Expanding PLA's Horizons in Global Market Growth

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PLA Market Evolution

Polylactic acid (PLA) has undergone a remarkable evolution in the global market since its commercial introduction in the late 20th century. Initially positioned as a niche bioplastic, PLA has steadily expanded its presence across various industries, driven by increasing environmental awareness and the demand for sustainable materials.

The market trajectory of PLA has been characterized by several distinct phases. In its early years, PLA was primarily utilized in medical applications due to its biocompatibility and biodegradability. This niche market provided a foundation for further research and development, leading to improved production processes and enhanced material properties.

As production costs decreased and material performance improved, PLA began to penetrate the packaging industry. This marked a significant turning point in its market evolution, as packaging represents a substantial portion of the global plastics market. The food and beverage sector, in particular, embraced PLA for its ability to meet stringent safety standards while offering a reduced environmental footprint.

The textile industry soon followed, recognizing PLA's potential as a sustainable alternative to traditional synthetic fibers. This expansion into textiles opened up new avenues for growth, particularly in the sportswear and fashion segments, where eco-friendly materials are increasingly valued by consumers.

In recent years, PLA has made significant inroads into the 3D printing market. Its low shrinkage rate, ease of printing, and biodegradability have made it a popular choice for both hobbyists and industrial applications. This development has further diversified PLA's market presence and contributed to its growing global demand.

The automotive and electronics industries have also begun to explore PLA's potential, particularly for interior components and disposable electronic devices. While these sectors represent a smaller market share for PLA, they demonstrate the material's versatility and potential for future growth.

Geographically, the PLA market has seen a shift from its initial concentration in North America and Europe to a more global distribution. Asia-Pacific has emerged as a key growth region, driven by increasing environmental regulations, rising consumer awareness, and the presence of major PLA manufacturers in countries like China and Japan.

Looking ahead, the PLA market is poised for continued expansion. Technological advancements in production processes and material properties are expected to further enhance PLA's competitiveness against traditional plastics. Additionally, the growing emphasis on circular economy principles and stricter environmental regulations worldwide are likely to create new opportunities for PLA in various applications, potentially reshaping the global plastics market landscape.

The market trajectory of PLA has been characterized by several distinct phases. In its early years, PLA was primarily utilized in medical applications due to its biocompatibility and biodegradability. This niche market provided a foundation for further research and development, leading to improved production processes and enhanced material properties.

As production costs decreased and material performance improved, PLA began to penetrate the packaging industry. This marked a significant turning point in its market evolution, as packaging represents a substantial portion of the global plastics market. The food and beverage sector, in particular, embraced PLA for its ability to meet stringent safety standards while offering a reduced environmental footprint.

The textile industry soon followed, recognizing PLA's potential as a sustainable alternative to traditional synthetic fibers. This expansion into textiles opened up new avenues for growth, particularly in the sportswear and fashion segments, where eco-friendly materials are increasingly valued by consumers.

In recent years, PLA has made significant inroads into the 3D printing market. Its low shrinkage rate, ease of printing, and biodegradability have made it a popular choice for both hobbyists and industrial applications. This development has further diversified PLA's market presence and contributed to its growing global demand.

The automotive and electronics industries have also begun to explore PLA's potential, particularly for interior components and disposable electronic devices. While these sectors represent a smaller market share for PLA, they demonstrate the material's versatility and potential for future growth.

Geographically, the PLA market has seen a shift from its initial concentration in North America and Europe to a more global distribution. Asia-Pacific has emerged as a key growth region, driven by increasing environmental regulations, rising consumer awareness, and the presence of major PLA manufacturers in countries like China and Japan.

Looking ahead, the PLA market is poised for continued expansion. Technological advancements in production processes and material properties are expected to further enhance PLA's competitiveness against traditional plastics. Additionally, the growing emphasis on circular economy principles and stricter environmental regulations worldwide are likely to create new opportunities for PLA in various applications, potentially reshaping the global plastics market landscape.

Global Demand Analysis

The global demand for Polylactic Acid (PLA) has been experiencing significant growth in recent years, driven by increasing environmental concerns and the shift towards sustainable materials. As a biodegradable and renewable polymer, PLA has gained traction across various industries, particularly in packaging, textiles, and medical applications.

In the packaging sector, PLA has emerged as a viable alternative to traditional petroleum-based plastics. The food and beverage industry, in particular, has shown a strong interest in PLA due to its biodegradability and food-safe properties. This demand is further bolstered by stringent regulations on single-use plastics in many countries, pushing manufacturers to seek eco-friendly alternatives.

The textile industry has also embraced PLA, utilizing it in the production of sustainable fabrics. PLA fibers offer properties similar to polyester but with a lower environmental impact, appealing to environmentally conscious consumers and brands alike. This trend is expected to continue as more fashion companies commit to sustainable practices.

In the medical field, PLA's biocompatibility and biodegradability make it an attractive material for various applications, including surgical sutures, implants, and drug delivery systems. The growing emphasis on personalized medicine and regenerative therapies is likely to further drive demand for PLA in this sector.

Geographically, North America and Europe currently lead the PLA market, owing to stringent environmental regulations and high consumer awareness. However, the Asia-Pacific region is expected to witness the fastest growth in PLA demand, driven by rapid industrialization, increasing disposable incomes, and growing environmental consciousness in countries like China and India.

Despite the positive outlook, challenges remain in expanding PLA's market share. The relatively higher cost of PLA compared to conventional plastics remains a barrier to widespread adoption, particularly in price-sensitive markets. Additionally, limitations in PLA's performance characteristics, such as heat resistance and barrier properties, continue to restrict its use in certain applications.

To address these challenges and capitalize on the growing demand, industry players are investing in research and development to improve PLA's properties and reduce production costs. Innovations in PLA blends and composites are expanding the material's potential applications, while advancements in production technologies are gradually bringing down costs.

As global sustainability initiatives gain momentum and consumer preferences shift towards eco-friendly products, the demand for PLA is projected to continue its upward trajectory. This presents significant opportunities for market expansion and technological innovation in the PLA industry, positioning it as a key player in the transition towards a more sustainable global economy.

In the packaging sector, PLA has emerged as a viable alternative to traditional petroleum-based plastics. The food and beverage industry, in particular, has shown a strong interest in PLA due to its biodegradability and food-safe properties. This demand is further bolstered by stringent regulations on single-use plastics in many countries, pushing manufacturers to seek eco-friendly alternatives.

The textile industry has also embraced PLA, utilizing it in the production of sustainable fabrics. PLA fibers offer properties similar to polyester but with a lower environmental impact, appealing to environmentally conscious consumers and brands alike. This trend is expected to continue as more fashion companies commit to sustainable practices.

In the medical field, PLA's biocompatibility and biodegradability make it an attractive material for various applications, including surgical sutures, implants, and drug delivery systems. The growing emphasis on personalized medicine and regenerative therapies is likely to further drive demand for PLA in this sector.

Geographically, North America and Europe currently lead the PLA market, owing to stringent environmental regulations and high consumer awareness. However, the Asia-Pacific region is expected to witness the fastest growth in PLA demand, driven by rapid industrialization, increasing disposable incomes, and growing environmental consciousness in countries like China and India.

Despite the positive outlook, challenges remain in expanding PLA's market share. The relatively higher cost of PLA compared to conventional plastics remains a barrier to widespread adoption, particularly in price-sensitive markets. Additionally, limitations in PLA's performance characteristics, such as heat resistance and barrier properties, continue to restrict its use in certain applications.

To address these challenges and capitalize on the growing demand, industry players are investing in research and development to improve PLA's properties and reduce production costs. Innovations in PLA blends and composites are expanding the material's potential applications, while advancements in production technologies are gradually bringing down costs.

As global sustainability initiatives gain momentum and consumer preferences shift towards eco-friendly products, the demand for PLA is projected to continue its upward trajectory. This presents significant opportunities for market expansion and technological innovation in the PLA industry, positioning it as a key player in the transition towards a more sustainable global economy.

Technical Barriers

PLA (Polylactic Acid) faces several technical barriers in its quest for global market expansion. One of the primary challenges is its inherent brittleness, which limits its application in products requiring high impact resistance or flexibility. This characteristic makes PLA less suitable for certain packaging applications and durable goods, where materials like polyethylene or polypropylene currently dominate.

Another significant barrier is PLA's relatively low heat resistance compared to conventional plastics. Its low glass transition temperature (around 60°C) can cause issues in hot-fill applications or products exposed to high temperatures during use or transportation. This limitation restricts PLA's use in sectors such as automotive parts or electronics housings, where heat stability is crucial.

PLA's moisture sensitivity presents additional challenges. The material tends to absorb moisture from the environment, which can lead to hydrolysis and degradation of its mechanical properties over time. This characteristic necessitates careful handling and storage, potentially increasing costs and complexity in the supply chain.

The production cost of PLA remains higher than that of petroleum-based plastics, primarily due to the complex fermentation and polymerization processes involved. This cost differential makes it challenging for PLA to compete on price in many mass-market applications, particularly in price-sensitive markets or regions with less stringent environmental regulations.

PLA's biodegradability, while generally an advantage, can also be a technical barrier in certain applications. The material's tendency to degrade under specific environmental conditions may limit its use in products requiring long-term stability or those exposed to varied environmental conditions during their lifecycle.

The limited availability of industrial composting facilities in many regions poses a challenge to realizing the full environmental benefits of PLA. Without proper end-of-life management infrastructure, PLA products may end up in conventional waste streams, negating their biodegradability advantage.

Lastly, the variability in PLA's properties depending on its production process and source of raw materials can lead to inconsistencies in product performance. This variability makes it challenging for manufacturers to maintain consistent quality standards across different batches or suppliers, potentially hindering widespread adoption in industries with stringent quality requirements.

Another significant barrier is PLA's relatively low heat resistance compared to conventional plastics. Its low glass transition temperature (around 60°C) can cause issues in hot-fill applications or products exposed to high temperatures during use or transportation. This limitation restricts PLA's use in sectors such as automotive parts or electronics housings, where heat stability is crucial.

PLA's moisture sensitivity presents additional challenges. The material tends to absorb moisture from the environment, which can lead to hydrolysis and degradation of its mechanical properties over time. This characteristic necessitates careful handling and storage, potentially increasing costs and complexity in the supply chain.

The production cost of PLA remains higher than that of petroleum-based plastics, primarily due to the complex fermentation and polymerization processes involved. This cost differential makes it challenging for PLA to compete on price in many mass-market applications, particularly in price-sensitive markets or regions with less stringent environmental regulations.

PLA's biodegradability, while generally an advantage, can also be a technical barrier in certain applications. The material's tendency to degrade under specific environmental conditions may limit its use in products requiring long-term stability or those exposed to varied environmental conditions during their lifecycle.

The limited availability of industrial composting facilities in many regions poses a challenge to realizing the full environmental benefits of PLA. Without proper end-of-life management infrastructure, PLA products may end up in conventional waste streams, negating their biodegradability advantage.

Lastly, the variability in PLA's properties depending on its production process and source of raw materials can lead to inconsistencies in product performance. This variability makes it challenging for manufacturers to maintain consistent quality standards across different batches or suppliers, potentially hindering widespread adoption in industries with stringent quality requirements.

Current PLA Solutions

01 Biodegradable packaging applications

PLA is increasingly used in biodegradable packaging applications, driving market growth. Its eco-friendly properties make it an attractive alternative to traditional plastics in food packaging, disposable cutlery, and other single-use items. The growing consumer demand for sustainable products is fueling the adoption of PLA in this sector.- Biodegradable packaging applications: PLA is increasingly used in biodegradable packaging applications, driving market growth. Its eco-friendly properties make it an attractive alternative to traditional plastics in food packaging, disposable containers, and other single-use items. The growing consumer demand for sustainable packaging solutions is fueling the expansion of PLA in this sector.

- Medical and pharmaceutical applications: The PLA market is experiencing growth in medical and pharmaceutical applications. PLA's biocompatibility and biodegradability make it suitable for various medical devices, implants, and drug delivery systems. The increasing focus on sustainable healthcare solutions is driving the adoption of PLA in this sector.

- Textile and fiber applications: PLA is gaining traction in the textile and fiber industry, contributing to market growth. Its use in producing biodegradable fabrics, nonwoven materials, and sustainable clothing is increasing. The growing demand for eco-friendly textiles and the push for reducing microplastic pollution are driving PLA adoption in this sector.

- 3D printing and additive manufacturing: The PLA market is expanding due to its widespread use in 3D printing and additive manufacturing. PLA's ease of use, low warping, and good layer adhesion make it a popular choice for hobbyists and industrial applications. The growth of the 3D printing industry is driving increased demand for PLA filaments.

- Improved PLA production processes: Advancements in PLA production processes are contributing to market growth. New technologies and methods for more efficient and cost-effective PLA synthesis are being developed. These improvements are helping to reduce production costs and increase the competitiveness of PLA against traditional petroleum-based plastics.

02 Medical and pharmaceutical applications

The biocompatibility and biodegradability of PLA make it ideal for medical and pharmaceutical applications. It is used in surgical sutures, drug delivery systems, and tissue engineering scaffolds. The growing healthcare industry and increasing focus on bioabsorbable medical devices are contributing to the expansion of the PLA market in this sector.Expand Specific Solutions03 Textile and fiber applications

PLA is gaining traction in the textile industry as a sustainable alternative to synthetic fibers. It is used in the production of eco-friendly fabrics, nonwoven materials, and upholstery. The growing demand for sustainable fashion and home textiles is driving the adoption of PLA in this sector, contributing to market growth.Expand Specific Solutions04 3D printing and additive manufacturing

PLA is widely used in 3D printing and additive manufacturing due to its ease of use, low warping, and biodegradability. The expanding 3D printing industry, particularly in prototyping and small-scale production, is driving the demand for PLA filaments and contributing to market growth in this sector.Expand Specific Solutions05 Technological advancements in PLA production

Ongoing research and development efforts are focused on improving PLA production processes, enhancing its properties, and reducing production costs. These advancements include new polymerization techniques, blending with other materials, and the development of high-performance PLA grades. Such innovations are expanding the potential applications of PLA and driving overall market growth.Expand Specific Solutions

Key Industry Players

The global market for PLA (Polylactic Acid) is experiencing significant growth, driven by increasing demand for sustainable packaging solutions. The industry is in a rapid expansion phase, with market size projected to reach substantial figures in the coming years. Technological maturity varies among key players, with companies like NatureWorks LLC and Total Research Corp leading in innovation. Universities such as the University of Florida and Tongji University are contributing to research advancements. Emerging players like Avantium Knowledge Centre BV and Galatea Biotech SRL are introducing novel approaches, while established corporations like 3M Innovative Properties Co. and LG Chem Ltd. are leveraging their resources to expand PLA applications. The competitive landscape is dynamic, with a mix of academic institutions, startups, and multinational corporations driving progress in PLA technology and market penetration.

Arkema France SA

Technical Solution: Arkema has developed a range of bio-based polymers under their Rilsan and Pebax Rnew product lines. These materials are derived from castor oil, a renewable resource. The Rilsan polyamide 11 is produced through a multi-step process that converts castor oil into 11-aminoundecanoic acid, which is then polymerized to form a high-performance, bio-based nylon. Pebax Rnew is a thermoplastic elastomer that combines blocks of polyamide 11 with polyether, resulting in a flexible and durable material with a high renewable content. Arkema has also invested in developing bio-based acrylic acid for use in various applications.

Strengths: High renewable content and excellent material properties. Weaknesses: Reliance on a single bio-based feedstock (castor oil) and potential supply chain vulnerabilities.

LG Chem Ltd.

Technical Solution: LG Chem has developed a range of bio-based materials, including their LUPOY EU series of bio-based polycarbonates. This technology involves incorporating bio-based isosorbide into the polycarbonate structure, replacing a portion of the petroleum-derived bisphenol A (BPA). The resulting material offers improved heat resistance and durability compared to conventional polycarbonates. LG Chem has also invested in the development of bio-based super absorbent polymers (SAPs) for use in hygiene products, utilizing renewable resources to create more sustainable alternatives to traditional SAPs.

Strengths: Improved material properties and reduced dependence on BPA. Weaknesses: Limited bio-based content and potential for higher production costs.

Breakthrough Patents

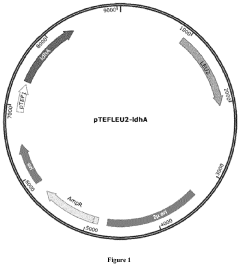

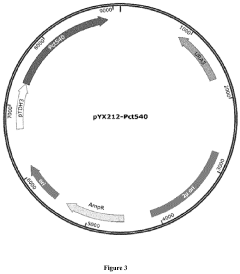

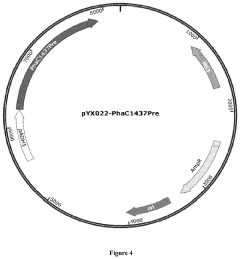

Process for cellular biosynthesis of poly d-lactic acid and poly l-lactic acid

PatentActiveUS20210324429A1

Innovation

- Engineering eukaryotic cells, such as yeast strains, to redirect metabolic pathways for the direct biological synthesis of PLLA and PDLA from carbon sources like glucose, using enzymes like D-lactate dehydrogenase, propionyl-CoA transferase, and polyhydroxyalkanoate synthase to convert pyruvate into lactyl-CoA and subsequently polymerize it into the desired polymers.

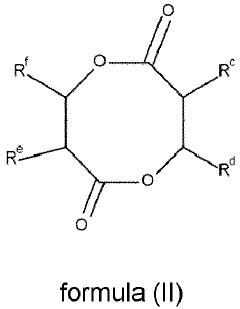

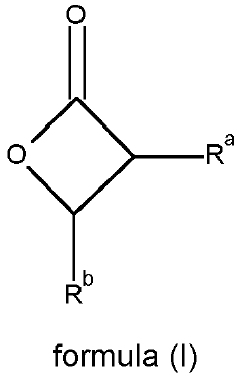

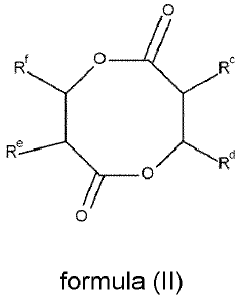

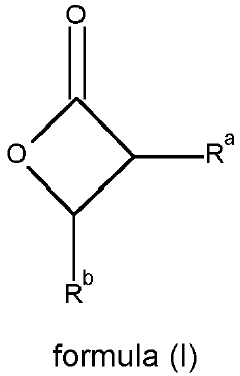

Process for preparing tailor-made lactide copolymers and lactide copolymers thereby obtained

PatentInactiveEP4092067A1

Innovation

- A process involving the copolymerization of lactide monomers with beta-lactones and diolides, in the presence of catalysts and optionally initiators, to produce lactide copolymers with tailored properties, including improved biodegradability and controlled physicochemical properties.

Regulatory Landscape

The regulatory landscape for PLA (Polylactic Acid) in the global market is complex and multifaceted, reflecting the diverse approaches of different countries and regions towards bioplastics and sustainable materials. In the European Union, PLA benefits from supportive policies under the European Green Deal and Circular Economy Action Plan, which promote the use of bio-based and biodegradable materials. The EU's Single-Use Plastics Directive, while restricting certain plastic products, creates opportunities for PLA as an alternative material.

In the United States, the regulatory environment is more fragmented, with policies varying at federal, state, and local levels. The FDA has approved PLA for food contact applications, facilitating its use in packaging. However, the lack of a unified national policy on bioplastics presents challenges for market expansion. Some states, like California, have implemented more stringent regulations on plastic use, potentially boosting demand for PLA-based alternatives.

Asian markets, particularly China and Japan, are increasingly adopting favorable policies towards bioplastics. China's ban on certain single-use plastics has created a significant market opportunity for PLA. Japan's commitment to reducing plastic waste has led to supportive measures for bioplastic adoption, including PLA.

Globally, the regulatory trend is moving towards stricter controls on conventional plastics and increased support for sustainable alternatives. This shift is driven by growing environmental concerns and international agreements such as the Paris Agreement. Many countries are implementing extended producer responsibility (EPR) schemes, which can indirectly benefit PLA producers by incentivizing the use of more environmentally friendly materials.

However, the regulatory landscape also presents challenges for PLA expansion. The lack of standardized end-of-life management systems for bioplastics in many regions can hinder proper disposal and recycling. Additionally, varying definitions and standards for biodegradability and compostability across different jurisdictions create compliance complexities for PLA manufacturers operating in multiple markets.

As the PLA industry seeks global market growth, navigating this diverse regulatory landscape is crucial. Companies must stay abreast of evolving regulations, engage with policymakers, and adapt their strategies to comply with regional requirements while capitalizing on supportive policies. The ongoing development of international standards for bioplastics could help harmonize regulations and facilitate PLA's expansion in the global market.

In the United States, the regulatory environment is more fragmented, with policies varying at federal, state, and local levels. The FDA has approved PLA for food contact applications, facilitating its use in packaging. However, the lack of a unified national policy on bioplastics presents challenges for market expansion. Some states, like California, have implemented more stringent regulations on plastic use, potentially boosting demand for PLA-based alternatives.

Asian markets, particularly China and Japan, are increasingly adopting favorable policies towards bioplastics. China's ban on certain single-use plastics has created a significant market opportunity for PLA. Japan's commitment to reducing plastic waste has led to supportive measures for bioplastic adoption, including PLA.

Globally, the regulatory trend is moving towards stricter controls on conventional plastics and increased support for sustainable alternatives. This shift is driven by growing environmental concerns and international agreements such as the Paris Agreement. Many countries are implementing extended producer responsibility (EPR) schemes, which can indirectly benefit PLA producers by incentivizing the use of more environmentally friendly materials.

However, the regulatory landscape also presents challenges for PLA expansion. The lack of standardized end-of-life management systems for bioplastics in many regions can hinder proper disposal and recycling. Additionally, varying definitions and standards for biodegradability and compostability across different jurisdictions create compliance complexities for PLA manufacturers operating in multiple markets.

As the PLA industry seeks global market growth, navigating this diverse regulatory landscape is crucial. Companies must stay abreast of evolving regulations, engage with policymakers, and adapt their strategies to comply with regional requirements while capitalizing on supportive policies. The ongoing development of international standards for bioplastics could help harmonize regulations and facilitate PLA's expansion in the global market.

Sustainability Impact

The expansion of PLA (Polylactic Acid) in the global market presents significant sustainability implications that warrant careful consideration. As a biodegradable and renewable polymer derived from plant-based sources, PLA offers a promising alternative to traditional petroleum-based plastics. Its growth in the global market aligns with increasing environmental consciousness and regulatory pressures to reduce plastic waste and carbon emissions.

PLA's sustainability impact extends across its entire lifecycle. During production, PLA requires less energy and generates fewer greenhouse gas emissions compared to conventional plastics. This advantage contributes to a reduced carbon footprint, making it an attractive option for environmentally conscious consumers and businesses. Additionally, PLA's plant-based origins mean it relies on renewable resources, potentially alleviating concerns about the depletion of fossil fuels associated with traditional plastic production.

The end-of-life phase of PLA products also offers sustainability benefits. Under proper conditions, PLA can biodegrade within a few months to several years, significantly faster than conventional plastics that may persist in the environment for centuries. This characteristic helps mitigate the accumulation of plastic waste in landfills and oceans, addressing one of the most pressing environmental challenges of our time.

However, the sustainability impact of PLA is not without complexities. The expansion of PLA production may lead to increased agricultural land use for growing feedstock crops, potentially competing with food production or contributing to deforestation if not managed responsibly. Furthermore, the biodegradability of PLA requires specific industrial composting conditions that are not universally available, which could limit its environmental benefits in regions lacking appropriate waste management infrastructure.

As PLA's global market share grows, its impact on recycling systems must be considered. While PLA can be recycled, it requires separate processing from conventional plastics to avoid contamination. The expansion of PLA usage necessitates the development and implementation of dedicated recycling streams to maximize its circular economy potential.

The sustainability impact of PLA's market growth also extends to consumer behavior and industry practices. As more products incorporate PLA, there is potential for increased awareness and adoption of sustainable materials across various sectors. This shift could catalyze broader changes in product design, manufacturing processes, and waste management strategies, fostering a more environmentally conscious approach to production and consumption globally.

PLA's sustainability impact extends across its entire lifecycle. During production, PLA requires less energy and generates fewer greenhouse gas emissions compared to conventional plastics. This advantage contributes to a reduced carbon footprint, making it an attractive option for environmentally conscious consumers and businesses. Additionally, PLA's plant-based origins mean it relies on renewable resources, potentially alleviating concerns about the depletion of fossil fuels associated with traditional plastic production.

The end-of-life phase of PLA products also offers sustainability benefits. Under proper conditions, PLA can biodegrade within a few months to several years, significantly faster than conventional plastics that may persist in the environment for centuries. This characteristic helps mitigate the accumulation of plastic waste in landfills and oceans, addressing one of the most pressing environmental challenges of our time.

However, the sustainability impact of PLA is not without complexities. The expansion of PLA production may lead to increased agricultural land use for growing feedstock crops, potentially competing with food production or contributing to deforestation if not managed responsibly. Furthermore, the biodegradability of PLA requires specific industrial composting conditions that are not universally available, which could limit its environmental benefits in regions lacking appropriate waste management infrastructure.

As PLA's global market share grows, its impact on recycling systems must be considered. While PLA can be recycled, it requires separate processing from conventional plastics to avoid contamination. The expansion of PLA usage necessitates the development and implementation of dedicated recycling streams to maximize its circular economy potential.

The sustainability impact of PLA's market growth also extends to consumer behavior and industry practices. As more products incorporate PLA, there is potential for increased awareness and adoption of sustainable materials across various sectors. This shift could catalyze broader changes in product design, manufacturing processes, and waste management strategies, fostering a more environmentally conscious approach to production and consumption globally.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!