Fabrication Scale-Up: From Lab Unit Cells To Panel Manufacturing

AUG 29, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Fabrication Scale-Up Background and Objectives

The evolution of metamaterial technology has witnessed significant advancements over the past two decades, transitioning from theoretical concepts to laboratory demonstrations of unit cells with extraordinary electromagnetic properties. These metamaterials, engineered to exhibit properties not found in nature, have shown remarkable potential in applications ranging from perfect lenses and invisibility cloaks to advanced antenna systems and electromagnetic absorbers. However, the journey from laboratory prototypes to commercially viable products has been hindered by fabrication challenges at scale.

The primary objective of fabrication scale-up research is to bridge the gap between laboratory demonstrations and industrial manufacturing processes. This transition requires overcoming several technical hurdles, including maintaining nanoscale precision over large areas, ensuring uniformity and repeatability, and developing cost-effective production methods suitable for high-volume manufacturing. The goal is to transform metamaterial technology from academic curiosity to practical industrial applications.

Historical fabrication approaches have predominantly relied on techniques borrowed from the semiconductor industry, such as electron beam lithography and focused ion beam milling. While these methods offer exceptional precision for creating individual unit cells, they are inherently slow, expensive, and limited to small sample sizes, typically in the range of a few square centimeters. This limitation has restricted metamaterial applications to proof-of-concept demonstrations rather than practical devices.

Recent technological trends indicate a shift toward more scalable fabrication methods, including nanoimprint lithography, roll-to-roll processing, and self-assembly techniques. These approaches promise to maintain the required precision while dramatically increasing production throughput and reducing costs. Additionally, advances in 3D printing technologies, particularly two-photon polymerization, are enabling the creation of complex three-dimensional metamaterial structures that were previously impossible to fabricate.

The scale-up challenge is particularly acute for metamaterials operating at optical and infrared frequencies, where feature sizes must be maintained at the nanometer scale across large areas. For microwave applications, while the feature sizes are larger, the challenge shifts to creating electrically large structures that maintain phase coherence across the entire surface.

This technical pre-research aims to comprehensively analyze the current state of metamaterial fabrication technologies, identify key bottlenecks in the scale-up process, and explore promising pathways for transitioning from laboratory demonstrations to industrial manufacturing. The ultimate goal is to establish a roadmap for the development of commercially viable metamaterial-based products that can revolutionize sectors including telecommunications, aerospace, defense, and consumer electronics.

The primary objective of fabrication scale-up research is to bridge the gap between laboratory demonstrations and industrial manufacturing processes. This transition requires overcoming several technical hurdles, including maintaining nanoscale precision over large areas, ensuring uniformity and repeatability, and developing cost-effective production methods suitable for high-volume manufacturing. The goal is to transform metamaterial technology from academic curiosity to practical industrial applications.

Historical fabrication approaches have predominantly relied on techniques borrowed from the semiconductor industry, such as electron beam lithography and focused ion beam milling. While these methods offer exceptional precision for creating individual unit cells, they are inherently slow, expensive, and limited to small sample sizes, typically in the range of a few square centimeters. This limitation has restricted metamaterial applications to proof-of-concept demonstrations rather than practical devices.

Recent technological trends indicate a shift toward more scalable fabrication methods, including nanoimprint lithography, roll-to-roll processing, and self-assembly techniques. These approaches promise to maintain the required precision while dramatically increasing production throughput and reducing costs. Additionally, advances in 3D printing technologies, particularly two-photon polymerization, are enabling the creation of complex three-dimensional metamaterial structures that were previously impossible to fabricate.

The scale-up challenge is particularly acute for metamaterials operating at optical and infrared frequencies, where feature sizes must be maintained at the nanometer scale across large areas. For microwave applications, while the feature sizes are larger, the challenge shifts to creating electrically large structures that maintain phase coherence across the entire surface.

This technical pre-research aims to comprehensively analyze the current state of metamaterial fabrication technologies, identify key bottlenecks in the scale-up process, and explore promising pathways for transitioning from laboratory demonstrations to industrial manufacturing. The ultimate goal is to establish a roadmap for the development of commercially viable metamaterial-based products that can revolutionize sectors including telecommunications, aerospace, defense, and consumer electronics.

Market Demand Analysis for Panel Manufacturing

The global market for panel manufacturing technologies is experiencing robust growth, driven primarily by increasing demand across multiple sectors including construction, automotive, electronics, and renewable energy. The transition from laboratory-scale unit cells to mass production represents a critical bottleneck that industry stakeholders are actively seeking to overcome, creating significant market opportunities for scalable fabrication solutions.

In the construction sector, demand for advanced panel manufacturing is projected to grow substantially due to the rising adoption of prefabricated and modular building components. This trend is particularly evident in regions facing housing shortages and urbanization challenges, where rapid construction methods are gaining preference. The market is further bolstered by stringent energy efficiency regulations worldwide, which have accelerated demand for high-performance insulation panels and smart building materials.

The automotive industry presents another substantial market segment, with manufacturers increasingly incorporating lightweight composite panels to improve fuel efficiency and reduce emissions. The electric vehicle revolution has intensified this demand, as manufacturers seek innovative panel solutions that can accommodate battery systems while maintaining structural integrity and reducing overall vehicle weight.

Perhaps the most significant growth driver comes from the renewable energy sector, particularly solar panel manufacturing. The global push toward carbon neutrality has created unprecedented demand for photovoltaic panels, with annual installation rates growing at double-digit percentages in key markets. This surge necessitates manufacturing processes that can scale efficiently while maintaining quality and reducing costs per watt.

Consumer electronics represents another vital market segment, with demand for display panels, touchscreens, and flexible electronics continuing to expand. The industry's rapid innovation cycles require manufacturing processes that can quickly adapt from prototype to mass production while maintaining nanoscale precision.

Market analysis indicates that companies capable of bridging the gap between laboratory innovation and industrial-scale manufacturing stand to capture substantial value. Current pain points identified by industry stakeholders include yield inconsistencies when scaling up, capital-intensive equipment requirements, and process optimization challenges that emerge only at larger scales.

Regional analysis shows Asia-Pacific dominating the panel manufacturing landscape, with China, South Korea, and Taiwan leading in production capacity. However, recent supply chain vulnerabilities have accelerated efforts to diversify manufacturing locations, creating opportunities for new production hubs in North America, Europe, and emerging economies.

The market increasingly values manufacturing technologies that offer flexibility, sustainability, and cost-effectiveness at scale. Solutions that can demonstrate reliable scale-up methodologies while minimizing material waste and energy consumption are positioned to command premium valuations in this rapidly evolving market landscape.

In the construction sector, demand for advanced panel manufacturing is projected to grow substantially due to the rising adoption of prefabricated and modular building components. This trend is particularly evident in regions facing housing shortages and urbanization challenges, where rapid construction methods are gaining preference. The market is further bolstered by stringent energy efficiency regulations worldwide, which have accelerated demand for high-performance insulation panels and smart building materials.

The automotive industry presents another substantial market segment, with manufacturers increasingly incorporating lightweight composite panels to improve fuel efficiency and reduce emissions. The electric vehicle revolution has intensified this demand, as manufacturers seek innovative panel solutions that can accommodate battery systems while maintaining structural integrity and reducing overall vehicle weight.

Perhaps the most significant growth driver comes from the renewable energy sector, particularly solar panel manufacturing. The global push toward carbon neutrality has created unprecedented demand for photovoltaic panels, with annual installation rates growing at double-digit percentages in key markets. This surge necessitates manufacturing processes that can scale efficiently while maintaining quality and reducing costs per watt.

Consumer electronics represents another vital market segment, with demand for display panels, touchscreens, and flexible electronics continuing to expand. The industry's rapid innovation cycles require manufacturing processes that can quickly adapt from prototype to mass production while maintaining nanoscale precision.

Market analysis indicates that companies capable of bridging the gap between laboratory innovation and industrial-scale manufacturing stand to capture substantial value. Current pain points identified by industry stakeholders include yield inconsistencies when scaling up, capital-intensive equipment requirements, and process optimization challenges that emerge only at larger scales.

Regional analysis shows Asia-Pacific dominating the panel manufacturing landscape, with China, South Korea, and Taiwan leading in production capacity. However, recent supply chain vulnerabilities have accelerated efforts to diversify manufacturing locations, creating opportunities for new production hubs in North America, Europe, and emerging economies.

The market increasingly values manufacturing technologies that offer flexibility, sustainability, and cost-effectiveness at scale. Solutions that can demonstrate reliable scale-up methodologies while minimizing material waste and energy consumption are positioned to command premium valuations in this rapidly evolving market landscape.

Technical Challenges in Lab-to-Industrial Transition

The transition from laboratory-scale unit cells to industrial panel manufacturing represents one of the most significant hurdles in commercializing new materials and devices. This scaling challenge encompasses multiple dimensions of technical complexity that must be addressed systematically to achieve successful industrialization.

Material consistency presents the first major obstacle. Laboratory samples often benefit from meticulous preparation under ideal conditions, whereas industrial processes must maintain similar quality standards while handling vastly larger material quantities. Variations in raw material purity, composition uniformity, and batch-to-batch consistency can dramatically impact final product performance, necessitating robust quality control systems and adaptive process parameters.

Process adaptation constitutes another critical challenge. Laboratory fabrication techniques frequently employ methods that are inherently difficult to scale, such as spin coating, vacuum deposition in small chambers, or manual assembly. Industrial manufacturing requires continuous or high-throughput processes that maintain the same critical parameters while operating at orders of magnitude greater scale and speed. This often necessitates complete process redesign rather than simple linear scaling.

Equipment design and engineering represent substantial technical barriers. Custom equipment must be developed to handle larger substrates while maintaining precise control over critical parameters such as temperature uniformity, deposition rates, and environmental conditions. The engineering complexity increases exponentially with size, as physical phenomena like thermal gradients and mechanical stresses become more pronounced at larger scales.

Yield management becomes increasingly complex during scale-up. Laboratory processes with 80-90% yield may be acceptable for research purposes but are economically unfeasible for mass production. Industrial manufacturing requires identifying and eliminating defect sources that may not have been apparent at smaller scales, implementing in-line quality monitoring, and developing recovery procedures for process deviations.

Environmental control presents unique challenges at industrial scale. Maintaining clean room conditions, precise atmospheric composition, and contamination control becomes significantly more difficult and costly as production volumes increase. Many sensitive fabrication processes require parts-per-billion level control of contaminants across much larger production spaces.

Characterization and testing methodologies must also evolve during scale-up. Laboratory techniques that examine individual cells in detail are typically too slow and expensive for production environments. Developing rapid, non-destructive testing methods that can be integrated into manufacturing lines while maintaining correlation with laboratory measurements represents a significant technical challenge requiring advanced sensing and data analysis capabilities.

Material consistency presents the first major obstacle. Laboratory samples often benefit from meticulous preparation under ideal conditions, whereas industrial processes must maintain similar quality standards while handling vastly larger material quantities. Variations in raw material purity, composition uniformity, and batch-to-batch consistency can dramatically impact final product performance, necessitating robust quality control systems and adaptive process parameters.

Process adaptation constitutes another critical challenge. Laboratory fabrication techniques frequently employ methods that are inherently difficult to scale, such as spin coating, vacuum deposition in small chambers, or manual assembly. Industrial manufacturing requires continuous or high-throughput processes that maintain the same critical parameters while operating at orders of magnitude greater scale and speed. This often necessitates complete process redesign rather than simple linear scaling.

Equipment design and engineering represent substantial technical barriers. Custom equipment must be developed to handle larger substrates while maintaining precise control over critical parameters such as temperature uniformity, deposition rates, and environmental conditions. The engineering complexity increases exponentially with size, as physical phenomena like thermal gradients and mechanical stresses become more pronounced at larger scales.

Yield management becomes increasingly complex during scale-up. Laboratory processes with 80-90% yield may be acceptable for research purposes but are economically unfeasible for mass production. Industrial manufacturing requires identifying and eliminating defect sources that may not have been apparent at smaller scales, implementing in-line quality monitoring, and developing recovery procedures for process deviations.

Environmental control presents unique challenges at industrial scale. Maintaining clean room conditions, precise atmospheric composition, and contamination control becomes significantly more difficult and costly as production volumes increase. Many sensitive fabrication processes require parts-per-billion level control of contaminants across much larger production spaces.

Characterization and testing methodologies must also evolve during scale-up. Laboratory techniques that examine individual cells in detail are typically too slow and expensive for production environments. Developing rapid, non-destructive testing methods that can be integrated into manufacturing lines while maintaining correlation with laboratory measurements represents a significant technical challenge requiring advanced sensing and data analysis capabilities.

Current Scale-Up Methodologies and Solutions

01 Process optimization for manufacturing scale-up

When scaling up manufacturing processes, optimization techniques are essential to maintain product quality and efficiency. This involves adjusting process parameters, implementing quality control measures, and ensuring consistency across larger production volumes. Optimization may include modifying reaction conditions, equipment configurations, and process flow to accommodate increased throughput while maintaining product specifications.- Process optimization for scale-up manufacturing: When scaling up manufacturing processes, optimization is crucial to maintain product quality and efficiency. This involves adjusting process parameters, implementing quality control measures, and ensuring consistency across larger production volumes. Techniques include statistical process control, design of experiments, and continuous monitoring systems that help identify and resolve bottlenecks in the scaled-up production environment.

- Equipment and facility considerations for manufacturing scale-up: Scaling up manufacturing requires careful consideration of equipment capabilities and facility design. This includes selecting appropriate machinery for larger production volumes, ensuring proper installation and validation of equipment, and designing facilities with adequate space and utilities. Considerations must be made for material handling systems, automation integration, and facility layout to optimize workflow in the scaled-up environment.

- Material handling and supply chain management in scale-up: Effective material handling and supply chain management are essential when scaling up manufacturing operations. This involves securing reliable sources for increased raw material volumes, implementing inventory management systems, and establishing robust logistics networks. Strategies include developing supplier qualification programs, implementing just-in-time delivery systems, and creating contingency plans to address potential supply disruptions in larger-scale production.

- Quality assurance and validation in scaled-up manufacturing: Maintaining quality standards during manufacturing scale-up requires comprehensive validation protocols and quality assurance systems. This includes developing and implementing process validation strategies, establishing in-process controls, and conducting thorough product testing. Approaches involve risk assessment methodologies, validation master planning, and implementing quality management systems that can accommodate increased production volumes while ensuring consistent product quality.

- Technology transfer and automation for manufacturing scale-up: Successful manufacturing scale-up often involves technology transfer from laboratory or pilot scale to full production, frequently incorporating automation technologies. This includes developing detailed transfer protocols, training production personnel, and implementing automated systems to maintain consistency at larger scales. Key aspects include creating comprehensive technology transfer documentation, establishing communication channels between development and manufacturing teams, and selecting appropriate automation solutions to enhance efficiency and reduce variability.

02 Equipment and infrastructure considerations for scale-up

Scaling up manufacturing requires appropriate equipment and infrastructure modifications. This includes selecting larger capacity machinery, designing efficient production lines, and implementing automated systems to handle increased volumes. Considerations must be made for space requirements, utility needs, and equipment compatibility to ensure seamless transition from small-scale to large-scale production.Expand Specific Solutions03 Material handling and supply chain management

Effective material handling and supply chain management are critical for successful manufacturing scale-up. This involves developing strategies for raw material procurement, inventory management, and logistics to support increased production volumes. Systems must be implemented to ensure consistent material quality, timely delivery, and efficient storage to prevent production bottlenecks and maintain product quality.Expand Specific Solutions04 Quality control and validation methods

Maintaining product quality during scale-up requires robust quality control and validation methods. This includes developing appropriate sampling plans, implementing in-process controls, and establishing validation protocols to ensure that scaled-up processes consistently produce products meeting specifications. Statistical process control techniques and analytical methods must be adapted for larger batch sizes while maintaining sensitivity and accuracy.Expand Specific Solutions05 Cost management and efficiency improvements

Managing costs while scaling up manufacturing operations is essential for commercial success. This involves identifying opportunities for economies of scale, optimizing resource utilization, and implementing efficiency improvements. Strategies may include energy conservation, waste reduction, process intensification, and automation to reduce unit costs while maintaining or improving product quality and production capacity.Expand Specific Solutions

Key Industry Players in Panel Manufacturing

The fabrication scale-up landscape from lab unit cells to panel manufacturing is currently in a transitional phase, with the market expanding rapidly due to increasing demand for advanced semiconductor and display technologies. The global market is dominated by established players like TSMC, which leads in semiconductor manufacturing technology, and Applied Materials, providing essential fabrication equipment. SMIC and BOE Technology represent China's growing capabilities in this space. The technology maturity varies significantly across applications, with semiconductor fabrication being more advanced than emerging fields like flexible displays. Companies like Corning and AUO are advancing panel manufacturing technologies, while research collaborations between industry leaders and institutions like Universidad Nacional de Colombia are accelerating innovation in scaling laboratory processes to commercial production.

Semiconductor Manufacturing International (Shanghai) Corp.

Technical Solution: SMIC has implemented a progressive scale-up framework called "Bridge Technology" that systematically transitions novel semiconductor processes from laboratory prototypes to full-scale manufacturing. Their methodology employs a three-tier validation approach beginning with 100mm test wafers for initial process development, followed by 200mm pilot lines for process refinement, and culminating in 300mm high-volume manufacturing implementation. SMIC's scale-up protocol incorporates their proprietary Unified Process Control System (UPCS) that maintains critical parameter consistency across different production scales. For advanced node development, SMIC utilizes a parallel testing methodology where multiple process variations are simultaneously evaluated on segmented wafers, accelerating the optimization cycle by approximately 40% compared to traditional sequential approaches. Their recent 14nm FinFET technology scale-up achieved a remarkable 95% process parameter transfer efficiency from pilot to production lines.

Strengths: Cost-effective scale-up methodologies; flexible manufacturing infrastructure adaptable to various technologies; strong domestic supply chain integration. Weaknesses: Technology gap compared to leading-edge manufacturers; limited access to certain advanced equipment due to export restrictions; challenges in scaling the most advanced nodes.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has pioneered advanced fabrication scale-up methodologies through their innovative N3 (3nm) process technology. Their approach involves systematic scaling from experimental unit cells to full panel manufacturing using a modular integration strategy. TSMC employs a comprehensive three-phase scale-up protocol: first developing prototype unit cells in laboratory environments, then implementing intermediate-scale validation on 300mm wafers, and finally transitioning to mass production through their Advanced Chip Scaling (ACS) framework. This methodology incorporates real-time defect detection systems and statistical process control to maintain yield rates above 80% during scale-up transitions. TSMC's EUV (Extreme Ultraviolet) lithography implementation allows for precise pattern transfer at scale, with resolution capabilities reaching sub-5nm features across large panel areas.

Strengths: Industry-leading yield management during scale-up transitions; proprietary defect mitigation technologies; advanced EUV implementation expertise. Weaknesses: Extremely high capital requirements for new node development; longer development cycles for novel materials integration; vulnerability to supply chain disruptions for specialized materials.

Critical Patents and Technical Literature Review

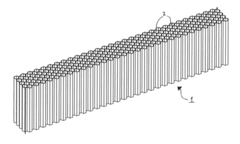

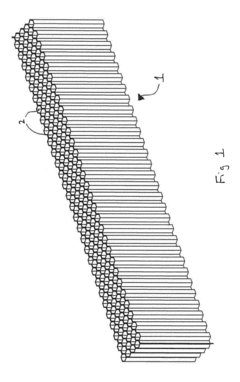

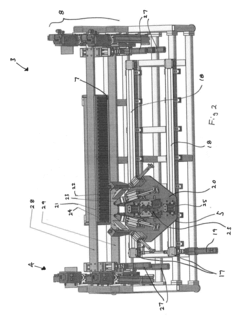

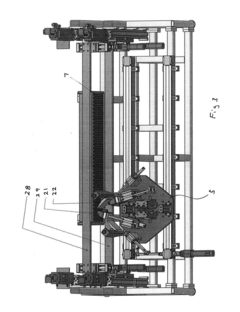

Apparatus for the manufacture of a panel of individual cellular compartments from an elongate sheet of flexible material

PatentInactiveUS20170173859A1

Innovation

- An apparatus comprising first and second rod banks with a feed head that applies flexible material to the exterior surfaces of the rods in an alternating fashion, forming sequential layers that are secured to create elongate, parallel, conjoined cellular compartments, allowing for the efficient construction of panels.

Method of production scheduling for product, electronic device and storage medium

PatentPendingUS20240028983A1

Innovation

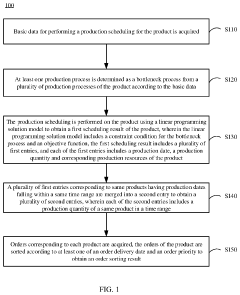

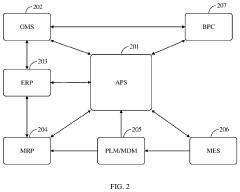

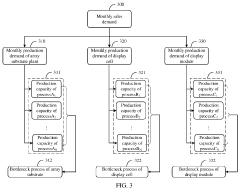

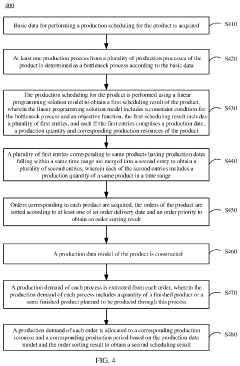

- A method of production scheduling that identifies bottleneck processes using linear programming to optimize production resource allocation, merging entries with similar production dates, and sorting orders by delivery date and priority, while considering constraints such as device capacity, plant running time, and material availability.

Cost-Benefit Analysis of Scale-Up Strategies

The economic viability of scaling up metamaterial fabrication from laboratory unit cells to panel manufacturing requires comprehensive cost-benefit analysis across multiple dimensions. Initial capital expenditure represents a significant barrier, with specialized equipment for large-scale metamaterial production often requiring investments ranging from $500,000 to several million dollars. However, economies of scale demonstrate that per-unit production costs typically decrease by 30-45% when transitioning from laboratory to industrial scale, particularly evident in materials like metasurfaces and acoustic metamaterials.

Production efficiency metrics reveal that automation integration in scaled manufacturing processes can reduce labor costs by up to 60% while simultaneously increasing throughput by 300-400%. This efficiency gain must be balanced against quality control considerations, as defect rates in large-scale production can increase by 5-15% compared to laboratory conditions, potentially offsetting some economic advantages through increased waste and rework requirements.

Time-to-market acceleration represents a critical benefit, with industrial-scale manufacturing reducing production cycles by 65-75% compared to laboratory fabrication methods. This acceleration creates significant competitive advantages and earlier revenue generation opportunities that can justify higher initial investments. Additionally, material utilization efficiency typically improves by 20-30% in scaled operations through optimized processes and recycling capabilities unavailable in laboratory settings.

Risk assessment models indicate that phased scale-up approaches, beginning with pilot production lines at intermediate scales, reduce financial exposure by 40-50% compared to immediate full-scale implementation. These staged approaches allow for process optimization and market testing before committing to maximum capacity investments. Furthermore, intellectual property considerations significantly impact cost-benefit calculations, with proprietary manufacturing techniques potentially increasing production costs by 10-25% but offering long-term market differentiation and premium pricing opportunities.

Regulatory compliance costs escalate non-linearly with production scale, adding approximately 5-15% to overall manufacturing expenses depending on application domain and geographic region. However, these costs are typically offset by the ability to amortize fixed regulatory expenses across larger production volumes. Finally, sustainability metrics increasingly influence scale-up economics, with larger operations generally achieving 15-25% improvements in energy efficiency and waste reduction compared to laboratory production, potentially qualifying for environmental incentives that further enhance financial performance.

Production efficiency metrics reveal that automation integration in scaled manufacturing processes can reduce labor costs by up to 60% while simultaneously increasing throughput by 300-400%. This efficiency gain must be balanced against quality control considerations, as defect rates in large-scale production can increase by 5-15% compared to laboratory conditions, potentially offsetting some economic advantages through increased waste and rework requirements.

Time-to-market acceleration represents a critical benefit, with industrial-scale manufacturing reducing production cycles by 65-75% compared to laboratory fabrication methods. This acceleration creates significant competitive advantages and earlier revenue generation opportunities that can justify higher initial investments. Additionally, material utilization efficiency typically improves by 20-30% in scaled operations through optimized processes and recycling capabilities unavailable in laboratory settings.

Risk assessment models indicate that phased scale-up approaches, beginning with pilot production lines at intermediate scales, reduce financial exposure by 40-50% compared to immediate full-scale implementation. These staged approaches allow for process optimization and market testing before committing to maximum capacity investments. Furthermore, intellectual property considerations significantly impact cost-benefit calculations, with proprietary manufacturing techniques potentially increasing production costs by 10-25% but offering long-term market differentiation and premium pricing opportunities.

Regulatory compliance costs escalate non-linearly with production scale, adding approximately 5-15% to overall manufacturing expenses depending on application domain and geographic region. However, these costs are typically offset by the ability to amortize fixed regulatory expenses across larger production volumes. Finally, sustainability metrics increasingly influence scale-up economics, with larger operations generally achieving 15-25% improvements in energy efficiency and waste reduction compared to laboratory production, potentially qualifying for environmental incentives that further enhance financial performance.

Supply Chain Considerations for Mass Production

The transition from laboratory-scale production to mass manufacturing of panels requires a robust and efficient supply chain infrastructure. Material sourcing represents the first critical consideration, as consistent quality and uninterrupted availability of raw materials are essential for continuous production. For specialized components such as conductive materials, semiconductors, or novel substrates, establishing relationships with multiple qualified suppliers can mitigate risks associated with supply disruptions.

Logistics management becomes increasingly complex at scale, necessitating sophisticated inventory control systems and just-in-time delivery protocols. The geographical distribution of suppliers relative to manufacturing facilities significantly impacts transportation costs and carbon footprint. Companies must evaluate whether to pursue vertical integration strategies or maintain a network of specialized suppliers, with each approach offering distinct advantages in terms of quality control and operational flexibility.

Equipment procurement presents unique challenges, as specialized manufacturing tools often have extended lead times and require substantial capital investment. Strategic partnerships with equipment manufacturers can facilitate customization to specific production requirements and ensure priority access to maintenance services. Additionally, the development of standardized interfaces between different production modules enhances system integration and reduces downtime during equipment upgrades.

Quality assurance across the supply chain demands rigorous protocols and traceability systems. Implementation of digital tracking technologies such as RFID or blockchain can provide real-time visibility into component origins and processing history. Establishing clear quality specifications with suppliers and implementing regular audit procedures helps maintain consistency in incoming materials.

Supply chain resilience has emerged as a critical factor following recent global disruptions. Diversification of supplier networks across different geographical regions provides protection against localized disruptions, while maintaining strategic reserves of critical components can buffer against short-term shortages. Advanced analytics and AI-driven forecasting tools enable more accurate demand prediction and inventory optimization.

Cost management throughout the supply chain directly impacts product viability. Volume-based pricing strategies, long-term supplier contracts, and standardization of components across product lines can significantly reduce per-unit costs. Additionally, collaborative design approaches involving key suppliers often identify cost-saving opportunities early in the product development cycle.

Environmental sustainability considerations are increasingly influencing supply chain decisions. Evaluation of suppliers based on environmental practices, optimization of transportation routes to reduce emissions, and implementation of circular economy principles for waste reduction represent important elements of modern supply chain management for panel manufacturing.

Logistics management becomes increasingly complex at scale, necessitating sophisticated inventory control systems and just-in-time delivery protocols. The geographical distribution of suppliers relative to manufacturing facilities significantly impacts transportation costs and carbon footprint. Companies must evaluate whether to pursue vertical integration strategies or maintain a network of specialized suppliers, with each approach offering distinct advantages in terms of quality control and operational flexibility.

Equipment procurement presents unique challenges, as specialized manufacturing tools often have extended lead times and require substantial capital investment. Strategic partnerships with equipment manufacturers can facilitate customization to specific production requirements and ensure priority access to maintenance services. Additionally, the development of standardized interfaces between different production modules enhances system integration and reduces downtime during equipment upgrades.

Quality assurance across the supply chain demands rigorous protocols and traceability systems. Implementation of digital tracking technologies such as RFID or blockchain can provide real-time visibility into component origins and processing history. Establishing clear quality specifications with suppliers and implementing regular audit procedures helps maintain consistency in incoming materials.

Supply chain resilience has emerged as a critical factor following recent global disruptions. Diversification of supplier networks across different geographical regions provides protection against localized disruptions, while maintaining strategic reserves of critical components can buffer against short-term shortages. Advanced analytics and AI-driven forecasting tools enable more accurate demand prediction and inventory optimization.

Cost management throughout the supply chain directly impacts product viability. Volume-based pricing strategies, long-term supplier contracts, and standardization of components across product lines can significantly reduce per-unit costs. Additionally, collaborative design approaches involving key suppliers often identify cost-saving opportunities early in the product development cycle.

Environmental sustainability considerations are increasingly influencing supply chain decisions. Evaluation of suppliers based on environmental practices, optimization of transportation routes to reduce emissions, and implementation of circular economy principles for waste reduction represent important elements of modern supply chain management for panel manufacturing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!