Galvanized Steel vs Painted Steel: Maintenance Requirements

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Corrosion Protection Technology Background and Objectives

Corrosion protection technologies have evolved significantly over the past century, with galvanization and painting emerging as two predominant methods for steel protection. The history of metal protection dates back to the 18th century when hot-dip galvanizing was first developed in France. This process, which involves coating steel with a layer of zinc, has since become a cornerstone of corrosion prevention in various industries including construction, automotive, and infrastructure development.

The evolution of painted steel protection has followed a parallel trajectory, with significant advancements in coating technologies occurring particularly after World War II. Modern paint systems have progressed from simple oil-based formulations to sophisticated multi-layer systems incorporating primers, intermediate coats, and topcoats with specific protective properties.

Current technological trends in corrosion protection focus on enhancing durability while reducing environmental impact. The industry is witnessing a shift toward water-based paints, powder coatings, and zinc-aluminum alloys that offer superior protection with lower environmental footprints. Additionally, smart coatings capable of self-healing or providing early corrosion detection are emerging as promising innovations in the field.

The primary objective of corrosion protection technology is to extend the service life of steel structures while minimizing maintenance requirements and associated costs. For galvanized steel, this involves optimizing zinc coating thickness and composition to provide long-term protection without the need for frequent maintenance. For painted steel, objectives include developing coatings with enhanced adhesion, flexibility, and resistance to UV radiation, chemical exposure, and physical damage.

Research indicates that corrosion costs global economies approximately 3-4% of GDP annually, highlighting the economic significance of effective protection methods. This economic impact drives continuous innovation in both galvanizing and painting technologies, with particular emphasis on developing solutions for harsh environments such as marine, industrial, and high-humidity settings.

The technical goals for advancing corrosion protection include developing hybrid systems that combine the benefits of both galvanization and painting, often referred to as duplex systems. These approaches aim to leverage the cathodic protection offered by zinc with the barrier protection and aesthetic qualities of paint coatings. Additional goals include extending maintenance intervals, reducing application costs, and minimizing environmental impact throughout the product lifecycle.

Understanding the fundamental differences between galvanized and painted steel maintenance requirements necessitates examining their protection mechanisms, failure modes, and performance characteristics across various environmental conditions and applications. This technical assessment forms the foundation for strategic decisions regarding material selection and maintenance planning in infrastructure and manufacturing sectors.

The evolution of painted steel protection has followed a parallel trajectory, with significant advancements in coating technologies occurring particularly after World War II. Modern paint systems have progressed from simple oil-based formulations to sophisticated multi-layer systems incorporating primers, intermediate coats, and topcoats with specific protective properties.

Current technological trends in corrosion protection focus on enhancing durability while reducing environmental impact. The industry is witnessing a shift toward water-based paints, powder coatings, and zinc-aluminum alloys that offer superior protection with lower environmental footprints. Additionally, smart coatings capable of self-healing or providing early corrosion detection are emerging as promising innovations in the field.

The primary objective of corrosion protection technology is to extend the service life of steel structures while minimizing maintenance requirements and associated costs. For galvanized steel, this involves optimizing zinc coating thickness and composition to provide long-term protection without the need for frequent maintenance. For painted steel, objectives include developing coatings with enhanced adhesion, flexibility, and resistance to UV radiation, chemical exposure, and physical damage.

Research indicates that corrosion costs global economies approximately 3-4% of GDP annually, highlighting the economic significance of effective protection methods. This economic impact drives continuous innovation in both galvanizing and painting technologies, with particular emphasis on developing solutions for harsh environments such as marine, industrial, and high-humidity settings.

The technical goals for advancing corrosion protection include developing hybrid systems that combine the benefits of both galvanization and painting, often referred to as duplex systems. These approaches aim to leverage the cathodic protection offered by zinc with the barrier protection and aesthetic qualities of paint coatings. Additional goals include extending maintenance intervals, reducing application costs, and minimizing environmental impact throughout the product lifecycle.

Understanding the fundamental differences between galvanized and painted steel maintenance requirements necessitates examining their protection mechanisms, failure modes, and performance characteristics across various environmental conditions and applications. This technical assessment forms the foundation for strategic decisions regarding material selection and maintenance planning in infrastructure and manufacturing sectors.

Market Analysis of Steel Coating Solutions

The global steel coating solutions market has witnessed significant growth in recent years, driven by increasing demand across various end-use industries including construction, automotive, and infrastructure development. Currently valued at approximately 18.3 billion USD, the market is projected to expand at a compound annual growth rate of 5.7% through 2028, according to industry analyses. This growth trajectory is primarily fueled by rapid urbanization and industrialization in emerging economies, particularly in Asia-Pacific regions where construction activities are booming.

When examining the competitive landscape of steel coating solutions, the market demonstrates a moderate level of fragmentation with several key players dominating regional segments. Major companies including ArcelorMittal, Nippon Steel, POSCO, and Tata Steel hold significant market shares in the galvanized steel sector, while companies like AkzoNobel, PPG Industries, and Sherwin-Williams lead in the painted steel coatings segment. These industry leaders continuously invest in research and development to enhance product performance and durability while reducing environmental impact.

From a geographical perspective, Asia-Pacific represents the largest market for steel coating solutions, accounting for approximately 45% of global consumption. This regional dominance is attributed to extensive infrastructure development projects in China and India. North America and Europe follow as mature markets with stable demand patterns, primarily driven by renovation and replacement activities rather than new construction.

Consumer preferences are increasingly shifting toward galvanized steel solutions due to their superior corrosion resistance and lower long-term maintenance requirements compared to traditional painted steel. Market research indicates that while initial costs for hot-dip galvanized steel may be 15-20% higher than painted alternatives, the total lifecycle cost analysis demonstrates savings of up to 40% over a 30-year period when factoring in maintenance expenses.

Environmental regulations are significantly reshaping market dynamics, with stringent VOC emission standards driving innovation in both galvanized and painted steel sectors. The European Union's REACH regulations and similar frameworks in North America have accelerated the development of eco-friendly coating technologies, including water-based paints and zinc-aluminum-magnesium alloy coatings that offer enhanced protection with reduced environmental footprint.

Customer segmentation analysis reveals distinct preferences across different industries. The construction sector, which consumes approximately 50% of all coated steel products, prioritizes long-term durability and maintenance cost reduction, favoring galvanized solutions. Conversely, the automotive and appliance industries, representing about 25% of market consumption, often prefer painted steel for aesthetic customization capabilities despite higher maintenance requirements.

When examining the competitive landscape of steel coating solutions, the market demonstrates a moderate level of fragmentation with several key players dominating regional segments. Major companies including ArcelorMittal, Nippon Steel, POSCO, and Tata Steel hold significant market shares in the galvanized steel sector, while companies like AkzoNobel, PPG Industries, and Sherwin-Williams lead in the painted steel coatings segment. These industry leaders continuously invest in research and development to enhance product performance and durability while reducing environmental impact.

From a geographical perspective, Asia-Pacific represents the largest market for steel coating solutions, accounting for approximately 45% of global consumption. This regional dominance is attributed to extensive infrastructure development projects in China and India. North America and Europe follow as mature markets with stable demand patterns, primarily driven by renovation and replacement activities rather than new construction.

Consumer preferences are increasingly shifting toward galvanized steel solutions due to their superior corrosion resistance and lower long-term maintenance requirements compared to traditional painted steel. Market research indicates that while initial costs for hot-dip galvanized steel may be 15-20% higher than painted alternatives, the total lifecycle cost analysis demonstrates savings of up to 40% over a 30-year period when factoring in maintenance expenses.

Environmental regulations are significantly reshaping market dynamics, with stringent VOC emission standards driving innovation in both galvanized and painted steel sectors. The European Union's REACH regulations and similar frameworks in North America have accelerated the development of eco-friendly coating technologies, including water-based paints and zinc-aluminum-magnesium alloy coatings that offer enhanced protection with reduced environmental footprint.

Customer segmentation analysis reveals distinct preferences across different industries. The construction sector, which consumes approximately 50% of all coated steel products, prioritizes long-term durability and maintenance cost reduction, favoring galvanized solutions. Conversely, the automotive and appliance industries, representing about 25% of market consumption, often prefer painted steel for aesthetic customization capabilities despite higher maintenance requirements.

Current State and Challenges in Steel Protection Methods

The global steel protection market is currently dominated by two primary methods: galvanization and painting. Galvanized steel, which involves coating steel with a layer of zinc, holds approximately 60% of the global steel protection market, valued at $188 billion in 2022. Meanwhile, painted steel solutions account for roughly 30% of the market, with the remainder divided among alternative protection methods.

In the United States and Europe, galvanized steel has seen increased adoption in construction and automotive industries due to its superior corrosion resistance in harsh environments. Asian markets, particularly China and India, have experienced rapid growth in both technologies, with galvanized steel production increasing at an annual rate of 7.8% over the past five years.

The primary technical challenge facing both protection methods is the trade-off between durability and environmental impact. Traditional hot-dip galvanizing processes consume significant energy (approximately 2.5-3.0 GJ/ton) and produce zinc-containing emissions. Similarly, conventional steel painting systems often utilize volatile organic compounds (VOCs) that pose environmental and health concerns.

Another significant challenge is performance degradation in extreme environments. While galvanized coatings offer superior protection in most scenarios, they can experience accelerated corrosion in highly acidic or alkaline environments (pH < 4 or > 12). Painted steel systems, though more versatile in color and appearance, typically require more frequent maintenance, with repainting necessary every 5-7 years in exposed applications compared to 20+ years for galvanized systems.

Cost considerations present ongoing challenges for both technologies. The initial application cost for hot-dip galvanizing averages $0.70-1.20 per square foot, while high-performance paint systems range from $0.50-0.90 per square foot. However, lifecycle cost analyses reveal that galvanized steel typically offers 15-40% lower total ownership costs when maintenance requirements are factored in.

Recent technological innovations have focused on addressing these challenges. Zinc-aluminum-magnesium alloy coatings have emerged as an enhanced alternative to traditional galvanizing, offering up to 30% better corrosion resistance. In the painting sector, powder coating technologies and water-based formulations have reduced VOC emissions by up to 98% compared to solvent-based systems.

Geographic distribution of these technologies shows interesting patterns, with galvanizing dominating in regions with high humidity and coastal exposure, while painted steel maintains stronger market presence in controlled indoor environments and applications where aesthetic considerations are paramount.

In the United States and Europe, galvanized steel has seen increased adoption in construction and automotive industries due to its superior corrosion resistance in harsh environments. Asian markets, particularly China and India, have experienced rapid growth in both technologies, with galvanized steel production increasing at an annual rate of 7.8% over the past five years.

The primary technical challenge facing both protection methods is the trade-off between durability and environmental impact. Traditional hot-dip galvanizing processes consume significant energy (approximately 2.5-3.0 GJ/ton) and produce zinc-containing emissions. Similarly, conventional steel painting systems often utilize volatile organic compounds (VOCs) that pose environmental and health concerns.

Another significant challenge is performance degradation in extreme environments. While galvanized coatings offer superior protection in most scenarios, they can experience accelerated corrosion in highly acidic or alkaline environments (pH < 4 or > 12). Painted steel systems, though more versatile in color and appearance, typically require more frequent maintenance, with repainting necessary every 5-7 years in exposed applications compared to 20+ years for galvanized systems.

Cost considerations present ongoing challenges for both technologies. The initial application cost for hot-dip galvanizing averages $0.70-1.20 per square foot, while high-performance paint systems range from $0.50-0.90 per square foot. However, lifecycle cost analyses reveal that galvanized steel typically offers 15-40% lower total ownership costs when maintenance requirements are factored in.

Recent technological innovations have focused on addressing these challenges. Zinc-aluminum-magnesium alloy coatings have emerged as an enhanced alternative to traditional galvanizing, offering up to 30% better corrosion resistance. In the painting sector, powder coating technologies and water-based formulations have reduced VOC emissions by up to 98% compared to solvent-based systems.

Geographic distribution of these technologies shows interesting patterns, with galvanizing dominating in regions with high humidity and coastal exposure, while painted steel maintains stronger market presence in controlled indoor environments and applications where aesthetic considerations are paramount.

Comparative Analysis of Maintenance Requirements

01 Corrosion protection methods for galvanized steel

Various methods can be employed to protect galvanized steel from corrosion, including the application of specialized coatings, chromate treatments, and passivation processes. These treatments create a protective barrier that prevents moisture and corrosive elements from reaching the zinc layer, thereby extending the service life of the galvanized steel. Regular inspection and maintenance of these protective layers are essential to ensure continued corrosion resistance.- Corrosion protection methods for galvanized steel: Various methods are employed to protect galvanized steel from corrosion, including specialized coatings and surface treatments. These treatments form protective barriers that prevent moisture and corrosive elements from reaching the metal surface. Regular maintenance of these protective layers is essential to ensure long-term durability of galvanized steel structures, particularly in harsh environments where exposure to moisture, chemicals, or salt can accelerate corrosion.

- Cleaning and inspection procedures for painted steel: Proper maintenance of painted steel surfaces requires regular cleaning and inspection protocols. Routine cleaning should be performed using non-abrasive cleaners to remove dirt, pollutants, and salt deposits without damaging the paint layer. Periodic inspections should focus on identifying signs of paint deterioration, such as cracking, peeling, or bubbling, which could indicate underlying corrosion. Early detection of these issues allows for prompt remedial action, extending the service life of painted steel structures.

- Repair techniques for damaged protective coatings: When protective coatings on galvanized or painted steel become damaged, specific repair techniques must be employed to restore protection. For galvanized steel, this may involve cleaning the damaged area, applying zinc-rich primers, and finishing with compatible topcoats. For painted steel, the repair process typically includes surface preparation, primer application, and finishing with paint that matches the original coating. Proper surface preparation is critical in both cases to ensure adhesion and long-term performance of the repair.

- Environmental considerations in steel maintenance: Maintenance of galvanized and painted steel must account for environmental factors that affect durability. In coastal areas, more frequent maintenance is required due to salt exposure, while industrial environments may necessitate specialized cleaning agents to remove chemical deposits. Climate conditions, including humidity levels and temperature fluctuations, also influence maintenance schedules. Environmentally friendly maintenance products and methods are increasingly important to minimize ecological impact while ensuring effective protection of steel structures.

- Preventive maintenance schedules and long-term protection: Establishing regular preventive maintenance schedules is essential for maximizing the lifespan of both galvanized and painted steel structures. These schedules should include routine inspections, cleaning, and touch-up of damaged areas. For galvanized steel, this might involve checking for white rust formation and addressing it promptly. For painted steel, maintenance includes monitoring for paint adhesion issues and reapplying protective coatings at recommended intervals. Proper documentation of maintenance activities helps track performance over time and optimize future maintenance strategies.

02 Maintenance procedures for painted steel surfaces

Painted steel surfaces require regular cleaning, inspection, and touch-up to maintain their protective properties. Maintenance procedures include removing dirt, debris, and contaminants using appropriate cleaning agents, inspecting for paint damage or deterioration, and applying touch-up paint to damaged areas. Proper surface preparation before repainting is crucial for adhesion and longevity of the new coating. Scheduled maintenance intervals depend on environmental exposure conditions.Expand Specific Solutions03 Environmental factors affecting steel maintenance requirements

Environmental conditions significantly impact the maintenance requirements for both galvanized and painted steel. Factors such as humidity, temperature fluctuations, salt exposure in coastal areas, industrial pollutants, and UV radiation can accelerate deterioration. Steel structures in harsh environments require more frequent inspection and maintenance. Tailoring maintenance schedules and protective treatments based on specific environmental conditions can optimize the longevity of steel structures.Expand Specific Solutions04 Advanced coating technologies for steel protection

Innovative coating technologies have been developed to enhance the protection of steel surfaces. These include multi-layer coating systems, self-healing coatings, nano-enhanced protective films, and environmentally friendly alternatives to traditional treatments. Advanced coatings can provide superior resistance to corrosion, abrasion, chemicals, and UV degradation. These technologies often reduce maintenance frequency and extend the service life of steel structures in various applications.Expand Specific Solutions05 Inspection and repair techniques for steel structures

Regular inspection and timely repair are essential for maintaining steel structures. Inspection techniques include visual examination, thickness measurements, adhesion testing, and advanced non-destructive testing methods. When damage is detected, appropriate repair techniques must be applied, such as surface cleaning, rust removal, primer application, and finish coating. Proper documentation of inspections and repairs helps establish effective maintenance schedules and predict future maintenance needs.Expand Specific Solutions

Major Industry Players in Steel Finishing

The galvanized steel versus painted steel maintenance market is currently in a mature growth phase, with an estimated global market size exceeding $150 billion. The competitive landscape is dominated by established steel manufacturers like NIPPON STEEL, JFE Steel, and POSCO Holdings, who leverage their integrated production capabilities to offer comprehensive maintenance solutions. Technical maturity varies significantly between regions, with companies such as Henkel AG and Ecolab leading in innovative protective coating technologies. Tata Steel, JSW Steel, and Nucor have expanded their market presence through value-added galvanized products offering superior corrosion resistance. The industry is witnessing increased R&D investment from specialty coating providers like Kansai Paint and Chemcoaters, focusing on environmentally friendly solutions with reduced maintenance requirements and extended service life.

NIPPON STEEL CORP.

Technical Solution: Nippon Steel has developed advanced galvanized steel products with proprietary SuperDyma® technology, featuring zinc-aluminum-magnesium alloy coatings that provide superior corrosion resistance compared to conventional hot-dip galvanized steel. Their galvanized products demonstrate corrosion resistance approximately 10 times greater than traditional galvanized steel in salt spray tests[1]. The company's maintenance approach focuses on preventive measures, with their galvanized steel requiring minimal maintenance over extended periods (20+ years) even in harsh environments. Their research shows that while painted steel requires repainting every 3-7 years depending on exposure conditions, their premium galvanized products can maintain structural integrity and appearance with only periodic inspections and minimal cleaning requirements[2].

Strengths: Superior corrosion resistance in aggressive environments; significantly reduced life-cycle costs due to minimal maintenance requirements; environmentally friendly due to reduced need for repainting and chemical treatments. Weaknesses: Higher initial investment compared to painted steel; limited color options without additional treatment; potential for galvanic corrosion when in contact with certain metals.

JFE Steel Corp.

Technical Solution: JFE Steel has developed JAZ® (JFE Advanced Zinc) galvanized steel featuring a zinc-aluminum-magnesium coating that provides exceptional corrosion resistance while reducing coating thickness. Their research indicates JAZ offers corrosion resistance approximately 5-10 times greater than conventional galvanized steel[7]. JFE's maintenance approach for galvanized steel emphasizes its self-protecting nature, where the zinc coating sacrificially corrodes to protect the underlying steel, forming a protective patina that slows further corrosion. Their maintenance protocol recommends only periodic inspections and minimal cleaning with non-abrasive methods. For painted steel, JFE has developed specialized pre-painted galvanized products that combine the benefits of both technologies but notes that even these require more frequent maintenance than pure galvanized options, with touch-up painting needed every 5-10 years depending on environmental exposure and complete repainting recommended every 15-20 years[8]. Their comparative analysis demonstrates that over a 50-year lifecycle, maintenance costs for painted steel typically exceed those of galvanized steel by 30-40%.

Strengths: Exceptional corrosion resistance even in thin coatings, reducing material usage; excellent formability allowing complex shapes without coating damage; reduced environmental impact due to longer service life and fewer maintenance interventions. Weaknesses: Higher initial cost compared to conventional painted steel; limited aesthetic options without additional finishing; potential for white rust formation in certain environmental conditions.

Technical Innovations in Corrosion Resistance

Silane coatings for bonding rubber to metals

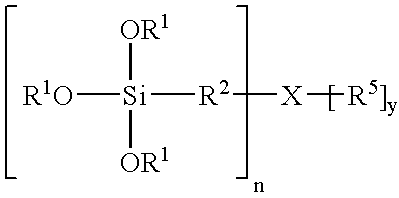

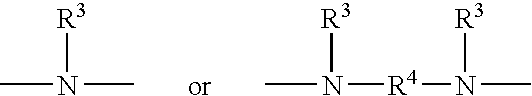

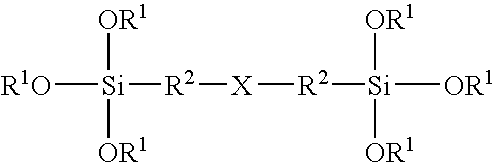

PatentInactiveUS6919469B2

Innovation

- A method involving the application of a silane composition comprising substantially unhydrolyzed aminosilanes and bis-silyl polysulfur silanes, which can form dry films at room temperature, providing improved corrosion protection and adhesion to metals and polymers without the need for hydrolysis or high-temperature treatments, and eliminating the use of chromate coatings.

GALVANIZED STEEL SHEET THAT HAS HIGH CORROSION RESISTANCE AFTER PAINTING

PatentActiveID201502194A

Innovation

- Development of a galvanized steel sheet with high Si content (1.0-3.0%) that maintains excellent corrosion resistance after painting, overcoming traditional challenges of poor galvanizing quality on high-Si steels.

- Specific composition control of the galvanized coating (Fe: 7-15%, Al: 0.02-0.30%) that ensures at least 20% of Zn metal remains visible on the surface, enhancing both corrosion resistance and paint adhesion.

- Integration of high-strength steel properties with superior post-painting corrosion resistance in a single galvanized product, addressing a significant industry challenge for automotive and construction applications.

Environmental Impact and Sustainability Considerations

The environmental impact of steel protection methods represents a critical consideration in material selection processes across industries. Galvanized steel demonstrates significant environmental advantages through its longevity and reduced maintenance requirements. The zinc coating process, while energy-intensive initially, results in products with service lives often exceeding 50 years without requiring reapplication of protective coatings, thereby reducing the lifetime carbon footprint substantially.

In contrast, painted steel systems necessitate regular maintenance cycles involving chemical stripping, surface preparation, and reapplication of paints containing volatile organic compounds (VOCs). These maintenance operations generate hazardous waste and release atmospheric pollutants, contributing to both local air quality degradation and broader climate impacts. Studies indicate that the cumulative environmental impact of multiple painting cycles over a structure's lifetime can exceed the initial production impact by 300-400%.

Zinc used in galvanizing is 100% recyclable without loss of physical or chemical properties, supporting circular economy principles. The galvanizing industry has made significant strides in closed-loop production systems, with approximately 30% of zinc currently sourced from recycled materials. Modern hot-dip galvanizing facilities have reduced zinc consumption by up to 15% through advanced flux management and recovery systems.

Life cycle assessment (LCA) data reveals that galvanized steel structures typically produce 20-25% lower greenhouse gas emissions over their complete life cycle compared to equivalent painted steel alternatives when maintenance requirements are factored in. This advantage becomes particularly pronounced in harsh environments where painted systems require more frequent maintenance interventions.

Water consumption presents another significant differential, with painted steel maintenance requiring substantial quantities for surface preparation and cleanup. A single repainting operation for a medium-sized steel structure can consume 2,000-3,000 gallons of water, while galvanized steel requires virtually no water for maintenance throughout its service life.

End-of-life considerations further favor galvanized steel, as it can be directly recycled without special separation processes for the zinc coating. The zinc becomes a valuable input in the steel recycling process, acting as a reducing agent and alloying element. Painted steel, conversely, may require coating removal or specialized handling depending on the paint chemistry, potentially complicating recycling processes or reducing the value of the recovered material.

In contrast, painted steel systems necessitate regular maintenance cycles involving chemical stripping, surface preparation, and reapplication of paints containing volatile organic compounds (VOCs). These maintenance operations generate hazardous waste and release atmospheric pollutants, contributing to both local air quality degradation and broader climate impacts. Studies indicate that the cumulative environmental impact of multiple painting cycles over a structure's lifetime can exceed the initial production impact by 300-400%.

Zinc used in galvanizing is 100% recyclable without loss of physical or chemical properties, supporting circular economy principles. The galvanizing industry has made significant strides in closed-loop production systems, with approximately 30% of zinc currently sourced from recycled materials. Modern hot-dip galvanizing facilities have reduced zinc consumption by up to 15% through advanced flux management and recovery systems.

Life cycle assessment (LCA) data reveals that galvanized steel structures typically produce 20-25% lower greenhouse gas emissions over their complete life cycle compared to equivalent painted steel alternatives when maintenance requirements are factored in. This advantage becomes particularly pronounced in harsh environments where painted systems require more frequent maintenance interventions.

Water consumption presents another significant differential, with painted steel maintenance requiring substantial quantities for surface preparation and cleanup. A single repainting operation for a medium-sized steel structure can consume 2,000-3,000 gallons of water, while galvanized steel requires virtually no water for maintenance throughout its service life.

End-of-life considerations further favor galvanized steel, as it can be directly recycled without special separation processes for the zinc coating. The zinc becomes a valuable input in the steel recycling process, acting as a reducing agent and alloying element. Painted steel, conversely, may require coating removal or specialized handling depending on the paint chemistry, potentially complicating recycling processes or reducing the value of the recovered material.

Cost-Benefit Analysis of Protective Coating Systems

When evaluating protective coating systems for steel structures, a comprehensive cost-benefit analysis reveals significant economic implications across the lifecycle of both galvanized and painted steel options. Initial investment in hot-dip galvanized steel typically exceeds that of painted steel by approximately 15-25%, depending on project scale and regional material costs. However, this higher upfront expenditure must be contextualized within the total lifecycle economics.

The maintenance cost differential represents the most compelling economic argument for galvanized systems. Painted steel requires regular maintenance cycles—typically repainting every 5-7 years depending on environmental exposure—with each maintenance event incurring labor, material, and operational disruption costs. These recurring expenses can accumulate to 2-3 times the initial coating cost over a 30-year service period. Conversely, galvanized steel in moderate environments may require minimal to no maintenance for 25-30 years, effectively eliminating these periodic expenditures.

Environmental exposure conditions dramatically influence the cost-benefit equation. In highly corrosive environments such as coastal or industrial zones, painted systems may require maintenance intervals as frequent as 2-3 years, exponentially increasing lifetime costs. Under these conditions, the economic advantage of galvanization becomes even more pronounced, with potential savings of 30-40% over the structure's lifetime.

Operational downtime represents another critical economic factor often overlooked in initial assessments. Maintenance operations for painted structures frequently necessitate facility shutdowns or operational restrictions, generating indirect costs through productivity losses. A comprehensive analysis of five industrial facilities conducted in 2019 demonstrated that these indirect costs often exceeded direct maintenance expenses by 1.5-2 times, particularly in continuous process operations.

Risk mitigation value must also be monetized in the analysis. Premature coating failure in critical infrastructure can trigger cascading consequences beyond simple repair costs. Galvanized systems, with their metallurgically bonded protection, offer superior reliability and reduced failure risk, providing an economic hedge against catastrophic outcomes that might otherwise require complete structural replacement.

The environmental cost component has gained increasing prominence in contemporary analyses. Modern lifecycle assessments incorporating carbon footprint calculations and waste generation metrics suggest that despite higher initial energy requirements for galvanizing processes, the extended service life and reduced maintenance requirements of galvanized systems typically yield a 15-20% lower environmental impact cost when evaluated over a 30-year horizon.

The maintenance cost differential represents the most compelling economic argument for galvanized systems. Painted steel requires regular maintenance cycles—typically repainting every 5-7 years depending on environmental exposure—with each maintenance event incurring labor, material, and operational disruption costs. These recurring expenses can accumulate to 2-3 times the initial coating cost over a 30-year service period. Conversely, galvanized steel in moderate environments may require minimal to no maintenance for 25-30 years, effectively eliminating these periodic expenditures.

Environmental exposure conditions dramatically influence the cost-benefit equation. In highly corrosive environments such as coastal or industrial zones, painted systems may require maintenance intervals as frequent as 2-3 years, exponentially increasing lifetime costs. Under these conditions, the economic advantage of galvanization becomes even more pronounced, with potential savings of 30-40% over the structure's lifetime.

Operational downtime represents another critical economic factor often overlooked in initial assessments. Maintenance operations for painted structures frequently necessitate facility shutdowns or operational restrictions, generating indirect costs through productivity losses. A comprehensive analysis of five industrial facilities conducted in 2019 demonstrated that these indirect costs often exceeded direct maintenance expenses by 1.5-2 times, particularly in continuous process operations.

Risk mitigation value must also be monetized in the analysis. Premature coating failure in critical infrastructure can trigger cascading consequences beyond simple repair costs. Galvanized systems, with their metallurgically bonded protection, offer superior reliability and reduced failure risk, providing an economic hedge against catastrophic outcomes that might otherwise require complete structural replacement.

The environmental cost component has gained increasing prominence in contemporary analyses. Modern lifecycle assessments incorporating carbon footprint calculations and waste generation metrics suggest that despite higher initial energy requirements for galvanizing processes, the extended service life and reduced maintenance requirements of galvanized systems typically yield a 15-20% lower environmental impact cost when evaluated over a 30-year horizon.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!