How to Refine Crankshaft Manufacturing Processes

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Crankshaft Manufacturing Evolution and Objectives

Crankshaft manufacturing has undergone significant evolution since the early days of internal combustion engines. Initially, crankshafts were primarily produced through casting methods, which provided limited precision and strength characteristics. The 1920s saw the introduction of forging techniques, marking a pivotal advancement in crankshaft production by enhancing structural integrity and durability under high-stress conditions.

The post-World War II era brought computerized machining technologies, revolutionizing manufacturing precision. By the 1970s, Computer Numerical Control (CNC) machining became standard practice, enabling tighter tolerances and more complex geometries. The 1990s witnessed further refinement with the integration of automated quality control systems and the adoption of advanced materials such as micro-alloyed steels and nodular cast iron.

Current technological trends in crankshaft manufacturing focus on process optimization, material innovation, and sustainability. Manufacturers are increasingly implementing Industry 4.0 principles, incorporating IoT sensors for real-time monitoring and predictive maintenance. Advanced simulation tools now allow for virtual testing of designs before physical prototyping, significantly reducing development cycles and costs.

The primary objectives for refining crankshaft manufacturing processes center around four key areas: quality enhancement, cost reduction, environmental sustainability, and production efficiency. Quality objectives include achieving tighter dimensional tolerances (typically below ±0.01mm), improving surface finish quality, and enhancing fatigue resistance properties. Cost reduction targets focus on minimizing material waste, optimizing energy consumption, and reducing labor costs through automation.

Environmental sustainability goals have become increasingly prominent, with manufacturers seeking to reduce carbon emissions, minimize hazardous waste generation, and implement closed-loop recycling systems for cutting fluids and metal chips. Production efficiency objectives include reducing cycle times, increasing machine utilization rates, and implementing lean manufacturing principles to eliminate non-value-adding activities.

Looking forward, the industry aims to develop more adaptive manufacturing systems capable of rapid reconfiguration for different crankshaft variants. There is also growing interest in exploring additive manufacturing techniques for specialized applications and developing hybrid manufacturing approaches that combine traditional methods with newer technologies. The ultimate goal is to establish manufacturing processes that deliver superior quality crankshafts with optimized weight-to-strength ratios, extended service life, and reduced environmental impact.

The post-World War II era brought computerized machining technologies, revolutionizing manufacturing precision. By the 1970s, Computer Numerical Control (CNC) machining became standard practice, enabling tighter tolerances and more complex geometries. The 1990s witnessed further refinement with the integration of automated quality control systems and the adoption of advanced materials such as micro-alloyed steels and nodular cast iron.

Current technological trends in crankshaft manufacturing focus on process optimization, material innovation, and sustainability. Manufacturers are increasingly implementing Industry 4.0 principles, incorporating IoT sensors for real-time monitoring and predictive maintenance. Advanced simulation tools now allow for virtual testing of designs before physical prototyping, significantly reducing development cycles and costs.

The primary objectives for refining crankshaft manufacturing processes center around four key areas: quality enhancement, cost reduction, environmental sustainability, and production efficiency. Quality objectives include achieving tighter dimensional tolerances (typically below ±0.01mm), improving surface finish quality, and enhancing fatigue resistance properties. Cost reduction targets focus on minimizing material waste, optimizing energy consumption, and reducing labor costs through automation.

Environmental sustainability goals have become increasingly prominent, with manufacturers seeking to reduce carbon emissions, minimize hazardous waste generation, and implement closed-loop recycling systems for cutting fluids and metal chips. Production efficiency objectives include reducing cycle times, increasing machine utilization rates, and implementing lean manufacturing principles to eliminate non-value-adding activities.

Looking forward, the industry aims to develop more adaptive manufacturing systems capable of rapid reconfiguration for different crankshaft variants. There is also growing interest in exploring additive manufacturing techniques for specialized applications and developing hybrid manufacturing approaches that combine traditional methods with newer technologies. The ultimate goal is to establish manufacturing processes that deliver superior quality crankshafts with optimized weight-to-strength ratios, extended service life, and reduced environmental impact.

Market Requirements for High-Precision Crankshafts

The automotive industry's demand for high-precision crankshafts has intensified significantly over the past decade, driven primarily by stringent emission regulations and the pursuit of enhanced fuel efficiency. Modern vehicles require crankshafts manufactured to tolerances measured in microns rather than millimeters, representing a fundamental shift in quality expectations across the supply chain.

Market analysis reveals that premium and luxury vehicle segments currently demonstrate the highest demand for ultra-precision crankshafts, with tolerances below 5 microns becoming standard. This trend is gradually permeating mid-range vehicle markets as consumers increasingly prioritize fuel economy and engine longevity. The commercial vehicle sector similarly shows growing demand for precision components to extend service intervals and reduce total ownership costs.

Performance metrics valued by OEMs have evolved beyond basic dimensional accuracy to include surface finish quality, material homogeneity, and fatigue resistance properties. Manufacturers capable of delivering crankshafts with Ra values below 0.2μm for bearing surfaces are securing premium contracts, indicating market willingness to pay for superior quality that translates to measurable performance improvements.

Regional market assessment indicates that European and Japanese automakers maintain the most stringent specifications, while North American and emerging market manufacturers are rapidly closing this gap. The Chinese automotive market, in particular, has demonstrated accelerated adoption of high-precision standards, driven by domestic competition and export ambitions.

Durability requirements have intensified across all market segments, with expected service life for passenger vehicle crankshafts now routinely exceeding 250,000 kilometers without significant wear. Commercial vehicle applications demand even greater longevity, with expectations approaching 1 million kilometers for heavy-duty applications.

Economic considerations remain paramount, with OEMs seeking precision improvements without proportional cost increases. Market research indicates acceptance of 5-8% cost premiums for crankshafts demonstrating 15-20% improvements in precision metrics and corresponding performance gains. This price sensitivity necessitates manufacturing process innovations that deliver precision improvements while maintaining cost competitiveness.

The aftermarket segment presents a distinct requirement profile, emphasizing dimensional consistency across production batches to ensure interchangeability, while specialized racing and high-performance markets demand customized solutions with extreme precision tolerances regardless of cost implications. This market segmentation requires manufacturers to develop flexible production capabilities addressing diverse precision requirements within a single manufacturing ecosystem.

Market analysis reveals that premium and luxury vehicle segments currently demonstrate the highest demand for ultra-precision crankshafts, with tolerances below 5 microns becoming standard. This trend is gradually permeating mid-range vehicle markets as consumers increasingly prioritize fuel economy and engine longevity. The commercial vehicle sector similarly shows growing demand for precision components to extend service intervals and reduce total ownership costs.

Performance metrics valued by OEMs have evolved beyond basic dimensional accuracy to include surface finish quality, material homogeneity, and fatigue resistance properties. Manufacturers capable of delivering crankshafts with Ra values below 0.2μm for bearing surfaces are securing premium contracts, indicating market willingness to pay for superior quality that translates to measurable performance improvements.

Regional market assessment indicates that European and Japanese automakers maintain the most stringent specifications, while North American and emerging market manufacturers are rapidly closing this gap. The Chinese automotive market, in particular, has demonstrated accelerated adoption of high-precision standards, driven by domestic competition and export ambitions.

Durability requirements have intensified across all market segments, with expected service life for passenger vehicle crankshafts now routinely exceeding 250,000 kilometers without significant wear. Commercial vehicle applications demand even greater longevity, with expectations approaching 1 million kilometers for heavy-duty applications.

Economic considerations remain paramount, with OEMs seeking precision improvements without proportional cost increases. Market research indicates acceptance of 5-8% cost premiums for crankshafts demonstrating 15-20% improvements in precision metrics and corresponding performance gains. This price sensitivity necessitates manufacturing process innovations that deliver precision improvements while maintaining cost competitiveness.

The aftermarket segment presents a distinct requirement profile, emphasizing dimensional consistency across production batches to ensure interchangeability, while specialized racing and high-performance markets demand customized solutions with extreme precision tolerances regardless of cost implications. This market segmentation requires manufacturers to develop flexible production capabilities addressing diverse precision requirements within a single manufacturing ecosystem.

Current Techniques and Barriers in Crankshaft Production

The crankshaft manufacturing industry currently employs several established techniques across different production scales. Traditional forging remains predominant for high-volume production, where steel billets are heated and shaped through die-pressing operations. This process offers excellent structural integrity and fatigue resistance, critical for automotive and heavy machinery applications. Casting methods, particularly ductile iron casting, serve the medium-volume market segment with acceptable performance characteristics at lower production costs.

CNC machining represents the precision end of current manufacturing techniques, allowing for tight tolerances and complex geometrical features. This approach is particularly valuable for specialized applications and prototype development, though it carries higher per-unit costs. Hybrid manufacturing approaches combining forging with subsequent precision machining have emerged as an effective compromise between structural integrity and dimensional accuracy.

Despite these established methods, significant barriers impede further advancement in crankshaft manufacturing. Material limitations present a fundamental challenge, as traditional steel alloys struggle to meet increasingly demanding performance requirements while maintaining cost-effectiveness. The industry faces growing pressure to develop lighter crankshafts without compromising strength and durability, particularly as vehicle electrification and efficiency standards evolve.

Production efficiency remains constrained by lengthy thermal treatment processes necessary for achieving desired metallurgical properties. Heat treatment cycles, including normalizing, hardening, and tempering, can extend manufacturing timelines by days, creating production bottlenecks and increasing energy consumption. Quality control presents another significant barrier, with non-destructive testing methods still lacking the precision needed to detect micro-defects that can lead to catastrophic failures.

Environmental regulations increasingly restrict traditional manufacturing processes, particularly regarding emissions from forging operations and chemical treatments. Compliance requires substantial investment in filtration systems and waste management infrastructure. Additionally, the high energy intensity of conventional manufacturing methods contributes significantly to production costs and environmental impact, with heating operations alone accounting for approximately 40% of energy consumption in typical crankshaft production.

Labor constraints further complicate advancement, as the specialized skills required for quality crankshaft production face declining availability in many manufacturing regions. The industry struggles with knowledge transfer as experienced craftspeople retire without adequate replacement. Meanwhile, automation integration remains challenging due to the complex geometries and quality verification requirements inherent to crankshaft production.

CNC machining represents the precision end of current manufacturing techniques, allowing for tight tolerances and complex geometrical features. This approach is particularly valuable for specialized applications and prototype development, though it carries higher per-unit costs. Hybrid manufacturing approaches combining forging with subsequent precision machining have emerged as an effective compromise between structural integrity and dimensional accuracy.

Despite these established methods, significant barriers impede further advancement in crankshaft manufacturing. Material limitations present a fundamental challenge, as traditional steel alloys struggle to meet increasingly demanding performance requirements while maintaining cost-effectiveness. The industry faces growing pressure to develop lighter crankshafts without compromising strength and durability, particularly as vehicle electrification and efficiency standards evolve.

Production efficiency remains constrained by lengthy thermal treatment processes necessary for achieving desired metallurgical properties. Heat treatment cycles, including normalizing, hardening, and tempering, can extend manufacturing timelines by days, creating production bottlenecks and increasing energy consumption. Quality control presents another significant barrier, with non-destructive testing methods still lacking the precision needed to detect micro-defects that can lead to catastrophic failures.

Environmental regulations increasingly restrict traditional manufacturing processes, particularly regarding emissions from forging operations and chemical treatments. Compliance requires substantial investment in filtration systems and waste management infrastructure. Additionally, the high energy intensity of conventional manufacturing methods contributes significantly to production costs and environmental impact, with heating operations alone accounting for approximately 40% of energy consumption in typical crankshaft production.

Labor constraints further complicate advancement, as the specialized skills required for quality crankshaft production face declining availability in many manufacturing regions. The industry struggles with knowledge transfer as experienced craftspeople retire without adequate replacement. Meanwhile, automation integration remains challenging due to the complex geometries and quality verification requirements inherent to crankshaft production.

Advanced Machining and Heat Treatment Solutions

01 Forging and machining processes for crankshaft manufacturing

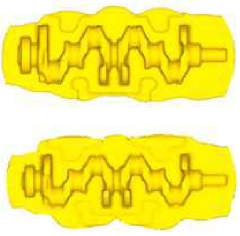

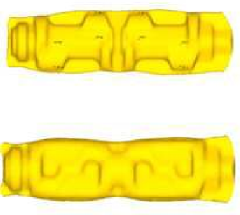

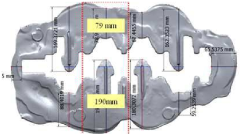

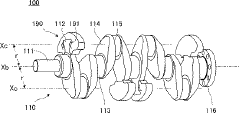

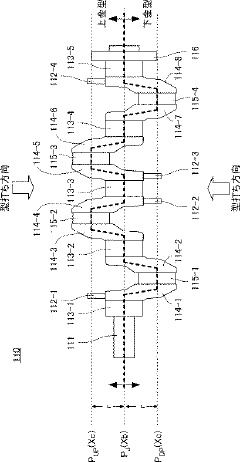

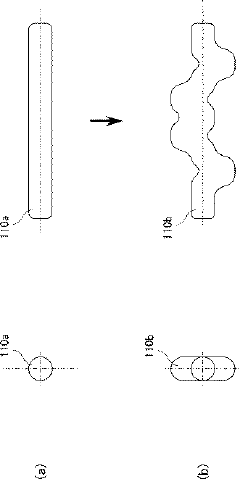

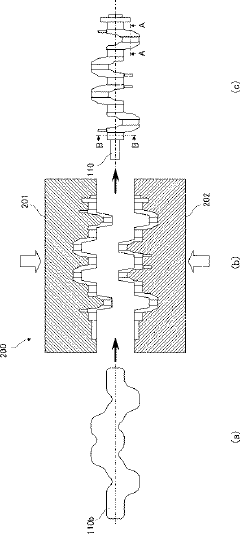

Crankshafts can be manufactured through forging followed by precision machining processes. The forging process involves heating metal billets and shaping them using dies under high pressure to create the basic crankshaft form. Subsequent machining operations refine the dimensions and surface quality to meet specifications. These processes can include turning, milling, drilling, and grinding to achieve the required tolerances and surface finish for critical bearing surfaces and counterweights.- Forging and machining techniques for crankshaft manufacturing: Advanced forging and machining techniques are essential in crankshaft manufacturing to ensure structural integrity and dimensional accuracy. These processes involve precision forging of raw materials followed by multi-stage machining operations to achieve the required specifications. Innovations in these techniques focus on reducing material waste, improving surface finish, and enhancing the mechanical properties of the final product. Computer-controlled machining centers enable complex geometries to be produced with high precision, contributing to improved crankshaft performance and durability.

- Heat treatment and surface hardening processes: Heat treatment and surface hardening processes are critical for enhancing the mechanical properties of crankshafts. These processes include induction hardening, nitriding, and carburizing, which improve wear resistance, fatigue strength, and overall durability. Controlled cooling techniques are employed to achieve the desired microstructure and hardness profile across different sections of the crankshaft. Advanced heat treatment methods focus on optimizing the balance between hardness and toughness while minimizing distortion, resulting in crankshafts that can withstand high mechanical and thermal stresses during operation.

- Quality control and inspection methods: Sophisticated quality control and inspection methods are implemented throughout the crankshaft manufacturing process to ensure compliance with stringent specifications. These methods include non-destructive testing techniques such as ultrasonic inspection, magnetic particle testing, and dimensional verification using coordinate measuring machines. Advanced imaging technologies and automated inspection systems enable the detection of surface and subsurface defects that could compromise crankshaft performance. Real-time monitoring and statistical process control are employed to maintain consistent quality and identify opportunities for process improvement.

- Innovative material selection and composition: The selection of appropriate materials and their composition plays a crucial role in crankshaft manufacturing. High-strength alloy steels, nodular cast iron, and advanced carbon-fiber reinforced composites are being explored to achieve optimal strength-to-weight ratios. Material innovations focus on improving fatigue resistance, reducing weight, and enhancing thermal stability. Microalloying techniques and controlled solidification processes are employed to achieve the desired microstructure and mechanical properties. These material advancements contribute to improved engine performance, fuel efficiency, and reduced emissions.

- Automation and digital manufacturing technologies: Automation and digital manufacturing technologies are revolutionizing crankshaft production processes. Industry 4.0 concepts, including digital twins, artificial intelligence, and machine learning, are being integrated into manufacturing systems to optimize process parameters and predict maintenance needs. Robotic handling systems and automated production lines increase efficiency and consistency while reducing human error. Computer-aided design and manufacturing (CAD/CAM) systems enable rapid prototyping and virtual testing of crankshaft designs before physical production. These technologies contribute to shorter development cycles, improved quality, and enhanced manufacturing flexibility.

02 Advanced surface treatment and hardening techniques

Various surface treatment methods can be applied to enhance crankshaft durability and performance. These include induction hardening, nitriding, shot peening, and roller burnishing to improve fatigue resistance and wear characteristics. Surface treatments create compressive stresses in critical areas like fillets and bearing journals, significantly extending service life. The hardening depth and pattern can be precisely controlled to optimize performance while maintaining core ductility for shock absorption.Expand Specific Solutions03 Quality control and inspection methods

Advanced inspection techniques ensure crankshaft manufacturing quality and reliability. These include non-destructive testing methods such as ultrasonic inspection, magnetic particle testing, and eddy current analysis to detect internal and surface defects. Dimensional verification using coordinate measuring machines (CMM) and optical scanning systems ensures geometric accuracy. Automated vision systems can be employed for real-time inspection during production, with data analytics helping to identify process variations and improvement opportunities.Expand Specific Solutions04 Innovative materials and composite crankshaft designs

Research into advanced materials and composite designs aims to improve crankshaft performance while reducing weight. High-strength alloy steels, microalloyed steels, and even carbon fiber composites are being explored for specific applications. Bimetallic and hybrid designs combine different materials to optimize strength-to-weight ratios. These innovations can lead to reduced reciprocating mass, improved engine efficiency, and better vibration characteristics while maintaining or enhancing durability under high-stress conditions.Expand Specific Solutions05 Automated manufacturing and process optimization

Modern crankshaft manufacturing increasingly relies on automated systems and digital process optimization. Computer numerical control (CNC) machining centers enable precise, repeatable operations with minimal human intervention. Robotic handling systems facilitate seamless movement between manufacturing stages. Digital twin technology and simulation software help optimize process parameters before physical production begins. Machine learning algorithms analyze production data to continuously refine processes, reduce cycle times, and minimize material waste while maintaining quality standards.Expand Specific Solutions

Leading Manufacturers and Industry Competitive Landscape

The crankshaft manufacturing industry is currently in a mature growth phase, characterized by established processes and incremental innovations. The global market size is estimated at $8-10 billion, with steady annual growth of 3-5% driven by automotive and industrial equipment sectors. Technologically, the field shows varying maturity levels across players, with Japanese and German companies leading innovation. Toyota, Honda, and NIPPON STEEL demonstrate advanced capabilities in high-precision manufacturing, while MAG Industrial Automation Systems and Erwin Junker offer specialized machinery solutions. Chinese manufacturers like Tianrun Industry and Weichai Power are rapidly advancing their technological capabilities, particularly in cost-effective mass production methods. Western automotive manufacturers including GM, Peugeot, and Audi continue to refine in-house processes for performance optimization.

MAG Industrial Automation Systems LLC

Technical Solution: MAG has developed comprehensive crankshaft manufacturing solutions that integrate multiple processes into highly efficient production cells. Their systems feature specialized multi-axis machining centers with hydrostatic bearings that provide exceptional rigidity and vibration damping, critical for maintaining tight tolerances during heavy cutting operations. MAG's process incorporates patented deep-hole drilling technology that achieves superior straightness in oil passages (deviation < 0.1mm over 300mm length) while maintaining high production rates. Their manufacturing cells utilize automated part handling with in-line measurement systems that provide closed-loop feedback for process control, automatically adjusting machining parameters to compensate for tool wear and material variations. MAG has pioneered the use of minimum quantity lubrication (MQL) technology in crankshaft machining, reducing coolant consumption by up to 95% while improving chip evacuation and extending tool life by approximately 30%.

Strengths: Comprehensive integration of multiple manufacturing processes; exceptional machine rigidity for heavy cutting operations; advanced automation and process control capabilities. Weaknesses: Complex systems require significant technical support; substantial floor space requirements for complete manufacturing cells; higher initial capital investment compared to standalone machine tools.

Toyota Motor Corp.

Technical Solution: Toyota has revolutionized crankshaft manufacturing through its Toyota Production System (TPS) principles applied to machining operations. Their process features a flexible machining line that can accommodate multiple crankshaft variants with minimal changeover time (under 10 minutes). Toyota employs high-precision CNC grinding with in-process measurement that achieves journal roundness tolerances of 2 microns or better. Their manufacturing system incorporates specialized oil-hole drilling techniques using multi-axis machining centers that optimize coolant delivery channels while maintaining structural integrity. Toyota has also developed proprietary surface treatment processes that enhance fatigue resistance by creating compressive residual stresses in critical areas. The company's approach includes real-time monitoring systems that track tool wear and automatically adjust machining parameters to maintain consistent quality throughout tool life cycles.

Strengths: Exceptional flexibility to handle product variations; industry-leading precision and surface finish quality; integrated quality control that virtually eliminates downstream defects. Weaknesses: Higher complexity in production control systems; requires highly skilled operators and maintenance personnel; potentially higher unit costs for lower volume production runs.

Critical Patents and Innovations in Crankshaft Technology

Crankshaft manufacturing method

PatentActiveKR1020140042099A

Innovation

- A method involving sequential forging with buster, blocker, and finisher molds to set primary and secondary shapes, adjusting the volume ratio to ensure the central segregation zone is not exposed on the pin portion surface, by deviating it to the flash unit.

Crank shaft manufacturing method and crank shaft

PatentInactiveJP2018099708A

Innovation

- The method involves separating the stamping direction of the pin and journal portions, forging along the material's fiber flow, and separately molding the counterweight portion, followed by crimping and additional machining to enhance rigidity and stability.

Material Science Advancements for Crankshaft Performance

Recent advancements in material science have significantly transformed crankshaft manufacturing, offering enhanced performance characteristics and durability. Traditional crankshaft materials like carbon steel and cast iron are increasingly being supplemented or replaced by innovative alloys and composites. Micro-alloyed steels containing precise amounts of vanadium, niobium, and titanium have demonstrated superior strength-to-weight ratios while maintaining excellent fatigue resistance properties essential for crankshaft applications.

Forged steel crankshafts have benefited from refined heat treatment processes, including controlled cooling techniques that optimize microstructure development. Induction hardening technologies have evolved to provide more precise control over surface hardening depths, creating wear-resistant surfaces while maintaining core ductility. These developments have extended crankshaft service life by up to 30% in high-stress applications.

Surface engineering breakthroughs have introduced advanced coating technologies such as physical vapor deposition (PVD) and diamond-like carbon (DLC) coatings. These ultra-thin films significantly reduce friction coefficients between crankshaft journals and bearings, decreasing energy losses and improving overall engine efficiency. Thermal spray coatings have also shown promise in enhancing wear resistance while providing additional corrosion protection.

Computational materials science has revolutionized crankshaft design through predictive modeling of material behavior under various operating conditions. Finite element analysis coupled with materials databases allows engineers to simulate fatigue performance and identify potential failure points before physical prototyping. This approach has reduced development cycles by approximately 40% while improving first-time quality rates.

Powder metallurgy techniques have emerged as viable alternatives for complex crankshaft geometries, offering near-net-shape manufacturing capabilities with reduced material waste. Advances in metal injection molding and hot isostatic pressing have improved the density and mechanical properties of powder metallurgy crankshafts, making them increasingly competitive with traditional forged components in certain applications.

Hybrid material solutions combining different metals through friction welding or bi-metal casting processes have enabled engineers to optimize material properties in specific crankshaft regions. These selective reinforcement techniques allow for stronger journal surfaces while maintaining appropriate flexibility in other areas, resulting in crankshafts that better withstand the complex stress patterns experienced during engine operation.

Nanotechnology applications in crankshaft materials are still emerging but show significant promise. Nano-structured materials and nano-particle reinforced alloys demonstrate improved strength and wear characteristics in laboratory testing. While commercial implementation remains limited, research indicates potential performance improvements of 15-25% over conventional materials when these technologies mature.

Forged steel crankshafts have benefited from refined heat treatment processes, including controlled cooling techniques that optimize microstructure development. Induction hardening technologies have evolved to provide more precise control over surface hardening depths, creating wear-resistant surfaces while maintaining core ductility. These developments have extended crankshaft service life by up to 30% in high-stress applications.

Surface engineering breakthroughs have introduced advanced coating technologies such as physical vapor deposition (PVD) and diamond-like carbon (DLC) coatings. These ultra-thin films significantly reduce friction coefficients between crankshaft journals and bearings, decreasing energy losses and improving overall engine efficiency. Thermal spray coatings have also shown promise in enhancing wear resistance while providing additional corrosion protection.

Computational materials science has revolutionized crankshaft design through predictive modeling of material behavior under various operating conditions. Finite element analysis coupled with materials databases allows engineers to simulate fatigue performance and identify potential failure points before physical prototyping. This approach has reduced development cycles by approximately 40% while improving first-time quality rates.

Powder metallurgy techniques have emerged as viable alternatives for complex crankshaft geometries, offering near-net-shape manufacturing capabilities with reduced material waste. Advances in metal injection molding and hot isostatic pressing have improved the density and mechanical properties of powder metallurgy crankshafts, making them increasingly competitive with traditional forged components in certain applications.

Hybrid material solutions combining different metals through friction welding or bi-metal casting processes have enabled engineers to optimize material properties in specific crankshaft regions. These selective reinforcement techniques allow for stronger journal surfaces while maintaining appropriate flexibility in other areas, resulting in crankshafts that better withstand the complex stress patterns experienced during engine operation.

Nanotechnology applications in crankshaft materials are still emerging but show significant promise. Nano-structured materials and nano-particle reinforced alloys demonstrate improved strength and wear characteristics in laboratory testing. While commercial implementation remains limited, research indicates potential performance improvements of 15-25% over conventional materials when these technologies mature.

Quality Control and Testing Methodologies

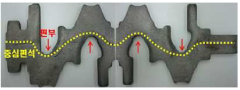

Quality control and testing methodologies represent critical components in refining crankshaft manufacturing processes. Modern crankshaft production facilities employ a multi-layered approach to quality assurance, beginning with incoming material inspection. Raw materials undergo rigorous chemical composition analysis and mechanical property testing to ensure they meet specified standards before entering the production line.

In-process inspection forms the backbone of quality control during manufacturing. Dimensional measurements are conducted at various stages using coordinate measuring machines (CMMs) with precision capabilities of ±0.001mm. These systems verify critical parameters including main and pin journal diameters, fillet radii, and overall length tolerances. Advanced facilities implement automated optical measurement systems that can capture thousands of data points per second, creating comprehensive digital profiles of each crankshaft.

Non-destructive testing methodologies have evolved significantly in recent years. Magnetic particle inspection (MPI) remains the industry standard for detecting surface and near-surface defects, while ultrasonic testing provides insights into internal material integrity. Eddy current testing has gained prominence for high-speed inspection of journal surfaces, capable of detecting microscopic cracks invisible to the naked eye.

Statistical process control (SPC) methodologies enable manufacturers to monitor process stability and capability. By tracking key quality characteristics over time, production engineers can identify trends before they result in defective parts. Industry leaders implement real-time SPC systems that automatically adjust machine parameters based on measurement feedback, maintaining optimal process conditions.

End-of-line testing represents the final verification of crankshaft quality. Dynamic balancing machines measure residual imbalance with sensitivities below 0.5 gram-millimeters. Crack detection systems utilizing fluorescent penetrant inspection provide final verification of surface integrity. Leading manufacturers have implemented automated 100% inspection cells that combine multiple testing methodologies in a single station.

Performance validation testing completes the quality assurance process. Sample crankshafts undergo fatigue testing to verify durability under simulated operating conditions. Advanced facilities utilize finite element analysis to correlate physical test results with theoretical models, continuously refining both manufacturing processes and quality control methodologies.

The integration of Industry 4.0 principles has transformed quality control approaches. Machine learning algorithms now analyze historical quality data to predict potential defects before they occur. Digital twin technology enables virtual testing of process modifications before implementation on the production floor, significantly reducing development time and costs.

In-process inspection forms the backbone of quality control during manufacturing. Dimensional measurements are conducted at various stages using coordinate measuring machines (CMMs) with precision capabilities of ±0.001mm. These systems verify critical parameters including main and pin journal diameters, fillet radii, and overall length tolerances. Advanced facilities implement automated optical measurement systems that can capture thousands of data points per second, creating comprehensive digital profiles of each crankshaft.

Non-destructive testing methodologies have evolved significantly in recent years. Magnetic particle inspection (MPI) remains the industry standard for detecting surface and near-surface defects, while ultrasonic testing provides insights into internal material integrity. Eddy current testing has gained prominence for high-speed inspection of journal surfaces, capable of detecting microscopic cracks invisible to the naked eye.

Statistical process control (SPC) methodologies enable manufacturers to monitor process stability and capability. By tracking key quality characteristics over time, production engineers can identify trends before they result in defective parts. Industry leaders implement real-time SPC systems that automatically adjust machine parameters based on measurement feedback, maintaining optimal process conditions.

End-of-line testing represents the final verification of crankshaft quality. Dynamic balancing machines measure residual imbalance with sensitivities below 0.5 gram-millimeters. Crack detection systems utilizing fluorescent penetrant inspection provide final verification of surface integrity. Leading manufacturers have implemented automated 100% inspection cells that combine multiple testing methodologies in a single station.

Performance validation testing completes the quality assurance process. Sample crankshafts undergo fatigue testing to verify durability under simulated operating conditions. Advanced facilities utilize finite element analysis to correlate physical test results with theoretical models, continuously refining both manufacturing processes and quality control methodologies.

The integration of Industry 4.0 principles has transformed quality control approaches. Machine learning algorithms now analyze historical quality data to predict potential defects before they occur. Digital twin technology enables virtual testing of process modifications before implementation on the production floor, significantly reducing development time and costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!