Exploring Polyurethane's Potential in Waste Management

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PU in Waste Management: Background and Objectives

Polyurethane (PU) has emerged as a versatile material with significant potential in waste management applications. The evolution of PU technology has been driven by the growing need for sustainable solutions in waste handling and disposal. As environmental concerns intensify globally, the focus on developing innovative materials for efficient waste management has become paramount.

The journey of PU in waste management began with its recognition as a durable and adaptable polymer. Initially used in various industrial applications, researchers and engineers started exploring its potential for addressing waste-related challenges. The unique properties of PU, including its flexibility, strength, and resistance to chemicals and abrasion, make it an ideal candidate for waste management solutions.

Over the years, the objectives for PU in waste management have expanded and evolved. The primary goal is to leverage PU's characteristics to create more effective and environmentally friendly waste handling systems. This includes developing PU-based materials for waste containment, filtration, and treatment processes. Additionally, there is a growing emphasis on utilizing PU in the creation of biodegradable or easily recyclable products to reduce overall waste generation.

One of the key technological trends in this field is the development of PU foams with enhanced absorption capabilities. These foams are being engineered to effectively capture and contain various types of waste, including hazardous materials and oil spills. Another significant trend is the creation of PU-based membranes for advanced filtration systems, capable of removing contaminants from water and air more efficiently than traditional methods.

The integration of PU into waste management strategies also aims to address the issue of plastic pollution. Researchers are exploring ways to incorporate PU into biodegradable plastics or as a component in multi-layer packaging that can be easily separated for recycling. This aligns with the broader objective of creating a circular economy where materials can be reused or recycled effectively.

As the field progresses, the focus is shifting towards developing 'smart' PU materials that can adapt to different waste management scenarios. This includes PU formulations that can change properties based on environmental conditions or those that can selectively capture specific pollutants. The ultimate goal is to create a range of PU-based solutions that can significantly improve the efficiency and sustainability of waste management processes across various industries and applications.

The journey of PU in waste management began with its recognition as a durable and adaptable polymer. Initially used in various industrial applications, researchers and engineers started exploring its potential for addressing waste-related challenges. The unique properties of PU, including its flexibility, strength, and resistance to chemicals and abrasion, make it an ideal candidate for waste management solutions.

Over the years, the objectives for PU in waste management have expanded and evolved. The primary goal is to leverage PU's characteristics to create more effective and environmentally friendly waste handling systems. This includes developing PU-based materials for waste containment, filtration, and treatment processes. Additionally, there is a growing emphasis on utilizing PU in the creation of biodegradable or easily recyclable products to reduce overall waste generation.

One of the key technological trends in this field is the development of PU foams with enhanced absorption capabilities. These foams are being engineered to effectively capture and contain various types of waste, including hazardous materials and oil spills. Another significant trend is the creation of PU-based membranes for advanced filtration systems, capable of removing contaminants from water and air more efficiently than traditional methods.

The integration of PU into waste management strategies also aims to address the issue of plastic pollution. Researchers are exploring ways to incorporate PU into biodegradable plastics or as a component in multi-layer packaging that can be easily separated for recycling. This aligns with the broader objective of creating a circular economy where materials can be reused or recycled effectively.

As the field progresses, the focus is shifting towards developing 'smart' PU materials that can adapt to different waste management scenarios. This includes PU formulations that can change properties based on environmental conditions or those that can selectively capture specific pollutants. The ultimate goal is to create a range of PU-based solutions that can significantly improve the efficiency and sustainability of waste management processes across various industries and applications.

Market Analysis for PU-based Waste Solutions

The global market for polyurethane-based waste management solutions is experiencing significant growth, driven by increasing environmental concerns and stringent regulations on waste disposal. The versatility of polyurethane (PU) in waste management applications has led to its adoption across various sectors, including construction, automotive, and packaging industries.

In the construction sector, PU-based solutions are gaining traction for their ability to improve waste segregation and recycling processes. The market for PU-based waste sorting systems is expected to grow as municipalities and waste management companies seek more efficient and cost-effective solutions. Additionally, PU-based insulation materials made from recycled waste are becoming increasingly popular, creating a circular economy within the industry.

The automotive sector presents another promising market for PU-based waste management solutions. As vehicle manufacturers strive to increase the recyclability of their products, PU-based components that can be easily separated and recycled are in high demand. This trend is particularly evident in the development of PU-based foams and adhesives that facilitate the dismantling and recycling of end-of-life vehicles.

In the packaging industry, PU-based biodegradable materials are emerging as a sustainable alternative to traditional plastics. The market for these materials is projected to grow significantly as consumers and regulators push for more environmentally friendly packaging solutions. PU-based packaging materials that offer both durability and biodegradability are particularly sought after in the food and beverage sector.

The Asia-Pacific region is expected to be the fastest-growing market for PU-based waste management solutions, driven by rapid industrialization, urbanization, and increasing environmental awareness. Countries like China and India are implementing stricter waste management regulations, creating opportunities for innovative PU-based solutions.

North America and Europe remain significant markets, with a focus on advanced recycling technologies and circular economy initiatives. The demand for PU-based products made from recycled materials is particularly strong in these regions, as companies seek to improve their sustainability credentials and meet consumer expectations.

Key market players in the PU-based waste management sector include chemical companies developing innovative PU formulations, waste management equipment manufacturers incorporating PU components, and recycling technology firms specializing in PU recovery and reprocessing. Collaborations between these players are becoming more common, leading to integrated solutions that address multiple aspects of the waste management value chain.

In the construction sector, PU-based solutions are gaining traction for their ability to improve waste segregation and recycling processes. The market for PU-based waste sorting systems is expected to grow as municipalities and waste management companies seek more efficient and cost-effective solutions. Additionally, PU-based insulation materials made from recycled waste are becoming increasingly popular, creating a circular economy within the industry.

The automotive sector presents another promising market for PU-based waste management solutions. As vehicle manufacturers strive to increase the recyclability of their products, PU-based components that can be easily separated and recycled are in high demand. This trend is particularly evident in the development of PU-based foams and adhesives that facilitate the dismantling and recycling of end-of-life vehicles.

In the packaging industry, PU-based biodegradable materials are emerging as a sustainable alternative to traditional plastics. The market for these materials is projected to grow significantly as consumers and regulators push for more environmentally friendly packaging solutions. PU-based packaging materials that offer both durability and biodegradability are particularly sought after in the food and beverage sector.

The Asia-Pacific region is expected to be the fastest-growing market for PU-based waste management solutions, driven by rapid industrialization, urbanization, and increasing environmental awareness. Countries like China and India are implementing stricter waste management regulations, creating opportunities for innovative PU-based solutions.

North America and Europe remain significant markets, with a focus on advanced recycling technologies and circular economy initiatives. The demand for PU-based products made from recycled materials is particularly strong in these regions, as companies seek to improve their sustainability credentials and meet consumer expectations.

Key market players in the PU-based waste management sector include chemical companies developing innovative PU formulations, waste management equipment manufacturers incorporating PU components, and recycling technology firms specializing in PU recovery and reprocessing. Collaborations between these players are becoming more common, leading to integrated solutions that address multiple aspects of the waste management value chain.

Current Challenges in PU Waste Management

Polyurethane (PU) waste management presents significant challenges due to the material's complex chemical structure and widespread use across various industries. One of the primary issues is the lack of efficient recycling methods for PU products, particularly foam-based items. Traditional recycling techniques often struggle to handle the diverse range of PU formulations, resulting in a large portion of PU waste ending up in landfills or incineration facilities.

The durability of PU products, while beneficial for their intended use, poses a problem for waste management. PU materials can persist in the environment for extended periods, contributing to long-term pollution. This persistence is particularly concerning for single-use PU products, which generate a substantial volume of waste with limited recycling options.

Another challenge lies in the presence of additives and contaminants in PU waste streams. Many PU products contain flame retardants, plasticizers, and other chemicals that complicate recycling processes and may release harmful substances during disposal or incineration. Separating these additives from the base PU material remains a technical hurdle in developing effective recycling strategies.

The energy-intensive nature of current PU recycling methods also presents environmental and economic challenges. Mechanical recycling, while feasible for some PU products, often results in downcycled materials with limited applications. Chemical recycling techniques, such as glycolysis and hydrolysis, show promise but require significant energy input and may produce hazardous by-products that necessitate further treatment.

The global distribution of PU waste adds complexity to management efforts. Developed countries often export PU waste to developing nations, where inadequate waste management infrastructure can lead to improper disposal and environmental contamination. This practice highlights the need for international cooperation and standardized approaches to PU waste management.

Lastly, the lack of economic incentives for PU recycling hinders the development and implementation of innovative waste management solutions. The relatively low cost of virgin PU production, coupled with the technical challenges of recycling, often makes recycled PU materials economically uncompetitive. This economic barrier discourages investment in recycling technologies and infrastructure, perpetuating the cycle of PU waste accumulation.

Addressing these challenges requires a multifaceted approach, combining technological innovation, policy interventions, and industry collaboration. Developing more efficient and cost-effective recycling technologies, implementing extended producer responsibility programs, and creating markets for recycled PU materials are crucial steps toward improving PU waste management practices globally.

The durability of PU products, while beneficial for their intended use, poses a problem for waste management. PU materials can persist in the environment for extended periods, contributing to long-term pollution. This persistence is particularly concerning for single-use PU products, which generate a substantial volume of waste with limited recycling options.

Another challenge lies in the presence of additives and contaminants in PU waste streams. Many PU products contain flame retardants, plasticizers, and other chemicals that complicate recycling processes and may release harmful substances during disposal or incineration. Separating these additives from the base PU material remains a technical hurdle in developing effective recycling strategies.

The energy-intensive nature of current PU recycling methods also presents environmental and economic challenges. Mechanical recycling, while feasible for some PU products, often results in downcycled materials with limited applications. Chemical recycling techniques, such as glycolysis and hydrolysis, show promise but require significant energy input and may produce hazardous by-products that necessitate further treatment.

The global distribution of PU waste adds complexity to management efforts. Developed countries often export PU waste to developing nations, where inadequate waste management infrastructure can lead to improper disposal and environmental contamination. This practice highlights the need for international cooperation and standardized approaches to PU waste management.

Lastly, the lack of economic incentives for PU recycling hinders the development and implementation of innovative waste management solutions. The relatively low cost of virgin PU production, coupled with the technical challenges of recycling, often makes recycled PU materials economically uncompetitive. This economic barrier discourages investment in recycling technologies and infrastructure, perpetuating the cycle of PU waste accumulation.

Addressing these challenges requires a multifaceted approach, combining technological innovation, policy interventions, and industry collaboration. Developing more efficient and cost-effective recycling technologies, implementing extended producer responsibility programs, and creating markets for recycled PU materials are crucial steps toward improving PU waste management practices globally.

Existing PU Waste Treatment Methods

01 Polyurethane synthesis and composition

This category focuses on the synthesis and composition of polyurethane materials. It includes various methods for producing polyurethane with specific properties, such as improved durability, flexibility, or chemical resistance. The synthesis may involve different types of isocyanates, polyols, and additives to achieve desired characteristics.- Polyurethane synthesis and composition: This category focuses on the synthesis and composition of polyurethane materials. It includes various methods for producing polyurethane with specific properties, such as improved durability, flexibility, or chemical resistance. The synthesis often involves the reaction of polyols with isocyanates, and may incorporate additional components to modify the final product's characteristics.

- Polyurethane applications in coatings and adhesives: This point covers the use of polyurethane in various coating and adhesive applications. Polyurethane-based coatings and adhesives offer excellent durability, chemical resistance, and bonding strength. These properties make them suitable for a wide range of industries, including automotive, construction, and electronics.

- Polyurethane foam technology: This category encompasses advancements in polyurethane foam technology. It includes innovations in foam formulation, processing techniques, and the development of specialized foam products. These foams can be tailored for various applications, such as insulation, cushioning, and structural components, with properties like density, rigidity, and thermal conductivity being optimized for specific uses.

- Sustainable and bio-based polyurethanes: This point focuses on the development of sustainable and bio-based polyurethane materials. It includes research into renewable raw materials, such as plant-based polyols, and the creation of biodegradable polyurethane products. These innovations aim to reduce the environmental impact of polyurethane production and use while maintaining or improving performance characteristics.

- Polyurethane in medical and healthcare applications: This category covers the use of polyurethane in medical and healthcare applications. It includes the development of biocompatible polyurethane materials for medical devices, implants, and wound dressings. These materials often require specific properties such as controlled drug release, antimicrobial activity, or tissue compatibility, and may involve specialized processing techniques to meet regulatory requirements.

02 Polyurethane applications in coatings and films

This point covers the use of polyurethane in various coating and film applications. It includes formulations for protective coatings, adhesive films, and specialty surface treatments. The polyurethane-based coatings and films may offer properties such as weather resistance, chemical resistance, and improved adhesion to different substrates.Expand Specific Solutions03 Polyurethane foam technology

This category encompasses innovations in polyurethane foam production and properties. It includes advancements in foam formulations, processing techniques, and the development of specialized foam products. The foams may have applications in insulation, cushioning, packaging, and other industries requiring lightweight, durable materials.Expand Specific Solutions04 Polyurethane in textile and fiber applications

This point focuses on the use of polyurethane in textile and fiber-related applications. It includes the development of polyurethane-based fibers, coatings for textiles, and treatments for enhancing fabric properties. Applications may include waterproof breathable fabrics, elastic textiles, and durable protective clothing.Expand Specific Solutions05 Environmentally friendly polyurethane innovations

This category covers advancements in making polyurethane more environmentally friendly. It includes the development of bio-based polyurethanes, recyclable or biodegradable formulations, and processes that reduce the environmental impact of polyurethane production and use. These innovations aim to address sustainability concerns in the polyurethane industry.Expand Specific Solutions

Key Players in PU Waste Management Industry

The exploration of polyurethane's potential in waste management is in its growth phase, with increasing market size and technological advancements. The global market for polyurethane recycling is expanding, driven by environmental concerns and regulatory pressures. Major players like BASF Corp., Covestro Deutschland AG, and Bayer AG are at the forefront of developing innovative solutions. The technology's maturity varies, with companies such as Evonik Operations GmbH and DuPont de Nemours, Inc. making significant strides in chemical recycling processes. Academic institutions like Sichuan University and Zhejiang University are contributing to research and development, while specialized firms like Resinate Materials Group, Inc. and Ioniqa Technologies BV are focusing on niche applications, indicating a diverse and competitive landscape in this emerging field.

BASF Corp.

Technical Solution: BASF has developed a novel polyurethane-based waste management solution called "ChemCycling". This process involves converting plastic waste into pyrolysis oil, which is then used as a feedstock for new chemical products, including polyurethanes. The technology allows for the recycling of mixed plastic waste that is typically difficult to recycle mechanically. BASF has also developed bio-based polyols for polyurethane production, which can be derived from renewable resources such as vegetable oils, further contributing to waste reduction and sustainability in the polyurethane industry.

Strengths: Innovative approach to plastic waste recycling, integration of circular economy principles, potential for large-scale implementation. Weaknesses: High initial investment costs, dependency on consistent waste supply, potential challenges in scaling up the technology.

Evonik Operations GmbH

Technical Solution: Evonik has developed a range of polyurethane additives and technologies aimed at improving waste management in the polyurethane industry. Their TEGOSTAB® series includes stabilizers that enhance the efficiency of polyurethane foam production, reducing waste and improving recyclability. Evonik has also introduced VESTENAMER®, a process additive that allows for the upcycling of rubber waste into high-quality polyurethane products. Additionally, they have developed bio-based polyols derived from renewable resources, which can be used in polyurethane production to reduce reliance on fossil-based materials and minimize waste.

Strengths: Diverse portfolio of waste management solutions, focus on both production efficiency and end-of-life recycling, strong research and development capabilities. Weaknesses: Some solutions may be specific to certain polyurethane applications, potential higher costs compared to traditional materials.

Innovative PU Recycling Techniques

Novel Polymers Depolymerizable by Metathesis of a Cleavable Unit

PatentActiveUS20210371575A1

Innovation

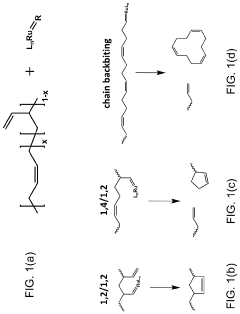

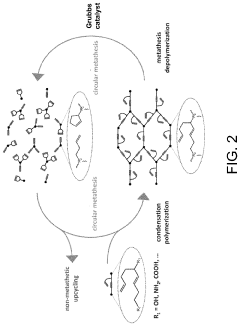

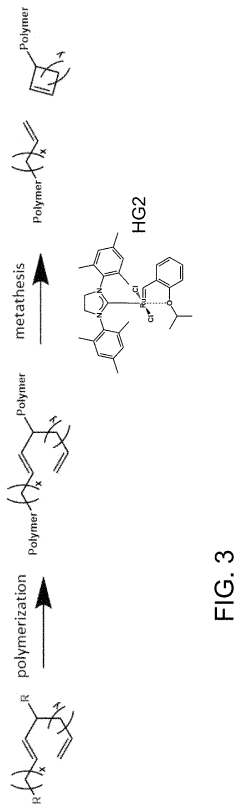

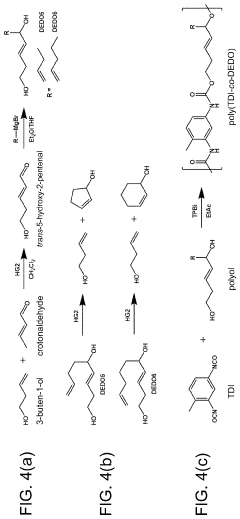

- Development of depolymerizable polymers with monomeric units containing double bonds in main-chain and side-chain configurations, enabling catalytic olefin metathesis for selective depolymerization using Grubbs' catalysts, which cleaves the polymer chain into low molecular weight products that can be re-polymerized through traditional methods.

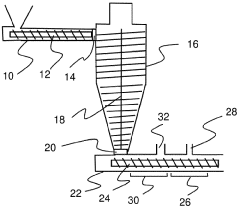

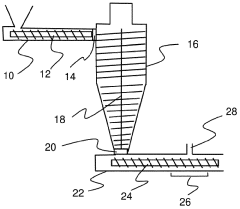

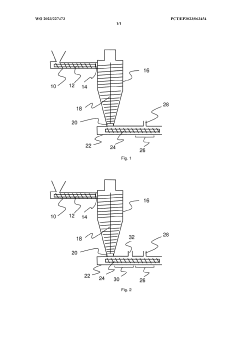

Conversion of polyurethane in a tapered reactor

PatentWO2023227473A1

Innovation

- A continuous process involving a tapered reactor where polyurethane, mixed with a limited amount of aqueous medium, is subjected to pressure and heat, converting it into a more manageable liquid form with a significant reduction in volume, allowing for easier handling and potential further processing.

Environmental Impact of PU Waste Solutions

The environmental impact of polyurethane (PU) waste solutions is a critical consideration in the exploration of PU's potential in waste management. As the global production and consumption of PU products continue to rise, the need for effective and environmentally friendly waste management solutions becomes increasingly urgent.

Traditional methods of PU waste disposal, such as landfilling and incineration, have significant negative environmental consequences. Landfilling PU waste leads to long-term soil and groundwater contamination due to the slow degradation of PU materials. Additionally, the release of harmful chemicals and microplastics from PU waste in landfills poses risks to ecosystems and human health.

Incineration of PU waste, while reducing the volume of waste, results in the emission of toxic gases and particulate matter. These emissions contribute to air pollution and can have adverse effects on both human health and the environment. Furthermore, the incineration process generates ash residues that require proper disposal, potentially leading to secondary environmental issues.

In response to these challenges, innovative PU waste management solutions are being developed with a focus on minimizing environmental impact. Mechanical recycling of PU waste has shown promise in reducing the need for virgin materials and decreasing energy consumption in production processes. This approach helps conserve natural resources and reduces the carbon footprint associated with PU manufacturing.

Chemical recycling methods, such as glycolysis and hydrolysis, offer the potential to break down PU waste into its chemical components for reuse. These processes can significantly reduce the environmental burden of PU waste by creating a closed-loop system that minimizes the need for new raw materials and reduces overall waste generation.

Biodegradable PU formulations are being researched as a long-term solution to the environmental persistence of PU waste. These materials are designed to break down more readily in natural environments, reducing the accumulation of PU waste in ecosystems and potentially mitigating the release of microplastics.

The development of PU-based composites that incorporate natural fibers or recycled materials is another avenue being explored to enhance the environmental profile of PU products. These composites can improve the biodegradability of PU materials while maintaining their desirable properties, offering a more sustainable alternative to traditional PU formulations.

As research in this field progresses, life cycle assessments (LCAs) are becoming increasingly important in evaluating the overall environmental impact of different PU waste management strategies. These assessments consider factors such as energy consumption, greenhouse gas emissions, and resource depletion throughout the entire life cycle of PU products and waste management processes.

Traditional methods of PU waste disposal, such as landfilling and incineration, have significant negative environmental consequences. Landfilling PU waste leads to long-term soil and groundwater contamination due to the slow degradation of PU materials. Additionally, the release of harmful chemicals and microplastics from PU waste in landfills poses risks to ecosystems and human health.

Incineration of PU waste, while reducing the volume of waste, results in the emission of toxic gases and particulate matter. These emissions contribute to air pollution and can have adverse effects on both human health and the environment. Furthermore, the incineration process generates ash residues that require proper disposal, potentially leading to secondary environmental issues.

In response to these challenges, innovative PU waste management solutions are being developed with a focus on minimizing environmental impact. Mechanical recycling of PU waste has shown promise in reducing the need for virgin materials and decreasing energy consumption in production processes. This approach helps conserve natural resources and reduces the carbon footprint associated with PU manufacturing.

Chemical recycling methods, such as glycolysis and hydrolysis, offer the potential to break down PU waste into its chemical components for reuse. These processes can significantly reduce the environmental burden of PU waste by creating a closed-loop system that minimizes the need for new raw materials and reduces overall waste generation.

Biodegradable PU formulations are being researched as a long-term solution to the environmental persistence of PU waste. These materials are designed to break down more readily in natural environments, reducing the accumulation of PU waste in ecosystems and potentially mitigating the release of microplastics.

The development of PU-based composites that incorporate natural fibers or recycled materials is another avenue being explored to enhance the environmental profile of PU products. These composites can improve the biodegradability of PU materials while maintaining their desirable properties, offering a more sustainable alternative to traditional PU formulations.

As research in this field progresses, life cycle assessments (LCAs) are becoming increasingly important in evaluating the overall environmental impact of different PU waste management strategies. These assessments consider factors such as energy consumption, greenhouse gas emissions, and resource depletion throughout the entire life cycle of PU products and waste management processes.

Regulatory Framework for PU Waste Management

The regulatory framework for polyurethane (PU) waste management is a complex and evolving landscape that plays a crucial role in shaping the industry's approach to sustainability and environmental protection. As governments and international bodies increasingly recognize the environmental impact of plastic waste, including PU, they have implemented various regulations and guidelines to address the issue.

In the European Union, the Waste Framework Directive (2008/98/EC) provides the overarching legal framework for waste management, including PU waste. This directive establishes a waste hierarchy that prioritizes prevention, reuse, and recycling over energy recovery and disposal. The EU has also introduced specific regulations targeting plastic waste, such as the Single-Use Plastics Directive (EU) 2019/904, which indirectly affects PU waste management practices.

In the United States, the Resource Conservation and Recovery Act (RCRA) governs the management of hazardous and non-hazardous solid waste. While PU waste is generally classified as non-hazardous, certain additives or manufacturing processes may result in hazardous waste classification, requiring special handling and disposal methods. Additionally, individual states often have their own regulations that supplement federal guidelines, creating a patchwork of requirements across the country.

China, as a major producer and consumer of PU products, has implemented its own set of regulations. The Circular Economy Promotion Law, enacted in 2009, promotes the efficient use of resources and encourages the recycling and reuse of materials, including PU waste. More recently, China's ban on importing certain types of solid waste has had a significant impact on global waste management practices, prompting other countries to develop domestic solutions for PU waste.

International agreements also play a role in shaping PU waste management regulations. The Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal provides a global framework for managing hazardous waste, including certain types of PU waste. This convention has been instrumental in regulating the international trade of waste materials and promoting environmentally sound management practices.

As the awareness of microplastics pollution grows, regulatory bodies are beginning to address this issue in relation to PU waste. For instance, the European Chemicals Agency (ECHA) has proposed restrictions on intentionally added microplastics, which could impact certain PU applications and waste management practices.

The regulatory landscape for PU waste management continues to evolve, with a trend towards more stringent requirements for recycling, extended producer responsibility, and circular economy principles. This dynamic environment presents both challenges and opportunities for the PU industry, driving innovation in waste reduction, recycling technologies, and sustainable product design.

In the European Union, the Waste Framework Directive (2008/98/EC) provides the overarching legal framework for waste management, including PU waste. This directive establishes a waste hierarchy that prioritizes prevention, reuse, and recycling over energy recovery and disposal. The EU has also introduced specific regulations targeting plastic waste, such as the Single-Use Plastics Directive (EU) 2019/904, which indirectly affects PU waste management practices.

In the United States, the Resource Conservation and Recovery Act (RCRA) governs the management of hazardous and non-hazardous solid waste. While PU waste is generally classified as non-hazardous, certain additives or manufacturing processes may result in hazardous waste classification, requiring special handling and disposal methods. Additionally, individual states often have their own regulations that supplement federal guidelines, creating a patchwork of requirements across the country.

China, as a major producer and consumer of PU products, has implemented its own set of regulations. The Circular Economy Promotion Law, enacted in 2009, promotes the efficient use of resources and encourages the recycling and reuse of materials, including PU waste. More recently, China's ban on importing certain types of solid waste has had a significant impact on global waste management practices, prompting other countries to develop domestic solutions for PU waste.

International agreements also play a role in shaping PU waste management regulations. The Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal provides a global framework for managing hazardous waste, including certain types of PU waste. This convention has been instrumental in regulating the international trade of waste materials and promoting environmentally sound management practices.

As the awareness of microplastics pollution grows, regulatory bodies are beginning to address this issue in relation to PU waste. For instance, the European Chemicals Agency (ECHA) has proposed restrictions on intentionally added microplastics, which could impact certain PU applications and waste management practices.

The regulatory landscape for PU waste management continues to evolve, with a trend towards more stringent requirements for recycling, extended producer responsibility, and circular economy principles. This dynamic environment presents both challenges and opportunities for the PU industry, driving innovation in waste reduction, recycling technologies, and sustainable product design.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!