Market Trends in Titanium Alloy vs Stainless Steel Applications

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Titanium & Steel Evolution Background

The evolution of titanium alloys and stainless steel represents one of the most significant metallurgical developments of the 20th century, fundamentally transforming multiple industries. Titanium, discovered in 1791 by William Gregor, remained largely theoretical until the Kroll process was developed in 1940, enabling commercial production. This breakthrough marked the beginning of titanium's industrial application, initially driven by aerospace and defense requirements during the Cold War era.

Stainless steel's journey began earlier, with Harry Brearley's discovery of corrosion-resistant steel in 1913. By the 1920s, various grades of stainless steel had been developed, quickly finding applications in cutlery, cookware, and architectural elements. The post-World War II industrial boom saw stainless steel become ubiquitous in consumer and industrial applications due to its corrosion resistance and relatively low cost.

The technological trajectories of these materials diverged significantly based on their inherent properties. Titanium alloys, with their exceptional strength-to-weight ratio and biocompatibility, evolved toward high-performance applications where weight savings justified premium costs. The development of alloys like Ti-6Al-4V in the 1950s established titanium as the material of choice for critical aerospace components.

Stainless steel evolution focused on diversification and cost optimization. The development of austenitic (300 series), ferritic (400 series), and precipitation-hardening grades expanded its application range. Manufacturing innovations like the argon-oxygen decarburization process in the 1970s significantly reduced production costs, further cementing stainless steel's position in mass-market applications.

The 1980s and 1990s saw significant advances in titanium processing technologies, including improved vacuum arc remelting and the development of near-net-shape manufacturing methods, gradually reducing the cost barrier. Simultaneously, specialized stainless steel grades with enhanced properties emerged, including duplex stainless steels combining strength and corrosion resistance.

Recent decades have witnessed convergence in certain application spaces as titanium has become more economically viable through improved manufacturing processes, while high-performance stainless steels have enhanced their property profiles. This evolution has created a complex competitive landscape where material selection increasingly depends on specific performance requirements rather than traditional industry conventions.

The historical development of both materials reflects broader technological trends: initial discovery, military/defense applications driving early adoption, gradual commercialization, and eventual market segmentation based on performance characteristics and economic considerations. This evolutionary pattern continues today as both materials adapt to new manufacturing paradigms and emerging application requirements.

Stainless steel's journey began earlier, with Harry Brearley's discovery of corrosion-resistant steel in 1913. By the 1920s, various grades of stainless steel had been developed, quickly finding applications in cutlery, cookware, and architectural elements. The post-World War II industrial boom saw stainless steel become ubiquitous in consumer and industrial applications due to its corrosion resistance and relatively low cost.

The technological trajectories of these materials diverged significantly based on their inherent properties. Titanium alloys, with their exceptional strength-to-weight ratio and biocompatibility, evolved toward high-performance applications where weight savings justified premium costs. The development of alloys like Ti-6Al-4V in the 1950s established titanium as the material of choice for critical aerospace components.

Stainless steel evolution focused on diversification and cost optimization. The development of austenitic (300 series), ferritic (400 series), and precipitation-hardening grades expanded its application range. Manufacturing innovations like the argon-oxygen decarburization process in the 1970s significantly reduced production costs, further cementing stainless steel's position in mass-market applications.

The 1980s and 1990s saw significant advances in titanium processing technologies, including improved vacuum arc remelting and the development of near-net-shape manufacturing methods, gradually reducing the cost barrier. Simultaneously, specialized stainless steel grades with enhanced properties emerged, including duplex stainless steels combining strength and corrosion resistance.

Recent decades have witnessed convergence in certain application spaces as titanium has become more economically viable through improved manufacturing processes, while high-performance stainless steels have enhanced their property profiles. This evolution has created a complex competitive landscape where material selection increasingly depends on specific performance requirements rather than traditional industry conventions.

The historical development of both materials reflects broader technological trends: initial discovery, military/defense applications driving early adoption, gradual commercialization, and eventual market segmentation based on performance characteristics and economic considerations. This evolutionary pattern continues today as both materials adapt to new manufacturing paradigms and emerging application requirements.

Market Demand Analysis for Advanced Alloys

The global market for advanced alloys has witnessed significant shifts in recent years, with titanium alloys and stainless steel competing for dominance across various industrial applications. Current market analysis indicates that the global titanium alloy market is valued at approximately 5.8 billion USD with a compound annual growth rate (CAGR) of 4.7%, while the stainless steel market stands at 111.4 billion USD with a CAGR of 6.3% through 2028.

Demand for titanium alloys has surged particularly in aerospace and defense sectors, which account for nearly 50% of titanium consumption globally. This growth is driven by the material's exceptional strength-to-weight ratio and corrosion resistance properties. Commercial aircraft manufacturers have increased titanium content in new generation aircraft by up to 15% compared to previous models, reflecting the material's growing importance in lightweight structural applications.

The medical implant industry represents another significant growth area for titanium alloys, with market research indicating a 7.2% annual growth rate in this sector. Titanium's biocompatibility and osseointegration properties make it ideal for orthopedic and dental implants, with over 4.5 million procedures utilizing titanium components annually worldwide.

Stainless steel continues to dominate in consumer goods, automotive, and construction sectors due to its cost-effectiveness and versatility. The food and beverage industry remains the largest consumer of stainless steel, accounting for approximately 30% of global demand. Recent innovations in lean duplex stainless steels have expanded applications in structural engineering, with a 12% increase in adoption over the past three years.

Regional analysis reveals that Asia-Pacific leads consumption of both materials, with China accounting for 35% of global stainless steel production and consumption. North America dominates in high-grade titanium alloy applications, particularly in aerospace and defense, representing 42% of global titanium aerospace consumption.

Emerging economies are showing increased demand for both materials, with India's consumption of stainless steel growing at 8.9% annually, significantly above the global average. Similarly, Brazil and Mexico have increased titanium alloy imports by 15% and 18% respectively in the past two years, primarily for expanding aerospace and medical device manufacturing sectors.

Price sensitivity remains a critical factor in material selection, with titanium alloys commanding a premium 5-7 times higher than comparable stainless steel grades. This price differential continues to limit titanium's penetration in cost-sensitive applications despite its superior technical properties, creating opportunities for hybrid solutions that optimize material usage based on specific performance requirements.

Demand for titanium alloys has surged particularly in aerospace and defense sectors, which account for nearly 50% of titanium consumption globally. This growth is driven by the material's exceptional strength-to-weight ratio and corrosion resistance properties. Commercial aircraft manufacturers have increased titanium content in new generation aircraft by up to 15% compared to previous models, reflecting the material's growing importance in lightweight structural applications.

The medical implant industry represents another significant growth area for titanium alloys, with market research indicating a 7.2% annual growth rate in this sector. Titanium's biocompatibility and osseointegration properties make it ideal for orthopedic and dental implants, with over 4.5 million procedures utilizing titanium components annually worldwide.

Stainless steel continues to dominate in consumer goods, automotive, and construction sectors due to its cost-effectiveness and versatility. The food and beverage industry remains the largest consumer of stainless steel, accounting for approximately 30% of global demand. Recent innovations in lean duplex stainless steels have expanded applications in structural engineering, with a 12% increase in adoption over the past three years.

Regional analysis reveals that Asia-Pacific leads consumption of both materials, with China accounting for 35% of global stainless steel production and consumption. North America dominates in high-grade titanium alloy applications, particularly in aerospace and defense, representing 42% of global titanium aerospace consumption.

Emerging economies are showing increased demand for both materials, with India's consumption of stainless steel growing at 8.9% annually, significantly above the global average. Similarly, Brazil and Mexico have increased titanium alloy imports by 15% and 18% respectively in the past two years, primarily for expanding aerospace and medical device manufacturing sectors.

Price sensitivity remains a critical factor in material selection, with titanium alloys commanding a premium 5-7 times higher than comparable stainless steel grades. This price differential continues to limit titanium's penetration in cost-sensitive applications despite its superior technical properties, creating opportunities for hybrid solutions that optimize material usage based on specific performance requirements.

Current Technical Limitations & Material Challenges

Despite the numerous advantages of titanium alloys and stainless steel, both materials face significant technical limitations and challenges that impact their broader application across industries. Titanium alloys, while offering exceptional strength-to-weight ratios and corrosion resistance, present substantial manufacturing difficulties. The high reactivity of titanium at elevated temperatures necessitates specialized processing environments, typically requiring vacuum or inert gas atmospheres during melting and casting operations, significantly increasing production costs.

The machining of titanium alloys presents another major challenge due to their low thermal conductivity, which causes rapid tool wear and decreased productivity. This characteristic makes titanium components approximately 5-10 times more expensive to machine compared to stainless steel counterparts. Additionally, titanium's work hardening properties further complicate forming processes, limiting design flexibility.

For stainless steel, despite its widespread use, several technical limitations persist. Chloride-induced stress corrosion cracking remains a significant concern, particularly in marine and chemical processing environments. Even high-grade austenitic stainless steels (300 series) can fail catastrophically under specific combinations of tensile stress and chloride exposure, necessitating careful material selection and design considerations.

The magnetic properties of many stainless steel grades (particularly ferritic and martensitic types) restrict their application in environments sensitive to electromagnetic interference. This limitation is particularly relevant in medical imaging equipment and certain scientific instruments where non-magnetic materials are essential.

Both materials face joining challenges, with titanium requiring specialized welding techniques to prevent oxygen and nitrogen contamination that can lead to embrittlement. Stainless steel welding often results in chromium carbide precipitation at grain boundaries, reducing corrosion resistance in heat-affected zones unless proper post-weld heat treatments are applied.

From a sustainability perspective, titanium extraction and processing are extremely energy-intensive, with primary production consuming approximately 5-10 times more energy than stainless steel production per unit weight. This energy requirement translates to significantly higher carbon footprints and production costs, limiting titanium's application in cost-sensitive markets.

Recent material science advancements have focused on addressing these limitations through the development of new alloy compositions, improved processing techniques, and surface modification technologies. However, the fundamental challenges of titanium's reactivity and stainless steel's specific corrosion vulnerabilities continue to constrain their application potential in various sectors, driving ongoing research into alternative materials and hybrid solutions.

The machining of titanium alloys presents another major challenge due to their low thermal conductivity, which causes rapid tool wear and decreased productivity. This characteristic makes titanium components approximately 5-10 times more expensive to machine compared to stainless steel counterparts. Additionally, titanium's work hardening properties further complicate forming processes, limiting design flexibility.

For stainless steel, despite its widespread use, several technical limitations persist. Chloride-induced stress corrosion cracking remains a significant concern, particularly in marine and chemical processing environments. Even high-grade austenitic stainless steels (300 series) can fail catastrophically under specific combinations of tensile stress and chloride exposure, necessitating careful material selection and design considerations.

The magnetic properties of many stainless steel grades (particularly ferritic and martensitic types) restrict their application in environments sensitive to electromagnetic interference. This limitation is particularly relevant in medical imaging equipment and certain scientific instruments where non-magnetic materials are essential.

Both materials face joining challenges, with titanium requiring specialized welding techniques to prevent oxygen and nitrogen contamination that can lead to embrittlement. Stainless steel welding often results in chromium carbide precipitation at grain boundaries, reducing corrosion resistance in heat-affected zones unless proper post-weld heat treatments are applied.

From a sustainability perspective, titanium extraction and processing are extremely energy-intensive, with primary production consuming approximately 5-10 times more energy than stainless steel production per unit weight. This energy requirement translates to significantly higher carbon footprints and production costs, limiting titanium's application in cost-sensitive markets.

Recent material science advancements have focused on addressing these limitations through the development of new alloy compositions, improved processing techniques, and surface modification technologies. However, the fundamental challenges of titanium's reactivity and stainless steel's specific corrosion vulnerabilities continue to constrain their application potential in various sectors, driving ongoing research into alternative materials and hybrid solutions.

Comparative Technical Solutions Analysis

01 Joining methods for titanium alloy and stainless steel

Various techniques are employed to join titanium alloy and stainless steel components, including diffusion bonding, friction welding, and explosive welding. These methods overcome the challenges of joining dissimilar metals with different thermal expansion coefficients and mechanical properties. Intermediate layers or transition materials are often used to improve bonding strength and prevent the formation of brittle intermetallic compounds at the interface.- Joining methods for titanium alloy and stainless steel: Various techniques are employed to join titanium alloy and stainless steel components, including diffusion bonding, friction welding, and explosive welding. These methods overcome the challenges of joining dissimilar metals with different thermal expansion coefficients and mechanical properties. Intermediate layers or transition materials are often used to improve bonding strength and prevent the formation of brittle intermetallic compounds at the interface.

- Composite structures combining titanium alloy and stainless steel: Composite structures that integrate titanium alloy and stainless steel take advantage of the beneficial properties of both materials. These structures are designed to optimize weight, strength, corrosion resistance, and cost-effectiveness. Applications include aerospace components, medical implants, and industrial equipment where specific performance requirements necessitate the use of both materials in different parts of the same component.

- Surface treatments and coatings for titanium-stainless steel interfaces: Surface treatments and specialized coatings are applied to improve the compatibility between titanium alloy and stainless steel. These treatments modify the surface properties to enhance bonding strength, prevent galvanic corrosion, and improve wear resistance at the interface. Techniques include nitriding, carburizing, PVD coating, and the application of intermediate metallic or ceramic layers.

- Corrosion prevention in titanium-stainless steel assemblies: Methods to prevent galvanic corrosion in assemblies containing both titanium alloy and stainless steel are essential for maintaining structural integrity. These include the use of insulating materials between the dissimilar metals, application of protective coatings, cathodic protection systems, and design considerations to minimize moisture accumulation at interfaces. Environmental factors and electrolyte exposure significantly influence the corrosion behavior of these bimetallic systems.

- Manufacturing processes for titanium-stainless steel components: Specialized manufacturing processes have been developed for producing components that incorporate both titanium alloy and stainless steel. These include advanced casting techniques, powder metallurgy, additive manufacturing, and hybrid manufacturing approaches. Process parameters must be carefully controlled to manage the different thermal properties and prevent defects at the interface between the dissimilar metals. Post-processing treatments are often required to optimize the mechanical properties and structural integrity of the final components.

02 Composite structures combining titanium alloy and stainless steel

Composite structures that integrate titanium alloy and stainless steel leverage the advantageous properties of both materials. These structures are designed to optimize weight, strength, corrosion resistance, and cost-effectiveness. Applications include aerospace components, medical implants, and industrial equipment where specific performance requirements necessitate the strategic placement of each material within the composite structure.Expand Specific Solutions03 Surface treatment and coating technologies

Surface treatments and coating technologies are applied to titanium alloy and stainless steel interfaces to enhance compatibility, prevent galvanic corrosion, and improve overall performance. These include physical vapor deposition, chemical vapor deposition, plasma spraying, and various surface modification techniques. Such treatments create protective barriers or transition layers that mitigate the electrochemical differences between the two materials.Expand Specific Solutions04 Corrosion resistance enhancement

Methods to enhance corrosion resistance in titanium alloy and stainless steel combinations focus on preventing galvanic corrosion that naturally occurs when these dissimilar metals are in contact. Techniques include the application of specialized coatings, creation of passive layers, introduction of sacrificial anodes, and environmental isolation strategies. These approaches are crucial for applications in marine environments, chemical processing, and medical implants.Expand Specific Solutions05 Manufacturing processes for hybrid components

Specialized manufacturing processes have been developed for producing hybrid components that incorporate both titanium alloy and stainless steel. These include advanced casting techniques, powder metallurgy, additive manufacturing, and multi-material forming processes. Such manufacturing methods enable the creation of complex geometries with optimized material distribution, allowing designers to place each material precisely where its properties are most beneficial.Expand Specific Solutions

Key Industry Players & Market Competition

The titanium alloy versus stainless steel market is currently in a mature growth phase, with increasing adoption of titanium alloys in high-performance applications despite stainless steel's dominance in traditional sectors. The global market size for these materials exceeds $200 billion, with titanium alloys growing at 4-5% annually compared to stainless steel's 2-3%. Leading companies like QuesTek Innovations and ATI are driving titanium alloy innovation through advanced materials design, while established players such as NIPPON STEEL, Kobe Steel, and Sandvik maintain strong positions in stainless steel. Aerospace leaders Boeing and Rolls-Royce are pushing titanium adoption, while research institutions like Shanghai Jiao Tong University and Ohio State University are developing next-generation alloys with enhanced properties, focusing on cost reduction to increase titanium's competitiveness against stainless steel.

QuesTek Innovations LLC

Technical Solution: QuesTek employs an Integrated Computational Materials Engineering (ICME) approach to develop advanced titanium alloys with superior properties. Their proprietary Materials by Design® methodology combines computational modeling, thermodynamics, and kinetics to create custom titanium alloys that outperform traditional options. QuesTek's Ti-6-4 ELI+ alloy demonstrates 15-20% higher strength than standard Ti-6Al-4V ELI while maintaining excellent corrosion resistance and biocompatibility. For aerospace applications, they've developed high-temperature titanium alloys that maintain structural integrity at temperatures up to 600°C, significantly higher than conventional titanium alloys. Their computational approach reduces development time by approximately 50% compared to traditional trial-and-error methods, allowing faster market entry for specialized applications where titanium outperforms stainless steel.

Strengths: Accelerated development timeline through computational modeling; highly customizable alloy properties for specific applications; reduced material waste during development. Weaknesses: Higher initial development costs compared to conventional alloys; requires sophisticated computational infrastructure; custom alloys may face regulatory hurdles in highly regulated industries like medical devices.

ATI Properties LLC

Technical Solution: ATI has pioneered advanced titanium alloy manufacturing through their Precision Rolled Strip® technology, which enables production of titanium sheets as thin as 0.1mm with exceptional flatness and surface quality. Their ATI 425® alloy offers a unique combination of high strength (up to 1000 MPa tensile strength) and excellent cold formability, addressing a key limitation of traditional titanium alloys. For corrosion-resistant applications, ATI has developed specialized titanium alloys containing small amounts of palladium or ruthenium that demonstrate superior resistance in highly acidic environments compared to both standard titanium and high-grade stainless steels. Their proprietary melting and processing techniques have reduced oxygen content in specialized grades to below 0.08%, enhancing ductility and fatigue resistance. ATI's recent innovations include titanium-aluminum-niobium alloys for high-temperature aerospace applications that maintain structural integrity at temperatures 150°C higher than conventional titanium alloys while being 40% lighter than comparable stainless steel components.

Strengths: Vertically integrated production capabilities from raw materials to finished products; extensive experience in both titanium and specialty stainless steels allows informed material selection; advanced processing techniques yield superior surface finishes. Weaknesses: Higher production costs compared to conventional stainless steel manufacturing; specialized titanium grades have limited supplier networks; longer lead times for custom specifications.

Critical Patents & Metallurgical Innovations

Titanium alloy

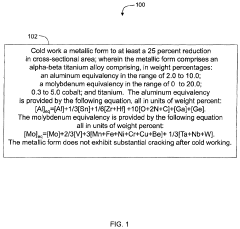

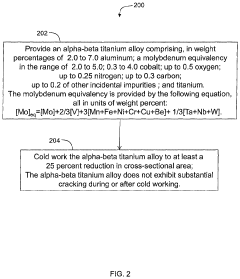

PatentActiveUS11851734B2

Innovation

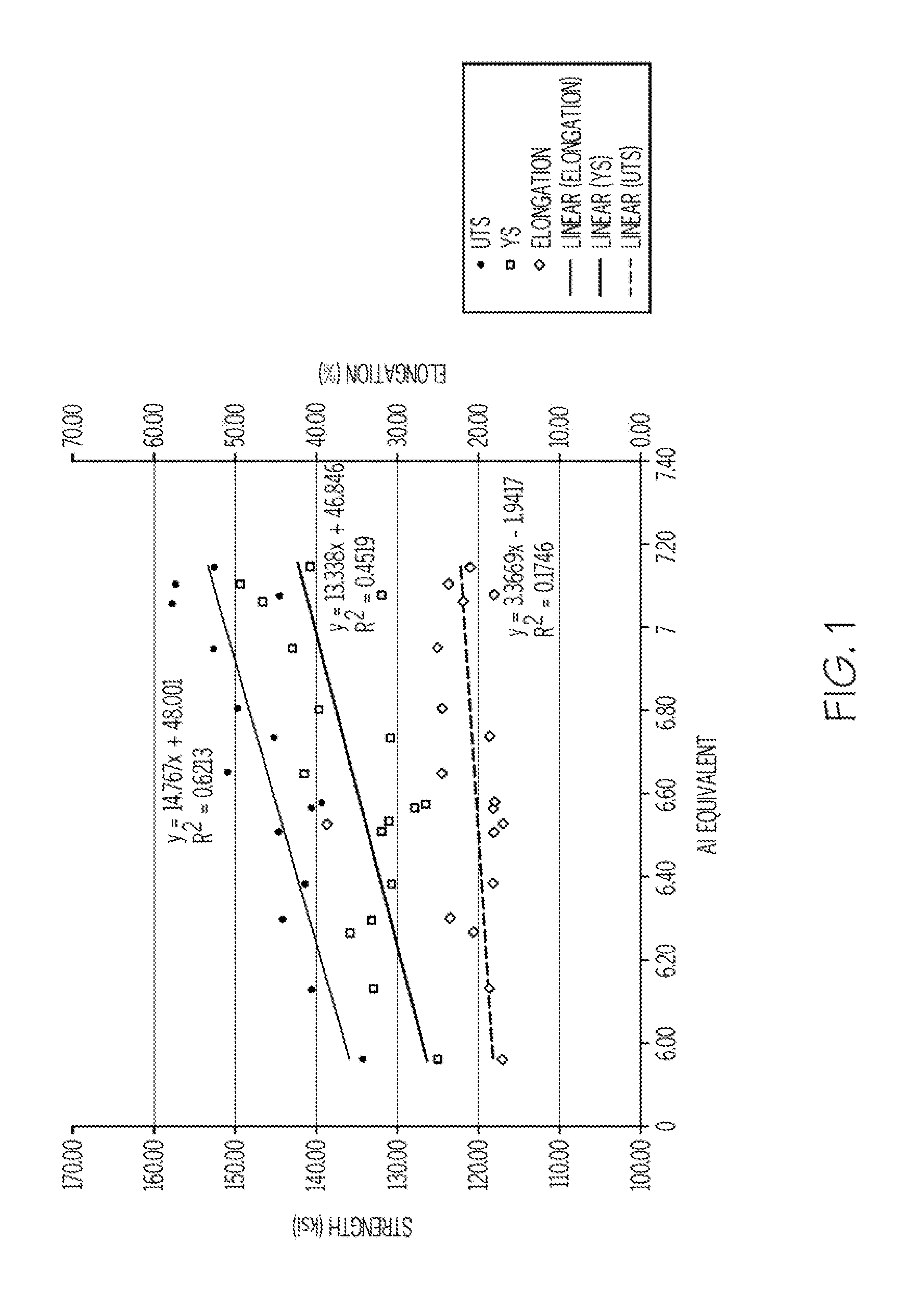

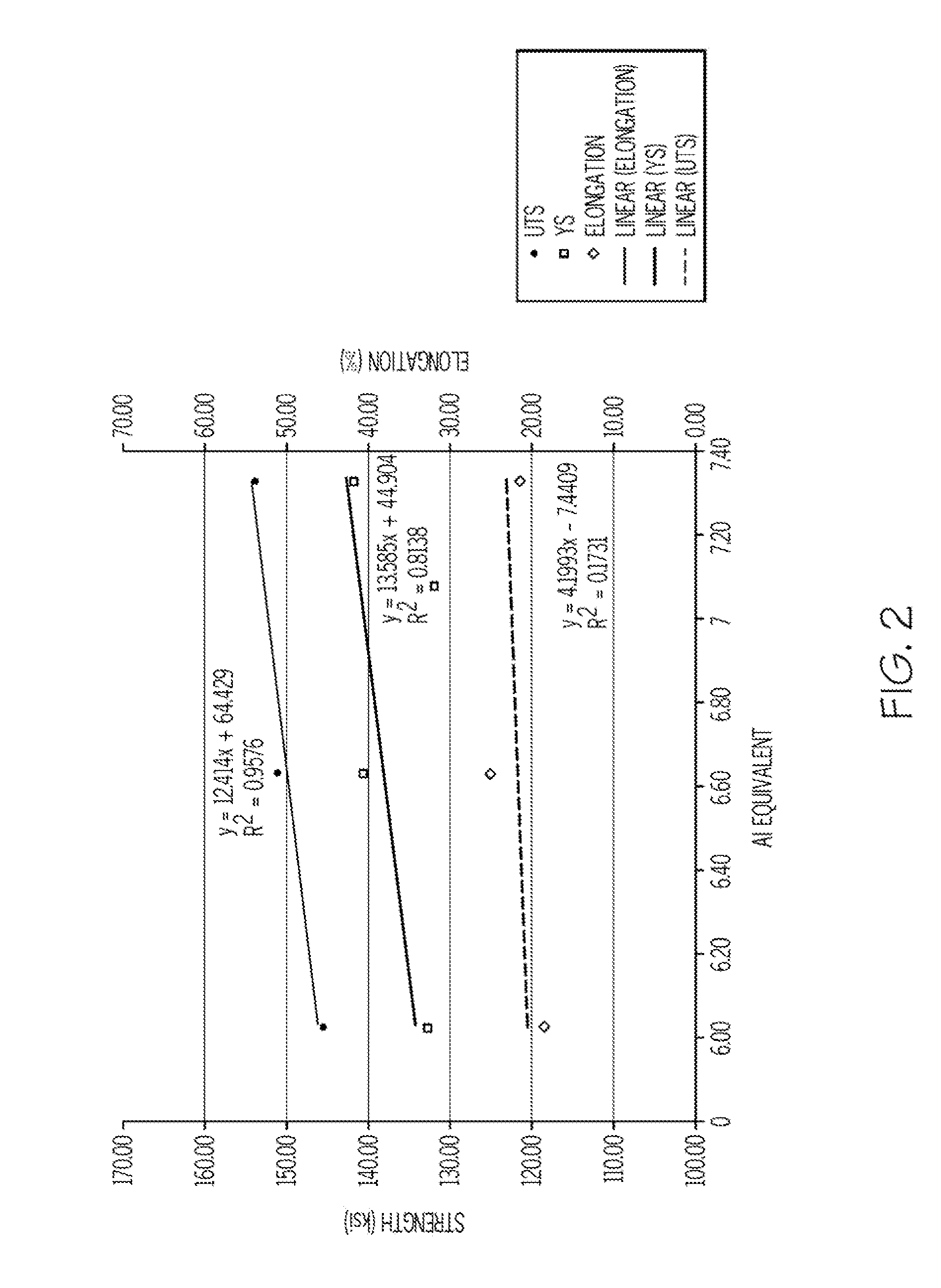

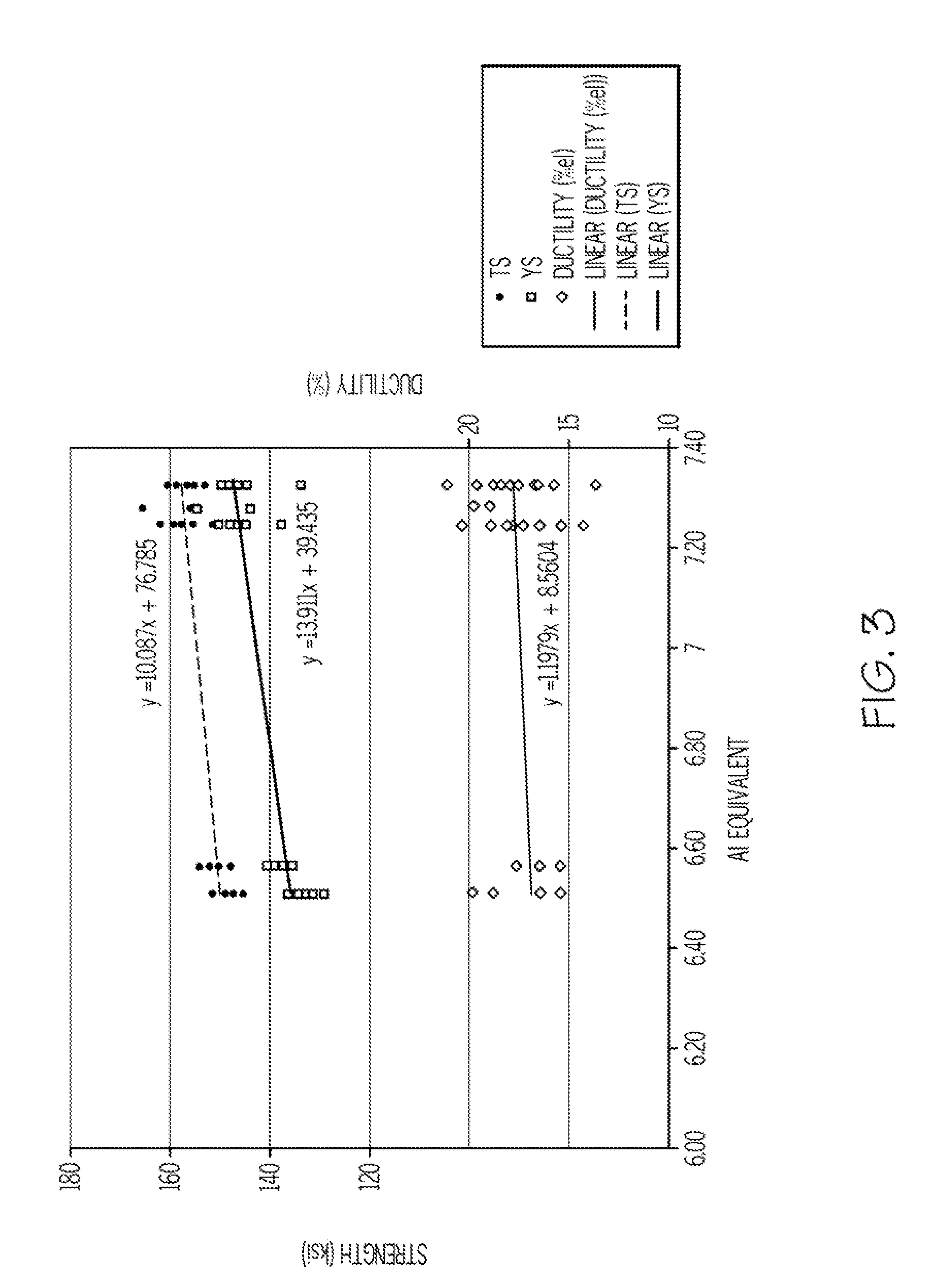

- Developing an alpha-beta titanium alloy with a composition that includes aluminum equivalency in the range of 2.0 to 10.0, molybdenum equivalency of 0 to 20.0, 0.3 to 5.0 cobalt, and incidental impurities, allowing for cold working with reduced cracking and maintaining strength, ductility, and avoiding substantial beta phase content.

High strength alpha/beta titanium alloy

PatentInactiveUS20120076686A1

Innovation

- An alpha/beta titanium alloy composition with specific ranges of aluminum (3.9-4.5%), vanadium (2.2-3.0%), iron (1.2-1.8%), and oxygen (0.24-0.30%), along with up to 0.30% of other elements, is developed to enhance cold deformability and mechanical properties, allowing for increased strength without compromising ductility.

Supply Chain Resilience & Raw Material Considerations

The global supply chains for both titanium alloys and stainless steel have experienced significant disruptions in recent years, highlighting the importance of resilience planning in material selection decisions. Titanium supply chains are characterized by geographic concentration, with major ore deposits located primarily in Australia, South Africa, and China. This concentration creates inherent vulnerabilities to geopolitical tensions, trade restrictions, and natural disasters affecting these regions.

Raw material considerations for titanium alloys present unique challenges. Titanium extraction and processing are energy-intensive, requiring specialized facilities and expertise. The limited number of qualified suppliers globally creates bottlenecks in production capacity, particularly during demand surges. Additionally, the aerospace and defense industries, which consume significant portions of global titanium production, often experience priority allocation during supply shortages, affecting availability for other sectors.

Stainless steel supply chains demonstrate greater geographical diversification, with production facilities distributed across North America, Europe, and Asia. This distribution provides natural resilience against regional disruptions. However, the dependence on key alloying elements like nickel and chromium introduces vulnerabilities, as these materials have their own supply constraints and price volatilities.

Price stability represents another critical dimension in supply chain resilience. Titanium has historically experienced greater price volatility than stainless steel, with fluctuations of up to 35% observed during recent five-year periods. This volatility complicates long-term procurement planning and cost management for manufacturers. Stainless steel pricing, while not immune to market forces, typically demonstrates more moderate fluctuations, enhancing predictability for procurement teams.

Recycling infrastructure also influences supply chain resilience significantly. Stainless steel benefits from well-established global recycling systems, with recovery rates exceeding 80% in developed markets. This circular economy aspect provides a buffer against raw material shortages. Titanium recycling, while technically feasible and growing, remains less developed, with recovery rates below 50% in most markets, representing an area for potential improvement in supply chain resilience.

Forward-looking manufacturers are increasingly implementing dual-sourcing strategies and maintaining strategic reserves of critical materials to mitigate supply risks. Material substitution capabilities are also being developed as contingency measures, though the specialized properties of titanium alloys often limit direct substitution possibilities in high-performance applications.

Raw material considerations for titanium alloys present unique challenges. Titanium extraction and processing are energy-intensive, requiring specialized facilities and expertise. The limited number of qualified suppliers globally creates bottlenecks in production capacity, particularly during demand surges. Additionally, the aerospace and defense industries, which consume significant portions of global titanium production, often experience priority allocation during supply shortages, affecting availability for other sectors.

Stainless steel supply chains demonstrate greater geographical diversification, with production facilities distributed across North America, Europe, and Asia. This distribution provides natural resilience against regional disruptions. However, the dependence on key alloying elements like nickel and chromium introduces vulnerabilities, as these materials have their own supply constraints and price volatilities.

Price stability represents another critical dimension in supply chain resilience. Titanium has historically experienced greater price volatility than stainless steel, with fluctuations of up to 35% observed during recent five-year periods. This volatility complicates long-term procurement planning and cost management for manufacturers. Stainless steel pricing, while not immune to market forces, typically demonstrates more moderate fluctuations, enhancing predictability for procurement teams.

Recycling infrastructure also influences supply chain resilience significantly. Stainless steel benefits from well-established global recycling systems, with recovery rates exceeding 80% in developed markets. This circular economy aspect provides a buffer against raw material shortages. Titanium recycling, while technically feasible and growing, remains less developed, with recovery rates below 50% in most markets, representing an area for potential improvement in supply chain resilience.

Forward-looking manufacturers are increasingly implementing dual-sourcing strategies and maintaining strategic reserves of critical materials to mitigate supply risks. Material substitution capabilities are also being developed as contingency measures, though the specialized properties of titanium alloys often limit direct substitution possibilities in high-performance applications.

Sustainability Impact & Circular Economy Potential

The sustainability profile of titanium alloys presents significant advantages over stainless steel in multiple dimensions of environmental impact. Titanium's exceptional durability and corrosion resistance translate to products with substantially longer service lives, reducing replacement frequency and associated resource consumption. While titanium production initially requires 1.7-3.5 times more energy than stainless steel manufacturing, this energy investment is offset by titanium's superior longevity and reduced maintenance requirements over the product lifecycle.

Titanium's recyclability rate exceeds 90%, with minimal quality degradation through multiple recycling cycles. The recycling process for titanium consumes approximately 95% less energy than primary production, creating a compelling case for closed-loop material systems. By contrast, stainless steel recycling, while efficient, often results in downcycling to lower-grade applications due to accumulated impurities.

Carbon footprint analyses reveal that titanium components, despite higher initial production emissions, frequently achieve lower lifetime environmental impacts in transportation applications through weight reduction and fuel savings. In aerospace applications, each kilogram of weight saved through titanium substitution can reduce CO2 emissions by 26-28 tons over an aircraft's operational life.

The circular economy potential for titanium alloys is particularly promising in sectors requiring high-performance materials with extended service lives. Emerging business models include titanium component leasing programs, where manufacturers retain material ownership and responsibility for end-of-life recovery. Several aerospace and medical device companies have implemented successful take-back programs, achieving titanium recovery rates of 85-95%.

Recent innovations in titanium powder metallurgy and additive manufacturing have further enhanced sustainability metrics by reducing material waste during fabrication from 80% to less than 5% in some applications. These technologies enable design optimization for material efficiency while maintaining or improving performance characteristics.

Water usage comparisons also favor titanium, with production processes requiring approximately 40% less water per functional unit than comparable stainless steel manufacturing when assessed on a lifecycle basis. This advantage becomes increasingly significant as water scarcity concerns intensify in manufacturing regions globally.

Titanium's recyclability rate exceeds 90%, with minimal quality degradation through multiple recycling cycles. The recycling process for titanium consumes approximately 95% less energy than primary production, creating a compelling case for closed-loop material systems. By contrast, stainless steel recycling, while efficient, often results in downcycling to lower-grade applications due to accumulated impurities.

Carbon footprint analyses reveal that titanium components, despite higher initial production emissions, frequently achieve lower lifetime environmental impacts in transportation applications through weight reduction and fuel savings. In aerospace applications, each kilogram of weight saved through titanium substitution can reduce CO2 emissions by 26-28 tons over an aircraft's operational life.

The circular economy potential for titanium alloys is particularly promising in sectors requiring high-performance materials with extended service lives. Emerging business models include titanium component leasing programs, where manufacturers retain material ownership and responsibility for end-of-life recovery. Several aerospace and medical device companies have implemented successful take-back programs, achieving titanium recovery rates of 85-95%.

Recent innovations in titanium powder metallurgy and additive manufacturing have further enhanced sustainability metrics by reducing material waste during fabrication from 80% to less than 5% in some applications. These technologies enable design optimization for material efficiency while maintaining or improving performance characteristics.

Water usage comparisons also favor titanium, with production processes requiring approximately 40% less water per functional unit than comparable stainless steel manufacturing when assessed on a lifecycle basis. This advantage becomes increasingly significant as water scarcity concerns intensify in manufacturing regions globally.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!