Galvanized Steel vs Anodized Aluminum: Weathering Resistance

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Corrosion Protection Technologies Background and Objectives

Corrosion protection technologies have evolved significantly over the past century, driven by industrial demands for materials that can withstand increasingly harsh environmental conditions. The comparison between galvanized steel and anodized aluminum represents a critical intersection in material science and corrosion engineering, with each offering distinct advantages in weathering resistance applications. Historically, galvanization emerged in the 19th century as one of the first widespread metal protection methods, while anodization gained prominence in the mid-20th century as aluminum applications expanded across industries.

The technological evolution in this field has been characterized by continuous improvements in coating processes, thickness control, and alloy compositions. Recent advancements have focused on enhancing the longevity and performance of these protective layers while reducing environmental impact and production costs. The market has witnessed a shift from purely functional protection to solutions that combine corrosion resistance with aesthetic qualities and additional performance characteristics.

Current research trends indicate growing interest in hybrid protection systems that leverage the strengths of both galvanized steel and anodized aluminum technologies. These developments aim to address the limitations of each method when used independently, particularly in extreme weather conditions or specialized industrial applications.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of galvanized steel and anodized aluminum technologies specifically regarding their weathering resistance properties. This includes evaluating performance metrics under various environmental conditions, including coastal areas with high salt content, industrial zones with chemical exposure, and regions experiencing extreme temperature fluctuations.

Secondary objectives include identifying the cost-effectiveness ratio of both technologies across their complete lifecycle, from production and installation to maintenance and end-of-life considerations. Additionally, this research aims to map emerging innovations that might bridge the performance gap between these two established technologies or potentially replace them in specific applications.

The technological trajectory suggests potential convergence of these protection methods through new composite materials or multi-layer protection systems. Understanding this evolution is crucial for industries where material selection directly impacts structural integrity, maintenance schedules, and overall project economics. This research will provide a foundation for strategic decision-making regarding material selection in weathering-critical applications across construction, transportation, energy, and consumer goods sectors.

The technological evolution in this field has been characterized by continuous improvements in coating processes, thickness control, and alloy compositions. Recent advancements have focused on enhancing the longevity and performance of these protective layers while reducing environmental impact and production costs. The market has witnessed a shift from purely functional protection to solutions that combine corrosion resistance with aesthetic qualities and additional performance characteristics.

Current research trends indicate growing interest in hybrid protection systems that leverage the strengths of both galvanized steel and anodized aluminum technologies. These developments aim to address the limitations of each method when used independently, particularly in extreme weather conditions or specialized industrial applications.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of galvanized steel and anodized aluminum technologies specifically regarding their weathering resistance properties. This includes evaluating performance metrics under various environmental conditions, including coastal areas with high salt content, industrial zones with chemical exposure, and regions experiencing extreme temperature fluctuations.

Secondary objectives include identifying the cost-effectiveness ratio of both technologies across their complete lifecycle, from production and installation to maintenance and end-of-life considerations. Additionally, this research aims to map emerging innovations that might bridge the performance gap between these two established technologies or potentially replace them in specific applications.

The technological trajectory suggests potential convergence of these protection methods through new composite materials or multi-layer protection systems. Understanding this evolution is crucial for industries where material selection directly impacts structural integrity, maintenance schedules, and overall project economics. This research will provide a foundation for strategic decision-making regarding material selection in weathering-critical applications across construction, transportation, energy, and consumer goods sectors.

Market Analysis of Weather-Resistant Metal Applications

The weather-resistant metal applications market has experienced significant growth over the past decade, driven primarily by expanding construction, automotive, and infrastructure sectors. Currently valued at approximately $156 billion globally, this market segment is projected to grow at a compound annual growth rate (CAGR) of 4.7% through 2028, according to recent industry analyses.

Galvanized steel and anodized aluminum represent two dominant materials within this market, collectively accounting for over 65% of weather-resistant metal applications. Galvanized steel maintains the larger market share at 38%, particularly strong in construction and infrastructure applications where cost-effectiveness remains a primary consideration. Anodized aluminum, commanding 27% of the market, has shown faster growth rates in premium construction, transportation, and consumer goods segments.

Regional market distribution reveals interesting patterns, with North America and Europe traditionally favoring anodized aluminum in architectural applications due to aesthetic considerations and long-term performance requirements. Meanwhile, Asia-Pacific markets have historically preferred galvanized steel for its lower initial cost, though this trend is shifting as economic development progresses and lifecycle cost awareness increases.

End-use segmentation shows construction and building materials as the largest application sector (42%), followed by transportation (23%), infrastructure (18%), and consumer goods (11%). The remaining 6% encompasses various specialized applications including marine environments and agricultural equipment. Within these segments, material selection increasingly follows performance-based specifications rather than traditional material preferences.

Market drivers include increasing awareness of lifecycle costs versus initial investment, growing emphasis on sustainability metrics including recyclability and embodied carbon, and rising demand for maintenance-free solutions in increasingly extreme weather conditions. The latter factor has become particularly significant as climate change intensifies weather patterns globally, creating more challenging operating environments for exposed metal components.

Pricing trends reveal a complex landscape. While galvanized steel maintains a 30-45% cost advantage in terms of raw material and processing costs, this gap narrows significantly when considering total lifecycle expenses including maintenance, replacement frequency, and end-of-life value. This economic reality is gradually shifting procurement decisions, especially in high-value applications where service life expectations exceed 15 years.

Customer preference analysis indicates growing sophistication in material selection criteria, with 73% of commercial buyers now considering weathering performance data as a primary decision factor, compared to just 48% five years ago. This represents a fundamental market shift from price-driven to performance-driven purchasing behaviors.

Galvanized steel and anodized aluminum represent two dominant materials within this market, collectively accounting for over 65% of weather-resistant metal applications. Galvanized steel maintains the larger market share at 38%, particularly strong in construction and infrastructure applications where cost-effectiveness remains a primary consideration. Anodized aluminum, commanding 27% of the market, has shown faster growth rates in premium construction, transportation, and consumer goods segments.

Regional market distribution reveals interesting patterns, with North America and Europe traditionally favoring anodized aluminum in architectural applications due to aesthetic considerations and long-term performance requirements. Meanwhile, Asia-Pacific markets have historically preferred galvanized steel for its lower initial cost, though this trend is shifting as economic development progresses and lifecycle cost awareness increases.

End-use segmentation shows construction and building materials as the largest application sector (42%), followed by transportation (23%), infrastructure (18%), and consumer goods (11%). The remaining 6% encompasses various specialized applications including marine environments and agricultural equipment. Within these segments, material selection increasingly follows performance-based specifications rather than traditional material preferences.

Market drivers include increasing awareness of lifecycle costs versus initial investment, growing emphasis on sustainability metrics including recyclability and embodied carbon, and rising demand for maintenance-free solutions in increasingly extreme weather conditions. The latter factor has become particularly significant as climate change intensifies weather patterns globally, creating more challenging operating environments for exposed metal components.

Pricing trends reveal a complex landscape. While galvanized steel maintains a 30-45% cost advantage in terms of raw material and processing costs, this gap narrows significantly when considering total lifecycle expenses including maintenance, replacement frequency, and end-of-life value. This economic reality is gradually shifting procurement decisions, especially in high-value applications where service life expectations exceed 15 years.

Customer preference analysis indicates growing sophistication in material selection criteria, with 73% of commercial buyers now considering weathering performance data as a primary decision factor, compared to just 48% five years ago. This represents a fundamental market shift from price-driven to performance-driven purchasing behaviors.

Current State and Challenges in Metal Surface Treatment

The global metal surface treatment industry is currently experiencing significant technological advancements, particularly in weathering resistance applications. Galvanized steel and anodized aluminum represent two dominant technologies in this space, each with distinct performance characteristics and market applications. Current market analysis indicates that the global metal surface treatment market reached approximately $13.5 billion in 2022, with projections suggesting growth to $18.7 billion by 2027, representing a CAGR of 6.7%.

Galvanized steel technology has evolved considerably over recent decades, with hot-dip galvanization remaining the industry standard for steel protection. The zinc coating provides sacrificial protection, corroding preferentially to protect the underlying steel. Modern galvanizing processes can achieve coating thicknesses ranging from 20-200 microns, with service lifespans of 25-50+ years depending on environmental exposure conditions. However, challenges persist in achieving uniform coating thickness on complex geometries and managing zinc runoff in certain environmental contexts.

Anodized aluminum technology has similarly advanced, with Type II (sulfuric acid) and Type III (hard) anodizing being the predominant methods. Current anodic layer thicknesses typically range from 5-25 microns for architectural applications and up to 100 microns for severe industrial environments. The sealed oxide layer provides excellent corrosion resistance without sacrificial action, unlike galvanized coatings. Recent innovations have focused on improving color stability and developing more environmentally friendly sealing processes.

A significant challenge facing both technologies is the increasingly stringent environmental regulations worldwide. Traditional galvanizing processes generate hazardous waste containing zinc, lead, and other heavy metals, while conventional anodizing produces acidic waste streams requiring neutralization. Industry leaders are investing heavily in developing more sustainable processes, including lower-temperature galvanizing baths and zero-discharge anodizing systems.

Climate change presents another critical challenge, as accelerated weathering cycles and increased atmospheric pollutants affect coating performance. Research indicates that traditional weathering models may underestimate degradation rates in modern urban and industrial environments. This has prompted renewed interest in developing enhanced testing protocols that better simulate real-world exposure conditions.

Regional disparities in technology adoption represent another challenge. While North America and Europe have largely transitioned to advanced coating technologies with improved environmental profiles, developing markets often continue to utilize older, less efficient processes due to cost constraints and regulatory differences. This creates inconsistency in global supply chains and product performance expectations.

The integration of nanotechnology into surface treatments represents both an opportunity and challenge. Nano-modified zinc coatings and nano-sealed anodic layers show promising performance improvements in laboratory testing, but scaling these technologies to industrial production volumes remains technically challenging and cost-prohibitive for widespread adoption.

Galvanized steel technology has evolved considerably over recent decades, with hot-dip galvanization remaining the industry standard for steel protection. The zinc coating provides sacrificial protection, corroding preferentially to protect the underlying steel. Modern galvanizing processes can achieve coating thicknesses ranging from 20-200 microns, with service lifespans of 25-50+ years depending on environmental exposure conditions. However, challenges persist in achieving uniform coating thickness on complex geometries and managing zinc runoff in certain environmental contexts.

Anodized aluminum technology has similarly advanced, with Type II (sulfuric acid) and Type III (hard) anodizing being the predominant methods. Current anodic layer thicknesses typically range from 5-25 microns for architectural applications and up to 100 microns for severe industrial environments. The sealed oxide layer provides excellent corrosion resistance without sacrificial action, unlike galvanized coatings. Recent innovations have focused on improving color stability and developing more environmentally friendly sealing processes.

A significant challenge facing both technologies is the increasingly stringent environmental regulations worldwide. Traditional galvanizing processes generate hazardous waste containing zinc, lead, and other heavy metals, while conventional anodizing produces acidic waste streams requiring neutralization. Industry leaders are investing heavily in developing more sustainable processes, including lower-temperature galvanizing baths and zero-discharge anodizing systems.

Climate change presents another critical challenge, as accelerated weathering cycles and increased atmospheric pollutants affect coating performance. Research indicates that traditional weathering models may underestimate degradation rates in modern urban and industrial environments. This has prompted renewed interest in developing enhanced testing protocols that better simulate real-world exposure conditions.

Regional disparities in technology adoption represent another challenge. While North America and Europe have largely transitioned to advanced coating technologies with improved environmental profiles, developing markets often continue to utilize older, less efficient processes due to cost constraints and regulatory differences. This creates inconsistency in global supply chains and product performance expectations.

The integration of nanotechnology into surface treatments represents both an opportunity and challenge. Nano-modified zinc coatings and nano-sealed anodic layers show promising performance improvements in laboratory testing, but scaling these technologies to industrial production volumes remains technically challenging and cost-prohibitive for widespread adoption.

Technical Comparison of Galvanized Steel and Anodized Aluminum

01 Surface treatments for galvanized steel weathering resistance

Various surface treatments can be applied to galvanized steel to enhance its weathering resistance. These treatments include chromate conversion coatings, phosphate treatments, and specialized sealants that form protective barriers against environmental factors. These treatments help prevent white rust formation and extend the service life of galvanized steel in outdoor applications by providing additional protection layers that complement the zinc coating.- Surface treatments for galvanized steel: Various surface treatments can be applied to galvanized steel to enhance its weathering resistance. These treatments include chromate conversion coatings, phosphate treatments, and polymer-based protective layers that form a barrier against corrosive elements. These treatments can significantly extend the service life of galvanized steel in outdoor applications by preventing white rust formation and delaying the onset of red rust, even in harsh environmental conditions.

- Anodizing processes for aluminum weathering resistance: Specialized anodizing processes can significantly improve the weathering resistance of aluminum. These processes create a thicker, more durable oxide layer on the aluminum surface that provides enhanced protection against environmental factors. The anodized layer can be further sealed with various compounds to fill the porous structure, creating a more effective barrier against moisture and corrosive agents. Different anodizing parameters such as current density, electrolyte composition, and processing time can be optimized for specific weathering requirements.

- Composite coatings for metal protection: Composite coating systems that combine multiple protective layers can provide superior weathering resistance for both galvanized steel and anodized aluminum. These systems typically include a primer layer for adhesion, a middle layer with corrosion inhibitors, and a top coat that provides UV and moisture resistance. Some advanced composite coatings incorporate nanoparticles or self-healing components that can repair minor damage automatically, extending the protective lifetime of the coating system under weathering conditions.

- Alloy modifications for improved corrosion resistance: Specific alloy compositions can be developed for both steel (before galvanizing) and aluminum (before anodizing) to enhance their inherent corrosion resistance. For galvanized steel, adding elements like nickel, manganese or chromium to the zinc coating can improve its durability. For aluminum, alloys containing magnesium, silicon, or copper in optimized proportions can provide better corrosion resistance after anodizing. These metallurgical approaches address weathering resistance at the material composition level rather than relying solely on surface treatments.

- Environmental testing and performance standards: Standardized testing methods have been developed to evaluate and compare the weathering resistance of galvanized steel and anodized aluminum. These include accelerated weathering tests using salt spray, humidity chambers, and UV exposure to simulate years of environmental exposure in a compressed timeframe. Performance standards specify minimum requirements for coating thickness, adhesion strength, and corrosion resistance that materials must meet for different exposure categories. These testing protocols help in selecting appropriate protection systems for specific environmental conditions and service life requirements.

02 Anodizing processes for aluminum weathering protection

Anodizing processes for aluminum involve creating a controlled oxide layer on the metal surface through electrolytic treatment. Different anodizing techniques, including hard anodizing and color anodizing, can be employed to enhance weathering resistance. The thickness and quality of the anodic oxide layer significantly impact the aluminum's ability to withstand environmental exposure, with properly sealed anodic coatings providing superior corrosion and UV resistance.Expand Specific Solutions03 Composite coating systems for metal weatherproofing

Composite coating systems combine multiple layers of different materials to provide comprehensive protection for both galvanized steel and anodized aluminum. These systems typically include primers, intermediate coats, and topcoats with specific functions such as adhesion promotion, barrier protection, and UV resistance. The synergistic effect of these layers results in superior weathering performance compared to single-layer protection, particularly in harsh environments with exposure to salt, pollution, or extreme temperatures.Expand Specific Solutions04 Alloy modifications for improved corrosion resistance

The composition of the base metal alloys can be modified to inherently improve weathering resistance before protective treatments are applied. For galvanized steel, adjustments to the zinc coating alloy composition, such as adding aluminum, magnesium or other elements, can significantly enhance corrosion resistance. Similarly, for aluminum, specific alloy formulations with elements like magnesium, silicon, or chromium can provide better natural resistance to environmental degradation while maintaining compatibility with anodizing processes.Expand Specific Solutions05 Environmental exposure testing and performance evaluation methods

Standardized testing methods are essential for evaluating and comparing the weathering resistance of galvanized steel and anodized aluminum. These include accelerated weathering tests using salt spray, humidity chambers, and UV exposure, as well as long-term outdoor exposure testing in various climates. Advanced analytical techniques such as electrochemical impedance spectroscopy and surface analysis methods help quantify protection levels and predict service life of these materials in different environmental conditions.Expand Specific Solutions

Leading Manufacturers and Industry Competitors

The galvanized steel versus anodized aluminum weathering resistance market is in a mature growth phase, with an estimated global market size exceeding $150 billion. Major steel players like Nippon Steel, POSCO Holdings, and Tata Steel dominate the galvanized segment, while companies such as Eloxal Hoefler specialize in aluminum anodizing technologies. Technical maturity varies between the two processes - galvanization represents a well-established technology with incremental innovations from JFE Steel and Baoshan Iron & Steel, while anodized aluminum continues to see technical advancements from specialized firms. The competitive landscape is characterized by regional strengths, with Asian manufacturers focusing on high-volume production and European companies emphasizing premium quality and specialized applications for extreme weather conditions.

NIPPON STEEL CORP.

Technical Solution: Nippon Steel has developed advanced galvanized steel products specifically engineered for superior weathering resistance. Their SuperDyma® technology incorporates zinc-aluminum-magnesium coatings that provide up to 10 times greater corrosion resistance than conventional hot-dip galvanized steel. The company utilizes a proprietary coating process that creates a dense, uniform zinc layer with controlled crystalline structure, enhancing barrier protection. Their research has demonstrated that the aluminum content in the coating forms a stable passive film, while magnesium promotes the formation of protective simonkolleite compounds in corrosive environments. Nippon Steel's galvanized products undergo rigorous testing in various environmental conditions, including salt spray tests exceeding 2,000 hours without red rust formation. For applications requiring both aesthetic appeal and durability, they offer colored galvanized steel with UV-resistant polymer topcoats that maintain appearance while preserving the underlying corrosion protection.

Strengths: Superior corrosion resistance in coastal and industrial environments; excellent cut-edge protection due to sacrificial properties of zinc; self-healing capabilities where zinc migrates to protect exposed steel at scratches or cuts. Weaknesses: Higher initial cost compared to standard galvanized products; potential for galvanic corrosion when in contact with certain metals; less suitable for applications requiring high-temperature resistance.

POSCO Holdings, Inc.

Technical Solution: POSCO has pioneered PosMAC® (POSCO Magnesium Alloy Coated), an advanced galvanized steel technology specifically designed for extreme weathering resistance. This proprietary coating combines zinc with carefully controlled amounts of magnesium (approximately 2.5-3%) and aluminum (approximately 2.5-3%), creating a unique microstructure that forms dense protective layers when exposed to environmental conditions. Independent testing has shown PosMAC® provides 5-10 times greater corrosion resistance than conventional galvanized steel. POSCO's manufacturing process employs precise temperature control during the coating solidification phase, resulting in optimized crystal structures that enhance barrier properties. Their continuous galvanizing lines incorporate advanced air knife systems that ensure uniform coating thickness (typically 7-25μm depending on application requirements). For applications requiring both corrosion resistance and formability, POSCO has developed specialized annealing processes that maintain the steel substrate's mechanical properties while maximizing the protective capabilities of the zinc-magnesium-aluminum coating.

Strengths: Exceptional corrosion resistance in severe environments including coastal areas; reduced zinc consumption compared to traditional galvanizing while providing superior protection; excellent formability allowing complex shapes without coating damage. Weaknesses: Higher production costs than standard galvanized steel; requires specialized welding techniques; limited high-temperature performance compared to some competing materials.

Key Patents and Research in Corrosion Resistance

High aluminum galvanized steel

PatentInactiveUS6372296B2

Innovation

- A batch hot-dip galvanization process using electroless plating to deposit a metallic layer on steel, followed by dipping in a molten zinc bath with 17-40% aluminum, forming a two-layer coating of intermetallic iron-aluminum and zinc-aluminum alloys, which enhances corrosion resistance and mechanical properties.

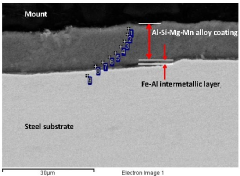

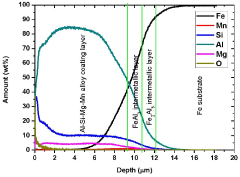

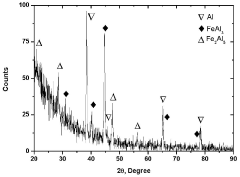

Al-si-mg-mn alloy coated steel sheet with excellent corrosion behaviour

PatentActiveIN201631042610A

Innovation

- An Al-Si-Mg-Mn alloy coating is applied to a steel substrate using a hot-dip process, comprising 82-85% Al, 11-12% Si, 3.5-4.5% Mg, and 0.2-0.5% Mn, with optional elements, demonstrating superior corrosion resistance and sacrificial properties.

Environmental Impact and Sustainability Considerations

The environmental impact of metal finishing processes and the sustainability of materials are increasingly critical considerations in material selection for outdoor applications. Galvanized steel and anodized aluminum present distinct environmental profiles throughout their lifecycle, from raw material extraction to end-of-life disposal.

Galvanized steel production involves significant energy consumption and carbon emissions during the initial steel manufacturing process. The galvanization process itself requires zinc, a finite resource, and utilizes hot-dip baths containing chemicals that can potentially harm the environment if not properly managed. However, galvanized steel offers exceptional durability, often lasting 50+ years in appropriate conditions, which distributes its initial environmental impact over a longer service life.

Anodized aluminum, while requiring substantial energy for initial aluminum production (approximately 3-4 times more energy-intensive than steel production), offers significant environmental advantages in other aspects. The anodizing process uses less toxic chemicals compared to galvanization and produces fewer harmful byproducts. Additionally, the lightweight nature of aluminum reduces transportation emissions and energy requirements during installation and maintenance.

Recyclability represents a major sustainability advantage for both materials, though with notable differences. Aluminum maintains nearly 100% of its properties through infinite recycling cycles and requires only about 5% of the energy needed for primary production when recycled. This closed-loop potential significantly enhances aluminum's sustainability credentials. Galvanized steel is also recyclable, though the zinc coating presents additional separation challenges in the recycling process.

Water usage patterns differ significantly between these finishing methods. Anodizing typically requires more water during the manufacturing process but generates fewer hazardous wastes. Modern anodizing facilities increasingly implement closed-loop water recycling systems to mitigate this impact. Galvanizing processes generally consume less water but may generate more problematic waste streams requiring specialized treatment.

End-of-life considerations favor anodized aluminum due to its higher scrap value and more established recycling infrastructure. However, both materials contribute to resource conservation when properly recycled rather than disposed of in landfills. The zinc from galvanized steel can be recovered, though with greater technical difficulty than aluminum recycling.

Recent life cycle assessments (LCAs) indicate that material choice should be application-specific, with environmental impact heavily dependent on expected service life, maintenance requirements, and local recycling infrastructure. For applications requiring frequent replacement, the lower initial production impact of galvanized steel may be preferable, while long-term installations with minimal maintenance might favor the superior recyclability of anodized aluminum.

Galvanized steel production involves significant energy consumption and carbon emissions during the initial steel manufacturing process. The galvanization process itself requires zinc, a finite resource, and utilizes hot-dip baths containing chemicals that can potentially harm the environment if not properly managed. However, galvanized steel offers exceptional durability, often lasting 50+ years in appropriate conditions, which distributes its initial environmental impact over a longer service life.

Anodized aluminum, while requiring substantial energy for initial aluminum production (approximately 3-4 times more energy-intensive than steel production), offers significant environmental advantages in other aspects. The anodizing process uses less toxic chemicals compared to galvanization and produces fewer harmful byproducts. Additionally, the lightweight nature of aluminum reduces transportation emissions and energy requirements during installation and maintenance.

Recyclability represents a major sustainability advantage for both materials, though with notable differences. Aluminum maintains nearly 100% of its properties through infinite recycling cycles and requires only about 5% of the energy needed for primary production when recycled. This closed-loop potential significantly enhances aluminum's sustainability credentials. Galvanized steel is also recyclable, though the zinc coating presents additional separation challenges in the recycling process.

Water usage patterns differ significantly between these finishing methods. Anodizing typically requires more water during the manufacturing process but generates fewer hazardous wastes. Modern anodizing facilities increasingly implement closed-loop water recycling systems to mitigate this impact. Galvanizing processes generally consume less water but may generate more problematic waste streams requiring specialized treatment.

End-of-life considerations favor anodized aluminum due to its higher scrap value and more established recycling infrastructure. However, both materials contribute to resource conservation when properly recycled rather than disposed of in landfills. The zinc from galvanized steel can be recovered, though with greater technical difficulty than aluminum recycling.

Recent life cycle assessments (LCAs) indicate that material choice should be application-specific, with environmental impact heavily dependent on expected service life, maintenance requirements, and local recycling infrastructure. For applications requiring frequent replacement, the lower initial production impact of galvanized steel may be preferable, while long-term installations with minimal maintenance might favor the superior recyclability of anodized aluminum.

Cost-Benefit Analysis of Competing Surface Treatments

When evaluating galvanized steel versus anodized aluminum for weathering resistance applications, cost considerations play a crucial role in the decision-making process. Initial investment for galvanized steel typically ranges from $0.80-$1.50 per square foot, while anodized aluminum commands a premium at $1.20-$3.00 per square foot. This price differential reflects not only material costs but also the complexity of the respective treatment processes.

The longevity factor significantly impacts the total cost of ownership. Galvanized steel coatings generally provide 15-30 years of protection in moderate environments, with maintenance requirements increasing in coastal or industrial settings. Anodized aluminum, by contrast, can maintain its protective properties for 20-40+ years with minimal maintenance, particularly with Class I (thick) anodization treatments.

Maintenance expenses reveal further distinctions between these surface treatments. Galvanized steel may require periodic inspection and touch-up treatments costing approximately $0.30-$0.75 per square foot every 5-10 years in challenging environments. Anodized aluminum typically demands only regular cleaning with mild detergents, representing an annual maintenance cost of less than $0.10 per square foot.

Installation considerations also affect the overall economic equation. Galvanized steel's greater weight increases transportation and handling costs by 15-25% compared to aluminum alternatives. However, steel's superior structural strength often allows for reduced material thickness, potentially offsetting some weight-related expenses.

Environmental factors introduce additional cost implications. Modern galvanizing processes have improved but still generate zinc-containing waste requiring specialized disposal at $150-$300 per ton. Anodizing produces acidic waste streams with treatment costs of $200-$400 per 1,000 gallons, though closed-loop systems can reduce this environmental burden and associated expenses.

End-of-life value presents another economic consideration. Galvanized steel retains approximately 40-60% of its original value as scrap, while anodized aluminum commands premium recycling rates at 60-80% of original material value. This recyclability factor becomes increasingly significant in projects with sustainability requirements or extended lifecycle planning.

When calculating return on investment, projects with expected lifespans exceeding 25 years typically favor anodized aluminum despite higher initial costs, while shorter-term applications often benefit from galvanized steel's lower upfront investment. The break-even point generally occurs between 12-18 years, depending on environmental exposure conditions and specific application requirements.

The longevity factor significantly impacts the total cost of ownership. Galvanized steel coatings generally provide 15-30 years of protection in moderate environments, with maintenance requirements increasing in coastal or industrial settings. Anodized aluminum, by contrast, can maintain its protective properties for 20-40+ years with minimal maintenance, particularly with Class I (thick) anodization treatments.

Maintenance expenses reveal further distinctions between these surface treatments. Galvanized steel may require periodic inspection and touch-up treatments costing approximately $0.30-$0.75 per square foot every 5-10 years in challenging environments. Anodized aluminum typically demands only regular cleaning with mild detergents, representing an annual maintenance cost of less than $0.10 per square foot.

Installation considerations also affect the overall economic equation. Galvanized steel's greater weight increases transportation and handling costs by 15-25% compared to aluminum alternatives. However, steel's superior structural strength often allows for reduced material thickness, potentially offsetting some weight-related expenses.

Environmental factors introduce additional cost implications. Modern galvanizing processes have improved but still generate zinc-containing waste requiring specialized disposal at $150-$300 per ton. Anodizing produces acidic waste streams with treatment costs of $200-$400 per 1,000 gallons, though closed-loop systems can reduce this environmental burden and associated expenses.

End-of-life value presents another economic consideration. Galvanized steel retains approximately 40-60% of its original value as scrap, while anodized aluminum commands premium recycling rates at 60-80% of original material value. This recyclability factor becomes increasingly significant in projects with sustainability requirements or extended lifecycle planning.

When calculating return on investment, projects with expected lifespans exceeding 25 years typically favor anodized aluminum despite higher initial costs, while shorter-term applications often benefit from galvanized steel's lower upfront investment. The break-even point generally occurs between 12-18 years, depending on environmental exposure conditions and specific application requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!