How to Streamline Polyurethane Supply Chains for Efficiency?

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PU Supply Chain Evolution

The polyurethane (PU) supply chain has undergone significant evolution over the past decades, driven by technological advancements, market demands, and environmental concerns. Initially, the PU supply chain was characterized by a linear model, with raw materials sourced from petrochemical industries, processed into PU products, and distributed to end-users. This traditional approach often resulted in inefficiencies, high costs, and environmental impacts.

As global awareness of sustainability grew, the PU industry began to shift towards more circular and efficient supply chain models. The introduction of bio-based raw materials marked a significant milestone, reducing dependence on fossil fuels and lowering the carbon footprint of PU products. This transition was accompanied by the development of more efficient production processes, such as continuous manufacturing techniques, which improved yield and reduced waste.

Digitalization has played a crucial role in streamlining PU supply chains. The implementation of advanced enterprise resource planning (ERP) systems and supply chain management software has enabled better coordination between suppliers, manufacturers, and distributors. Real-time data analytics and predictive modeling have enhanced inventory management, reducing stockouts and overstock situations.

The concept of just-in-time (JIT) manufacturing has been increasingly adopted in the PU industry, minimizing inventory holding costs and improving cash flow. This approach requires close collaboration with suppliers and sophisticated logistics systems to ensure timely delivery of raw materials and finished products.

In recent years, the PU supply chain has seen a growing emphasis on traceability and transparency. Blockchain technology is being explored to create immutable records of raw material sourcing, production processes, and product distribution. This not only helps in quality control but also addresses consumer demands for ethical and sustainable products.

The COVID-19 pandemic highlighted vulnerabilities in global supply chains, prompting the PU industry to reconsider its reliance on single-source suppliers and long-distance transportation. As a result, there has been a trend towards localization and diversification of supply sources, creating more resilient and agile supply networks.

Looking ahead, the PU supply chain is poised for further evolution. Emerging technologies such as artificial intelligence and the Internet of Things (IoT) are expected to drive the next wave of efficiency improvements. These technologies promise to enable predictive maintenance, optimize production schedules, and create self-adjusting supply chains that can respond dynamically to market changes and disruptions.

As global awareness of sustainability grew, the PU industry began to shift towards more circular and efficient supply chain models. The introduction of bio-based raw materials marked a significant milestone, reducing dependence on fossil fuels and lowering the carbon footprint of PU products. This transition was accompanied by the development of more efficient production processes, such as continuous manufacturing techniques, which improved yield and reduced waste.

Digitalization has played a crucial role in streamlining PU supply chains. The implementation of advanced enterprise resource planning (ERP) systems and supply chain management software has enabled better coordination between suppliers, manufacturers, and distributors. Real-time data analytics and predictive modeling have enhanced inventory management, reducing stockouts and overstock situations.

The concept of just-in-time (JIT) manufacturing has been increasingly adopted in the PU industry, minimizing inventory holding costs and improving cash flow. This approach requires close collaboration with suppliers and sophisticated logistics systems to ensure timely delivery of raw materials and finished products.

In recent years, the PU supply chain has seen a growing emphasis on traceability and transparency. Blockchain technology is being explored to create immutable records of raw material sourcing, production processes, and product distribution. This not only helps in quality control but also addresses consumer demands for ethical and sustainable products.

The COVID-19 pandemic highlighted vulnerabilities in global supply chains, prompting the PU industry to reconsider its reliance on single-source suppliers and long-distance transportation. As a result, there has been a trend towards localization and diversification of supply sources, creating more resilient and agile supply networks.

Looking ahead, the PU supply chain is poised for further evolution. Emerging technologies such as artificial intelligence and the Internet of Things (IoT) are expected to drive the next wave of efficiency improvements. These technologies promise to enable predictive maintenance, optimize production schedules, and create self-adjusting supply chains that can respond dynamically to market changes and disruptions.

Market Demand Analysis

The polyurethane market has been experiencing steady growth, driven by increasing demand across various industries such as construction, automotive, furniture, and electronics. The global polyurethane market size was valued at approximately $70 billion in 2020 and is projected to reach $90 billion by 2025, growing at a CAGR of around 5% during the forecast period.

The construction industry remains the largest consumer of polyurethane products, accounting for nearly 30% of the total market share. The growing urbanization and infrastructure development in emerging economies are fueling the demand for polyurethane-based insulation materials, sealants, and adhesives. The automotive sector is another significant contributor to market growth, with polyurethane being extensively used in vehicle interiors, seating, and lightweight components to improve fuel efficiency.

In recent years, there has been a notable shift towards sustainable and eco-friendly polyurethane products. Consumers and regulatory bodies are increasingly demanding bio-based polyurethanes and recyclable materials, driving manufacturers to invest in research and development of green alternatives. This trend is expected to reshape the supply chain dynamics, with a focus on sourcing renewable raw materials and implementing circular economy principles.

The Asia-Pacific region dominates the polyurethane market, accounting for over 40% of global consumption. China, India, and Southeast Asian countries are witnessing rapid industrialization and urbanization, leading to increased demand for polyurethane products. North America and Europe follow, with mature markets focusing on high-performance and specialty polyurethane applications.

Supply chain efficiency has become a critical factor in meeting market demands and maintaining competitiveness. The polyurethane industry faces challenges such as volatile raw material prices, complex logistics, and the need for just-in-time delivery to meet customer expectations. Streamlining supply chains has become imperative to reduce costs, improve responsiveness, and enhance overall operational efficiency.

To address these challenges, companies are increasingly adopting digital technologies and advanced analytics to optimize their supply chain operations. Real-time tracking, predictive maintenance, and demand forecasting are being implemented to minimize disruptions and improve inventory management. Additionally, vertical integration strategies are being explored by some manufacturers to gain better control over raw material supplies and reduce dependencies on external suppliers.

The construction industry remains the largest consumer of polyurethane products, accounting for nearly 30% of the total market share. The growing urbanization and infrastructure development in emerging economies are fueling the demand for polyurethane-based insulation materials, sealants, and adhesives. The automotive sector is another significant contributor to market growth, with polyurethane being extensively used in vehicle interiors, seating, and lightweight components to improve fuel efficiency.

In recent years, there has been a notable shift towards sustainable and eco-friendly polyurethane products. Consumers and regulatory bodies are increasingly demanding bio-based polyurethanes and recyclable materials, driving manufacturers to invest in research and development of green alternatives. This trend is expected to reshape the supply chain dynamics, with a focus on sourcing renewable raw materials and implementing circular economy principles.

The Asia-Pacific region dominates the polyurethane market, accounting for over 40% of global consumption. China, India, and Southeast Asian countries are witnessing rapid industrialization and urbanization, leading to increased demand for polyurethane products. North America and Europe follow, with mature markets focusing on high-performance and specialty polyurethane applications.

Supply chain efficiency has become a critical factor in meeting market demands and maintaining competitiveness. The polyurethane industry faces challenges such as volatile raw material prices, complex logistics, and the need for just-in-time delivery to meet customer expectations. Streamlining supply chains has become imperative to reduce costs, improve responsiveness, and enhance overall operational efficiency.

To address these challenges, companies are increasingly adopting digital technologies and advanced analytics to optimize their supply chain operations. Real-time tracking, predictive maintenance, and demand forecasting are being implemented to minimize disruptions and improve inventory management. Additionally, vertical integration strategies are being explored by some manufacturers to gain better control over raw material supplies and reduce dependencies on external suppliers.

Current Challenges

The polyurethane supply chain faces several significant challenges that hinder its efficiency and sustainability. One of the primary issues is the volatility of raw material prices, particularly for key components such as isocyanates and polyols. These price fluctuations can lead to unpredictable costs and difficulties in long-term planning for manufacturers and suppliers.

Another major challenge is the complexity of the supply chain itself. The polyurethane industry involves multiple stakeholders, including raw material suppliers, chemical manufacturers, formulators, and end-users across various sectors. This intricate network can lead to communication gaps, inventory management issues, and inefficiencies in logistics and distribution.

Environmental concerns and regulatory pressures also pose significant challenges to the polyurethane supply chain. Increasing focus on sustainability and reducing carbon footprint has led to stricter regulations on chemical production and usage. Compliance with these regulations often requires substantial investments in new technologies and processes, which can strain resources and impact overall efficiency.

The global nature of the polyurethane supply chain introduces additional complexities. Geopolitical tensions, trade disputes, and regional disparities in regulations can disrupt supply chains and create uncertainties in procurement and distribution. This global dimension also amplifies the impact of localized disruptions, such as natural disasters or political instability, on the entire supply chain.

Technological limitations in production and processing present another set of challenges. While advancements have been made, there is still a need for more efficient and sustainable production methods. The lack of standardization across different manufacturers and regions can lead to inconsistencies in product quality and performance, further complicating supply chain management.

Inventory management remains a persistent challenge in the polyurethane industry. The diverse range of products and applications requires careful balancing of stock levels to meet demand while avoiding excess inventory. This is particularly challenging given the limited shelf life of some polyurethane components and the need for specialized storage conditions.

Lastly, the industry faces a skills gap and workforce challenges. The specialized nature of polyurethane chemistry and manufacturing processes requires highly skilled workers. However, attracting and retaining talent in this field has become increasingly difficult, potentially impacting innovation and operational efficiency throughout the supply chain.

Another major challenge is the complexity of the supply chain itself. The polyurethane industry involves multiple stakeholders, including raw material suppliers, chemical manufacturers, formulators, and end-users across various sectors. This intricate network can lead to communication gaps, inventory management issues, and inefficiencies in logistics and distribution.

Environmental concerns and regulatory pressures also pose significant challenges to the polyurethane supply chain. Increasing focus on sustainability and reducing carbon footprint has led to stricter regulations on chemical production and usage. Compliance with these regulations often requires substantial investments in new technologies and processes, which can strain resources and impact overall efficiency.

The global nature of the polyurethane supply chain introduces additional complexities. Geopolitical tensions, trade disputes, and regional disparities in regulations can disrupt supply chains and create uncertainties in procurement and distribution. This global dimension also amplifies the impact of localized disruptions, such as natural disasters or political instability, on the entire supply chain.

Technological limitations in production and processing present another set of challenges. While advancements have been made, there is still a need for more efficient and sustainable production methods. The lack of standardization across different manufacturers and regions can lead to inconsistencies in product quality and performance, further complicating supply chain management.

Inventory management remains a persistent challenge in the polyurethane industry. The diverse range of products and applications requires careful balancing of stock levels to meet demand while avoiding excess inventory. This is particularly challenging given the limited shelf life of some polyurethane components and the need for specialized storage conditions.

Lastly, the industry faces a skills gap and workforce challenges. The specialized nature of polyurethane chemistry and manufacturing processes requires highly skilled workers. However, attracting and retaining talent in this field has become increasingly difficult, potentially impacting innovation and operational efficiency throughout the supply chain.

Existing Optimization

01 Supply chain optimization and management

Implementing advanced supply chain management techniques to improve efficiency in polyurethane production and distribution. This includes optimizing inventory levels, streamlining logistics, and enhancing communication between suppliers, manufacturers, and customers.- Supply chain optimization and management: Implementing advanced supply chain management techniques to improve efficiency in polyurethane production and distribution. This includes optimizing inventory levels, streamlining logistics, and enhancing communication between suppliers, manufacturers, and customers. These strategies can lead to reduced costs, improved lead times, and better overall supply chain performance.

- Digital transformation and data analytics: Utilizing digital technologies and data analytics to enhance decision-making and operational efficiency in polyurethane supply chains. This involves implementing advanced software systems, leveraging big data analytics, and employing artificial intelligence to predict market trends, optimize production schedules, and improve resource allocation.

- Sustainable and eco-friendly practices: Incorporating sustainable practices and eco-friendly materials in polyurethane production and supply chains. This includes developing bio-based polyurethanes, implementing recycling processes, and reducing waste throughout the supply chain. These initiatives aim to improve environmental performance while maintaining or enhancing efficiency.

- Collaborative supplier networks: Establishing collaborative networks with suppliers to improve efficiency and responsiveness in polyurethane supply chains. This involves developing strategic partnerships, implementing shared planning and forecasting systems, and creating transparent communication channels to reduce lead times and improve overall supply chain agility.

- Advanced manufacturing technologies: Integrating advanced manufacturing technologies to enhance production efficiency in polyurethane supply chains. This includes implementing automation, robotics, and smart manufacturing systems to improve production speed, quality control, and resource utilization. These technologies can lead to reduced production costs and increased overall supply chain efficiency.

02 Digital transformation and data analytics

Utilizing digital technologies and data analytics to enhance decision-making processes in polyurethane supply chains. This involves implementing AI-driven forecasting, real-time tracking systems, and predictive maintenance to reduce downtime and improve overall efficiency.Expand Specific Solutions03 Sustainable and eco-friendly practices

Incorporating sustainable practices in polyurethane supply chains to improve efficiency and reduce environmental impact. This includes using recycled materials, optimizing energy consumption, and implementing closed-loop systems to minimize waste.Expand Specific Solutions04 Collaborative planning and forecasting

Implementing collaborative planning and forecasting techniques to improve coordination among supply chain partners. This involves sharing real-time information, aligning production schedules, and jointly developing demand forecasts to reduce lead times and improve overall efficiency.Expand Specific Solutions05 Lean manufacturing and process optimization

Applying lean manufacturing principles and process optimization techniques to improve efficiency in polyurethane production. This includes reducing waste, minimizing non-value-added activities, and implementing continuous improvement methodologies to enhance overall supply chain performance.Expand Specific Solutions

Key Industry Players

The polyurethane supply chain efficiency market is in a growth phase, driven by increasing demand for streamlined processes and cost reduction. The market size is expanding as industries seek to optimize their operations. Technologically, the field is moderately mature, with ongoing innovations. Key players like BASF Corp., Dow Global Technologies LLC, and Covestro Intellectual Property GmbH & Co. KG are leading advancements in supply chain optimization. Wanhua Chemical Group Co., Ltd. and Evonik Operations GmbH are also making significant contributions. The competitive landscape is characterized by a mix of established chemical giants and specialized polyurethane technology providers, all striving to develop more efficient and sustainable supply chain solutions.

BASF Corp.

Technical Solution: BASF has developed an innovative approach to streamline polyurethane supply chains through their "Verbund" concept. This integrated production system connects production sites, allowing for efficient use of resources and byproducts. They've implemented advanced digital solutions for real-time inventory management and demand forecasting. BASF also focuses on sustainable raw material sourcing and has developed bio-based polyols to reduce environmental impact. Their supply chain optimization includes strategic partnerships with key suppliers and logistics providers to ensure reliable and flexible delivery.

Strengths: Integrated production system, advanced digital solutions, sustainable raw materials. Weaknesses: Potential over-reliance on in-house production, complexity in managing diverse product lines.

Dow Global Technologies LLC

Technical Solution: Dow has implemented a comprehensive supply chain optimization strategy for polyurethanes. They utilize advanced analytics and AI-driven forecasting models to predict market demands and optimize production schedules. Dow has invested in smart manufacturing technologies, including IoT sensors and real-time monitoring systems, to improve production efficiency and reduce waste. They've also developed a network of strategically located distribution centers to minimize transportation costs and delivery times. Dow's approach includes collaboration with customers to develop tailored solutions and just-in-time delivery systems.

Strengths: Advanced analytics, smart manufacturing, strategic distribution network. Weaknesses: High initial investment costs, potential vulnerability to global supply chain disruptions.

Innovative Technologies

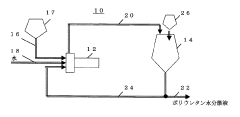

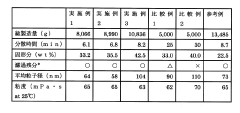

Method for producing aqueous polyurethane dispersion and its system

PatentActiveJP2009286892A

Innovation

- A method involving two steps of mixing and stirring using a continuous dispersing device, with controlled polyurethane concentrations and circulation of the dispersion, along with the use of a continuous dispersing device and tank system to enhance dispersion efficiency and reduce prepolymer residue.

Method and device for the production of coated molded pieces

PatentActiveEP1960171A1

Innovation

- A method and device utilizing a cylindrical mixing chamber with a gas stream introduction into a flow channel for spraying reactive components, followed by mechanical cleaning with an axial ejector to minimize aerosol production and enable rapid, homogeneous application without interruptions.

Regulatory Compliance

Regulatory compliance plays a crucial role in streamlining polyurethane supply chains for efficiency. The polyurethane industry is subject to various regulations and standards that govern the production, transportation, and use of chemicals involved in the manufacturing process. Adhering to these regulations is essential for ensuring product safety, environmental protection, and maintaining a competitive edge in the global market.

One of the primary regulatory bodies overseeing the polyurethane industry is the Environmental Protection Agency (EPA). The EPA enforces regulations such as the Toxic Substances Control Act (TSCA) and the Clean Air Act, which impact the production and use of polyurethane materials. Compliance with these regulations requires careful monitoring of chemical inventories, emissions control, and waste management practices throughout the supply chain.

In addition to environmental regulations, occupational health and safety standards set by organizations like the Occupational Safety and Health Administration (OSHA) must be strictly followed. These standards ensure the safety of workers involved in the production, handling, and transportation of polyurethane materials. Implementing robust safety protocols and providing adequate training to employees are essential components of regulatory compliance in the polyurethane supply chain.

International regulations also play a significant role in the polyurethane industry, particularly for companies operating in global markets. The Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation in the European Union, for example, imposes strict requirements on the registration and evaluation of chemical substances. Compliance with REACH and similar regulations in other regions is crucial for maintaining access to international markets and ensuring the free flow of goods across borders.

To streamline polyurethane supply chains while maintaining regulatory compliance, companies must adopt a proactive approach. This includes implementing robust tracking systems to monitor the movement of chemicals and materials throughout the supply chain, ensuring proper documentation and labeling, and conducting regular audits to identify and address potential compliance issues. Investing in advanced software solutions and data management systems can greatly enhance a company's ability to track and report on regulatory compliance across the entire supply chain.

Collaboration with suppliers and partners is another key aspect of regulatory compliance in the polyurethane industry. Establishing clear communication channels and shared compliance standards can help ensure that all parties involved in the supply chain are aligned with regulatory requirements. This collaborative approach can lead to more efficient processes, reduced compliance risks, and improved overall supply chain performance.

As regulations continue to evolve, staying informed about upcoming changes and proactively adapting to new requirements is essential for maintaining compliance and efficiency in polyurethane supply chains. Regular training programs for employees, participation in industry associations, and engagement with regulatory bodies can help companies stay ahead of regulatory changes and implement necessary adjustments in a timely manner.

One of the primary regulatory bodies overseeing the polyurethane industry is the Environmental Protection Agency (EPA). The EPA enforces regulations such as the Toxic Substances Control Act (TSCA) and the Clean Air Act, which impact the production and use of polyurethane materials. Compliance with these regulations requires careful monitoring of chemical inventories, emissions control, and waste management practices throughout the supply chain.

In addition to environmental regulations, occupational health and safety standards set by organizations like the Occupational Safety and Health Administration (OSHA) must be strictly followed. These standards ensure the safety of workers involved in the production, handling, and transportation of polyurethane materials. Implementing robust safety protocols and providing adequate training to employees are essential components of regulatory compliance in the polyurethane supply chain.

International regulations also play a significant role in the polyurethane industry, particularly for companies operating in global markets. The Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation in the European Union, for example, imposes strict requirements on the registration and evaluation of chemical substances. Compliance with REACH and similar regulations in other regions is crucial for maintaining access to international markets and ensuring the free flow of goods across borders.

To streamline polyurethane supply chains while maintaining regulatory compliance, companies must adopt a proactive approach. This includes implementing robust tracking systems to monitor the movement of chemicals and materials throughout the supply chain, ensuring proper documentation and labeling, and conducting regular audits to identify and address potential compliance issues. Investing in advanced software solutions and data management systems can greatly enhance a company's ability to track and report on regulatory compliance across the entire supply chain.

Collaboration with suppliers and partners is another key aspect of regulatory compliance in the polyurethane industry. Establishing clear communication channels and shared compliance standards can help ensure that all parties involved in the supply chain are aligned with regulatory requirements. This collaborative approach can lead to more efficient processes, reduced compliance risks, and improved overall supply chain performance.

As regulations continue to evolve, staying informed about upcoming changes and proactively adapting to new requirements is essential for maintaining compliance and efficiency in polyurethane supply chains. Regular training programs for employees, participation in industry associations, and engagement with regulatory bodies can help companies stay ahead of regulatory changes and implement necessary adjustments in a timely manner.

Environmental Impact

The environmental impact of polyurethane supply chains is a critical consideration in streamlining efforts for efficiency. Polyurethane production and distribution involve various processes that can have significant ecological consequences. The primary environmental concerns include greenhouse gas emissions, energy consumption, waste generation, and the use of potentially harmful chemicals.

Manufacturing polyurethane requires substantial energy inputs, contributing to carbon dioxide emissions and climate change. The production of raw materials, such as isocyanates and polyols, is particularly energy-intensive. Additionally, the use of blowing agents in foam production can release volatile organic compounds (VOCs) and other pollutants into the atmosphere. These emissions not only affect air quality but also contribute to the formation of ground-level ozone and smog.

Water pollution is another significant environmental issue in polyurethane supply chains. The production process generates wastewater containing various chemicals, which, if not properly treated, can contaminate water sources and harm aquatic ecosystems. Moreover, the disposal of polyurethane products at the end of their lifecycle poses challenges due to their slow degradation rates and potential release of toxic substances.

To address these environmental concerns, companies are increasingly adopting sustainable practices throughout the polyurethane supply chain. This includes implementing more efficient production technologies to reduce energy consumption and emissions. For instance, the use of bio-based raw materials and recycled content in polyurethane production can significantly lower the carbon footprint of the final products.

Waste reduction and recycling initiatives are also gaining traction in the industry. Advanced recycling technologies are being developed to break down polyurethane waste into its chemical components, which can then be reused in new production cycles. This circular economy approach not only reduces waste but also decreases the demand for virgin raw materials, further mitigating environmental impact.

Transportation optimization within the supply chain plays a crucial role in reducing the overall environmental footprint. By strategically locating production facilities closer to raw material sources and end markets, companies can minimize transportation distances and associated emissions. Additionally, the adoption of more fuel-efficient vehicles and alternative fuels in logistics operations can further reduce the carbon intensity of polyurethane distribution.

As environmental regulations become more stringent globally, polyurethane manufacturers and suppliers are increasingly focusing on developing eco-friendly formulations and production processes. This includes the use of water-based systems instead of solvent-based ones, which significantly reduces VOC emissions. Furthermore, the industry is exploring innovative technologies such as CO2-based polyols, which can sequester carbon dioxide and use it as a raw material, potentially turning a greenhouse gas into a valuable resource.

Manufacturing polyurethane requires substantial energy inputs, contributing to carbon dioxide emissions and climate change. The production of raw materials, such as isocyanates and polyols, is particularly energy-intensive. Additionally, the use of blowing agents in foam production can release volatile organic compounds (VOCs) and other pollutants into the atmosphere. These emissions not only affect air quality but also contribute to the formation of ground-level ozone and smog.

Water pollution is another significant environmental issue in polyurethane supply chains. The production process generates wastewater containing various chemicals, which, if not properly treated, can contaminate water sources and harm aquatic ecosystems. Moreover, the disposal of polyurethane products at the end of their lifecycle poses challenges due to their slow degradation rates and potential release of toxic substances.

To address these environmental concerns, companies are increasingly adopting sustainable practices throughout the polyurethane supply chain. This includes implementing more efficient production technologies to reduce energy consumption and emissions. For instance, the use of bio-based raw materials and recycled content in polyurethane production can significantly lower the carbon footprint of the final products.

Waste reduction and recycling initiatives are also gaining traction in the industry. Advanced recycling technologies are being developed to break down polyurethane waste into its chemical components, which can then be reused in new production cycles. This circular economy approach not only reduces waste but also decreases the demand for virgin raw materials, further mitigating environmental impact.

Transportation optimization within the supply chain plays a crucial role in reducing the overall environmental footprint. By strategically locating production facilities closer to raw material sources and end markets, companies can minimize transportation distances and associated emissions. Additionally, the adoption of more fuel-efficient vehicles and alternative fuels in logistics operations can further reduce the carbon intensity of polyurethane distribution.

As environmental regulations become more stringent globally, polyurethane manufacturers and suppliers are increasingly focusing on developing eco-friendly formulations and production processes. This includes the use of water-based systems instead of solvent-based ones, which significantly reduces VOC emissions. Furthermore, the industry is exploring innovative technologies such as CO2-based polyols, which can sequester carbon dioxide and use it as a raw material, potentially turning a greenhouse gas into a valuable resource.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!