Future Prospect Organic Thermoelectrics Roadmap For Commercialization

AUG 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Organic Thermoelectrics Background and Objectives

Organic thermoelectric materials represent a promising frontier in sustainable energy technology, offering the potential to convert waste heat into electricity through environmentally friendly, flexible, and cost-effective solutions. The development of these materials has evolved significantly over the past three decades, transitioning from academic curiosity to commercially viable technology. Initially, organic thermoelectrics were limited by poor performance metrics, particularly low ZT (figure of merit) values compared to their inorganic counterparts.

The technological evolution has been marked by several breakthrough moments, including the discovery of conductive polymers in the 1970s, which earned the Nobel Prize in Chemistry in 2000, and subsequent advancements in molecular design and doping techniques that have progressively enhanced thermoelectric efficiency. Recent innovations in nanostructuring and composite formation have further accelerated performance improvements, pushing organic thermoelectrics closer to practical application thresholds.

Current research trends indicate a convergence of materials science, chemistry, and electrical engineering to overcome persistent challenges in stability, scalability, and performance optimization. The field is witnessing increased attention to structure-property relationships, with particular focus on enhancing electrical conductivity while maintaining low thermal conductivity—a critical balance for thermoelectric efficiency.

The primary technical objectives for organic thermoelectrics center on achieving ZT values exceeding 1.0 at room temperature, developing manufacturing processes suitable for large-scale production, and ensuring long-term operational stability under varying environmental conditions. Additionally, there is growing emphasis on creating materials that maintain flexibility and stretchability while delivering consistent thermoelectric performance, essential for wearable and conformable energy harvesting applications.

Beyond performance metrics, the field aims to establish comprehensive standardization protocols for material characterization and device testing, facilitating meaningful comparisons across different research efforts and accelerating commercialization pathways. Environmental sustainability objectives are increasingly prominent, with research directed toward non-toxic, biodegradable materials that align with circular economy principles.

The trajectory of organic thermoelectrics points toward integration with Internet of Things (IoT) devices, wearable technology, and distributed energy harvesting systems. As global energy demands continue to rise alongside concerns about carbon emissions, organic thermoelectrics represent a strategic technology with potential to contribute significantly to energy efficiency improvements and waste heat recovery across multiple sectors, from consumer electronics to industrial processes and building systems.

The technological evolution has been marked by several breakthrough moments, including the discovery of conductive polymers in the 1970s, which earned the Nobel Prize in Chemistry in 2000, and subsequent advancements in molecular design and doping techniques that have progressively enhanced thermoelectric efficiency. Recent innovations in nanostructuring and composite formation have further accelerated performance improvements, pushing organic thermoelectrics closer to practical application thresholds.

Current research trends indicate a convergence of materials science, chemistry, and electrical engineering to overcome persistent challenges in stability, scalability, and performance optimization. The field is witnessing increased attention to structure-property relationships, with particular focus on enhancing electrical conductivity while maintaining low thermal conductivity—a critical balance for thermoelectric efficiency.

The primary technical objectives for organic thermoelectrics center on achieving ZT values exceeding 1.0 at room temperature, developing manufacturing processes suitable for large-scale production, and ensuring long-term operational stability under varying environmental conditions. Additionally, there is growing emphasis on creating materials that maintain flexibility and stretchability while delivering consistent thermoelectric performance, essential for wearable and conformable energy harvesting applications.

Beyond performance metrics, the field aims to establish comprehensive standardization protocols for material characterization and device testing, facilitating meaningful comparisons across different research efforts and accelerating commercialization pathways. Environmental sustainability objectives are increasingly prominent, with research directed toward non-toxic, biodegradable materials that align with circular economy principles.

The trajectory of organic thermoelectrics points toward integration with Internet of Things (IoT) devices, wearable technology, and distributed energy harvesting systems. As global energy demands continue to rise alongside concerns about carbon emissions, organic thermoelectrics represent a strategic technology with potential to contribute significantly to energy efficiency improvements and waste heat recovery across multiple sectors, from consumer electronics to industrial processes and building systems.

Market Demand Analysis for Organic Thermoelectric Applications

The global market for organic thermoelectric materials and devices is experiencing significant growth driven by increasing demand for sustainable energy solutions and waste heat recovery systems. Current market assessments indicate that the thermoelectric market as a whole is projected to reach approximately $7 billion by 2027, with organic thermoelectrics representing an emerging segment with substantial growth potential.

Energy harvesting applications constitute the primary market driver for organic thermoelectrics. With industrial processes globally wasting nearly 70% of energy as heat, there exists an enormous untapped potential for technologies that can convert this waste heat into usable electricity. Industries such as manufacturing, automotive, and power generation are actively seeking cost-effective solutions to improve energy efficiency and reduce carbon footprints.

Consumer electronics represents another rapidly expanding market segment. The proliferation of Internet of Things (IoT) devices, wearable technology, and remote sensors has created demand for self-powered systems that can operate without traditional batteries. Organic thermoelectric materials offer compelling advantages in this space due to their flexibility, light weight, and ability to generate power from small temperature differentials created by body heat or ambient conditions.

The healthcare sector demonstrates increasing interest in organic thermoelectrics for medical devices and monitoring systems. Applications include self-powered implantable devices, temperature-regulated drug delivery systems, and continuous health monitoring equipment that can operate without frequent battery replacement.

Building and construction markets are exploring organic thermoelectric solutions for smart building systems, where these materials can be integrated into walls, windows, or HVAC systems to capture thermal gradients and supplement power needs. This sector values the non-toxic nature and potential cost advantages of organic materials compared to traditional inorganic alternatives.

Market analysis reveals regional variations in demand patterns. North America and Europe currently lead in research and early commercial applications, while Asia-Pacific markets show the highest growth potential due to rapid industrialization and strong government support for green technologies.

Consumer and industrial preferences are shifting toward sustainable and environmentally friendly technologies. Organic thermoelectrics align with this trend due to their reduced environmental impact compared to traditional thermoelectric materials that often contain toxic or rare elements. This sustainability factor is increasingly becoming a market differentiator and driver of adoption.

The market faces adoption barriers including performance limitations compared to inorganic counterparts, manufacturing scalability challenges, and limited awareness among potential end-users. However, these barriers are gradually being addressed through technological advancements and increased industry collaboration.

Energy harvesting applications constitute the primary market driver for organic thermoelectrics. With industrial processes globally wasting nearly 70% of energy as heat, there exists an enormous untapped potential for technologies that can convert this waste heat into usable electricity. Industries such as manufacturing, automotive, and power generation are actively seeking cost-effective solutions to improve energy efficiency and reduce carbon footprints.

Consumer electronics represents another rapidly expanding market segment. The proliferation of Internet of Things (IoT) devices, wearable technology, and remote sensors has created demand for self-powered systems that can operate without traditional batteries. Organic thermoelectric materials offer compelling advantages in this space due to their flexibility, light weight, and ability to generate power from small temperature differentials created by body heat or ambient conditions.

The healthcare sector demonstrates increasing interest in organic thermoelectrics for medical devices and monitoring systems. Applications include self-powered implantable devices, temperature-regulated drug delivery systems, and continuous health monitoring equipment that can operate without frequent battery replacement.

Building and construction markets are exploring organic thermoelectric solutions for smart building systems, where these materials can be integrated into walls, windows, or HVAC systems to capture thermal gradients and supplement power needs. This sector values the non-toxic nature and potential cost advantages of organic materials compared to traditional inorganic alternatives.

Market analysis reveals regional variations in demand patterns. North America and Europe currently lead in research and early commercial applications, while Asia-Pacific markets show the highest growth potential due to rapid industrialization and strong government support for green technologies.

Consumer and industrial preferences are shifting toward sustainable and environmentally friendly technologies. Organic thermoelectrics align with this trend due to their reduced environmental impact compared to traditional thermoelectric materials that often contain toxic or rare elements. This sustainability factor is increasingly becoming a market differentiator and driver of adoption.

The market faces adoption barriers including performance limitations compared to inorganic counterparts, manufacturing scalability challenges, and limited awareness among potential end-users. However, these barriers are gradually being addressed through technological advancements and increased industry collaboration.

Current Status and Technical Challenges in Organic Thermoelectrics

Organic thermoelectric materials have emerged as promising candidates for sustainable energy harvesting and thermal management applications. Currently, the field is witnessing significant advancements, with research institutions and companies worldwide actively pursuing breakthroughs in material design and device fabrication. Despite this progress, organic thermoelectrics still lag behind their inorganic counterparts in terms of efficiency, stability, and scalability.

The global research landscape shows concentrated efforts in Asia (particularly Japan, China, and South Korea), North America, and Europe. Each region demonstrates distinct research focuses: Asian institutions emphasize material synthesis and processing techniques, European researchers concentrate on fundamental understanding and novel device architectures, while North American teams often lead in computational design and high-throughput screening methodologies.

A primary technical challenge facing organic thermoelectrics is their relatively low figure of merit (ZT), which typically remains below 0.5, compared to values exceeding 2.0 for leading inorganic materials. This efficiency gap stems from the inherent trade-off between electrical conductivity and thermal conductivity in organic materials, as well as challenges in optimizing the Seebeck coefficient without compromising other properties.

Material stability presents another significant hurdle. Organic thermoelectric materials often suffer from performance degradation under operational conditions, including thermal cycling, humidity exposure, and oxidative environments. This instability limits their practical application in real-world scenarios where long-term reliability is essential.

Manufacturing scalability remains problematic, with laboratory-scale synthesis methods proving difficult to translate to industrial production. Current fabrication techniques often yield materials with inconsistent properties and performance variability across batches, hampering commercialization efforts.

Interface engineering represents a critical technical bottleneck. Contact resistance between organic thermoelectric materials and electrodes significantly reduces device efficiency, while thermal and electrical interfaces between different components in multilayer structures often create performance losses that are difficult to mitigate.

Recent advances in doping strategies have shown promise in enhancing carrier concentration and mobility, but precise control over doping levels and distribution remains challenging. Similarly, nanostructuring approaches have demonstrated potential for reducing thermal conductivity while preserving electrical properties, though reproducibility issues persist.

Computational modeling and simulation tools, while increasingly sophisticated, still struggle to accurately predict the thermoelectric properties of complex organic systems, limiting their utility in accelerating materials discovery and optimization. This gap between theoretical predictions and experimental results highlights the need for improved modeling frameworks that can capture the unique physics of charge and heat transport in disordered organic systems.

The global research landscape shows concentrated efforts in Asia (particularly Japan, China, and South Korea), North America, and Europe. Each region demonstrates distinct research focuses: Asian institutions emphasize material synthesis and processing techniques, European researchers concentrate on fundamental understanding and novel device architectures, while North American teams often lead in computational design and high-throughput screening methodologies.

A primary technical challenge facing organic thermoelectrics is their relatively low figure of merit (ZT), which typically remains below 0.5, compared to values exceeding 2.0 for leading inorganic materials. This efficiency gap stems from the inherent trade-off between electrical conductivity and thermal conductivity in organic materials, as well as challenges in optimizing the Seebeck coefficient without compromising other properties.

Material stability presents another significant hurdle. Organic thermoelectric materials often suffer from performance degradation under operational conditions, including thermal cycling, humidity exposure, and oxidative environments. This instability limits their practical application in real-world scenarios where long-term reliability is essential.

Manufacturing scalability remains problematic, with laboratory-scale synthesis methods proving difficult to translate to industrial production. Current fabrication techniques often yield materials with inconsistent properties and performance variability across batches, hampering commercialization efforts.

Interface engineering represents a critical technical bottleneck. Contact resistance between organic thermoelectric materials and electrodes significantly reduces device efficiency, while thermal and electrical interfaces between different components in multilayer structures often create performance losses that are difficult to mitigate.

Recent advances in doping strategies have shown promise in enhancing carrier concentration and mobility, but precise control over doping levels and distribution remains challenging. Similarly, nanostructuring approaches have demonstrated potential for reducing thermal conductivity while preserving electrical properties, though reproducibility issues persist.

Computational modeling and simulation tools, while increasingly sophisticated, still struggle to accurately predict the thermoelectric properties of complex organic systems, limiting their utility in accelerating materials discovery and optimization. This gap between theoretical predictions and experimental results highlights the need for improved modeling frameworks that can capture the unique physics of charge and heat transport in disordered organic systems.

Current Technical Solutions for Organic Thermoelectric Devices

01 Market strategies for organic thermoelectric technologies

Various market strategies can be employed to commercialize organic thermoelectric technologies. These include identifying target markets, developing pricing models, creating distribution channels, and implementing marketing campaigns. Effective commercialization requires understanding consumer needs and positioning organic thermoelectric products as sustainable alternatives to conventional technologies, highlighting their unique benefits such as flexibility, lightweight properties, and eco-friendliness.- Market strategies for organic thermoelectric technologies: Various market strategies are employed to commercialize organic thermoelectric technologies, including market analysis, consumer targeting, and pricing strategies. These approaches help companies identify potential markets, understand consumer needs, and develop effective pricing models for organic thermoelectric products. Strategic marketing and business models are crucial for successful commercialization in this emerging field.

- Manufacturing processes for organic thermoelectric materials: Specialized manufacturing processes are developed for the production of organic thermoelectric materials at commercial scale. These processes focus on cost-effective production methods, quality control systems, and scalable manufacturing techniques that maintain the performance characteristics of organic thermoelectric materials. Innovations in manufacturing technology are essential for transitioning from laboratory-scale production to commercial manufacturing.

- Intellectual property and licensing frameworks: Intellectual property protection and licensing frameworks play a critical role in the commercialization of organic thermoelectric technologies. Patent portfolios, licensing agreements, and IP strategies help companies secure their innovations while enabling technology transfer and partnerships. These frameworks facilitate collaboration between research institutions and industry partners to bring organic thermoelectric technologies to market.

- Application development for organic thermoelectric devices: Commercial applications for organic thermoelectric devices are being developed across various sectors. These include wearable electronics, energy harvesting systems, cooling solutions, and sensor technologies. Application development focuses on identifying use cases where organic thermoelectrics offer advantages over conventional technologies, such as flexibility, lightweight properties, or environmental benefits. Product design and integration strategies are tailored to specific market needs.

- Sustainability and environmental impact assessment: Sustainability considerations and environmental impact assessments are increasingly important for the commercialization of organic thermoelectric technologies. These include life cycle analysis, environmental benefits compared to traditional thermoelectric materials, and compliance with environmental regulations. The eco-friendly aspects of organic thermoelectric materials, such as reduced toxicity and potential for biodegradability, are highlighted as competitive advantages in commercialization strategies.

02 Manufacturing processes for organic thermoelectric devices

The commercialization of organic thermoelectrics depends on scalable manufacturing processes. These include solution processing techniques, roll-to-roll printing, and other methods suitable for mass production of organic thermoelectric materials and devices. Optimizing these manufacturing processes is crucial for reducing production costs and ensuring consistent quality, which are essential factors for successful market entry and commercial viability.Expand Specific Solutions03 Intellectual property and licensing frameworks

Intellectual property protection and licensing strategies play a vital role in the commercialization of organic thermoelectric technologies. This includes patent portfolios, licensing agreements, and technology transfer mechanisms that enable businesses to protect their innovations while facilitating market entry. Effective IP management helps companies secure competitive advantages and create revenue streams through licensing to manufacturers or forming strategic partnerships.Expand Specific Solutions04 Investment and funding mechanisms

Securing adequate funding is critical for commercializing organic thermoelectric technologies. Various funding mechanisms include venture capital, government grants, corporate partnerships, and crowdfunding. Investment strategies need to address the high initial costs of research, development, and scaling up production. Financial models must account for the timeline from laboratory research to market-ready products, with appropriate risk management approaches for this emerging technology sector.Expand Specific Solutions05 Applications and integration with existing systems

Successful commercialization of organic thermoelectrics involves identifying practical applications and integration pathways with existing systems. Potential applications include wearable electronics, IoT devices, building materials, and automotive components. Integration strategies must address compatibility issues, performance requirements, and consumer expectations. Demonstrating real-world benefits through pilot projects and case studies helps build market confidence and accelerates commercial adoption of these novel materials.Expand Specific Solutions

Key Industry Players and Research Institutions

The organic thermoelectrics market is currently in an early growth phase, characterized by significant research activity but limited commercial deployment. The global market size is estimated at approximately $30-40 million, with projections to reach $100 million by 2030 as applications in wearable electronics and waste heat recovery expand. Technologically, the field shows varying maturity levels across different players. Academic institutions like Northwestern University, Shenzhen University, and Chinese Academy of Sciences are advancing fundamental research, while companies including BASF, Sumitomo Chemical, and FUJIFILM are developing more application-ready technologies. Commercial players such as Merck and IBM are focusing on scalable manufacturing processes and material optimization, indicating progression toward commercialization despite efficiency and stability challenges remaining to be addressed.

BASF Corp.

Technical Solution: BASF has developed a comprehensive approach to organic thermoelectrics focusing on conductive polymers and organic-inorganic hybrid materials. Their technology leverages PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) as a primary material, which they've modified through various doping strategies to enhance the Seebeck coefficient while maintaining electrical conductivity. BASF's solution includes post-treatment methods using polar solvents like ethylene glycol and dimethyl sulfoxide to optimize the morphology and electrical properties of the polymer films. They've achieved ZT values approaching 0.42 at room temperature through their proprietary formulation processes. Additionally, BASF has developed flexible thermoelectric modules using screen printing and roll-to-roll manufacturing techniques that enable cost-effective production of large-area organic thermoelectric devices for waste heat recovery applications in industrial settings and automotive exhaust systems.

Strengths: BASF's extensive chemical expertise allows for precise molecular engineering of organic thermoelectric materials. Their established manufacturing infrastructure enables rapid scaling from lab to commercial production. Weaknesses: Their organic thermoelectric materials still exhibit lower ZT values compared to inorganic counterparts, limiting efficiency in high-temperature applications. Durability and long-term stability of their polymer-based devices remain challenges in harsh operating environments.

Merck Patent GmbH

Technical Solution: Merck has pioneered a multi-faceted approach to organic thermoelectrics centered on their expertise in liquid crystal and OLED materials. Their technology platform incorporates small-molecule organic semiconductors with precisely engineered energy levels to optimize the power factor (S²σ). Merck's solution includes proprietary n-type organic semiconductors based on naphthalene diimide derivatives that achieve electron mobilities exceeding 1 cm²/Vs while maintaining low thermal conductivity (< 0.3 W/mK). Their manufacturing process utilizes vacuum thermal evaporation for small molecules and solution processing for polymeric materials, enabling precise multilayer structures with controlled interfaces. Merck has developed composite materials combining organic semiconductors with carbon nanotubes to enhance electrical conductivity without significantly increasing thermal conductivity. Their recent advancements include self-assembled monolayers that modify electrode interfaces to optimize charge injection and extraction, resulting in improved device performance and stability under thermal cycling conditions.

Strengths: Merck's extensive experience with organic electronic materials provides them with deep understanding of structure-property relationships in organic semiconductors. Their established position in display and electronic materials markets offers clear commercialization pathways. Weaknesses: Their organic thermoelectric materials require complex processing techniques that may limit cost-effective mass production. The performance gap between their organic materials and conventional inorganic thermoelectrics remains significant for high-power applications.

Core Patents and Breakthrough Technologies

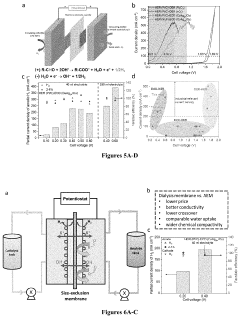

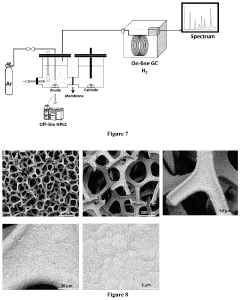

System and methods for low-voltage bipolar hydrogen production from aldehydes and water

PatentPendingUS20230332307A1

Innovation

- A system comprising a metal-based alloy catalyst anode, a Ni2P or Pt/C cathode, and a dialysis membrane separator for low-voltage bipolar hydrogen production through electrocatalytic oxidative dehydrogenation of aldehydes, which enables efficient hydrogen production at ultra-low cell voltages and co-generation of carboxylic acids.

Commercialization Roadmap and Timeline Projections

The commercialization of organic thermoelectric (OTE) technologies is projected to follow a multi-phase roadmap spanning the next decade. In the immediate term (2023-2025), we anticipate the establishment of pilot production lines focused on niche applications where traditional inorganic thermoelectrics are unsuitable. These early commercial deployments will likely target low-power wearable devices, medical monitoring equipment, and specialized industrial sensors where flexibility and biocompatibility offer distinct advantages.

The mid-term phase (2026-2028) should witness significant scaling of manufacturing capabilities as production processes mature and material costs decrease. During this period, we expect the emergence of standardized OTE modules that can be integrated into consumer electronics, smart textiles, and automotive applications. Key milestones will include the first mass-market consumer products incorporating OTE technology, potentially in the form of self-powered IoT sensors or supplementary power systems for portable electronics.

By the late-term phase (2029-2031), organic thermoelectrics may achieve performance metrics approaching those of traditional inorganic materials, while maintaining their inherent advantages in flexibility, weight, and environmental compatibility. This period should see widespread integration into building materials for waste heat recovery, advanced automotive systems, and potentially grid-scale applications in industrial settings.

Critical to this timeline is the parallel development of supporting technologies and infrastructure. Manufacturing innovations in roll-to-roll processing, printing technologies, and encapsulation methods will need to advance concurrently to enable cost-effective mass production. Similarly, standardization efforts for testing protocols, performance metrics, and integration specifications must be established to facilitate market adoption.

Financial projections indicate a compound annual growth rate of approximately 25-30% for the OTE market through this period, with initial revenues dominated by specialty applications before transitioning to broader consumer and industrial markets. Investment patterns suggest venture capital will drive early commercialization efforts, with larger corporate investments becoming prevalent as the technology matures and demonstrates market viability.

Regulatory considerations, particularly regarding material safety and end-of-life recycling, will need to be addressed proactively to prevent market barriers. Early engagement with regulatory bodies and development of industry standards will be essential to establishing a sustainable commercialization pathway for this promising technology domain.

The mid-term phase (2026-2028) should witness significant scaling of manufacturing capabilities as production processes mature and material costs decrease. During this period, we expect the emergence of standardized OTE modules that can be integrated into consumer electronics, smart textiles, and automotive applications. Key milestones will include the first mass-market consumer products incorporating OTE technology, potentially in the form of self-powered IoT sensors or supplementary power systems for portable electronics.

By the late-term phase (2029-2031), organic thermoelectrics may achieve performance metrics approaching those of traditional inorganic materials, while maintaining their inherent advantages in flexibility, weight, and environmental compatibility. This period should see widespread integration into building materials for waste heat recovery, advanced automotive systems, and potentially grid-scale applications in industrial settings.

Critical to this timeline is the parallel development of supporting technologies and infrastructure. Manufacturing innovations in roll-to-roll processing, printing technologies, and encapsulation methods will need to advance concurrently to enable cost-effective mass production. Similarly, standardization efforts for testing protocols, performance metrics, and integration specifications must be established to facilitate market adoption.

Financial projections indicate a compound annual growth rate of approximately 25-30% for the OTE market through this period, with initial revenues dominated by specialty applications before transitioning to broader consumer and industrial markets. Investment patterns suggest venture capital will drive early commercialization efforts, with larger corporate investments becoming prevalent as the technology matures and demonstrates market viability.

Regulatory considerations, particularly regarding material safety and end-of-life recycling, will need to be addressed proactively to prevent market barriers. Early engagement with regulatory bodies and development of industry standards will be essential to establishing a sustainable commercialization pathway for this promising technology domain.

Sustainability and Environmental Impact Assessment

The environmental impact of organic thermoelectric (OTE) materials presents a significant advantage over conventional inorganic alternatives. OTEs typically utilize abundant, non-toxic elements and compounds, avoiding the scarce and sometimes hazardous materials found in traditional thermoelectrics such as tellurium, lead, and bismuth. This fundamental material difference translates to a substantially reduced environmental footprint across the entire lifecycle of OTE devices.

Manufacturing processes for organic thermoelectrics generally require lower processing temperatures and fewer energy-intensive steps compared to their inorganic counterparts. While inorganic thermoelectric materials often demand high-temperature synthesis exceeding 600°C, many organic materials can be processed at temperatures below 200°C, resulting in significantly lower energy consumption during production. Additionally, solution-based processing methods applicable to many OTEs further reduce energy requirements and enable more environmentally friendly manufacturing approaches.

Life cycle assessment (LCA) studies indicate that OTE devices could potentially reduce embodied carbon by 30-45% compared to conventional thermoelectric systems. This reduction stems from both material selection and manufacturing efficiencies. Furthermore, the biodegradability potential of certain organic materials presents opportunities for end-of-life management that are simply unavailable with inorganic systems.

Water usage represents another critical environmental consideration where OTEs demonstrate advantages. Conventional semiconductor processing typically requires substantial quantities of ultra-pure water, whereas many organic manufacturing routes significantly reduce this requirement. Recent innovations in green solvent systems for OTE production have further improved this aspect, with some processes achieving water consumption reductions of up to 70%.

Resource depletion metrics also favor organic thermoelectrics. By utilizing carbon-based materials rather than rare or geopolitically constrained elements, OTEs help mitigate supply chain vulnerabilities while reducing extraction-related environmental impacts. This aspect becomes increasingly important as global demand for energy harvesting technologies continues to grow.

Despite these advantages, challenges remain in fully optimizing the environmental profile of OTEs. Current limitations include the use of certain environmentally problematic dopants and processing additives, as well as durability concerns that may impact lifetime performance. Research priorities should include developing fully biodegradable variants, eliminating persistent organic pollutants from production processes, and establishing comprehensive recycling protocols.

Regulatory frameworks will play a crucial role in maximizing the sustainability benefits of OTEs. Policies promoting extended producer responsibility, material disclosure requirements, and end-of-life management will be essential as these technologies move toward widespread commercialization. Industry-academic partnerships focused specifically on green chemistry approaches for OTE development represent a promising pathway for addressing remaining environmental challenges.

Manufacturing processes for organic thermoelectrics generally require lower processing temperatures and fewer energy-intensive steps compared to their inorganic counterparts. While inorganic thermoelectric materials often demand high-temperature synthesis exceeding 600°C, many organic materials can be processed at temperatures below 200°C, resulting in significantly lower energy consumption during production. Additionally, solution-based processing methods applicable to many OTEs further reduce energy requirements and enable more environmentally friendly manufacturing approaches.

Life cycle assessment (LCA) studies indicate that OTE devices could potentially reduce embodied carbon by 30-45% compared to conventional thermoelectric systems. This reduction stems from both material selection and manufacturing efficiencies. Furthermore, the biodegradability potential of certain organic materials presents opportunities for end-of-life management that are simply unavailable with inorganic systems.

Water usage represents another critical environmental consideration where OTEs demonstrate advantages. Conventional semiconductor processing typically requires substantial quantities of ultra-pure water, whereas many organic manufacturing routes significantly reduce this requirement. Recent innovations in green solvent systems for OTE production have further improved this aspect, with some processes achieving water consumption reductions of up to 70%.

Resource depletion metrics also favor organic thermoelectrics. By utilizing carbon-based materials rather than rare or geopolitically constrained elements, OTEs help mitigate supply chain vulnerabilities while reducing extraction-related environmental impacts. This aspect becomes increasingly important as global demand for energy harvesting technologies continues to grow.

Despite these advantages, challenges remain in fully optimizing the environmental profile of OTEs. Current limitations include the use of certain environmentally problematic dopants and processing additives, as well as durability concerns that may impact lifetime performance. Research priorities should include developing fully biodegradable variants, eliminating persistent organic pollutants from production processes, and establishing comprehensive recycling protocols.

Regulatory frameworks will play a crucial role in maximizing the sustainability benefits of OTEs. Policies promoting extended producer responsibility, material disclosure requirements, and end-of-life management will be essential as these technologies move toward widespread commercialization. Industry-academic partnerships focused specifically on green chemistry approaches for OTE development represent a promising pathway for addressing remaining environmental challenges.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!