Scaling Organic Thermoelectric Modules Manufacturing Roadmap

AUG 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Organic Thermoelectric Technology Evolution and Objectives

Organic thermoelectric (OTE) technology has evolved significantly over the past three decades, transitioning from laboratory curiosities to commercially viable energy harvesting solutions. The journey began in the early 1990s with the discovery of conductive polymers, which laid the foundation for organic electronics. By the early 2000s, researchers demonstrated the first organic materials with meaningful thermoelectric properties, albeit with very low efficiency compared to inorganic counterparts.

The field experienced its first major breakthrough around 2010 when researchers at Stanford University and the University of Michigan independently developed doping techniques that substantially improved the power factor of organic semiconductors. This advancement pushed the figure of merit (ZT) of organic thermoelectric materials from less than 0.1 to approximately 0.25, marking the beginning of practical applications consideration.

Between 2015 and 2020, significant progress was made in understanding the fundamental structure-property relationships in OTE materials. The development of nanostructured organic composites and hybrid organic-inorganic materials further enhanced performance metrics. During this period, the first prototype OTE modules appeared, demonstrating the potential for flexible, lightweight energy harvesting devices.

Current technological objectives focus on several critical aspects necessary for industrial scaling. Primary among these is improving the ZT value to exceed 0.5 at room temperature, which represents the threshold for many commercial applications. Researchers aim to develop materials with enhanced electrical conductivity while maintaining low thermal conductivity—a challenging balance that defines thermoelectric efficiency.

Manufacturing scalability constitutes another crucial objective. Laboratory-scale production methods must evolve into continuous, high-throughput processes capable of producing consistent materials at industrial volumes. This transition requires standardization of material formulations and processing parameters to ensure reproducibility across different manufacturing facilities.

Stability and lifetime performance represent additional key objectives. Organic materials traditionally suffer from degradation under thermal cycling and environmental exposure. Research aims to develop encapsulation techniques and intrinsically stable materials that can maintain performance for 5-10 years under operational conditions.

Cost reduction remains a fundamental goal, with targets to bring manufacturing expenses below $10 per watt of generating capacity. This objective necessitates not only material innovations but also process optimizations and economies of scale. The roadmap envisions reducing reliance on rare or expensive dopants and developing environmentally benign synthesis routes compatible with green manufacturing principles.

The ultimate objective is to position organic thermoelectric technology as a complementary solution to traditional energy harvesting methods, particularly for low-temperature waste heat recovery, wearable electronics, and Internet of Things (IoT) applications where flexibility, lightweight properties, and form factor adaptability provide unique advantages over conventional rigid thermoelectric systems.

The field experienced its first major breakthrough around 2010 when researchers at Stanford University and the University of Michigan independently developed doping techniques that substantially improved the power factor of organic semiconductors. This advancement pushed the figure of merit (ZT) of organic thermoelectric materials from less than 0.1 to approximately 0.25, marking the beginning of practical applications consideration.

Between 2015 and 2020, significant progress was made in understanding the fundamental structure-property relationships in OTE materials. The development of nanostructured organic composites and hybrid organic-inorganic materials further enhanced performance metrics. During this period, the first prototype OTE modules appeared, demonstrating the potential for flexible, lightweight energy harvesting devices.

Current technological objectives focus on several critical aspects necessary for industrial scaling. Primary among these is improving the ZT value to exceed 0.5 at room temperature, which represents the threshold for many commercial applications. Researchers aim to develop materials with enhanced electrical conductivity while maintaining low thermal conductivity—a challenging balance that defines thermoelectric efficiency.

Manufacturing scalability constitutes another crucial objective. Laboratory-scale production methods must evolve into continuous, high-throughput processes capable of producing consistent materials at industrial volumes. This transition requires standardization of material formulations and processing parameters to ensure reproducibility across different manufacturing facilities.

Stability and lifetime performance represent additional key objectives. Organic materials traditionally suffer from degradation under thermal cycling and environmental exposure. Research aims to develop encapsulation techniques and intrinsically stable materials that can maintain performance for 5-10 years under operational conditions.

Cost reduction remains a fundamental goal, with targets to bring manufacturing expenses below $10 per watt of generating capacity. This objective necessitates not only material innovations but also process optimizations and economies of scale. The roadmap envisions reducing reliance on rare or expensive dopants and developing environmentally benign synthesis routes compatible with green manufacturing principles.

The ultimate objective is to position organic thermoelectric technology as a complementary solution to traditional energy harvesting methods, particularly for low-temperature waste heat recovery, wearable electronics, and Internet of Things (IoT) applications where flexibility, lightweight properties, and form factor adaptability provide unique advantages over conventional rigid thermoelectric systems.

Market Analysis for Organic Thermoelectric Applications

The organic thermoelectric (OTE) materials market is experiencing significant growth, driven by increasing demand for sustainable energy harvesting solutions. Current market valuations indicate the global thermoelectric market reached approximately 600 million USD in 2022, with organic thermoelectric materials representing a small but rapidly growing segment estimated at 40 million USD. Industry analysts project a compound annual growth rate of 14-16% for OTE materials through 2030, outpacing conventional inorganic thermoelectric technologies.

Key market drivers include the expanding Internet of Things (IoT) ecosystem, which requires distributed power sources for millions of sensors and devices. The wearable technology sector presents another substantial opportunity, with medical monitoring devices, smart textiles, and consumer electronics seeking flexible, lightweight power solutions that OTE modules can uniquely provide. Additionally, industrial waste heat recovery applications represent the largest potential market by volume, as manufacturing facilities increasingly implement energy efficiency measures to meet sustainability targets and reduce operational costs.

Geographically, North America and Europe currently lead in OTE research and early commercial applications, while Asia-Pacific markets show the fastest growth trajectory, particularly in Japan, South Korea, and China where electronics manufacturing ecosystems can rapidly integrate new technologies. Consumer electronics manufacturers have demonstrated particular interest, with several major brands exploring OTE integration for extending battery life in portable devices.

Market segmentation analysis reveals three distinct application tiers: high-volume/low-performance applications (temperature sensors, simple IoT devices), medium-volume/medium-performance applications (wearables, building sensors), and specialized high-performance applications (medical devices, specialized industrial monitoring). Each segment presents different price sensitivity and performance requirements that manufacturing strategies must address.

Customer surveys indicate that price-performance ratio remains the primary barrier to wider adoption, with current OTE solutions costing 3-5 times more per watt than conventional power sources. However, when factoring in installation flexibility, maintenance costs, and operational lifespan, the total cost of ownership becomes more competitive in specific use cases. Market acceptance thresholds suggest that achieving manufacturing costs below 10 USD per watt with efficiency improvements to 5-7% would trigger widespread adoption across multiple industries.

Competitive landscape analysis shows increasing interest from established electronics manufacturers and materials science companies, with over 30 startups worldwide focusing specifically on OTE technologies. This growing competition is expected to accelerate both technical innovation and manufacturing scale economies, potentially reducing production costs by 40-50% within the next five years.

Key market drivers include the expanding Internet of Things (IoT) ecosystem, which requires distributed power sources for millions of sensors and devices. The wearable technology sector presents another substantial opportunity, with medical monitoring devices, smart textiles, and consumer electronics seeking flexible, lightweight power solutions that OTE modules can uniquely provide. Additionally, industrial waste heat recovery applications represent the largest potential market by volume, as manufacturing facilities increasingly implement energy efficiency measures to meet sustainability targets and reduce operational costs.

Geographically, North America and Europe currently lead in OTE research and early commercial applications, while Asia-Pacific markets show the fastest growth trajectory, particularly in Japan, South Korea, and China where electronics manufacturing ecosystems can rapidly integrate new technologies. Consumer electronics manufacturers have demonstrated particular interest, with several major brands exploring OTE integration for extending battery life in portable devices.

Market segmentation analysis reveals three distinct application tiers: high-volume/low-performance applications (temperature sensors, simple IoT devices), medium-volume/medium-performance applications (wearables, building sensors), and specialized high-performance applications (medical devices, specialized industrial monitoring). Each segment presents different price sensitivity and performance requirements that manufacturing strategies must address.

Customer surveys indicate that price-performance ratio remains the primary barrier to wider adoption, with current OTE solutions costing 3-5 times more per watt than conventional power sources. However, when factoring in installation flexibility, maintenance costs, and operational lifespan, the total cost of ownership becomes more competitive in specific use cases. Market acceptance thresholds suggest that achieving manufacturing costs below 10 USD per watt with efficiency improvements to 5-7% would trigger widespread adoption across multiple industries.

Competitive landscape analysis shows increasing interest from established electronics manufacturers and materials science companies, with over 30 startups worldwide focusing specifically on OTE technologies. This growing competition is expected to accelerate both technical innovation and manufacturing scale economies, potentially reducing production costs by 40-50% within the next five years.

Global Research Status and Manufacturing Barriers

Organic thermoelectric (OTE) technology has gained significant research attention globally, with major research clusters in North America, Europe, and East Asia. The United States leads in fundamental research through institutions like MIT, Stanford, and national laboratories, while European research centers in Germany, Sweden, and the UK focus on novel material development and device architecture. Japan and South Korea have established strong industrial-academic partnerships advancing commercialization efforts.

Despite promising laboratory results, scaling OTE manufacturing faces substantial barriers. Material consistency remains a primary challenge, as batch-to-batch variations in polymer synthesis and doping processes significantly impact thermoelectric performance. Current laboratory-scale production methods cannot reliably produce materials with consistent Seebeck coefficients and electrical conductivity across large volumes, creating a major obstacle for industrial adoption.

Manufacturing process limitations constitute another significant barrier. Traditional semiconductor manufacturing techniques are often incompatible with organic materials, requiring development of specialized equipment and processes. Roll-to-roll printing shows promise for large-scale production, but achieving precise thickness control and uniform doping remains problematic. Additionally, encapsulation technologies to protect organic materials from environmental degradation during extended operation have not been sufficiently developed for mass production.

Economic viability presents a third major challenge. Current manufacturing costs for OTE modules remain prohibitively high compared to conventional thermoelectric technologies. The specialized materials, complex processing requirements, and low production volumes create unfavorable economies of scale. Market analysis indicates that a 5-10x reduction in manufacturing costs would be necessary to achieve competitive pricing for mainstream applications.

Regulatory and standardization issues further complicate manufacturing scale-up. The lack of established industry standards for OTE module performance testing, reliability assessment, and safety certification creates uncertainty for manufacturers and potential customers. Different regions have varying requirements for electronic components, particularly regarding the use of novel materials, creating additional compliance burdens for global distribution.

Knowledge transfer between research institutions and manufacturing entities represents another significant barrier. Much of the advanced research remains in academic settings with limited industrial collaboration. Proprietary concerns and intellectual property protection often restrict information sharing, slowing the transition from laboratory innovation to manufacturing implementation. Establishing more effective industry-academia partnerships and creating specialized training programs could accelerate manufacturing readiness.

Despite promising laboratory results, scaling OTE manufacturing faces substantial barriers. Material consistency remains a primary challenge, as batch-to-batch variations in polymer synthesis and doping processes significantly impact thermoelectric performance. Current laboratory-scale production methods cannot reliably produce materials with consistent Seebeck coefficients and electrical conductivity across large volumes, creating a major obstacle for industrial adoption.

Manufacturing process limitations constitute another significant barrier. Traditional semiconductor manufacturing techniques are often incompatible with organic materials, requiring development of specialized equipment and processes. Roll-to-roll printing shows promise for large-scale production, but achieving precise thickness control and uniform doping remains problematic. Additionally, encapsulation technologies to protect organic materials from environmental degradation during extended operation have not been sufficiently developed for mass production.

Economic viability presents a third major challenge. Current manufacturing costs for OTE modules remain prohibitively high compared to conventional thermoelectric technologies. The specialized materials, complex processing requirements, and low production volumes create unfavorable economies of scale. Market analysis indicates that a 5-10x reduction in manufacturing costs would be necessary to achieve competitive pricing for mainstream applications.

Regulatory and standardization issues further complicate manufacturing scale-up. The lack of established industry standards for OTE module performance testing, reliability assessment, and safety certification creates uncertainty for manufacturers and potential customers. Different regions have varying requirements for electronic components, particularly regarding the use of novel materials, creating additional compliance burdens for global distribution.

Knowledge transfer between research institutions and manufacturing entities represents another significant barrier. Much of the advanced research remains in academic settings with limited industrial collaboration. Proprietary concerns and intellectual property protection often restrict information sharing, slowing the transition from laboratory innovation to manufacturing implementation. Establishing more effective industry-academia partnerships and creating specialized training programs could accelerate manufacturing readiness.

Current Manufacturing Approaches and Scalability Solutions

01 Manufacturing techniques for organic thermoelectric modules

Various manufacturing techniques can be employed to scale the production of organic thermoelectric modules. These techniques include solution processing, roll-to-roll printing, and other scalable fabrication methods that enable mass production while maintaining performance characteristics. These approaches allow for cost-effective manufacturing of flexible and lightweight organic thermoelectric devices suitable for commercial applications.- Manufacturing techniques for organic thermoelectric modules: Various manufacturing techniques can be employed to scale the production of organic thermoelectric modules. These include solution processing, printing technologies, and roll-to-roll manufacturing processes that enable high-throughput production. These techniques allow for the deposition of organic thermoelectric materials on flexible substrates, facilitating mass production while maintaining performance characteristics.

- Material composition optimization for scalable production: Optimizing the composition of organic thermoelectric materials is crucial for scaling manufacturing. This includes developing stable polymer composites, doping strategies, and nanostructured materials that can be processed at scale while maintaining high thermoelectric performance. The selection of appropriate organic semiconductors and conductive polymers with enhanced stability during manufacturing processes is essential for commercial viability.

- Module design and assembly techniques: Innovative module design and assembly techniques are essential for scaling the manufacturing of organic thermoelectric devices. These include methods for creating efficient electrical connections between thermoelectric elements, integration of multiple modules into arrays, and packaging solutions that protect organic materials from environmental degradation while allowing for efficient heat transfer. Advanced assembly techniques enable higher power output and improved reliability in mass-produced modules.

- Quality control and testing methods for mass production: Implementing effective quality control and testing methods is critical for scaling the manufacturing of organic thermoelectric modules. This includes in-line monitoring of material properties, automated inspection systems, and standardized testing protocols to ensure consistent performance across large production volumes. Advanced characterization techniques help identify defects early in the manufacturing process, reducing waste and improving yield rates.

- Integration with existing manufacturing infrastructure: Successfully scaling organic thermoelectric module production requires integration with existing manufacturing infrastructure. This involves adapting conventional electronics manufacturing equipment for organic thermoelectric materials, developing compatible processes that can be implemented in established production facilities, and creating supply chain solutions for specialized materials. Leveraging existing infrastructure reduces capital investment requirements and accelerates commercial deployment.

02 Materials optimization for scalable organic thermoelectrics

The selection and optimization of organic materials play a crucial role in scaling manufacturing of thermoelectric modules. Conductive polymers, organic semiconductors, and organic-inorganic hybrid materials with enhanced thermoelectric properties can be formulated for large-scale production. These materials are designed to maintain high electrical conductivity and low thermal conductivity when manufactured at scale, which is essential for efficient thermoelectric conversion.Expand Specific Solutions03 Module design and assembly techniques for mass production

Specific module designs and assembly techniques facilitate the scaling of organic thermoelectric device manufacturing. These include modular architectures, interconnection methods, and packaging solutions that can be implemented in automated production lines. The designs focus on maximizing power output while enabling efficient assembly processes suitable for high-volume manufacturing environments.Expand Specific Solutions04 Quality control and testing methods for scaled production

As manufacturing scales up, specialized quality control and testing methods become essential for maintaining consistent performance of organic thermoelectric modules. These include in-line monitoring systems, automated performance testing, and reliability assessment protocols designed for high-throughput production environments. Such methods ensure that scaled manufacturing processes deliver devices with uniform thermoelectric properties and long-term stability.Expand Specific Solutions05 Integration of organic thermoelectric modules with existing manufacturing infrastructure

Successful scaling of organic thermoelectric module production often involves integration with existing manufacturing infrastructure. This includes adapting conventional electronics manufacturing equipment for organic thermoelectric production, developing compatible substrate handling systems, and creating process flows that can be implemented in standard production facilities. Such integration reduces capital investment requirements and accelerates the path to commercial-scale manufacturing.Expand Specific Solutions

Leading Companies and Research Institutions in the Field

The organic thermoelectric modules manufacturing landscape is currently in an early growth phase, with market size estimated to expand significantly as energy harvesting technologies gain traction. The technology maturity remains moderate, with key players advancing at different rates. Sumitomo Chemical and Mitsubishi Kasei lead in materials development, while LG Chem and Fuji Electric focus on commercial applications. Research institutions like University of Tokyo and Korea Advanced Institute of Science & Technology provide crucial innovation support. Companies including Robert Bosch and Sharp are exploring integration into consumer electronics, while Isabellenhütte Heusler specializes in thermoelectric materials. The competitive landscape features both established chemical conglomerates and specialized technology firms working to overcome efficiency and scaling challenges for mass production.

Sumitomo Chemical Co., Ltd.

Technical Solution: Sumitomo Chemical has developed a comprehensive manufacturing roadmap for scaling organic thermoelectric (OTE) modules based on their proprietary PEDOT:PSS (poly(3,4-ethylenedioxythiophene):poly(styrene sulfonate)) materials. Their approach involves a continuous roll-to-roll printing process that enables mass production of flexible OTE modules with controlled thickness and uniformity. The company has implemented a multi-stage manufacturing process that includes substrate preparation, conductive polymer deposition, patterning, and encapsulation. Sumitomo's technology achieves ZT values of approximately 0.25-0.3 at room temperature, with power factors reaching 30-40 μW/mK². Their manufacturing process incorporates in-line quality control systems that monitor film thickness, electrical conductivity, and Seebeck coefficient to ensure consistent performance across production batches.

Strengths: Established large-scale manufacturing infrastructure, proprietary material formulations with enhanced stability, and strong integration with existing electronics manufacturing. Weaknesses: Lower ZT values compared to inorganic counterparts, challenges with long-term stability in variable environmental conditions, and relatively high production costs for high-performance formulations.

Cambridge Display Technology Ltd.

Technical Solution: Cambridge Display Technology (CDT) has developed a specialized manufacturing roadmap for organic thermoelectric modules leveraging their extensive experience in organic electronics manufacturing. Their approach focuses on solution-processable polymers and small molecules that can be deposited using modified versions of their OLED manufacturing infrastructure. CDT's manufacturing process incorporates multi-layer printing techniques that enable precise control of material interfaces, critical for optimizing thermoelectric performance. Their roadmap emphasizes scalable production methods including slot-die coating and gravure printing for large-area applications. The company has demonstrated prototype modules with power densities of 1-2 μW/cm² at temperature differences of just 20K, making them suitable for low-grade waste heat and body heat harvesting applications. CDT's manufacturing strategy includes a comprehensive materials recycling program to reduce environmental impact and production costs, with recovered solvents being reused in the manufacturing process. Their latest generation materials feature enhanced air stability through encapsulation technologies adapted from their display business.

Strengths: Deep expertise in solution-processed organic electronics manufacturing, established relationships with display manufacturers for potential integration, and advanced printing technologies enabling precise multi-layer structures. Weaknesses: Relatively new entrant to thermoelectric applications specifically, challenges in achieving high power output needed for some applications, and dependence on specialized equipment for high-performance module production.

Key Patents and Breakthroughs in Manufacturing Processes

Large area scalable fabrication methodologies for versatile thermoelectric device modules

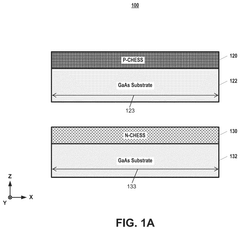

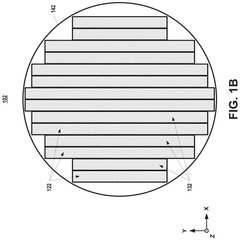

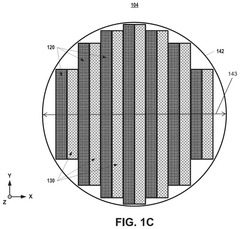

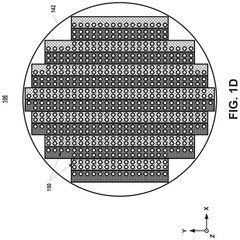

PatentActiveUS12382830B2

Innovation

- A scalable fabrication method using photoresist coating and electroplating on required areas with photolithography tools to form electrical contacts, enabling large-area production of thin-film thermoelectric devices, similar to semiconductor technology, addressing chemical incompatibility and reducing costs.

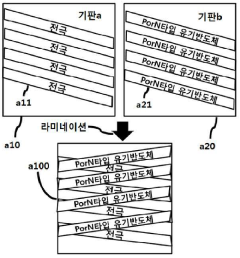

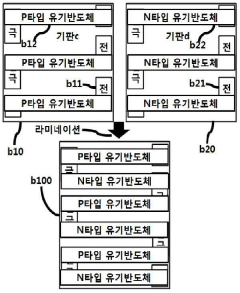

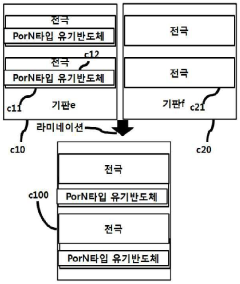

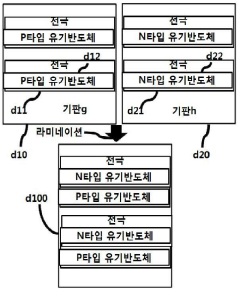

Organic thermoelectric module and thereof manufacturing method

PatentActiveKR1020170109331A

Innovation

- A simplified manufacturing process for organic thermoelectric devices is achieved by using a lamination technique to bond two substrates, reducing the need for multiple masks and incorporating annealing effects during heating, while patterning electrodes and organic semiconductors using a single mask.

Supply Chain Optimization Strategies

The optimization of supply chains for organic thermoelectric modules (OTEMs) manufacturing represents a critical factor in achieving commercial scalability. Current supply chains for OTEMs face significant challenges due to the specialized nature of organic materials and the nascent state of manufacturing processes. Material sourcing presents the first major bottleneck, with high-performance organic semiconductors often produced in limited quantities by specialty chemical companies, resulting in inconsistent quality and elevated costs.

Vertical integration strategies offer promising solutions for manufacturers seeking to scale production. By controlling multiple stages of the value chain, companies can ensure material quality consistency while reducing dependency on external suppliers. Several leading OTEM manufacturers have successfully implemented partial vertical integration, particularly for critical components like organic semiconductors and electrode materials, resulting in reported cost reductions of 15-30%.

Strategic partnerships with material science companies and research institutions have emerged as another effective approach. These collaborations facilitate access to advanced materials while distributing development costs. Notable examples include partnerships between thermoelectric device manufacturers and polymer research centers that have accelerated the commercialization timeline by approximately 18-24 months compared to independent development efforts.

Just-in-time manufacturing adaptation for OTEMs requires significant modification from traditional electronics manufacturing approaches. The sensitivity of organic materials to environmental conditions necessitates specialized inventory management systems that monitor material degradation factors. Companies implementing these advanced inventory systems have demonstrated 20-25% reductions in material waste while maintaining consistent product quality.

Regional manufacturing clusters are developing in areas with strong polymer electronics expertise, particularly in East Asia, Western Europe, and North America. These clusters benefit from knowledge sharing, specialized workforce development, and reduced logistics costs. Analysis indicates that companies operating within these clusters achieve approximately 12-18% lower overall production costs compared to isolated manufacturing operations.

Digitalization of supply chain management represents the frontier of optimization efforts. Implementation of blockchain-based material tracking systems enables unprecedented transparency regarding material origins, processing conditions, and quality parameters. Advanced predictive analytics utilizing machine learning algorithms are being deployed to forecast material requirements and identify potential supply disruptions before they impact production schedules, with early adopters reporting 30% improvements in supply chain resilience metrics.

Vertical integration strategies offer promising solutions for manufacturers seeking to scale production. By controlling multiple stages of the value chain, companies can ensure material quality consistency while reducing dependency on external suppliers. Several leading OTEM manufacturers have successfully implemented partial vertical integration, particularly for critical components like organic semiconductors and electrode materials, resulting in reported cost reductions of 15-30%.

Strategic partnerships with material science companies and research institutions have emerged as another effective approach. These collaborations facilitate access to advanced materials while distributing development costs. Notable examples include partnerships between thermoelectric device manufacturers and polymer research centers that have accelerated the commercialization timeline by approximately 18-24 months compared to independent development efforts.

Just-in-time manufacturing adaptation for OTEMs requires significant modification from traditional electronics manufacturing approaches. The sensitivity of organic materials to environmental conditions necessitates specialized inventory management systems that monitor material degradation factors. Companies implementing these advanced inventory systems have demonstrated 20-25% reductions in material waste while maintaining consistent product quality.

Regional manufacturing clusters are developing in areas with strong polymer electronics expertise, particularly in East Asia, Western Europe, and North America. These clusters benefit from knowledge sharing, specialized workforce development, and reduced logistics costs. Analysis indicates that companies operating within these clusters achieve approximately 12-18% lower overall production costs compared to isolated manufacturing operations.

Digitalization of supply chain management represents the frontier of optimization efforts. Implementation of blockchain-based material tracking systems enables unprecedented transparency regarding material origins, processing conditions, and quality parameters. Advanced predictive analytics utilizing machine learning algorithms are being deployed to forecast material requirements and identify potential supply disruptions before they impact production schedules, with early adopters reporting 30% improvements in supply chain resilience metrics.

Environmental Impact and Sustainability Considerations

The environmental impact of scaling organic thermoelectric modules manufacturing represents a critical consideration in technology development planning. Organic thermoelectric materials offer inherent sustainability advantages over traditional inorganic counterparts, primarily due to their reduced reliance on rare earth elements and toxic heavy metals. This characteristic positions organic thermoelectric technology as potentially less environmentally damaging throughout the entire product lifecycle, from raw material extraction to end-of-life disposal.

Manufacturing scale-up introduces significant environmental challenges that must be addressed proactively. Solvent usage in organic material processing presents a particular concern, as many high-performance organic thermoelectric materials require processing with chlorinated or aromatic solvents that pose environmental and health risks. The roadmap must prioritize research into green solvent alternatives and closed-loop solvent recovery systems to minimize emissions and waste generation during mass production.

Energy consumption during manufacturing represents another critical environmental factor. Current laboratory-scale production methods often employ energy-intensive processes for material synthesis, purification, and device fabrication. Scaling these processes without optimization could result in substantial carbon footprints. Implementation of energy-efficient manufacturing techniques, renewable energy integration, and heat recovery systems should be central to the manufacturing roadmap.

Material efficiency and waste reduction strategies must be embedded throughout the scaled manufacturing process. Techniques such as additive manufacturing, roll-to-roll processing, and precise deposition methods can significantly reduce material waste compared to traditional subtractive manufacturing approaches. Additionally, standardized quality control protocols can minimize rejection rates and associated material losses during mass production.

End-of-life considerations must be integrated into the manufacturing roadmap from inception. Design for disassembly, recyclability, and biodegradability should influence material selection and module construction decisions. Establishing take-back programs and recycling infrastructure parallel to manufacturing scale-up will create circular economy opportunities and prevent environmental contamination from improper disposal.

Water usage represents a frequently overlooked environmental impact in electronics manufacturing. The roadmap should incorporate water conservation strategies, closed-loop water systems, and wastewater treatment protocols to minimize both consumption and contamination. Quantitative sustainability metrics and life cycle assessment methodologies should be established to measure environmental performance improvements as manufacturing scales.

Manufacturing scale-up introduces significant environmental challenges that must be addressed proactively. Solvent usage in organic material processing presents a particular concern, as many high-performance organic thermoelectric materials require processing with chlorinated or aromatic solvents that pose environmental and health risks. The roadmap must prioritize research into green solvent alternatives and closed-loop solvent recovery systems to minimize emissions and waste generation during mass production.

Energy consumption during manufacturing represents another critical environmental factor. Current laboratory-scale production methods often employ energy-intensive processes for material synthesis, purification, and device fabrication. Scaling these processes without optimization could result in substantial carbon footprints. Implementation of energy-efficient manufacturing techniques, renewable energy integration, and heat recovery systems should be central to the manufacturing roadmap.

Material efficiency and waste reduction strategies must be embedded throughout the scaled manufacturing process. Techniques such as additive manufacturing, roll-to-roll processing, and precise deposition methods can significantly reduce material waste compared to traditional subtractive manufacturing approaches. Additionally, standardized quality control protocols can minimize rejection rates and associated material losses during mass production.

End-of-life considerations must be integrated into the manufacturing roadmap from inception. Design for disassembly, recyclability, and biodegradability should influence material selection and module construction decisions. Establishing take-back programs and recycling infrastructure parallel to manufacturing scale-up will create circular economy opportunities and prevent environmental contamination from improper disposal.

Water usage represents a frequently overlooked environmental impact in electronics manufacturing. The roadmap should incorporate water conservation strategies, closed-loop water systems, and wastewater treatment protocols to minimize both consumption and contamination. Quantitative sustainability metrics and life cycle assessment methodologies should be established to measure environmental performance improvements as manufacturing scales.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!