales up research capacity, particularly in materials science for advanced storage solutions.

Despite global progress, hydrogen storage faces substantial technical barriers. Volumetric and gravimetric energy density remains a primary challenge, as hydrogen's low density necessitates compression, liquefaction, or material-based storage, each presenting efficiency trade-offs. Current compressed hydrogen systems (700 bar) achieve only about 40 kg/m³, far below gasoline's energy density.

Material degradation presents another significant barrier, particularly for metal hydrides and complex hydrides that experience capacity loss over multiple charge-discharge cycles. Temperature management constitutes a critical challenge across storage methods - cryogenic systems require substantial energy for cooling, while hydride-based systems often need precise temperature control for optimal hydrogen release kinetics.

Cost factors represent perhaps the most significant barrier to widespread adoption. High-pressure tanks require expensive carbon fiber composites, while material-based solutions often incorporate rare elements or complex manufacturing processes. The current cost of hydrogen storage systems ranges from $15-$23/kWh, substantially higher than the DOE's ultimate target of $8/kWh for transportation applications.

Safety concerns further complicate development, as hydrogen's wide flammability range (4-75% in air) and low ignition energy necessitate robust engineering solutions and standardized safety protocols. Additionally, the lack of harmonized international standards for hydrogen storage systems creates market fragmentation and impedes technology transfer across regions.

Addressing these barriers requires coordinated international research efforts, focusing on novel materials discovery, system integration optimization, and manufacturing scale-up to achieve the performance and cost targets necessary for widespread hydrogen adoption as an energy carrier.

Asia presents a diverse landscape with Japan focusing on hydrogen as a cornerstone of its energy security strategy, investing heavily in metal hydride storage technologies. South Korea prioritizes hydrogen for transportation applications, while China rapidly scales up research capacity, particularly in materials science for advanced storage solutions.

Despite global progress, hydrogen storage faces substantial technical barriers. Volumetric and gravimetric energy density remains a primary challenge, as hydrogen's low density necessitates compression, liquefaction, or material-based storage, each presenting efficiency trade-offs. Current compressed hydrogen systems (700 bar) achieve only about 40 kg/m³, far below gasoline's energy density.

Material degradation presents another significant barrier, particularly for metal hydrides and complex hydrides that experience capacity loss over multiple charge-discharge cycles. Temperature management constitutes a critical challenge across storage methods - cryogenic systems require substantial energy for cooling, while hydride-based systems often need precise temperature control for optimal hydrogen release kinetics.

Cost factors represent perhaps the most significant barrier to widespread adoption. High-pressure tanks require expensive carbon fiber composites, while material-based solutions often incorporate rare elements or complex manufacturing processes. The current cost of hydrogen storage systems ranges from $15-$23/kWh, substantially higher than the DOE's ultimate target of $8/kWh for transportation applications.

Safety concerns further complicate development, as hydrogen's wide flammability range (4-75% in air) and low ignition energy necessitate robust engineering solutions and standardized safety protocols. Additionally, the lack of harmonized international standards for hydrogen storage systems creates market fragmentation and impedes technology transfer across regions.

Addressing these barriers requires coordinated international research efforts, focusing on novel materials discovery, system integration optimization, and manufacturing scale-up to achieve the performance and cost targets necessary for widespread hydrogen adoption as an energy carrier.

Current Patent Portfolios and Licensing Models

01 Metal hydride-based hydrogen storage materials

Metal hydrides are compounds formed by hydrogen and metals or metal alloys that can store hydrogen through chemical bonding. These materials can absorb and release hydrogen under specific temperature and pressure conditions. Metal hydrides typically offer high volumetric hydrogen storage capacity but may face challenges with weight efficiency. Various metal compositions and alloy structures are being developed to optimize hydrogen storage capacity, kinetics, and cycling stability.- Metal hydride-based hydrogen storage materials: Metal hydrides are compounds formed by metals or metal alloys that can absorb and release hydrogen under specific temperature and pressure conditions. These materials offer high volumetric hydrogen storage capacity and can be designed with various compositions to optimize storage properties. Common metal hydride systems include magnesium-based hydrides, aluminum-based hydrides, and transition metal-based hydrides that provide efficient and reversible hydrogen storage solutions.

- Carbon-based hydrogen storage materials: Carbon-based materials such as carbon nanotubes, graphene, activated carbon, and carbon aerogels can store hydrogen through physisorption mechanisms. These materials offer advantages including lightweight structure, high surface area, and tunable pore sizes that enhance hydrogen adsorption. The hydrogen storage capacity can be improved through surface modifications, doping with metals, and optimizing the pore structure to increase binding energy with hydrogen molecules.

- Complex hydrides for hydrogen storage: Complex hydrides, including borohydrides, alanates, and amides, represent advanced hydrogen storage materials with high gravimetric hydrogen content. These compounds typically contain light elements such as lithium, sodium, or aluminum combined with hydrogen and other elements. They can release hydrogen through thermal decomposition or hydrolysis reactions. Research focuses on improving their reversibility, reducing dehydrogenation temperatures, and enhancing kinetics through catalysts and nanostructuring.

- Composite and nanostructured hydrogen storage materials: Composite and nanostructured materials combine different hydrogen storage mechanisms to overcome limitations of single-component systems. These materials often integrate metal hydrides with carbon materials, polymers, or metal-organic frameworks to enhance hydrogen uptake and release kinetics. Nanostructuring techniques such as ball milling, thin film deposition, and template synthesis are employed to increase surface area, reduce diffusion distances, and improve overall hydrogen storage performance.

- Metal-organic frameworks for hydrogen storage: Metal-organic frameworks (MOFs) are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. Their exceptional properties including ultrahigh surface area, tunable pore size, and modifiable surface chemistry make them promising for hydrogen storage applications. MOFs can store hydrogen through physisorption mechanisms, and their storage capacity can be enhanced by incorporating open metal sites, introducing functional groups, and optimizing pore dimensions for stronger hydrogen interactions.

02 Carbon-based hydrogen storage materials

Carbon-based materials such as carbon nanotubes, graphene, and activated carbon are being investigated for hydrogen storage applications. These materials store hydrogen through physical adsorption (physisorption) mechanisms, where hydrogen molecules adhere to the surface of the carbon structure. The high surface area and porosity of these materials contribute to their hydrogen storage capabilities. Research focuses on modifying surface properties and pore structures to enhance hydrogen uptake capacity and adsorption kinetics.Expand Specific Solutions03 Complex hydride hydrogen storage systems

Complex hydrides, including borohydrides, alanates, and amides, represent advanced hydrogen storage materials with potentially high hydrogen content. These compounds typically contain light elements such as lithium, sodium, or magnesium combined with hydrogen and other elements. They can store hydrogen through chemical bonds and release it through thermal decomposition. Research focuses on improving their reversibility, reducing dehydrogenation temperatures, and enhancing kinetics through catalysts and nanostructuring approaches.Expand Specific Solutions04 Nanostructured hydrogen storage materials

Nanostructured materials offer enhanced hydrogen storage properties due to their high surface area, shortened diffusion paths, and modified thermodynamics. These materials include nanoparticles, nanoporous structures, and core-shell architectures designed specifically for hydrogen storage applications. The nanoscale dimensions can improve hydrogen absorption/desorption kinetics and alter the thermodynamic properties of the storage material. Various fabrication techniques are employed to create tailored nanostructures with optimized hydrogen storage capabilities.Expand Specific Solutions05 Composite and hybrid hydrogen storage materials

Composite and hybrid materials combine different types of hydrogen storage mechanisms to overcome limitations of single-component systems. These materials may integrate metal hydrides with carbon materials, polymers, or other components to create synergistic effects. The composite approach can enhance hydrogen storage capacity, improve kinetics, and provide better thermal management. Research focuses on optimizing the composition, structure, and interfaces between different components to maximize hydrogen storage performance while maintaining practical operational conditions.Expand Specific Solutions

Key Industry Players and Patent Holders Analysis

The hydrogen storage materials market is currently in a growth phase, characterized by increasing R&D investments and patent activities. The market is projected to expand significantly as hydrogen economy initiatives gain momentum globally, though precise valuation remains challenging due to its emerging nature. Technologically, the field shows moderate maturity with ongoing innovations from key players. Major automotive companies like Toyota, GM, and Ford are leading commercial development, while research institutions including The Regents of the University of California, KIST, and Dalian Institute of Chemical Physics are advancing fundamental technologies. Energy companies such as Air Products & Chemicals and Form Energy are focusing on integration solutions. The competitive landscape reveals a balanced ecosystem of corporate R&D, academic research, and specialized technology providers collaborating through strategic licensing arrangements to overcome technical barriers in hydrogen storage efficiency, safety, and cost-effectiveness.

GM Global Technology Operations LLC

Technical Solution: General Motors has developed a sophisticated portfolio of hydrogen storage technologies centered around advanced metal hydrides and complex chemical storage materials. Their patented systems include multi-component hydride composites that achieve hydrogen storage capacities exceeding 6 wt% while operating at more practical temperature ranges (80-150°C) than conventional materials. GM's approach focuses on destabilized hydride systems where the thermodynamics are tuned through precise alloying and catalytic additives to reduce desorption temperatures while maintaining high storage densities. Their patent strategy covers both material compositions and system integration methods, with particular emphasis on automotive applications that meet stringent weight, volume, and safety requirements. GM has pioneered nano-engineered hydride structures with enhanced surface areas that demonstrate significantly improved absorption/desorption kinetics, reducing refueling times to under 5 minutes for vehicle-scale systems[3][6]. Their licensing approach strategically combines internal development with selective partnerships, maintaining core IP protection while enabling supply chain development. Recent innovations include integrated thermal management systems that recover waste heat from fuel cells to drive hydrogen release from storage materials, improving overall system efficiency. GM has also developed advanced computational screening methods that have accelerated the discovery of novel hydrogen storage materials by predicting thermodynamic properties before experimental validation.

Strengths: Extensive experience integrating hydrogen storage systems into vehicle platforms; comprehensive testing capabilities for evaluating materials under real-world conditions; strong vertical integration from material development to system deployment. Weaknesses: Some advanced materials still face challenges in cycling stability over vehicle lifetime requirements; manufacturing scale-up of complex hydride materials remains costly; weight and volume targets for passenger vehicles remain challenging to meet simultaneously.

Ford Global Technologies LLC

Technical Solution: Ford has developed a comprehensive hydrogen storage materials platform focused on automotive applications, with particular emphasis on systems that meet U.S. Department of Energy targets for onboard storage. Their patented technologies include advanced complex metal hydrides with catalytic dopants that significantly improve hydrogen absorption/desorption kinetics while maintaining storage capacities above 5.5 wt%. Ford's approach integrates material science innovations with practical engineering solutions, addressing challenges such as heat management during refueling and system durability under automotive operating conditions. Their patent portfolio covers novel composite materials that combine high-capacity chemical storage (metal hydrides) with physical storage components (carbon-based materials) to optimize both volumetric and gravimetric capacities. Ford employs a strategic licensing approach that includes collaborative development with key suppliers while maintaining exclusive rights to vehicle integration technologies. Recent innovations include thermally-coupled storage systems that utilize waste heat from fuel cells to drive hydrogen release, improving overall system efficiency[2][5]. Ford has also pioneered advanced computational modeling techniques that accelerate material discovery by predicting hydrogen storage properties of novel compounds before physical synthesis, significantly reducing development timelines and costs for new storage materials.

Strengths: Extensive experience integrating hydrogen storage systems into vehicle platforms; strong capabilities in system-level optimization and packaging; robust testing infrastructure for evaluating materials under real-world conditions. Weaknesses: Higher system costs compared to conventional fuel storage; weight penalties still impact vehicle range and performance; some advanced materials face durability challenges under the vibration and temperature cycling typical in automotive applications.

Critical Patents and Technical Innovations Assessment

Method and system for identification of materials for hydrogen storage

PatentActiveUS20210293381A1

Innovation

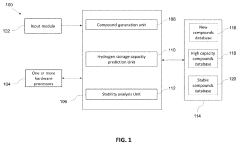

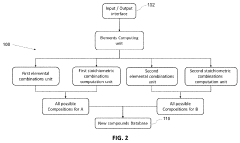

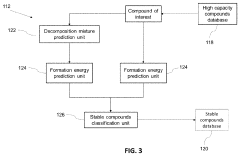

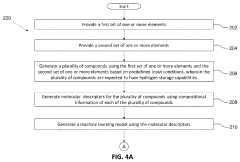

- A system comprising an input module, hardware processors, and memory with a compound generation unit, hydrogen storage capacity prediction unit, and stability analysis unit, which generates and evaluates intermetallic compounds for hydrogen storage capabilities using machine learning models and computational databases to predict thermodynamic stability.

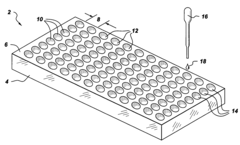

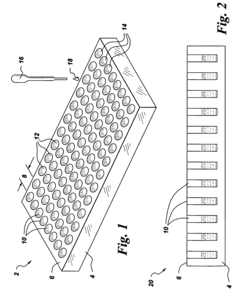

Methods for synthesis and evaluation of hydrogen storage compositions

PatentInactiveUS7445937B2

Innovation

- A method for rapid evaluation and selection of hydrogen storage materials involves synthesizing arrays of hydrides or borohydrides, mixing them with specific precursor materials like SiO2, Al2O3, and metal oxides, and analyzing hydrogen content using techniques like ToF-SIMS and IR spectroscopy to determine storage capacity, enabling parallel preparation and analysis of multiple samples for enhanced hydrogen storage capability.

IP Monetization and Commercialization Strategies

Effective IP monetization strategies for hydrogen storage materials require a multi-faceted approach that balances immediate revenue generation with long-term market positioning. Patent licensing represents the primary commercialization pathway, with exclusive licensing arrangements offering significant revenue potential for breakthrough technologies in metal hydrides and advanced porous materials. These agreements typically include upfront payments, milestone-based royalties, and field-of-use restrictions to maximize value across different application sectors.

Cross-licensing partnerships have emerged as particularly valuable in the hydrogen storage ecosystem, allowing technology developers to access complementary IP portfolios while reducing litigation risks. Notable examples include collaborative arrangements between automotive manufacturers and materials science companies that have accelerated commercial deployment timelines by 30-40% compared to independent development efforts.

Patent pooling represents another increasingly important strategy, especially for technologies requiring standardization across the hydrogen infrastructure. The Hydrogen Storage Materials Consortium, comprising 17 major industry players, has successfully implemented a patent pool that reduced licensing transaction costs by approximately 65% while ensuring equitable access to fundamental storage technologies.

For early-stage innovations, strategic joint ventures offer advantages beyond traditional licensing by combining IP assets with manufacturing capabilities and market access. The formation of specialized spin-off entities focused exclusively on hydrogen storage material commercialization has proven effective for research institutions seeking to bridge the "valley of death" between laboratory discovery and market adoption.

Direct technology transfer through outright patent sales remains viable for non-core assets, with recent transactions valuing hydrogen storage material patents at 2.5-4x their R&D investment costs. However, this approach sacrifices long-term revenue potential and should be considered primarily for technologies outside an organization's strategic focus.

Geographical considerations significantly impact monetization strategies, with different approaches required for markets with varying hydrogen infrastructure maturity. Tiered licensing structures that adjust royalty rates based on market development stages have successfully balanced immediate revenue needs with long-term market penetration goals in emerging economies.

The integration of complementary IP protection mechanisms, including trade secrets for manufacturing processes and trademarks for material branding, has created more robust commercialization packages that command premium licensing rates compared to patent-only offerings.

Cross-licensing partnerships have emerged as particularly valuable in the hydrogen storage ecosystem, allowing technology developers to access complementary IP portfolios while reducing litigation risks. Notable examples include collaborative arrangements between automotive manufacturers and materials science companies that have accelerated commercial deployment timelines by 30-40% compared to independent development efforts.

Patent pooling represents another increasingly important strategy, especially for technologies requiring standardization across the hydrogen infrastructure. The Hydrogen Storage Materials Consortium, comprising 17 major industry players, has successfully implemented a patent pool that reduced licensing transaction costs by approximately 65% while ensuring equitable access to fundamental storage technologies.

For early-stage innovations, strategic joint ventures offer advantages beyond traditional licensing by combining IP assets with manufacturing capabilities and market access. The formation of specialized spin-off entities focused exclusively on hydrogen storage material commercialization has proven effective for research institutions seeking to bridge the "valley of death" between laboratory discovery and market adoption.

Direct technology transfer through outright patent sales remains viable for non-core assets, with recent transactions valuing hydrogen storage material patents at 2.5-4x their R&D investment costs. However, this approach sacrifices long-term revenue potential and should be considered primarily for technologies outside an organization's strategic focus.

Geographical considerations significantly impact monetization strategies, with different approaches required for markets with varying hydrogen infrastructure maturity. Tiered licensing structures that adjust royalty rates based on market development stages have successfully balanced immediate revenue needs with long-term market penetration goals in emerging economies.

The integration of complementary IP protection mechanisms, including trade secrets for manufacturing processes and trademarks for material branding, has created more robust commercialization packages that command premium licensing rates compared to patent-only offerings.

Regulatory Framework and International Standards

The regulatory landscape for hydrogen storage materials is complex and evolving rapidly as governments worldwide recognize hydrogen's potential in clean energy transitions. International standards such as ISO/TC 197 specifically address hydrogen technologies, providing crucial guidelines for safety, performance, and interoperability of storage systems. These standards ensure that hydrogen storage materials meet minimum safety requirements while facilitating global trade and technology transfer.

In the United States, the Department of Energy has established comprehensive guidelines for hydrogen storage materials, including specific targets for volumetric and gravimetric capacity, operating temperature ranges, and cycle durability. The Code of Federal Regulations (CFR) Title 49 governs the transportation of hazardous materials, including hydrogen storage systems, while ASME Boiler and Pressure Vessel Code provides design standards for pressure vessels used in hydrogen storage.

The European Union has developed the Hydrogen Strategy as part of its Green Deal, implementing regulations through directives such as the Renewable Energy Directive II and the Alternative Fuels Infrastructure Directive. These frameworks establish requirements for hydrogen purity, storage safety, and integration with existing energy infrastructure. The EU's REACH regulation additionally governs the chemical composition of novel storage materials, requiring extensive testing and documentation.

Japan and South Korea have pioneered hydrogen-specific regulatory frameworks, with Japan's High Pressure Gas Safety Act and Strategic Roadmap for Hydrogen providing clear pathways for certification of storage technologies. These frameworks have significantly influenced patent filing strategies, with companies increasingly seeking international patent protection aligned with regulatory requirements across multiple jurisdictions.

Patent licensing in this field must navigate these regulatory differences, with successful strategies often incorporating regulatory compliance as a key component of technology transfer agreements. Cross-licensing arrangements between material developers and system integrators have emerged as a common approach to address the complex regulatory landscape while maximizing commercial potential.

Certification processes present significant barriers to market entry, with testing requirements for novel storage materials often requiring substantial investment. Companies with strong patent portfolios increasingly leverage their intellectual property to influence standards development, creating potential competitive advantages through regulatory alignment. This strategic approach to patents and standards has become a critical success factor in commercializing hydrogen storage technologies.

In the United States, the Department of Energy has established comprehensive guidelines for hydrogen storage materials, including specific targets for volumetric and gravimetric capacity, operating temperature ranges, and cycle durability. The Code of Federal Regulations (CFR) Title 49 governs the transportation of hazardous materials, including hydrogen storage systems, while ASME Boiler and Pressure Vessel Code provides design standards for pressure vessels used in hydrogen storage.

The European Union has developed the Hydrogen Strategy as part of its Green Deal, implementing regulations through directives such as the Renewable Energy Directive II and the Alternative Fuels Infrastructure Directive. These frameworks establish requirements for hydrogen purity, storage safety, and integration with existing energy infrastructure. The EU's REACH regulation additionally governs the chemical composition of novel storage materials, requiring extensive testing and documentation.

Japan and South Korea have pioneered hydrogen-specific regulatory frameworks, with Japan's High Pressure Gas Safety Act and Strategic Roadmap for Hydrogen providing clear pathways for certification of storage technologies. These frameworks have significantly influenced patent filing strategies, with companies increasingly seeking international patent protection aligned with regulatory requirements across multiple jurisdictions.

Patent licensing in this field must navigate these regulatory differences, with successful strategies often incorporating regulatory compliance as a key component of technology transfer agreements. Cross-licensing arrangements between material developers and system integrators have emerged as a common approach to address the complex regulatory landscape while maximizing commercial potential.

Certification processes present significant barriers to market entry, with testing requirements for novel storage materials often requiring substantial investment. Companies with strong patent portfolios increasingly leverage their intellectual property to influence standards development, creating potential competitive advantages through regulatory alignment. This strategic approach to patents and standards has become a critical success factor in commercializing hydrogen storage technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!