Mini LED as Preferred Choice for Automotive Displays

SEP 12, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Mini LED Automotive Display Technology Background and Objectives

Mini LED technology has emerged as a significant advancement in display technology over the past decade, bridging the gap between conventional LCD and OLED displays. The evolution of this technology can be traced back to the early 2010s when researchers began exploring ways to enhance LCD performance through improved backlighting systems. By 2015, the concept of Mini LED backlighting had gained substantial traction in research communities, with commercial applications beginning to appear around 2018-2019.

The automotive display market has undergone a dramatic transformation during this period, evolving from simple instrument clusters to sophisticated infotainment systems and digital cockpits. This shift has created a growing demand for display technologies that can deliver superior performance in the challenging automotive environment, characterized by extreme temperature variations, high ambient light conditions, and stringent reliability requirements.

Mini LED technology represents a strategic solution to these challenges, offering a compelling combination of high brightness, excellent contrast ratios, and energy efficiency. With LED chips sized between 100-200 micrometers, Mini LEDs enable thousands of dimming zones in a display, significantly enhancing contrast and image quality while maintaining power efficiency crucial for electric vehicles.

The technical objectives for Mini LED implementation in automotive displays are multifaceted. Primary goals include achieving brightness levels exceeding 1,000 nits to ensure visibility in direct sunlight, while maintaining contrast ratios approaching 1,000,000:1 for enhanced visual experience. Additionally, the technology aims to deliver wide color gamut coverage (>90% DCI-P3) and response times under 1ms to support dynamic content display.

Longevity represents another critical objective, with automotive-grade Mini LED displays expected to maintain performance for 10+ years under extreme temperature conditions (-40°C to 85°C). Power efficiency targets include reducing energy consumption by 30-40% compared to traditional automotive displays, directly contributing to extended range in electric vehicles.

The technology trend indicates a progressive miniaturization of LED chips, with research moving toward Micro LED integration for even finer control of local dimming. Simultaneously, manufacturing processes are evolving to address yield challenges and cost concerns, with particular focus on improving transfer and bonding techniques for the thousands of Mini LED chips required per display.

As automotive interfaces continue to expand in both size and functionality, Mini LED technology is positioned to become the preferred solution for premium and mid-range vehicles, offering an optimal balance of performance, reliability, and cost-effectiveness compared to alternative technologies like OLED and conventional LCD.

The automotive display market has undergone a dramatic transformation during this period, evolving from simple instrument clusters to sophisticated infotainment systems and digital cockpits. This shift has created a growing demand for display technologies that can deliver superior performance in the challenging automotive environment, characterized by extreme temperature variations, high ambient light conditions, and stringent reliability requirements.

Mini LED technology represents a strategic solution to these challenges, offering a compelling combination of high brightness, excellent contrast ratios, and energy efficiency. With LED chips sized between 100-200 micrometers, Mini LEDs enable thousands of dimming zones in a display, significantly enhancing contrast and image quality while maintaining power efficiency crucial for electric vehicles.

The technical objectives for Mini LED implementation in automotive displays are multifaceted. Primary goals include achieving brightness levels exceeding 1,000 nits to ensure visibility in direct sunlight, while maintaining contrast ratios approaching 1,000,000:1 for enhanced visual experience. Additionally, the technology aims to deliver wide color gamut coverage (>90% DCI-P3) and response times under 1ms to support dynamic content display.

Longevity represents another critical objective, with automotive-grade Mini LED displays expected to maintain performance for 10+ years under extreme temperature conditions (-40°C to 85°C). Power efficiency targets include reducing energy consumption by 30-40% compared to traditional automotive displays, directly contributing to extended range in electric vehicles.

The technology trend indicates a progressive miniaturization of LED chips, with research moving toward Micro LED integration for even finer control of local dimming. Simultaneously, manufacturing processes are evolving to address yield challenges and cost concerns, with particular focus on improving transfer and bonding techniques for the thousands of Mini LED chips required per display.

As automotive interfaces continue to expand in both size and functionality, Mini LED technology is positioned to become the preferred solution for premium and mid-range vehicles, offering an optimal balance of performance, reliability, and cost-effectiveness compared to alternative technologies like OLED and conventional LCD.

Market Demand Analysis for Automotive Display Solutions

The automotive display market is experiencing a significant transformation driven by the increasing integration of advanced technologies in modern vehicles. Current market analysis indicates a robust growth trajectory for automotive displays, with a particular surge in demand for high-quality visual interfaces that enhance both functionality and aesthetic appeal. This growth is primarily fueled by the rising consumer expectations for smartphone-like experiences in vehicles, the expansion of infotainment systems, and the evolution toward more sophisticated driver assistance displays.

Mini LED technology has emerged as a particularly compelling solution within this expanding market. Industry reports suggest that the automotive display market is projected to grow substantially over the next five years, with premium display technologies capturing an increasing share. The demand for Mini LED displays specifically is expected to accelerate as automakers seek to differentiate their offerings through superior visual experiences.

Several key market drivers are propelling the adoption of advanced display technologies like Mini LED in automotive applications. The growing emphasis on connected vehicles and autonomous driving capabilities necessitates displays with higher brightness, contrast ratios, and energy efficiency – all areas where Mini LED excels. Additionally, the trend toward larger display surfaces in vehicle interiors, including integrated dashboard displays and passenger entertainment screens, creates natural opportunities for Mini LED implementation.

Consumer preference studies indicate that display quality significantly influences purchasing decisions in premium and luxury vehicle segments. The superior visual performance of Mini LED displays, particularly in challenging lighting conditions common in automotive environments, addresses a critical pain point in current display solutions. Market surveys reveal that consumers increasingly value high-resolution displays with excellent visibility in direct sunlight – a scenario where Mini LED technology demonstrates clear advantages over conventional LCD displays.

Regional market analysis shows varying adoption rates, with premium European and Asian automotive manufacturers leading the integration of advanced display technologies. North American markets are showing accelerated adoption rates as consumer awareness of display quality increases. The commercial vehicle segment is also beginning to incorporate advanced displays for fleet management and driver assistance systems, expanding the total addressable market for Mini LED solutions.

Supply chain considerations are increasingly favorable for Mini LED adoption in automotive applications. The maturing production ecosystem for Mini LED components is gradually reducing manufacturing costs, making the technology more accessible to mid-range vehicle segments. This trend is expected to accelerate as production scales and manufacturing efficiencies improve, potentially positioning Mini LED as the standard for automotive displays across multiple vehicle categories in the coming years.

Mini LED technology has emerged as a particularly compelling solution within this expanding market. Industry reports suggest that the automotive display market is projected to grow substantially over the next five years, with premium display technologies capturing an increasing share. The demand for Mini LED displays specifically is expected to accelerate as automakers seek to differentiate their offerings through superior visual experiences.

Several key market drivers are propelling the adoption of advanced display technologies like Mini LED in automotive applications. The growing emphasis on connected vehicles and autonomous driving capabilities necessitates displays with higher brightness, contrast ratios, and energy efficiency – all areas where Mini LED excels. Additionally, the trend toward larger display surfaces in vehicle interiors, including integrated dashboard displays and passenger entertainment screens, creates natural opportunities for Mini LED implementation.

Consumer preference studies indicate that display quality significantly influences purchasing decisions in premium and luxury vehicle segments. The superior visual performance of Mini LED displays, particularly in challenging lighting conditions common in automotive environments, addresses a critical pain point in current display solutions. Market surveys reveal that consumers increasingly value high-resolution displays with excellent visibility in direct sunlight – a scenario where Mini LED technology demonstrates clear advantages over conventional LCD displays.

Regional market analysis shows varying adoption rates, with premium European and Asian automotive manufacturers leading the integration of advanced display technologies. North American markets are showing accelerated adoption rates as consumer awareness of display quality increases. The commercial vehicle segment is also beginning to incorporate advanced displays for fleet management and driver assistance systems, expanding the total addressable market for Mini LED solutions.

Supply chain considerations are increasingly favorable for Mini LED adoption in automotive applications. The maturing production ecosystem for Mini LED components is gradually reducing manufacturing costs, making the technology more accessible to mid-range vehicle segments. This trend is expected to accelerate as production scales and manufacturing efficiencies improve, potentially positioning Mini LED as the standard for automotive displays across multiple vehicle categories in the coming years.

Current State and Challenges of Mini LED in Vehicles

Mini LED technology has emerged as a promising solution for automotive displays, offering significant improvements over traditional LCD and OLED technologies. Currently, the implementation of Mini LED in vehicles is in its early to middle stages of adoption, with premium vehicle manufacturers leading the integration. Companies like Audi, BMW, and Mercedes-Benz have begun incorporating Mini LED displays in their high-end models, primarily for instrument clusters, central information displays, and entertainment systems.

The current state of Mini LED in automotive applications demonstrates several advantages. The technology provides enhanced brightness levels of 1,000-2,000 nits, which significantly improves visibility in varying lighting conditions—a critical factor for automotive displays that must perform optimally under direct sunlight. The local dimming capabilities of Mini LED backlight systems enable contrast ratios approaching 1,000,000:1, substantially better than conventional LCD displays.

Power efficiency has also improved, with Mini LED displays consuming approximately 20-30% less power than traditional LCD systems of equivalent size and brightness. This efficiency gain contributes to extended battery life in electric vehicles and reduced energy consumption in conventional automobiles. Additionally, Mini LED displays offer a wider color gamut, typically covering 90-95% of the DCI-P3 color space, resulting in more vibrant and accurate color reproduction.

Despite these advancements, Mini LED technology faces several significant challenges in the automotive sector. Temperature stability remains a primary concern, as automotive environments demand operation across extreme temperature ranges (-40°C to 85°C). Current Mini LED implementations show performance variations at temperature extremes, affecting brightness consistency and color accuracy.

Manufacturing complexity presents another substantial hurdle. The precise placement of thousands of Mini LEDs requires specialized equipment and processes, leading to higher production costs compared to conventional display technologies. This cost premium currently restricts widespread adoption to luxury vehicle segments.

Reliability and longevity requirements in automotive applications exceed those of consumer electronics, with expected lifespans of 10-15 years under harsh conditions. Mini LED technology must demonstrate consistent performance throughout this extended period, including resistance to vibration, humidity, and temperature cycling.

Integration challenges also exist with automotive systems. Mini LED displays must interface seamlessly with existing vehicle architectures and comply with automotive-specific protocols like CAN, MOST, or Automotive Ethernet. Additionally, the technology must meet stringent automotive safety standards and electromagnetic compatibility requirements.

Supply chain constraints represent another obstacle, with limited manufacturers capable of producing automotive-grade Mini LED components at scale. This limitation affects both availability and cost competitiveness compared to more established display technologies in the automotive sector.

The current state of Mini LED in automotive applications demonstrates several advantages. The technology provides enhanced brightness levels of 1,000-2,000 nits, which significantly improves visibility in varying lighting conditions—a critical factor for automotive displays that must perform optimally under direct sunlight. The local dimming capabilities of Mini LED backlight systems enable contrast ratios approaching 1,000,000:1, substantially better than conventional LCD displays.

Power efficiency has also improved, with Mini LED displays consuming approximately 20-30% less power than traditional LCD systems of equivalent size and brightness. This efficiency gain contributes to extended battery life in electric vehicles and reduced energy consumption in conventional automobiles. Additionally, Mini LED displays offer a wider color gamut, typically covering 90-95% of the DCI-P3 color space, resulting in more vibrant and accurate color reproduction.

Despite these advancements, Mini LED technology faces several significant challenges in the automotive sector. Temperature stability remains a primary concern, as automotive environments demand operation across extreme temperature ranges (-40°C to 85°C). Current Mini LED implementations show performance variations at temperature extremes, affecting brightness consistency and color accuracy.

Manufacturing complexity presents another substantial hurdle. The precise placement of thousands of Mini LEDs requires specialized equipment and processes, leading to higher production costs compared to conventional display technologies. This cost premium currently restricts widespread adoption to luxury vehicle segments.

Reliability and longevity requirements in automotive applications exceed those of consumer electronics, with expected lifespans of 10-15 years under harsh conditions. Mini LED technology must demonstrate consistent performance throughout this extended period, including resistance to vibration, humidity, and temperature cycling.

Integration challenges also exist with automotive systems. Mini LED displays must interface seamlessly with existing vehicle architectures and comply with automotive-specific protocols like CAN, MOST, or Automotive Ethernet. Additionally, the technology must meet stringent automotive safety standards and electromagnetic compatibility requirements.

Supply chain constraints represent another obstacle, with limited manufacturers capable of producing automotive-grade Mini LED components at scale. This limitation affects both availability and cost competitiveness compared to more established display technologies in the automotive sector.

Current Mini LED Implementation Approaches for Vehicles

01 Mini LED Display Technology

Mini LED technology represents an advancement in display technology, utilizing smaller LED chips compared to traditional LEDs but larger than micro LEDs. These displays offer improved contrast ratios, higher brightness levels, and better local dimming capabilities. The technology is increasingly being adopted in various applications including televisions, monitors, and portable devices due to its superior performance characteristics while maintaining cost-effectiveness compared to OLED or micro LED alternatives.- Mini LED display technology and structure: Mini LED technology involves the use of miniaturized LED chips in display panels, offering improved brightness, contrast ratio, and energy efficiency compared to traditional LED displays. These displays typically consist of a backlight module with thousands of tiny LED chips that provide more precise local dimming zones. The structure often includes a light guide plate, optical films, and a diffuser to ensure uniform light distribution across the display panel.

- Mini LED backlight modules and arrangements: Backlight modules for Mini LED displays feature specific arrangements of LED chips to optimize light output and uniformity. These modules may include reflective layers, light guide plates, and optical films to enhance brightness and reduce light leakage. Various configurations of Mini LED arrays are designed to achieve better local dimming control, which improves contrast ratio and reduces power consumption in display applications.

- Mini LED manufacturing processes and materials: Manufacturing processes for Mini LED displays involve specialized techniques for chip production, transfer, and mounting. These processes may include wafer-level packaging, mass transfer technologies, and precision bonding methods to place thousands of tiny LED chips accurately. Advanced materials are used for substrates, encapsulation, and interconnects to ensure reliability and performance of the Mini LED components while reducing production costs.

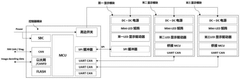

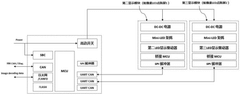

- Mini LED driving circuits and control systems: Driving circuits for Mini LED displays are designed to provide precise current control to thousands of individual LED zones. These circuits may incorporate advanced pulse width modulation techniques, current compensation algorithms, and temperature monitoring to ensure consistent brightness and color accuracy. Control systems manage local dimming functions to enhance contrast ratio and reduce power consumption while maintaining image quality across the display.

- Mini LED applications in various display products: Mini LED technology is implemented in various display products including televisions, monitors, laptops, tablets, and automotive displays. These applications leverage the advantages of Mini LED backlighting such as high brightness, improved contrast ratio, and better HDR performance. Special design considerations are made for different form factors, including ultra-thin displays, curved screens, and foldable devices that incorporate Mini LED technology.

02 Mini LED Backlight Solutions

Mini LED backlight units (BLUs) provide enhanced backlighting for LCD displays by incorporating thousands of tiny LED chips arranged in multiple dimming zones. This configuration enables precise local dimming, resulting in deeper blacks, improved contrast ratios, and reduced blooming effects compared to conventional LED backlighting. These solutions typically include specialized optical films, reflectors, and diffusers to optimize light distribution and uniformity across the display panel.Expand Specific Solutions03 Mini LED Manufacturing and Packaging Techniques

Advanced manufacturing and packaging methods for Mini LEDs focus on improving production efficiency and yield rates while reducing costs. These techniques include transfer printing processes, mass transfer technologies, and specialized pick-and-place equipment for handling the small LED chips. Novel packaging approaches such as chip-on-board (COB) and flip-chip bonding are employed to achieve higher density arrays and better thermal management, which are critical for Mini LED display performance.Expand Specific Solutions04 Mini LED Driving and Control Systems

Sophisticated driving and control systems are essential for Mini LED displays to achieve their full potential. These systems include advanced driver ICs, pulse width modulation (PWM) controllers, and local dimming algorithms that precisely control thousands of individual Mini LEDs or dimming zones. The control architecture typically incorporates compensation mechanisms for brightness and color uniformity, as well as power management solutions to optimize energy efficiency while maintaining display performance.Expand Specific Solutions05 Mini LED Applications and Integration

Mini LED technology is being integrated into diverse applications beyond traditional displays, including automotive dashboards, wearable devices, AR/VR headsets, and specialized lighting solutions. The integration often involves custom optical designs, flexible substrates, or curved surfaces to accommodate various form factors. Recent innovations focus on combining Mini LED technology with other display technologies or incorporating additional functionalities such as touch sensors, biometric systems, or transparent display capabilities.Expand Specific Solutions

Key Industry Players in Automotive Mini LED Ecosystem

The Mini LED automotive display market is currently in a growth phase, with increasing adoption driven by superior brightness, contrast, and energy efficiency compared to traditional displays. The market is expected to expand significantly as automakers prioritize advanced digital cockpits and infotainment systems. Key players include established display manufacturers like BOE Technology, TCL's China Star Optoelectronics, and Tianma Microelectronics, who are leveraging their expertise in Mini LED technology. Automotive specialists such as Magneti Marelli and Changzhou Xingyu are integrating these displays into vehicle systems, while premium automakers like BMW are driving demand for high-quality displays. The technology is approaching maturity with companies like AUO, VueReal, and APT Electronics making significant advancements in manufacturing processes, yield rates, and cost reduction.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced Mini LED backlight technology specifically optimized for automotive displays, featuring ultra-thin designs with thicknesses under 5mm. Their automotive Mini LED solutions incorporate Local Dimming Control (LDC) technology with thousands of dimming zones, achieving contrast ratios exceeding 1,000,000:1 and peak brightness of 1,500 nits while maintaining power efficiency. BOE's automotive Mini LED displays utilize chip-scale packaging technology with LED chips smaller than 200 micrometers, enabling higher pixel density and improved optical performance. The company has implemented specialized heat dissipation systems to ensure stable operation across extreme automotive temperature ranges (-40°C to 85°C). Additionally, BOE has developed proprietary anti-glare and anti-reflection coatings specifically designed for automotive environments, enhancing visibility under various lighting conditions while meeting stringent automotive reliability standards with a minimum 10-year operational lifespan.

Strengths: Industry-leading local dimming technology providing superior contrast ratios; advanced thermal management systems specifically designed for automotive environments; mature mass production capabilities. Weaknesses: Higher initial cost compared to traditional LCD solutions; more complex supply chain with specialized Mini LED components; requires sophisticated driving algorithms to prevent halo effects in high-contrast scenes.

Wuhan China Star Optoelectronics Technology Co., Ltd.

Technical Solution: Wuhan China Star Optoelectronics (CSOT) has developed a proprietary Mini LED backlight solution for automotive displays featuring ultra-high brightness exceeding 1,800 nits and a contrast ratio of 1,200,000:1. Their technology implements a multi-zone local dimming architecture with over 2,000 independently controlled zones, significantly reducing power consumption by up to 40% compared to conventional LCD displays. CSOT's automotive Mini LED displays incorporate specialized optical films that enhance light utilization efficiency and reduce internal reflections, critical for maintaining visibility in bright daylight conditions. The company has also developed a unique temperature compensation algorithm that maintains consistent color performance across the wide temperature range required for automotive applications (-40°C to 105°C). Their displays feature specialized anti-vibration mounting systems and reinforced panel structures to withstand the mechanical stresses common in automotive environments, with demonstrated reliability through accelerated life testing equivalent to 15 years of typical usage.

Strengths: Superior brightness performance ideal for high ambient light conditions in vehicles; advanced local dimming technology providing exceptional contrast; proven durability in automotive environments with specialized mechanical reinforcement. Weaknesses: Higher manufacturing complexity requiring precise LED placement; potential for increased thickness compared to OLED alternatives; higher initial production costs requiring significant capital investment in specialized equipment.

Core Patents and Technical Innovations in Automotive Mini LED

Automobile lamp control system of Mini-LED display driver and automobile lamp

PatentPendingCN118711509A

Innovation

- A mini-LED display driver car light control system is designed, including a controller module and a display module. Different types of LED display drivers are connected through SPI and UART communication, and the hardware and software interfaces are unified to realize one controller compatible with different display modules. , improving the reusability of electronic designs and the development complexity and time of replacing LED display drivers.

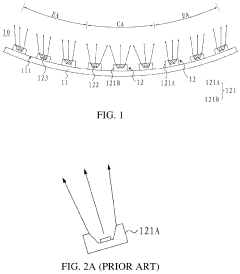

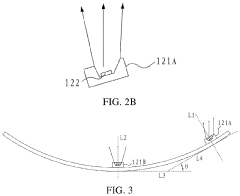

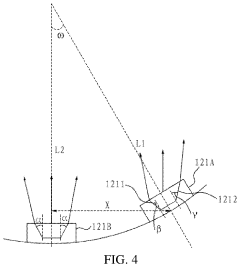

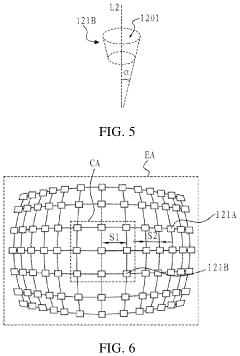

Curved surface backlight module and curved surface display device

PatentActiveUS11994770B2

Innovation

- A curved surface backlight module with asymmetric first reflector cups at the edge partition and symmetrical second reflector cups at the central partition, where the first reflector cups' lateral walls are angled to direct light emission parallel to the user's viewing direction, reducing brightness attenuation by optimizing the light distribution.

Supply Chain and Manufacturing Considerations

The Mini LED supply chain for automotive displays presents a complex ecosystem that requires careful consideration of multiple factors. The manufacturing process begins with the production of LED chips by specialized semiconductor manufacturers, followed by packaging into Mini LED modules. These modules are then integrated into display panels by display manufacturers before final assembly into automotive systems. This multi-tiered supply chain necessitates robust coordination among various stakeholders to ensure consistent quality and timely delivery.

Material sourcing represents a critical challenge in Mini LED production for automotive applications. High-quality semiconductor materials, particularly gallium nitride (GaN) substrates, are essential for producing Mini LEDs with the brightness and durability required for automotive environments. The limited number of suppliers capable of producing these materials to automotive-grade specifications creates potential bottlenecks in the supply chain, particularly as demand increases across multiple industries.

Manufacturing yield rates significantly impact the economic viability of Mini LED automotive displays. The miniaturization of LED chips increases production complexity, with current industry yield rates for automotive-grade Mini LEDs typically ranging from 70-85%. Improving these rates requires substantial investment in advanced manufacturing equipment and process optimization. Companies with established expertise in high-precision manufacturing processes hold a competitive advantage in this market segment.

Quality control standards for automotive applications exceed those of consumer electronics, necessitating specialized testing and validation procedures throughout the manufacturing process. Each Mini LED must undergo rigorous testing for brightness consistency, color accuracy, and longevity under extreme temperature conditions. These stringent requirements increase production costs but are essential for meeting automotive safety and reliability standards.

Regional manufacturing capabilities vary significantly, with East Asian countries—particularly Taiwan, South Korea, and China—currently dominating Mini LED production. However, concerns about supply chain resilience are driving initiatives to develop additional manufacturing capacity in Europe and North America, supported by government incentives aimed at reducing dependency on single-region sourcing for critical automotive components.

Scaling production to meet growing automotive demand presents both challenges and opportunities. Current manufacturing facilities require significant retooling to accommodate the precision requirements of Mini LED production at automotive volumes. Industry analysts project that manufacturing capacity will need to increase by 300% over the next five years to meet projected automotive sector demand, creating opportunities for new entrants and established players willing to invest in expanded production capabilities.

Material sourcing represents a critical challenge in Mini LED production for automotive applications. High-quality semiconductor materials, particularly gallium nitride (GaN) substrates, are essential for producing Mini LEDs with the brightness and durability required for automotive environments. The limited number of suppliers capable of producing these materials to automotive-grade specifications creates potential bottlenecks in the supply chain, particularly as demand increases across multiple industries.

Manufacturing yield rates significantly impact the economic viability of Mini LED automotive displays. The miniaturization of LED chips increases production complexity, with current industry yield rates for automotive-grade Mini LEDs typically ranging from 70-85%. Improving these rates requires substantial investment in advanced manufacturing equipment and process optimization. Companies with established expertise in high-precision manufacturing processes hold a competitive advantage in this market segment.

Quality control standards for automotive applications exceed those of consumer electronics, necessitating specialized testing and validation procedures throughout the manufacturing process. Each Mini LED must undergo rigorous testing for brightness consistency, color accuracy, and longevity under extreme temperature conditions. These stringent requirements increase production costs but are essential for meeting automotive safety and reliability standards.

Regional manufacturing capabilities vary significantly, with East Asian countries—particularly Taiwan, South Korea, and China—currently dominating Mini LED production. However, concerns about supply chain resilience are driving initiatives to develop additional manufacturing capacity in Europe and North America, supported by government incentives aimed at reducing dependency on single-region sourcing for critical automotive components.

Scaling production to meet growing automotive demand presents both challenges and opportunities. Current manufacturing facilities require significant retooling to accommodate the precision requirements of Mini LED production at automotive volumes. Industry analysts project that manufacturing capacity will need to increase by 300% over the next five years to meet projected automotive sector demand, creating opportunities for new entrants and established players willing to invest in expanded production capabilities.

Automotive Safety Standards and Compliance Requirements

Automotive displays incorporating Mini LED technology must adhere to stringent safety standards and compliance requirements to ensure reliable operation in various driving conditions. The automotive industry is governed by international standards such as ISO 26262, which establishes a framework for functional safety in road vehicles. This standard specifically addresses electrical and electronic systems, requiring manufacturers to implement systematic approaches to risk assessment and mitigation throughout the product development lifecycle.

For Mini LED displays in automotive applications, compliance with ECE Regulation No. 21 is essential, as it regulates the internal fittings of vehicles to minimize injury risks during accidents. The displays must demonstrate resilience against impact and maintain structural integrity even under extreme conditions. Additionally, electromagnetic compatibility standards (ECE Regulation No. 10) ensure that Mini LED displays neither emit harmful electromagnetic interference nor are susceptible to external electromagnetic disturbances.

Temperature performance requirements present another critical compliance area. Automotive displays must function reliably across extreme temperature ranges, typically from -40°C to +85°C, with Mini LED technology requiring validation for consistent brightness and color accuracy across this spectrum. The SAE J1455 standard provides comprehensive testing protocols for electronic equipment in heavy-duty vehicles, including temperature cycling, humidity, and mechanical shock resistance.

Optical performance standards such as VESA DisplayHDR Automotive 1000 establish minimum requirements for high dynamic range performance in automotive displays. Mini LED backlighting systems must meet specific luminance, color gamut, and contrast ratio specifications while maintaining readability under various ambient lighting conditions, from direct sunlight to complete darkness. The ISO 15008 standard specifically addresses ergonomic aspects of transport information and control systems, setting requirements for visual presentation to ensure driver safety.

Reliability testing frameworks like AEC-Q100 for integrated circuits and AEC-Q200 for passive components apply to Mini LED display components, requiring extensive validation through accelerated life testing, thermal cycling, and vibration resistance assessments. These standards ensure that automotive displays maintain functionality throughout the vehicle's operational lifetime, typically 10-15 years under harsh environmental conditions.

Environmental compliance regulations, including RoHS and REACH, restrict the use of hazardous substances in electronic components. Mini LED manufacturers must document material composition and demonstrate compliance with these evolving global requirements, particularly as automotive supply chains become increasingly scrutinized for environmental impact and sustainability.

For Mini LED displays in automotive applications, compliance with ECE Regulation No. 21 is essential, as it regulates the internal fittings of vehicles to minimize injury risks during accidents. The displays must demonstrate resilience against impact and maintain structural integrity even under extreme conditions. Additionally, electromagnetic compatibility standards (ECE Regulation No. 10) ensure that Mini LED displays neither emit harmful electromagnetic interference nor are susceptible to external electromagnetic disturbances.

Temperature performance requirements present another critical compliance area. Automotive displays must function reliably across extreme temperature ranges, typically from -40°C to +85°C, with Mini LED technology requiring validation for consistent brightness and color accuracy across this spectrum. The SAE J1455 standard provides comprehensive testing protocols for electronic equipment in heavy-duty vehicles, including temperature cycling, humidity, and mechanical shock resistance.

Optical performance standards such as VESA DisplayHDR Automotive 1000 establish minimum requirements for high dynamic range performance in automotive displays. Mini LED backlighting systems must meet specific luminance, color gamut, and contrast ratio specifications while maintaining readability under various ambient lighting conditions, from direct sunlight to complete darkness. The ISO 15008 standard specifically addresses ergonomic aspects of transport information and control systems, setting requirements for visual presentation to ensure driver safety.

Reliability testing frameworks like AEC-Q100 for integrated circuits and AEC-Q200 for passive components apply to Mini LED display components, requiring extensive validation through accelerated life testing, thermal cycling, and vibration resistance assessments. These standards ensure that automotive displays maintain functionality throughout the vehicle's operational lifetime, typically 10-15 years under harsh environmental conditions.

Environmental compliance regulations, including RoHS and REACH, restrict the use of hazardous substances in electronic components. Mini LED manufacturers must document material composition and demonstrate compliance with these evolving global requirements, particularly as automotive supply chains become increasingly scrutinized for environmental impact and sustainability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!