Hydrofluoric Acid Role in Ammonium Fluoride Production

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HF Acid Technology Evolution and Production Goals

Hydrofluoric acid (HF) has undergone significant technological evolution since its first industrial production in the late 19th century. Initially produced through the reaction of calcium fluoride (fluorspar) with sulfuric acid, the manufacturing process has evolved considerably to meet growing industrial demands and address safety concerns. The Freon refrigerant boom of the mid-20th century catalyzed major advancements in HF production technology, as it became a critical precursor for fluorocarbon manufacturing.

The modern production landscape is dominated by the anhydrous hydrogen fluoride (AHF) process, which has been refined to achieve higher purity levels and improved energy efficiency. Recent technological innovations have focused on reducing environmental impact through closed-loop systems and advanced scrubbing technologies that minimize fluoride emissions. These developments align with increasingly stringent environmental regulations worldwide and reflect the industry's commitment to sustainable production practices.

In the context of ammonium fluoride production, HF serves as the primary fluorine source, reacting with ammonia to form this essential compound. The quality of HF directly impacts the purity and performance characteristics of the resulting ammonium fluoride, making advances in HF production technology particularly relevant to downstream applications. Recent innovations have targeted precise control of reaction parameters to optimize yield and quality while minimizing waste generation.

Current technological goals in the HF sector focus on several key areas. First, improving energy efficiency across the production chain to reduce carbon footprint and operational costs. Second, developing more selective catalysts and reaction pathways that minimize byproduct formation. Third, implementing advanced process control systems utilizing AI and machine learning to optimize reaction conditions in real-time, ensuring consistent product quality while maximizing resource utilization.

Safety enhancement represents another critical goal, with significant investment in inherently safer design principles and advanced containment technologies. The highly corrosive nature of HF necessitates continuous innovation in materials science, with new fluoropolymer and ceramic composites being developed specifically for HF handling equipment.

Looking forward, the industry aims to achieve near-zero emission production systems through closed-loop processes and advanced recovery technologies. Research is also underway to explore alternative synthesis routes that could potentially reduce dependence on fluorspar, addressing concerns about the long-term sustainability of this critical raw material. Electrochemical production methods show particular promise, potentially offering more environmentally benign pathways to high-purity HF production.

The integration of HF production with ammonium fluoride manufacturing through continuous flow processes represents another frontier, potentially reducing intermediate handling steps and associated safety risks while improving overall process efficiency and product consistency.

The modern production landscape is dominated by the anhydrous hydrogen fluoride (AHF) process, which has been refined to achieve higher purity levels and improved energy efficiency. Recent technological innovations have focused on reducing environmental impact through closed-loop systems and advanced scrubbing technologies that minimize fluoride emissions. These developments align with increasingly stringent environmental regulations worldwide and reflect the industry's commitment to sustainable production practices.

In the context of ammonium fluoride production, HF serves as the primary fluorine source, reacting with ammonia to form this essential compound. The quality of HF directly impacts the purity and performance characteristics of the resulting ammonium fluoride, making advances in HF production technology particularly relevant to downstream applications. Recent innovations have targeted precise control of reaction parameters to optimize yield and quality while minimizing waste generation.

Current technological goals in the HF sector focus on several key areas. First, improving energy efficiency across the production chain to reduce carbon footprint and operational costs. Second, developing more selective catalysts and reaction pathways that minimize byproduct formation. Third, implementing advanced process control systems utilizing AI and machine learning to optimize reaction conditions in real-time, ensuring consistent product quality while maximizing resource utilization.

Safety enhancement represents another critical goal, with significant investment in inherently safer design principles and advanced containment technologies. The highly corrosive nature of HF necessitates continuous innovation in materials science, with new fluoropolymer and ceramic composites being developed specifically for HF handling equipment.

Looking forward, the industry aims to achieve near-zero emission production systems through closed-loop processes and advanced recovery technologies. Research is also underway to explore alternative synthesis routes that could potentially reduce dependence on fluorspar, addressing concerns about the long-term sustainability of this critical raw material. Electrochemical production methods show particular promise, potentially offering more environmentally benign pathways to high-purity HF production.

The integration of HF production with ammonium fluoride manufacturing through continuous flow processes represents another frontier, potentially reducing intermediate handling steps and associated safety risks while improving overall process efficiency and product consistency.

Market Analysis for Ammonium Fluoride Applications

The global ammonium fluoride market has demonstrated consistent growth over the past decade, primarily driven by its diverse applications across multiple industries. The market size was valued at approximately 618 million USD in 2022 and is projected to reach 825 million USD by 2028, representing a compound annual growth rate (CAGR) of 4.9% during the forecast period.

Semiconductor and electronics manufacturing constitute the largest application segment, accounting for nearly 40% of the total market share. The increasing demand for high-performance electronic devices and the expansion of semiconductor fabrication facilities, particularly in Asia-Pacific regions, have significantly contributed to this growth. Ammonium fluoride serves as a critical etching agent in semiconductor production, where precision and purity requirements continue to drive premium product demand.

The pharmaceutical sector represents another substantial market segment, utilizing ammonium fluoride in the synthesis of various fluorinated compounds and active pharmaceutical ingredients (APIs). This segment has shown a growth rate of approximately 5.3% annually, slightly outpacing the overall market average. The increasing focus on novel drug development and the rising prevalence of chronic diseases have bolstered pharmaceutical applications.

Agricultural applications of ammonium fluoride, primarily as a component in certain pesticides and fertilizers, account for roughly 15% of the market. This segment exhibits regional variations, with stronger demand in developing agricultural economies. Recent regulatory changes regarding fluoride-containing agricultural products have created both challenges and opportunities for market participants.

Geographically, Asia-Pacific dominates the ammonium fluoride market with a 45% share, followed by North America (28%) and Europe (20%). China remains the largest producer and consumer, driven by its robust electronics manufacturing sector and chemical industry. However, emerging economies in Southeast Asia are showing the fastest growth rates, particularly Vietnam and Malaysia, where semiconductor manufacturing is rapidly expanding.

Market dynamics are increasingly influenced by sustainability concerns and regulatory frameworks governing fluoride compounds. Environmental regulations in Europe and North America have prompted manufacturers to develop more environmentally friendly production processes, creating a premium segment for "green" ammonium fluoride products with reduced environmental footprint.

Supply chain considerations have gained prominence following recent global disruptions. The market has witnessed price volatility due to fluctuations in raw material availability, particularly hydrofluoric acid, which serves as the primary feedstock for ammonium fluoride production. This has prompted some end-users to secure long-term supply agreements and explore alternative sourcing strategies.

Semiconductor and electronics manufacturing constitute the largest application segment, accounting for nearly 40% of the total market share. The increasing demand for high-performance electronic devices and the expansion of semiconductor fabrication facilities, particularly in Asia-Pacific regions, have significantly contributed to this growth. Ammonium fluoride serves as a critical etching agent in semiconductor production, where precision and purity requirements continue to drive premium product demand.

The pharmaceutical sector represents another substantial market segment, utilizing ammonium fluoride in the synthesis of various fluorinated compounds and active pharmaceutical ingredients (APIs). This segment has shown a growth rate of approximately 5.3% annually, slightly outpacing the overall market average. The increasing focus on novel drug development and the rising prevalence of chronic diseases have bolstered pharmaceutical applications.

Agricultural applications of ammonium fluoride, primarily as a component in certain pesticides and fertilizers, account for roughly 15% of the market. This segment exhibits regional variations, with stronger demand in developing agricultural economies. Recent regulatory changes regarding fluoride-containing agricultural products have created both challenges and opportunities for market participants.

Geographically, Asia-Pacific dominates the ammonium fluoride market with a 45% share, followed by North America (28%) and Europe (20%). China remains the largest producer and consumer, driven by its robust electronics manufacturing sector and chemical industry. However, emerging economies in Southeast Asia are showing the fastest growth rates, particularly Vietnam and Malaysia, where semiconductor manufacturing is rapidly expanding.

Market dynamics are increasingly influenced by sustainability concerns and regulatory frameworks governing fluoride compounds. Environmental regulations in Europe and North America have prompted manufacturers to develop more environmentally friendly production processes, creating a premium segment for "green" ammonium fluoride products with reduced environmental footprint.

Supply chain considerations have gained prominence following recent global disruptions. The market has witnessed price volatility due to fluctuations in raw material availability, particularly hydrofluoric acid, which serves as the primary feedstock for ammonium fluoride production. This has prompted some end-users to secure long-term supply agreements and explore alternative sourcing strategies.

Current HF Acid Production Challenges

The production of hydrofluoric acid (HF) faces significant challenges that impact its availability and application in ammonium fluoride synthesis. Currently, the primary method for HF production involves the reaction of calcium fluoride (fluorspar) with concentrated sulfuric acid, which generates numerous operational difficulties and environmental concerns.

Raw material quality represents a major constraint, as high-grade fluorspar (containing >97% CaF2) has become increasingly scarce globally. Mining operations in China, Mexico, and South Africa—which collectively account for over 75% of global production—are experiencing declining ore grades, necessitating more complex and costly beneficiation processes. This quality degradation directly impacts HF purity and yield.

Process safety challenges remain paramount in HF production facilities. The extremely corrosive nature of HF requires specialized equipment constructed from materials like Monel, Inconel, or specialized fluoropolymers, substantially increasing capital expenditure and maintenance costs. Despite engineering controls, accidental releases continue to pose severe health risks to workers and surrounding communities.

Energy intensity presents another significant hurdle. The reaction between fluorspar and sulfuric acid requires temperatures of 200-250°C, contributing to high operational costs and substantial carbon footprints. Recent estimates suggest that HF production consumes approximately 11-13 MWh of energy per ton produced, placing pressure on manufacturers facing increasingly stringent carbon regulations.

Waste management constitutes a persistent challenge, as the process generates calcium sulfate (gypsum) as a byproduct at a rate of approximately 4.5 tons per ton of HF produced. This material often contains fluoride residues and trace impurities that complicate disposal or repurposing efforts. Regulatory frameworks in Europe and North America have tightened restrictions on fluoride-containing waste streams, forcing producers to implement costly treatment systems.

Transportation and storage of HF present logistical complications that affect supply chain reliability for ammonium fluoride production. HF requires specialized containers and handling protocols, with transportation costs typically representing 15-20% of the total delivered price. Recent disruptions in global shipping have exacerbated these challenges, leading to supply uncertainties for downstream manufacturers.

Regulatory compliance costs continue to escalate as authorities worldwide implement stricter controls on fluoride emissions and occupational exposure limits. The EU's REACH regulation and similar frameworks in other regions have imposed additional testing and documentation requirements, adding administrative burden and compliance costs estimated at 3-5% of operational expenses for typical producers.

Raw material quality represents a major constraint, as high-grade fluorspar (containing >97% CaF2) has become increasingly scarce globally. Mining operations in China, Mexico, and South Africa—which collectively account for over 75% of global production—are experiencing declining ore grades, necessitating more complex and costly beneficiation processes. This quality degradation directly impacts HF purity and yield.

Process safety challenges remain paramount in HF production facilities. The extremely corrosive nature of HF requires specialized equipment constructed from materials like Monel, Inconel, or specialized fluoropolymers, substantially increasing capital expenditure and maintenance costs. Despite engineering controls, accidental releases continue to pose severe health risks to workers and surrounding communities.

Energy intensity presents another significant hurdle. The reaction between fluorspar and sulfuric acid requires temperatures of 200-250°C, contributing to high operational costs and substantial carbon footprints. Recent estimates suggest that HF production consumes approximately 11-13 MWh of energy per ton produced, placing pressure on manufacturers facing increasingly stringent carbon regulations.

Waste management constitutes a persistent challenge, as the process generates calcium sulfate (gypsum) as a byproduct at a rate of approximately 4.5 tons per ton of HF produced. This material often contains fluoride residues and trace impurities that complicate disposal or repurposing efforts. Regulatory frameworks in Europe and North America have tightened restrictions on fluoride-containing waste streams, forcing producers to implement costly treatment systems.

Transportation and storage of HF present logistical complications that affect supply chain reliability for ammonium fluoride production. HF requires specialized containers and handling protocols, with transportation costs typically representing 15-20% of the total delivered price. Recent disruptions in global shipping have exacerbated these challenges, leading to supply uncertainties for downstream manufacturers.

Regulatory compliance costs continue to escalate as authorities worldwide implement stricter controls on fluoride emissions and occupational exposure limits. The EU's REACH regulation and similar frameworks in other regions have imposed additional testing and documentation requirements, adding administrative burden and compliance costs estimated at 3-5% of operational expenses for typical producers.

Current HF-Based NH4F Production Methods

01 Etching applications of hydrofluoric acid

Hydrofluoric acid is widely used as an etching agent in semiconductor manufacturing and glass processing. It effectively removes silicon dioxide layers and can be formulated with buffering agents to control the etching rate. Various compositions have been developed to optimize etching performance while minimizing damage to underlying materials. These formulations often include additives to improve uniformity and selectivity of the etching process.- Etching applications of hydrofluoric acid: Hydrofluoric acid is widely used as an etching agent in semiconductor manufacturing and glass processing. It effectively removes silicon dioxide layers and can be formulated with buffering agents to control the etching rate. Various compositions containing hydrofluoric acid are used for selective etching of different materials, with applications in microelectronics fabrication and surface treatment of glass products.

- Purification and recovery methods for hydrofluoric acid: Various techniques have been developed for purifying and recovering hydrofluoric acid from industrial processes. These methods include distillation, adsorption, membrane separation, and chemical precipitation to remove impurities such as metal ions, particulates, and organic contaminants. Recovery systems help reduce waste and environmental impact while providing economic benefits through reuse of the acid in manufacturing processes.

- Safety measures and handling of hydrofluoric acid: Due to its highly corrosive nature and ability to penetrate tissue, specialized safety protocols are essential when handling hydrofluoric acid. These include the use of specific personal protective equipment, neutralizing agents, emergency response procedures, and specialized storage containers. Safety systems often incorporate detection methods for leaks and spills, along with first aid protocols specifically designed for hydrofluoric acid exposure.

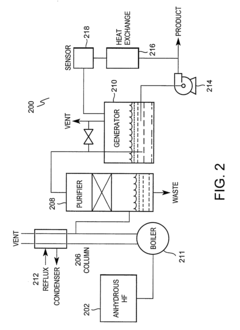

- Production methods of hydrofluoric acid: Industrial production of hydrofluoric acid typically involves the reaction of calcium fluoride (fluorspar) with sulfuric acid under controlled conditions. Alternative manufacturing methods include the processing of fluorosilicic acid and other fluoride-containing compounds. Production processes often incorporate specialized equipment made from corrosion-resistant materials and employ various techniques to capture and purify the resulting hydrogen fluoride gas before conversion to the aqueous acid form.

- Applications in chemical processing and manufacturing: Beyond etching, hydrofluoric acid serves as a catalyst and reagent in various chemical processes including alkylation in petroleum refining, synthesis of fluorine-containing compounds, and production of refrigerants. It is also used in metal surface treatment for removing oxide layers and preparing surfaces for coating or plating. In the pharmaceutical and agricultural industries, it serves as an intermediate in the production of certain active ingredients and chemical compounds.

02 Purification and recovery methods for hydrofluoric acid

Various techniques have been developed for purifying and recovering hydrofluoric acid from industrial processes. These methods include distillation, adsorption, membrane separation, and chemical precipitation. Purification is essential for removing contaminants that could affect the acid's performance in high-precision applications. Recovery systems help reduce environmental impact and operational costs by allowing the acid to be reused in manufacturing processes.Expand Specific Solutions03 Safety measures and neutralization of hydrofluoric acid

Due to its highly corrosive and toxic nature, specialized safety protocols and neutralization methods have been developed for handling hydrofluoric acid. These include the use of specific neutralizing agents like calcium compounds that can bind with fluoride ions, personal protective equipment designs, emergency response procedures, and detection systems. Various formulations have been created to effectively neutralize spills while minimizing secondary reactions.Expand Specific Solutions04 Production methods for hydrofluoric acid

Industrial production of hydrofluoric acid typically involves the reaction of calcium fluoride (fluorspar) with sulfuric acid. Alternative production methods have been developed to improve yield, purity, and energy efficiency. These include catalytic processes, continuous flow reactors, and methods utilizing fluoride-containing waste streams. Innovations focus on reducing environmental impact and improving the economics of production while maintaining high purity levels.Expand Specific Solutions05 Specialized formulations of hydrofluoric acid for industrial applications

Specialized hydrofluoric acid formulations have been developed for specific industrial applications such as metal surface treatment, cleaning of industrial equipment, and chemical synthesis. These formulations often include additives like surfactants, corrosion inhibitors, and stabilizing agents to enhance performance for particular uses. The compositions are designed to optimize effectiveness while minimizing hazards associated with handling concentrated hydrofluoric acid.Expand Specific Solutions

Key Industry Players in Fluorochemical Manufacturing

The hydrofluoric acid market in ammonium fluoride production is currently in a growth phase, with increasing demand driven by semiconductor and electronics manufacturing. The global market size is expanding at approximately 5-7% CAGR, valued at over $2 billion. Technologically, established players like Daikin Industries, Honeywell, and Arkema France demonstrate high maturity with advanced production processes, while emerging companies such as Do-Fluoride New Materials and Foosung Co. are rapidly advancing with innovative approaches. Chinese manufacturers including Xi'an Modern Chemistry Research Institute and Hualu Engineering are gaining market share through cost-effective production methods. The competitive landscape features strategic partnerships between chemical producers and end-users, particularly in high-purity applications for semiconductor manufacturing.

Do-Fluoride New Materials Co., Ltd.

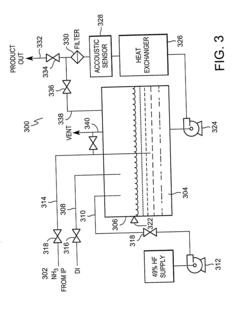

Technical Solution: Do-Fluoride employs a continuous flow reactor system for ammonium fluoride production where hydrofluoric acid reacts with ammonia in precisely controlled conditions. Their process utilizes a multi-stage neutralization technique that maintains reaction temperatures between 40-60°C to optimize yield while minimizing unwanted byproducts. The company has developed proprietary scrubbing systems that capture and recycle unreacted HF, achieving over 99% conversion efficiency. Their advanced process control system monitors pH levels in real-time, automatically adjusting HF and ammonia flow rates to maintain optimal 1:1 stoichiometric ratios. Do-Fluoride has also pioneered crystallization techniques that produce high-purity ammonium fluoride (>99.99%) suitable for semiconductor applications, using controlled cooling rates and specialized filtration systems.

Strengths: High conversion efficiency and product purity with minimal environmental impact due to closed-loop recycling systems. Weaknesses: The process requires sophisticated control systems and specialized corrosion-resistant equipment, resulting in higher capital investment compared to batch production methods.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed an advanced ammonium fluoride production technology as part of their specialty chemicals portfolio. Their process utilizes a proprietary reactor design that enables precise control of the highly exothermic reaction between hydrofluoric acid and ammonia. The company employs a continuous flow microreactor system that maximizes surface area-to-volume ratio, allowing for exceptional heat transfer and temperature control within ±0.5°C. This precise control prevents localized hotspots that can lead to product decomposition and equipment corrosion. Honeywell's technology incorporates advanced materials of construction, including specialized fluoropolymer linings and high-nickel alloys that resist the corrosive nature of both hydrofluoric acid and ammonium fluoride solutions. Their process achieves over 99.8% conversion efficiency through optimized residence time distribution and reaction kinetics modeling. The company has also developed sophisticated safety systems including multiple containment layers, advanced leak detection, and automated emergency response protocols to manage the hazards associated with hydrofluoric acid handling.

Strengths: Superior process safety features and precise reaction control, resulting in consistent product quality and reduced operational risks. Weaknesses: Higher capital costs due to specialized materials of construction and safety systems, requiring significant production volumes to achieve economic viability.

Critical Patents in Ammonium Fluoride Synthesis

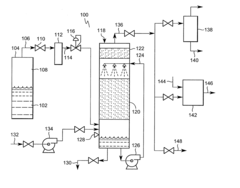

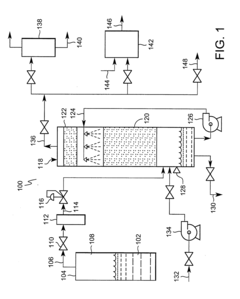

On-site generation of ultra-high-purity buffered-HF and ammonium fluoride

PatentInactiveUS20020079478A1

Innovation

- A compact on-site system for generating ultra-high-purity buffered-hydrofluoric acid and ammonium fluoride by bubbling purified ammonia vapor into ultra-pure hydrofluoric acid, using on-site purification units for ammonia and HF to minimize impurities and reduce handling risks.

Process for the Production of Ammonium Fluoride.

PatentInactiveGB1199468A

Innovation

- Reacting ammonium bifluoride with ammonia in the presence of controlled amounts of water at specific temperature and pressure conditions, allowing for the conversion to ammonium fluoride with optional excess ammonia to accelerate the reaction, and incorporating water through washing or steam addition.

Safety and Environmental Considerations

The handling of hydrofluoric acid (HF) in ammonium fluoride production presents significant safety and environmental challenges that require comprehensive management strategies. HF is classified as an extremely hazardous substance due to its corrosive properties and ability to penetrate tissue, causing severe burns and systemic toxicity through calcium depletion. Production facilities must implement rigorous safety protocols including specialized containment systems, acid-resistant materials, and advanced ventilation infrastructure to minimize exposure risks.

Personal protective equipment requirements for workers handling HF are exceptionally stringent, necessitating full-face protection, chemical-resistant suits, and specialized gloves. Emergency response procedures must be meticulously designed with immediate access to calcium gluconate antidotes and decontamination facilities. Regular safety training and drills are essential components of operational protocols in ammonium fluoride production facilities.

Environmental considerations are equally critical, as HF releases can cause severe ecological damage. Wastewater from production processes contains fluoride compounds that can contaminate water bodies, potentially leading to fluorosis in aquatic organisms and affecting drinking water quality. Advanced treatment systems employing precipitation methods with calcium compounds are typically required to reduce fluoride concentrations to regulatory compliance levels before discharge.

Atmospheric emissions present another significant concern, with potential for hydrogen fluoride gas releases that can damage vegetation and contribute to acid rain formation. Modern facilities incorporate scrubber systems and absorption technologies to capture and neutralize these emissions, with continuous monitoring systems to detect leaks or abnormal release events.

Regulatory frameworks governing HF handling vary globally but generally include strict permitting requirements, regular compliance inspections, and comprehensive reporting obligations. The European Union's REACH regulations, the United States EPA's Risk Management Plan requirements, and similar frameworks in Asia impose increasingly stringent controls on fluoride-containing waste streams and emissions.

Industry best practices now emphasize process intensification and green chemistry approaches to minimize HF quantities required in production. Closed-loop systems that recover and recycle fluoride compounds are becoming standard, reducing both safety risks and environmental footprint. Some manufacturers are exploring alternative synthesis routes for ammonium fluoride that reduce or eliminate HF dependency, though these alternatives often face challenges in product purity and economic viability.

Personal protective equipment requirements for workers handling HF are exceptionally stringent, necessitating full-face protection, chemical-resistant suits, and specialized gloves. Emergency response procedures must be meticulously designed with immediate access to calcium gluconate antidotes and decontamination facilities. Regular safety training and drills are essential components of operational protocols in ammonium fluoride production facilities.

Environmental considerations are equally critical, as HF releases can cause severe ecological damage. Wastewater from production processes contains fluoride compounds that can contaminate water bodies, potentially leading to fluorosis in aquatic organisms and affecting drinking water quality. Advanced treatment systems employing precipitation methods with calcium compounds are typically required to reduce fluoride concentrations to regulatory compliance levels before discharge.

Atmospheric emissions present another significant concern, with potential for hydrogen fluoride gas releases that can damage vegetation and contribute to acid rain formation. Modern facilities incorporate scrubber systems and absorption technologies to capture and neutralize these emissions, with continuous monitoring systems to detect leaks or abnormal release events.

Regulatory frameworks governing HF handling vary globally but generally include strict permitting requirements, regular compliance inspections, and comprehensive reporting obligations. The European Union's REACH regulations, the United States EPA's Risk Management Plan requirements, and similar frameworks in Asia impose increasingly stringent controls on fluoride-containing waste streams and emissions.

Industry best practices now emphasize process intensification and green chemistry approaches to minimize HF quantities required in production. Closed-loop systems that recover and recycle fluoride compounds are becoming standard, reducing both safety risks and environmental footprint. Some manufacturers are exploring alternative synthesis routes for ammonium fluoride that reduce or eliminate HF dependency, though these alternatives often face challenges in product purity and economic viability.

Regulatory Framework for Fluorochemical Industry

The fluorochemical industry operates within a complex web of regulations designed to protect human health, worker safety, and the environment. For hydrofluoric acid (HF) used in ammonium fluoride production, these regulations are particularly stringent due to the highly corrosive and toxic nature of the compounds involved.

At the international level, the Strategic Approach to International Chemicals Management (SAICM) provides a policy framework to promote chemical safety around the world. The Montreal Protocol specifically regulates substances that deplete the ozone layer, which impacts certain fluorochemical production processes. Additionally, the Stockholm Convention on Persistent Organic Pollutants addresses long-lasting organic pollutants, some of which are related to fluorochemical manufacturing.

In the United States, the Environmental Protection Agency (EPA) regulates hydrofluoric acid under the Toxic Substances Control Act (TSCA) and the Clean Air Act. Facilities handling significant quantities of HF must comply with the Risk Management Plan (RMP) Rule, requiring detailed safety protocols and emergency response plans. The Occupational Safety and Health Administration (OSHA) establishes permissible exposure limits for workers and mandates comprehensive safety measures for handling HF.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes strict requirements for registering, evaluating, and obtaining authorization for chemical substances. The Classification, Labeling and Packaging (CLP) Regulation ensures that hazards presented by chemicals are clearly communicated to workers and consumers through standardized classification and labeling.

In Asia, China has implemented the Measures for Environmental Management of New Chemical Substances, while Japan enforces the Chemical Substances Control Law. Both regulatory frameworks require extensive testing and reporting for fluorochemicals.

Specific to ammonium fluoride production, regulations often mandate closed-system processing, advanced air filtration systems, wastewater treatment protocols, and regular environmental monitoring. Transportation of hydrofluoric acid is subject to hazardous materials regulations that dictate specialized containers, vehicle requirements, and driver training.

Recent regulatory trends show increasing scrutiny of per- and polyfluoroalkyl substances (PFAS), which may indirectly impact the broader fluorochemical industry through heightened oversight and public awareness. Companies involved in ammonium fluoride production must maintain robust compliance programs that track evolving regulations across multiple jurisdictions and anticipate future regulatory developments.

At the international level, the Strategic Approach to International Chemicals Management (SAICM) provides a policy framework to promote chemical safety around the world. The Montreal Protocol specifically regulates substances that deplete the ozone layer, which impacts certain fluorochemical production processes. Additionally, the Stockholm Convention on Persistent Organic Pollutants addresses long-lasting organic pollutants, some of which are related to fluorochemical manufacturing.

In the United States, the Environmental Protection Agency (EPA) regulates hydrofluoric acid under the Toxic Substances Control Act (TSCA) and the Clean Air Act. Facilities handling significant quantities of HF must comply with the Risk Management Plan (RMP) Rule, requiring detailed safety protocols and emergency response plans. The Occupational Safety and Health Administration (OSHA) establishes permissible exposure limits for workers and mandates comprehensive safety measures for handling HF.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation imposes strict requirements for registering, evaluating, and obtaining authorization for chemical substances. The Classification, Labeling and Packaging (CLP) Regulation ensures that hazards presented by chemicals are clearly communicated to workers and consumers through standardized classification and labeling.

In Asia, China has implemented the Measures for Environmental Management of New Chemical Substances, while Japan enforces the Chemical Substances Control Law. Both regulatory frameworks require extensive testing and reporting for fluorochemicals.

Specific to ammonium fluoride production, regulations often mandate closed-system processing, advanced air filtration systems, wastewater treatment protocols, and regular environmental monitoring. Transportation of hydrofluoric acid is subject to hazardous materials regulations that dictate specialized containers, vehicle requirements, and driver training.

Recent regulatory trends show increasing scrutiny of per- and polyfluoroalkyl substances (PFAS), which may indirectly impact the broader fluorochemical industry through heightened oversight and public awareness. Companies involved in ammonium fluoride production must maintain robust compliance programs that track evolving regulations across multiple jurisdictions and anticipate future regulatory developments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!